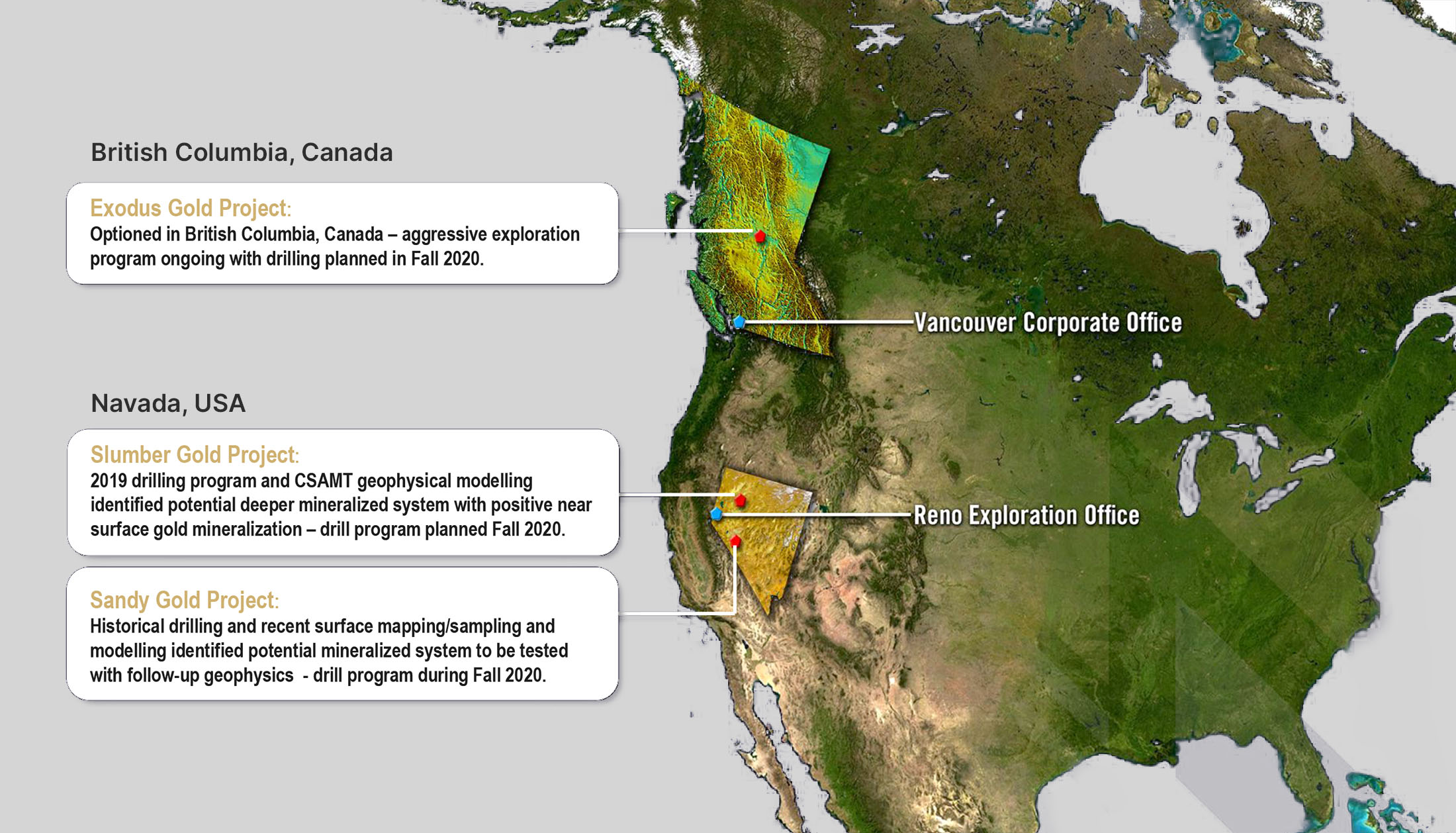

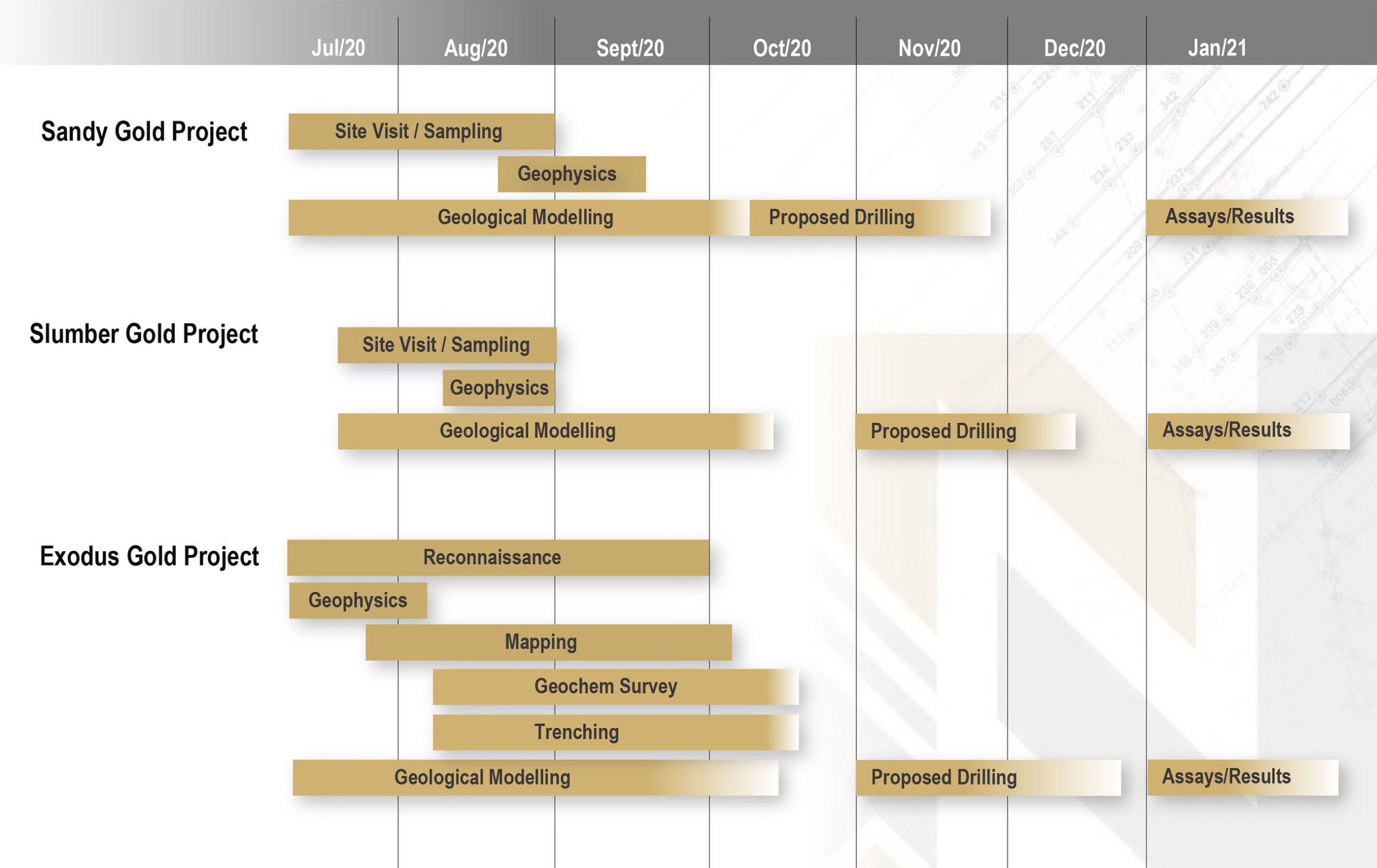

The last time we caught up with Peter Ball, President & CEO of NV Gold (NVX.V), we were zooming in on the Exodus gold property in British Columbia which the company had just acquired at that point. However, it looks like the high-impact news flow in the current quarter will be generated in the namesake state of the company: Nevada. After completing geophysical surveys on both Slumber and Sandy gold projects, NV Gold is now gearing up for a multiple drill programs starting with Sandyin October followed by a Slumber drill program in November where the CSAMT survey confirmed a juicy exploration target just a little bit deeper than where the holes in the 2019 program ended.

The CSAMT survey at Slumber has helped the company to fine-tune the target, and within the next few months, we’ll know if the exploration target indeed contains gold. The drill results from Fremont Gold (FRE.V) on its Nevada-based Griffon project were disappointing but fortunately, there’s much more to be count on in Nevada and our eyes are now on Contact Gold’s (C.V) Green Springs project for the oxide gold areas, while NV Gold’s Sandy and Slumber projects will both be drill-tested at depth for high-grade gold in sulphide mineralization in the next few weeks.

Nevada remains one of the preferred destinations for gold exploration and although the region is very well known for its historical gold and silver production, there still is much more to be discovered.

Slumber & Sandy

You recently completed two different geophysical surveys on both Slumber and Sandy. There was a CSAMT survey completed at Slumber while the Sandy gold project was subject to a magnetic, electromagnetic and radiometric survey. Could you elaborate on these different types of geophysical surveys and how they help you to define drill targets?

