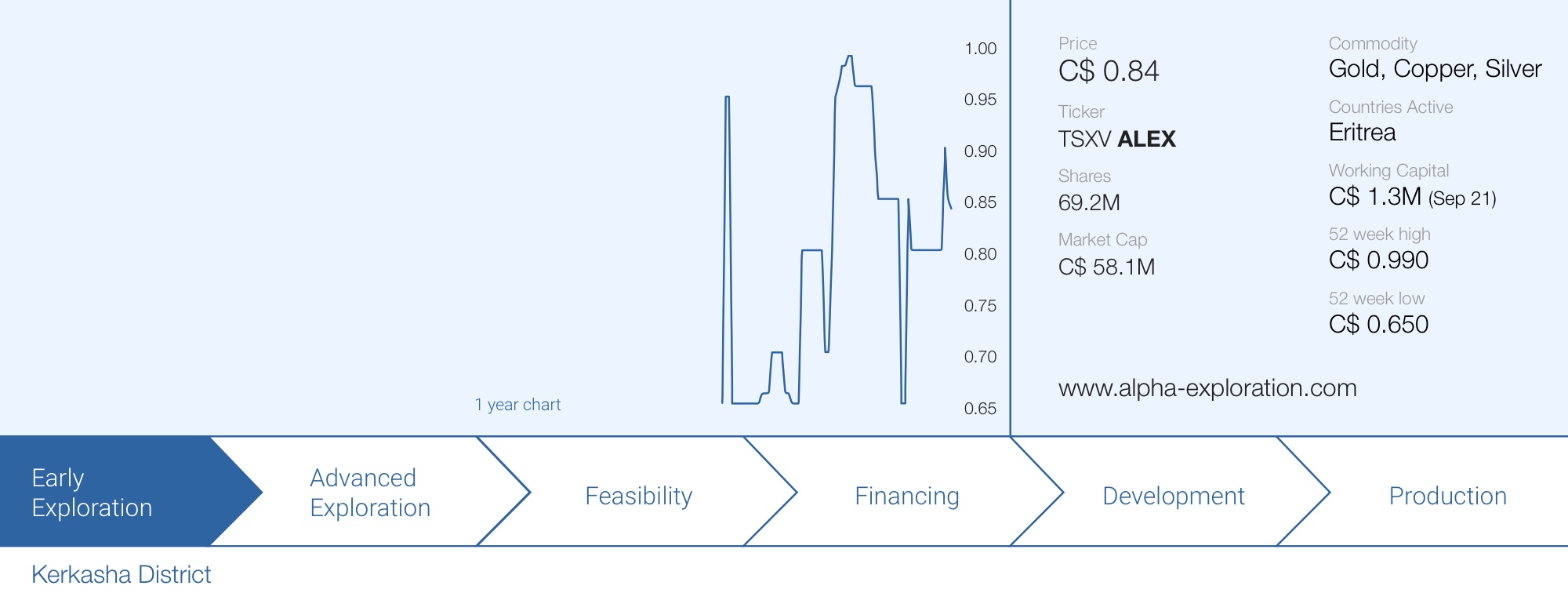

Alpha Exploration (ALEX.V) is one of the newest companies on the TSX Venture Exchange as the company completed all the required paperwork for its listing in the fourth quarter of 2021 which resulted in a first trading day on November 1st 2021.

Alpha Exploration is led by a veteran management team with President & CEO Michael Hopley, who has plenty of experience in the Horn of Africa as he also was the President & CEO of Sunridge Gold Corp (SGC.V) which developed a VMS project in Eritrea when it was acquired by a Chinese company (Sichuan Road & Bridge). Hopley is now back as Chief Executive of Alpha Exploration and he definitely knows the ropes in Eritrea.

