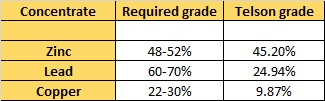

Telson Mining (TSN.V), which still is in the process of acquiring the Campo Morado polymetallic mine from Brussels-listed Nyrstar (NYR.BR), has released its production results for the first quarter of this year, and unfortunately not a single one of its concentrates met the minimum requirement of the smelters. Let’s have a look at the company’s reported concentrate grades, and the grades the smelters would like to see:

As you can see, none of the concentrates meets the minimum requirement of the smelters, and this usually results in heavily penalized payment calculations for the concentrate grade. Telson Mining made our life easier (kudos for the transparency) by providing the revenue from its concentrates, and this confirms the payability rates are nowhere near standard rates.

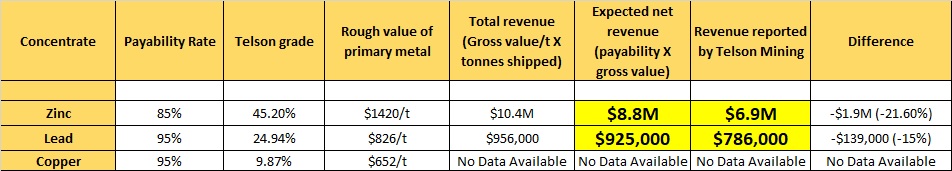

The next table shows you the normal payability ratios, and the gross value of the primary metal (note, this means any other metal but the concentrate metal is being ignored in this calculation. So for the zinc concentrate, we are using a payability ratio of 85% for the zinc as well as a payability ratio of 70% for the silver (with 0% for the first 3 ounces, which is the industry standard). In the lead concentrate, we also included an 85% payability for the silver on top of the 95% payability for the lead, whilst keeping all other commodities at a 0% payability rate.

We have highlighted the discrepancy between the theoretical value of the concentrate (after applying the appropriate payability percentages for the respective commodities), and the fact Telson reported a revenue lower than the theoretical revenue is the best evidence the company’s concentrates do get penalized by the smelters for not meeting the minimum requirements. And it really is a shame to see a zinc concentrate with a silver content of in excess of 400 g/t, as silver reporting to the zinc con (rather than to the lead con) is rarely payable by the smelters (miners receive 70% of the value, but the first 3 ounces per tonne of concentrate aren’t payable).

Sure, Campo Morado is still in the pre-production phase and the current head grades might not be fully representative for the future head grades once the mine is fully up and running, but due to the refractory nature of the ore, the recovery rate for the gold and silver will always remain low. That being said, we weren’t convinced at all by the company’s management team on a recent roadshow in Europe. We asked what the anticipated mining cost per tonne was at Campo Morado, and CEO Berlanga Balderas said ‘$12/t’. This seemed absurdly low, so we double-checked: ‘$12/tonne?’. ‘Yes’.

Not only did this appear to be absurdly low, it effectively was absurdly low. Looking at the recently announced Preliminary Economic Assessment of the Campo Morado project (which has been filed on SEDAR), the real mining cost is estimated at $32.78/t (which is definitely much more realistic), a difference of 173%.

Seeing these bad concentrate results and knowing Telson Mining still needs to raise US$16.5M before June 13th to ensure it has enough cash on hand to make the final property payment to Nyrstar. But with these sub-par concentrate results, it will be interesting to see the terms Telson will be raising money at. Should Telson raise C$25M at C$0.60/share, it would have to issue an additional 42M shares, pushing the total share count to almost 170M shares.

Go to Telson’s website

The author has no position in Telson Mining. Please read the disclaimer