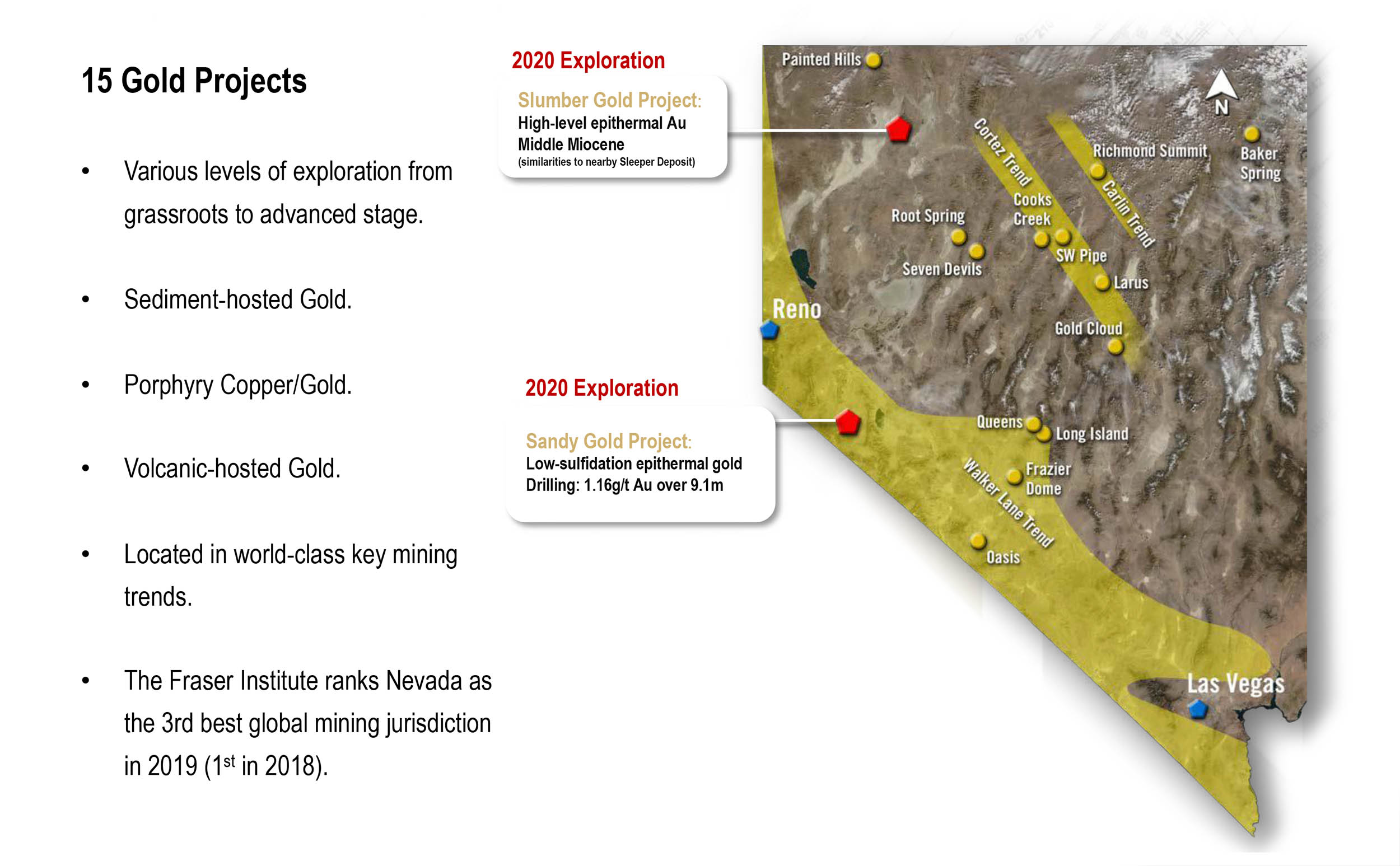

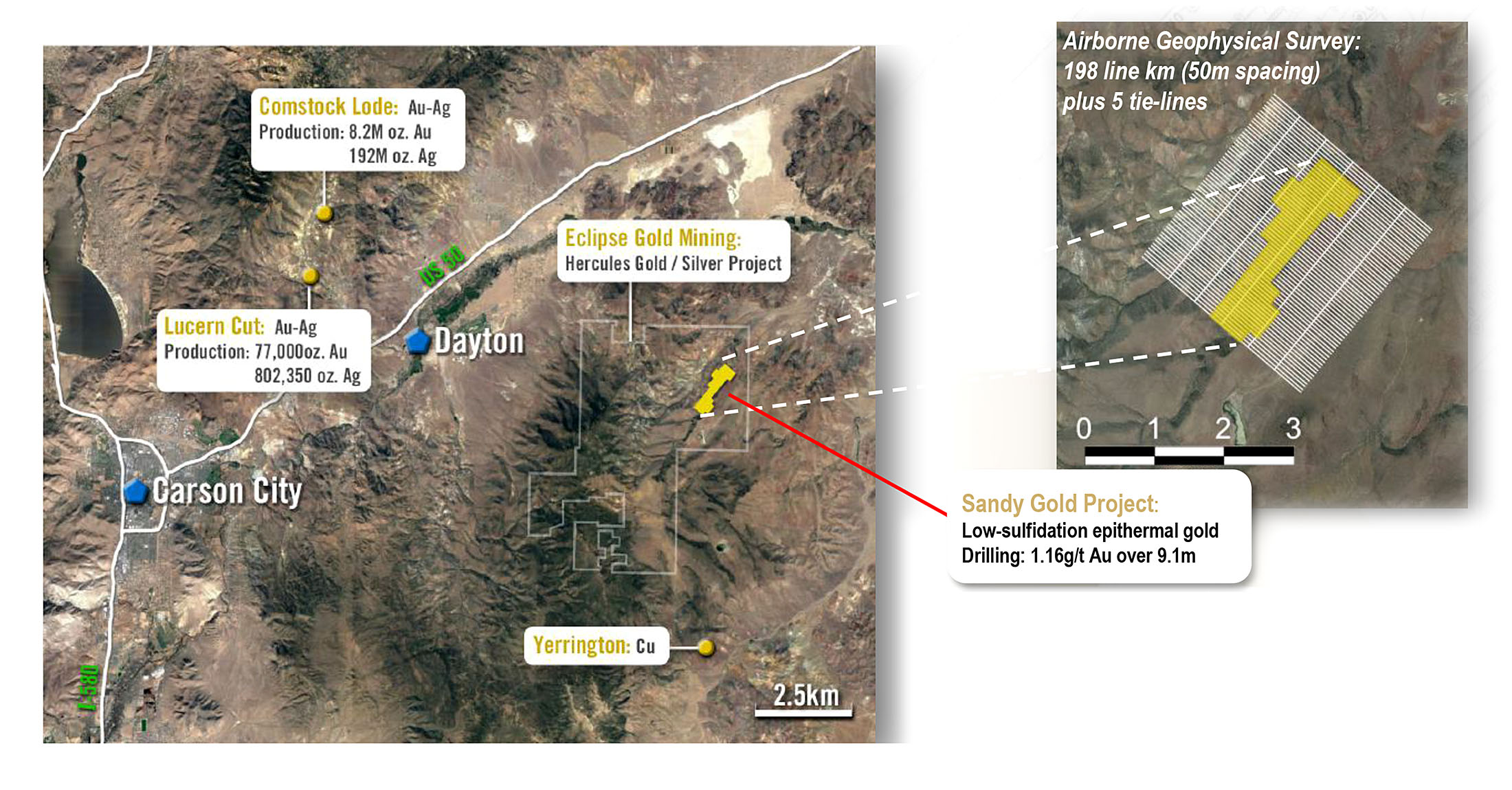

The EM/MAG geophysical survey completed at the Sandy Gold Project was used to assist in defining structures or interpreted fault liniments that would align with the identified surface structures mapped recently by our technical team. The subsurface interpreted orientation or direction of the targets could also be derived to assist the upcoming Sandy Gold Project drill program to assist in vectoring targets.

