As an investor, it’s always very important to make sure you don’t put all your eggs in just one basket as you would obviously want to diversify your risk. For smaller investors who don’t always have time to keep their fingers on the pulse of what could be a very volatile market, it could make sense to buy an investment vehicle but these usually are passive funds and just follow a benchmark, whilst you’d need to have a more actively managed vehicle to make sure Mr. Market doesn’t take you by surprise.

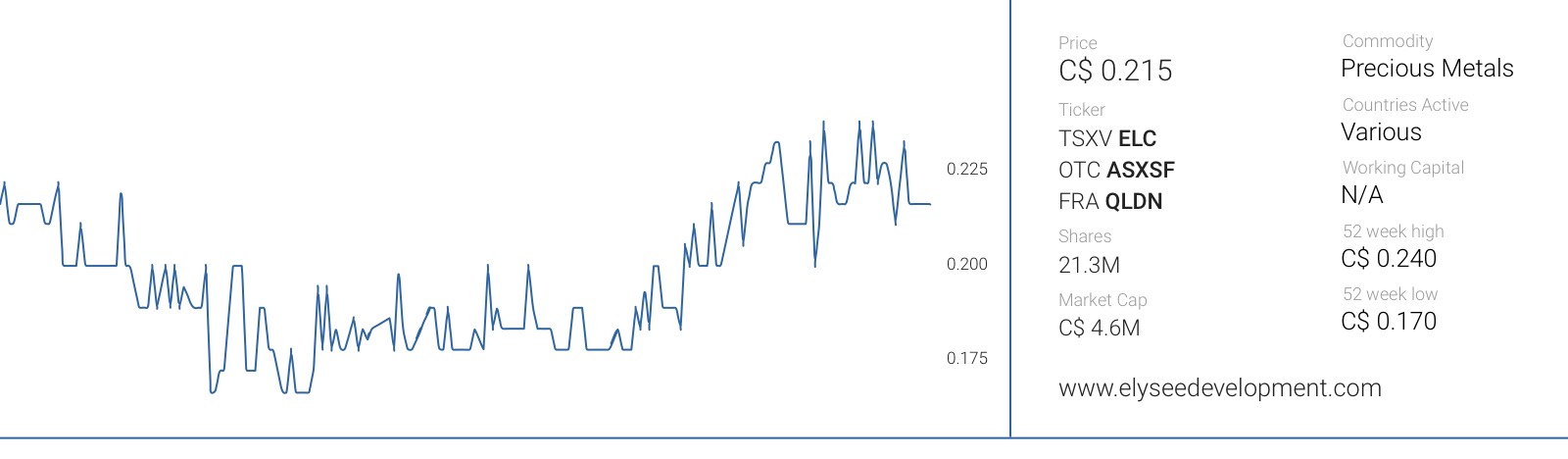

That’s when we identified Elysee Development Corp. (ELC.V) as an interesting investment opportunity. Elysee is an actively managed investment company (not a fund!) that can acquire shares or bonds in the market, participate in private placements, negotiate private deals, acquire royalties or even participate at the project level. Elysee doesn’t have to follow an index but could immediately decide to take advantage of investment opportunities.

We sat down with Guido Cloetens, Elysee’s Executive Chairman, who owns almost 25% of the company’s stock which indicates his interests are aligned with the interests of the other shareholders.

The history of Elysee Development

Guido, most shareholders will remember Elysee back from the days when it was still called Alberta Star Development (ASX.V). Perhaps you can elaborate a bit on what happened there and why you decided to get a control position in the company?

Until 2012, Alberta Star was an exploration company with a specific focus on uranium. The company raised a lot of money in the heydays of the uranium bull market and subsequently spent the majority of it searching for an economic deposit. However, with the price of uranium falling and the lack of any significant exploration success the company saw its share price fall sharply. The subsequent diversification into the oil sector wasn’t a great success either.

As a significant shareholder, I had incurred a significant loss on my investment and it goes without saying that most shareholders weren’t happy with how things were going. That’s when I decided to get involved with the company. In June of 2012 I became a director and the Executive Chairman of the company. At the same time Stuart Rogers was appointed as CEO.

