The team of the ‘old’ Integra Gold (ICG.V) must have thought a one month holiday was long enough as surprisingly, all pieces of the puzzle started falling into place to hit the ground running. Integra Resources (ITR.V) was born, and its flagship gold asset is located in Idaho. We had a long conversation with CEO George Salamis about the completion of the deal, the recent capital raise and the plans to move the DeLamar asset to the next level.

Stay in touch with our weekly newsletter and when we publish a report. Unsubscribe at any time.

The start of ‘Integra 2.0’

The ‘old’ Integra Gold team was surprisingly fast back in the saddle. Less than two months after finally completing the sale of Integra Gold to Eldorado Gold (EGO, ELD.TO), everyone is back in the saddle for Integra Resources (ITR.V), also known as Integra 2.0. How did you come across the asset, and why was the senior management team so certain the DeLamar project would be a worthy successor of Lamaque?

After coming off of the win at Integra Gold, the team was pitched on a number of very interesting ventures and projects, and we really used the “spec sheet” at the Lamaque Project as a bit of a screening tool when evaluating the different prospects we had in front of us.

Similar to Lamaque, you’ll see that DeLamar offers a site with a well-established production history and and what we view as low permitting risk. The site comes with a robust resource base, actually much larger than what we started off with in Integra 1.0 at Lamaque, with enough drill hole data to help us evaluate the project, providing us with invaluable geologic knowledge as well as confidence in metallurgy.

