Life is slowly getting back to normal again in Asia and Europe – albeit the recovery will very likely be gradual. As the Asian economies have reopened before the European (and North American) economies and as several countries imposed mandatory mine closures to protect human life, one could actually make the argument the COVID-19 crisis could have a slightly positive impact on inventory levels. Yes, we are entering a phase with a reduced demand for base metals like copper, but the recent closures mean the supply side of the equation will also decrease and won’t easily and immediately go back to normalized levels and the next six months could be quite interesting.

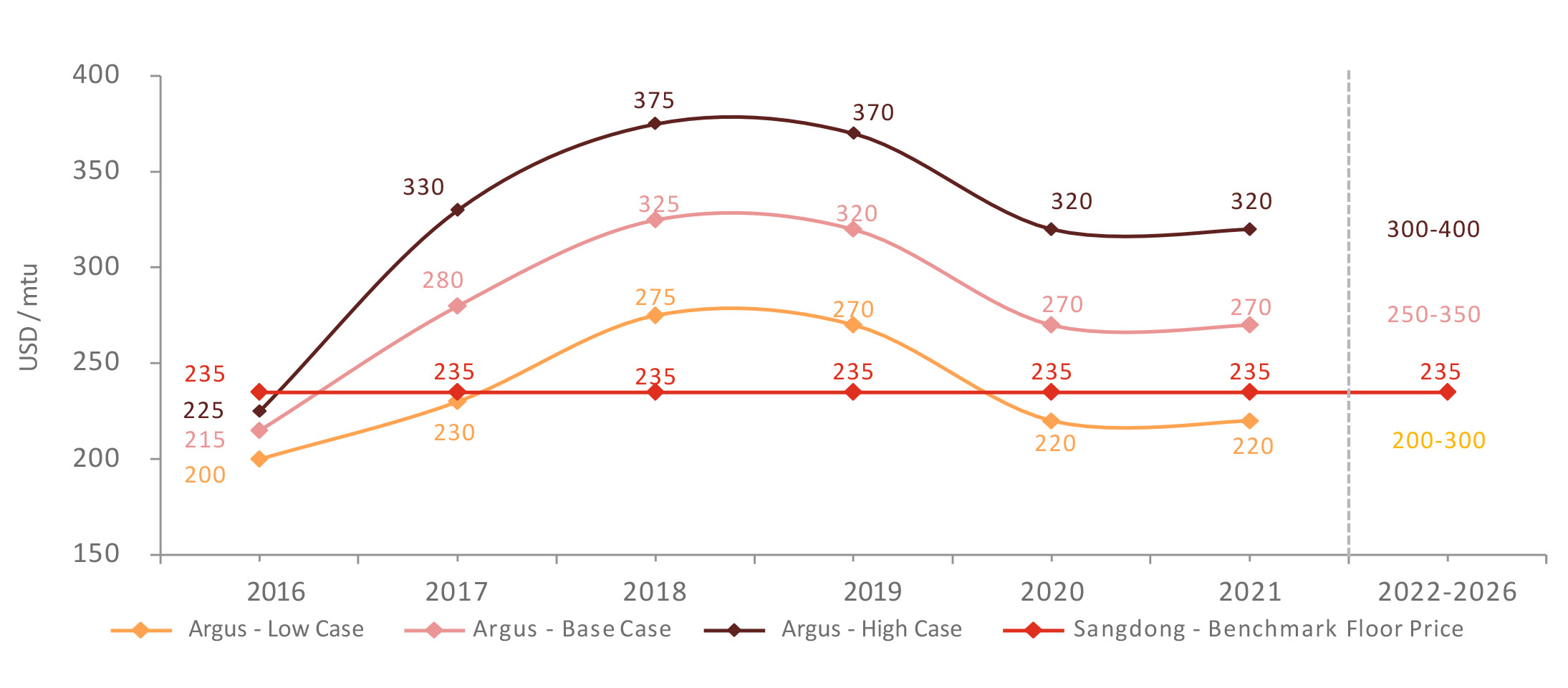

Fortunately for Almonty Industries (AII.TO) its main product, tungsten, is mainly traded on a contract basis and doesn’t encounter huge price swings like other base metals do. The tungsten APT price is currently trading at around $220/mtu (down from $240/mtu) but this is pretty irrelevant to Almonty as it has entered into a binding offtake agreement with a floor price of $235/mtu (resulting in $183 per mtu of tungsten concentrate).

This doesn’t mean Almonty wasn’t impacted at all. The company had hoped to finalize its cheap debt financing before Easter and it shouldn’t be a surprise to see the finalization of the debt taking a little bit longer than expected. We checked in with CEO Lewis Black to get an update on all aspects of Almonty.

