The share price of Amex Exploration (AMX.V) has been relatively volatile lately. The shares have been bouncing back and forth between the C$1.60 and C$1.80 level but spiked to almost C$2.50 per share in April. The company’s exploration program on the flagship Perron project is still in full swing and recent results have confirmed the Team Zone continues to grow while more VMS mineralization has been discovered as well. While we obviously still consider the Perron project to be a gold asset, we can’t ignore the nearby Normétal mine was a VMS mine and finding more VMS mineralization in the same horizon that hosts the Normétal mineralization is not a coincidence.

Amex Exploration continues to advance the Perron project towards a maiden resource estimate. Completing said resource calculation is taking longer than we originally anticipated but we now also expect that maiden resource to be larger than originally anticipated. CEO Victor Cantore likely wants to surprise to the upside and recent drill results indeed appear to indicate there is much more to be found at Perron and the company is still just scratching the surface.

The Team Zone continues to expand

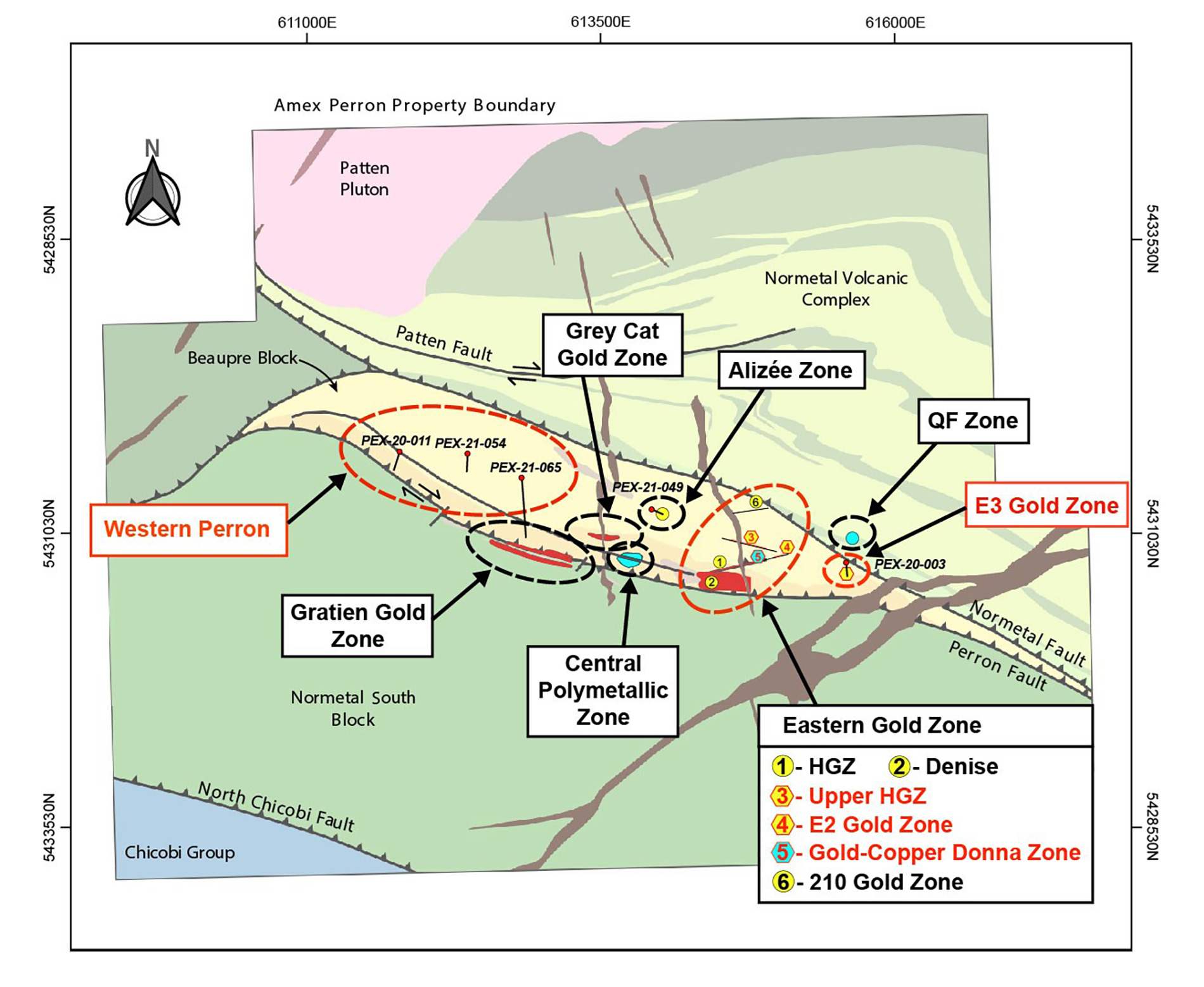

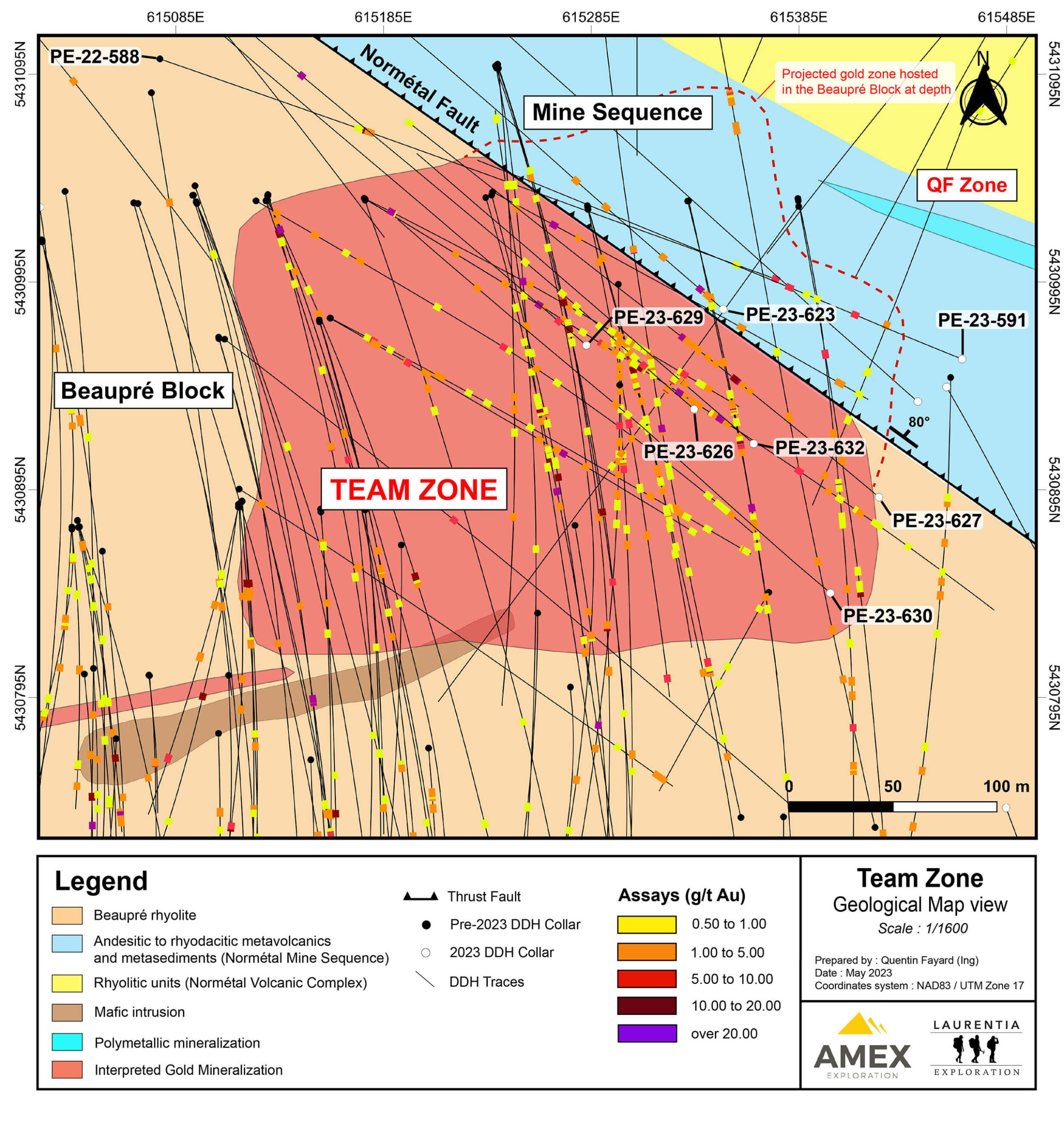