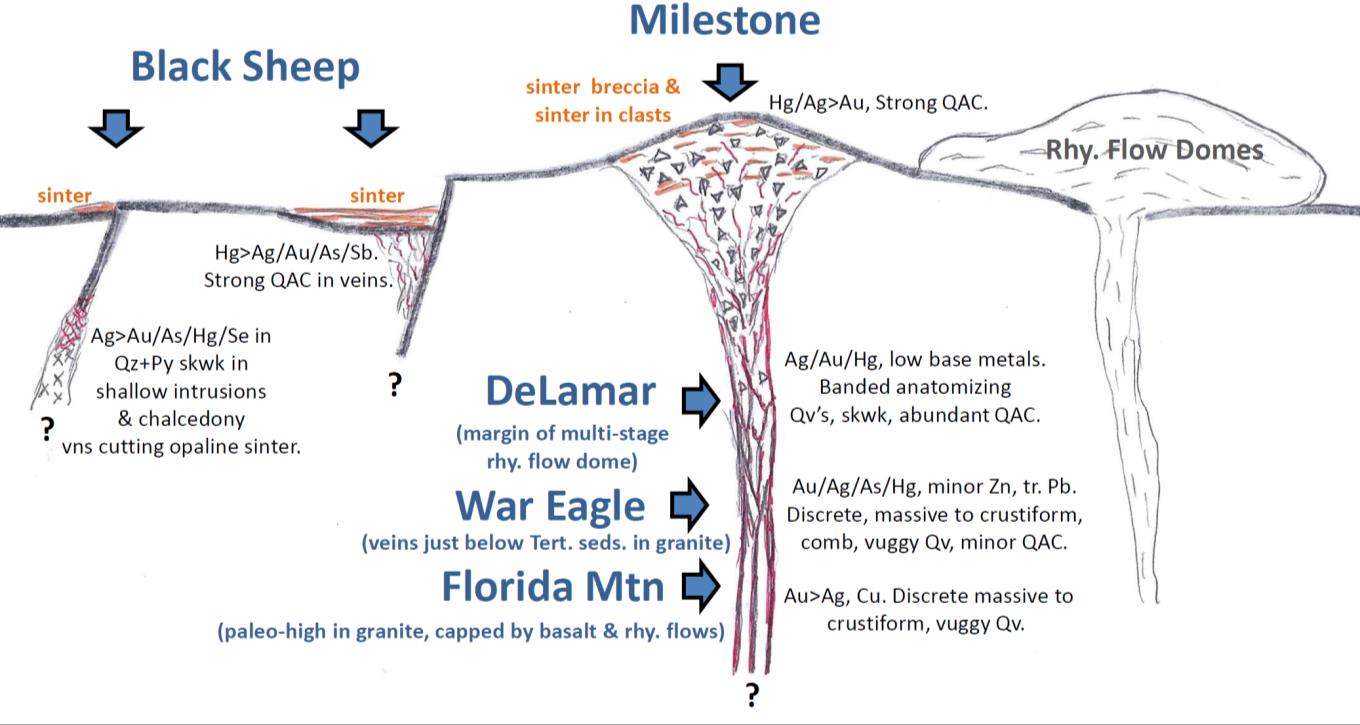

As with Lamaque, the first thing we did was evaluate the historic drill data – and what the data suggests is some significant exploration potential for both near surface bulk tonnage mineralization, as well as slightly deeper high-grade vein type mineralization that had been subject to very limited modern exploration, yet having produced a significant amount of high grade gold and silver in the late 1800’s. It was clear to us that the “under the radar” DeLamar Project represented an opportunity that had a clear pathway to production with significant exploration upside – so enter Integra 2.0.

The Asset

It’s our understanding from previous conversations Kinross Gold (KGC, K.TO), the project’s previous owner, was mainly interested in a ‘fill the leach pads’ strategy and prioritized the discovery of bulk mineable but low-grade zones over higher grade vein systems. Could you elaborate on Integra Resources’ exploration strategy?

That’s exactly right – Kinross, at the end of the site’s operation, was running the mill at a very high capacity while fighting a plummeting gold price in the late 1990’s. The mill was churning through over 4000 tonnes of ore per day, which is a very hungry operation for this type of deposit. The demanding mill-feed requirements left no time or desire to test the slightly deeper high-grade feeder zones on the property, as the focus was on continuing to provide the mill with large volumes of near-surface low-grade feed.

