There are very few development stage companies that have delivered on what they promised in the past little while but ever since Minera Alamos (MAI.V) acquired our position in Corex Gold (which owned the almost-producing Santana gold project), the company has ticked every box it had set for itself.

In the past few weeks, Minera added a third property to its pipeline and will close a C$13-15M bought deal (depending on National Bank exercising the over-allotment option) in the next few weeks. Plenty of reason to sit down with President Doug Ramshaw for a chat. Please note, the share count and working capital position next to the chart above are before taking the bought deal into consideration. In case the bought deal ends up being C$15M, about 24M shares will be added to the share count, while the working capital position will increase towards C$20M.

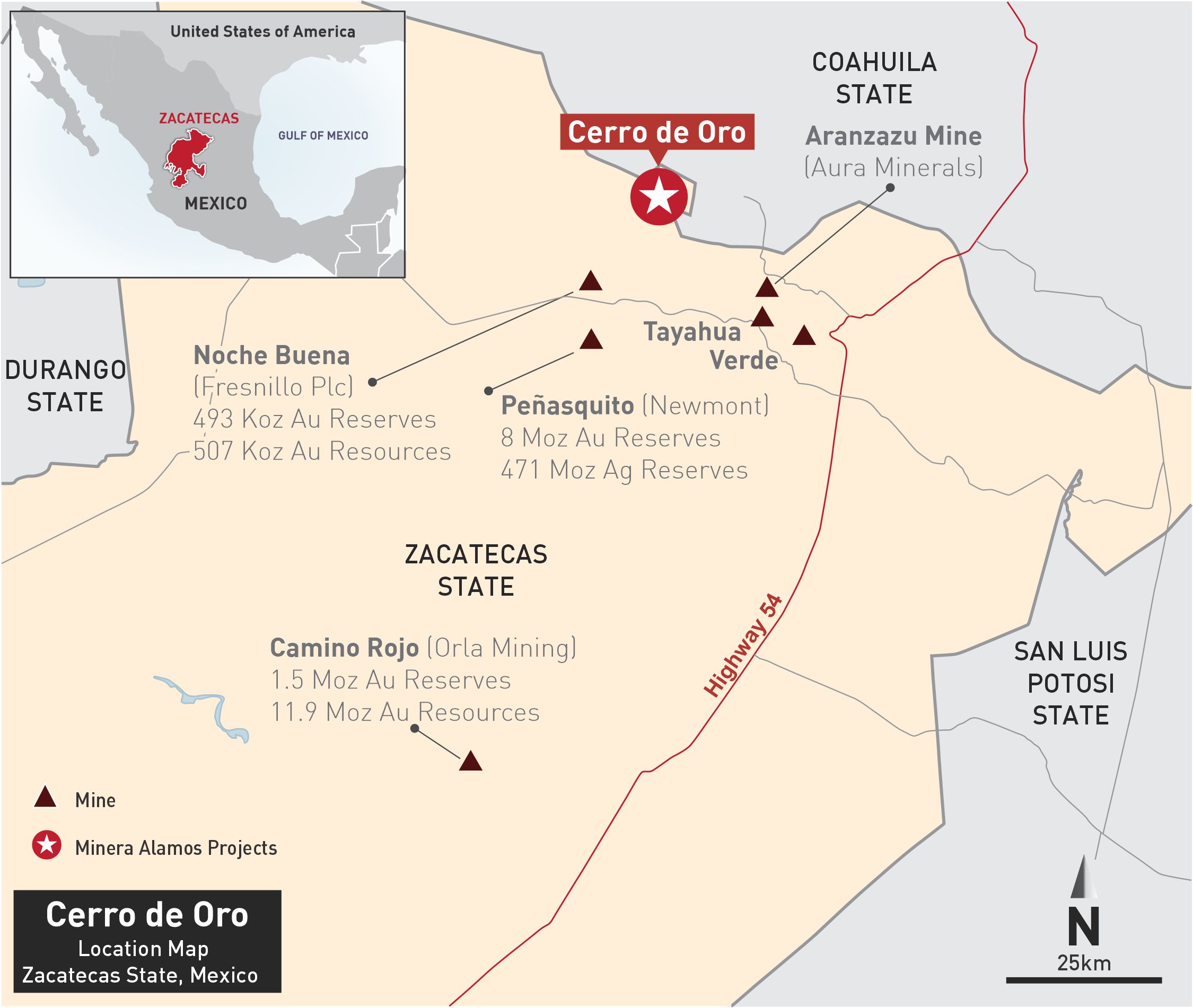

Cerro de Oro

About a year after selling your option to acquire Los Reyes to Prime Mining, you added a new ‘third’ project to your pipeline with the acquisition of Cerro de Oro. An interesting project as its previous Vancouver-based owners (Galileo Minerals, a private company) had invested quite a few dollars before being unable to come up with a payment where after the project was handed back to the underlying owner. There is no NI43-101 compliant resource on the project just yet, but the tandem of a geologist like you and a good metallurgist like Koningen obviously liked what it saw. Can you elaborate on how you came across the project and what the main reasons were to pull the trigger?