What happened next?

The first action we took was to dramatically reduce the administrative expenses. If you’d look at our financial statements, our overhead expenses were less than half a million Canadian Dollar in the previous financial year, and those were further reduced to less than C$100,000 in the first quarter of this year. We really try to run a ‘lean and mean’ operation that is predominantly focusing on creating value for all shareholders.

We then assessed the value of the different assets. With the uranium market in the doldrums it quickly became obvious that the uranium leases had little value so we decided to stop all exploration expenditures and write off these assets.

We subsequently sold our interest in the loss-making oil wells in Alberta for C$1.8 million prior to the recent collapse in the energy market. The proceeds of this sale were distributed to our shareholders as a return of capital of $0.08 per share. We also started a normal course issuer bid in May of 2013. Since then the company bought back over 1.4 million shares, all at a huge discount to our Net Asset Value, which benefits the NAV/share.

It took a while before Elysee received exchange approval to convert itself into an investment company. Why is this designation so important for Elysee?

In 2013 and 2014 we looked at many options for the company. We took an in-depth look at a number of interesting properties and projects. However, after seeing what the severe bear market did to gold mining companies, we realized that it would be cheaper to invest and be involved with existing mining companies that were deeply undervalued, rather than starting with a new project from scratch and spending a lot of money in the process.

Being an investment issuer provides us with a lot of flexibility and it gave us the possibility to be involved with well managed mining companies at a discount, given the market sentiment last year. Hence, we decided to convert the company into an investment issuer.

Who are your main shareholders? What’s the total ownership of management and insiders?

I personally own approximately 23.7% of the shares outstanding. Management as a whole owns just over 27% based on the outstanding shares. I would like to point out that most of these shares were acquired on the open market at market prices, so we all have a lot of skin in this game.

In addition, Elysee is blessed with a number of long term shareholders who have been and still are very supportive of the company.

The Investment strategy

How does the company select the investments it wants to make? Can you elaborate a bit on the investment process?

The vast majority of our investments are related to the natural resource sector. Our approach is that of an opportunistic value investor. There are a number of criteria involved in the decision-making process. First, we try to determine the underlying value of a project and the amount of money that already has been invested on a project. We also look at the market it is operating in. Of particular interest is the net cash flow a company or a project could generate over time. The quality of the management is something many investors forget to look at but it is incredibly important, especially for junior companies. We look to get involved with companies where we can have an active dialogue with management. Diversification and limiting our downside risk are other factors we take into account.

What are the minimum requirements for an investment? Do you have specific return targets?

Investing in mining projects means you’re exposed to quite a bit of risk, consequently, we expect high returns. I don’t really want to pin us down on reaching specific returns but it’s obvious that we are not in this game to make modest returns. We are more ambitious than that.

According to the most recent overview of the portfolio, 2/3rd of the equity portfolio has been invested in precious metals. Will this continue to be the case going forward? Or will you allocate more funds to other commodities and oil and gas in the future?

For the time being we are heavily invested in the precious metals sector because we believe this bull market has only just started after the unbelievable sell-off that took place over the last few years. It will remain our focus for now.

However, we recently have diversified into the oil sector with an investment in Jericho Oil (JCO.V), specialty metals and other sectors. We also own sizeable positions in convertible debentures of Energy Fuels (EFR.TO) (Uranium) and Difference Capital (DCF.V) (media, technology).

Jericho Oil, a company Elysee invested in.

Does Elysee intend to be a passive shareholder, or will it take up a more active role in companies wherein it has a substantial stake?

It is not our intention to take up an activist role for the time being. We are however a supportive shareholder. That means that we try to provide assistance and advice to the companies we invest in, sometimes through industry relationships that our board members have or for instance by providing additional capital in case of a capital raise or loan.