At the end of May, Amex released additional assay results from its flagship Perron project where it has been busy with expanding the Team Zone, which is located just 600 meters to the northeast of the High Grade Zone. The Team Zone was only discovered last year but Amex has made great progress in advancing this specific exploration target.

The Team Zone has now been traced over a surface area of 350 meters by 200 meters and to a depth of 400 meters. That already is 28 million cubic meter and close to 80 million tonnes using a density of 2.80 tonnes per cubic meter (it is however possible the density may be even higher). This does not mean every single tonne is mineralized and it does not mean we can easily and immediately extrapolate the gold results but it gives you an idea of how nicely the Team Zone is shaping up. The image below shows the highlights of the assay results that were recently published. Keep in mind the true width of the intervals remains unknown at this point.

Needless to say the management and exploration team is very happy with these results as it is starting to look like the Team Zone is coming together pretty nicely. The quote provided by Jacques Trottier is quite interesting as well:

‘We are very excited to be seeing both high grade mineralization and longer intervals of near-continuous gold within the system as we continue to advance our understanding of the Team Zone. With any new zone it takes time to understand the system through modelling and drilling. The oriented drilling that we have been doing on the Team Zone since September has proven to be very helpful in targeting. We have identified five distinct orientations of gold-bearing veins and are adjusting drill targeting as we advance. Upcoming drilling, along with pending holes, will continue to delineate the zone at 50 metres centres as well as expanding along trend, particularly to the northwest towards the previously discovered 210 Gold Zone.’

Jacques Trottier

Drilling at the Team Zone is ongoing and the company will continue to gradually release fresh assay results.

The Team Zone obviously wasn’t the only area of the project that was drilled this winter. The main focus of the winter drill program was to reach and drill-test areas that are not or not easily accessible during warmer weather. Drilling was focused on the N110 Gold Corridor (a new discovery which runs north of the Gratien Gold Zone) and the eastern extent of the property along the projected extension of the Beaupre Rhyolite.

At the N110 Gold Corridor, Amex has intersected several veins and veinlets of which some included visible gold, but the samples are still at the lab and the assay results still have to be announced. That being said the company mentioned it is very encouraged by the amount of visible gold and is already planning and designing a follow-up exploration program. The N110 Gold Corridor definitely is one of the zones we are pretty keen on seeing the results and follow-up plans for.

