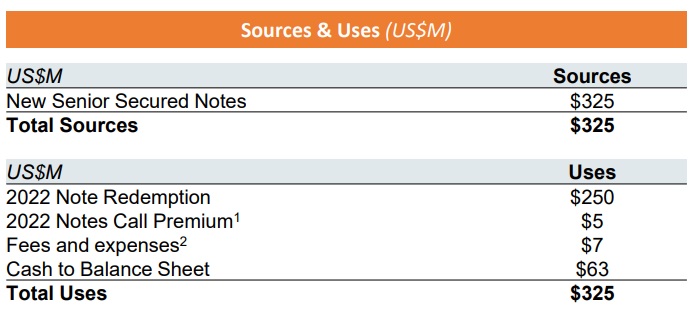

Taseko Mines (TGB, TKO.TO) is taking advantage of the strong copper price and although its own financial situation and performance could be improved upon, the company successfully issued US$400M of debt with a 7% coupon, more than the $325M Taseko was aiming to raise. A portion of the funding will be used to retire the $250M notes which have a 8.75% coupon which were slated to mature in 2022 anyway.

This is a good move by Taseko as it reduces its cost of the existing debt: retiring the 8.75% notes will reduce the interest expenses by $4.4M per year but considering the issue is larger than the 2022 notes that are being retired the total interest expense will increase by just over US$6M per year. Not a bad trade-off. The remainder of the cash (around US$131M, so higher than the $63M in the image above which was part of the marketing material based on the original US$325M amount) will be used to help fund the Florence copper project which has an estimated capex of US$230M so the cash from the newly issued note will go a long way.

Disclosure: The author has no position in Taseko Mines. Please read our disclaimer.