At the end of 2016, Redstar Gold (RGC.V) was able to drill some holes on the Unga gold project in Alaska. The company subsequently released the assay results of these holes in January and provided an exploration update and the plans for this year. We met with CEO Peter Ball to get a better understanding of the results from the 2016 exploration season.

2016 Exploration Season

You scrambled to get some drill holes in at the end of 2016, before the winter season started. You drilled 7 holes for a total of 1,500 meters, and encountered gold and silver mineralization in every single hole. Did the 2016 drill program meet your expectations?

Peter Ball: “The goal of the drill program was to validate our internal model and to test whether or not the historical view of the Shumagin Gold Zone may have been a bit inaccurate.

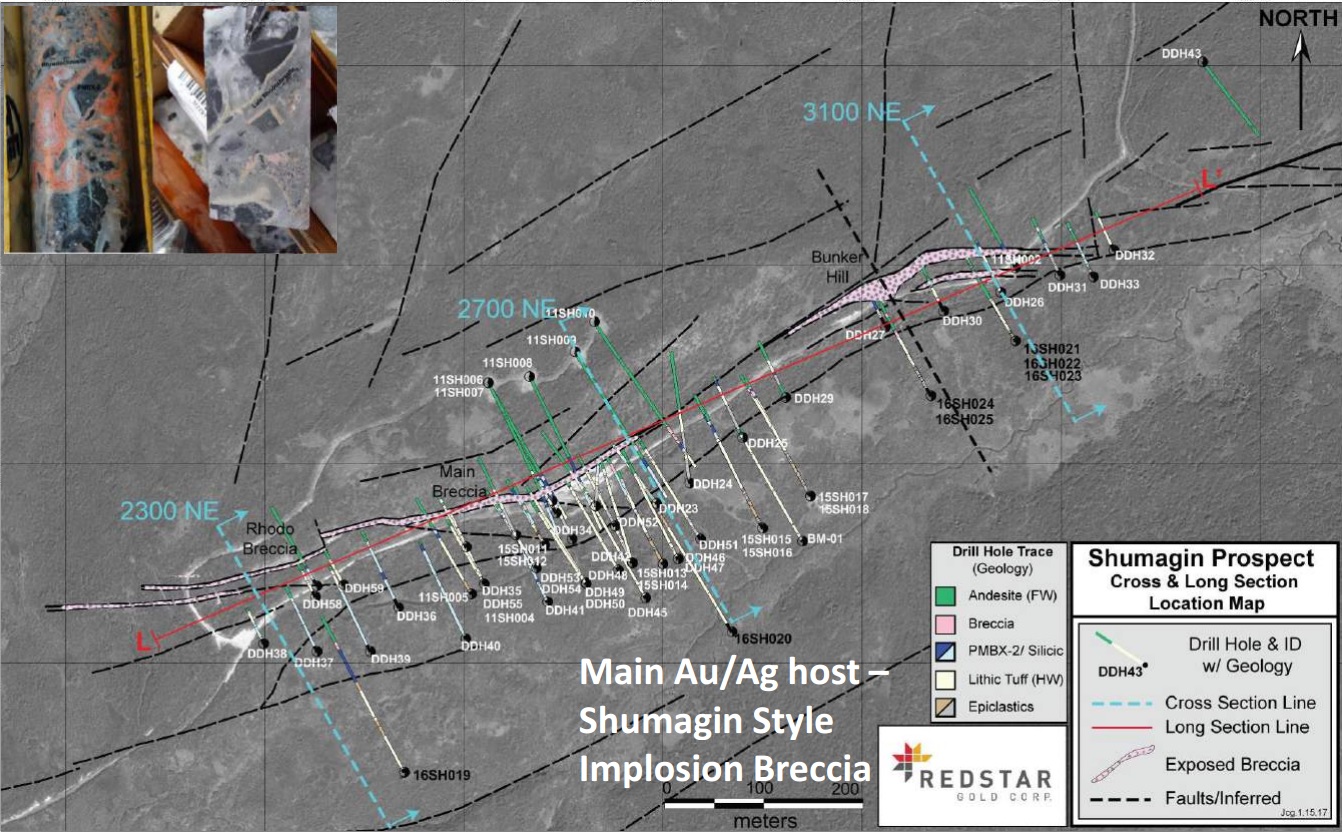

Previously, the model implied the zone was potentially a single 250m-300m strike length zone at surface that plunged at depth to the north east, noting historical results at surface yielded little information on known strike extensions to the north east or south west along surface. In 2016, before the drill program, we completed a very successful surface exploration program on four of the multiple zones located within the Unga Gold Project.