Sangdong

The main question on everyone’s mind if obviously enquiring about the status of the financing of the construction of the Sangdong tungsten mine. It took you years to get the KfW Ipexbank and the Austrian Credit Agency across the finish line and you were aiming to get all the Is dotted and Ts crossed before Easter, but then COVID-19 came along and everything got delayed. As there has been no news discussing the opposite, may we assume the financing remains on track? What still needs to be done before you can officially release the definitive agreements?

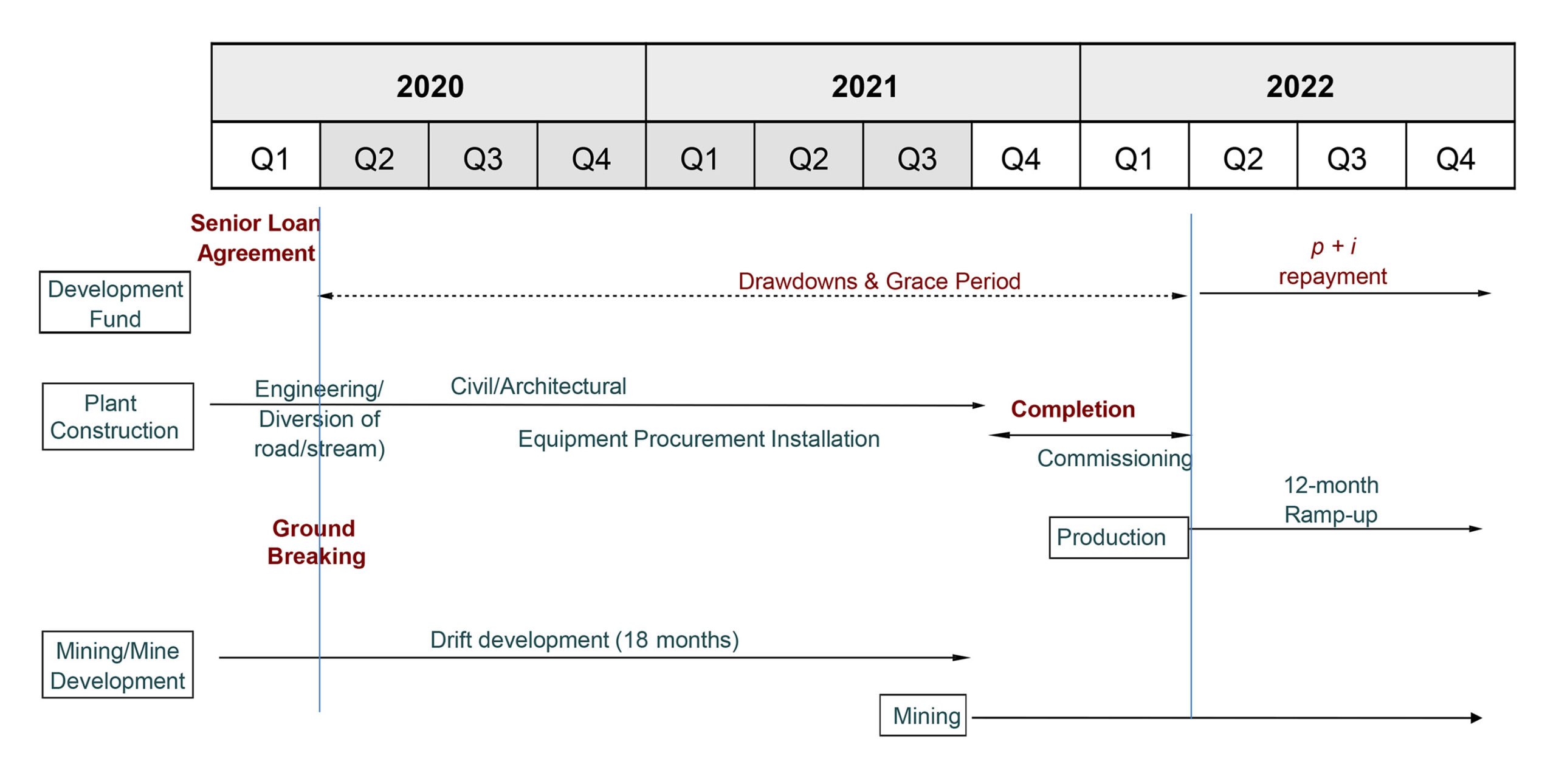

We are currently working through the over 400-page term sheet. There are 4 sets of attorneys working in 4 different jurisdictions (UK whose law the agreement is governed under, South Korea, Canada and Germany). Project finance documents are notoriously long winded especially when Governments are involved but this is the price you pay for extremely cost-effective debt (as our cost of debt will be 3M LIBOR + 2.3%. As the current 3 month LIBOR RATE is now below 0.5%, our total cost of debt at this point would be just 2.8%). All terms have been agreed upon and now multiple lawyers charging extraordinary amounts are busy papering all the terms into the loan documents and we should have news in the next few weeks.

