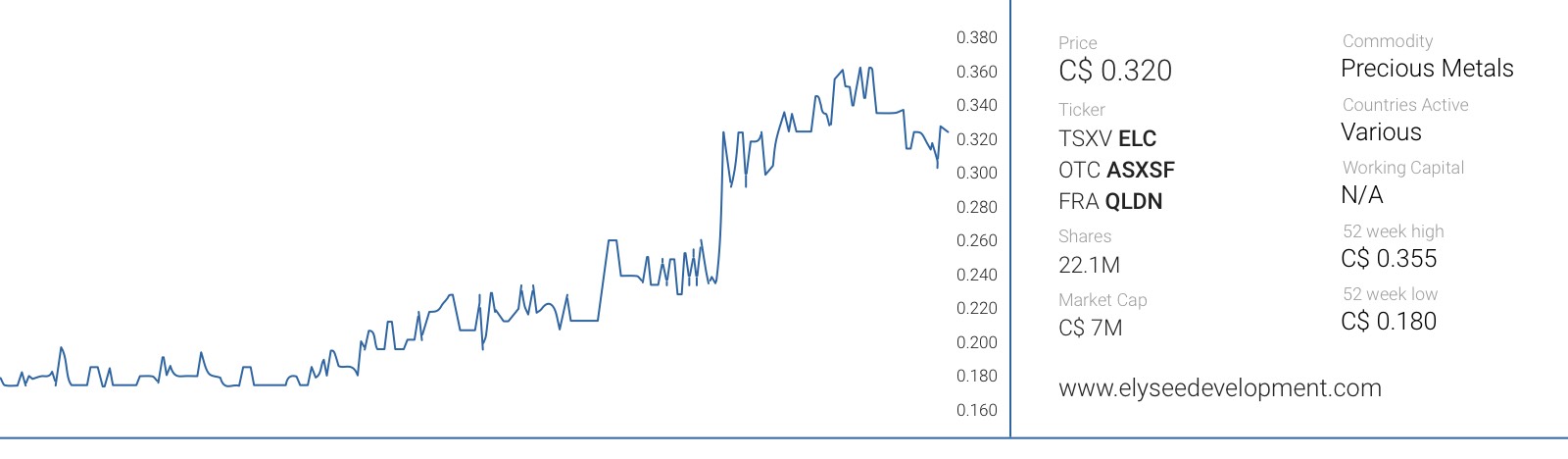

Another quarter, another excellent result from Elysee Development Corp (ELC.V), as the company’s net income in the first three quarters of the current financial year increased to almost 26 cents per share. Not bad if you know the company started the year at a share price of just C$0.185!

We sat down with Executive Chairman Guido Cloetens to discuss the company’s performance, new investments and his view on the gold market.

The financial results

Guido, Elysee Development Corp (ELC.V) recently released its financial statements for the first nine months of the current financial year, and it looks like the company benefited tremendously from the continuously strong commodities market in the third quarter. As Elysee is an actively managed investment issuer, you also took some chips off the table when the valuations increased (too much).

That’s right, in Q3 we slightly reduced our investments in the precious metals mining sector. Although we remain positive in the long term for gold and silver, the investor sentiment was becoming too bullish during the summer months with share prices (and valuations) already anticipating much higher bullion prices.

Your share price is now almost 50% higher than when we initiated coverage, but is still trading at a substantial discount of 42% to its NAV of C$0.55 (as of at the end of August). You started to buy back more stock and have repurchased approximately 1% of your share count in the first nine months of the year, which helped to offset the dilution from option exercises. Do you have specific plans to try to close the gap between the share price and the NAV/share? Will you accelerate your Normal Course Issuer Bid?

Our priority over the last couple of years was to establish a track-record which is what we did. Now we feel it is time to reach out more actively to the investor community in North America and Europe. Our NCIB remains in place and we have bids in the market all the time. However, there are limits as to how many shares we’re allowed to buy back.

Also, we don’t want to use our cash position just buying back our own stock in the market. Our business is investing in other companies and we think we can increase our NAV/share faster by making external investments rather than repurchasing our own stock.

And perhaps even more important, should Elysee’s shareholders expect to see a dividend being declared after this exceptional year?

After the close of Elysee’s financial year the Board of Directors will decide if the company will pay another dividend. Based on the current results I believe it’s very likely that Elysee will pay another dividend but it’s not etched in stone and everything depends on the results as of November 30th.

