Even though the real ‘hype’ surrounding graphite and the graphite market is over (which we don’t mind, as this allows the serious companies to come to surface), it’s definitely still possible to come across some really interesting graphite companies.

You might remember we covered Elcora Graphite (ERA.V) approximately two years ago, and were obviously very happy when the company’s share price five-folded in the subsequent eighteen months.

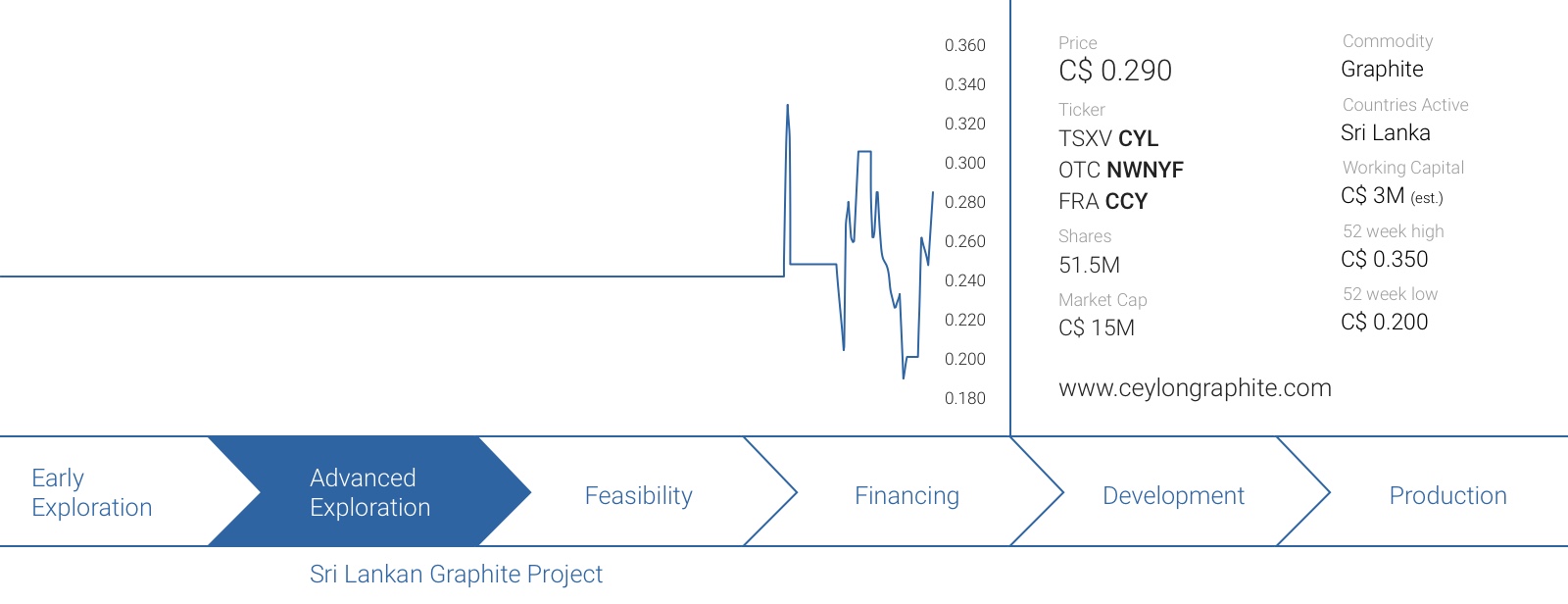

In this report, we’d like to introduce you to a new player in the Sri Lankan graphite space, Ceylon Graphite (CYL.V). This company was created approximately four years ago and started trading in January 2017. We sat down with company representatives to get a better understanding of the company and its plans in Sri Lanka.

