Callinex Mines (CNX.V) used to focus on its VMS project in Manitoba’s Flin Flon region, but the company recently closed the acquisition of no less than three zinc-focused projects at fire-sale prices. We sat down with CEO Max Porterfield to gain some more insight in these new acquisitions.

Point Leamington

In May, you acquired the Point Lemington VMS project from Newmarket Gold ( NMI.TO), which obviously wants to focus on its gold mining operations in Australia. What was the main reason for Callinex Mines to decide to look outside of your assets in Manitoba’s Flin Flon belt?

Callinex has always been focused on evaluating more advanced stage assets and as part of the process an opportunity was identified to acquire the Point Leamington Project. In early 2016, we wanted to increase our exposure to zinc given the fundamentals we were seeing, such as a primary supply-demand deficit, dwindling above ground stockpiles and a tightening market on the smelter side. At the time zinc was trading below USD$0.70 and we felt this was not representative of the long-term outlook, and the zinc market has proven us right.

The Point Leamington deposit was one that we were pursuing, along with the acquisition of two other zinc deposits, and we were able acquire all three at less than 5% dilution while providing significant leverage to the zinc market for our shareholders. On the project level, we identified opportunities to materially increase metallurgical recoveries of gold at Point Leamington which, if our thesis is confirmed, would lead to a major revaluation of the asset.

We also recognized district-scale exploration potential within the region that had previously attracted both BHP Billiton (BHP) and Inmet during the early 2000s and felt we could leverage our technical team to discover additional deposits in the area. We were particularly excited about the opportunity since there had not been any exploration drilling conducted since 2004 and that VMS deposits, such as Point Leamington, are often defined by several deposits within close proximity.

Since we started negotiating the acquisition terms the price of zinc has increased by over 30% and early work has provided encouragement that modern metallurgical advancements may be able to extract significantly more metals than identified by historic work. We believe Point Leamington is one of the better undeveloped zinc deposits within Canada and in a rising zinc price environment our shareholders will have significant upside.

The purchase price of C$515,000 and a 1% NSR looks really cheap for an advanced-stage exploration property with in excess of half a billion pounds of zinc (as well as almost half a million ounces of gold and almost 8 million ounces of silver and 130 million pounds and copper), and it looks like Callinex is now in an excellent position to benefit from increasing zinc prices.

We were fortunate to have acquired this project before the bull market resumed its pace in early 2016. This was at a time when zinc prices were at a five year low and the vendor, Newmarket Gold, was focused on its production stage assets in Australia.

One of the primary objectives for Callinex was to build a leading technical team with the ability to evaluate opportunities such as the Point Leamington Project. To this end, we have three former PDAC award winning geologists and geophysicist, in-house mining engineers, a resource modeller and a metallurgist who headed up one of the top metallurgical laboratories in Canada for nearly 15 years on the team. The contributions from everyone allowed us to identify unique opportunities associated with this project.

Can you elaborate a bit on the infrastructure surrounding the project? We notice it’s just 30 kilometers north of Highway 1. How easy is it to access the property, and how difficult would it be to for instance connect any future mine with the power grid?

Callinex has focused extensively on ensuring that its projects are located within or in close proximity to established mining jurisdictions. We believe, particularly in a bull market for zinc and gold, that assets that have potential to be advanced towards production within the current cycle will receive a premium compared to assets that may take another 10 years to be brought into production.

The project is located nearby Highway 1 as you noted and is accessible by road and trail and there is also another access route that comes within 3km to the deposit. A provincial power grid is located approximately 20km away and it is likely it could be extended along the existing road/trails, which would significantly reduce costs. Access to grid power is a tremendous benefit for the project given low power rates, which ultimately have the potential for reduced operating costs.

The nearby city of Grand Falls-Windsor has a work force that could be a source of labour, particularly because of its close proximity to Teck’s (TCK) recently closed Duck Pond Mine and Mill and several other past-producing mines.