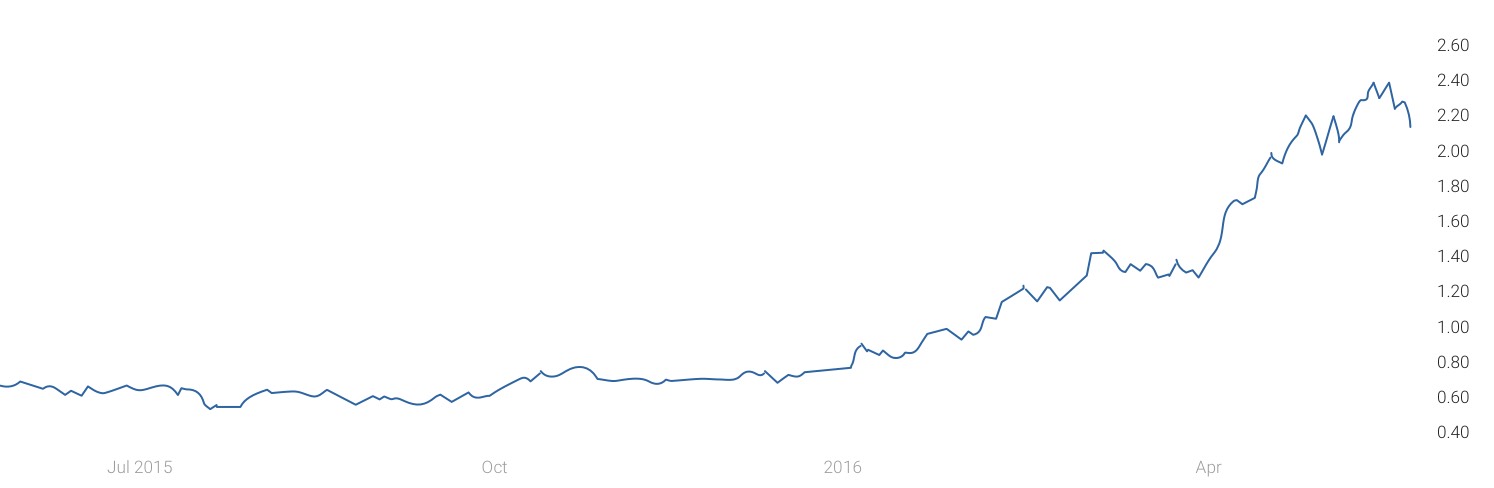

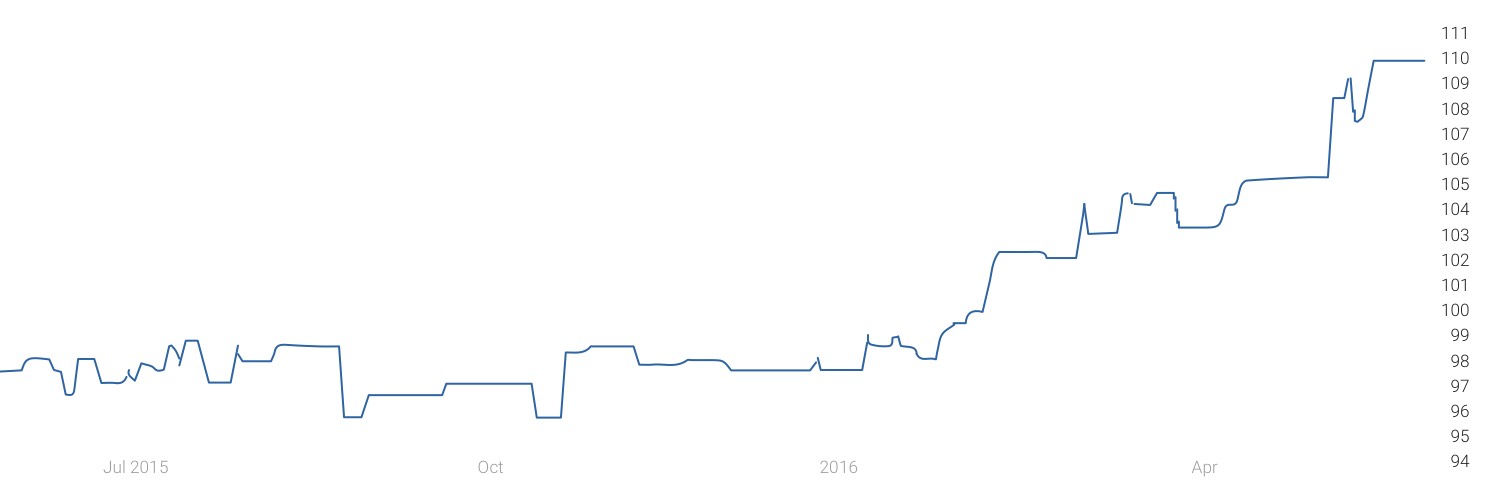

A substantial part of the total net assets has been invested in bonds. It’s our understanding the convertible debt of Newmarket Gold (NMI.TO) and Lake Shore Gold (LSG.TO) has done very well in the past few quarters. As the commodity sector is once again gaining momentum, do you think you will be able to find more undervalued convertible debt securities?

Last year, before the rally in the gold mining sector began, we selected a number of convertible debentures that we considered very interesting for a number of reasons. Back then, it was impossible to determine when the junior gold market would turn bullish again so the safe bet was to acquire convertible bonds of undervalued mining companies we liked and that were trading below face value.

There were a number of advantages: The yield to maturity of some of these bonds was very high (up to 15%), they generated a fixed income, there was an option to convert the debentures into shares and they provided downside protection to some degree. As a result we acquired bonds of Kirkland Lake Gold, Lake Shore Gold, and Newmarket Gold. We subsequently converted the bonds of Lake Shore and Newmarket Gold into shares after the fantastic rally they enjoyed. We are still holding the bonds of Kirkland Lake Gold (KGI.TO).

It has become more difficult to find interesting listed bonds of gold or silver companies but there are still other opportunities in the private bond market and there are other ways of generating income in a comparable manner.

Can you tell us a bit more about your latest investments?

Sure. We recently participated in a number of private placements. We acquired units in Focus Ventures (FCV.V), Alexco Resources (AXR.TO) and IBC Advanced Alloys (IB.V).

Focus owns 70% of a sedimentary phosphate deposit in Northern Peru and the recently updated pre-feasibility study looks very attractive especially when one takes into account that the mine life could (and very likely will) be much longer than what is shown in their most recent Pre-Feasibility Study. Demand for organic direct application phosphate fertilizers shows a long term growth pattern especially in countries where the population is growing fast.