We knew of the project years ago but as you point out it was under option to another company. The vendor reached out a few months ago and we quickly came to terms with him to be able to add it to our pipeline. He saw value in an operating team taking it to the obvious next step of development and we saw a classic Minera type project which had sufficient resources to develop an open pit heap-leach operation while offering visibility on additional resources that could be added over time by reinvesting the cashflow from the starter operation.

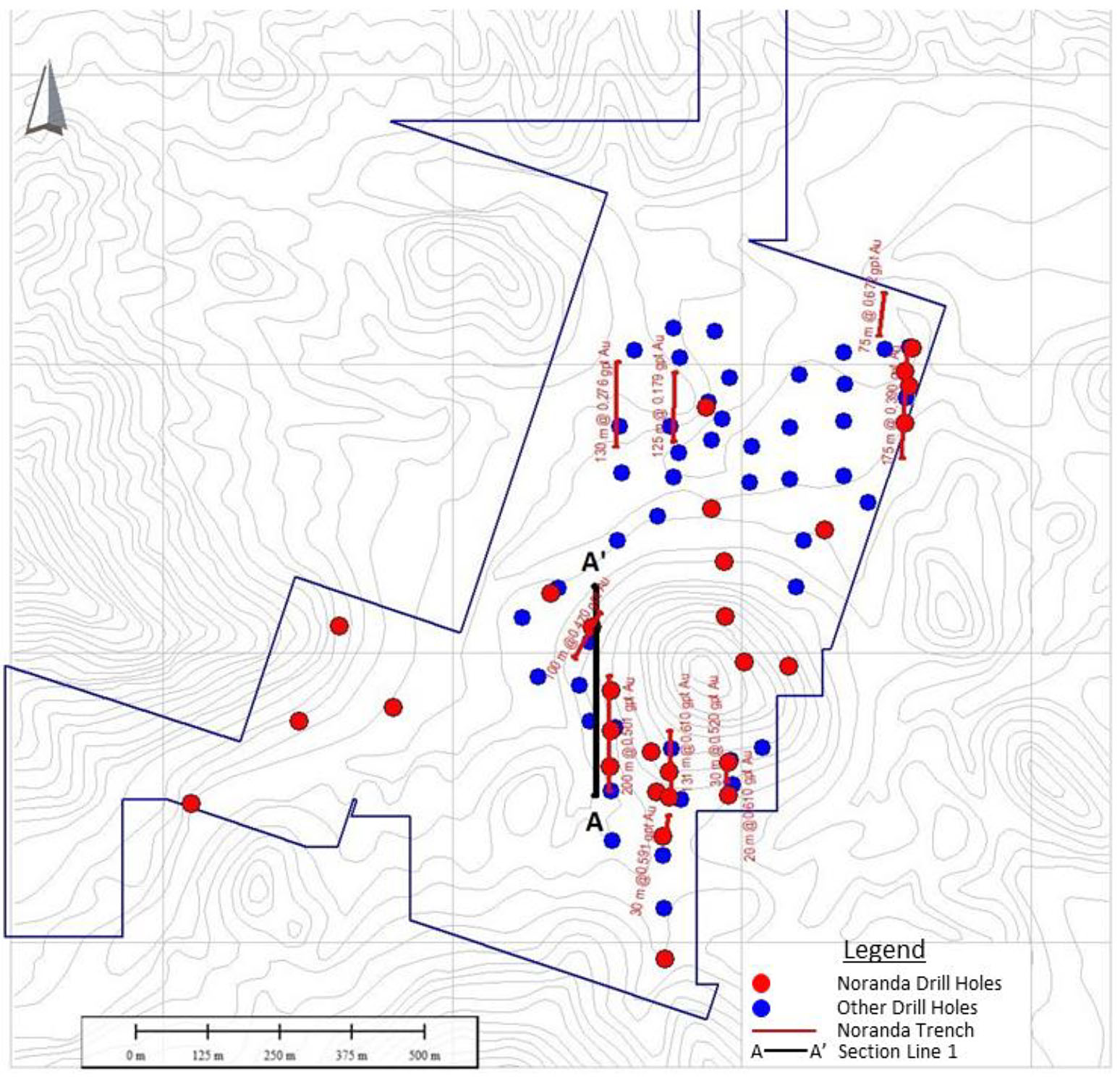

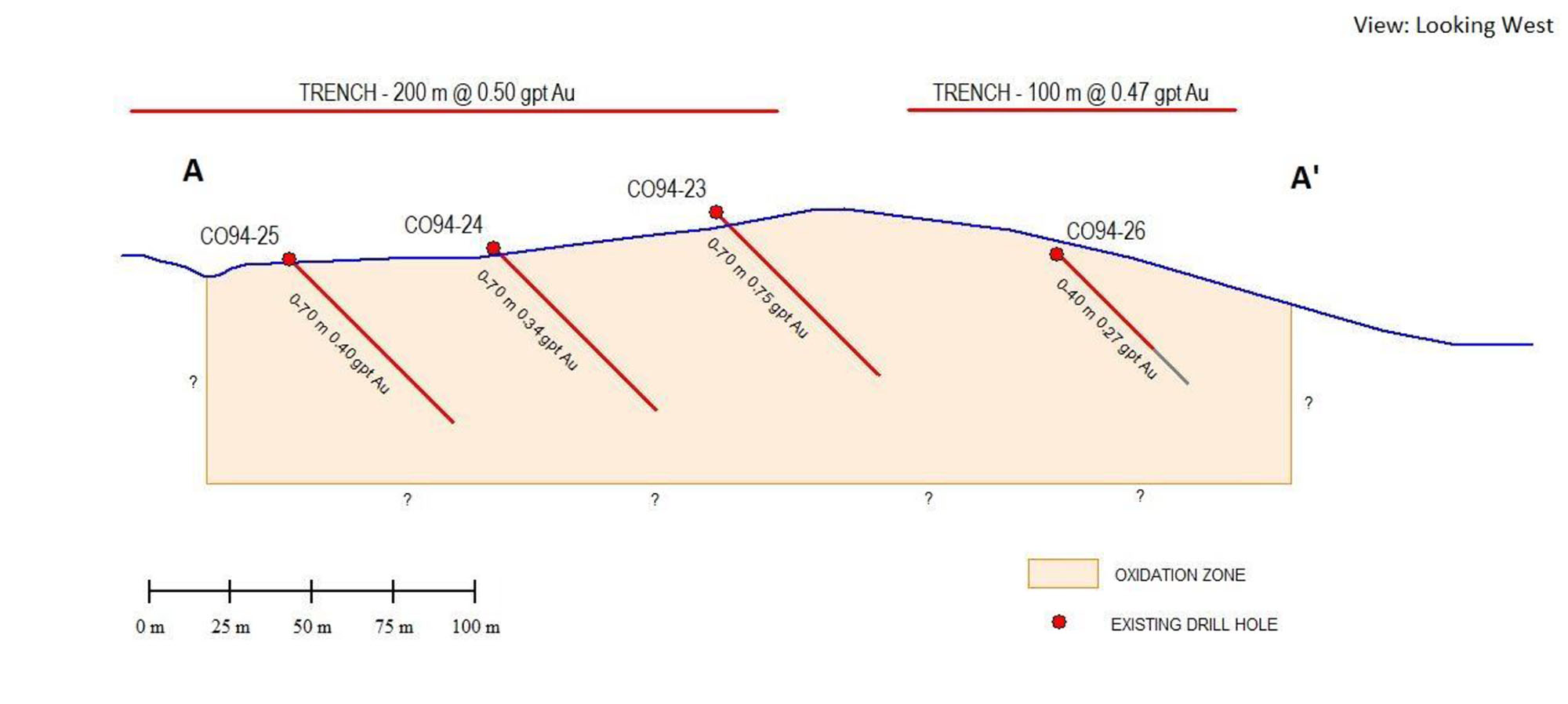

The grade at Cerro de Oro appears to be on the lower end of the spectrum (but we expect the upcoming resource to have a very reasonable grade of around 0.4 g/t gold) but given the low capital intensity of the project, everything will stand or fall with the anticipated metallurgy at Cerro de Oro. The press release didn’t contain any details on this but historical documents from Galileo indicate 80% of the gold leaches in less than 50 hours while a recovery rate of around 85% can be obtained within 96 hours. Do you consider those numbers realistic? Do you see any room for improvement?

We have modeled the resource internally, which is being worked on now to produce a NI43-101 compliant resource, but our modeled grade is higher than the historic interpretations.

