Here at Caesars we love the so-called “nearology” plays, and we have had some pretty good successes with that. Very few people will remember we added a C$6.8M market cap uranium company to our Mining Top 25 for 2010 and we think we were the very first one to highlight that small company which was subsequently bought out for C$70M and a stake in a SpinCo. That SpinCo has a market capitalization of C$400M as of today. Yes, indeed, we were backing the very first Fission Energy when its market capitalization was less than C$70M, and there’s no doubt Fission Uranium (FCU.TO) is now one of the hottest exploration stories in the Athabasca Basin.

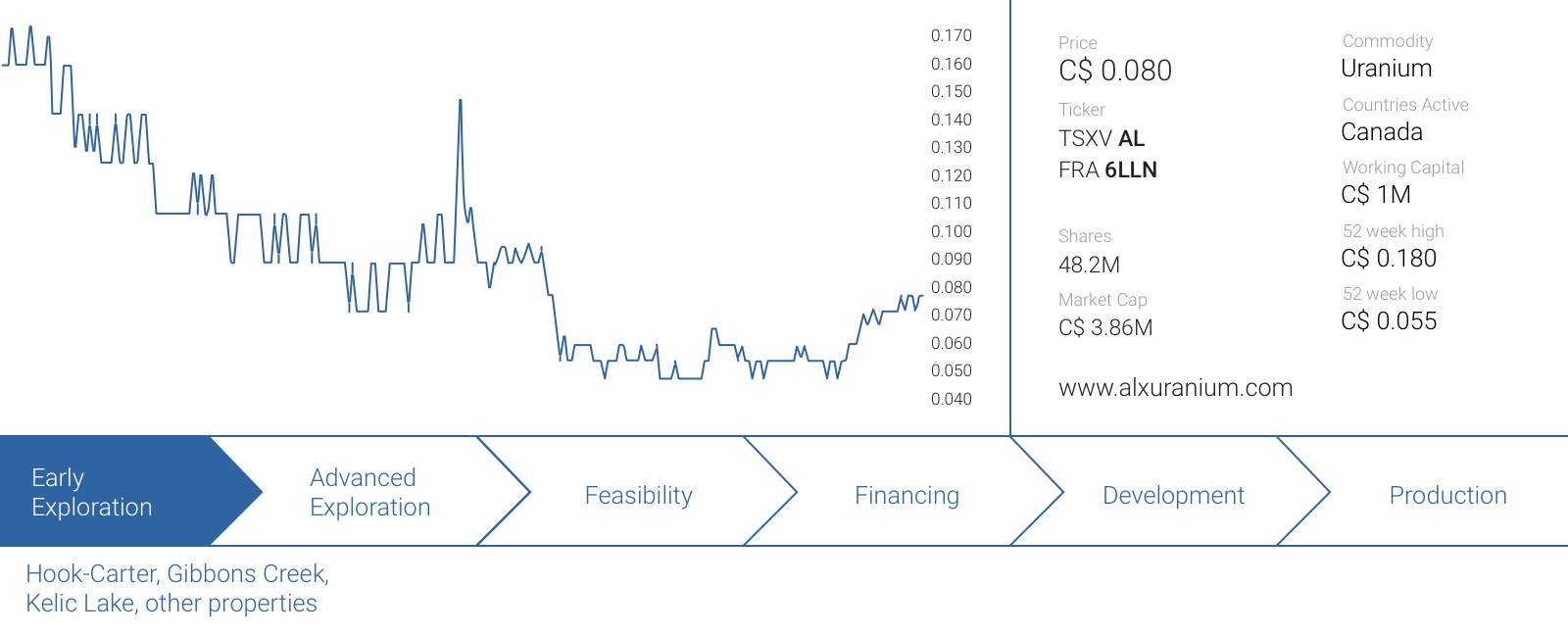

Does history repeat itself? Maybe. We had a closer look at ALX Uranium (AL.V) as its Hook Carter project is located in the Southwestern Athabasca Basin, on the Patterson Lake Corridor. The best place to discover a new deposit is in the shadow of a recently discovered one, and this could very well be true for ALX Uranium. It’s obviously still very early days, but the risk/reward ratio for the sub-C$5M company could be attractive.