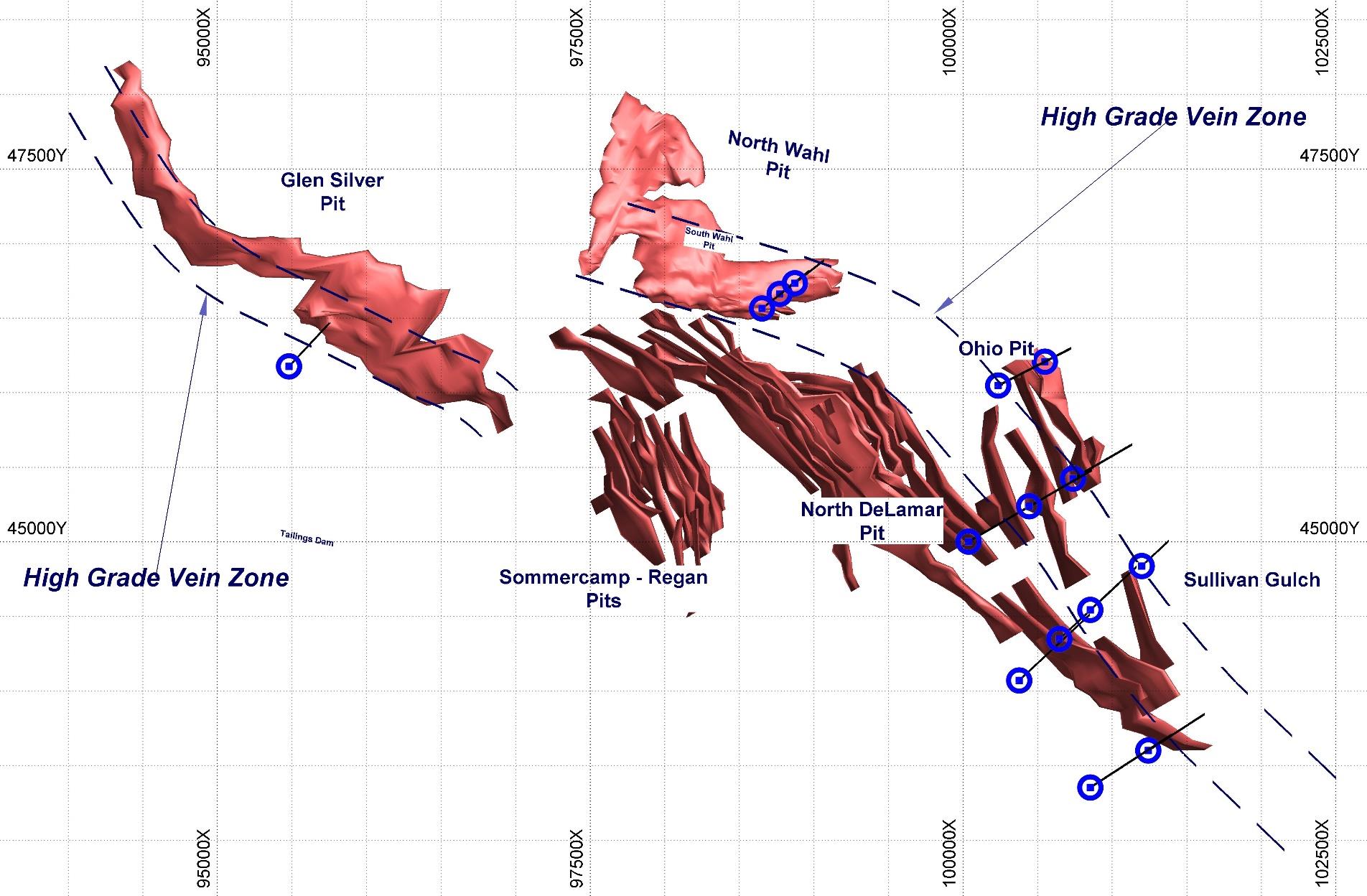

In examining the historic data, Max Baker, our VP Exploration, looked for valid data on some of the historically mined zones that were exploited underground during the gold rush of the late 19th and early 20th The area was known to have produced some of the highest grade ores and purest dore bars ever recorded in all of North America. A number of historic holes designed by Kinross to define low grade near source, actually continued past the low grade and intersected some of the historically mined high grade “feeder veins” with decent widths, including 105 g/t Au and 41 g/t Ag over 10.7 metres, 10 g/t Au and 116 g/t Ag over 18 metres, and 10 g/t Au and 188 g/t Ag over 18 metres.

Our upcoming drill program will be biphasic in its approach, with the first 4000 meters looking to test the potentially high-grade feeders immediately below the low-grade near-surface mineralization, in areas including Ohio, Sullivan Gulch, and Sommercamp.

As it will be the first exploration conducted on site in almost 25 years, the small 4000 m program will also serve as a chance for our technical staff to hone logging, sampling, and QA/QC protocols before the ensuing 16,000m+ program embarks. The follow up program will aim to continue characterizing the high-grade mineralization, while in some instances continuing to quantify the extent of the low grade mineralization lying above the high grade.

Some drill holes will help in confirming the historically determined metallurgical characteristics of the zones, providing some sample material for future heap leach amenability test work.

The average grade of the open pit resource of 0.41 g/t gold and 24.34 g/t silver seems to be low, but it could definitely work given the excellent historical recovery rates of the gold, and surprisingly, the silver as well (using a CIL circuit) based on the historical production results (rather than met work in the lab). Do you expect the recovery rates of a heap leach scenario to be materially different from these historic results?

Historically at DeLamar, the mill that produced for about 20 years, performed very well. The records show that the milling of oxide ores achieved gold recoveries in excess of 95% and silver in excess of 75%. Transitional/mixed oxide and sulphide ores reported recoveries of 85% and 70% respectively for gold and silver. So the short answer is “yes”, future milling could work very well. In summary, there’s nothing that we’ve seen in the metallurgical history of the gold and silver at DeLamar which gives us cause for concern.

Heap -leaching was never used as a commercial scale means of gold extraction at DeLamar, though a lot of testwork done by Kinross in the past would suggest that heap leaching might work quite well. Past test work has shown that an +85% gold recovery and a +35% silver recovery can be obtained at a 1 to 2 inch crush on oxide and transitional material in a column leach that roughly resembled heap leach conditions. So you can expect that we’ll be doing a lot of column leach test work at DeLamar, because if its demonstrated to work, it’s a potential game changer given the amount of low grade near surface ore left over by past operators.

You have highlighted two cutoff grades in your maiden resource estimate at DeLamar. Can we assume you would use the 0.3 g/t cutoff grade for a heap leach-based operation, and the 0.75 g/t cutoff for a CIL circuit focused operation?

