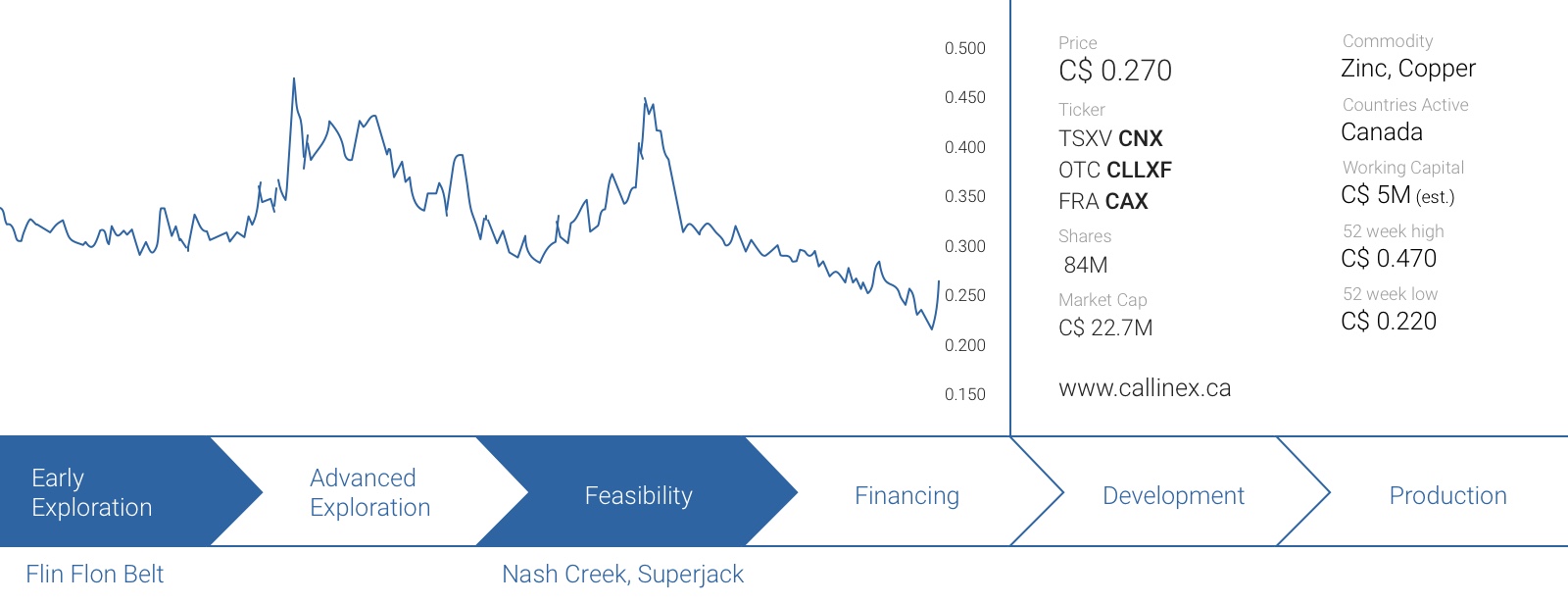

After acquiring the Nash Creek and Superjack projects just two years ago, Callinex Mines (CNX.V) embarked on two exploration programs to upgrade and increase the existing resources. This culminated in a decent resource update in April where the total amount of zinc and lead showed a substantial increase. The cut-off grade was lowered, but this didn’t have a noticeable impact on the average grade of the resource.

That was a relief, and Callinex used that resource estimate to immediately start working on a Preliminary Economic Assessment to determine the viability of Nash Creek as a standalone project. Whilst the technical report will only be filed within the next 45 days, the summary of the PEA has now been published by Callinex (read press release here).

A quick recap of the Nash Creek project

Callinex Mines acquired the Nash Creek and Superjack projects in 2016, as the company saw an opportunity to diversify its asset base with more advanced-stage projects. It identified zinc as a metal with upside potential, and it negotiated a purchase deal when the zinc price was just $0.75-0.80 per pound. At those prices, Superjack may have had potential to be satellite deposit for another operation (thanks to a relatively high-grade core close to surface), but Nash Creek wasn’t viable given its size at the time and was considered to be a nice call option on the zinc price.

As the zinc price started to increase from the moment the letter of intent was signed, Callinex’ cheap ‘bet’ paid off. Not only was it able to add quite a few tonnes to the existing resource estimate, but the combination with a higher zinc price meant the Nash Creek and Superjack projects suddenly became viable on a standalone basis.

