The Firefox Gold (FFOX.V) share price has been on a tear lately as the share price moved up by in excess of 50% without any apparent reason. Is the market waking up the fact it’s working on some very prospective licenses in the Central Lapland Greenstone Belt where for instance Rupert Resources (RUP.V) has enjoyed tremendous exploration success this summer?

Whereas the share price reached an all-time low of just C$0.035/share in March when the COVID-19 pandemic caused a standstill of the entire world economy, it reached a high of C$0.325 just last week, an increase of more than 800% from the lows this year. Not only did the share price move higher, Firefox also raised money along the way and its net cash position is currently almost twice as high as its market capitalization back in March.

A phenomenal comeback and as the winter drill program is in full swing, we caught up with CEO Carl Löfberg to discuss the progress in Finland.

Sitting down with Carl Löfberg

You have recently started a drill program on both the Mustajarvi and the Jeesio areas, could you elaborate a bit on what you are planning to prove up there?

This drill program is part of the 2020 fall-winter drill campaign that is expected to include up to 1,400 metres of drilling to test new targets at Mustajärvi followed by approximately 400 metres of reconnaissance drilling at the Jeesiö Gold Project (“Jeesiö”), located approximately 40 kilometres to the southeast.

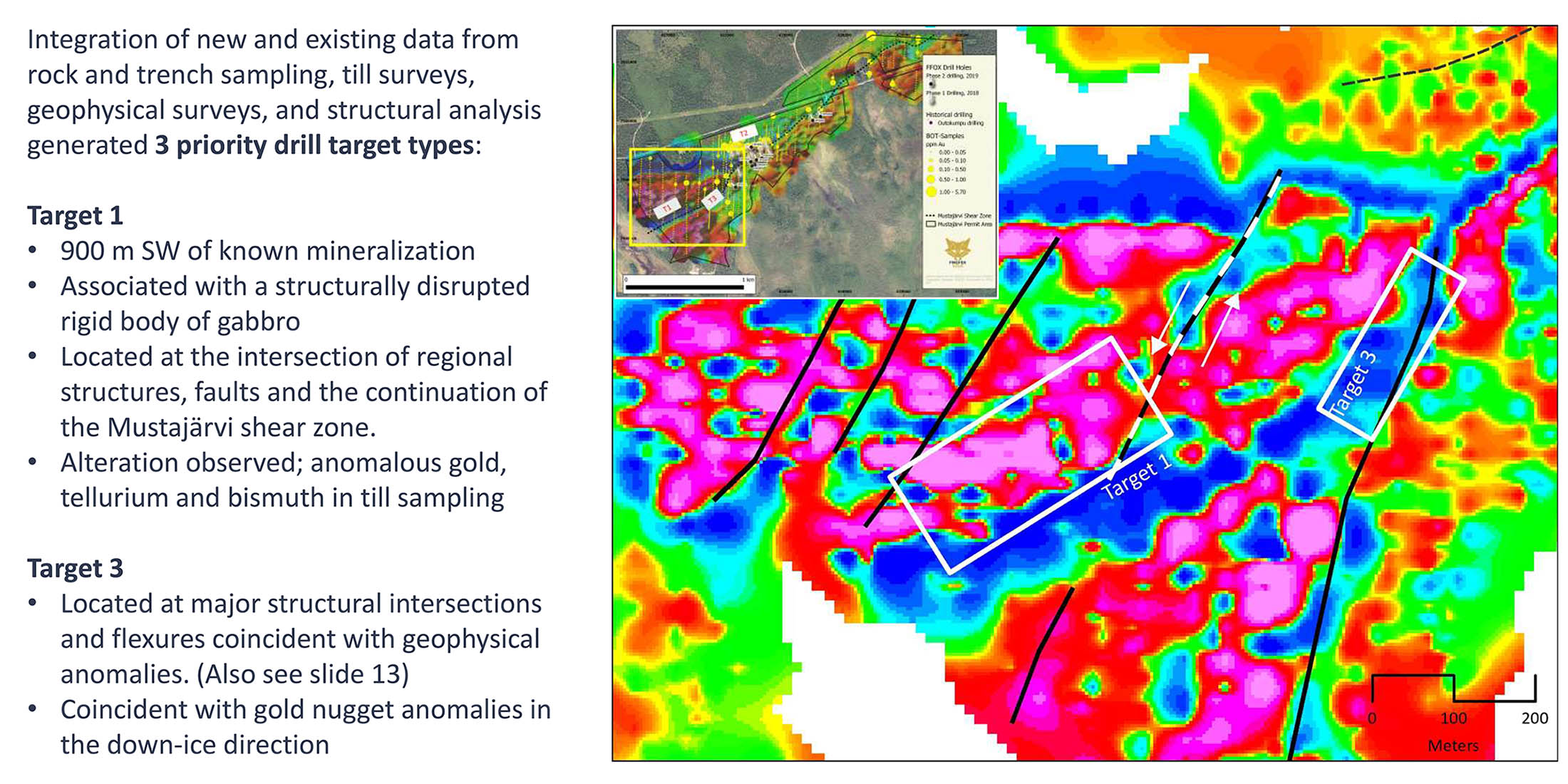

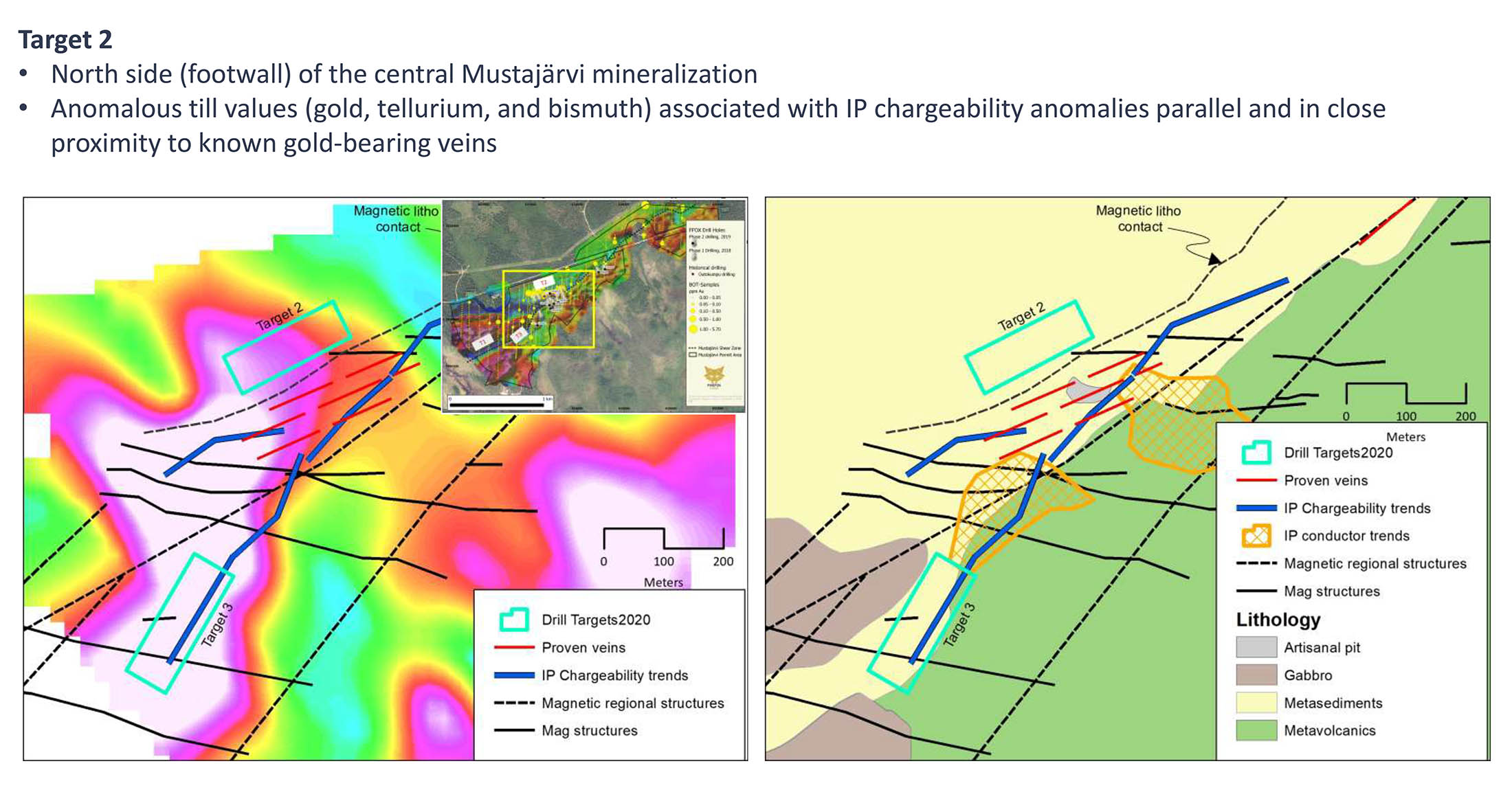

At Mustajärvi FireFox’s summer 2020 program integrated new and existing data from rock and trench sampling, till surveys, geophysical surveys, and structural analysis. At Mustajärvi, this process generated three types of priority drill targets:– Continuation of chargeability anomalies into metasediments north of known mineralization;

– Major structural intersections and flexures coincident with geophysical anomalies; and

– Structurally disrupted rigid bodies with alteration as well as gold and geochemical anomalies in till.

These targets are described more in detail in our presentation on slides 12 and 13 (see below).