ALX’ main asset is located on an existing uranium trend

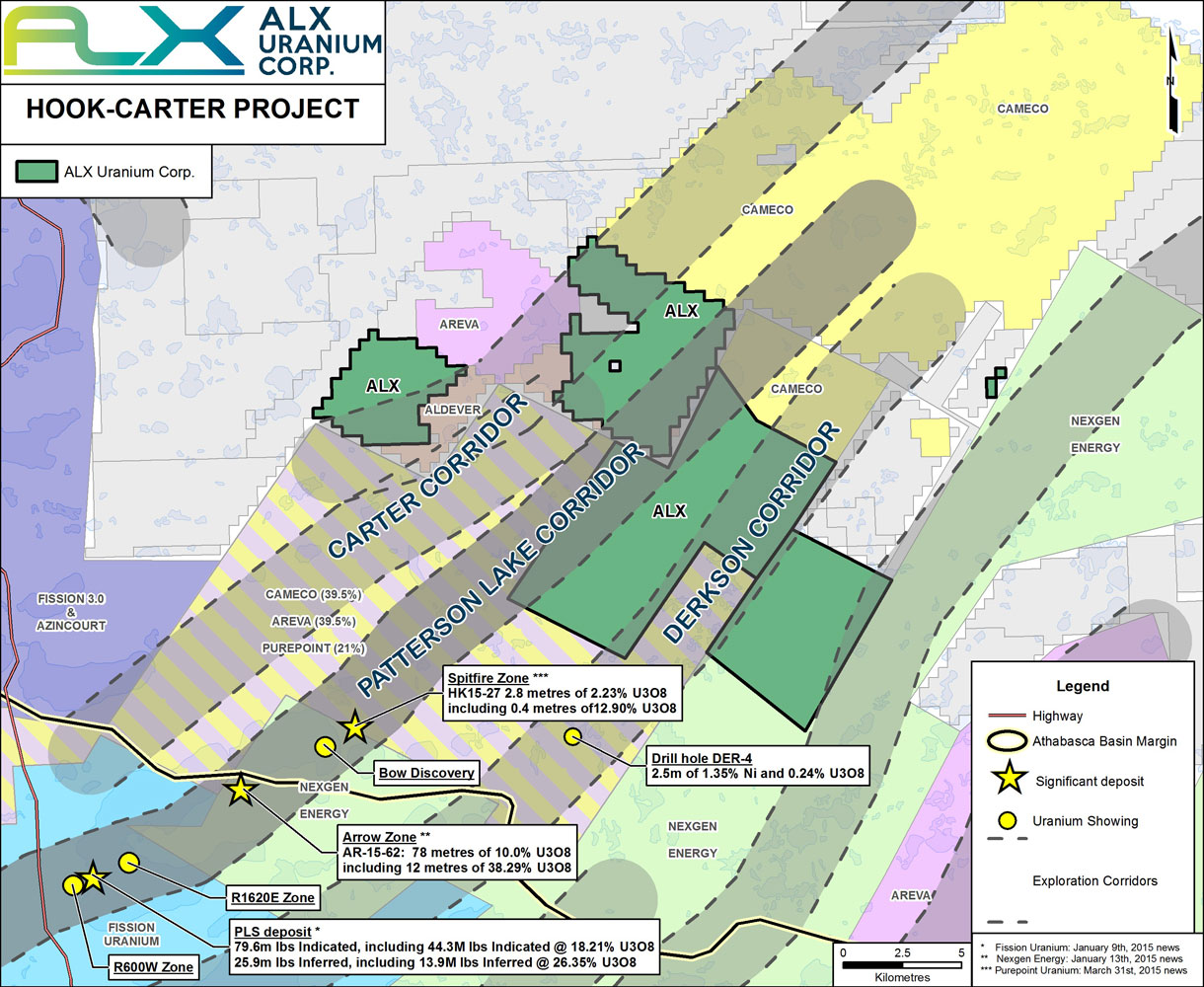

In this report we’d like to focus on ALX’ Hook-Carter property which consists of a 16,500 hectare land package within the Patterson Lake South camp and has three different corridors running over the property. The three conductive trends (Patterson Lake, Derkson and Carter) are clearly visible on the next map:

What’s interesting here is the fact that ALX’ Hook-Carter property is located towards the northeast of no less than three exciting discoveries of uranium mineralization. Fission Uranium (FCU.TO) owns the Triple-R project which will very likely shape up to be a 150M lbs+ project whilst NexGen Energy (NGE.V) recently released a maiden resource estimate containing in excess of 200 million pounds of uranium, whilst the mineralized zones remain open for expansion. Throw in the recently-discovered mineralization at Purepoint Uranium’s (PTU.V) Spitfire zone with intercepts of 7.2 meters of 1.3% U3O8 and in excess of 18 meters at almost 0.7% U3O8, and you indeed understand ALX’ land package is situation right next to existing ‘hot spots’ in the uranium landscape!

Does this mean ALX’ exploration success is guaranteed? No, not at all. Exploring for uranium can take a long time, and drilling in the Athabasca Basin isn’t too cheap either, so ALX will have to make sure it’s drilling its holes on the most promising spots.