These gold zones were the Aquila/Amethyst Zone, Orange Mountain Zone, Empire Ridge, and the Shumagin Zone. Work from each area identified strong indicators of gold mineralization in many locations, other than where we have drilled at the Shumagin Gold Zone and this has validated historical work done in the 80s.

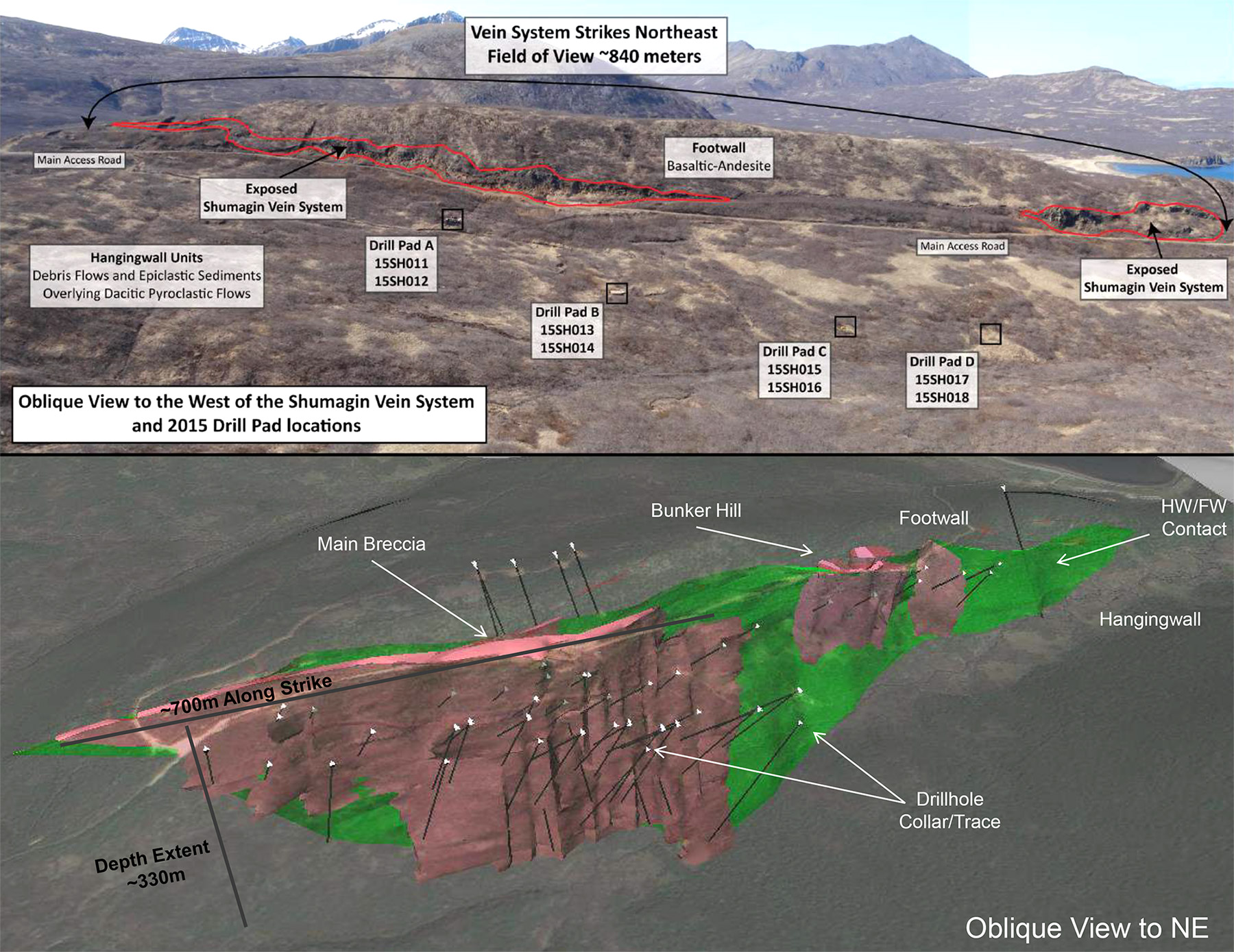

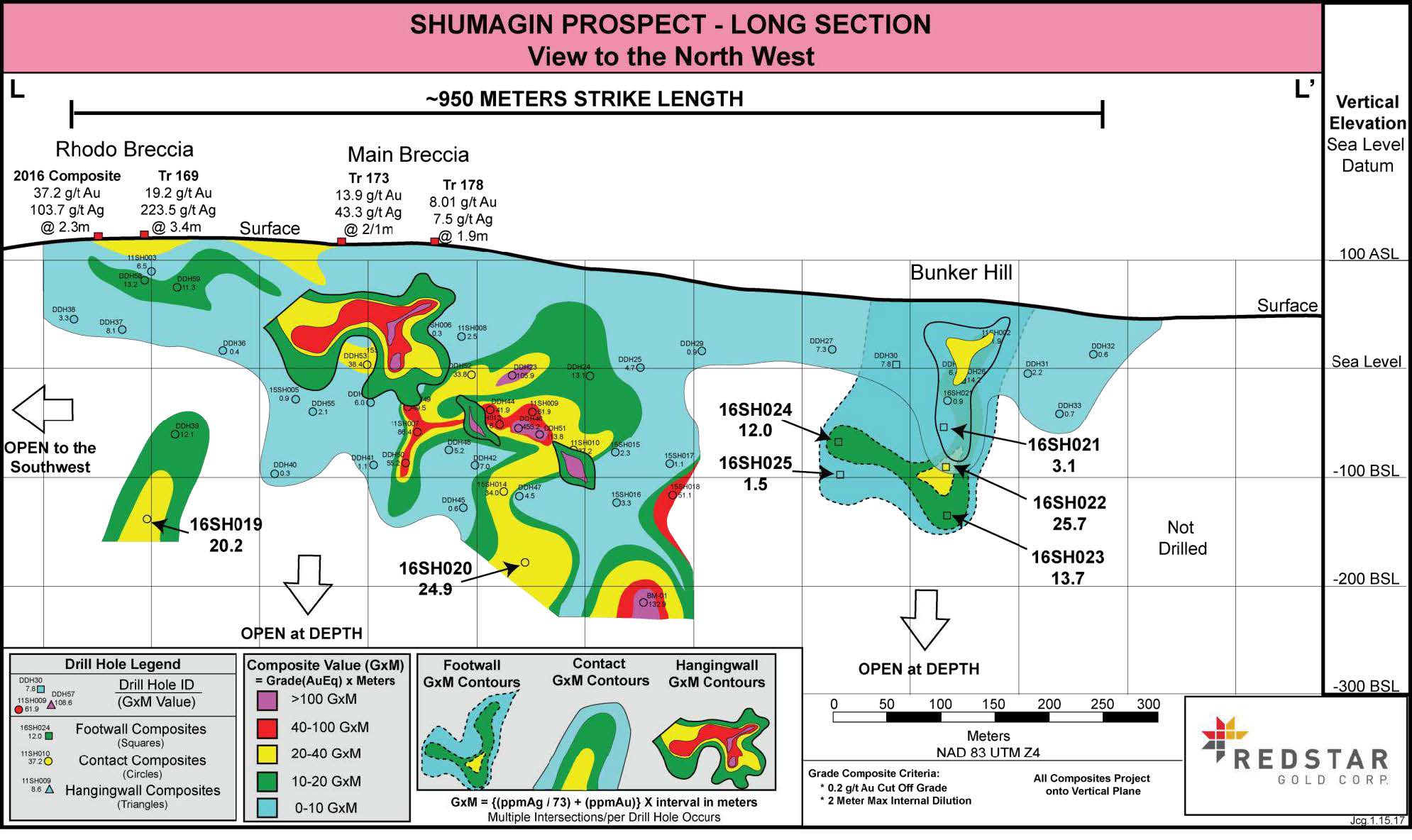

The work completed at the Shumagin Gold Zone identified mineralization in soils or rocks for close to 1.2 km. Fault structures and other structural controls have been identified for up to 3-4 kms. So not only did surface work validate and meet our expectations of extending the gold zone at Shumagin, but the drilling clearing identified continuity of mineralization for about 950m drill to date and also at depth up to 330m.

The system at Shumagin actually continues to get larger and we hit the Shumagin structure and the brecciated colloform rhodoschrosite, which I categorize as the signature rock which tells us the system is intact and the known depth and strike is unknown, but definitely larger than was known previously.

The intersections yielded double digit gold in multiple holes with visible gold in the core. So, yes, our drill program has met and actually exceeded our expectations and we have received many emails from technical groups reviewing our assets that the results were excellent and clearly showed the Shumagin system is promising; not only on a technical basis but on size potential.”

