Amex Exploration (AMX.V) has been working on its flagship Perron project for several years now, completing 250,000 meters of drilling in just the calendar years 2020 and 2021 alone. Drilling will continue in 2022 and this should culminate in a maiden resource estimate in the second half of this year. At that point, there will be some ‘tangible’ value to the project and this should help underpin Amex’ valuation of approximately C$300M (we are already taking the share count into consideration including the impact of the bought deal which should close this week).

In this initial report we’d like to set the scene and explain why the Perron property appears to be quite intriguing as the recent exploration activities have expanded the mineralized footprint. High-grade gold mineralization ahs now been traced over a total strike length of 3.6 kilometers and to a depth of up to 1.35 kilometers. While Amex has been flying under the radar despite the large size of the discovery and the (sometimes very) high-grade gold occurrences, the maiden resource estimate will hopefully draw more attention to the story.

The Flagship project: Perron

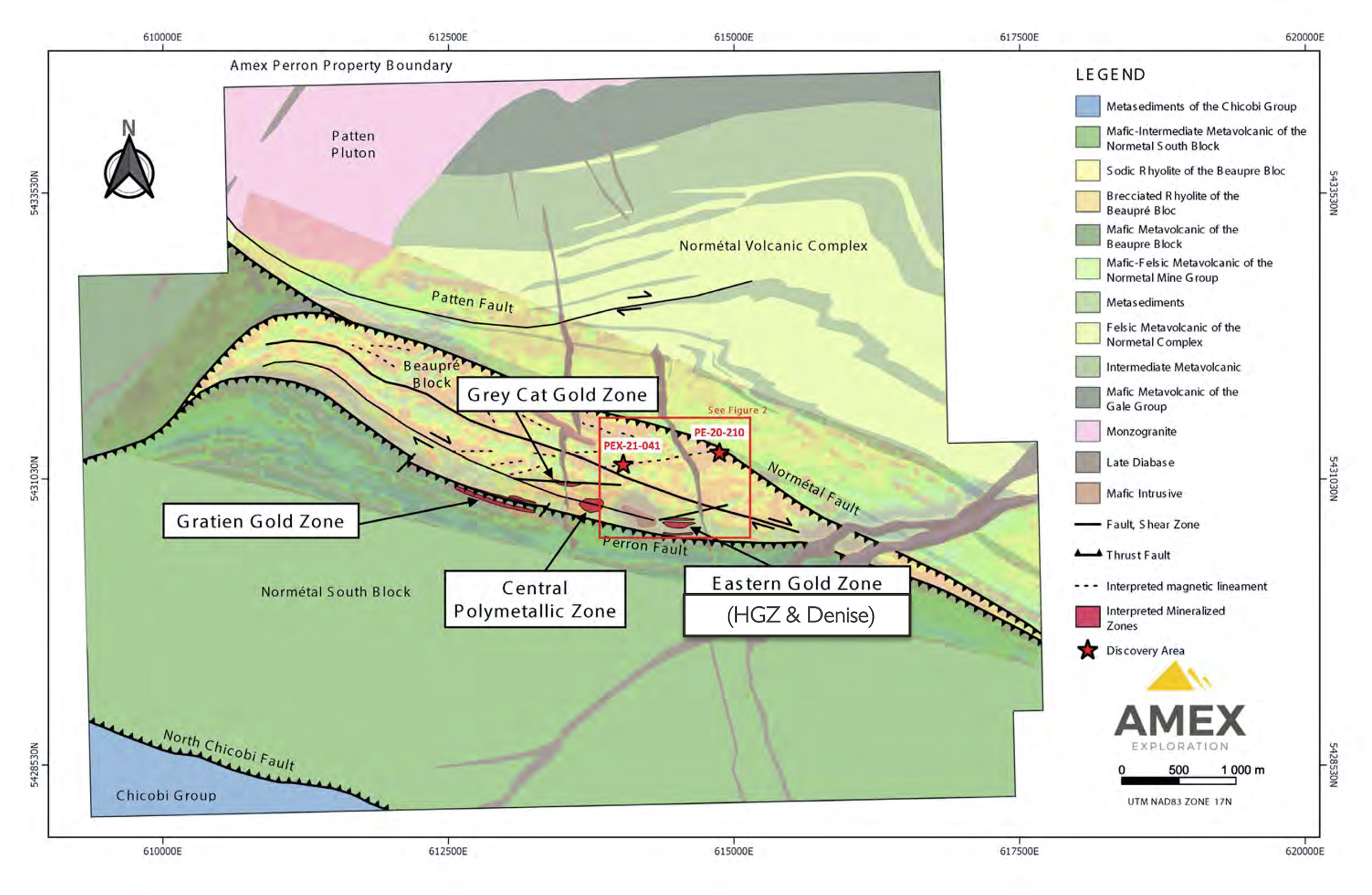

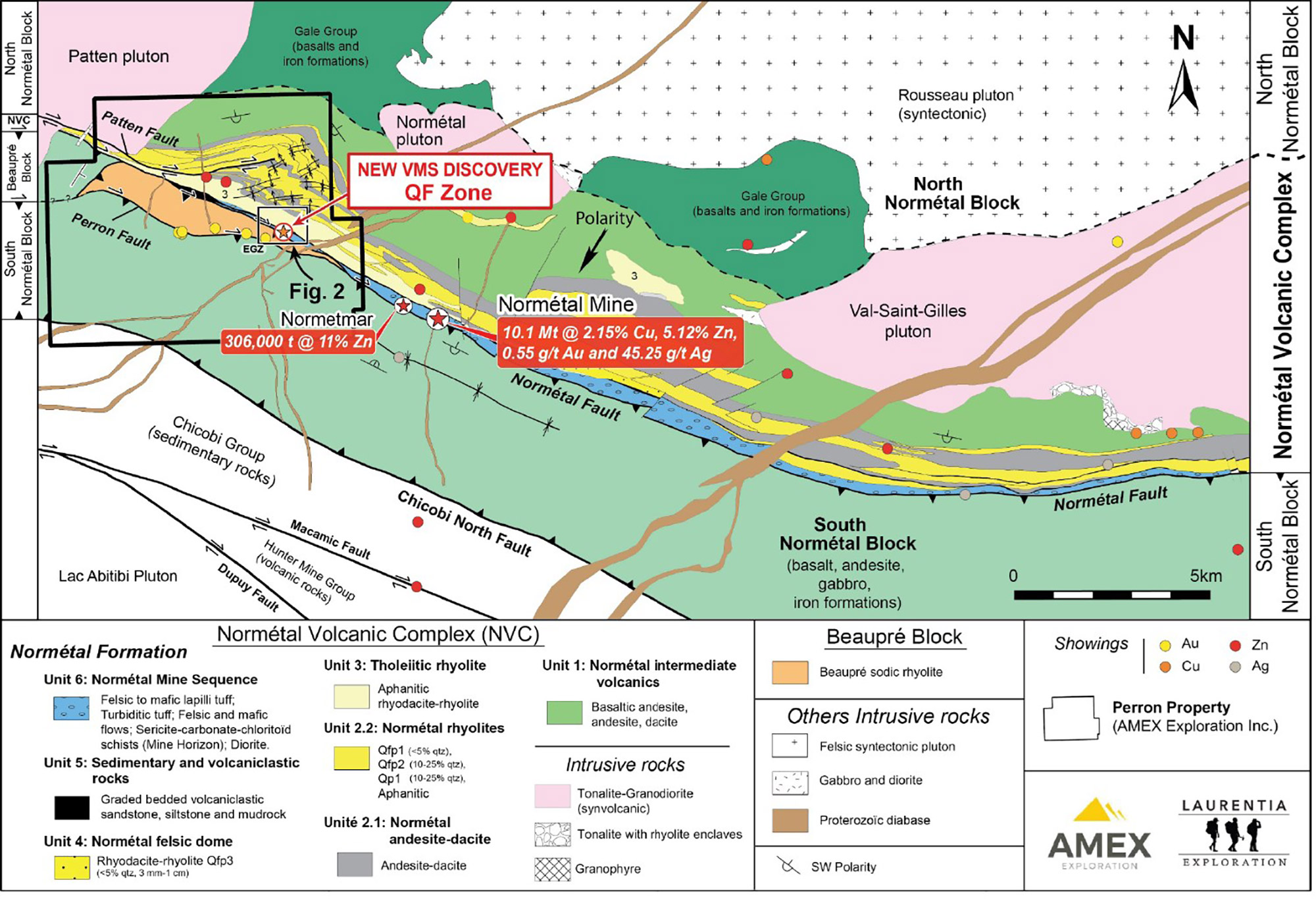

Right on the border between Québec and Ontario is the Perron project, within walking distance from the village of Normetal and just over 100 kilometers north of Rouyn-Noranda, a well-known mining town in Québec just to the west of Val d’Or. This is pure mining country as there are plenty of large gold mines within a 150-kilometer radius from Perron while the nearby village of Normetal is an actual mining town. It serviced the historic Normetal mine which produced in excess of 10 million tonnes at an average grade of 2.15% copper, 5.12% zinc, 0.55 g/t gold and almost 1.5 ounces of silver per tonne, reaching a depth of almost 2.7 kilometers according to the publicly available data.