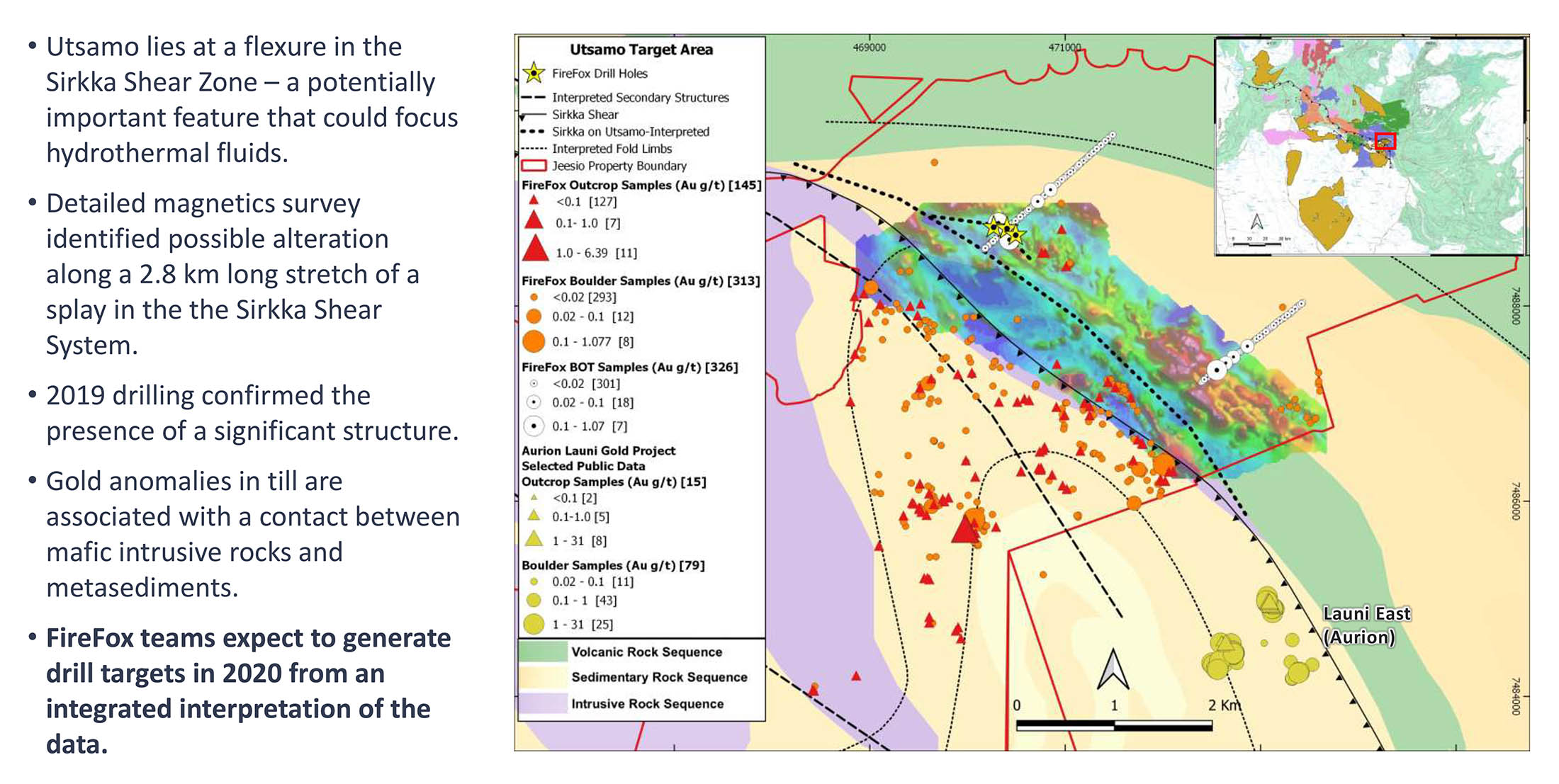

The reconnaissance drill program in Jeesiö is planned to include up to 400 metres in 3 to 4 drill holes in targets at Utsamo, near the Sirkka Shear Zone. Much of the Utsamo area is covered by swamps and thicker glacial deposits, and FireFox plans to conduct base-of-till (BOT) sampling in that area later in the winter. On higher ground to the south, FireFox geologists collected gold-bearing quartz vein samples during 2019 and 2020 in an area that will be the subject of this modest reconnaissance drilling program. The holes planned in this structurally complex area are based on new information from the 2020 UAV magnetics survey integrated with the regional electromagnetics and rock sampling data. The team has interpreted a large-scale fold in the area that hosts Aurion’s Launi gold-bearing quartz veins on the eastern limb and is cut by late faults that appear to control anomalous gold samples collected on the FireFox ground.

We noticed you are using two different drill contractors for Mustajarvi/Jeesio (Kati Drilling) and the second follow-up program at Jeesio where you will launch a combined BOT and diamond drill program (Taratest). Is there a specific reason to use a different drill contractor?

Kati does not have BOT rigs. The BOT subcontracting market is very limited in Lapland and we wanted to bring in Taratest, and well-established company in southern Finland, who our board member Timo Mäki knows well.

Taratest has drilled in the Pyhäsalmi mine in central Finland, back in the days, when Timo was head geologist at Pyhäsalmi mine. I have been ice dipping with the CEO of Taratest, Tero Mäkinen, and I am confident we will have an excellent program with Taratest as we did with Kati, the number one diamond drill company in Finland. Taratest diamond drill rigs can also reach depths of 200 meters, which we think could be useful in Greenfields exploration.