Point Leamington has had several different operators and optionors, some of them were very well-known (Noranda, Newmont Mining, Phelps Dodge, …), do you have access to all historical data?

This is one of the real advantages for Callinex that we don’t’ typically see in the industry – exceptional data management. There is an extensive database of drilling, metallurgical work and geophysical data. In fact, after the most recent exploration drilling program in 2004 an airborne survey conducted to cover a large area of the nearby region and over 40 airborne anomalies were identified, many along strike and hosted within the same geology as the Point Leamington deposit.

These targets have never been followed up on and the raw data is proprietary to Callinex. We have recently been reviewing this data and have identified priority areas to acquire in order to establish a regional-scale land package. We believe there is a strong possibility that there are additional deposits within the area to be discovered.

When we had a first look at Falco Resources (FPC.V), we immediately identified potential improvements in the recovery of some metals as that company’s recovery rates were based on techniques from the seventies and eighties, and using modern metallurgical applications, the recovery rates were boosted quite tremendously. Do you anticipate a similar improvement at Point Leamington, as the previous metallurgical test work was completed several decades ago?

Exactly, and in fact I believe work for both projects may have been conducted at the very same facility owned by Noranda. For us, we see two major metallurgical opportunities. The first is the advancement of fine grinding techniques which is required for many VMS projects since they tend to occur in fine grained massive sulphides. The cost and ability related to fine grinding is much more economic and Trevali Mining (TV.TO) is proving this at their Caribou Mine, one that has historically been metallurgically challenged and now is in operational production with solid performance at the processing facility.

Secondly, the focus on precious metals within base metal deposits was secondary because of depressed gold prices at the time. This provided very little incentive to explore for and attempt to recover precious metals unless it occurred within the normal flow sheet. In particular, we will be investigating creating an arsenopyrite concentrate that could potentially contain a majority of gold within the deposit. Noranda recognized this potential and initial tests they conducted demonstrated that gold and arsenic did in fact have a relationship together. The method for creating an arsenopyrite concentrate has changed from the methods they used and often times deposits are amenable to creating an arsenopyrite concentrate.

These two opportunities could lead to exciting developments for our shareholders at very accretive terms. The existing mineral resource, along with regional-scale land package, could be very interesting if our work plans yield favourable results.

In the same week you announced the acquisition of Point Leamington, you also acquired two projects from Slam Exploration. Can you elaborate a bit more on both the Nash and Superjack projects?