The Project

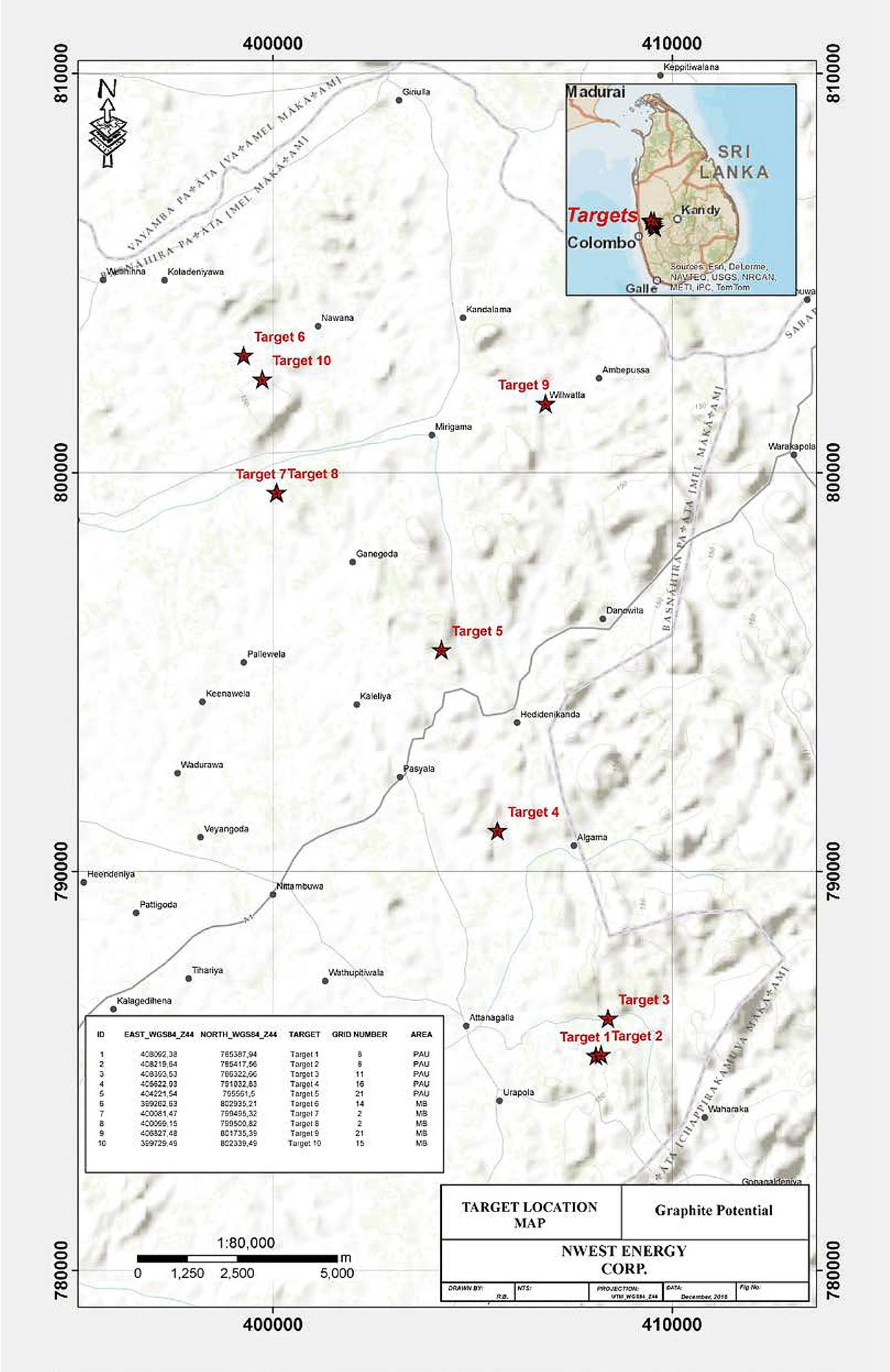

Ceylon Graphite’s land package consists of 116 square kilometers in ‘grids’. It’s our understanding the project actually is a historic producer. Could you elaborate a bit on the historical production (output, buyers,…) and why mining has stopped?

We don’t have the exact details about the output numbers, but the buyers of the Sri Lankan graphite product were very diverse and actually also included US-based purchasers. Mining activities stopped predominantly because the graphite price decreased and as shafts went deeper, ventilation and dewatering issues started.

Keep in mind these historical mines were operated by artisanal miners and they just didn’t have the capital or know-how to deal with these issues.