We received some questions and remarks from readers about the short intervals of the intercepts. We weren’t surprised by that at all, as the Unga project and Shumagin zone have always been known for short but ultra-high grade intervals. What’s your view/take on this?

Peter Ball: “The drill results were firstly technically rewarding for the project, noting the continuity of the mineralization was clearly identified at depth and along strike.

In a system like Shumagin, the opportunity of intersecting mineralization can be a hit and miss at times. Noting we hit double digit gold grades in multiple holes and all holes reported some form of gold mineralization is fantastic. The depth extent of the system was also validated, which was excellent to see and the widths of the intersections is secondary at this point in the drilling.

We have seen much larger widths such as 1.9m of 202 g/t gold and 5.49m of 24.1 g/t gold. This type of system can vary overall in drill holes and I suspect we will see longer intercepts as we continue to drill off the system along strike and eventually as we look to do an infill drill program in the future. The program on a technical basis far exceeded our expectations, and we are confident to now look to complete a step out program to see how big the Shumagin Gold Zone can get.”

You have now extended the strike length at Shumagin to almost one kilometer, but now doesn’t seem to be constrained to a ‘northeast plunging mineralized shoot’, as you previously expected. For the non-geologists amongst us, what does this really mean?

Peter Ball: “As I mentioned above in your first question, the historical view of the property was envisaging a smaller NE plunging shoot. This “shoot” size appeared to have a limited surface strike length of 250 meters and a depth of 250 meter. The math on this panel yielded a historical resource of about 250,000 ounces which graded 27 g/t gold and 135 g/t silver.

The resource is non-compliant noting its historical nature, but was an indication from previous operators that they were onto something.

Previous tests along strike to the north east yielded limited results and tests along surface to the south west were never completed. Gold prices used to be much lower back in the day, and perhaps the historical zone was viewed as too small. In 2016, we stepped outside of this “shoot” in five holes to the north east and 2 holes to the south west, and we hit. This now gives us the indication that the shoot might not be constrained at all and more gold could be found outside the boundaries.

This is a great thing as we confirmed continuity of the gold along strike and it looks like the system might be getting bigger… We hope our 2017 exploration plans will confirm this!”

Also, in layman’s terms, how important is the ‘discovery’ of the syn-hydrothermal eruption breccias, and the fact the hydrothermal system is described as ‘robust’?

Peter Ball: “The discovery of the breccias is key to the multiple pulses seen at the system and the heat intensity that has allowed the gold to come to surface. Robust is also a great word!

A great deal or multiple eruption events has occurred yielding multiple veins that has been traced to 330 meters below surface and still yielding good gold and silver grades mostly barren of sulphides or noted as <1% sulphides.

The depths and gold grades still present also show the robust nature of the overall system that made its way to surface millions of years ago. These types of textures of rocks or styles of mineralization have been seen globally in many world-class epithermal intermediate sulfidation gold systems.

The Unga Gold project has significant potential based on these type of similarities, and with the number of gold zones identified at Unga, the potential for a big discovery is imminent.”

2017 Exploration Season

In 2017, you plan to drill a total of 5,000 meters to extend the mineralized zone and an infill program to ‘assist in defining a geological resource model’. When do you anticipate you will be ready to release a maiden resource estimate at Unga’s Shumagin trend? 2018?

Peter Ball: “In 2017, we plan on drilling a minimum of 5,000 meters and the goal initially is to highlight and understand the true strike length of the Shumagin Gold Zone. Remember, the gold zone has been identified for a strike length of 950 meters to date, but has been traced in soils and rocks for 1.2 km and structurally for 3-4 km.

We understand the market would like to see some sort of official resource estimate, but before we tackle a maiden resource we need to quantify the size of the system to determine the boundaries of the gold panel or system before completing an infill drill program to reach a resource.

The system can expand and grow quickly, and we look to get a handle of the size. A resource model will be built along the way, and that is something we can look at in 2018. The good thing is we significantly increase and highlight the opportunity of what Shumagain Gold Zone and the Unga District effectively with a targeted drill program with step out holes and geophysics.”

Could you elaborate on which parts the 2017 drill program will consist of?

Peter Ball: “2017 will focus on a few key elements to de-risk the asset and also add implied value for the potential of the project. One aspect is to start looking at the metallurgical characteristics of the rock at Shumagin, and re-confirm what was done in the 80s with preliminary metallurgy. It is one of the questions I continue to get asked and metallurgy is always key to the future potential economics of any project.