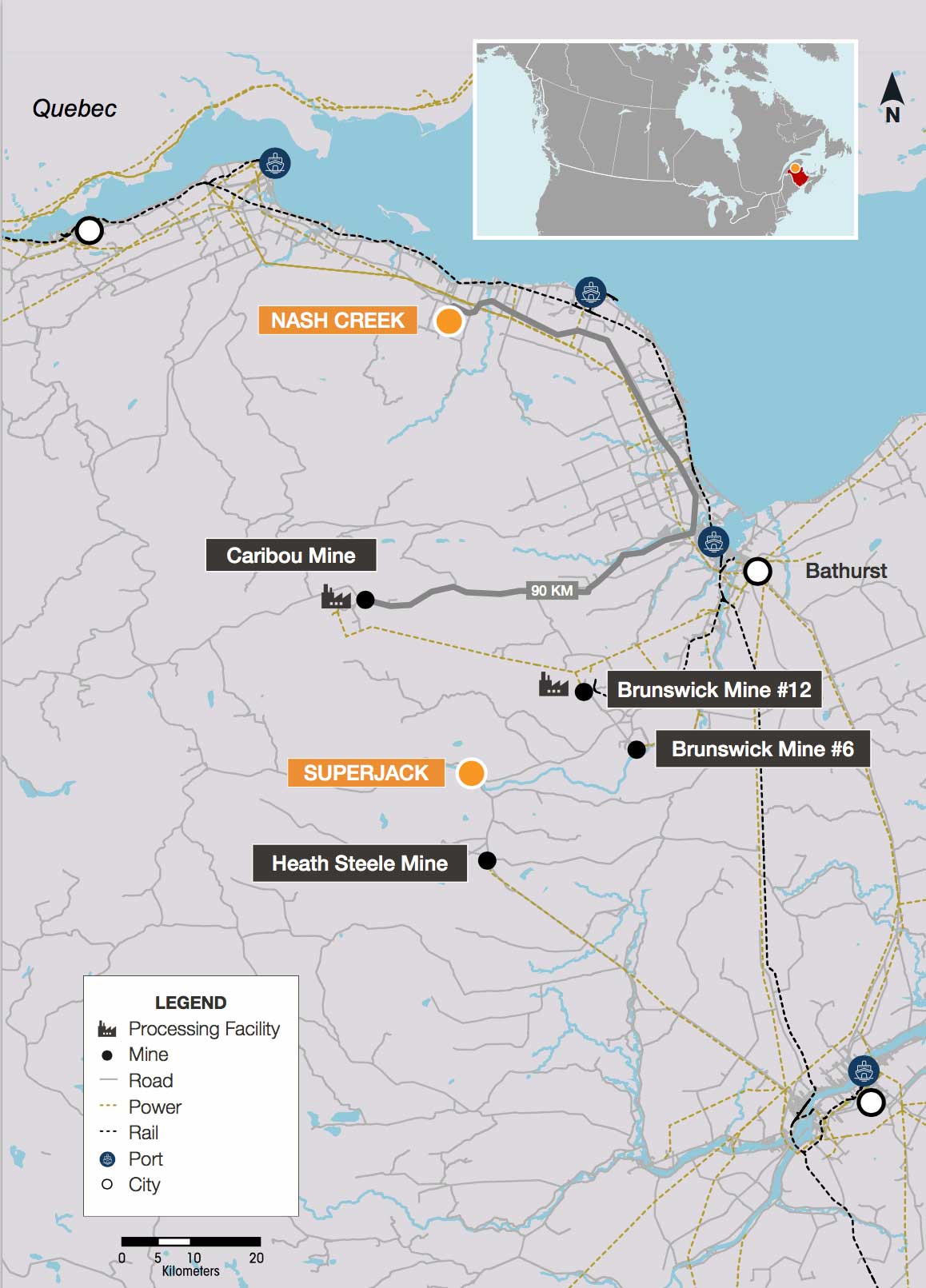

Yes, we acquired the Superjack and Nash Creek projects which both host significant mineral resources. Our exploration team was very excited about the prospects of new discoveries at the Superjack Project based on historic drilling and its geological pedigree, being just 15km away from and in the same stratigraphic package as the Brunswick No. 12 Mine, operated by Xstrata and Glencore (GLEN.L). For your readers that may be unfamiliar, the Brunswick No. 12 Mine contained over 200 million tonnes of mineralization and was one of the worlds largest zinc mines. This is truly a world-class district for zinc deposits and we are excited to have assembled this land position.

The Superjack Project has three zones, the largest of which is completely open at depth where the last drilling program intersected mineralization along an approximate 250 meter strike length. The grades are increasing grades at depth and all three of the deepest drill holes intersected between 12-18% Zn Eq. over widths up to 6m in thickness. We have recently completed a borehole survey on these previously drilled holes to evaluate the depth potential of the mineralization and will provide an update to the market in short order.

The Nash Creek Project is essentially a large option call on zinc, which helps to balance our project portfolio. We are currently updating the resource but the vast majority of mineralization is already drilled to an Indicated category. We recently provided guidance that the Indicated resource and contained metal is expected to increase from the previous estimate. In the event zinc advances to higher levels as several research firms and analysts are predicting, we think this large resource base within an established mining camp will be of significant value.