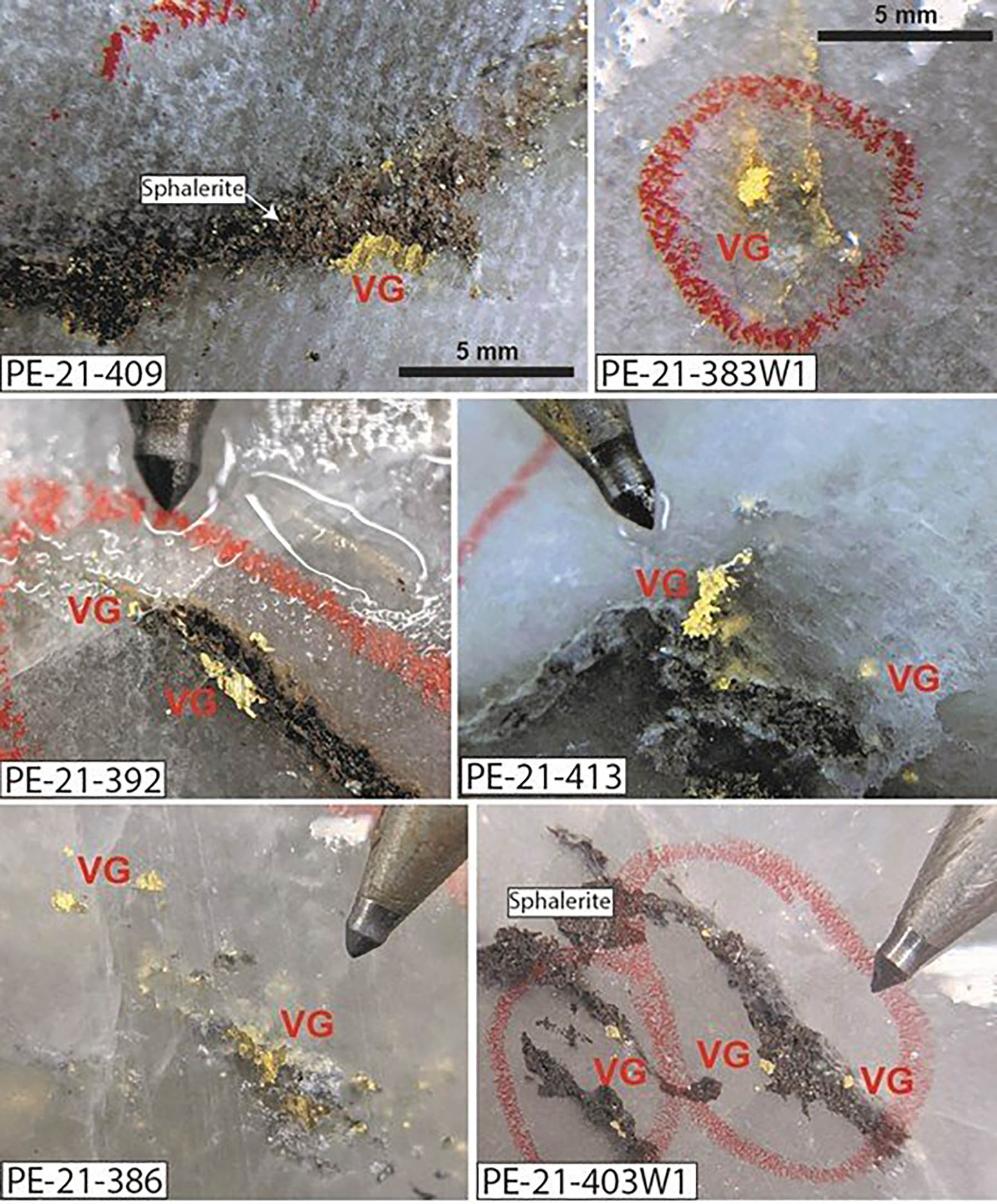

Further to the west from the Normetal mine there’s an additional mineralized deposit called Normetmar which also hosts a few hundred thousand tonnes of rock at an average grade of 11% zinc (according to a historical resource estimate). Needless to say the Perron project has the right postal code (literally, in this case) and Amex Exploration was able to scoop up a ‘forgotten’ part of the Abitibi gold belt. While the vast majority of the attention was drawn to new discoveries and developments around the larger cities of Rouyn-Noranda and Val d’Or, the Perron project has seen some exploration work (with a work program completed by Agnico Eagle in the second half of last decade), but the ball really got rolling when Amex discovered high-grade gold mineralization in January 2019. The assay results of the very first hole on the Eastern Gold Zone that was released that year contained 1.7 meters at 393 g/t gold and this was soon followed up with 0.65 meters containing almost 215 g/t gold.

