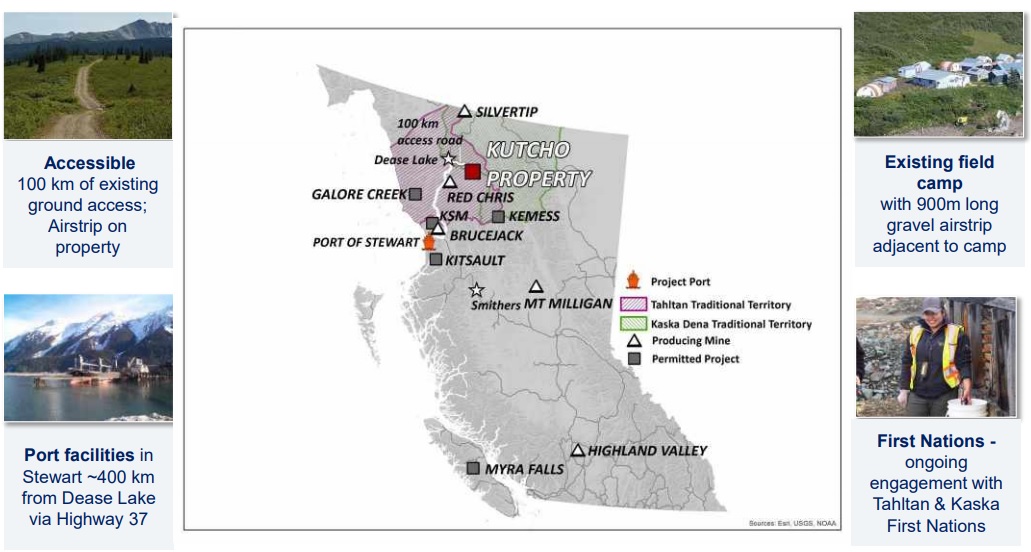

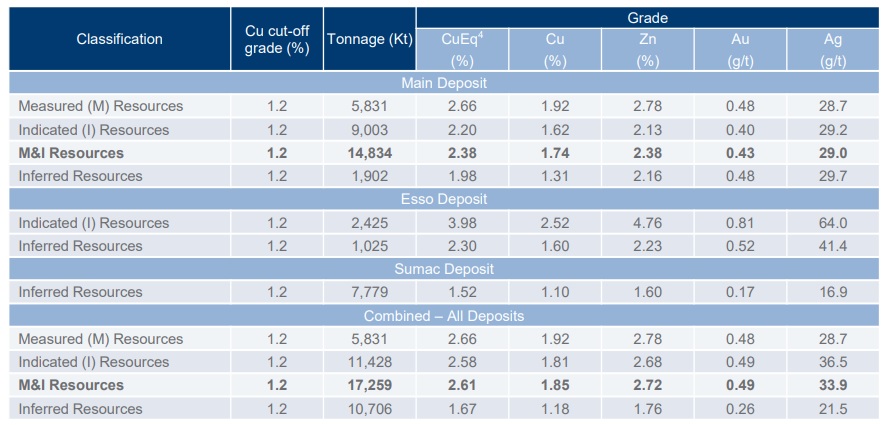

Kutcho Copper (KC.V) released the results of additional metallurgical test work at the end of June as the company continued to finetune the recovery results for its polymetallic underground resource on the Kutch project in British Columbia.

The main lens boasts recovery results of 87.4% copper, 63.8% for the zinc, 36.9% for gold and 59% for silver while the smaller Esso lens enjoys much higher recovery rates of 94.5% for copper, 89.3% for zinc, 49.8% for gold and just over 71% for the silver. Additionally, leaching the tailings stream from both zones will result in an additional amount of metals being recovered (with the recovery rates of the main lens tailings stream being higher than the Esso lens as the latter already enjoys higher recovery rates in the ‘normal’ production process).

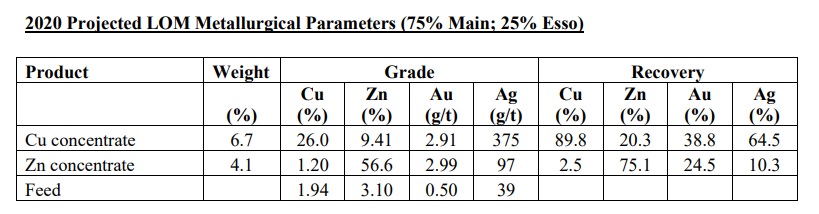

This means that on an average weighted basis (75% of the rock in the mine plan will be sourced from the main lens and 25% will be mined from the Esso lens), the total recovery rates( in the primary stage as well as the additional recoveries from leaching the tailings) are estimated to be around 96.4% for copper, 75% for zinc, 70% for gold and almost 83% for silver.

Looking at the LOM concentrate parameters, it looks like the majority of the silver will be recovered in the copper concentrate, which is exactly what you’d want to see (as the first three ounces of silver per tonne of zinc concentrate are not being paid for by the smelters). With a copper concentrate grade of 26% and a zinc concentrate grade of almost 57%, both concentrates meet the smelter requirements.

The Kutcho project appears to be very sound and robust from a technical perspective and the only reason why Kutcho Copper isn’t more aggressive in developing the asset can be found in the company’s financial situation. The liabilities side of the balance sheet still contains the C$22.5M in convertible debt owed to Wheaton Precious Metals (WPM, WPM.TO), and although the Kutcho asset is very valuable by itself with an after-tax NPV8% of C$265M at $2.75 copper increasing to in excess of C$300M at $3 copper, $1375 gold and $1.20 zinc. With a current enterprise value (market cap + debt) of around C$35M, Kutcho Copper is valued at just a fraction of its NPV right now.

Disclosure: The author has a long position in Kutcho Copper. Kutcho is a sponsor of the website.