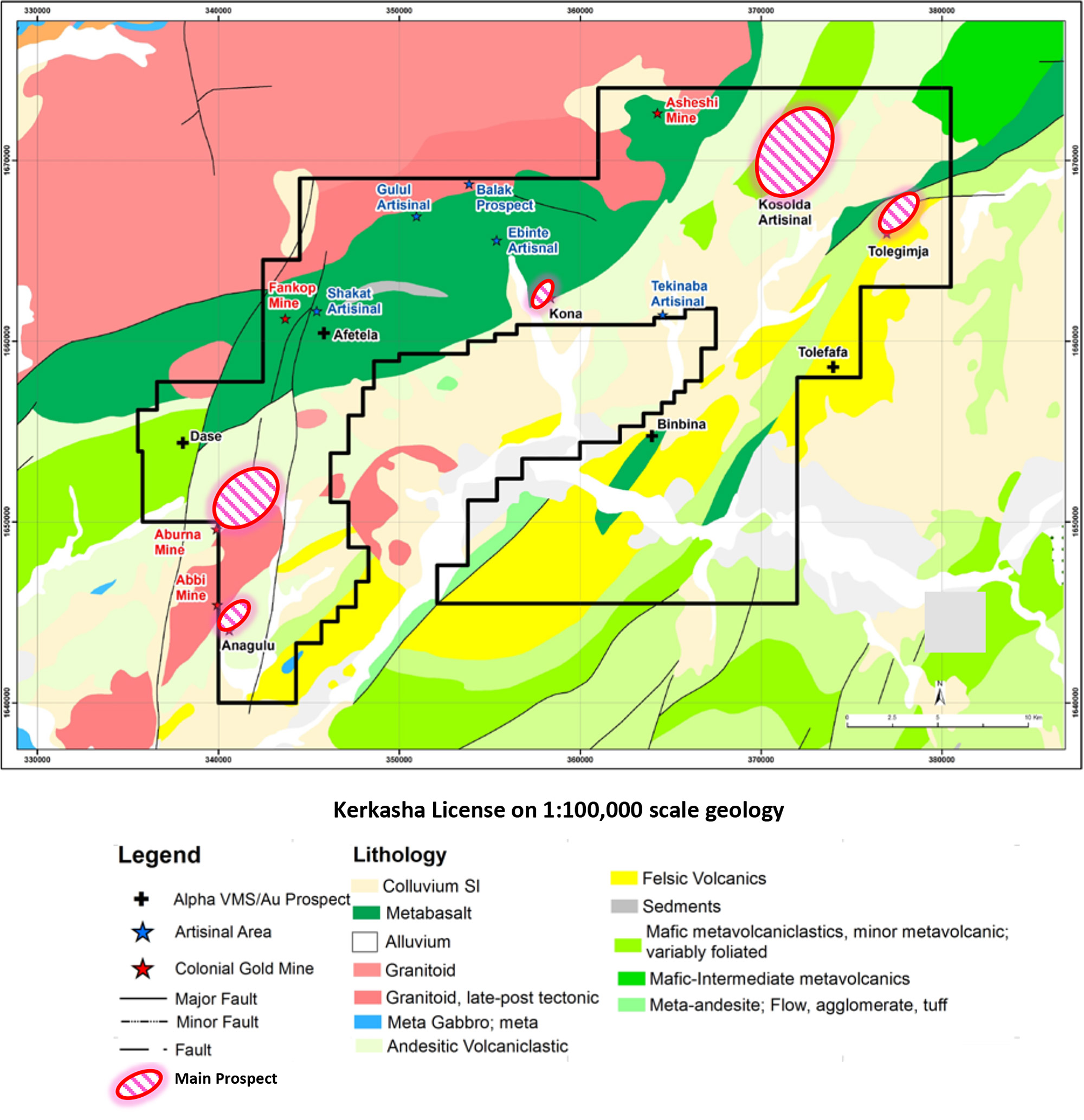

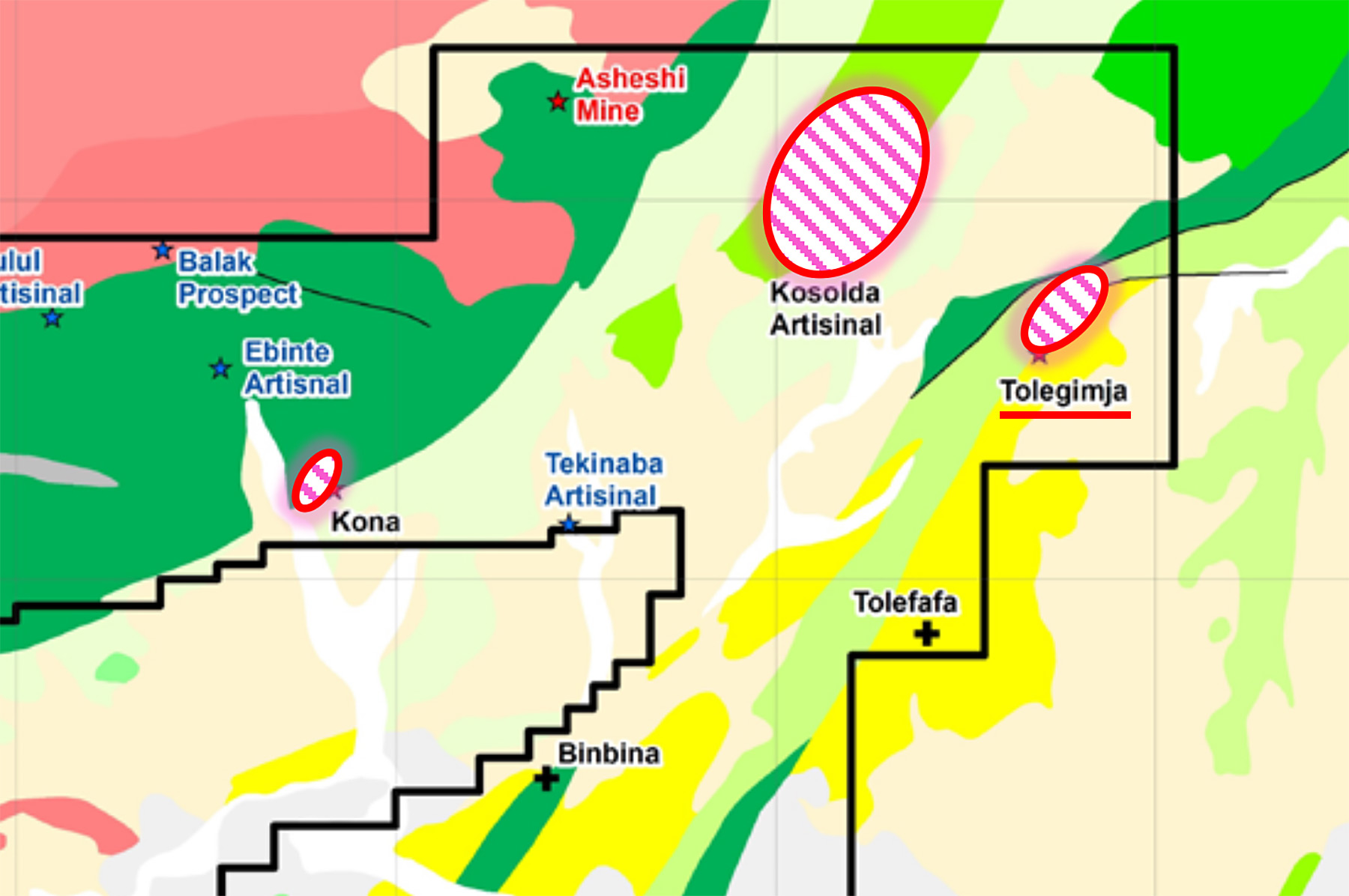

In this initial report, we’ll dig a bit deeper into the Kerkasha Project, Alpha’s Exploration License in Eritrea. Kerkasha hostsa very extensive land package which includes four Colonial Gold Mines and 6 Artisanal mining areas. Alpha Exploration is the first company to drill test some of the most promising areas at Kerkasha in the modern era. The company is planning for a very busy 2022 as it expects to advance 3 of the Prospects (Aburna, Tolegimja and Kona West) at Kerkasha in the current quarter.