The share price six-folded in a matter of weeks, Amex took advantage to tap the market to raise cash (with Eric Sprott as a lead order) in February 2019 and has just kept on drilling ever since as the high grade results kept on coming which made it easier for the company to raise funds.

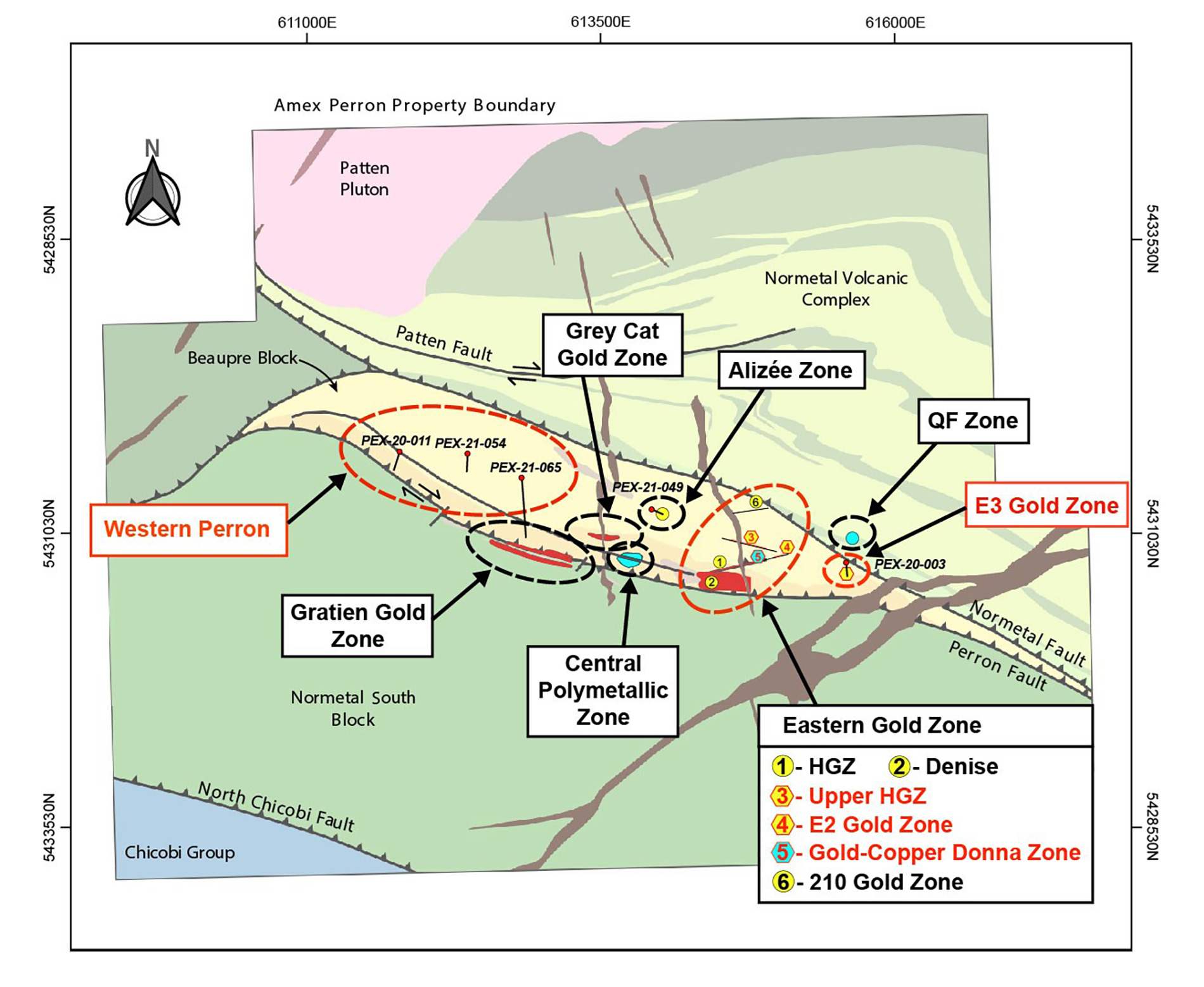

The Perron project actually consists of four separate and distinct mineralized zones along a 3.6 kilometer long corridor. While the Gratien Gold Zone (GGZ), Grey Cat Zone (GCZ) and Eastern Gold Zone (EGZ) and the Central Polymetallic zone are literally just a stone throw away from each other, they should really be considered distinct areas of interest.