Another aspect of ensuring we get the best value from the drill bit is to de-risk each hole and refine or define the collar and direction of each hole to ensure we hit what we are aiming for. Our technical team, led by Jesse Grady (VP Exploration) was very successful in the 2016 program by hitting the structure and gold in all seven (7) holes.

So, first we will run a ground geophysical program across the known structure where we have drilled and we have significant geological information on the rocks, faults and a historical/recent model.

We are looking at completing ground magnetics, some IP, and maybe Gravity surveys over the known 1.2 kilometer long Shumagin trend. Each survey type can yield enough information to give us what we call a footprint or signature of the known drilled gold zone at Shumagin.

Once we are confident in the information we will repeat the same survey to the south west and look for structures and anomalies and faulting and ensure we can plot our next set of drill holes. Drilling is one of the most expensive parts of any exploration program and the surveys will ensure when we spend shareholder dollars on a drill hole, we effectively have a higher chance of success.

When we feel comfortable enough to start drilling, We will, based on geophysical data, start stepping out along the Shumagin Gold Zone along strike to the south west and look for the structure and veining. We will continue this until the structure is no longer being intersected and then model results and regroup for next steps. We anticipate to have about 2,000 meters completed by May and we expect to continue to drill into the summer.“

Corporate

At the end of December, you had a working capital position of in excess of C$6.5M which puts you in a much better position than just one year ago. How much will you spend on exploration in 2017, and how much cash will you still have left by the end of this calendar year?

Peter Ball: “When I started with the Company in January of 2016, we had less than C$200K in the treasury and yes, being cashed up with C$6.5M is a great point to start 2017.

During 2017 we are looking at a staged approach based on results. If results are good, we may look to expand the drill program and re-capitalize at some point to get more aggressive with our overall drilling plan. If we just drilled 5,000 to 6,000 meters we would have just under $2M remaining at year end.

We want to ensure we get every bit of value from our treasury to advance Unga, but also ensure we remain in a strong position at all times based on changes in the market. Unga is a large project that has many gold zones that could be drilled for years and likely yield many discoveries.

We will monitor each part of program to ensure at times we can slow down and review each step, and also be ready to flip the switch in high gear when results are yielding what we anticipate – which is high grade gold hits, multiple intersections, and a methodical expansion of the Shumagin Gold Zone, along with reconnaissance exercises on other known secondary drill targets.”

It looks like the 6.17 million shares you own in NV Gold have not been included in the ‘marketable securities’ part of your assets, but are instead listed as longer-term assets. Is this due to a sale restriction, or because you really see the NV Gold stake as a core asset for Redstar, considering you have enough cash to cover your needs?

Peter Ball: “We took a look at many options for the Nevada portfolio we controlled when I joined the company.

My goal was to find a management team with exceptional knowledge of Nevada and the ability to utilize the database, make a discovery, but to also advance the assets of the newco or company and the overall value creation for Redstar’s shareholders as we continue to hold the shares.

At some point, we will sell the shares to finance further corporate action by Redstar and we don’t have a hold on their stock. We got to meet the NV Gold team led by John Watson (CEO and largest shareholder), Quinton Hennigh (Director and CEO of Novo Resources), and Odin Christensen (Director and ex Chief Geologist for Newmont Mining for 20 years).

Ken Booth and myself from Redstar joined the board of NV Gold and we look forward to see a wonderful year for NV Gold and our investment.”

In 2016, you were also able to welcome Eric Sprott as a new shareholder. How important is it to have another big name backing you? What percentage of the stock is now in the hands of management and institutional investors?

Peter Ball: “Yes in 2016, Eric joined the list of stellar and well known gold bugs and institutions of Redstar.

Having Eric become an insider and large shareholder of the Company was significant in many ways. Firstly I wanted to add another name to our solid group of shareholders, and his name helped validate the quality of the project and the opportunity for success going forward. I am hoping to get Eric up to site in 2017 if possible, along with other new groups to highlight the significance of the district and potential of the multiple gold zones to yield new discoveries and multi-million ounce gold deposits.

Management and institutional shareholders control just over 60% of the Company, led by Mount Everest Finance 15% from London England (Mr. Jacques Vaillancourt, who is also Executive Chairman), Eric Sprott ~10.1% (Personal Account – Toronto), George Ireland of Geologic Resource Partners ~9% (USA), Gold2000 (Zurich), US Global (USA), Odey Asset Management (London) and Gabelli Gold (NY).”

Disclosure: Redstar Gold is a sponsor of the website. The author has a long position in Redstar Gold.