I’ll tip toe around the subject for compliance reasons until we come out with our resource numbers but we are comfortable that it exceeds the grade/starting ounces/and strip ratio that was present at El Castillo which the team successfully developed when they ran Castle Gold. As for metallurgy we are pretty comfortable with what was quite extensive test work that has been conducted in the past although we will be doing our own additional test work in the coming months to confirm modeling.In addition, we will do some further test work on the sulphide zone (which didn’t factor in to our decision to acquire the project but would be nice gravy to the potential of the project), at Santana we can leach the sulphide whereas El Castillo the sulphides didn’t leach. I guess this is where I hope the analogue with El Castillo breaks down a bit in our favour.

We know you are bound by NI43 guidelines and can’t expand into too many details, but in an old presentation, the private owner of the project mentioned a US$30M capex to start producing at a rate of 45,000 ounces per year. In your professional opinion as a mining executive, would that be a capex you consider to be reasonable, or will Darren Koningen find ways to cut costs here as well, to make the project even more lean and efficient?

We would view that capex as high for sure. I think it’s going to be a Santana like build although I expect higher mining rate and more pad space as the grade is less than Santana. I’ll be conservative and simply say <C$20 million so at worst probably half of that historic number. Heap-leach doesn’t need to be over engineered as we are showing at Santana and with no ADR built and contract mining its not a capital-intensive project.