The background of the Kerkasha District

It’s perhaps wrong to refer to Kerkasha as a ‘project’ as Alpha Exploration has got its hands on an entire district with a total size of in excess of 770km². For the purpose of this report, we will refer to Kerkasha as ‘the district’ and the separate exploration targets on the Kerkasha license as the ‘separate’ Prospects. Originally in excess of 1,000 square kilometers in size, Alpha reduced the total size of the Kerkasha land package by 25% to 771km² as per the requested practices within the Eritrean mining law. Alpha Exploration owns 100% of the license subject to the normal royalties payable to the government as well as a 2% NSR payable to Nubian Royalty.

Kerkasha is located approximately 135 kilometers west-southwest from Asmara, the capital of Eritrea. This isn’t exactly uncharted territory as the District was previously owned and explored by a joint venture between AngloGold-Ashanti (AU) and Thani Investments which signed a joint exploration agreement in 2010. That agreement remained in place until 2013 and the data gathered by the two parties allowed Alpha Exploration to kickstart their own exploration programs. The image below shows and explains how the cumulative exploration expenditures have already reached C$15M. A lot of the heavy lifting has already been done and now it’s up to Alpha Exploration to work through the list of 17 (!) known prospects and focus on the most promising ones first.

Alpha Exploration was the first company to drill-test targets on the Kerkasha license in the modern era. Limited fieldwork was completed up to Alpha being awarded the License in January 2018. Alpha hit the ground running as it started drilling in December 2018 and that drill program consisted of 22 RC holes of which 10 were targeting the Kona West Prospect with 12 RC holes also drilled at Anagulu Prospect. A subsequent drill program in 2019 was zooming in on the Kosolda Prospect where 9 diamond drill holes were completed and the Asheshi Prospect where 9 RC holes and 4 diamond holes were drilled before the drill rig was redirected to Anagulu to complete 3 additional holes. And those 3 additional holes at Anagulu seemed to improve the prospectivity of Anagulu with an intercept in ARN015 of 42 meters of 0.18% copper and 0.29 g/t gold.

Anagulu Prospect

When Alpha Exploration started drilling the Kerkasha district in 2018, twelve RC holes were drilled on the Anagulu target and some of these holes immediately encountered mineralization with a grade that appears to be economical with for instance 4 meters of 0.4% copper and 0.51 g/t gold and 3 meters of 0.92% copper, 0.55 g/t gold and 7.65 g/t silver in holes ANR001 and ANR002 respectively.

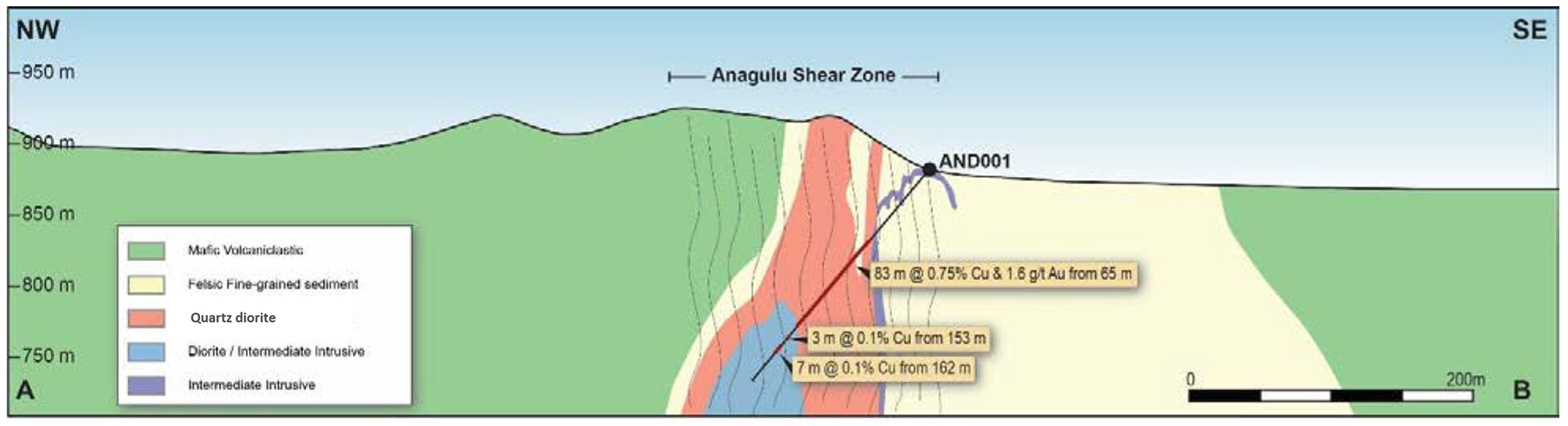

This immediately catapulted Anagulu to the pole position and it’s safe to say Anagulu is Alpha’s flagship Prospect as this copper-gold porphyry discovery has now been traced over a length of approximately 2 kilometers. The very first diamond drill hole (AND001, drilled in January 2020) returned an outstanding intercept of 108m @ 1.24 g/t Au & 0.60% Cu & 3.57g/t Ag (60 – 168m) including 49m @ 2.42 g/t Au & 1.10% Cu & 6.83g/t Ag (80 – 129m) . Considering the true width is estimated to be 60-80% of the reported interval, we are for sure talking about a rather sizeable intercept here.