Alexco Resources owns the Keno Hill Silver District in the Yukon which includes the high-grade Bellekeno silver mine. The mine was in operation until 2013 when operations were temporarily suspended in order to optimize operations and to adjust to low silver prices. In addition, they own a very interesting deposit called Flame & Moth. Recently the company made an extremely high grade silver discovery at Bermingham. Based on these preliminary results it’s possible that this will be a game changer for AXR. There are few primary silver producers in the world and Alexco is one of them.

IBC Advanced Alloys is the most recent addition to our portfolio. IBC is an advanced alloys and precision castings company serving a variety of industries like oil & gas, nuclear, automotive, telecommunications, aerospace and defense. The fact that IBC was able to close contracts with Lockheed Martin (LMT) to supply parts for the F-35 Joint Strike Fighter is a testimony to the engineers working at IBC.

Even though the last couple of years haven’t been easy for the company I believe there is a lot of potential there. I think the market is still underestimating the potential of IBC.

Alexco Resources, a company Elysee invested in.

Unlocking value

Elysee is trading at a huge discount to its NAV, which is approximately C$0.42 per share (based on the Q1 results). How do you intend to close this valuation gap?

One of the first measures we took when we redirected this company was to reduce our budget for Investor Relations to virtually nil. The idea was to first “clean up” the company and to build value before spending any money on promoting the stock.

We now feel that we are ready to present the company to the investor community again and that is what we will be doing over the next couple of months.

Also, don’t forget that we still have an active normal course issuer bid in place. When the discount gets too big the company buys back its own shares. It’s another way of returning money to the shareholders, as the NAV per remaining share increases.