The Eastern Gold Zone

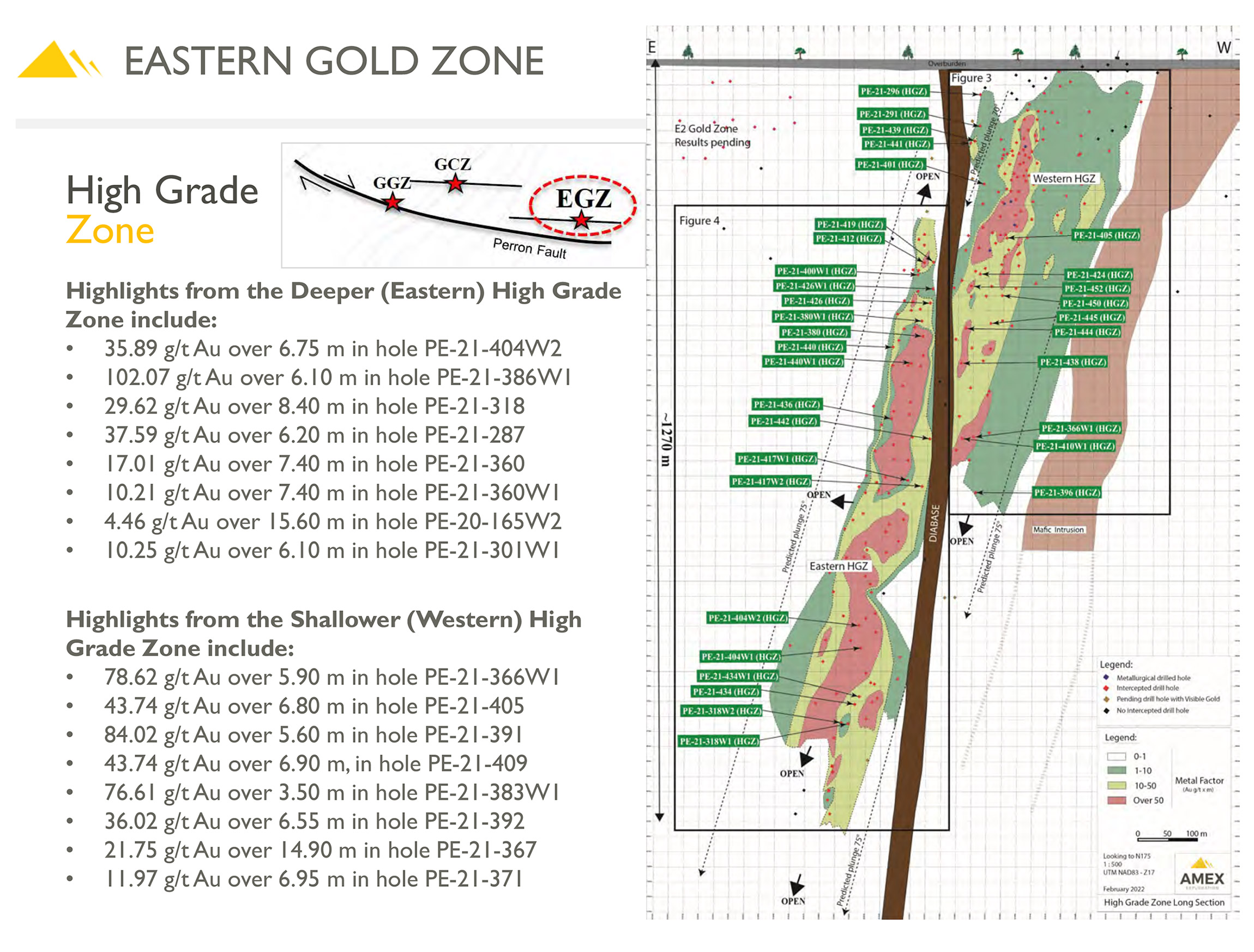

The Eastern Gold Zone is by far the most advanced portion of the Perron project and consists of the High-Grade Zone and the Denise Zone. Both zones remain open along strike and more importantly, at depth. We know these Abitibi gold systems can run very deep (Agnico Eagle Mines (AEM, AEM.TO) La Ronde gold mine is now mining ore at a depth of almost 3,000 meters). While drilling deep holes can be quite expensive, confirming the mineralization to a vertical depth of over 1,000 meters is a key element in proving up the value of HGZ, Denise and by extension, the whole project.

