Although the share price evolution seems to indicate otherwise, Amex Exploration (AMX.V) really is on the right track. Its massive drill program at Perron is in full swing and assay results are released on a continuous basis. A total of 280,000 meters has already been drilled since making the initial discoveries in 2018 and an additional 60-70,000 meters is expected to be completed by the end of this year as Amex is drilling at a rate of 10,000 meters per month, using up to ten drill rigs.

As Amex Exploration is sharing every hole and every lab result on its website, every interested person can run a back-of-the-envelope resource model, but the real litmus test will be the maiden resource calculation which will likely be published around year’s end. That’s the goal, but we wouldn’t mind a delay if it means additional zones, tonnes or ounces could be added in a straightforward fashion.

We recently got an update from CEO Victor Cantore while Wanda Cutler, Corporate Development walked us through the core facility at the exploration site. As you may remember, the Perron project is located on the outskirts of Normétal, a small town with a vibrant mining history, named after the prolific Normétal mine. The project location is very helpful in increasing the efficiency of the exploration programs while keeping the cost low.

The drill program at Perron is in full swing

Amex Exploration currently has up to 10 drill rigs working on the Perron property which means that on average about 500-700 meters of core is coming in on a daily basis. This fluctuates as deeper holes have a lower meterage per day as the hole progresses. That’s a lot of core to cut and send off for analysis, so it is good to see the Amex Exploration camp appears to be a well-oiled machine.

We won’t be rehashing all the drill results from the past few months as the company does an excellent job in putting them out while adding commentary to them. We would rather try to start putting everything into perspective as Amex is getting closer to releasing its maiden resource estimate.