In April, Callinex released an updated resource estimate on its fully-owned Nash Creek zinc project in New Brunswick. The total resource estimate now contains 13.6 million tonnes in the indicated category (at an average grade of 2.68% zinc) and an additional 5.9 million tonnes in the inferred category (at 2.68% zinc as well) for a total zinc-equivalent content of at Nash Creek and an additional 328 million pounds zinc-equivalent at Superjack.

Although Callinex used a lower cutoff grade of 1.5% zinc-equivalent (compared to the 2% ZnEq cutoff grade in the previous resource estimate), the total zinc-equivalent grade barely decreased. Whereas the previous resource had an average ZnEq grade of 3.22% in the indicated resource and 3.14% in the inferred resource, the average grade of the new resource is 3.21% and 3.11%. In fact, the ‘pure’ zinc grade in the inferred resource actually increased.

This updated resource estimate was the starting point for Callinex to engage an independent engineering firm to design a mine plan and a evaluate the economic results in a Preliminary Economic Assessment.

The preliminary results of the PEA

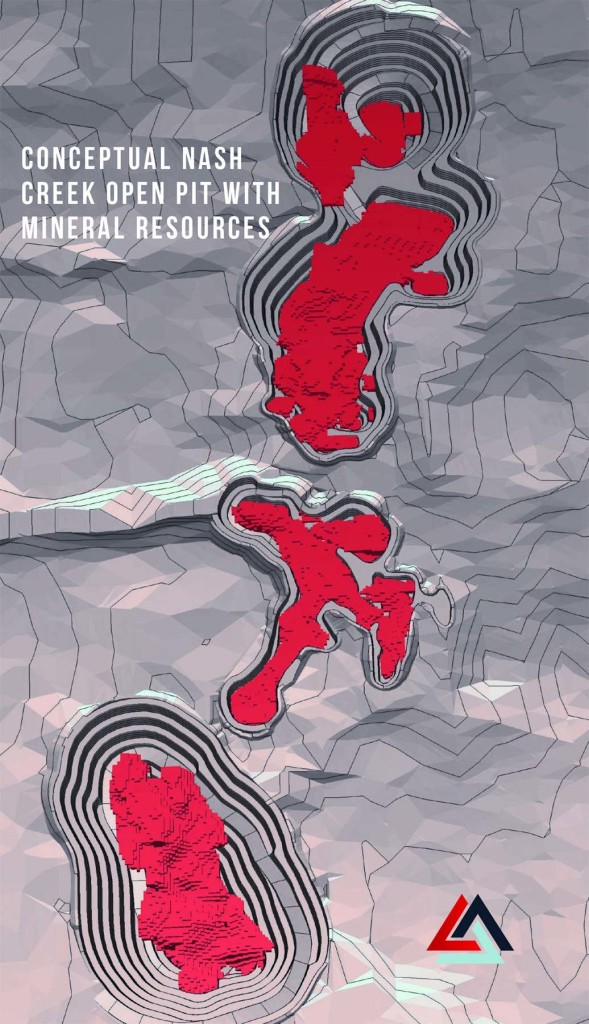

The PEA is based on an average annual mining rate of 1.425 million tonnes of rock per year. As we explained in our previous reports and blog posts, the average head grade of the Nash Creek is at the lower end of the spectrum, but fortunately the higher grade Superjack ore (which could be mined at a very low strip ratio) is a tremendous help in the first year of the mine life. Additionally, being able to use a Dense Media Separation stage in the process will be a big advantage as well.

is is a very efficient way to separate the ‘good’ ore from the rest (which is semi-waste as the Nash Creek project seems to be ‘interlayered’ with good grades and barren rock. That’s exactly why the DMS phase will be so important). If DMS could not have been applied to this project, the economics of the Nash Creek and Superjack mine plan would be pretty marginal at $1.25 zinc). According to the PEA, the rejection rate of the DMS stage is approximately 50%, and combined with a 7% loss of the sulphides (no process is perfect), the average zinc-equivalent head grade will increase by a factor of 1,86 [calculated as (1/0.5)*0.93]. This has two advantages.

First of all, the average zinc-equivalent grade increases to 6.88% which obviously increases the rock value per tonne of ore that goes into the mill. Secondly, because half of the tonnage gets rejected in the DMS stage, your processing plant only needs to be able to handle half the capacity of the DMS plant. According to the PEA, the processing plant will have a capacity of just 1,950 tonnes per day (for almost 720,000 tonnes per year), which helps to keep the initial capex as low as possible. Should more resources be found, the total throughput of the plant could be upgraded as well, but 1950 tpd was deemed to be the optimal size for the current resource.