Yes indeed, we basically reported two different cut-offs and corresponding average grades. The one you mentioned, 0.41 g/t gold and 24.34 g/t silver, is a scenario that we view as the grade range we would approach if we were to look at the amenability of the deposit to low cost, low-capital heap leaching. A separate cut-off range, using a 0.75 gold equivalent cut-off, netting an average gold grade of 0.69 g/t Au and 48.69 g/t silver for approximately 1.35 M ounces, we view as a scenario whereby milling would be considered in the future.

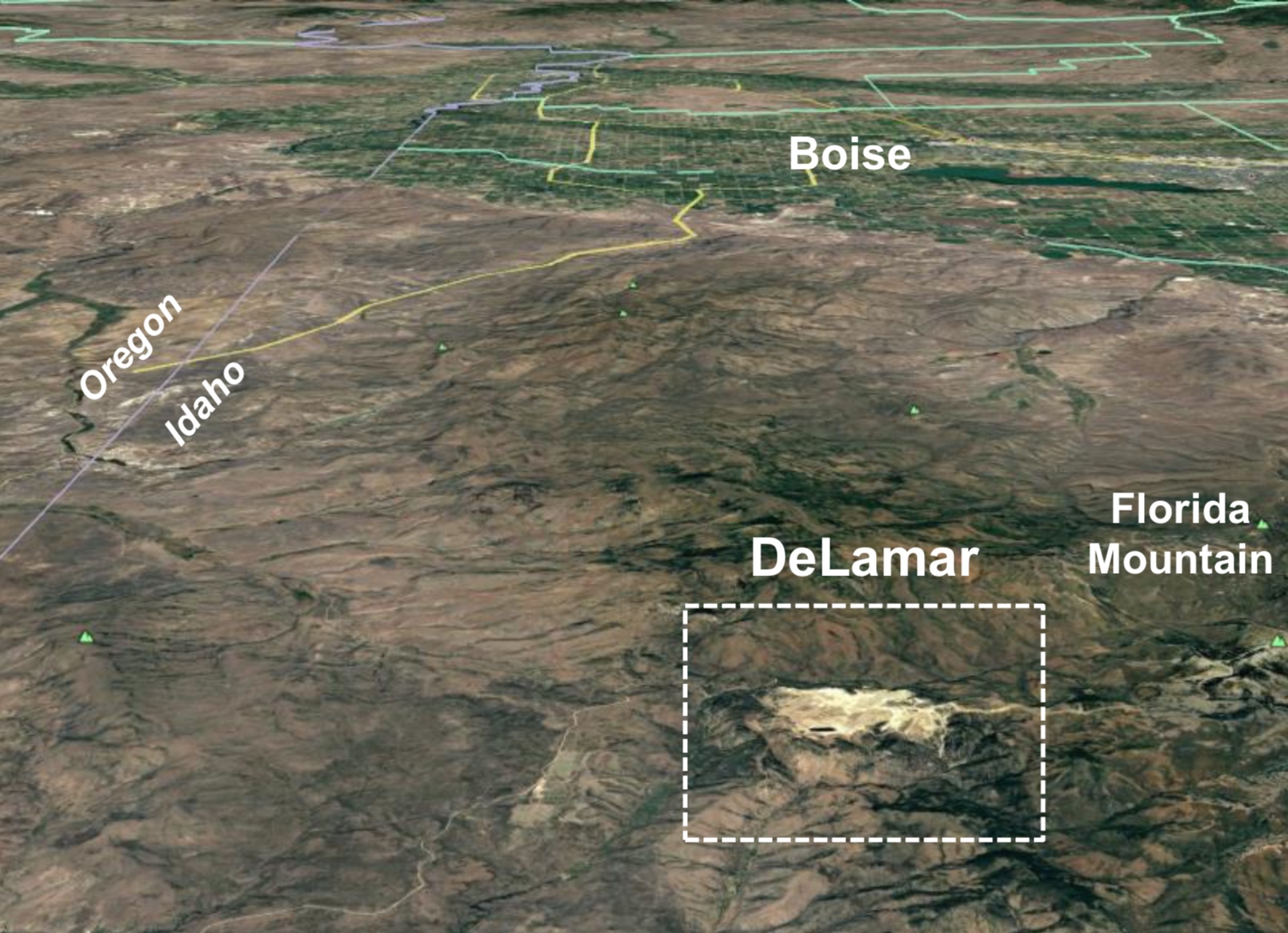

How easy will it be to get a heap leach mine permitted in Idaho? Do you consider the location an advantage (Idaho is mining friendly, and the project is located close to the NV border) or a disadvantage (Idaho has historically mainly dealt with underground mines)?