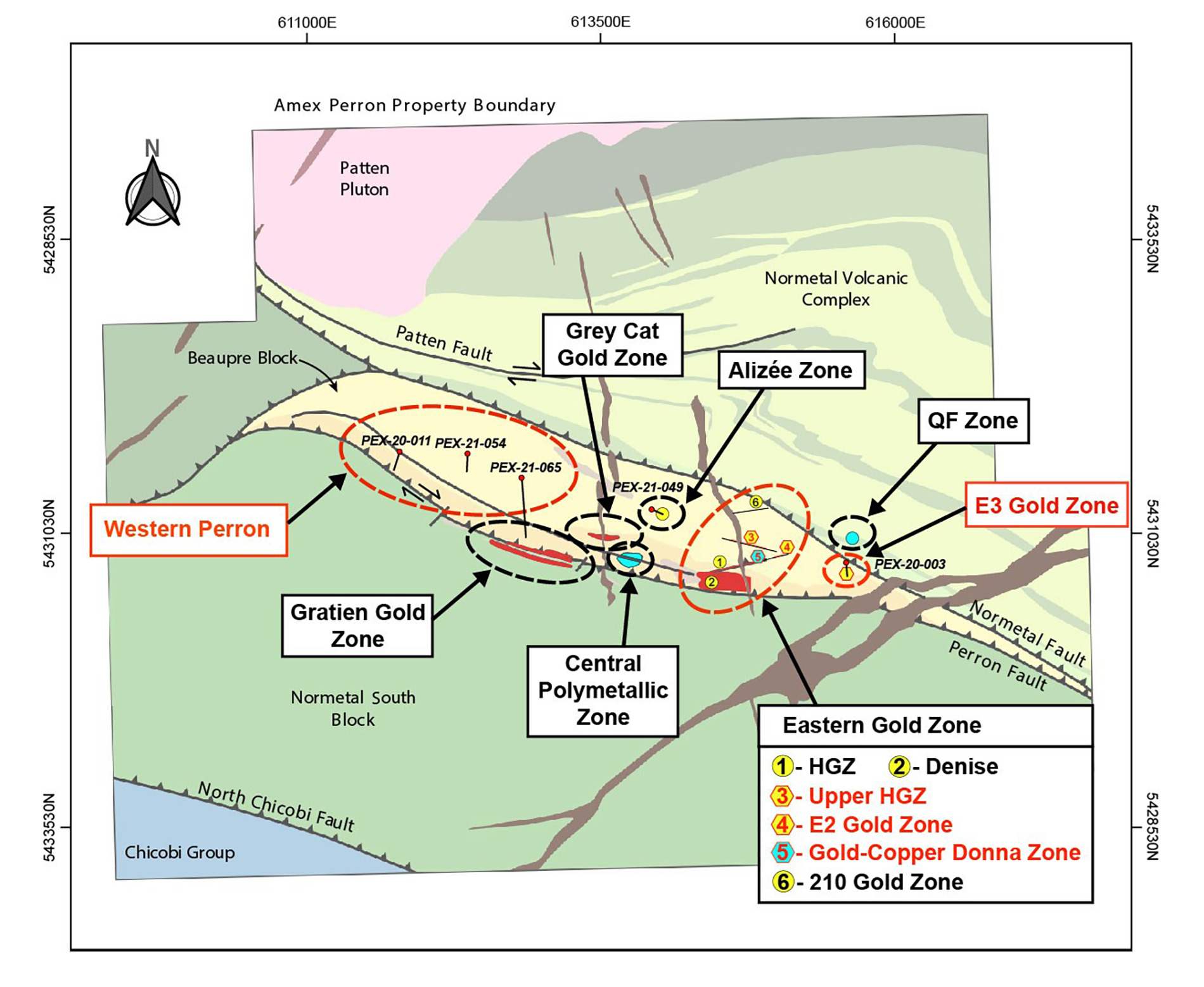

One of the unique features of the Perron project are the several distinct zones with each their own qualities. The two most advanced zones, the High Grade Zone and the Denise open pit are perfectly complementing each other as it is now starting to look like a high-grade underground mine and a bulk tonnage but lower grade open pit mine could be developed simultaneously.

This creates the unique scenario where Amex could be in a position to ‘throttle’ each of the zones depending on the gold price. Of course, there are limits to this approach, but it does provide the company with additional flexibility and optionality.

There is one area on the Perron project where we would like to take an additional minute to dig a little bit deeper. While our immediate attention is obviously on the gold zones – after all, we do consider Amex Exploration to be a gold exploration company – we shouldn’t ignore the recent base metal findings. That’s not entirely a surprise as the nearby past-producing Normétal mine was a base metal producer but it is for sure very encouraging to see the first few holes in the VMS target are already encountering high-grade copper with a bunch of by-product credits.

The company’s most recent exploration update came from the QF zone where Amex drilled a few holes to follow up on the VMS-type mineralization it discovered in previous drill programs. Encountering VMS mineralization should not be a massive surprise as the QF zone is located on strike of the Normetal mine which produced in excess of 10 million tonnes at an average grade of 2.15% copper, 5.12% zinc, 0.55 g/t gold and almost 1.5 ounces of silver per tonne.

The company released the assay results from several holes drilled at the QF zone, and all holes have intersected the typical VMS style mineralization at depth. The table above contains the highlights of the holes and although the width of the intersected zones is relatively narrow, Amex mentions both the grade and width compares favorably to the Normetal mine which was operated for several decades, reaching a total depth of 2,400 meters below surface.

As the Amex drill data shows, the drill bit intersected the mineralization at roughly 700 meters downhole and knowing the Normetal mine was developed to a depth of 2,400 meters and knowing Amex is drilling in what appears to be the same mineralized horizon, odds are the VMS mineralization continues to run at depth.

According to Executive Chairman Jacques Trottier, the results confirm the copper-rich area of the QF zone is becoming more robust at the 600 meter level and shows a very good eastern lateral extension with copper values of over 2% over widths of 4-5 meters. Trottier is right. Even though the width is relatively narrow, the grade is good. If we would for instance look at the results of hole PEX-21-095 which encountered 1.95 meters of 1.2% copper, 1.33% zinc, 0.63 g/t gold and 57.07 g/t silver, the gross rock value is actually $228/t using $4 copper, $1.50 zinc, $1800 gold and $23 silver. The copper-equivalent grade used by the company is 2.59% but for those who prefer to look at things from a gold-equivalent perspective, using the commodity prices we used to calculate the gross rock value, the gold-equivalent grade would be around 3.95 g/t.