The initial capex is estimated at C$168.3M, which includes a 20% contingency on the most expensive elements of the initial capex. C$168M isn’t cheap, but is relatively low to Canadian standards. Using a base case scenario of $1.25 zinc, $1.1 lead and $17 silver, the after-tax NPV8% comes in at C$128M with an IRR of 25.2%. Using the current spot prices of $1.40 zinc, $1.05 lead and $16.70 silver the after-tax NPV8% increases to almost C$161M, whilst the IRR increases to almost 29%. Using a lower discount rate of 5%, the base case scenario results in an after-tax NPV of C$176M, whilst the spot price scenario shows a C$216M NPV. Although we do like to use after-tax NPV’s rather than pre-tax calculations, we think Callinex has a good shot at obtaining tax breaks to reduce the applicable tax rates (not in the least because New Brunswick is one of the provinces with the highest average tax rates. Paying less taxes could have a big impact on the Net Present Value and the IRR.

The lead concentrate (grading 50.3%) could be processed at the local Belledune smelter, whilst there are several options for the zinc concentrate. According to our information, Trevali used to ship its zinc concentrate from the Caribou mine to the Nyrstar-owned zinc smelter in Baal, Belgium. So there are plenty of options, and it will very likely depend on the trade-off between concentrate treatment charges and the transportation cost. The treatment charges could be – on average – higher than the $150/dmt used in the PEA. The current contract price is $147/t after zinc smelters have been competing to secure zinc concentrate, but the treatment charges used to be higher in the recent past. The PEA was aiming to determine the viability of the project, and deciding where the concentrate will be shipped to (and at what terms) will be checked more closely in a feasibility study.

Is there room for improvement?

First of all, we noticed the PEA incorporates a 1% NSR, payable to the vendors. However, the existing royalty structure would allow Callinex to pay less than 1%. This is the schedule representing the sliding Net Smelter Royalty:

According to the purchase agreement, Callinex is entitled to repurchase half of the NSR for C$500,000. This means that should Callinex write a C$0.5M cheque, its effective NSR would decrease to 0.5% at a zinc price of $1.25 per pound, increasing to 0.625% as long as the zinc price is moving in between $1.2501 and $1.50 per pound. This is 0.375% lower than the 1% used in the PEA. According to the company’s expected net smelter revenues from its lead and zinc concentrate, the undiscounted value of the 0.375% would be approximately C$4.3M. As a substantial part of the revenue would be generated in the very first year of the operations, we think it would make a lot of sense to exercise the option to repurchase half of the NSR, as this operation would have a payback period of just 18 months.

Secondly, Callinex Mines seems to indicate it has a good shot at adding more higher grade resources to the mine plan. As you can see on the next image, the average grade of the processed ore will be the highest in the very first year (thanks to the contribution of high-grade ore from the Superjack project), which is expected to result in a total cash flow in Y1 higher than Y2 and Y3 combined.

Considering the capacity of the processing plant is just 1,950 tonnes per day, just 500,000 to 1 million tonnes of additional high grade rock could do miracles here. Not only would the cash flow profile increase in Y2, this would have a direct impact on the NPV and IRR as well, as the applied cumulative discount rate would be marginal. The golden rule is simple: the higher the cash flow in the first few years of the mine life, the better the economics will look due to that same discount factor.

Conclusion

Callinex paid just C$750,000 for the Nash Creek and Superjack assets (and had the option to pay C$650,000 in shares at a deemed value of C$0.50 per share, so it really paid just C$100,000 and issued/will issue 1.3 million shares). Throw in around $2 million dollars in exploration expenditures, and a higher zinc price, and Callinex now ended up with an asset with an after-tax NPV8% of C$128M and a NPV5% of C$176M with significant exploration upside in a great jurisdiction with existing infrastructure and a lot of technical know-how.

Is this PEA perfect? No. But it does give a good indication of where the projects currently stand. And now it’s up to Callinex Mines to try to increase the value of Nash Creek and Superjack. Adding more (high-grade) resources that could be processed in the first three years of the mine life appears to be key, as the revenue and operating cash flow appears to be falling sharply after the first year of the mine life. This study really is what it is; a ‘preliminary’ look at the economics, with room for improvement.

It’s our understanding Callinex Mines is anticipating to embark on a discovery-focused drill program this year, in an attempt to define an additional satellite deposits with enough tonnage to really move the needle. We expect Callinex Mines to announce a new exploration program within the next few weeks, designed to optimize the economics of the PEA. And considering Osisko Metals (OM.V) was willing to pay C$34M for Pine Point Mining (which has similar grades and flow sheet) for a project in the Northwest Territories, Callinex’ current enterprise value of C$15M appears to be very favorable.

Disclosure: Callinex Mines is a sponsor of the website, we also have a long position. Please read the disclaimer