Existing projects

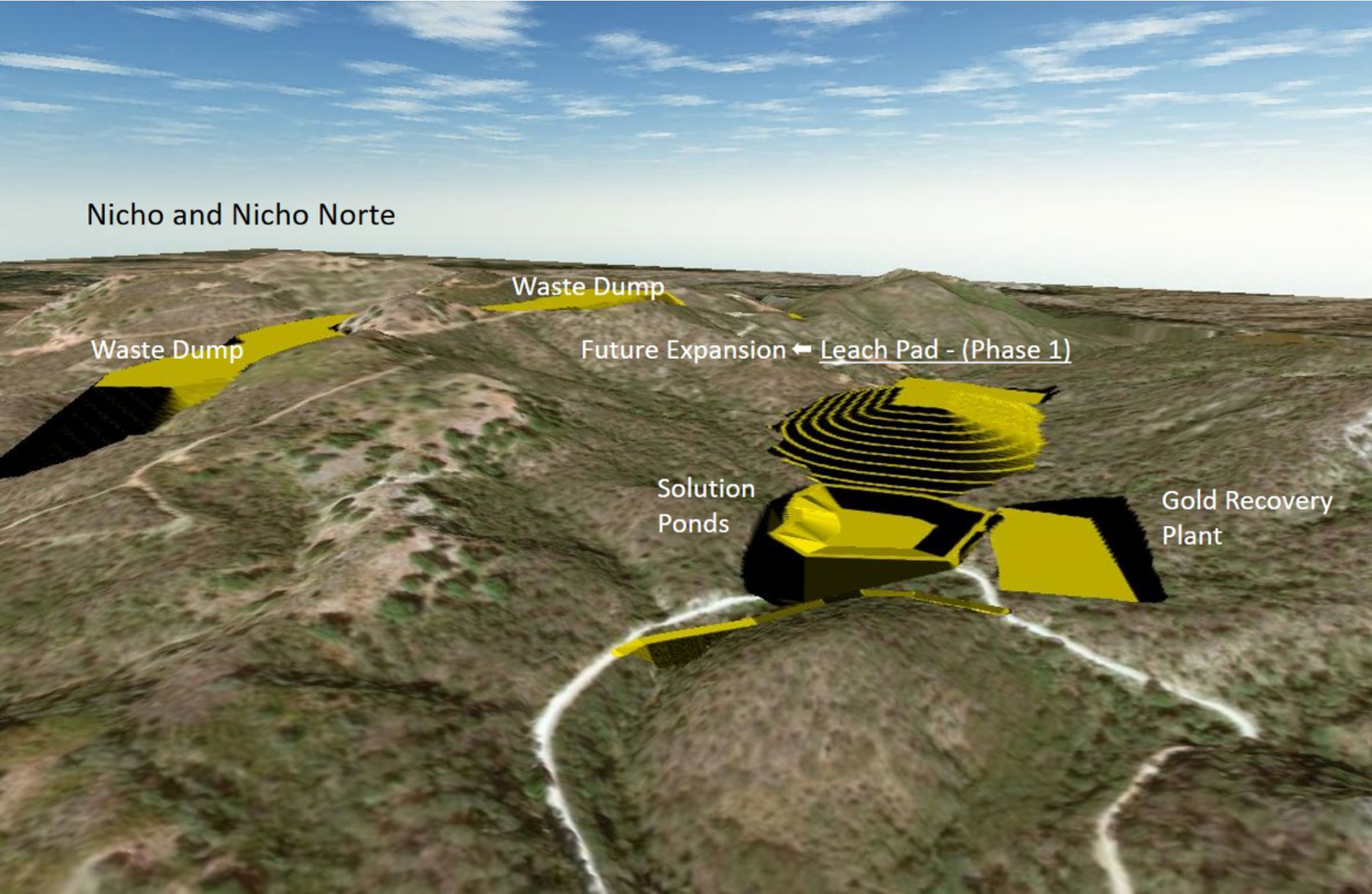

Meanwhile, in your portfolio of existing projects, the development activities at Santana are ongoing after a brief COVID-related pause and according to your timeline you remain on track to start mining in Q4 of this year or Q1 2021. Leaching will take a few weeks, so would it be fair to assume you will generate your first revenue towards the end of Q1 2021?

Right now that is our guidance but we are obviously in a fluid situation both in Mexico and the world in general. Following the rainy season (which is expected to be a neutral event this year) we should be in a position to update that guidance but right now it would appear that some minor pre-stripping that is required would probably commence around year-end allowing mining to commence early in Q1 2021. As for the leach cycle, it clearly takes some time to build up to a point where we would make our first shipment of concentrate but I think its fair to say first revenues in the first half of 2021. I will always tend to err on a more conservative timeline and hope we can beat it.

At Santana, you are also eyeing a production expansion decision in the second semester of next year. Will that decision depend on a resource increase beyond the 1M ounces you are targeting, or will it merely be based on how well your Phase 1 production is going?