While the focus is on the gold zones, we don’t think a lot of tonnage is needed to also consider developing the base metal zones. The Horne smelter operated by Glencore (GLEN.L) is just about 1.5 hours south-southeast from Normetal. As the Google Maps screenshot below shows, the distance from Normétal to the Horne smelter is just 114 kilometers or about 1.5 hours by truck. So it’s not difficult to consider a scenario where the VMS system will be mined and processed at Normétal before the concentrate gets shipped off to Horne.

That’s just us theoreticizing out loud. The first step for Amex Exploration is obviously to build tonnage at the VMS discovery to see if a development scenario is actually viable. But we just wanted to point out there are plenty of options for processing the concentrate that would be produced in a mining scenario.

The company is sticking to the plan to have a maiden resource out by year-end: what can we expect?

Despite the excellent drill results, Amex has seen its share price drop by about 50% in just the past two months. While we can understand the market is in a risk-off mode when it comes to pure exploration stories, Amex Exploration is standing out from the crowd as it has committed to publishing a maiden resource estimate around the end of this year.

We saw a recent brokers note from Canaccord estimating the current resources at 2.85 million ounces: 1.5 million ounces in a high grade underground resource at EGZ and about 1.15 million ounces in the Denise open pit. As Amex makes all drill data publicly available, we would expect the analyst to have a pretty good idea of where the company currently stands at.

We talked to CEO Cantore and when discussing the High Grade Zone, it seemed fair to use an average gold content of 1,000-1,100 ounces of gold per vertical meter. With the HGZ already extending to a depth of 1,500 meters, applying that number indeed gets you close to the 1.5Moz mentioned in the Canaccord report.

But we have the impression the fastest resource growth will come from HGZ. Not just at depth but also from a lateral perspective. Allow us to explain.

Thanks to the consistency of the mineralization at depth, a resource modeler will likely feel sufficiently confident to assume the mineralization continues at depth for an additional 100-200 meters. So if Amex successfully reaches 1,500 meters, it is not unthinkable a resource modeler will use 1,600-1,700 meters in its calculations. Applying a ratio of 1,100 ounces per meter of vertical depth on, say, 1,650 meters vertical depth increases the potential gold resource to 1.8 million ounces.

That’s just one element the growth will come from. The High Grade Zone is divided in the Eastern HGZ and the Western HGZ. As you can see below, the Eastern zone has been pretty well drilled out at depth, but the Western Zone has currently reached a depth of approximately 800-850 meters.

Should that Western Zone be further extended at depth, the total amount of ounces per vertical meter would increase by a double-digit percentage given the lateral expansion. If we would see a bump to 1,300 ounces per vertical meter over 1,600 meters (and that’s not too optimistic as for instance Integra Gold saw about 2,000 ounces per vertical meter at Lamaque, now owned by Eldorado Gold (EGO, ELD.TO) after its C$600M buyout of Integra), the High Grade Zone could easily exceed 2 million ounces of gold. And to state the obvious: at this point, the zone remains open at depth, but it doesn’t make a lot of sense to drill even deeper and spending C$2-3M on one hole.

At the Denise Zone where the company is working towards an open pit resource, the ‘easy’ upside seems to be coming from drilling more holes in the east. As shown below, the Western portion of the Denise Zone has seen a lot of drill holes but exploration has just started on the Eastern Denise Zone.

While the Western zone appears to be pretty coherent and consistent (as shown on the right-hand side of the image below), the low-hanging fruit appears to be on the eastern side of the diabase where the few holes that have been completed so far indeed seem to confirm the mineralization is continuing towards the east. While it’s too early to form definitive conclusions, the upside potential is quite obvious.