The CSAMT geophysical survey at the Slumber Gold Project was used to assist NV Gold determine more accurate vectoring of drill targets on the vertical scale by basically helping map our the subsurface hydrothermal plumbing. This basically allows targeting to be highly effective and accurate on location of the future drilling.

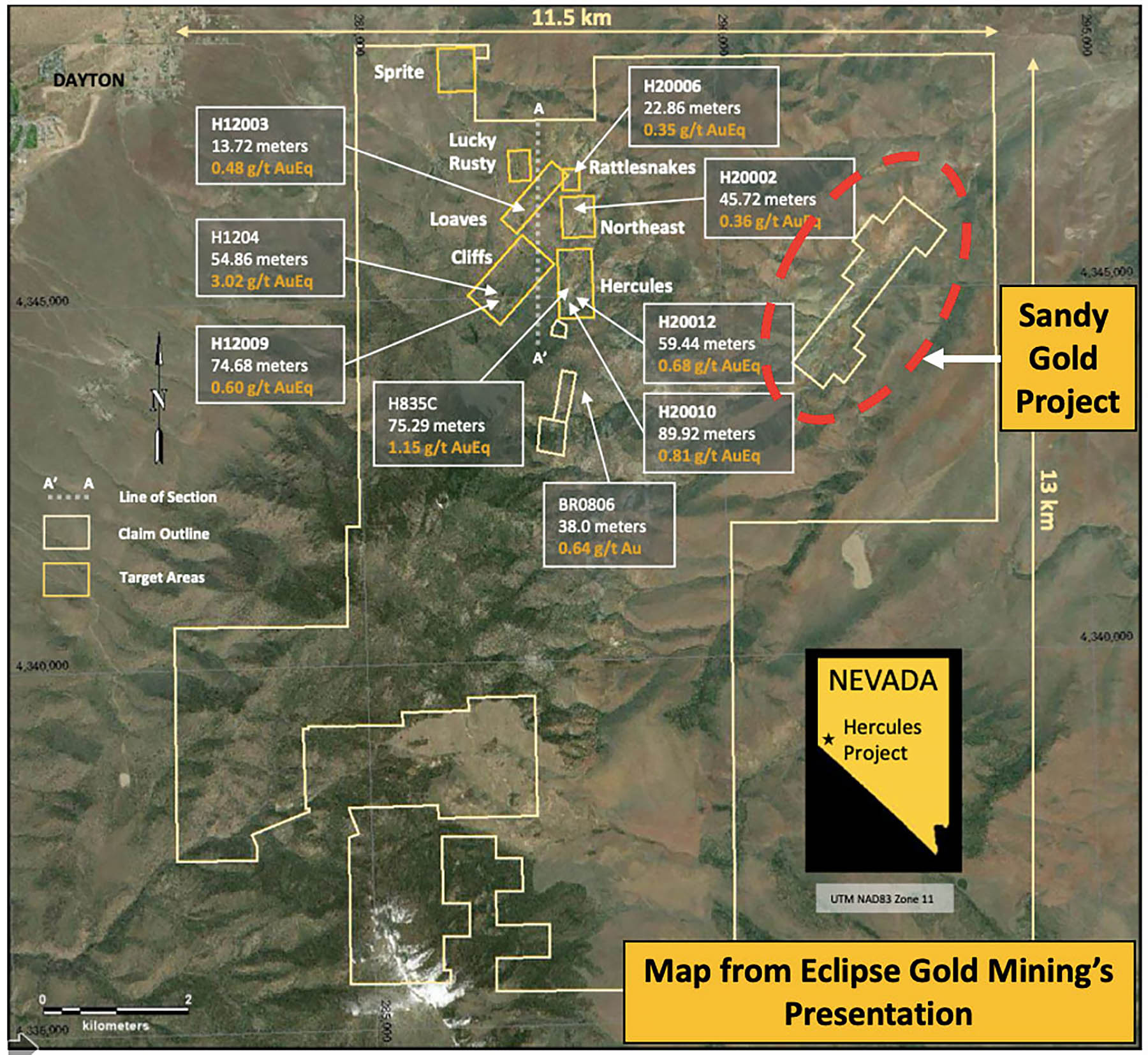

Just last week, you announced you have received the drill permits for Sandy and you are planning to drill 1,500 meters in 10 holes. Has the recent drill program conducted by Eclipse Gold (EGLD.V) which is surrounding the Sandy license been helpful for you to help define your own drill targets?