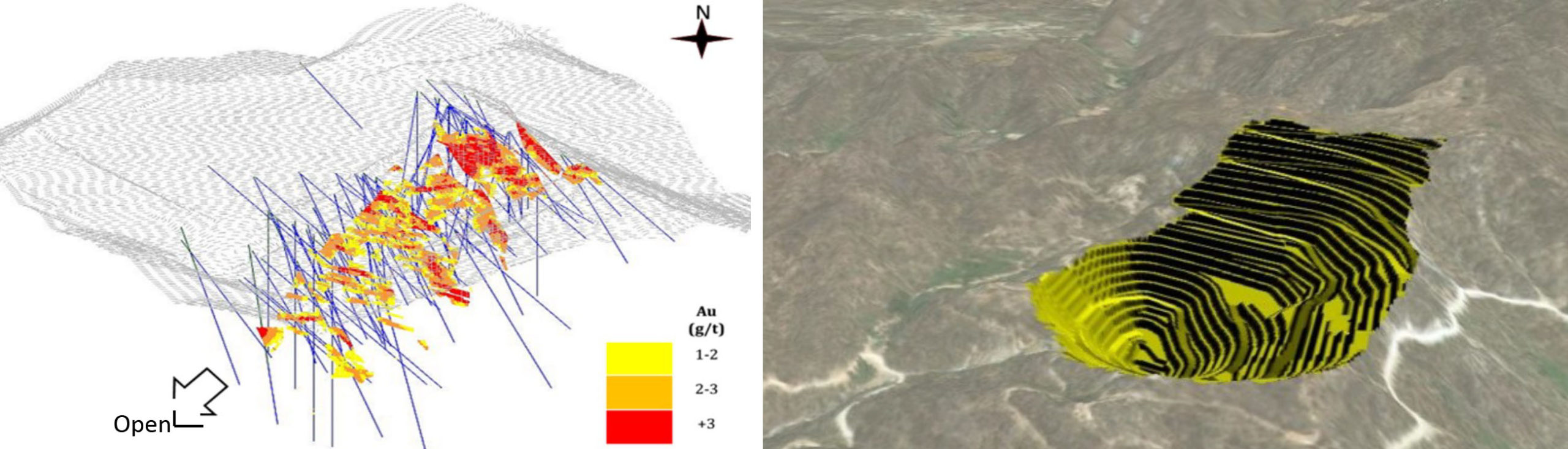

Well the first expansion phase at Santana is more just the organic growth we forecast from our conservative year one guidance. I think all things being equal without really much in the way of incremental cost we should see the production profile rise. Whether we have a full expansion to higher rates will be determined by us successfully demonstrating that some of the other pipes, which we know to be gold bearing, are successfully defined by phase 3 drilling later this year.

Successfully demonstrating a couple of other Nicho-like pipes could have a dramatic impact on the Santana project and the overall production rates achievable. We remain confident ahead of that drilling that Santana will not be defined by an operation solely based around the original Nicho pipe.