The New Positions

Subsequent to the end of the third quarter of the fiscal year, you also acquired 1.11 million units of Largo Resources (LGO.V), one of the lowest cost vanadium producers in the world. What were your main reasons to diversify into Vanadium?

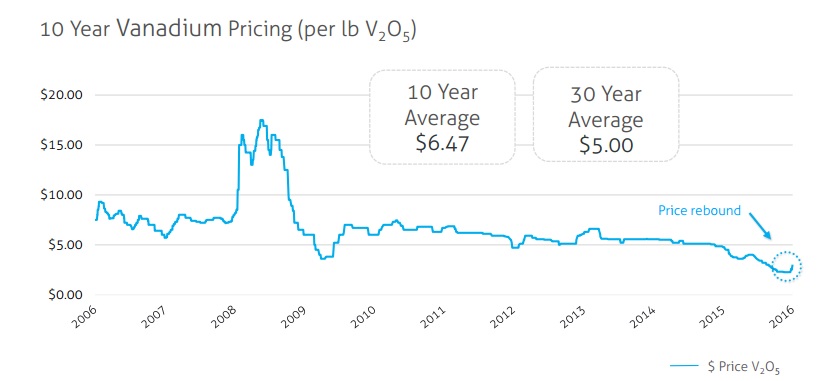

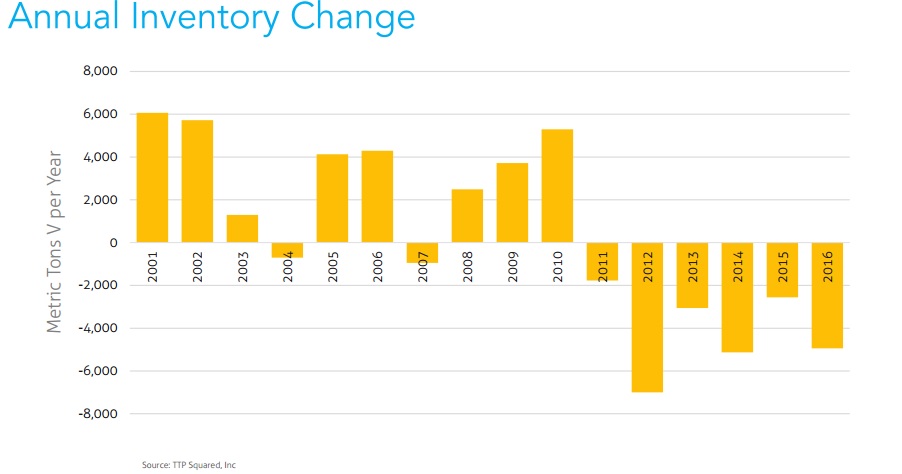

First of all, demand for vanadium is expected to continue to grow in the years to come. Largo Resources is one of the lowest cost primary vanadium producers in the world that recently started ramping up its production. Vanadium is mostly a by-product of iron ore production. When the price of iron ore rose to new highs a few years ago, so did the output of iron ore and (consequently) vanadium, causing excess supply.

Today we see that the oversupply of vanadium is disappearing. Actually, existing inventories are being depleted. Combined with growing demand for new applications this will likely lead to higher prices in the years to come. Largo’s Menchen mine in Brazil is a high grade mine with a long mine life and very low operating costs. It really deserves to be discovered by the investment community. Therefore the company is currently considering a listing on a major US exchange.

Additionally, you will be participating in the financing of Polymet Mining (PLM, POM.TO), which aims to develop a large copper-focused project in the USA. Could you elaborate a bit on why this company attracted your interest?