The mineralization in and around the Eclipse Gold Mining Hercules Project is classified by Eclipse as a district-wide gold system. With the Sandy Gold Project as a strategic inlier or claim block within Eclipses, and with historical positive drill results and mineralization from the 90s (including Sandy-6: 0.84 g/t Au from 45.7m to 57.9m, 1.16 g/t Au from 106.7m to 115.8m, 0.53 g/t Au from 131.1m to 140.2; Sandy-7: 0.91 g/t Au from 48.8m to 54.9m; and Sandy-10: 0.44 g/t Au from 48.8m to 54.9m), Sandy will be an exciting drill target. Anything over 0.6 g/t Au in Nevada is a positive sign as the cutoff grades for oxide mines these days is just around 0.15-0.2 g/t gold thanks to the low cost nature of heap leach operations.

Given the relatively small size of the Sandy project, would you agree it would make sense if the entire district would be consolidated? Although you will be drilling Sandy yourself, do you remain open for joint venture proposals?

The Hercules project has been around for nearly 30 years, and we understand the system and area well noting our Chairman John Watson drilled most of the holes back in the 80s/90s at Eclipse’s Hercules Project. We are always open to JV proposals at Sandy to ensure the project moves forward. It’s a great project in the middle of a district play, where Eclipse has already raised C$20M. A lot of capital is being deployed into this area.

Eclipse Gold thinks it has a tiger by its tail at its Hercules project. Is there a specific reason why NV Gold never picked up more land in the immediate area? Was it because the Sandy target was still preliminary in nature?

We found Sandy in our geological database and it cost us $2,000 to stake and own 100% of the project with no underlying NSR’s. We actually staked this project literally the day before Eclipse staked the entire valley and with limited capital for new acquisitions, we believed we acquired a strategic portion of the area for basically nothing. It now looks very interesting and we will be on the drill bit by the end of the month. We also recently completed geophysics at the project and will finalize the interpretation over the next couple weeks, but the model is slowly coming together. Also nothing better than having a neighbor spending millions of dollars immediately next to you as this highlights the potential of the entire district.