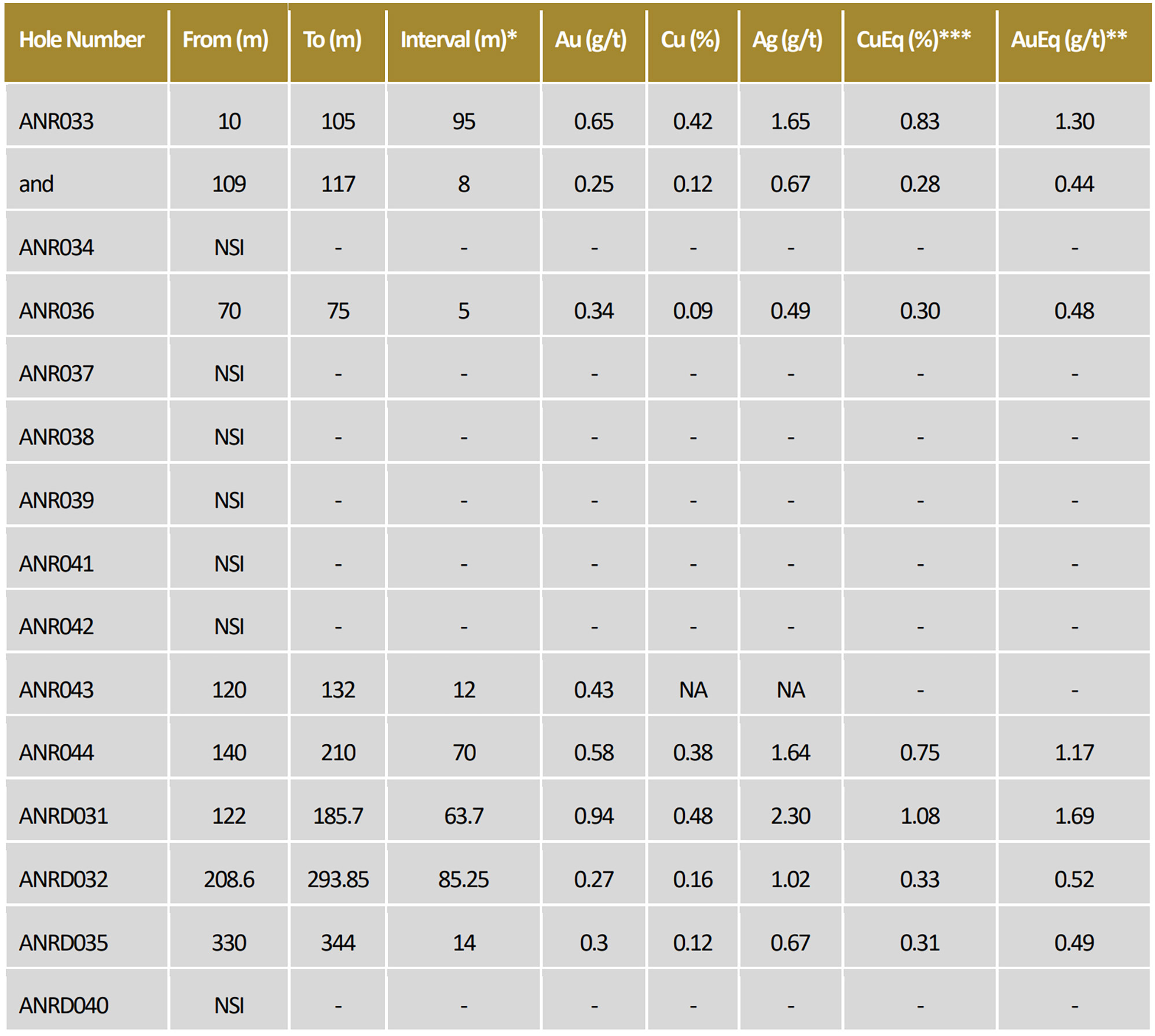

Finding something like this immediately catapults Anagulu to the top of the priority list, and in December 2021, Alpha Exploration reported on the assay results from fourteen holes that made up the Phase 3 drill program at Anagulu. A total of 3,038 meters were drilled in a combination of RC and diamond drilling to get a better understanding of the geology and controls to mineralisation.

Of course this still is an early-stage exploration project and not every hole has hit (economic) mineralization. Of the 14 holes, half came up empty. The other 7 holes were okay to excellent. While for instance 85.25 meters of 0.27 g/t gold and 0.16% copper is hardly exciting (considering it started at a depth of 209 meters downhole), it does provide more indications of a large and widespread copper-gold porphyry system. And to be clear, some of the 14 holes reported good to excellent results. Hole ANR033 for instance encountered 95 meters of 0.65 g/t gold and 0.42% copper starting at a downhole depth of just 10 meters; so almost right at surface. With a gross rock value of US$75/t using $1800 gold and $4 copper, that would most definitely be an economically viable interval.

Overall, the assay results from these 14 holes should be described as ‘encouraging’. As this still is an early-stage exploration program, there will always be dusters and once Alpha Exploration gets a better understanding of the geological controls to mineralisation, we can expect the hit ratio of the drill programs to increase. Alpha plans to drill an additional 2,000 meters at Anagulu before the summer but, it’s clear the company’s technical team wants to increase the meterage at Anagulu as soon as it is able to raise additional capital.

Kona (West) Prospect

The Kona area was one of the first zones to be drilled after the Kerkasha license was awarded to Alpha Exploration but that initial drill program was quite disappointing with just one of the ten holes actually showing ‘okay’ mineralization, although 2 meters of 0.3% copper and 0.02 g/t gold aren’t anything to write home about for a VMS-type prospect.

Back to the drawing board indeed, and Alpha Exploration completed an IP survey at Kona West which shows two large IP anomalies in the center and the west of the Kona West prospect. The previous drill program did not have this data and as such, none of the anomalies have been drill tested so far and the upcoming 1,000-meter drill program will be the very first time the company is targeting any of these IP anomalies.