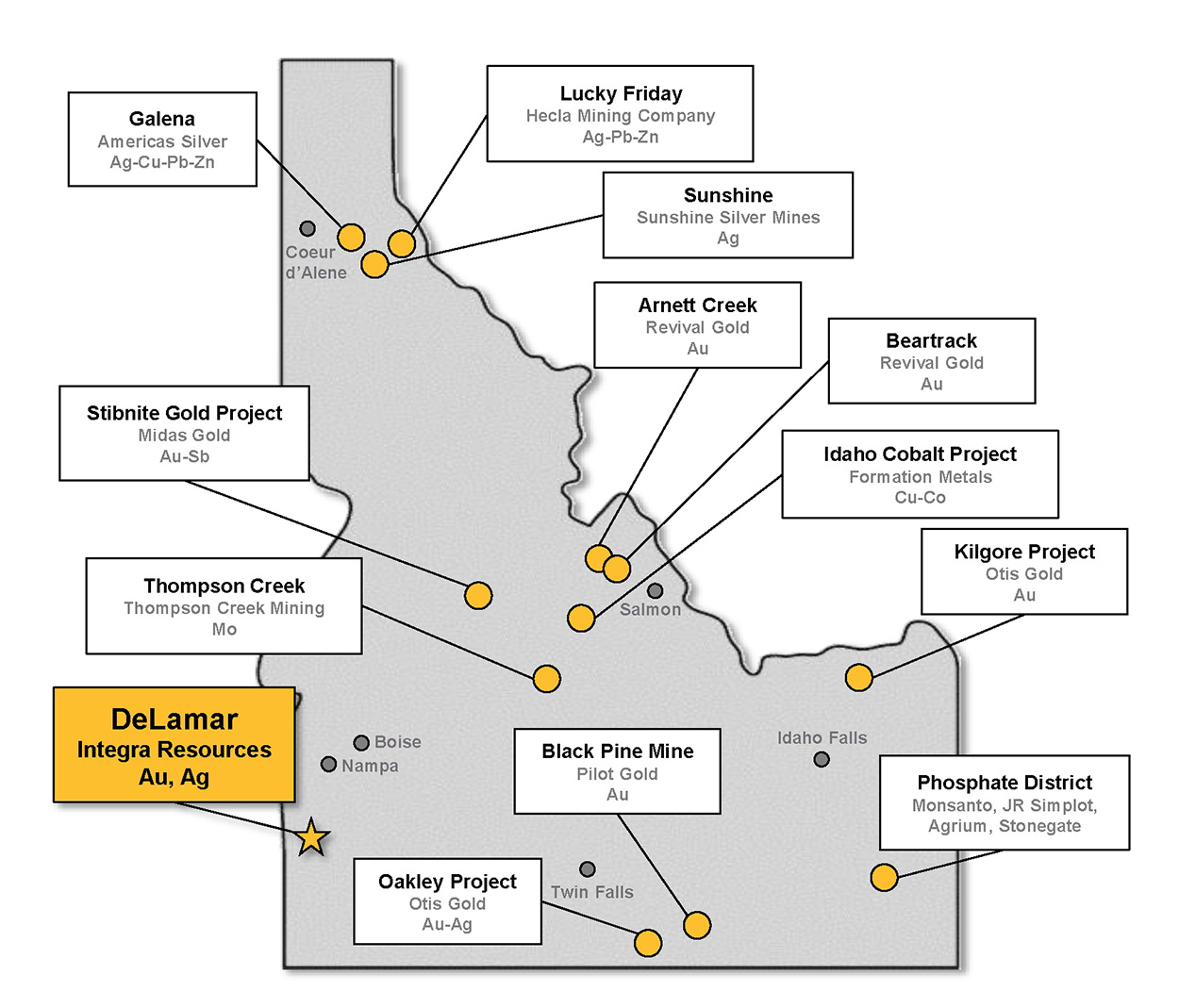

Integra sees Idaho as one of the best jurisdictions in the entire US – and a number of companies including Revival Gold (RVG.V), Otis Gold (OOO.V), Liberty Gold (LGD.TO) and Midas Gold (MAX.TO) are successfully de-risking projects (including open pit / heap leach projects) at varying stages of development. The DeLamar site last operated as an open pit mine in the late 90’s and with proper planning and execution on the permitting front, we see the past history of production at the site as a great advantage for us on our pathway to mine development.