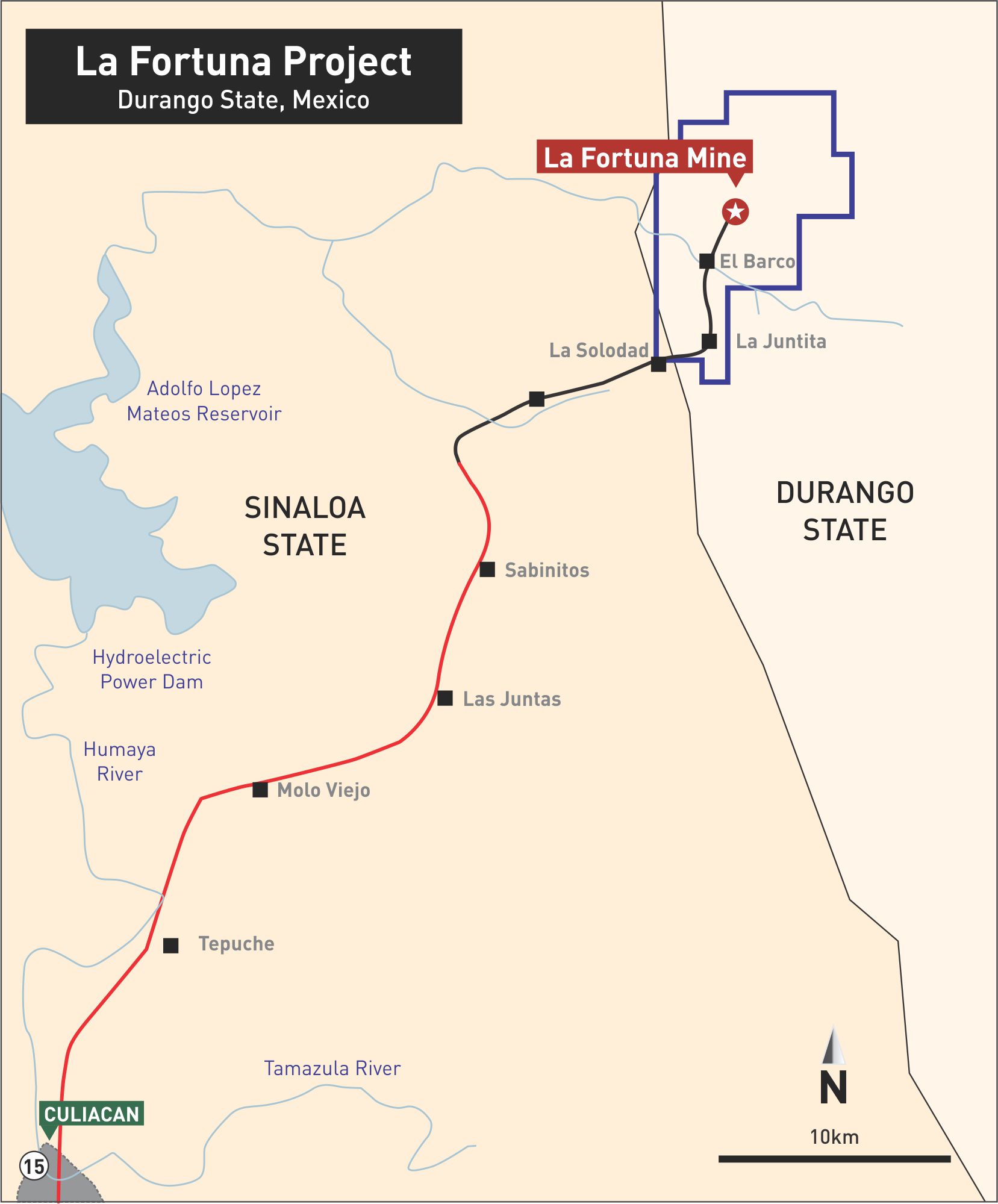

Construction at Fortuna should start towards the end of this year, which means there will be a short overlap of having two projects under construction (the end phase of Santana and the start of the Fortuna construction). Your initial capex at Fortuna is just around C$35M so it should be manageable for Minera to have a cash outflow related to two development projects at the same time considering the Fortuna financing structure will be independent from generating any revenue from Santana, correct?

I think the biggest change with Cerro de Oro being added to the pipeline is we do have some scheduling flexibility. Fortuna is more advanced right now but we are already starting engineering work and preparing for the permitting process at Cerro de Oro. No final decision has been made to shift our scheduling but it could be that we push Fortuna back a little and accelerate work at Cerro de Oro – there are many benefits in doing this, most notably if we build out two heap leaches first then those two up and running may avoid us needing to take debt on to build Fortuna. Secondly, if Fortuna was pushed back we could use that time to add resources there so we are coming out the gate with a longer initial mine life than the 5 years based purely around the higher grade starter pit defined within the Fortuna PEA.

At Fortuna, are you sticking to the existing mine plan now the gold price is about 60% higher than in your base case? It sure makes sense to start out with the high-grade starter pit, but at $2000 gold, may we assume you are considering your options to perhaps accelerate the build-out to 2,000 tonnes per day by also throwing in some lower grade rock in the mill (depending on the gold price)?

I think this is a further luxury of having a project we can move forward while adopting a plan similar to that mentioned above. While we are adding resources to the Fortuna project we can also use that time to do further optimization of the mine plan/throughput etc. We know we have a PEA that calls for an 1100 tpd throughput but a mill that has 2000 tpd capacity and with that comes a lot of options for how we approach things, especially in light of the current gold environment.

You used a cutoff grade of 1 g/t for the Fortuna resource & PEA. At what point in the gold cycle would you feel comfortable enough to have another look at Fortuna’s resources to figure out if it would make sense to (slightly) reduce the cutoff grade? Would that make any sense, or is that just wishful thinking from our part? What other possibilities do you have to take advantage of the gold price? Would more aggressive pre-strip activities in the first year of the mine life be an option you’d consider? We noticed ‘delaying stripping activities’ was a possibility to reduce costs, but is the opposite possible too?

I think a lot of new optimization work could be applied to Fortuna as it could many projects in the mining space in light of rising gold prices. We will obviously evaluate things, but the simple truth is Fortuna is an operation designed for the worst of times that should be considerably better in these improved precious metal markets. So, without saying too much I think this is one of those questions I will defer until more of the re-optimization work is done.