That’s why the company has sent out a geophysical team to two of the three corridors on the Hook-Carter property. ALX Uranium plans to complete an airborne and ground SAM TEM (Sub-Audio Magnetic Transient ElectroMagnetic) exploration program. A total of 115 kilometers of helicopter-based SAM TEM has been completed and according to the company, it confirmed the existence of several basement conductive units. That’s quite interesting, and we’re looking forward to see the final report on this geophysical exploration program.

Additionally, ALX would like to drill four drill holes, of which two will be testing a group of targets in the Patterson Corridor, whilst another two holes will be focusing on the Derkson Corridor. This 50/50 split is a little bit surprising considering the Derkson Corridor is the most advanced part of the company’s land package, but ALX obviously wants to find out what’s underneath the surface at several ‘areas of interest’.

The new deal with Holystone Energy is a ‘thumbs up’

ALX Uranium recently signed an important agreement with a strategic partner. The company has formed a three year partnership with Holystone Energy, whereby the latter will invest C$750,000 in ALX by purchasing 12.5M new shares at a price of C$0.06 per share (there will be no warrants attached). As Holystone will become a major shareholder of ALX after this deal closes (Holystone will own approximately 20% of ALX’ share capital), it will also be allowed to nominate one person to ALX’ board of directors.

That’s an interesting vote of confidence as it does look like Holystone is convinced ALX Uranium might be the best horse to gain exposure to the Patterson Lake South zone. Holystone could have invested in either Fission Uranium, NexGen Energy or even Purepoint Uranium, but Holystone preferred to bet on ALX Uranium. Very likely because this company doesn’t just own the Hook-Carter property on trend with the Triple R and Arrow deposits, but because ALX also owns several other exploration-stage projects in the Athabasca Basin.

2015 drilling campaign at Gibbons Creek

The financial situation and the management team

ALX’ financial situation also is quite a bit better than a lot of other companies out there. The company hasn’t published its year-end financials yet, but as of at the end of September last year, ALX Uranium had a positive working capital position of C$1.2M and it subsequently raised C$350,000 in financings in December and January.

This was followed by closing the first tranche of the financing deal with Holystone Energy for a total value of C$318,000, so ALX was definitely able to raise quite a bit of cash in the past few months. We’re unsure about how much cash the company has been spending on exploration in the past few months, but the annual statements which should be filed in the next few weeks will obviously provide some clarity.

We also think ALX’ management team is one of the main reasons why Holystone was so interested in getting involved in this company.

Management

Michael Gunning

BSc (Hons), MSc, PhD, Pgeo – EXECUTIVE CHAIRMAN, DIRECTOR

Dr. Gunning brings a very diverse and valuable range of experience and proven leadership to Alpha from his 25 years in the mineral exploration and geological research sectors.

As active Executive Chairman at Alpha Minerals, the precursor to Alpha Exploration, he led equity financings of more than $20M which funded exploration at the Patterson Lake South uranium discovery, and he steered the eventual sale of the Company in an all-share transaction valued at $189M, while retaining working capital and non-core assets for the successor company Alpha Exploration.

Most recently as former President and CEO of Hathor Exploration Ltd, he successfully transitioned the Company from the grass roots discovery to the delineation and economic evaluation of the Roughrider uranium deposit, and he steered the eventual sale of the Company to Rio Tinto Plc. in an all-cash transaction valued at $654M.

Jon Armes

B.A.Sc. – PRESIDENT, CEO & DIRECTOR

Mr. Armes has been President, CEO and Director of Lakeland since 2010 and has stewarded the Company’s move into uranium and the Athabasca Basin. Prior to joining Lakeland, Mr. Armes provided corporate development, finance and management services to mining exploration companies for over 15 years including Band-Ore Resources Ltd. (now part of Lake Shore Gold Corp.) and Trelawney Mining and Exploration Inc. (acquired by IamGold in 2012).

R. Sierd Eriks

P. Geo – VP EXPLORATION

Sierd Eriks, B.A (Geology), has worked in mineral exploration for over thirty-five years with a focus on uranium exploration for the past two decades. From 1979 to 1998, he gained geological and managerial experience with major mining companies, including SMDC (now Cameco Corporation), Falconbridge Limited, Noranda Exploration Co. Ltd. and Cogema Resources Inc. (now AREVA Resources Canada Inc.) in base metals, gold, PGE and uranium exploration. In 1999, he became a consulting geologist and worked as a consultant on numerous uranium and PGE exploration programs. Prior to joining Alpha, he was Vice-President, Exploration with UEX Corporation from 2007 to 2014.