Amex’ corporate presentation does an excellent job in highlighting why the HGZ got its name and more importantly, the image below offers an excellent insight in how the mineralized structure is behaving. Consistency will be key in figuring out the economic viability of the High-Grade zone and we expect a portion of the 2022 drill program to work on infill drilling to both fill in the gaps in between existing holes in order to reduce the drill spacing.

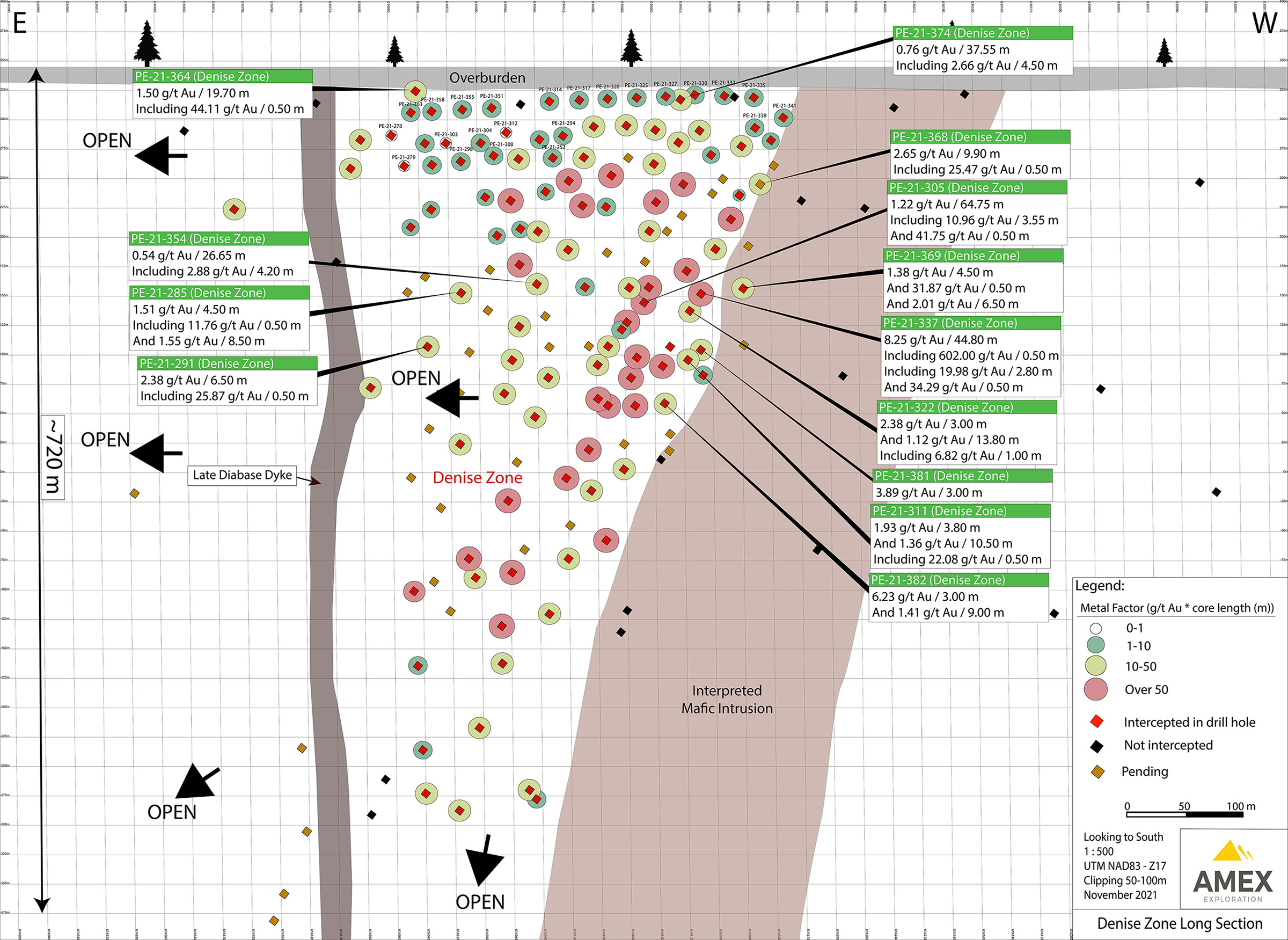

Immediately bordering and parallel to the High-Grade Zone is the Denise Zone, just about 50 meters away. Rather than seeing the same high-grade gold results as in the HGZ, Denise is completely different as it appears to be a near-surface bulk tonnage target. This means the grade is much lower, but the intervals are much longer. The drill bit has traced mineralization for a strike length of about 500 meters and has confirmed the mineralization extends to as deep as 700 meters below surface.