On the Almonty website, we regularly see updates from the mine site and in April you were hosting provincial government officials to make them more familiar with the project. In that brief update you also mentioned the government will begin the process of providing cash subsidies. Can you elaborate a bit on these grants?

The regional government along with the local government are now publicly connected to the development of Sangdong and this shift has occurred because they are now extremely comfortable that the financing is all but done. The support of local and regional government is instrumental in the development of the mine and under a 20 year decree for special areas we will qualify for a number of cash subsidies and tax benefits given we are located in one of only three special economic zones that pre-qualify for this support. We are expecting somecash support once the construction has commenced and a host of other programs designed to support construction and rapid growth. This figure is linked to the decree which stipulates spend X and receive automatically back Y.

What are your total capex needs (including working capital requirements) from this date until Sangdong starts to generate a positive free cash flow? How do you anticipate to finance the potential shortfall?

The budgeted total project cost is US$105m which includes all working capital, 2-year interest payments, bank fees, 15% contingency, DRSA reserve account and so on. The remaining $31M we will need on top of the debt facility will be a hybrid/grant to minimize dilution and to reflect the high-quality debt that has been provided to the company from KFW-Ipex bank.

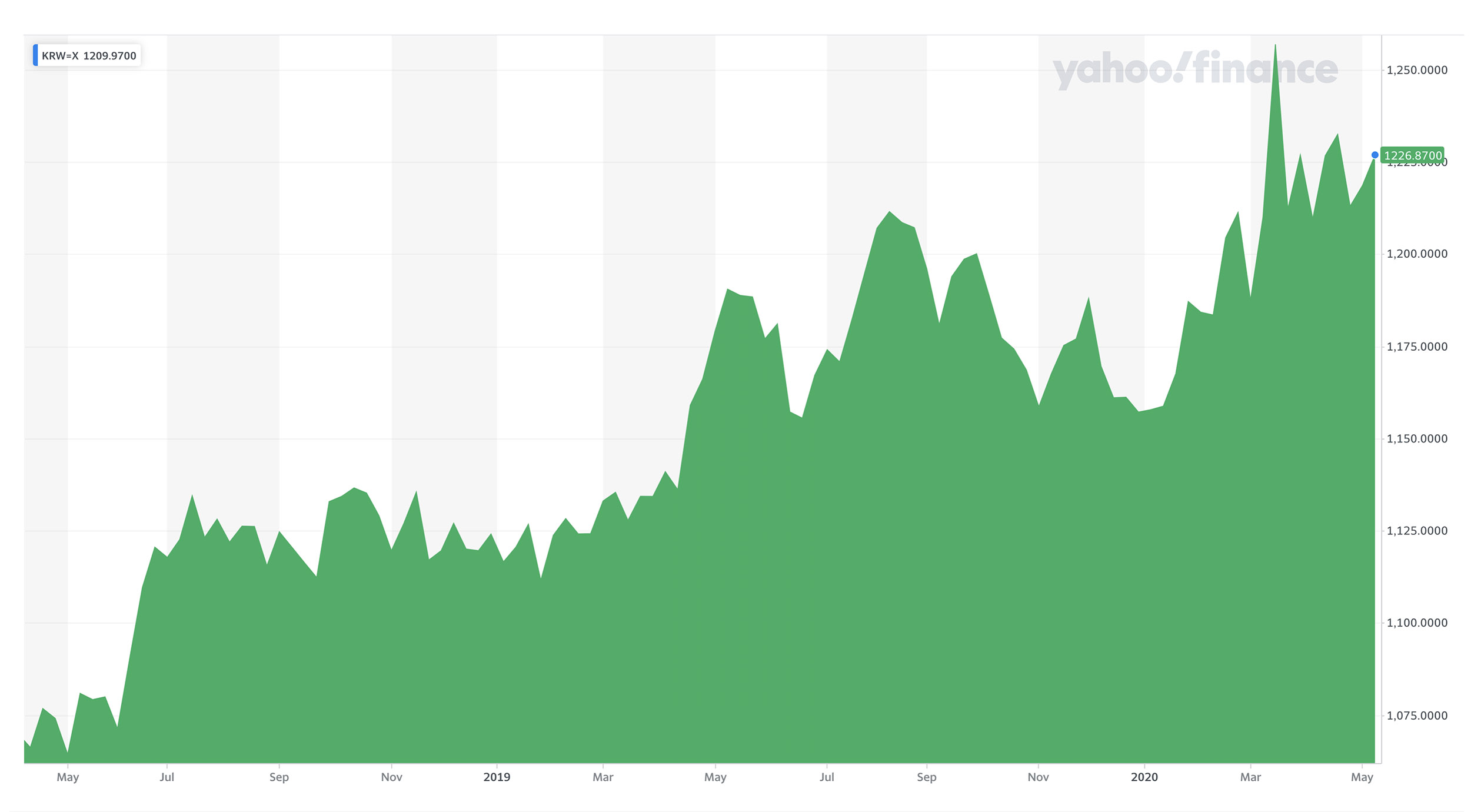

In the past six months, the South Korean Won has lost about 5% compared to the US Dollar. Will this have a noticeable impact on the capex and opex, or are most of those elements USD-denominated?

70% of our costs in the build are designated Won and so this decrease in the value of the Won has a positive affect on dollar cost when pegged back to the loan. If this trend continues, we also will see a strengthening of our margin given our costs are Won and our revenue is in USD.

In March, you announced the pilot plant is operating as expected, what are you hoping to learn from the pilot plant program? Would that be just to confirm the anticipated recovery rates and concentrate grade as envisaged in the feasibility study, or are you hoping to further improve on those numbers?

The purpose of the pilot plant to us is to continually examine operational issues that could occur. We need to understand, for instance, tailings consistency given we are paste filling them back underground. Also, what happens with environmental temperatures as it can have wind chill of -20c in winter and 35c in summer? Are the size particles of the slimes going to be efficient with our thickener design?