The IP survey could be a game-changer for the Kona West Zone as the anomaly is very close to the previous drill program (which was mainly based on surface sampling anomalies). Although 1,000 meters isn’t a whole lot, it should provide the company with a lot more insight on how to tackle the future exploration efforts at Kona West.

Aburna Prospect

Aburna also ranks pretty high on the company’s priority list, mainly because it has evidence of historical mining with the Italians developing several Gold Mines in the area during the colonial period ( in the 1920s) while more recently, artisanal gold mining has taken place (artisanal mining is discouraged by the Government but Alpha Exploration has found traces of small-scale artisanal activity).

Tolegimja Prospect

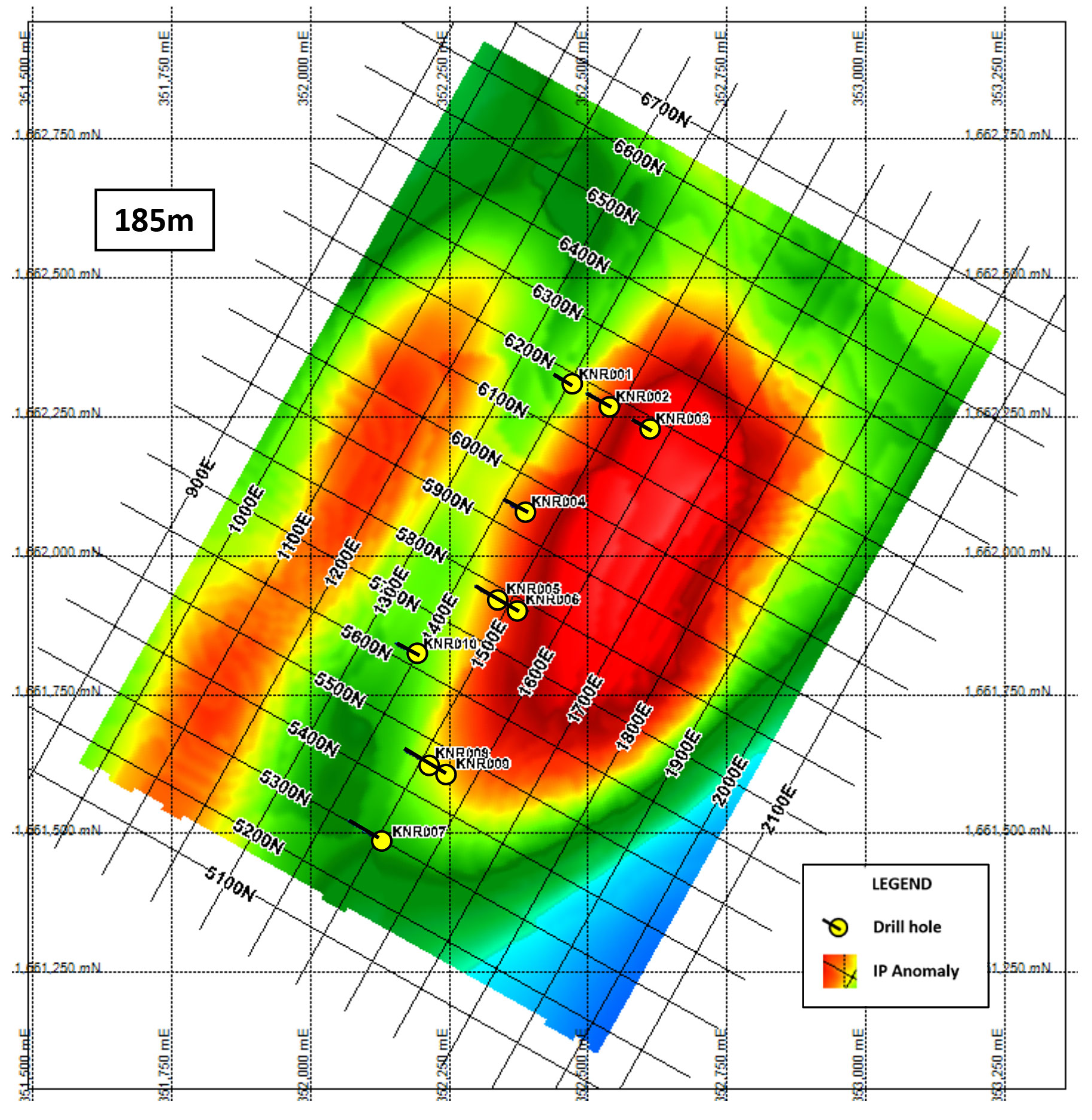

Alpha Exploration has hit the ground running at Tolegimja as the company recently received and published the results of a structural mapping program and IP Geophysical survey. As you can see in the image above, Tolegimja is located in the northeastern section of the Kerkasha project.

The IP survey defined three high-priority drill targets (conveniently called TOL 1, TOL 2 and TOL 3) with the first two targets being highly chargeable and conductive bodies extending to depth. An additional bonus is that TOL-1 and TOL-2 appear to correlate with the surface sampling program which had already discovered anomalous copper values. According to the consultants who interpreted the data, TOL-3 is also a high-priority drill target but is smaller in size. Interestingly, this conductive zone could actually be an extension of the TOL-1 drill target.

The results of the IP Survey in combination with a more detailed mapping program completed in November and December 2021 have reconfirmed Tolegimja as a valid VMS target and Alpha Exploration is drilling this prospect right now.