Let’s discuss the Jeesio Bottom of Till program for a minute. Is the additional BOT program expected to define new drill targets in other areas than where your small reconnaissance drill program will be focusing on? What is the purpose of doing some recon drilling at the Utsamo first, only to follow up on it with a BOT program later on?

The recon drilling is on higher ground close to the Launi border. A significant part of the BOT drilling is on swampy areas which can only be accessed in the winter, when everything is frozen. The overall Utsamo area is big, with several different targets. The BOT program could give us new drill targets on swampy areas which we could then diamond drill with Taratest’s rigs or Kati’s more robust rigs in the March-April drill program.

You recently announced you were able to add two licenses to your already extensive portfolio, Keulakko and Lehto2. Could you perhaps briefly explain why these two properties were of interest to you?

These are key areas next to our Sarvi tenement application only 3km from Rupert’s Ikkari discovery and Lehto2 is and expansion of the Lehto tenement application also relatively close to Ikkari.

And perhaps a follow-up question on Keulakko and Lehto2, do you have any idea why these licenses were still available, despite the spotlights having been on the Central Lapland Greenstone Belt this year? Is there a specific reason you were able to scoop up the ground before anyone else does?

The areas are relatively small, as they are just a few square kilometers in size. I believe that Major companies see them as too small for a multi million dollar projects, even though they might be prospective, and other juniors see them possibly as distraction from their main projects. To us they are expansion of our existing projects and fit well with our strategy.