What we like most about these projects is the location. It’s not far away from Glencore’s Brunswick smelting operations in Belledune, but perhaps even more important is the fact both projects are located within trucking distance from Trevali Mining’s (TV.TO) Caribou project, which really highlights how prospective the region is you’re working in. Do you agree this provides you with the flexibility to look at both Superjack and Nash as either a standalone operation or a potential toll milling operation?

I certainly agree this provides significant optionality which has been one of the factors that has contributed to our exploration activities in the Flin Flon region. The ability to leverage existing infrastructure reduces the economic hurdles to advance a project towards production. Also, it reduces the timeline and in a situation where zinc becomes in scarce supply these are exactly the sort of assets we want to have in the portfolio.

The Bathurst camp where these projects are located, along with the Flin Flon Mining District, are, I believe, the top two VMS mining jurisdiction in the world as defined by historic production. That is, in my opinion, the definition of world-class and we believe these projects are heavily underexplored.

The Superjack project contains a high-grade near-surface core that starts at surface and increasing grades at depth could be an interesting source of future feed for the facilities, which are only 50km away by road. Additional trade-off studies will be necessary to evaluate the Nash Creek project and whether it makes sense as a satellite or standalone operation. Recent work completed at Nash Creek has confirmed that the deposit is amenable for Dense Media Separation (‘DMS’), which effectively increases the grade of the mill feed by an order of 40-173%.

As both projects have been around for quite some time as well, do you anticipate the modern mining and processing techniques might boost the potential economics of these projects?

The majority of drilling for both of these projects occurred from 2005-2011, in what many refer to as the ‘good ole days’. These assets were held by the same company, which was more recently focused on obtaining funding for its gold project – like many juniors. From that perspective, these projects offer a lot of upside.

For instance, we use borehole geophysical surveys on every hole we drill as a valuable exploration tool. This technology allows us to vector our drilling towards conductive massive sulphide material. Only very sporadic surveys were completed at the Superjack project despite the “modern” era of exploration. There were no borehole surveys completed on two of the three zones at Superjack and no surveys were completed to evaluate the potential for the mineralization to continue at depth. These are exactly the sort of situations we love to put our technical team to work on in world-class districts.

Are you still looking to add more projects to your asset portfolio? If so, would you continue to focus on zinc (and other base metals) in the same geographic region?

We are always looking for selective opportunities to advance our project portfolio. Our objective is to acquire existing deposits within established mining jurisdictions on accretive terms and ensure that the characteristics of these deposits provide superior leverage to zinc.

Of course, the simple fact Callinex is increasing its exposure to zinc doesn’t mean it has given up on its project in Manitoba’s Flin Flon region. Can you elaborate a bit more on this summer’s drill program at Sourdough? You’re planning to drill one deep hole, right?

Yes of course. We have had an +85 year history focused on the VMS exploration in the Flin Flon area and members of our Technical Team have discovered three of the four largest deposits ever found within the belt. While we are looking to leverage this expertise in additional areas as well, we are quite focused on our ongoing exploration.

Currently we are drilling a hole to test a deep borehole geophysical target at the Sourdough area of our Pine Bay Project. The anomaly is highly conductive and has size extent which, combined with a magnetic signature, is a great target to test. It also happens to occur down plunge from our Sourdough deposit and along strike from recently discovered mineralization.

We also plan to extend two previously drilled holes by Inmet and Placer Dome to maximize geophysical coverage over a prospective VMS horizon where we recently discovered our Pine Bay East Zone. This drilling will assist us in determining if these new mineralized areas have large-scale size potential.

We are certainly looking forward to results at all of our projects and excited about the prospects ahead for Callinex shareholders.

Conclusion

With the acquisition of these three zinc projects, Callinex is now ‘fighting’ on several fronts and will be able to provide news year-round. We are specifically looking forward to the metallurgical test work at Point Leamington to find out if the recovery rate for the gold can indeed be boosted, as this –combined with a zinc price of in excess of $1/lbs – could substantially improve the potential economics at this VMS project.

Callinex Mines is a sponsor of this website and we have a long position. Please read the disclaimer