Trident Royalties (TRR.L) still seems to be flying a bit under the radar but over the course of the past fifteen months, the company has acquired some interesting royalties on non-precious metals deposits. One of the key assets in the portfolio is the 60% ownership in an 8% gross revenue royalty (4.8% attributable to Trident).

Thacker Pass is operated by Lithium Americas which wants to bring the project into production in the next few years. Ahead of the development of the mine, Lithium Americas has released an updated resource estimate on Thacker Pass, which now contains 13.7 million tonnes of LCE in the measured and indicated resource categories and an additional 4.4 million tonnes of contained LCE in the inferred resource category (at a respective grade of 2,231 ppm and 2,112 ppm lithium). The results of this resource update allow Lithium Americas to investigate a production scenario of 40,000 tonnes of LCE per year followed by a Phase 2 expansion to 80,000 tonnes per year (up from 30,000 tonnes and 60,000 tonnes respectively).

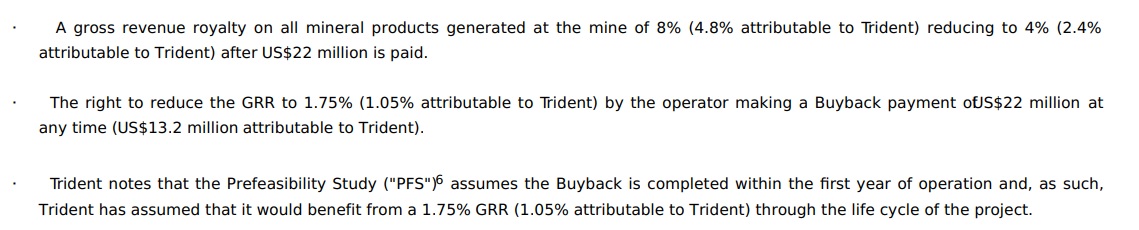

As mentioned, Trident owns 60% of an 8% GRR but it’s very likely Lithium Americas will repurchase the GRR to the bare minimum, especially in the expanded production scenario as an 8% GRR would result in an annual royalty payment of over $64M at the current lithium prices. The image below shows the different clauses and conditions related to the royalty:

We should indeed assume Trident will end up with an attributable gross revenue royalty of 1.05% as it would make zero economic sense for Lithium Americas to forego the repurchase of the royalty. As it would only cost Lithium Americas US$22M to save about $38M per year in royalty payments at 40,000 tonnes per year and a LCE price of $15,000/t. This means Trident will likely receive US$13.2M in cash when Lithium Americas repurchases the royalty while the remaining 1.05% will bring in over $6M per year (again at 40,000 tonnes per year and a $15,000/t lithium price).

This makes the Thacker Pass royalty very valuable for Trident Royalties and as the Thacker Pass project gets derisked, the value of the royalty will increase towards a value that could likely be in excess of the current market cap of Trident.

Disclosure: The author has no position in Trident Royalties. Please read our disclaimer.