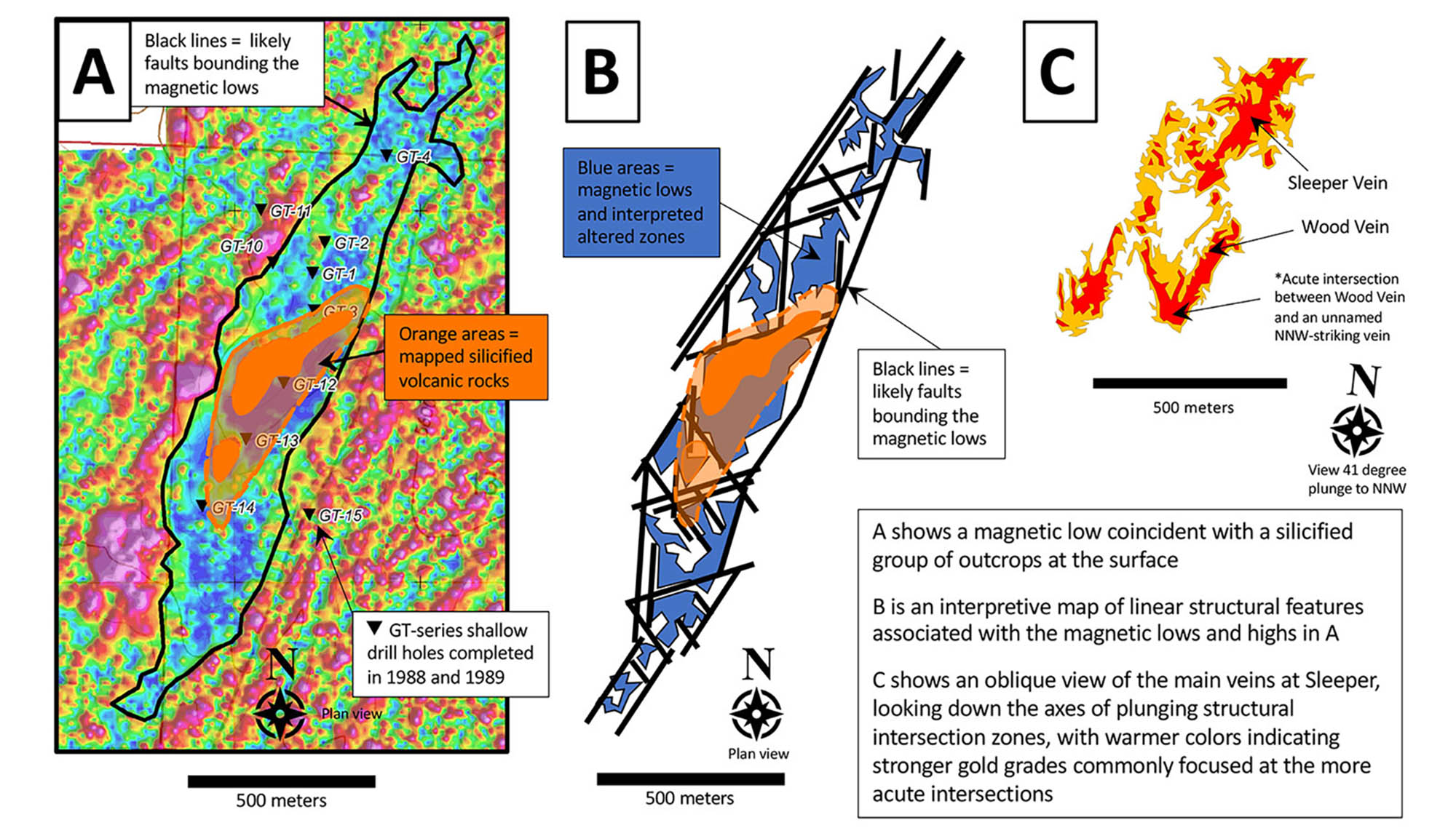

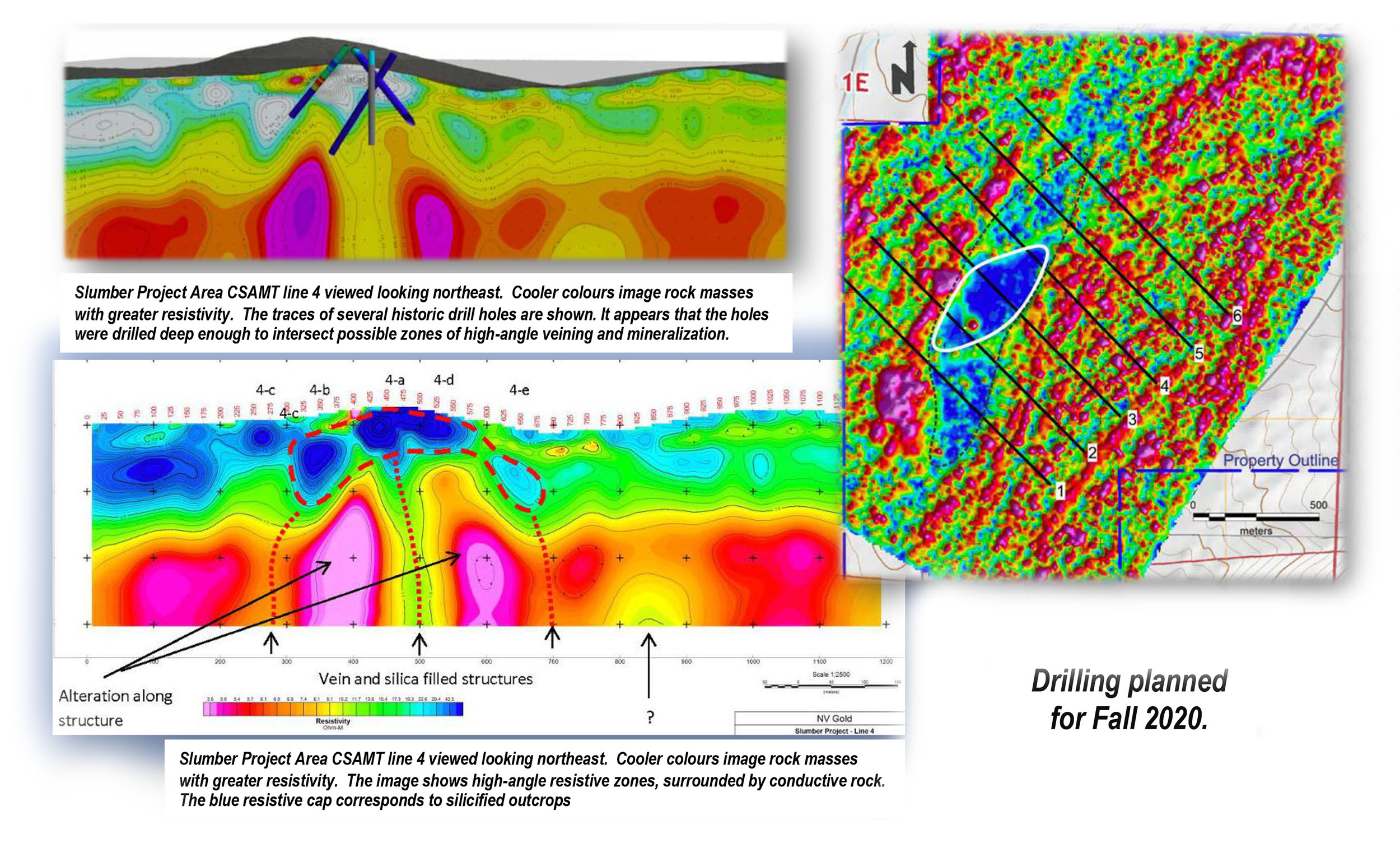

Going back to Slumber, your updated company presentation has some nice images from the CSAMT survey. Can you walk us through what the results of this survey tell you vis-à-vis the interpretation before the 2019 drill program?

Back in the nineties, Slumber was drilled after interpretation of the surface expression and geology had similar characteristics to the historical very high “bonanza” grade Sleeper mine about 21 miles to the east. Drilling confirmed low gold mineralization but interpretation even back then indicated a potential robust gold system at depth which we were targeting last year.

