Valterra Resource Corp. (VQA.V) has closed a second tranche of its C$0.075 placement raising C$1.1M which brings the total size of the placement to C$1.64M as it issued almost 21.9M units in two separate tranches .The units were priced at C$0.075 and consisted of one common share as well as half a warrant with each full warrant allowing the warrant holder to acquire an additional share of Valterra at C$0.125. As almost 11M warrants were issued, Valterra would be able to raise an additional C$1.4M should all warrants be exercised (the warrants expire within three years after their respective issue dates).

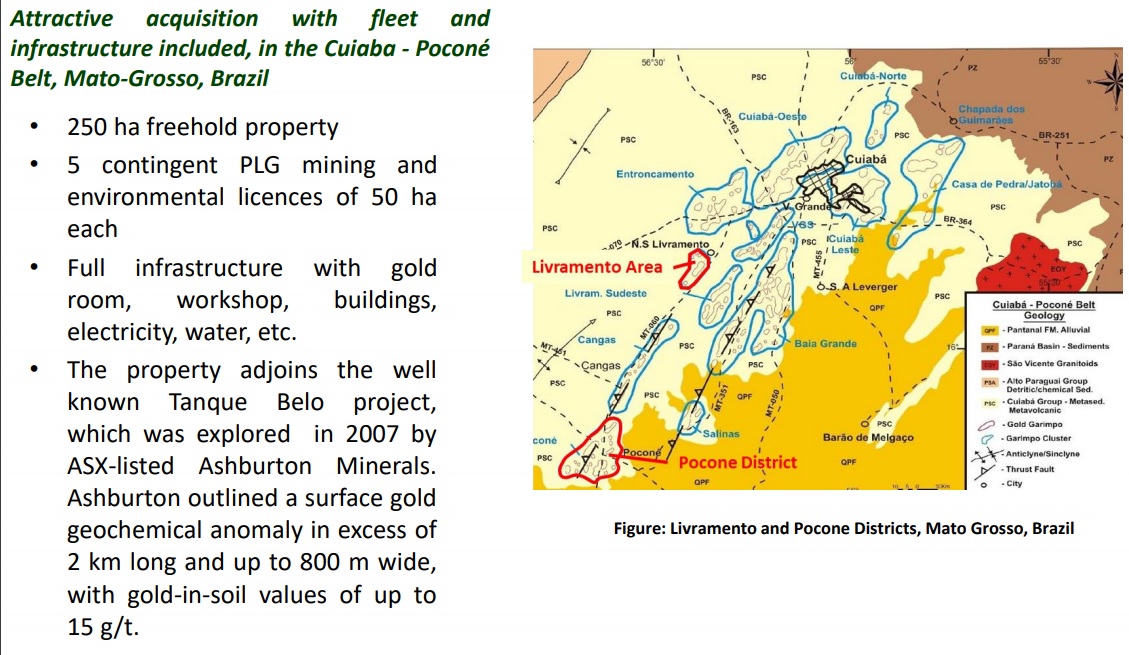

Valterra continues to work towards closing the acquisition of Poconé Mining Mineracao, the Brazilian company which owns a 100% interest in the Livramento gold project in Brazil. Valterra will issue 8 million shares and 8 million warrants (priced at C$0.10, expiring 4 years after the issue date) and issue the owners of PMM a 1.5% NSR on the gold production from the property. Since signing the original deal in June, Valterra has already advanced C$2M in loans to PMM ahead of formally consummating the acquisition. The 5,000 tonne bulk sample is in progress, and the results of the bulk sample will provide a lot of information about the grades and the efficiency of the milling process.

Disclosure: The author has a small long position in Valterra. Please read our disclaimer.