Aben Resources (ABN.V) wanted to be the first company to release assay results from a drill program in the Golden Triangle this year. Unfortunately GT Gold was one day earlier, but the drill results released by Aben Resources yesterday were much better as the very first hole intersected no less than four (!) layers of high-grade gold mineralization within 125 meters from surface. A barnbuster hole.

The assay results of the first hole are exceptional

Although we were hopeful Aben Resources would immediately follow up on the excellent results it encountered at the end of last year’s drill season, the assay results of the very first drill hole of the 2018 campaign have surpassed our expectations on all levels.

This hole was drilled approximately 230 meters north of the hole drilled by Noranda in 1991, which returned 0.4 meters of 326 g/t gold, and 35 meters northwest and along strike from the drill pad where the final holes of last year’s drill season were drilled (as a reminder; those three holes encountered 10 meters at 6.7 g/t gold and 0.9% copper, 6 meters at 21.5 g/t gold, 28.5 g/t silver and 3.1% copper, as well as 14 meters at 2.9 g/t gold and 5.2 g/t silver).

Aben Resources was able to immediately pick up where it left off, as it successfully intersected what appears to be the same high-grade gold-silver-copper structure. But rather than encountering just one interval of gold mineralization in the drill hole, it has discovered no less than four stacked layers of gold, and every single one of those layers contains high grade gold mineralization.

As you can see in the table, the four zones are very well-defined by what appears to be layers of barren rock. The mineralization starts just 61 meters downhole and an interval of 13 meters containing 3.9 g/t gold and 0.62% copper is an absolutely fantastic result. Just to give you an idea of how important this interval is: even if we exclude the value of the silver from the equation, the gold and copper alone represent a rock value of US$195 per tonne (using a gold price of $1225/oz and a copper price of $3/lb, and without adjusting for recoveries and payability ratios by the smelter).

That’s a good start and after 18 meters of barren rock, an additional 4 meters at 22 g/t gold and 0.17% copper was encountered (rock value: $877/t) followed by an additional barren zone where after the real eye-opening result was encountered: 10 meters at 38.7 g/t gold, which includes 1 meter at 331 g/t gold. The first thought always is ‘that looks like smearing’, but no. After isolating the 1 meter interval, the average grade of the remaining 9 meters is approximately 6.2 g/t, starting just 114 meters downhole.

No smearing here, just a really good hole. The 10-meter interval has a rock value of US$1530/t, and if you’d exclude the 1-meter interval from the equation, the 9 meters containing 6.22 g/t still has a residual value of US$245/t. Not bad for what seems to be open pit material. This interval was encountered 114 meters down-hole, but looking at the angle of the drill hole in the cross section, this zone is located at a vertical depth of just 75-90 meters. Definitely open pit material.

If we would add all intervals together (which is absolutely not NI43-101 compliant, but we just wanted to paint a picture), you’ll end up with 33 meters at 17.4 g/t gold. Of course, these are the reported intervals and not the true widths and looking at the cross section, we would guesstimate the true widths to be approximately 50-60% of the reported widths. Applying those percentages, we see a combined thickness of 16-20 meters. Which is still excellent considering we are talking about the first 125 meters from surface.

What’s next?

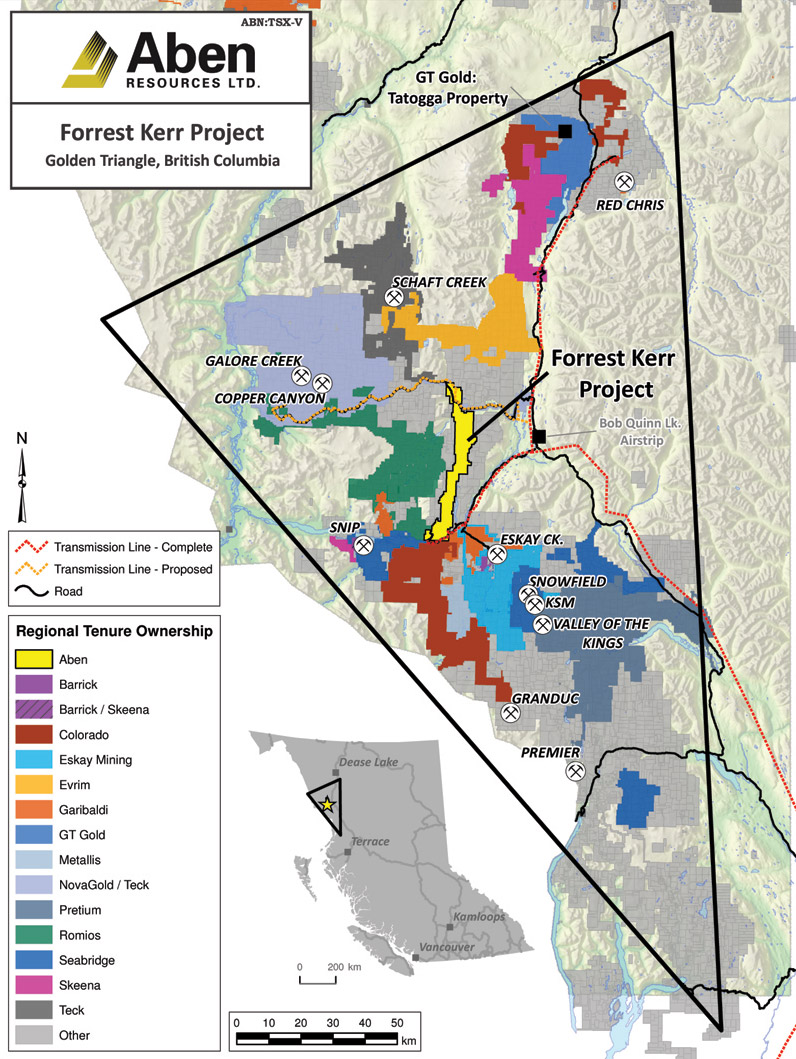

The geological situation is quite complex and it’s no secret the Forrest Kerr project needs a lot more drilling to ensure Aben’s geologists have a good understanding of the mineralized envelope. The assay results of seven more holes are still pending, and those will give us a good idea of how the gold mineralization is structured.

Considering yesterday’s closing price of C$0.29 and the total trading volume of 22.5 million shares, there seems to be considerable interest in Aben Resources after releasing the first hole. As the project is located in British Columbia we can imagine there’s considerable interest from flow-through investors to fund the continuing exploration plans on the Forrest Kerr project. Based on yesterday’s closing price, we wouldn’t be surprised to see flow-through investors willing to participate in a flow-through financing at a substantial premium to the market price (as a reminder: in the April financing, the flow-through shares were priced at C$0.18 per unit, which was a 44% premium on the C$0.125 hard dollar units).

For the record: Aben Resources has not announced any placement, but we think it would make sense to top up the treasury on the back of this discovery.

Conclusion

It’s still very early days at Forrest Kerr but the very first drill hole of the 2018 exploration season has confirmed (and exceeded) the assay results of the three holes that were drilled and released at the end of the 2017 exploration program. The high-grade gold zones appear to be wide-spread, and as everything is located within the first 125 meters from surface, Aben Resources might have an elephant by its tail here.

Disclosure: Aben Resources is a sponsoring company. We have a long position. Please read the disclaimer