Vanstar Mining (VSR.V) had another difficult weak as its share price touched a low of C$0.43 on relatively high volume as the total trading volume exceeded 600,000 shares on both Thursday and Friday. The trading volume appeared to come solely from the United States as the total volume this week on the US exchanges was approximately 1.4 million shares compared to just over 1.7 million shares on the Canadian listing of the company.

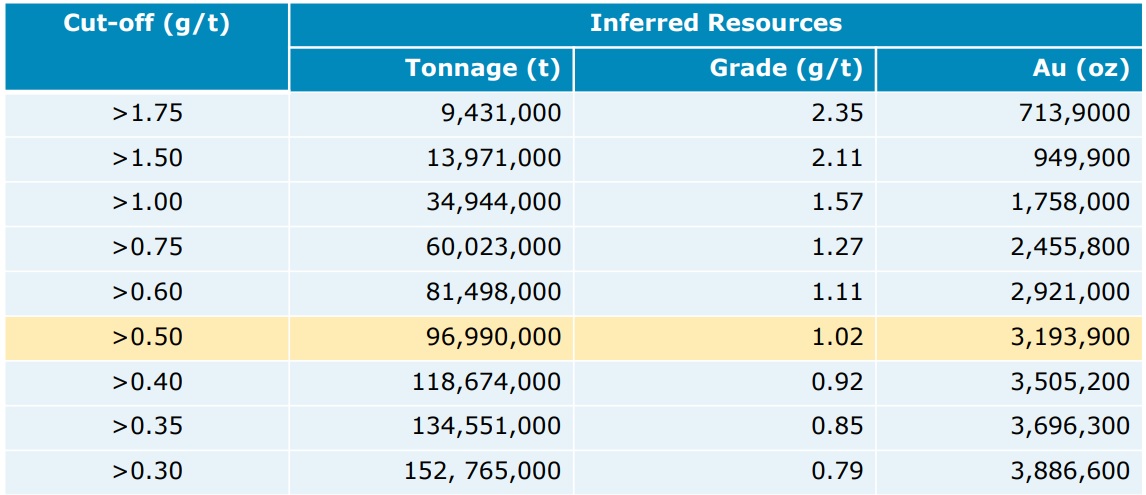

Meanwhile, nothing has changed when it comes to the fundamentals of the company. Vanstar still owns 25% of the multi-million ounce Nelligan gold project (and a 1% Net Smelter Royalty on some of the claims) and the gold price actually moved up the past week. Vanstar also reported its financial statements for the second quarter which ended in June.

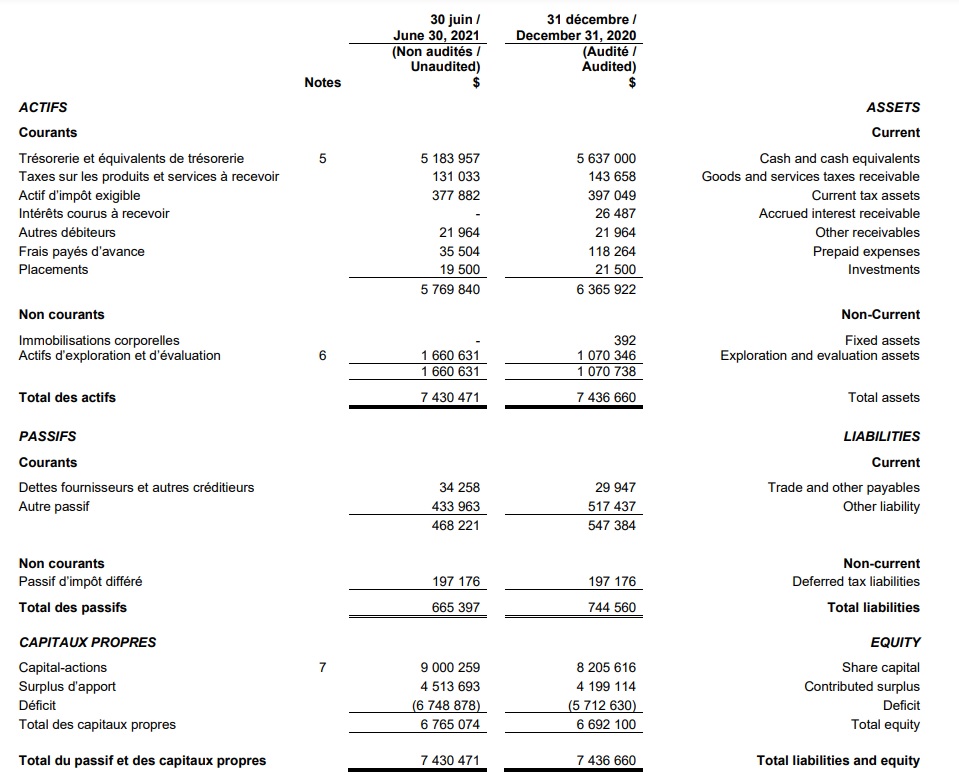

VSR ended Q2 with about C$5.2M in cash which represents about C$0.09 per share, indicating the enterprise value of Vanstar right now is just around C$20M. And as partner IAMgold (IMG.TO, IAG) is funding all activities at Nelligan, Vanstar can throttle its own cash burn based on its existing cash balance. In the first six months of this year, for instance, the total cash burn by Vanstar was just C$960,000, including C$590,000 spent on exploration on its own properties. With a normalized cash burn of less than C$1M per year excluding exploration activities, Vanstar can make its cash balance last for a very long time.

Disclosure: The author has a long position in Vanstar Mining and has added more this week. Please read our disclaimer.