When NV Gold drilled Slumber in 2019 on a blind target that was identified by geophysics, anomalous mineralization was encountered over significant lengths in our holes SL-02 and SL-01, and were some 450 meters apart. This was interpreted as the presence of a large gold-bearing hydrothermal system in the sub-surface. Its characteristics exhibited similarities to several other high-grade systems in the region.

As seen below, our blind drilling but appearing to be somewhat accurate (and historical drilling) was ended too soon and the CSAMT survey appears to indicate we were close to potentially making a discovery at depth if we would have drilled a little bit deeper in some of the holes.

The CSAMT survey maps zones of resistivity high which are interpreted to reflect the presence of both structurally controlled veins and pervasive silicification within the surrounding altered volcanic rocks. Basically, the thin red lines show interpreted vertical veining (where the gold may be hosted). Any vertical high resistivity feature may be associated with quartz veins or pervasive silicification. So….we want to drill through the identified outer red layer as this may be the high-grade mineralization. Remember at the Sleeper Gold Deposit it took extensive drilling and a lot of holes to find the bonanza mineralization as they didn’t have CSAMT back then. The first few thousand tons mined at Sleeper graded 15.7 oz per ton.

The recent CSAMT geophysical survey at Slumber may just help us speed up the potential discovery to be sooner…maybe this Fall. The drill bit will tell and will be an exciting drill project in the latter parts of October and into November 2020.

You mentioned you are expediting the drill permits for Slumber, how long do you estimate this will take and how many meters/drill pads did you request approval for? And following up, how many holes do you think you will need to drill-test your exploration theory to figure out if there are higher-grade structures down there?

We have submitted our permit application and we believe we could have the approval by the end of October. Sandy took about 3 weeks, so we can assume roughly the same time frame. We have permitted for nine drill pads on an area measuring approximately 2500m to 2750m. We are looking to do 1,000 ft holes (around 300 meters), and with CSAMT we should be able to vector extremely close to the targets. As you know, Dr. Quinton Hennigh has used this very successfully at multiple other projects globally.

