Strategic Metals (SMD.V) has just closed a C$5.9M placement consisting of a combination of flow-through shares (priced at C$0.64) and a hard dollar financing (priced at C$0.45 with a full warrant valid for two years with an exercise price of C$0.65) and is now fully cashed up for the ongoing exploration season in Canada’s Yukon Territory.

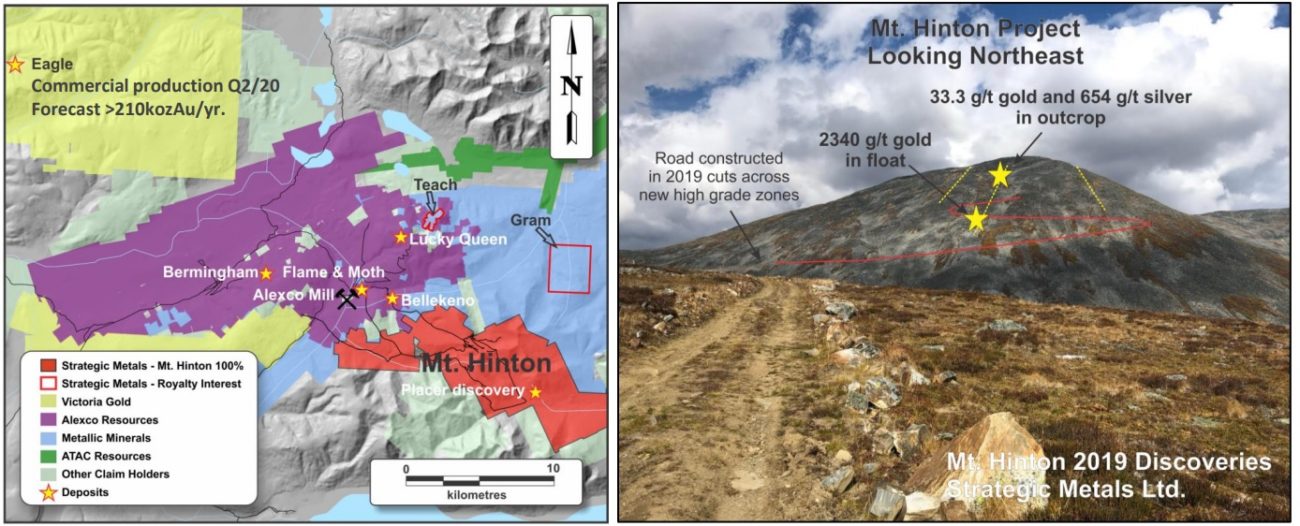

The company has started a diamond drill program on its Mt Hinton gold-silver project in the Keno Hill district where two drill rigs are now testing the potential for high-grade veins for the first time in the history of the project. One rig is currently working on the Granite North Zone where a 2019 sampling program encountered some high-grade gold and silver results Strategic wanted to follow up on. The holes on that section of the project will be a section line across a 300 meter wide zone.

A second drill rig is working on the Northern Stuctural Corridor where Strategic has defined more than 50 veins and vein segment in a combined strike length of approximately 4 kilometers in an area with widths up to 750 meters. Of specific interest will be the assay results of the 19 vein where a sampling program returned an average grade of 6.51 g/t gold and 68.57 g/t silver over an average with of 1.7 meter along 24 meters of exposed strike. Additionally, the 21 vein was sampled over a length of 22 meters and yielded 42.5 g/t gold and 319 g/t silver over an average width of 1.05 meters while the 24 vein returned 17.5 g/t gold and 1546 g/t silver over a width of 0.49 meters and a strike length of about 24 meters. Interesting sampling results, and Strategic is now drill-testing those specific areas.

Disclosure: The author has a long position in Strategic Metals.