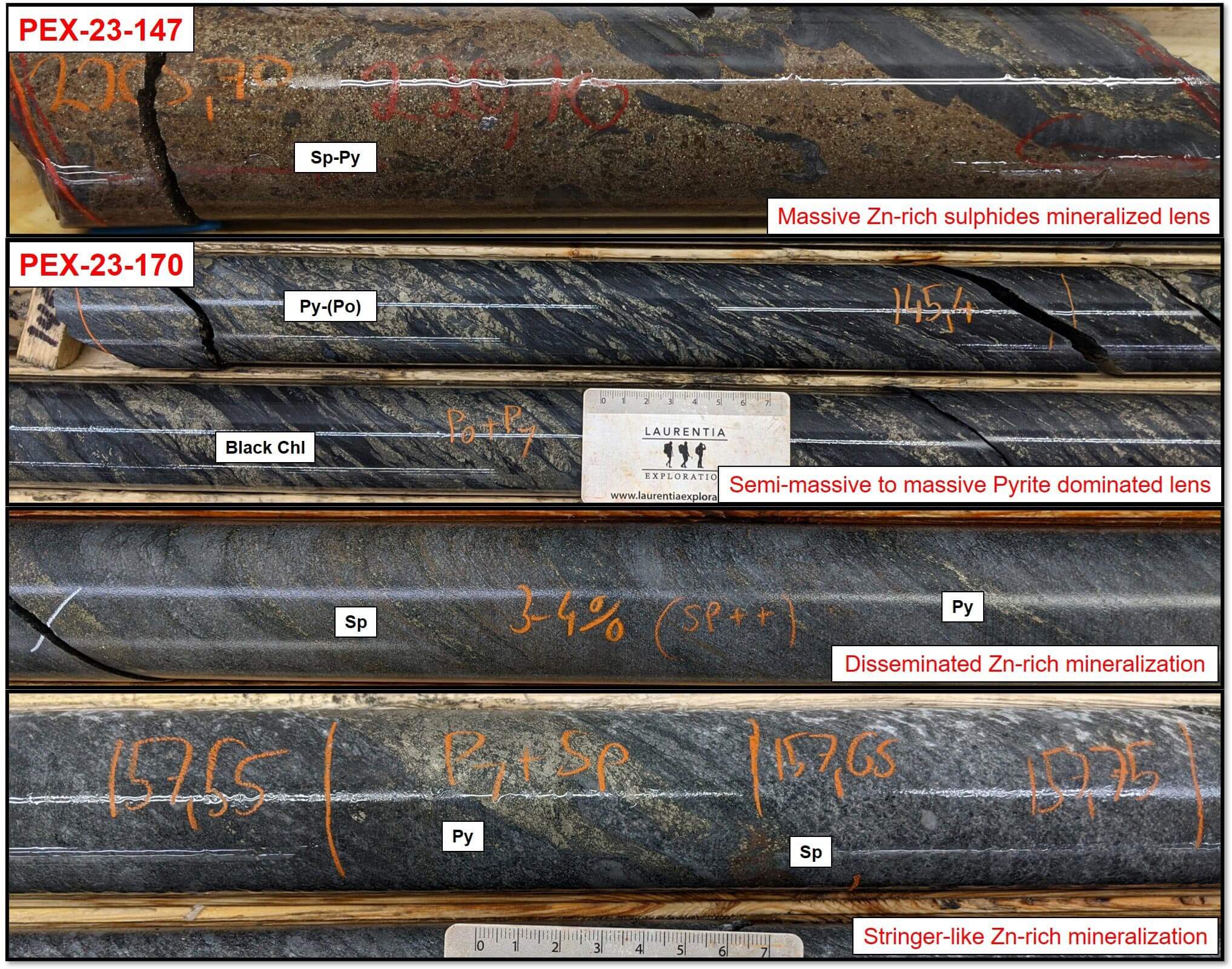

More evidence of VMS mineralization at Perron

The company recently completed two geochemical programs at Perron: one program consisted of an ionic leach soil survey which covered about 2/3rd of the Perron property along with another biogeochemical sampling program focusing on the bark of spruce trees which were sampled to locate mineralized areas with limited or no rock exposure due to the overburden. The sampling of the bark of black spruce trees works well because this type of tree has the capacity to absorb and retain metals from weathered bedrock and groundwater thanks to the extensive root system of these treas. It helps particularly well with finding additional VMS type mineralization.