And although the Denise Zone appears to be getting narrower at depth, the total tonnage in an area of 450 meters (strike length) by 150 meters (our assumed width, based on exploration results) by 350 meters (a conservative depth, considering the mineralization has been confirmed to extend to a depth of at least 700 meters below surface) alone would contain north of 60 million tonnes and about 2.3-2.5 million ounces using an average grade of 1.1 g/t gold. We are NOT saying the maiden resource at Denise will immediately contain several millions of ounces of gold from the start, but the potential to rapidly build out a bulk tonnage resource is very real. And the company plans to complete a step-out drill program this year in an attempt to further expand Denise towards the west.

The QF Zone

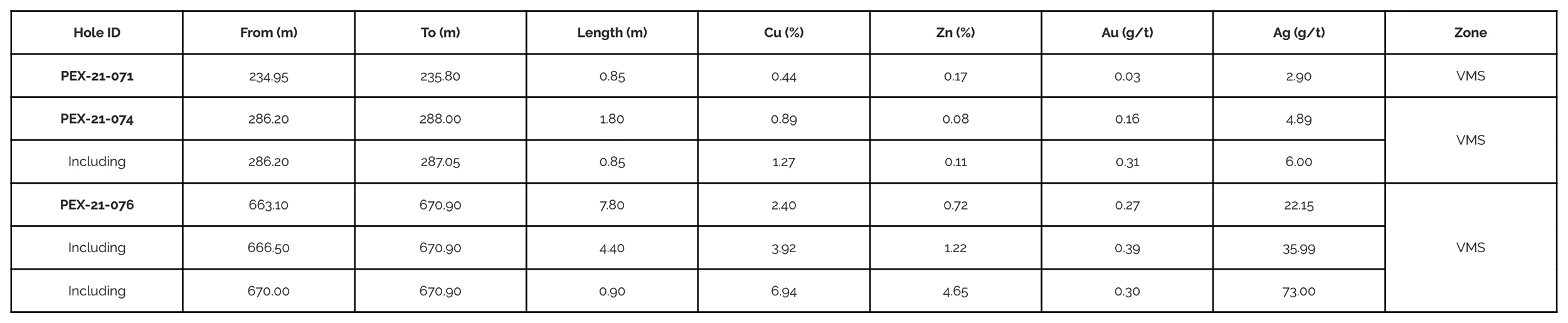

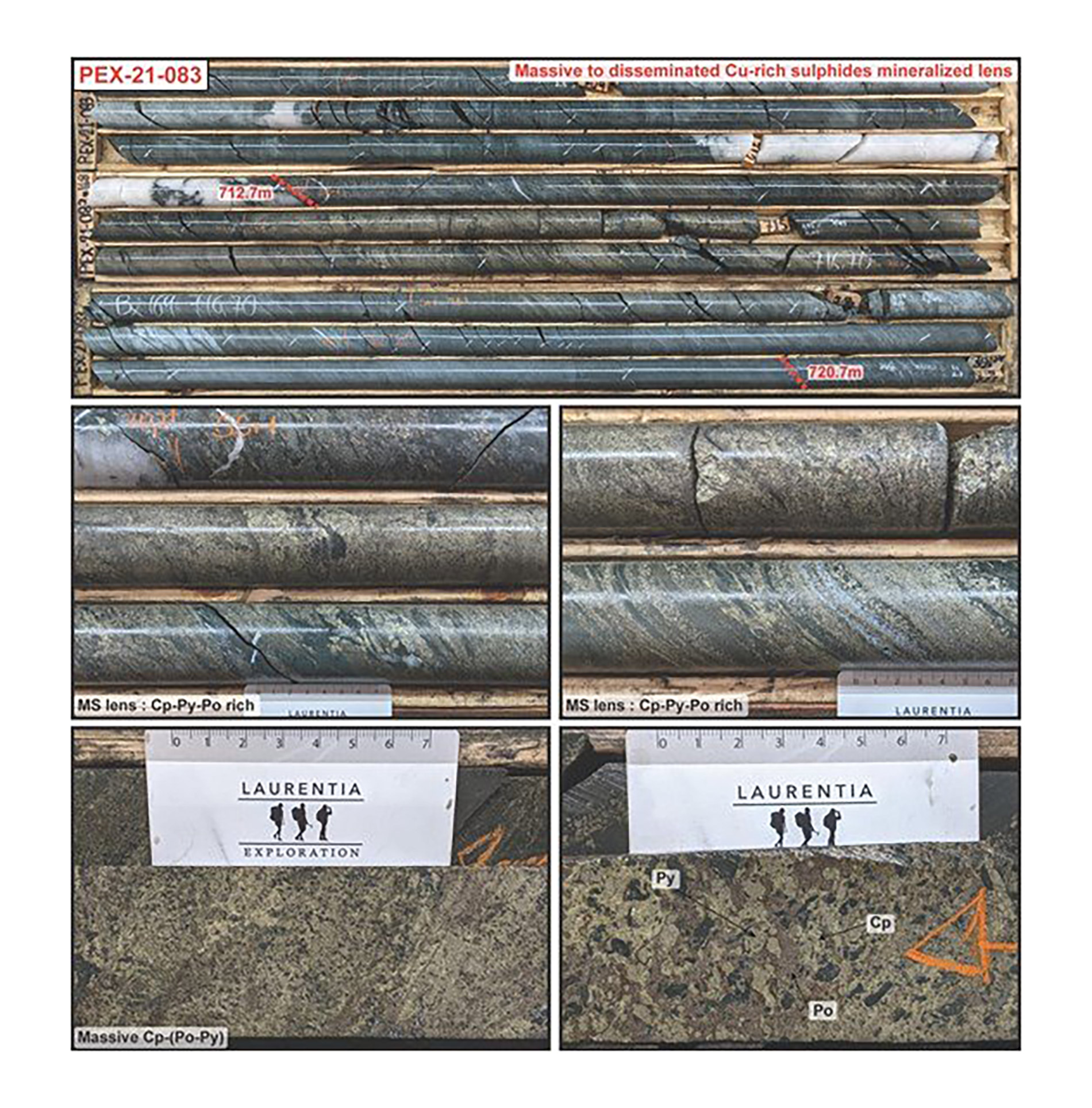

While the Eastern Gold Zone by itself could potentially be a company maker, Amex Exploration made a new discovery just a little bit to the west from the EGZ. Surprisingly, this wasn’t a gold discovery but a polymetallic discovery as the drill bit struck VMS-type mineralization.

Or perhaps we shouldn’t be surprised. Earlier in this article we explained how the Perron project has the right postal code given the proximity to the Normetal mine and the Normetmar deposit. Both the location (along strike) and the type of mineralization encountered at the Polymetallic zone seem to indicate the Central Polymetallic Zone could be a satellite deposit to the known mine. And base metal occurrences aren’t strange, as the Perron project was actually explored for base metals in the 1960s.

While it’s still too early to say the QF could be a ‘new Normetal’, the similar mineralization is striking with the QF showing the same copper-zinc-silver-gold mineralization. Although Amex will continue to focus on its gold zones, the QF zone is an interesting bonus feature of the Perron project.