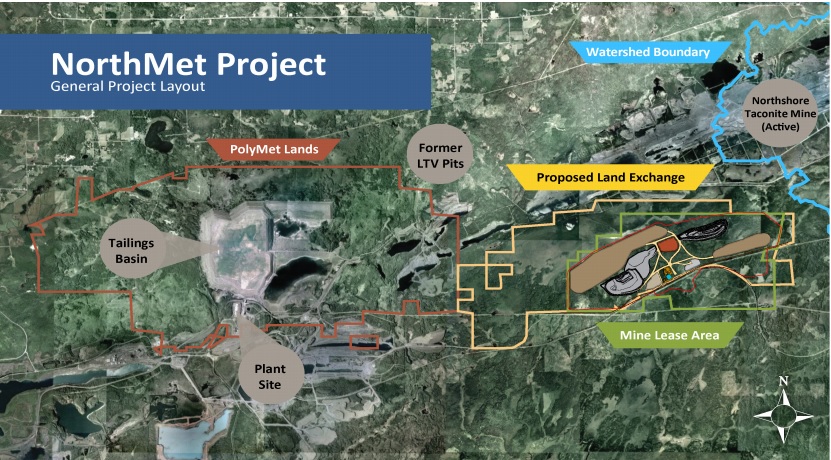

We believe the underlying value of the assets Polymet owns is much greater than the current enterprise value of the company. Polymet owns the massive Northmet project near Duluth, Minnesota where it plans to produce 72 million pounds of copper, 15 million pounds of nickel, 730,000 pounds of cobalt and 106,000 ounces of precious metals annually. The mine plan is based on processing 32,000 tonnes per day for almost 20 years, but the measured, indicated and inferred resources combined contain almost 4 times more than the tonnage that will be mined.

POM also was able to acquire the Erie plant and we think the market undervalues the added value of this important part of the infrastructure. Glencore owns about 35% of the company and is very supportive. The company expects to receive the final mining permits in 2017 after which they can start construction. Hopefully investors will then recognize the vast potential of this very advanced project. (Editor’s note: we will shortly review Polymet Mining on the blog).

Perhaps also important was your participation in a private placement of IBC Advanced Alloys (IB.V) before the summer. IB isn’t a traditional mining company but rather focuses on alloys, of which its Beryllium-Aluminum alloy seems to have impressive characteristics and got the attention of Lockheed Martin (LMT). 2015 and 2016 were relatively dull years, but you’re expecting to see great things from this company in 2017. Would you care to explain your investment thesis for this company?

IBC went through a reorganization in 2016 with a new management and board being appointed, followed by a capital raise and a company-wide cost-cutting program. The company is already witnessing a remarkable turnaround in its traditional business, the copper alloys division.

The future growth of the company should come from its Engineered Materials Division however. This division is developing breakthrough alloys for major defense contractors and aerospace companies. This year, IBC completed a multi-year qualification process for its beryllium-aluminium products and I’m expecting a significant increase in the order book for 2017 and subsequent years. They have an impressive customer list with companies like General Dynamics (GD), Raytheon (RTN), BAE systems, Lockheed Martin among others.

You also participated in a private placement of Rye Patch Gold (RPM.V) which purchased the Florida Canyon mine in Nevada. Rye Patch thinks it can bring this project back into commercial production within months, making it a very interesting near-term producer. What do you expect from Rye Patch? Do you think it’s a buyout target or rather a potential new consolidator in Nevada once it reaches a cash flow positive stage?

What attracted me to RPM was the fact that they were able to buy an existing gold mine in an excellent jurisdiction at a bargain price and that they are able to restart gold production in the very short term. The company is currently preparing to bring the recently acquired Florida Canyon mine back into commercial production in the first part of 2017 for an initial capex of less than US$30M.

The average annual production rate will be slightly over 75,000 ounces of gold at an AISC of less than US$900/oz, providing a healthy margin, even at $1250 gold. The after-tax NPV5% at US$1200 gold is estimated at C$125M (C$0.35 per share), whilst at $1300 gold this increases to C$168M (C$0.46/share). This means you’re basically only paying for Florida Canyon and get all the other projects (Lincoln Hill, Wilco) thrown in for free. And with the cash generated at Florida Canyon, Rye Patch will be in a much stronger position to explore its other properties as well.

Source: Rye Patch Gold – a company Elysee invested in

Subsequent to the Rye Patch investment, you also participated in the C$0.30 financing from NuLegacy Gold (NUG.V) which is also exploring for gold in Nevada, one of the safest and best mining jurisdictions on earth. How important is the potential geopolitical risk in your assessment of potential investments? Would you consider investing in riskier areas if the potential reward would compensate for the higher risk? Or are the ‘dodgy’ countries like the DRC, Indonesia,… always a ‘no go’ zone for Elysee?

I’m very hesitant about investing in companies that operate in countries where the legal framework is “questionable”. On the other hand, in some ”developed” countries it is very difficult obtaining an actual mining permit just because there are too many legal hurdles. It really depends on the individual situation. Does the company have experience in that specific country, who are they partnering with, what’s the track record of the country in honouring past agreements etc. Politics play an important role of course.