Eritrea as a country

As the project is located approximately 10 kilometers from the border between Eritrea and Ethiopia, it’s perhaps not the easiest region to work in from a geopolitical point of view. After several years of peace and the Ethiopian Prime Minister actually taking the Nobel Peace Prize back home the unrest in the border region was stirred up again in late 2020. To be clear: there is no international war between Eritrea and Ethiopia and the Ethiopian conflict is an internal conflict in Ethiopia. But it obviously does not help the perception of the Horn of Africa to the world.

The Corruption Perceptions Index usually is a good measure to see how a country is doing and unfortunately, Eritrea is still ranking pretty poor as 161st of the 180 countries included in this index. That being said, it’s important to note the mining sector has not (openly) been affected by this. And although there was a major issue with Nevsun Mining’s case of forced labor about a decade ago, Eritrea hasn’t really had a bad rep since.

Looking at the Fraser Institute 2020 Survey of Mining Companies (the 2021 report will only be released later this month and we’ll make sure to provide an update once this report has been published), there’s no updated opinion available as the report only takes countries into consideration with at least five responses (to make sure their sampling and polling statistics are representative of the underlying perception). Let’s hope the renewed efforts in the region will bring Eritrea back in the 2021 and 2022 reports as these Fraser surveys do provide useful information and background on these lesser-known mining jurisdictions.

Long story short, it’s not easy to find independent reviews of how mining companies and mining projects are faring in Eritrea so that somewhat increases the political risk in the country from a statistical point of view. But there are good reasons to give the country the benefit of the doubt. Once the labor issue in Eritrea was resolved, Nevsun Mining was able to perform quite well and eventually sold itself to Zijin in an all-cash deal. And of course the Alpha Exploration team has been able to operate in the country without any noteworthy issues, and that’s a very important takeaway.

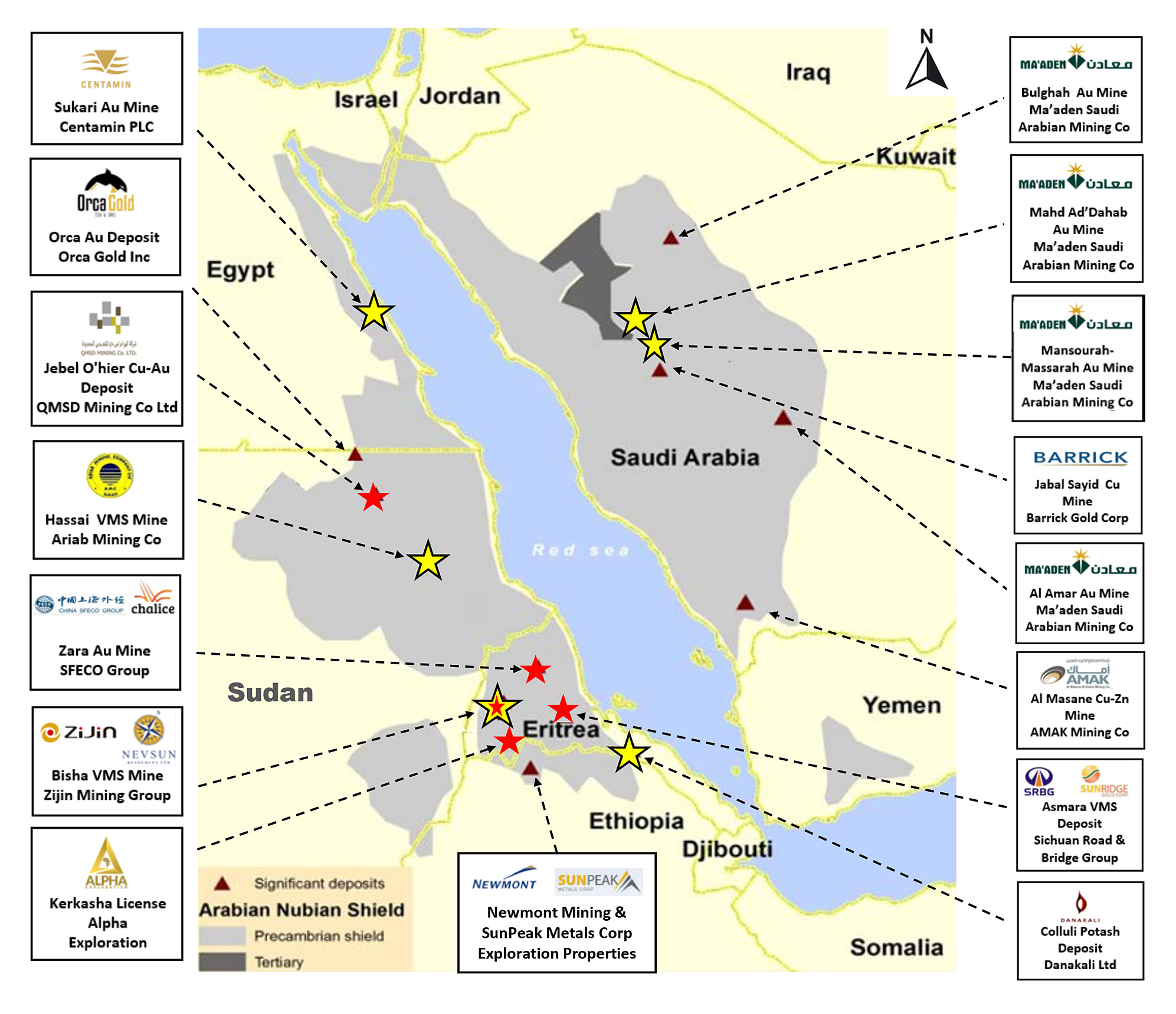

So, while investors always have to be mindful of investing in lower-tier jurisdictions, this also creates opportunities, like Alpha Exploration snatching up a 1,000+ square kilometer land package with multiple separate mineral occurrences. It will be important to keep an eye on the political climate in this one-party state. Fortunately, most African countries seem to realize minerals and mining are a good source of hard dollars to support the local economy. The Arabian-Nubian Shield (‘ANS’) is very prospective and as you can see in the image below, the shield covers pretty much all of Eritrea and it’s not a surprise the relatively small country hosts numerous important mining and exploration projects.