Conclusion

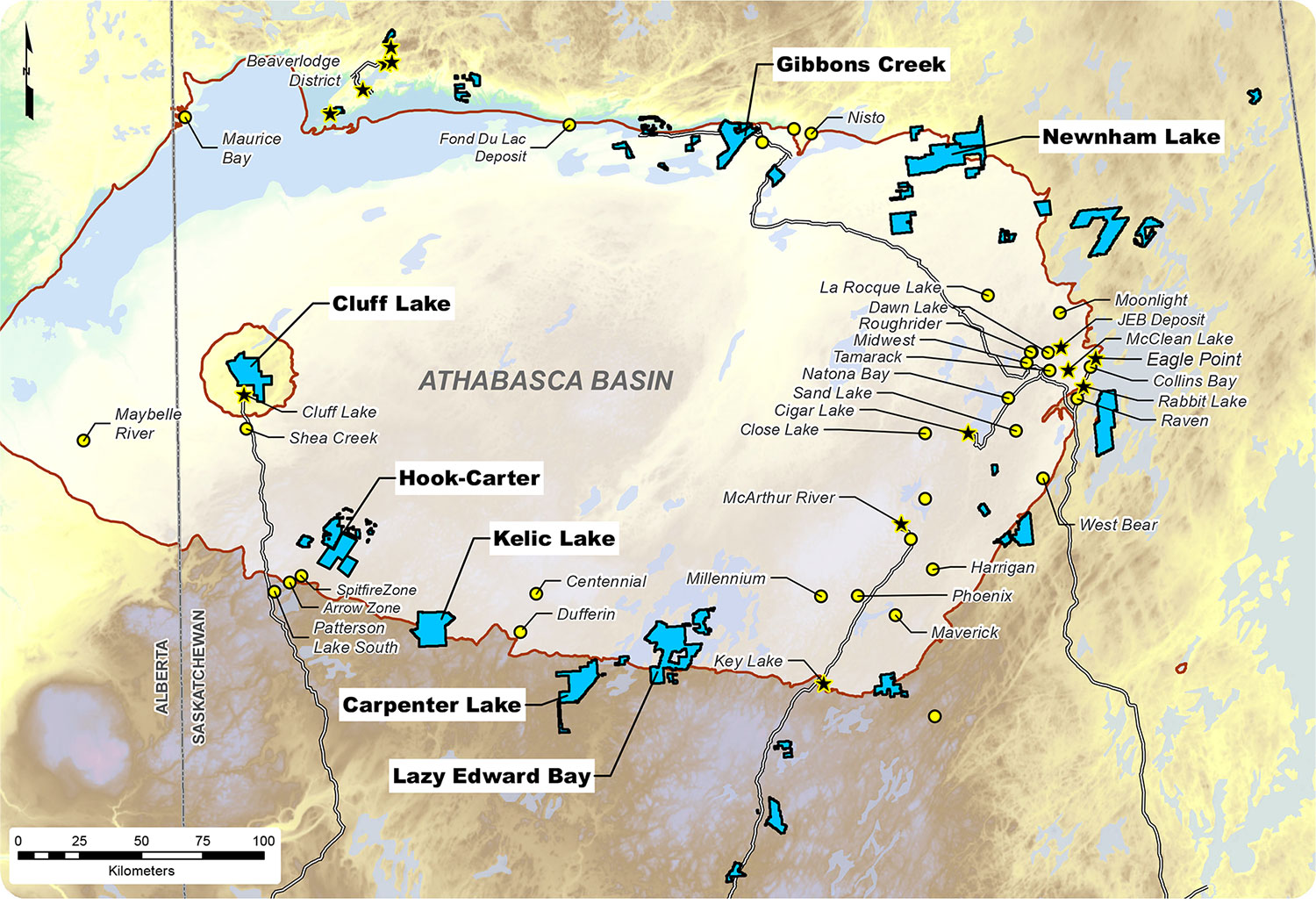

Does this mean you should run out and immediately buy ALX Uranium? No. We just wanted to point out this small company owns a substantial land package in the Athabasca basin (in excess of 240,000 hectares), which is the real epicenter of Canada’s uranium exploration and production scene.

Keep an eye out on ALX Uranium, as we expect the company will be quite active in the next few months and quarters to prepare for a winter drill program at Hook-Carter, Gibbons Creek and Kelic Lake. With a working capital position of in excess of C$1M (our own estimate) and an additional C$400,000 on its way from its strategic partner, ALX can advance its properties in 2016 without having to go back to the market before a potential winter drill program.

We hold no position in ALX Uranium, Zimtu Capital is a sponsor of the website, we do not hold a position in any of the companies. Please read the disclaimer