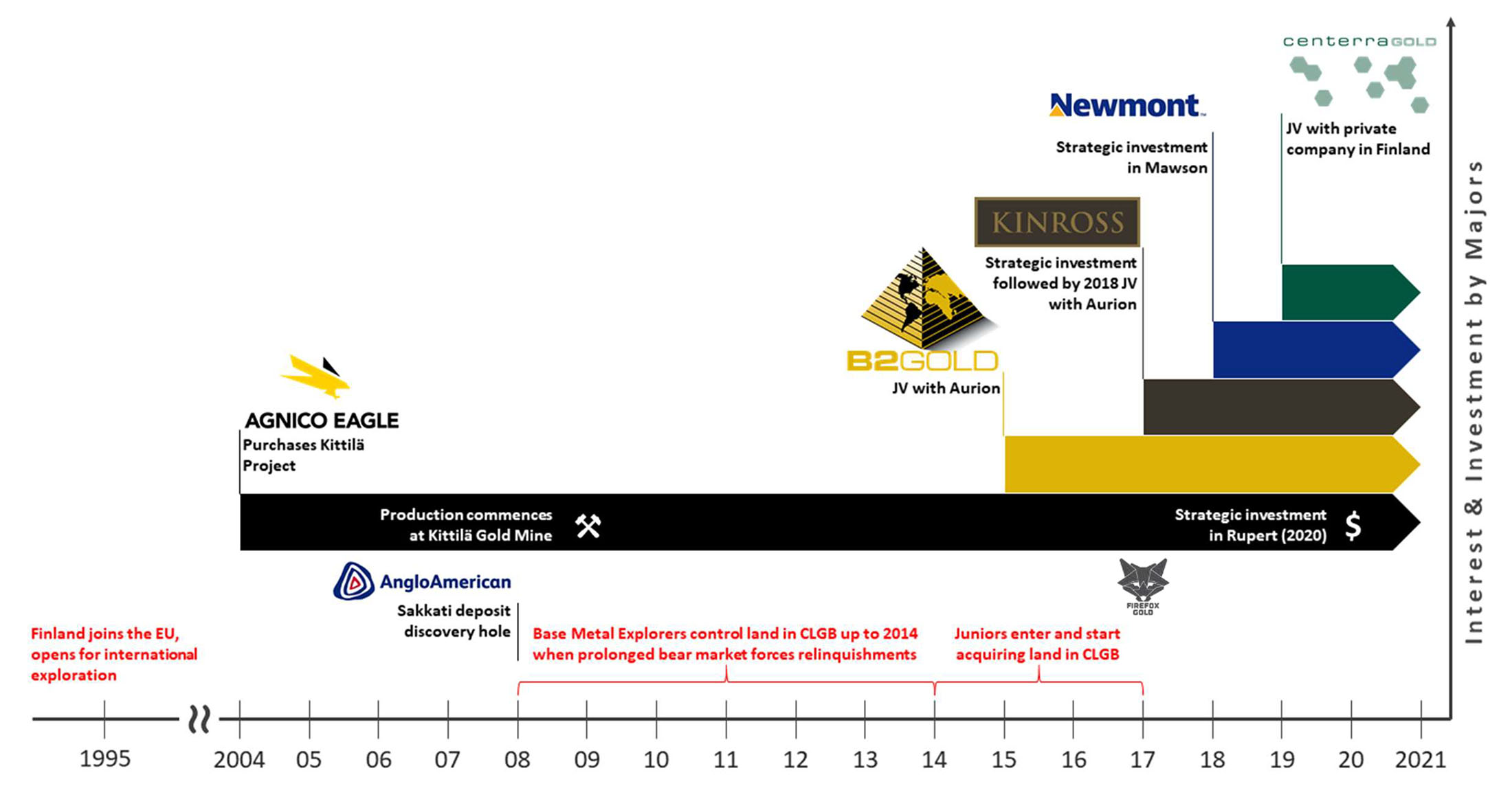

We hear plenty of news flow from your neighbour Rupert Resources, but larger companies in the region like Agnico Eagle and B2Gold obviously don’t have to report on their exploration activities as those will be non-material for them. But do you have any insight on how and what the big boys are doing in Lapland? Are they actively exploring greenfields targets, or are they leaning back to see what the different exploration companies can accomplish?

Both Agnico and B2Gold should have decent exploration budgets and are active to my knowledge.