It’s also important to note the Eritrean government has traditionally been very supportive of mining companies. ENAMCO, the state-owned mining company, always gets a 10% free carried interest but also tends to exercise its right to acquire an additional 30% in the mining projects that make it to pre-feasibility and feasibility study stage. In the case of Alpha at Kerkasha, ENAMCO has the right to acquire 30% of every project within a 90 day period after completing a bankable feasibility study by paying 33.3% of the incurred exploration expenditure to the date of purchase. Once that has been completed, a joint venture is formed with a 60/40 economic interest but ENAMCO will contribute 33.3% of the expenditures going forward.

This makes Alpha Exploration’s case even more interesting. The Kerkasha license hosts 17 interesting prospects but Alpha obviously won’t drill all these out right away. Instead, we are expecting to see the company focus on one or two zones of major importance (Anagulu being the front runner here) and upon ENAMCO exercising its back-in right to acquire the additional 30% stake in the projects, it would also have to contribute 33.3% of all exploration expenditures going forward from the point of exercising their right. If ENAMCO backs in, it will be committed to the entire Kerkasha license, it won’t be able to cherry-pick the areas or Prospects it likes the most.

The Eritrean mining law also contains some interesting elements. The royalty rate of 5% on precious metals and 3.5% on other metals is rather high, as is the corporate tax rate of 38%. However, mines are depreciated on a very aggressive schedule in just four years time which tends to create an important tax shield during those years, and sometimes even longer than those initial four years. That’s a positive feature to calculate an after-tax NPV as the cash flows when taxes are actually due will be more heavily discounted while the cash flows during the aggressive depreciation period will contribute most to the NPV.

The exploration plans for this year

Alpha Exploration plans to hit the ground running this year as it wants to drill three prospects in the current quarter. Alpha recently reported on the Tolegimja IP Survey Results, and the drill rig is currently drilling (which started on January 26th) there. The company has budgeted for a total of about 1,000 meters in this initial programme.

Once drilling wraps up at Tolegimja, the same RC rig will immediately make its way to the Kona West Prospect which is located approximately 20kms west-southwest from Tolegimja. Alpha expects to complete 1,000 meters of RC drilling at Kona West to drill-test the IP anomaly that is beneath anomalous surface sampling results for copper..

The Q1 drill program will be completed with a 2,000 meter RC drill program designed on the Aburna gold prospect where the company’s Geologists have defined a 2,000 meter by 4,000 meter surface gold anomaly trending northeast from the past producing Aburna Colonial Gold Mine. This mine was operated in the 1920s by Italians but has not seen any exploration activity since.

The assays will then be shipped to the ALS laboratory in Ireland and Alpha Exploration expects a turnaround time of approximately six weeks, although the timeline cannot be nailed down now the COVID infections are causing staffing issues in Europe. We should anticipate seeing some delays but with a little bit of luck we can see assay results by the end of the current quarter but we should for sure see the company reporting on the lab results in April 2022.

The Q1 drill program will set the tone for the entire 2022 exploration program. Drilling Tolegimja, Aburna and Kona West are just the ‘warm-up phase’ of this year’s exploration program. The majority of the attention will still be geared towards the flagship Anagulu prospect. An initial 2,000 meters of drilling has been budgeted for the second quarter of this year but it’s no secret Alpha Exploration would like to spend considerable effort and time at Anagulu in order to define a maiden resource estimate at Anagulu. Expanding the 2,000 meter RC drill program will fully depend on the company’s ability to raise cash to fund a full year work programme.

The financial situation

Of course, a non-revenue exploration company is at the mercy of the equity markets to raise money to fund the exploration programs.

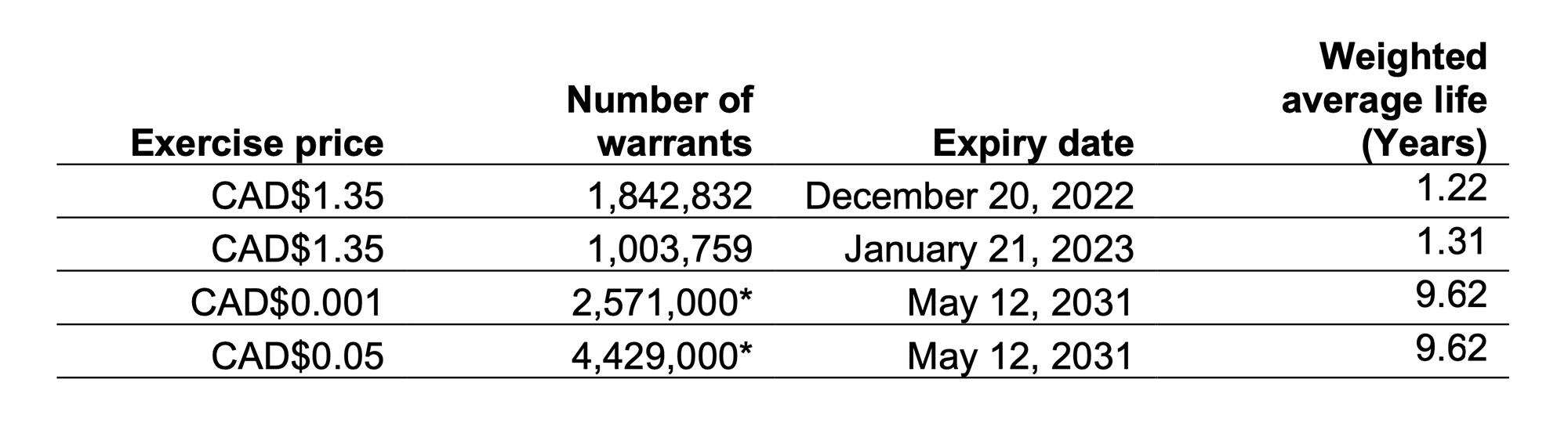

As of the end of September, the company’s most recent filed financials, Alpha Exploration had approximately US$1.3M in working capital. Alpha will obviously have to raise more cash if it indeed wants to tackle the Anagulu prospect with further drilling. There are some warrants but except for the ultra-cheap performance warrants (comparable to options), the 2.85 million warrants with a C$1.35 exercise price are currently out of the money.

