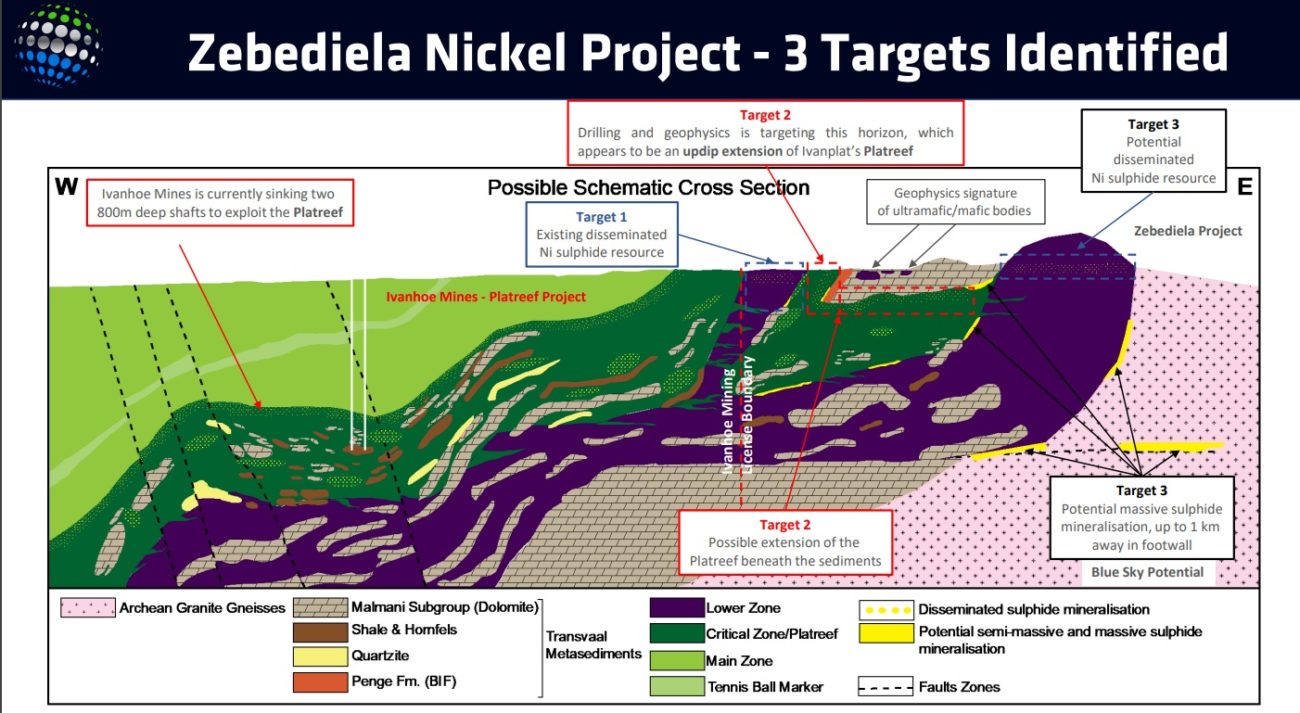

ZEB Nickel (ZBNI.V) has confirmed it will soon start drilling the Zebediela nickel exploration project, where it will be targeting the high grade nickel sulphide mineralization to the east of the historical resource.

That historical resource already makes Zebediela one of the largest nickel projects in the world, and according to the company the total of 1.6 billion tonnes of rock at an average nickel grade of 0.25% nickel makes it the 8th largest nickel deposit in the world with about 9 billion pounds of nickel. The grade of 0.25% isn’t high but using a nickel price of $15,000/t results in a gross rock value of around $37.5/t. This means metallurgy will play a very important role at Zebediela as the payable portion of nickel in concentrate is traditionally quite low (75%). So the better the quality of the end product, the higher the effectively received price per pound will be.

ZEB Nickel will be drilling the eastern portion of the resource where historical drilling in 2017 intersected higher grade mineralization with for instance 2.25 meters of 1.7% nickel and 0.7 g/t platinum group elements + gold just below the historical resource. Although the interval was narrow, the grade was almost 7 times higher than the average grade in the historical resource so it’s for sure worth trying to follow up on these 2017 drill results.

ZEB Nickel should have started a 3,600 meter drill program by now, and the company will target the higher grade footwall target and anticipates to encounter average widths between 1.8 and 10 meters. As the footwall target has a strike length of 5,000 meters, it should be easy to build tonnage. Just as a pro forma explanation (and this for sure isn’t any sort of exploration target), but identifying a continuous zone of 4,000 meters by 5 meters by 250 meters would add about 13-15 million tonnes to the resource. So the impact on the tonnage could remain limited, but if that tonnage contains high grade nickel, the average grade of the entire resource would be positively impacted.

Disclosure: The author has no position in ZEB Nickel. Please read our disclaimer.