The pilot plant affords us the luxury of resolving problems before they occur because they are very costly problems in full production! Regarding the process we are comfortable with level in the FS and our lock cycle test in the pilot plant has confirmed the process’s efficiency. Improvements always occur in production but the pilot plant to us is an opportunity to spend almost 2 years operational dissecting the process and trying to anticipate operational issues. This will represent enormous cost savings to resolve any issues now and not after commissioning the main plant.

In a previous update we briefly discussed the potential to produce value-add products at the Sangdong mine site and ferro-tungsten was one of the ideas. What would be required to upgrade a part of the production to ferro-tungsten? Would this also fall under the offtake agreement with Plansee, or would you have to secure another buyer for that product?

The offtake with Plansee/GTP is specific to the contracted quantity of concentrate. Any down stream product such as ferro tungsten are outside that offtake and will represent an opportunity for the company in high demand times to value add whilst benefiting from decreasing costs per ton. The capex required for such downstream products are realistic given they do not have to have large capacities – we would not be passing other sourced material and would be eligible for government support and benefit from the low carbon neutral energy cost we have at site. There are no shortages of quality customers who are interested in a secure, transparent, free world source of product.

About the other projects

The production at Los Santos has ceased, are there any requirements related to the reclamation of the mine site? Is there any use for existing equipment to be transferred to other operations like for instance Valtreixal in Spain?

Los Santos will reopen later this year to pass just tailings. This is part of our reclamation plan and minimises the cost of this reclamation. The plan is to finalise the permits at the open pit Valtreixal and then relocate the Los Santos plant to that site given that the plant is an extremely efficient and capable one and we would enjoy a far lower start up cost given we already have a plant!

How did COVID-19 impact the existing production in Portugal, where Almonty operates the Panasqueira mine, producing one of the cleanest tungsten concentrates in the world?

There were no guidelines issued anywhere in Europe for the mining sector, but we developed in house a robust program to ensure safety levels continue to be maintained. Even our shipments and the containers that are used are thoroughly disinfected and our customers have remarked on the pungent smell of disinfectant when the shipment arrives.

About tungsten

Let’s talk about tungsten for a minute. Could you perhaps provide some background about the tungsten market; what are its main uses, and where is most of the tungsten mined?

80% of the worlds production is conducted in China who in turn consume approximately half of the worlds production. Traditionally the market grows between 1.5% to 3% per year globally. Aerospace, car, military, mining, oil and gas, manufacturing, medical and infrastructure are the main consumers.

How do you see the demand and supply for tungsten evolve in the near-term (2 years) and longer term (5+ years) future? What will be the main drivers on the tungsten market?