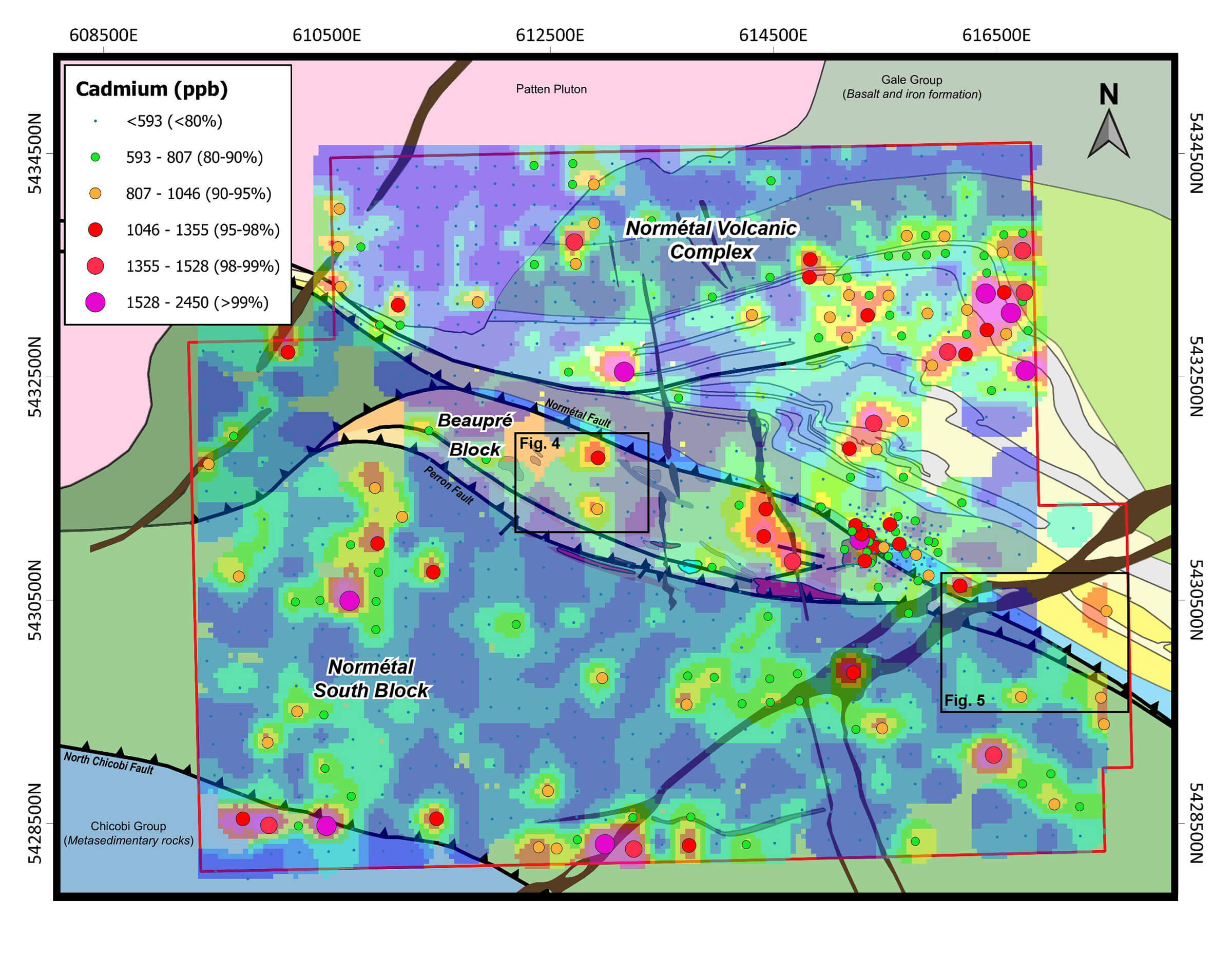

Interestingly, the geochemical surveys also discovered a sizeable cadmium anomaly through the discovery of cadmium in said trees. According to Amex, it makes more sense to sample the bark for cadmium rather than zinc as the latter is an essential element for plant metabolism while cadmium isn’t (and thus higher cadmium values are encountered in the bark). Elevated cadmium numbers may indicate the presence of a mineralized zone with anomalous zinc values. The cadmium-high anomaly was encountered

The ionic leach survey also resulted in a few interesting targets. As you can imagine there were plenty of gold hits on the property with a few specific highlights in the Northeastern section of the Perron project which really lights up on the map (and interestingly the spruce bark sampling program also confirmed the gold zones discovered through the ionic leach sampling program but the ionic leach survey was also instrumental in discovering a large zinc anomaly of 600 by 300 meters along the eastern portion of the Normetal Mine horizon.

