Generation Mining (GENM.C) has now released the results of the Preliminary Economic Assessment on its Marathon PGM project in Ontario, Canada.

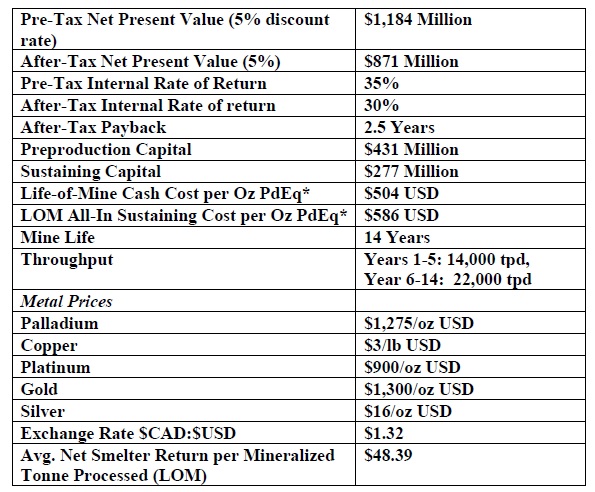

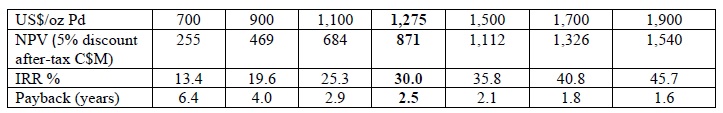

And the results are very encouraging. Using a palladium price of $1275 and a platinum price of $900/oz as base case scenario, the after-tax NPV5% of the project comes in at C$871M (using an USD/CAD exchange rate of 1.32) while the IRR comes in at an impressive 30%. The initial capex is lower than we expected (C$431M versus closer to C$500-520M we used in our DCF calculation) and this, combined with a strong output of 194,000 palladium-equivalent ounces (107,000 ounces palladium with by)product credits) and a low AISC of US$586/oz helps to keep the payback limited to just 2.5 years of the 14 year mine life.

Also keep in mind the base case scenario uses a lower palladium and platinum price than the current spot price (which we feel is the right thing to do), but the sensitivity analysis is quite interesting. At $1900 palladium the NPV increases to C$1.54B but even if you would go in the other direction, the NPV at $900 palladium remains robust at C$469M while the after-tax IRR also remains high at almost 20%. The important takeaway is that the Marathon project seems to work at sub-$1000 palladium prices as well.