The continuing push by the consumers toward more transparency in the supply chain and to operate in countries with legal systems allowing the enforcement of contracts (and thus leading to greater reliability of supply) are the biggest factor affecting our industry. There is a paradigm shift toward these conditions by the non-Chinese consumer base. Coupled with the increasing expansion for the use of Tungsten such as battery technology and rapid charging plus huge innovation in the medical field, the consensus is there will be accelerated growth for mines that fit this new required criteria.

About Lewis Black

We rarely see someone who’s as ‘all-in’ on one commodity as you seem to be as after Primary Metals got sold to Sojitz, you stuck to the tungsten space with Almonty Industries. Why?

When you factor the 126 years our Panasquiera mine has been in production we have a unique position globally in being the most recognised and accomplished tungsten operational team currently in the world. Just our senior management have over 200 years experience of Tungsten between them.

We have built a reputation withing the entire industry that enables us to command higher than market fixed price contracts and even hard floor offtakes shielding us from commodity down tun cycles. We are respected worldwide for our ability to operate competitively with far lower costs countries and we are at the forefront of developing tungsten process technologies. We believe playing to your strength is more important than expanding into metals we do not have such a deep understanding of.

What was your career like before entering the public companies space in 2005?

My business partner Dan D’Amato (who sits on the Almonty board) and myself have been working together most of our professional lives. As entrepreneurs we have always tried to operate in sectors where we had access to extraordinary talent in that field. In regard to Tungsten this cam with the opportunity to acquire the largest pool of tungsten knowledge that exists at the Panasquiera mine.

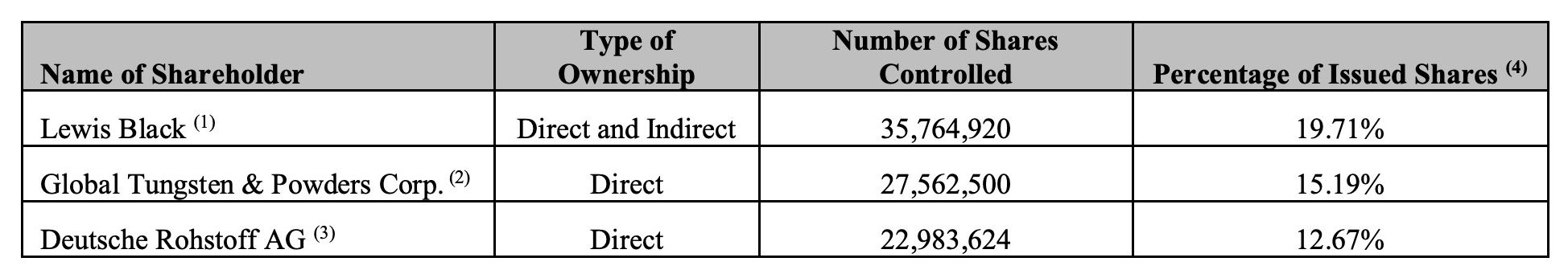

Approximately half of the shares are owned by just three shareholders and you are the largest one with almost 35.8M shares representing just short of 20% of the share count. Needless to say your interests are very much aligned with smaller shareholders, and you will make your real money on a higher share price. How do you anticipate to reward shareholders further down the road? Are you planning dividends? On-market buybacks? A Dutch tender auction?

A continued value add to the company with nominal or no dilution will always amount to share appreciation. This can be built upon with dividends (something that we have paid before at Almonty) or ultimately an exit (As we did before at 40 times investment with PMI/Sojitz). We have the worlds best Tungsten project in a safe jurisdiction in South Korea, with 70 plus years of reserves, with one of the highest grades in the world, financed by KFW who have a 100% track record in successful mine developments underwritten by OeKB and backed by a 15 year hard floor no cap upside offtake.

We have an opportunity to reopen a mine for about $100M that would otherwise probably cost around $1B if one would have to build it from scratch. To just have one of these items has value but to have all of them makes this situation quite unique.

Conclusion

The COVID-19 outbreak has definitely slowed down the entire world but Almonty Industries should only experience minor impacts from these delays. The legal teams are working through the documents to finalize the low-cost loan that will provide approximately 70% of the required funding to bring Sangdong back into production.

The tungsten price has declined by approximately 10% in the past few months but this won’t have a noticeable impact as Almonty’s offtake partner has entered into an offtake contract which includes a floor price for the tungsten concentrate. This makes Almonty’s development plans for Sangdong immune to the fluctuations of the tungsten price and will allow the company to hit the ground running once all final signatures have been completed.

Disclosure: the author has a long position in Almonty Industries. Almonty is not a sponsor of the website, but a third party person is.