Sometimes situations can change, like in Argentina for example where the new government seems to be much more mining-friendly than their predecessor(s). As the risk/reward ratio has fundamentally changed, we are no longer opposed to investing in Argentina, and have initiated a long position in Golden Arrow Resources (GRG.V) by participating in its recent private placement.

Source: Golden Arrow Resources – a company Elysee invested in

TerraX Minerals is performing really well…

We recently attended a presentation by TerraX Minerals (TXR.V), which currently is the largest position in Elysee’s investment portfolio. Even though the share price has quadrupled and the market cap reached almost C$90M before the gold price softened, it doesn’t look like the company is overvalued as CEO Joseph Campbell is still expecting to find several million ounces of gold at the Yellowknife City gold project, and is ‘postponing’ a maiden resource estimate until the company has most certainly reached a threshold that will surprise the market and make sure the results get noticed. Elysee Development is still holding onto most of the shares it originally acquired, so your level of confidence must be high. What are you expecting from TerraX this winter?

TerraX has a 27,000 metre drill program underway and only received assays back from the first four holes and reported exceptional results. The company will be winding up the summer portion of the drill program later this month by which time they expect to have drilled about 10,000 metres on three target areas.

We expect extensive news flow through the balance of the year as these results are received, interpreted and reported, with winter drilling scheduled to resume in early January after the ice roads are ready. TerraX is fully funded for the most extensive drill program they have ever undertaken and we fully expect the company to continue to be successful in its attempts to define a multi-million ounce gold project.

Do you think this will ultimately be a takeover-play? We would assume any mid-tier or senior gold mining company would be interested in acquiring an entire district.

TerraX controls a major high-grade gold district, with full infrastructure beside a mining city in a stable political jurisdiction. And they continue to report impressive high-grade gold drill intercepts. Who wouldn’t be interested?

Source: TerraX Minerals – a company Elysee invested in

About Gold and Oil

The Elysee investment portfolio is still heavily focused on precious metals (even though some of the recent acquisitions will reduce your percentual exposure to gold and silver), so we are obviously also curious to hear your thoughts about the current situation on the PM markets. Last week, the gold and silver price nosedived and fell through some key support levels (although some other technical analysts claim the $1250-1255 level will be more important). Does this change your view on the precious metals sector as a whole?

No, it doesn’t. This correction was long overdue but it wasn’t “normal” profit-taking. I’m curious to learn what the real motivation is/was behind the aggressive manner in which some of the sales on the futures markets took place as in excess of 1,000 tonnes of paper gold were dumped on the market on Tuesday. Just to put things into perspective, that’s approximately 30% of the total annual world production from gold mines.

On a longer term basis, the picture remains intact. In a world awash in debt, no growth, negative real interest rates and a banking system that’s still very shaky one wants to own real (hard) assets. Unlike gold, paper money isn’t one of them.

Let’s perhaps also take a moment to discuss oil. Only a very minimal portion of the total portfolio (<1%) has been deployed in oil and gas and Jericho Oil (JCO.V) is currently your only exposure to oil and gas. Now the OPEC seems to have reached an agreement to curb the output to bring the oil market to an equilibrium faster than expected, would you consider to increase the exposure to oil, or are you still skeptical about the sector?

It’s difficult to predict the long term outlook for oil due to the politics involved. The future of fossil fuels is too uncertain to allocate a big part of our portfolio to this sector. If we invest in oil companies there needs to be a specific reason to do so.

I believe Jericho’s approach is the right one. Buying distressed oil producing assets (with existing reserves) on the cheap like they did in 2015 and earlier this year is a good way to make money even at depressed prices. (I reckon Jericho will be able to increase its production in the months to come thereby boosting its cash flow.)

Source: Jericho Oil – a company Elysee invested in

Conclusion

We’re really glad to see Elysee Development is meeting our expectations and the company shows that investing in other mining-related companies can be really profitable. Thanks to the excellent investment decisions and the low overhead expenses, the NAV has increased from C$0.39 to C$0.55 in just ten months and that’s exactly the performance you’d like to see from an actively managed and well-diversified investment issuer.

Disclosure: Elysee Development is a sponsoring company, we have a long position. Additionally, Jericho Oil also is a sponsor of the website.