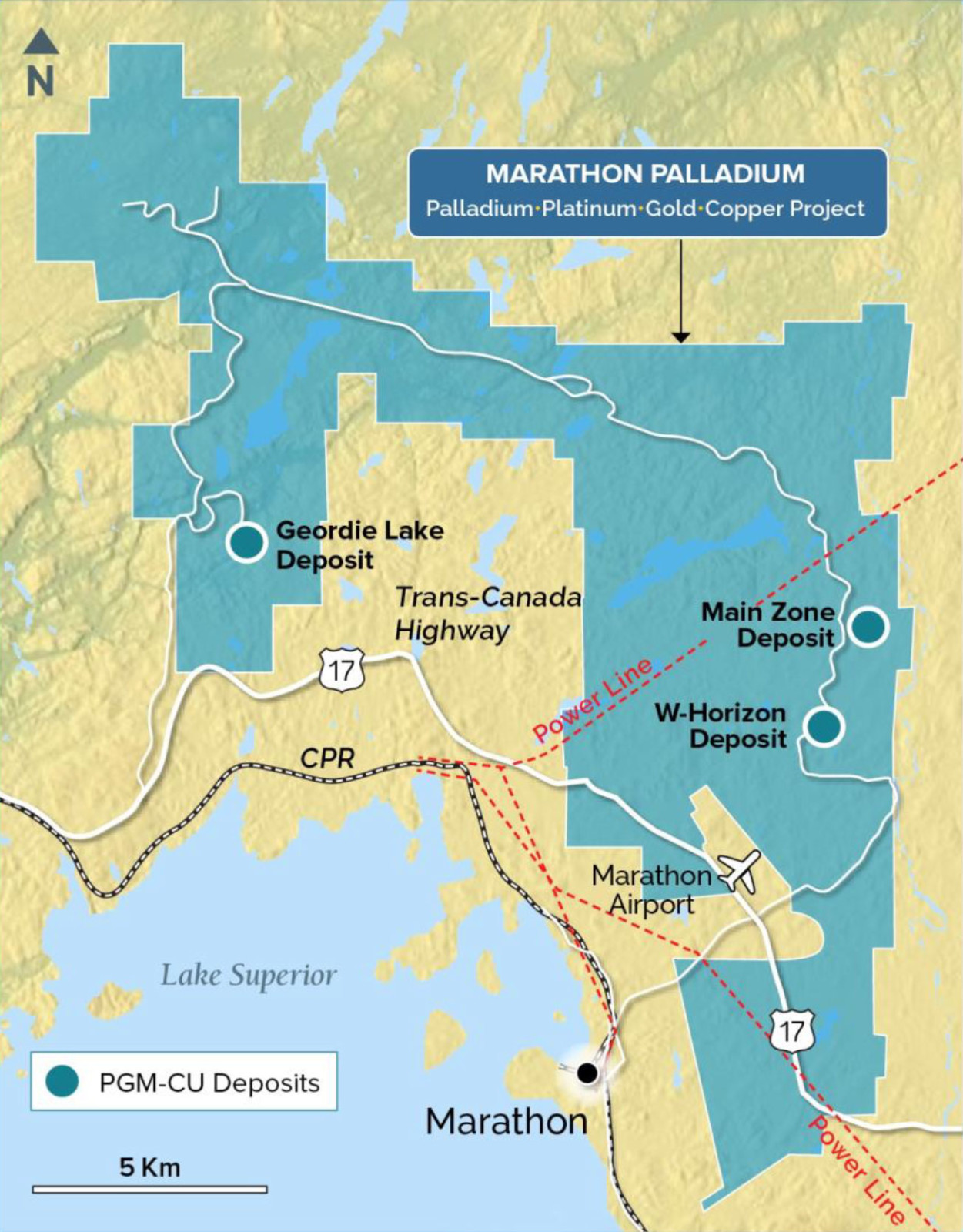

We already ran the numbers in November based on our own assumptions and ended up with an after-tax NPV7% of US$478M (C$630M). In fact, if we would have applied the same capex as Generation Mining (US$74M below our assumed capex) and a similar 5% discount rate (instead of the more conservative 7% we used), our after-tax NPV was actually within a 2% margin of error of the final result. And keep in mind this still excludes the additional potential of the Sally and Geordie satellite deposits that are NOT included in the economic study yet.

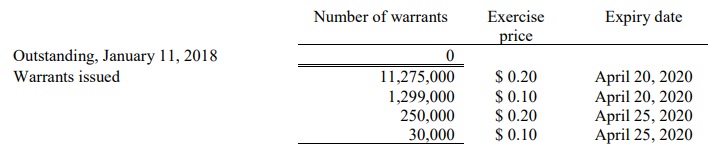

Generation Mining will file the full technical report in the next few weeks and once that report will have been filed we will provide a more detailed full update. But at first sight, the Marathon deposit is clearly living up to our expectations and we are happy to see the PEA is confirming our back of the envelope calculations. The market reacted positively and given the strong volumes lately, it shouldn’t be too hard for the 12.85 million warrants that are expiring in April to be exercised. If all warrants will be exercised, Generation Mining will receive an additional C$2.44M in cash. And the 14M+ warrants priced at C$0.45 expiring in 2021 are now also on the brink of being in the money which could bring in up to an additional C$6.3M in cash.

Although that would put Generation Mining in a comfortable position, it probably wouldn’t be a bad idea to take the market’s temperature to raise more money at or around the current levels, especially if flow-through money would be available above C$0.50/share. That could really accelerate Generation’s earn-in requirements as the company needs to spend C$10M by the summer of 2023 to effectively establish its 80% interest in the property. So far, just over C$3M has been spent so the company is well ahead of schedule to complete the earn-in before the deadline.

Disclosure: The author has a long position in Generation Mining. Generation Mining is a sponsor of the website.