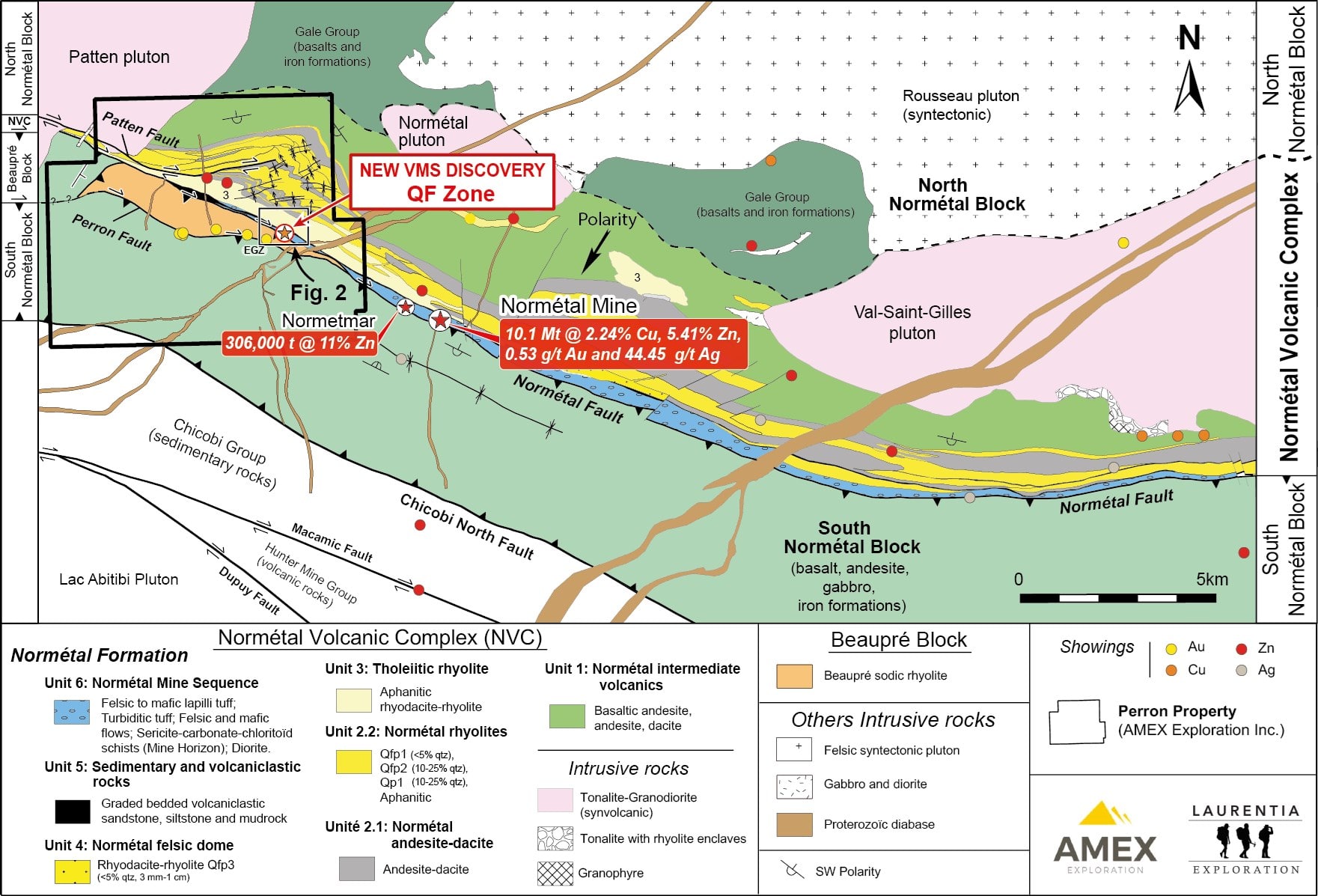

Finding more VMS style mineralization should not come as a surprise. After all, the nearby Normétal mine was a pure VMS deposit that was in operation for about five decades. The total amount of material that was produced from the main Normétal deposits was about 10 million tonnes at an average grade of in excess of 2.2% copper, just over 5.4% zinc, about 0.5 g/t gold and almost 1.5 ounces of silver per tonne of rock). So, needless to say encountering VMS mineralization is not a surprise. Amex did it before with the discovery of the QF zone, and an interesting addendum to this piece of information is that all three zones (the Normétal mine, the QF Zone and the new target zone) are located in the same horizon. This confirms Amex is using the right exploration approach at Perron and although the market still doesn’t have anything tangible (like a resource estimate) to hang its hat on, Amex Exploration isn’t being coy and makes all drill data (good or bad) public.

The surveys also highlighted additional gold exploration targets and while it still is early days, the gold enrichment encountered within the Beaupre block is consistent with the lithological units that t host the gold mineralization at Perron. The company also completed an analysis to determine the correlation between the gold signal strength and the thickness of the overburden (known from the analysis of existing drill holes). According to that internal analysis, the gold anomalies were absent in areas where the overburden exceeds 20 meters, but the ionic leach program showed very promising gold anomalies at for instance the western area of the Beaupre block and generates more exploration targets.

The balance sheet still looks strong

In hindsight, the decision of Amex Exploration to raise C$49.6M in flow-through financing in February 2022 was a master move. To this date, the company is still benefiting from that decision which most definitely is a blessing given the current situation on the financial markets and seeing how difficult it is for exploration-stage companies to secure funding.