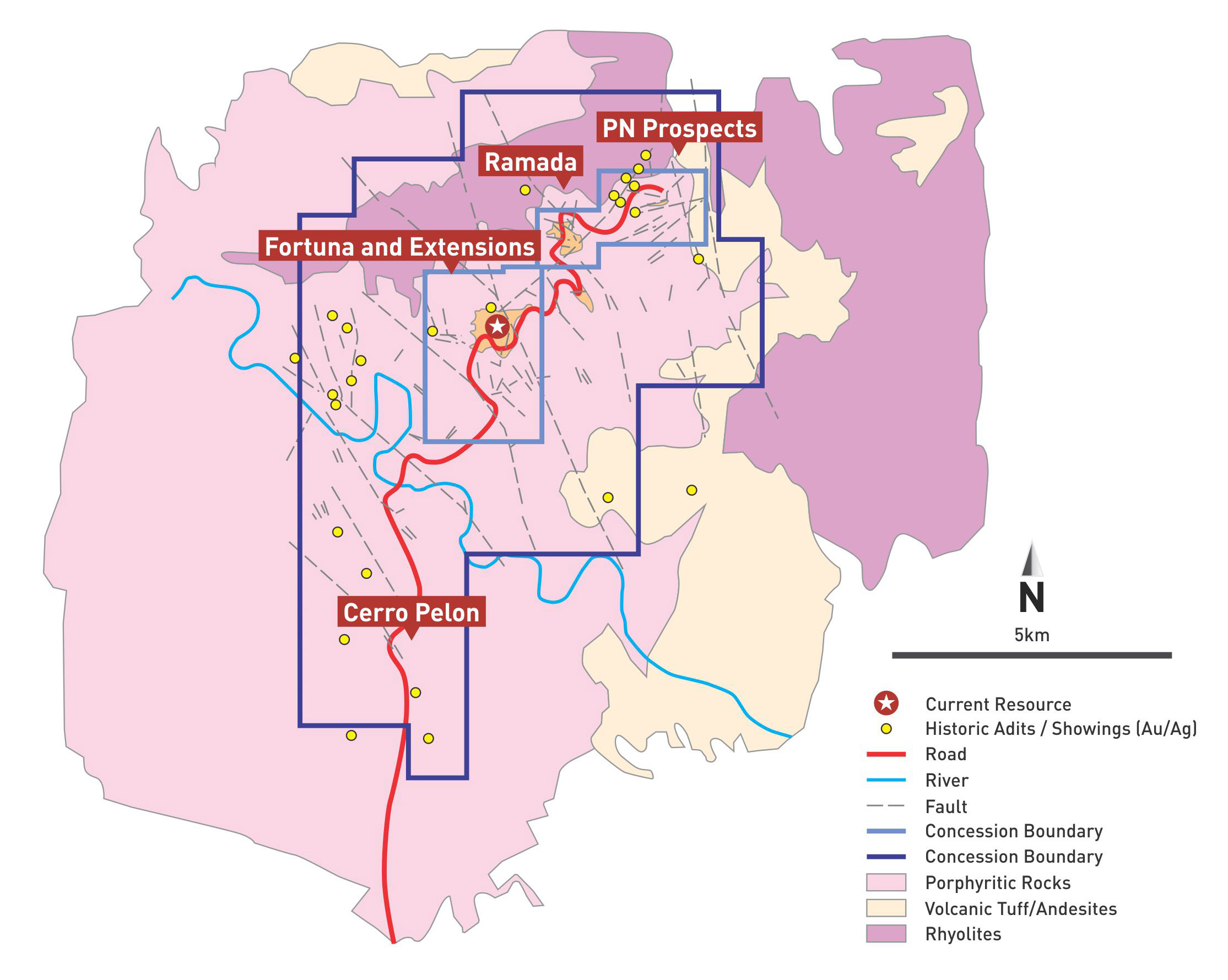

According to the Fortuna sensitivity analysis in the PEA, your after-tax NPV7.5% increases to US$115M (C$150M) at $1625 gold. Needless to say that at $2000 gold you are getting close to C$200M in NPV on Fortuna alone, and that excludes any exploration potential. Understandably, you have been focusing on Santana’s exploration potential as you’d like to go ahead with an expanded production scenario as fast as possible, but could you elaborate on where you see some exploration upside at Fortuna, and how Minera is planning to unlock that?

This is a good question because in my mind should sequencing of the two heap leach projects push Fortuna back a year in its development we could more than re-capture some of the NAV lost in a modest deferment not just from the corporate side where we may need to avoid taking on as much debt in its development but I think more importantly use that time to expand the known resource.

To me at least, it would make sense to drill off the extensions to the current pit and build resources that would allow us to start Fortuna with an 8 year plus mining life rather than the currently designed 5 year high grade pit. This could be done in parallel with the optimization studies for higher gold prices and probably involve us looking at green fields targets on the extensive land position we have around the core claims where the last work was done by our team when they owned the project in the Castle Gold days. I think what this highlights is with adding Cerro de Oro we have a multitude of ways to grow the Company and an inherent flexibility that really didn’t exist up until a few weeks ago and the CdO announcement.

Given the low capital intensity of Cerro de Oro and your desire to expand the mine life at Fortuna to 8 years from the current 5 years, your hint at potentially adding CdO in the development queue before Fortuna makes a lot of sense. The current capital raise, in combination with the cash flow from Santana Phase I could be sufficient to cover the costs associated with expanding the production at Santana and develop the second heap leach project, where after you could just use the cash flow of both mines to build Fortuna without adding debt to the balance sheet. Do you reckon that is feasible?

Quite feasible I believe should we shift sequencing. In many ways the financing mandate I asked my board of directors for $10-15m was taking such development plan in to account. We should have something close to C$23 million in cash and C$4 million in marketable securities post financing close which would be sufficient to build out Santana and Cerro de Oro given Santana should be contributed some significant cash flows in the second half of 2021 which would be used to support CdO and Santana’s own organic growth.

You also appear to be very confident in being able to get Cerro de Oro to a production decision sooner rather than later. Could you perhaps talk us through your near-term timeline for CdO and when you anticipate to make a production decision?

We are commencing engineering work as we speak and beginning the process of preparing for permit submission. Ahead of that will come community agreements that start the process in Mexico. We expect that the project can be permitted within 10-12 months of starting the process so its conceivable we could be in a position to commence construction in late Q3 or Q4 of 2021. By way of example to support these timelines in the case of Santana, even in an election year which slowed the country down for 4 months the permitting process was 14 months.

Could you briefly elaborate on the permitting process at Cerro de Oro? What would you be required to do before submitting a permit application?

