Strategic Resources (SR.V) has released the results of the PFS level engineering study condctd on its 4 million tonnes per year pelletizer project in the port of Saguenay. The project is expected to produce a Direct Reduction pellet product, as the demand for this type of iron ore is expected to increase in the next decade.

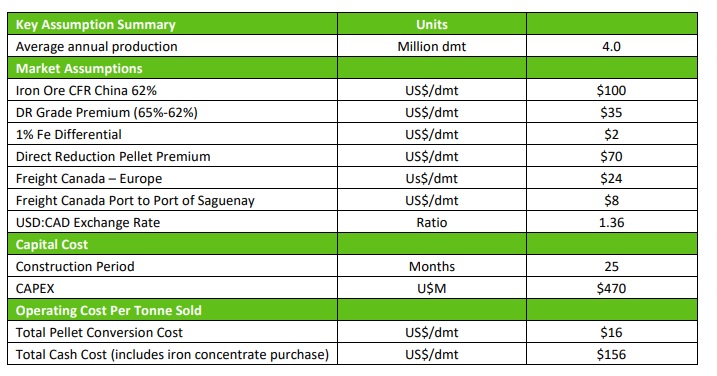

Based on an average premium of US$70 per dry metric tonne for such product and the US$470M initial capex, the after-tax NPV8% of this project is estimated at US$957M for an IRR of 25% while even a 30% lower direct reduction pellet premium would still yield an after-tax NPV8% of US$331M for an IRR of 14%.

This upgrade project is completely independent from the company’s own BlackRock iron ore project as it assumes Strategic Resources will purchase third party iron ore concentrate for conversion into pellets. And that makes it an interesting ‘industrial’ project which should be valued using an EBITDA multiple for industrial projects. The $70/t may be a bit optimistic as the DR premium was approximately $55/t in the first quarter of this year and recent discussions in Brazil are pointing in the direction of a $53/t premium. But the current premiums are obviously somewhat irrelevant for a project that likely will need another half decade before it gets commissioned.

Disclosure: The author has a long position in Strategic Resources. Please read the disclaimer.