However, should Alpha Exploration be successful this year and this translates into a share price that’s sufficiently high to incentivize the exercise of the warrants, the exercise of all warrants would bring in an additional C$3.5M in cash. The C$1.35 share price mark will be important for the company as that’s the sole source of ‘secondary funding’ available. Even if the C$0.001 and C$0.05 performance warrants would be exercised before their expiry date, they would barely bring in any hard cash. So the C$1.35 warrants could be an interesting source of funding throughout the year but that obviously won’t materialize unless the share price is trading substantially above that level.

Management

Eritrea poses some challenges on the geopolitical front and that’s why it’s important to have the right people in the right places.

Michael Hopley – President, Chief Executive Officer And Director

Mr. Hopley has more than 35 years of international experience in the mineral exploration business.

He has BSc (Geology) from London University and is a Member of American Institute of Professional Geologists. He has held executive and board positions with companies such as Gold Fields Mining, Bema Gold Corp. Arizona Star, Tournigan Gold Corp. European Uranium, Sun Peak Metals and Azarga Metals Corp.

Between 2004 and 2016 Michael was President and CEO of Sunridge Gold Corp. (TSX listed) that owned the Asmara Project in Eritrea. During this time, Sunridge raised and spent over $80 million exploring and discovering many deposits including the 80 million tonne Emba Derho copper – zinc – gold VMS deposit. Sunridge completed a bankable feasibility study on four of the deposits in 2014 and sold the project to a large Chinese company in 2016.

Alasdair Smith – Technical Director

Bachelor of Science (Geology) Degree from Victoria University, New Zealand (1982)

+30 years’ experience as a Geologist in Australia and Africa

Discoveries:

– Australia (Jundee NW & Main Zone Au deposits, Enterprise ISCG deposit)

– Guinea (Boukaria Au deposit)

– Eritrea (Zara Au deposit).

Developments:

– Australia (Banderol, Highway, Butcherbird, Kingfisher, Mystery, Culculli Au deposits & Jundee Au Mine).

– Guinea (Siguiri Au Mine).

– Tanzania (Buzwagi Au-Cu Mine & Nyamulilima Hill &, Nyanzaga Au deposits).

– Eritrea (Zara Au Mine, Debarwa & Adi Nefas VMS deposits & Gupo Au deposit).

Tewelde Haile – Exploration Manager

Bachelor of Science Honors (Geology) Degree from Addis Ababa University (1985), MSc, Indian Institute of Technology – Kharagpur (1987-1988).

More than 30 years work experience with Mineral Exploration companies and with the Geological Surveys of Ethiopia and Eritrea.

Tewelde has worked in the Adola gold belt in Ethiopia and the Koka gold field in Eritrea (Zara gold mine) and has also been involved as a Lecturer at Asmara University.

Scott Mckeag – Project Manager (Anagulu)

BSc (Earth Science), California Polytechnic University-Pomona (1982), MSc (Economic Geology), University of Otago, New Zealand (1987) – Consulting Geologist

- More than 30 years’ experience as a geologist in North America, the Middle East, Africa and Oceana

- Instrumental in discoveries and developments that resulted in producing mines, including; the Morningstar Gold Mine (IRGD) in California, Simberi Oxide Gold (hot spring epithermal) in PNG, Macraes (orogenic) in Otago, New Zealand and Jebel Ohier (porphyry) in the Red Sea State, Sudan

- Designed the drill-out of Island Mountain (breccia pipe) in the Alaskan Range (2012) resulting in an indicated resource of 2 M tonnes at 1.2 gpt Au equivalent

- Designed the favorable horizon VTEM geophysical exploration program at Jabal Sayid in Saudi Arabia (2012-2013) successfully identifying three large exploration targets aligned with Lode 3 and stretching 6 kilometers to the south of the main portal (undrilled to date)

- Designed the exploration drill program that led to the discovery of Jebel Ohier (2013-2017), the first recognized Neoproterozoic porphyry copper deposit in the Arabian Nubian Shield, currently at 285 Mtonnes at 0.44% Copper.

Conclusion

Alpha Exploration is exploring in one of the last frontiers in the world, the Arab-Nubian Shield. Although this shield already hosts several mines and tens of millions of ounces of gold, it still is very much under-explored. Nevsun did an excellent job in showing it is doable to actually permit and construct a mine in Eritrea without seeing the asset seized or being subject to new tax rules. Alpha is led by a veteran team, not just in exploration and mining, but with plenty of in-country experience under its belt and that will likely prove to be an asset.

Alpha Exploration has only been listed for just over three months now and the stock still seems to be trading ‘by appointment’. Volumes are low and the spread between bid and ask is sometimes extremely wide so working with limit orders will always be very important. The company has been releasing several updates in the past few weeks and this will hopefully help to increase and improve the awareness of the company.

And the best way to get more eyeballs on the story is by releasing positive exploration results and hopefully, the drill bit will speak for itself in 2022. Several prospects will be drilled, but we are mainly looking forward to the company trying to aggressively advance the Anagulu copper-gold porphyry discovery towards a maiden resource estimate.

Disclosure: The author has a long position in Alpha Exploration. Alpha Exploration is a sponsor of the website. Please read our disclaimer.