Although scheduled for the end of this year, we wouldn’t mind if Amex takes a few months longer to complete the maiden resource if this means additional tonnes and ounces get added to the resource.

We know the company would like to come out of the gate strong and isn’t interested in releasing an initial resource of 2 or even 3 million ounces of gold. Reading between the lines, Amex Exploration would likely want to come in at around 4-5 million ounces in its maiden resource estimate. Even at the lower end of this range that would be a stellar maiden resource for a junior exploration company and should hopefully make some heads turn. And it is our understanding this maiden resource will only include the High-Grade Zone, the Denise Zone, Gratian and Grey Cat at this moment, which leaves plenty of blue sky exploration potential from the other recently discovered zones.

The treasury is still in a very healthy position

Amex Exploration took advantage of an excellent financing window in the first quarter. While a lot of companies seem to shiver when you talk about flow-through funds, Amex used the flow-through and more specifically the charity flow-through possibility to its advantage.

It announced a financing on January 17th and closed a financing to the tune of almost C$50M on February 17th consisting of just under 10.3 million charity flow-through shares priced at C$4.82. That indeed is more than three times higher than where we are at today. And as this was a charity flow-through financing, the shares were immediately placed into stronger hands as the brokers conducting the financing were building a book to take care of the back-end of this financing. The back-end buyers paid C$2.68 for their shares which also is about 80% higher than the current share price.

The back-end portion of this financing became free trading on June 18th but the share price had already dropped to less than C$2/share at that point. In fact, the last time the share price closed at or above the C$2.68 back-end price level was on May 19th when the stock closed at C$2.71 (after having traded below C$2.50 for multiple days before). While there for sure will have been some back-end buyers selling their position, we don’t think this was the main cause for the share price decrease as there was absolutely no tick-up in the daily trading volumes and it looks like Amex Exploration was just a victim of the market.

What really matters is that Amex Exploration ‘got the job done’. It knew it was gearing up for a massive drill program and rather than applying the strategy of ‘hoping the financing opportunities will be available’ and risking the market putting the company with its back against the wall, it immediately raised enough cash to last all the way until the end of 2023. And we tip our hats to the people who decided to pull the trigger on this as by issuing just over 10 million shares (the charity flow-through financing was a no-warrant deal!) its financing needs for about two years were met.

Amex still has just over 100M shares outstanding. There are zero warrants (so no overhang at all) and just 6.5 million options. Of those 6.5M options outstanding as of the end of Q1, 1.45M with an exercise price of C$0.26 have expired by now which leaves 2.7M options at C$1.19 and 1.925M options with an exercise price of C$2.77 outstanding. Should all options be exercised (we sincerely hope the C$2.77 options get back in the money before the expiry date in July 2025), the treasury will see an additional cash inflow of C$8.5M.

Conclusion

It’s easy to complain. We aren’t happy with Amex’s share price either but that hardly is the company’s fault. With a market capitalization of just around C$150M with over C$40M in cash, the current enterprise value is barely over C$100M. While we should assume the cash will be gone by the end of next year, that still gives us an enterprise value of C$150M to work with. Offset by a maiden resource estimate of approximately 4 million ounces (and more to come as it looks like the maiden resource estimate will only contain the EGZ and Denise Zones), Amex would be trading at a value of C$37.5 per ounce in the ground. This isn’t just cheap for viable ounces in Quebec, it is also relatively cheap for a company that will undoubtedly have optionality with the high-grade underground EGZ operation and lower-grade Denise open pit (of course assuming the project will be viable).

The recent share price decrease appears to be undeserved. Amex Exploration is doing everything right and has been ticking all the boxes so let’s hope the market will start to care before too long. If Amex can indeed come out of the gate with a 4 million ounce gold resource and potential for growth, the company should be due for a re-rating.

Disclosure: The author has a long position in Amex Exploration. Amex Exploration is a sponsor of the website. Please read our disclaimer.