The financial situation

You raised a few hundred thousand dollars during the darkest days in April, but have subsequently successfully closed larger raises. You raised C$2M in June/July followed by an additional C$2.14M priced at C$0.18/share and this means you’re probably still sitting on C$3.5-4M in working capital, a very comfortable position to be in. Will your cashed-up situation result in accelerating your plans for 2021?

The financings this summer have gone as planned. We have a clear exploration path for the following 18 months with a Kati diamond drill rig reserved for the whole next winter 2021-2022. Naturally, Kati will also drill later this winter in March-April.

We use our cash resources effectively and in a systematic manner. No need to speed things up. I am excited about this winter but even more excited about next winter. The market does not necessarily want to hear this; being excited about next winter as the market mainly seem to care about short-term catalysts, but let’s not forget this is a multi year business, whether you like it or not. We are well prepared and know what we are doing. We don’t even know all the drill target for this winter but we are simultaneously partially planning for the winter of 2021-2022. I feel that you should plan for many different time horizons, as we are doing.

Do you think the recent drill success of Rupert Resources has helped to get more eyeballs on your company?

To some extent yes, but I feel that Rupert and Aurion are now known to many, FFOX not so much. I believe that things will be quite different after this winter after an decent exploration program. We have targets to drill-test for years to come.

You currently have 7.5M warrants at 0.15, 5.6M warrants at 0.08 and 10M warrants at 0.12 that are currently in the money or at the money (this excludes the almost 6M warrants at C$0.27 as part of your October placement). Should these all be exercised, you’d see a total cash inflow of C$2.7M. Are you counting on warrant exercises to replenish your cash position? Do any of the warrants have acceleration provisions?

The warrants don’t have acceleration provisions. I believe that effectively all warrants should be exercised.

Corporate

How important has the input of GoldSpot Discoveries (SPOT.V) been so far?

They complement our team. Sven Hönig from GoldSpot knows our Exploration Manager Petri Peltonen from a few years ago. It has been good to work with them as well, but Petri and Timo have more than a generation on knowledge of Finnish rocks. The overall team in GoldSpot with many talented geophysicists and chemists have been good and as said they compliment our team. The co-operation could be for a longer time as it has worked out well, so far.

You recently added Quinton Hennigh to the technical advisory board. Was this a request from Crescat Capital?

No. Crescat got involved based on Quinton’s recommendation. Quinton and our Chairman Patrick Highsmith have been friends for about 20 years.

The Rupert discoveries have obviously re-kindled the interest in the Central Lapland Greenstone Belt. Do you have the impression investors are looking at Firefox Gold and its C$20M market capitalization as a ‘nearology’ play?