Just to be clear, the current 2.7Moz AuEq resource estimate is an open pit resource and is only based on historical drilling. Do you think there’s a decent potential to increase the size of the open pit resource at the same average grade?

The DeLamar project offers great optionality, and one of those options is obviously continuing with what was a very successful mining operation with a prolific history. Current defined resources depicted in Integra’s recent NI43-101 compliant Resource Estimate show a resource that already hosts a similar number of ounces to what was historically mined, with great potential to expand in a number of near-surface areas. Keep in mind that this project was halted with gold prices below $300/oz, and was put on care and maintenance due to market conditions, not geologically based factors.

What’s your plan to tackle the underground mineralization? The historical grades are very encouraging with double-digit gold grades and multi-ounce silver grades. How will your exploration approach be different from the strategy you deployed at Lamaque?

As I mentioned above in the comment about optionality, the very exciting and largely unexplored and overlooked option lies in the potential for underground mineralization to be present at DeLamar. Taking into account the previous 4000tpd mill, and the drill hole data set with average drill hole depths being below 120m, its clear that previous operators (as was “the norm” in mining at the time) were strictly focussed on near-surface open-pittable low grade mill feed.

Our strategy at DeLamar with the imminent drill program will be to first test the high-grade mineralization immediately below the low-grade near-surface resources and mined-out open pits, based on projections from previous Kinross drill intercepts and certain validated historical information from the early 20th The program will look to test a few key theories, and we expect to build on this year’s drilling with follow up multi-rig campaigns in the future.

MDA has recommended a C$8.7M exploration program in its technical report, which would include 20,000 meters of RC and core drilling. Do you agree with this assessment, or can we look forward to an even busier exploration year (in true Integra-style)?

If you look back to the 5 year timeline at Integra Gold, it wasn’t until after 2 drill seasons were under our belt that the multi-rig drill campaign approach was rolled out on the project. While we too are keen to build a prolific core library and get aggressive with the drill bit, it is important to lay successful groundwork with carefully planned drill holes that will later direct the large campaigns. Don’t change the channel, stay tuned!

The DeLamar property has been in reclamation mode for the past 10 years. What does this mean for the exploration program and the future development phase of a mine (should your studies confirm the DeLamar mine could be brought back into production)?

Being on a very well reclaimed brownfield site gives us confidence in the ability to successfully develop and operate and then reclaim the site again in the future, should it be warranted. But this time we will have the full benefit of having learned from the great stewards at Kinross who already did an amazing job at it once. Idaho State law asks that after 4 years of a mine not being in operation, that either a production re-start or reclamation decision be made. Gold prices were still in the low $300 range when the decision to reclaim was made, and that set the stage for the many years that passed until Integra entered the story.

Corporate

When do you anticipate the Florida Mountain transaction to close?

We are hoping to close part of the Florida Mountain transaction by the end of the year with the rest to close in Q1 2018.

What’s the current cash position of the company?

Integra currently has $18M in the treasury.

How instrumental will Max Baker be for this company?

Max is an extremely key figure in the organization. He spent a long period of time studying DeLamar for Kinross and has gotten to know the “lay of the land” out there from a geological perspective. He’s fully compiled the high grade mineralization and the low grade mineralization on the project and has a great handle for where everything is in 3D space and where, with a high degree of probability, to find more low grade and high grade gold and silver.

Max has a long and successful history on these types of deposits, Low Sulphidation Epithermal Deposits, but is publicly very understated about his past successes and abilities to spot value in projects. His track record is excellent and he’s regarded as an outperformer in the field of exploration by his peers. So short answer – “yes” , Max, supported by his team of geologists, will be hugely instrumental in our success. We are lucky to have him aboard in Integra 2.0.

Thank you!

Stay in touch with our weekly newsletter and when we publish a report. Unsubscribe at any time.

Disclosure: Integra Resources is not a sponsor of the website but we expect the company to become a sponsor. The author has a long position in Integra Resources. Please read the disclaimer