British Columbia

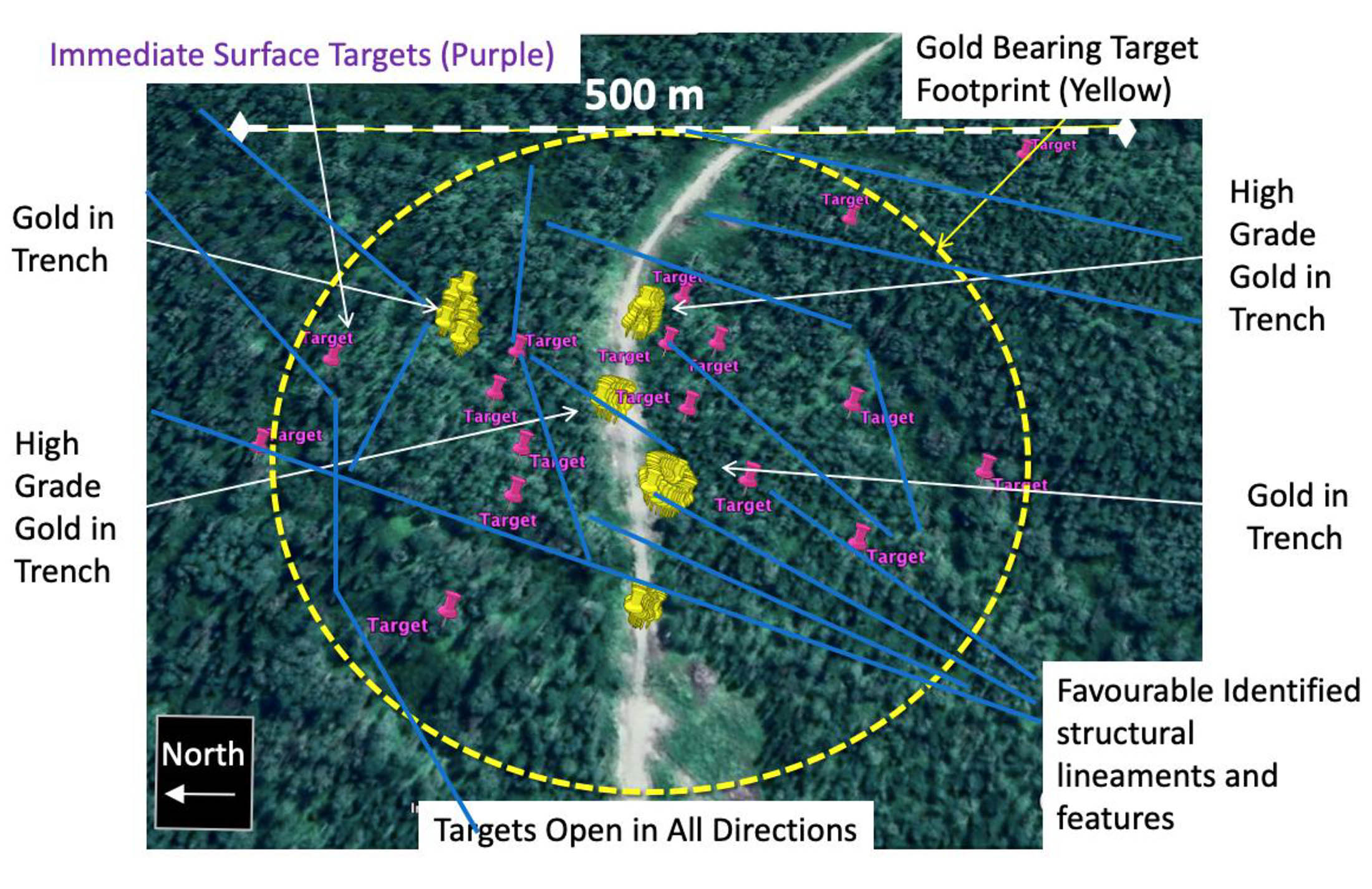

You have also had a busy summer up in British Columbia where you acquired the rights to the Exodus gold project and immediately started a summer exploration program. You conducted a sampling program on a 2 square km area, and assays are pending. Recent reports indicate the labs in BC have a serious backlog these days, do you have any idea when we may anticipate seeing some assay results?

Yes assay labs are very busy and likely later in October we will have our soil samples and channel / trench samples received and modelled for news flow.

You have already started the drill permitting process at Exodus. Do you think the project is drill-ready after this summer exploration season, or are you just proactive in securing the drill permit to make sure you won’t encounter any delays in 2021?

We are planning and based on activity to-date we anticipate pushing forward with a maiden drill program in November 2020. Again this is a brand new area chasing a discovery. Any information we can gain before heading into 2021 will assist the company in planning next years activities.

Corporate

In August, you raised about C$3M in a placement priced at C$0.32 per unit. About 1/3rd of that placement was taken up by Crescat Capital, an entity that has ties with Quinton Hennigh, one of your directors. Could you elaborate on the relationship, and what Crescat is most interested in? The Nevada assets or the new property in BC?

Crescat invested in NV Gold based on the management team and our focus to make a major discovery and as a long term shareholder who requested the right to maintain its equity interest in all future financings. We have three very interesting and different gold project all being drilled in the next few weeks and months. We also have a portfolio of drill ready gold projects in Nevada that we can drill or maybe look to lease or joint venture to new groups looking to enter Nevada. We also have an extensive database that we can generate new projects and our technical team is currently working with Goldspot Discoveries Corp. to assist in generating targets and new projects.

As of the end of May you had a working capital position of around C$1.4M. Now you have raised C$3M in August, may we assume your year-end financials (your Financial Year ends in August) will show a positive working capital position exceeding C$3-3.5M?

Yes we will have close to a $3M working capital position and no debt as at the end of August. We also have a very low burn rate when not drilling so we are well financed into 2021, even with the planned drill programs.

You currently have about 8.7M warrants that are in the money with an exercise price of $0.20 and expiring in September 2021 (4.4M warrants) and May 2022 (4.3M warrants). Are you already seeing exercises on a regular basis, or are your warrant holders patient?

We indeed have seen some warrants being exercised, and currently have about $1.7M of the $0.20 warrants in the money remaining. Our shareholders understand our model to focus 100% of our time and funds into the ground to make a major discovery and our team is known globally for the technical experience in such discoveries. Our C$0.14 financing came free trading a couple weeks ago and their support clearly showed their intent not to sell and we maintained our share price in the mid $0.30 level.

You currently have about 65M shares outstanding but only 4.85M options. Whereas most companies are issuing options to insiders and consultants as fast as they can, you still have a long way to go before you reach the maximum threshold of 10% of the share count which really sets you apart from the crowd. Could you elaborate on the option policy of NV Gold?

We do issue options to our team and consultants as required and we don’t pay board fees as other companies like to do. Our team is invested in NV Gold as our shareholders are and we manage our dilution. We don’t really have a corporate office and all work from home to minimize our cash burn to ensure we utilize our capital where our shareholders want it to be used…..drilling to make a discovery.

And finally, what’s your take on the gold market?

The gold market is a sector I grew up watching and being involved with my entire life as a fifth generation mining (53 year old) kid. Cycles come and go…. and when you are in the upswing, you must capitalize on it and move fast, but watch the funds and allocate them cautiously but focused. I listen to the street, the investors, bankers, dreamers, pessimists, optimists, newsletter friends, analysts, and execute accordingly.

The “herd mentality” is we are going to have strong market into 2021.That I believe ….beyond 2022 is where we need to listen closer and watch the treasury even more. So with three drill programs upcoming during the Fall of 2020, why not make a discovery now or 2021 and we don’t have to worry to much for the unknown in 2022. One of the Big Six Banks was just fined $128M in gold manipulation so really hard to know what really guides the price, but COVID-19, US Debt, global swings in government relations, printing paper / QE mechanisms could add a few dollars going forward to the price. I’ll leave that up to the market players, as right now NV Gold has a mission: make a significant gold discovery, minimize dilution, manage our treasury efficiently, and be accessible and transparent and communicate our extensive news flow well into 2021.

As a reminder, the 1-888-363-9883 toll free number connects directly to my cell phone. I guarantee to return all calls the same day (usually within an hour), or email me at peter@nvgoldcorp.com.

Conclusion

Although the recently acquired Exodus gold project in British Columbia is an interesting addition to the project portfolio, all eyes will very likely be on the Slumber project where NV Gold will be targeting a Sleeper 2.0 when it drill-tests the high-quality CSAMT exploration targets. But Sandy will be first, and the drill program should start soon.

Disclosure: The author has a long position in NV Gold. NV Gold is a sponsor of the website.