Considering the project is a historical producer, it indeed makes a lot of sense to restart production starting at one vein at one grid to get the cash flow going. According to your presentation, the total production cost will be approximately $275/t ($400/t if you’d include the royalty expenses and G&A expenses to the cost basis), and you will be able to sell the graphite at approximately $1250/t. What kind of initial production rate (in tonnes per year) do you expect for the initial $3M capital expenditures?

We estimate the total start-up cost of each grid to be approximately C$350,000-500,000. This should allow us to reach ‘commercial’ production rates at the veins, and we expect each production site to produce 150 to 300 tonnes of graphite per month (which will obviously vary depending on the quality of the vein and other parameters).

Our plan is to put three grids into production, and go from there. As you can see, the entire start-up process isn’t very capital intensive at all, and that’s why we like to do business in Sri Lanka.

Also keep in mind our production cost estimates are pretty conservative, and we hope to be able to produce the graphite at a lower cost than the $275/t (excluding royalties and G&A). We don’t have an official feasibility study on this project, but we feel comfortable with our numbers.

Will the remaining veins also have a development capex of approximately $3M, or will it vary depending on the location, depth, etc.?

As said before, each mine site should cost between C$350,000 and C$500,000. As the veins go deeper, and should we elect to continue to chase and mine those veins, the cost might obviously increase.

But let’s be clear, in the first stages of our business plan, we will go after the ‘low hanging fruit’ and mine the easily accessible veins on the grids.

Would you be able to give an updated timeline? When do you expect the first production permits to be issued? When do you anticipate to be in full production on the first vein?

We expect to receive our production permits within the next 60 to 90 days and aim to be in production within six months.

The Company

The first step is obviously to produce and ship the ‘raw’ graphite, but Ceylon Graphite also intends to focus on other value-added products. Could you elaborate a bit on these plans, even though it’s still early days?

Sure. Our first and primary objective is to establish a joint venture with a battery manufacturer. We would actually like to see a partner effectively coming into Sri Lanka and actually produce the anodes in the country.

We think this would be a win-win-win situation. We would benefit from partnering up with another company, the government would see we are very serious about our commitments in Sri Lanka, will see a higher tax revenue and a lower unemployment rate, whilst a battery manufacturer will benefit from low-cost labor and perhaps even a tax holiday.

You currently have 51.5M shares outstanding, and will issue an additional 25.4M new shares by converting the special warrants upon the start of commercial production. How will you define when ‘commercial production’ will have started?

The Company has 25,393,500 Special Warrants. Each Special Warrant can be converted, without any further consideration, into 1 common share of the Company. Conversion of the outstanding Special Warrants is subject to the Company receiving sales proceeds of a minimum of 350 tonnes of graphite from the property. The Special Warrants are held in escrow and will also be subject to a time based release over 36 months as follows:

[table caption=”” colalign=”center|center|center|center”]

Release dates;Special Warrants eligible for conversion

On Closing date;1/10

6 months after Closing date;1/6

12 months after Closing date;1/5

18 months after Closing date;1/4

24 months after Closing date;1/3

30 months after Closing date;1/2

36 months after Closing date;Remaining balance

[/table]

You currently have approximately C$3M in cash, is this sufficient to reach the cash flow positive phase, or will you need to raise more cash? If so, what would be your preferred way to raise cash?

As the initial capex on the grids will be very low, we don’t anticipate we need to go back to the market to raise cash prior to reaching a positive operating cash flow.

Will you add more people to the team? Will you appoint a COO with in-country experience?

Yes, there will be someone to manage the exploration activities, as we will have a full time drill crew working on the property, providing data on all grids. There will also be a person overseeing mining plans and mining operations. The expanded staff will very likely consist of external consultants and our own employees.

Conclusion

Ceylon Graphite is ready to hit the ground running in Sri Lanka. With C$3M in cash and an anticipated start-up cost of just C$0.5M per grid, the management’s claim it won’t need to raise more cash before reaching production seems to be credible.

Ceylon Graphite will very likely be in production before the end of this year, and we will provide more details focusing on the economic potential of the graphite project shortly in a separate report!

Disclosure: Ceylon Graphite is a sponsor of the website. We have a long position.