As of the end of Q1, Amex had approximately C$18.3M in cash and a net positive working capital position of approximately C$17M. A Certificate of Deposit with an annual coupon of 1.68% matured during the first quarter and it looks like the company hasn’t deposited its cash in another fixed income security yet. That makes sense considering Amex is burning through in excess of C$5M per quarter so it’s likely very useful to keep all the cash on hand right now, rather than committing to a term investment. All cash is now invested in GICs (guaranteed investment certificate) that are cashable at any time (that’s important!) at an average interest rate between 4% and 4.35%. This means the company will likely generate close to half a million Canadian Dollar in net interest income this year (each subsequent quarter will likely have a lower interest income as the cash pile depletes).

During the first quarter, Amex spent about C$5.6M on exploration (which was capitalized) as it obviously continues to aggressively explore the Perron project. At the current burn rate, the company has approximately three quarters of runway left. This means Amex should be in a position to hold off on a financing until ‘flow-through season’ starts again in the final quarter of this year. Considering all funds that will be raised will be spent within Québec, Amex should be able to put a very strong double digit premium on the pricing of any flow-through financing (assuming that’s what the company plans to do).

Conclusion

The main comment we hear when we discuss Amex Exploration is ‘the company has been drilling for so long but still hasn’t provided a maiden resource estimate, therefore something must be wrong’. That’s an interesting interpretation but let’s not forget the Amex team has a very strict methodological approach. Additionally, the market is always backward-looking and an initial resource would have to be seen as an ‘interim stepping stone’ as the recent results once again confirm there’s so much more to be found at Perron.

That being said, we are not deaf for those concerns and we would also like to see the company bite the bullet in 2024 to publish a long-awaited maiden resource estimate. While we trust Amex Exploration’s exploration team, it will be good to have something to underpin the current valuation of the company, whether that maiden resource would contain 3 million ounces or 6 million ounces of gold-equivalent.

Disclosure: The author has a long position in Amex Exploration. Amex Exploration is a sponsor of the website. Please read our disclaimer.