Back in 2013 the company paid a special distribution of C$0.08 as a capital reduction, and at the end of April, Elysee paid a dividend of C$0.02 per share to its shareholders. Is paying a dividend something you’d like to do on a regular (annual) basis, or was this a one-time event?

The plan is indeed to pay a dividend on a regular basis. The payment of any dividend will depend on the results Elysee achieves. I feel that it is important to return some money to the shareholders from time to time, either by way of a dividend or through an issuer bid and as the largest shareholder of the company, I have a vested interest in making sure the shareholders are taken care of.

Outlook

Finally, what are your expectations for Elysee for the rest of the year?

The year started off well for Elysee and while no one can say for sure I believe the rally in precious metal stocks still has plenty of room to run. However, in the short term it would be very healthy and even desirable if the market would consolidate for a while. We are actively managing our portfolio and with our cash position of C$2M+, we are ready to deploy more funds when we see excellent opportunities in the market.

Conclusion

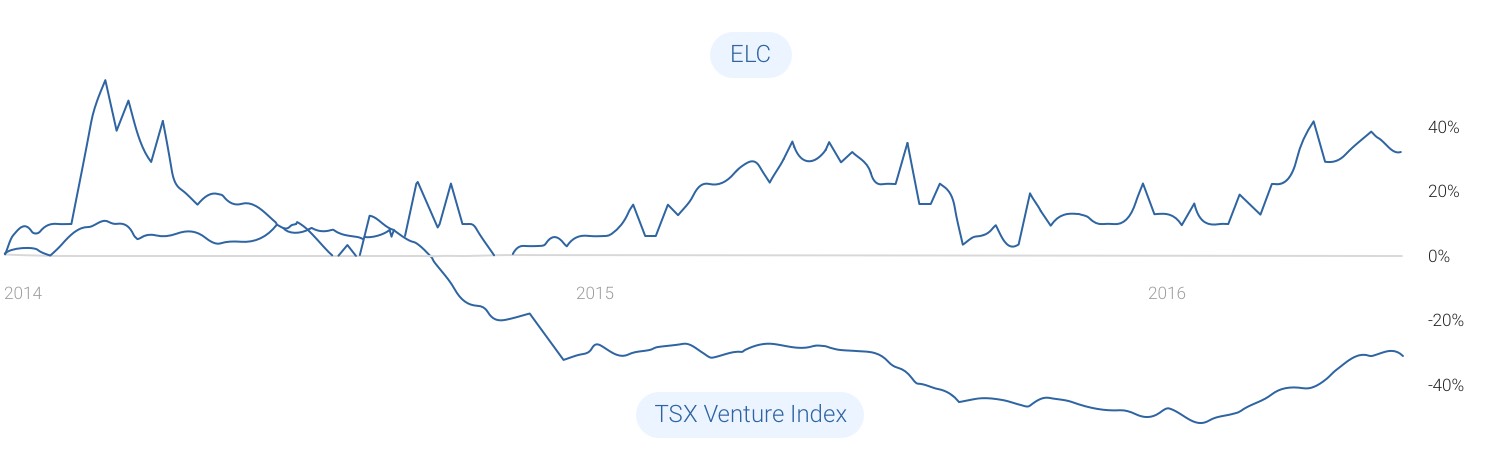

It doesn’t happen very often to see an investment issuer with a very low overhead cost where the interest of the management is completely aligned with the interest of the normal shareholders. Elysee aims to continue to pay a dividend (the yield based on the FY 2015 dividend was 9%!) whilst increasing its asset base.

By buying stock of Elysee Development, you’re basically buying a basket of cash and existing investments in stock and bonds for 52 cents on the dollar. It’s an excellent way to add additional diversification to your portfolio and let someone else do the heavy lifting for you.

Disclosure: The author currently has no position in Elysee Development (yet), but has a long position in Focus Ventures and Jericho Oil. Elysee Development, Focus Ventures and Jericho Oil are sponsors of the website.. Please read the disclaimer