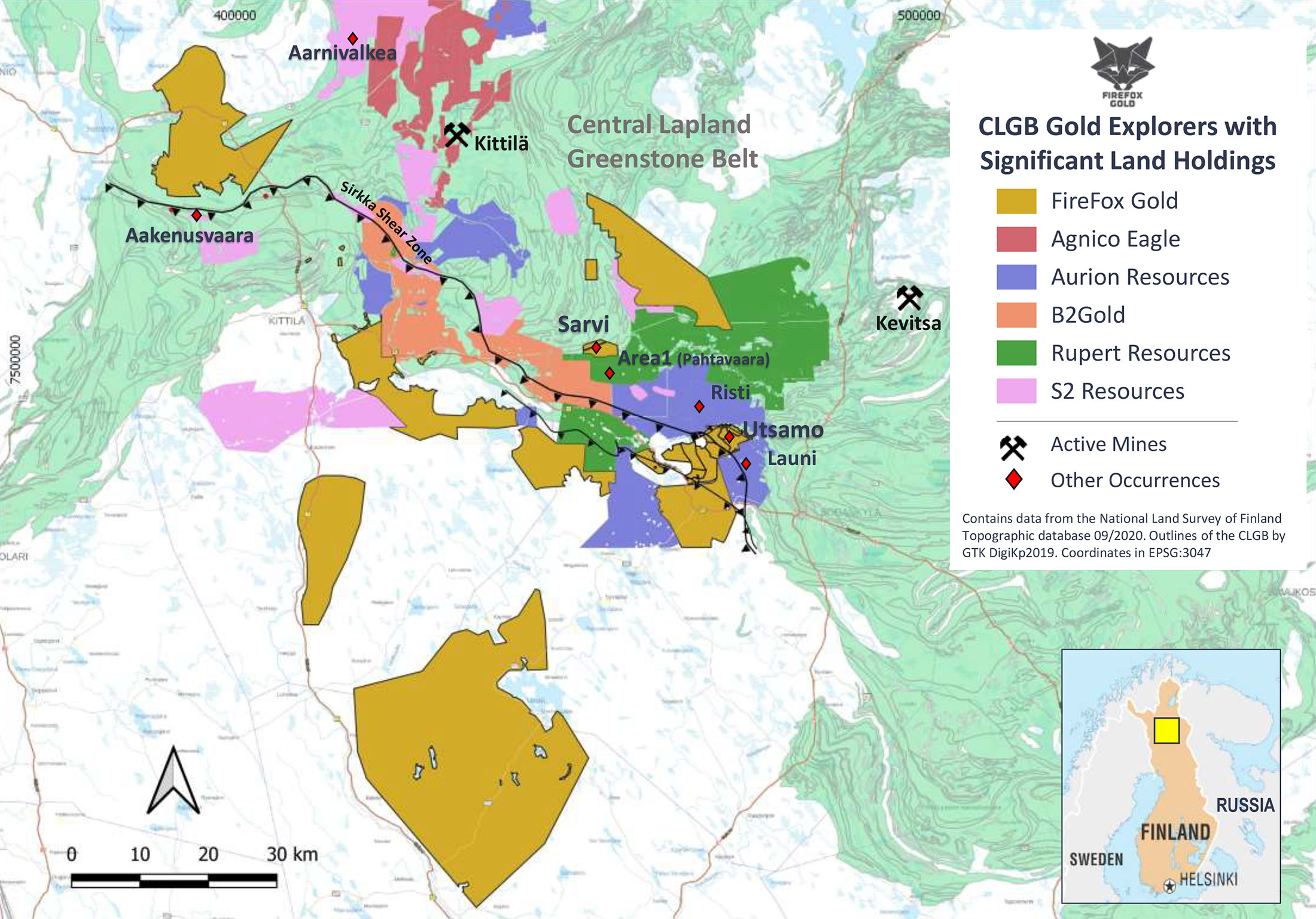

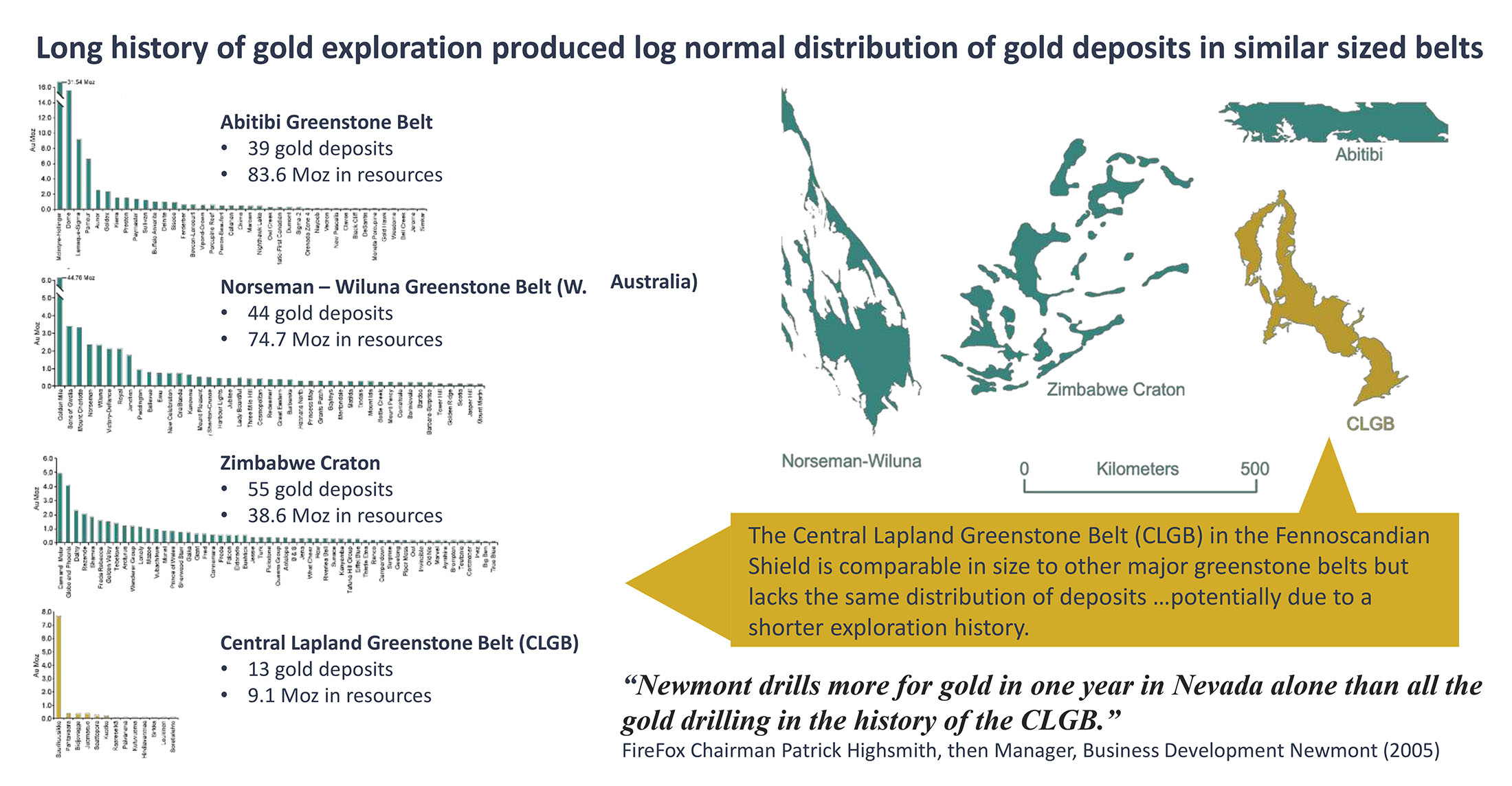

If one looks at slide 8 in our presentation (see below) to me it is just a question of time when the third, fourth, fifth and sixth major gold discovery is going to be made in CLGB (Kittila and Ikkari being the two first genuine discoveries). It’s a game of patience but the two other juniors have seen share price go up more than 100x in the past 6 years (Aurion and Rupert, which even increased by a factor of 250). To me it is more or less binary, as can be quite clearly seen from Rupert’s price performance this year alone. (From less than C$100M in Q1 to over C$1B in Q4.)

Do you expect to see more consolidation in the area where for instance the number of junior exploration companies decrease from the 4 (?) that are currently active?

As far as I have understood S2 Resources (S2R.AX) is focusing on Australia at the moment and not that active at least with new acquisition in Finland. For the rest (Rupert, Aurion, FFOX) if you take a look from a 6-year perspective I believe that the juniors will have one or more serious take-over bids from Majors. So yes, I believe there will be consolidation if the juniors are willing to be bought out.

It will be a great decade for all gold juniors in Lapland in my opinion. A number of majors with limited land position or only JV’s still in Finland who have just entered Finland a few years ago. To me it means more consolidation. Or at least consolidation attempts.

Conclusion

Drills are turning in Lapland and Firefox should be able to release a first batch of assay results in December while the assay results from the last few holes likely won’t be ready before January. Firefox did an excellent job of tapping the equity markets when financing windows opened and as the company is a careful spender, the current cash position will go a long way.

Additionally, the strong share price will likely also result in participants in previous financings starting to exercise warrants and this will be a tremendous help to Firefox to replenish the treasury. The existing cash position should be sufficient to last well into 2022 and we expect any future financing by Firefox to be accretive (either at good terms and/or having an important strategic investor) as the company has zero need to raise more cash now.

Rupert Resources and Aurion Resources have been leading the way in Lapland, and with the drill rigs now turning, let’s hope Firefox can follow suit!

Disclosure: Firefox Gold is a sponsor of the website. The author has a long position in Firefox Gold but has sold shares in the past two weeks with the intent to exercise warrants. Please read our disclaimer.