Mexico does permitting the right way. You can’t even begin the Federal permitting process unless you have your social licence addressed by way of a community agreement. The region of Northern Zacatecas we are located in is a mining district, communities are a big part of the workforce and support to some of the large mines in the region. I think its fair to say they see the great benefits of the relationship with their people and the mines of the area. Our COO, Federico Alvarez typically handles these initial discussions that drive the creation of the community agreement and he does so with care and consideration and great effectiveness.

Corporate Development

You sold a bunch of Prime Mining (PRYM.V) shares to generate some cash to fund the initial Cerro de Oro payments. You now have approximately 2 million shares left which currently still have a value of around C$4M. May we assume you will be looking to monetize the remaining position over the next few months to increase your cash buffer ahead of the simultaneous Santana and Fortuna cash outflows?

We are in no hurry to liquidate our remaining shares. We have from time to time sold blocks to cover at first our sunk costs into that former project, thereafter it was to buy the crushing system that saved us many millions in replacement costs. Most recently, the sales were initiated to provide our initial minimal budgets for the Cerro de Oro acquisition. In each event, the residual value of our holdings has continued to appreciate and certainly leaves us with a very nice buffer of retained value from assigning an option that if not for that deal we would have likely dropped for zero value.

Your bought deal with National Bank was oversubscribed before the market opened (which puts investors using Vancouver brokers at a disadvantage, as we noticed when we tried to submit our expression of interest to participate) which speaks to the strong demand in the more eastern time zones, and you subsequently increased the size of the offering to C$13M. Could you comment on the size of the order book for your financing, and how likely it is you will see National Bank exercise its over-allotment option so you’d raise C$15M (with C$14M in net proceeds to you)? And now allocations have been confirmed, would you care to comment on the ratio of retail/institutionals getting into this round?

While that is fair to a point it also wasn’t my intention to make this a retail based financing. This was all about broadening institutional ownership of the Company and not taking a flurry of small retail orders. So while time zone could be perceived as being a disadvantage it had less to do with that in reality and more to do with me and my guidance to NBF on how I would like the book to be constituted. Having said that I know retail that expressed their interest through their broker to NBF and were allocated so there is a lesson here and that’s if interested then put your hand up and you may be surprised at the outcome.

The over-allotment option is an option of NBF’s as such I assume it will be exercised as we have fully allocated a book that includes the extra $2 million but it will ultimately be a decision of theirs and one I wont pre-empt. Institutional involvement was over $10 million with probably another $4 million that could be described as HNWI, Wealth Management Groups and Family Office.

In your presentation you confirm you are on the lookout for a 4th asset. It’s interesting you specifically use the number ‘4’ rather than keeping your options open. May we assume that once you reach your production phase and cash comes pouring in you would have no issues further expanding your portfolio beyond 4 to keep your pipeline filled?

For now, four simply represents an incremental pipeline move from the 3 we have and wouldn’t read too much into it. Honestly, I think a fourth project would set the table nicely and would be more than sufficient to develop and build out that cumulative production profile offered by the first 3 or 4 projects. We have a natural pace to our development schedule, and I doubt we will veer away dramatically from that. Trying to do too much too quickly is what can get companies in to trouble. The pipeline we have assembled right now can lead to a significant production profile. If there are smart ways we can add to that then we will continue to consider them. In many ways, asset number 4 just like the asset number 3, which sat in our deck un-named for over a year until CdO, is our indication that this company has built a foundation to grow and then grow some more.

Further to the previous question, how is the current situation in Mexico in terms of project acquisitions? Do valuations remain very reasonable (or just outright cheap, like Cerro de Oro), or are sellers getting a bit carried away by the current gold price?

We can continue to make smart asset level deals. I think the real strength for us is we have a team that actually wants to build a mine. So hypothetically say a project has 500-600,000 oz of gold it really doesn’t move the needle for anyone buying it and even if the vendor or another company spends a bunch of money and adds a few hundred thousand ounces, it still doesn’t really move the needle for an acquisition.

For our team 500,000 oz of gold resource, with visibility on a higher number from our own geological interpretation, is more than sufficient for us to take it on, build it, then grow it out of production cashflows. These kind of opportunities abound for us and I expect unless we suddenly have a slew of operating teams driven to build mines (which I consider unlikely) we will have a great advantage over our competition in securing the right assets.

How do you see the gold price evolve? And are you considering hedging a minimal portion of your gold production to build in some safety, or is it your intention to remain a 100% hedge-free gold producer?

I think we were set up pre-Covid to a very positive outlook for gold, however, this has likely been amplified by the economic response to the virus. I don’t really get in to too much forward looking/forecasting on where gold can go, I will leave that to way better guessers than myself. What we are doing is building a business model that isn’t predicated on needing higher gold prices but will gladly benefit from them. It is more important for me to think about building a company that can survive the bad gold markets. As for hedging, no plans, in fact the only time a hedge would even be considered is if some future debt package required a modest hedge of gold production while the debt was in place. I think shareholders should have full exposure to the upside in metal prices.

Disclosure: The author has a long position in Minera Alamos. Minera Alamos is not a sponsor of the website.