Subsequently to the release of the assay results of the hole above, Amex was able to further confirm the mineralization in hole 83 which intersected 8 meters of 1.93% copper, 0.15% zinc, 0.28 g/t gold and 14 g/t silver. Good grades and a good width, extending the mineralized footprint as the mineralization was encountered approximately 65 meters deeper than the discovery hole.

Gratien Gold Zone (‘GGZ’)

The Gratien gold zone is actually the only zone with an existing NI43-101 compliant resource estimate on the Perron project. Back in 2009, an independent review calculated a total resource of just under 70,000 ounces of gold at an average grade of 1.86 g/t gold in 1.2 million tonnes of rock. This sounds underwhelming, but keep in mind this is based on a strike length of just over 1 kilometer, an average thickness of 4.5 meters and using a vertical depth of just 40-200 meters.

Although the 2009 resource is obviously rather redundant now, it did help Amex to target the known gold zones and the first holes drilled on the property in about ten years immediately struck it rich with for instance 2 meters of 14.39 g/t gold and just under 1.5 meters containing 67.5 g/t gold (that’s over two ounces of gold per tonne of rock). Needless to say this changed the entire perception of the Gratien gold zone. While the widths are a bit narrower, the grade is substantially higher thanks to Amex applying the exact same targeting methodology as it had successfully applied on the Eastern Gold Zone. Of course there are plenty of lower grade intervals in the Gratien core, but adding more higher grade intervals could and should result in a bump in the average grade.

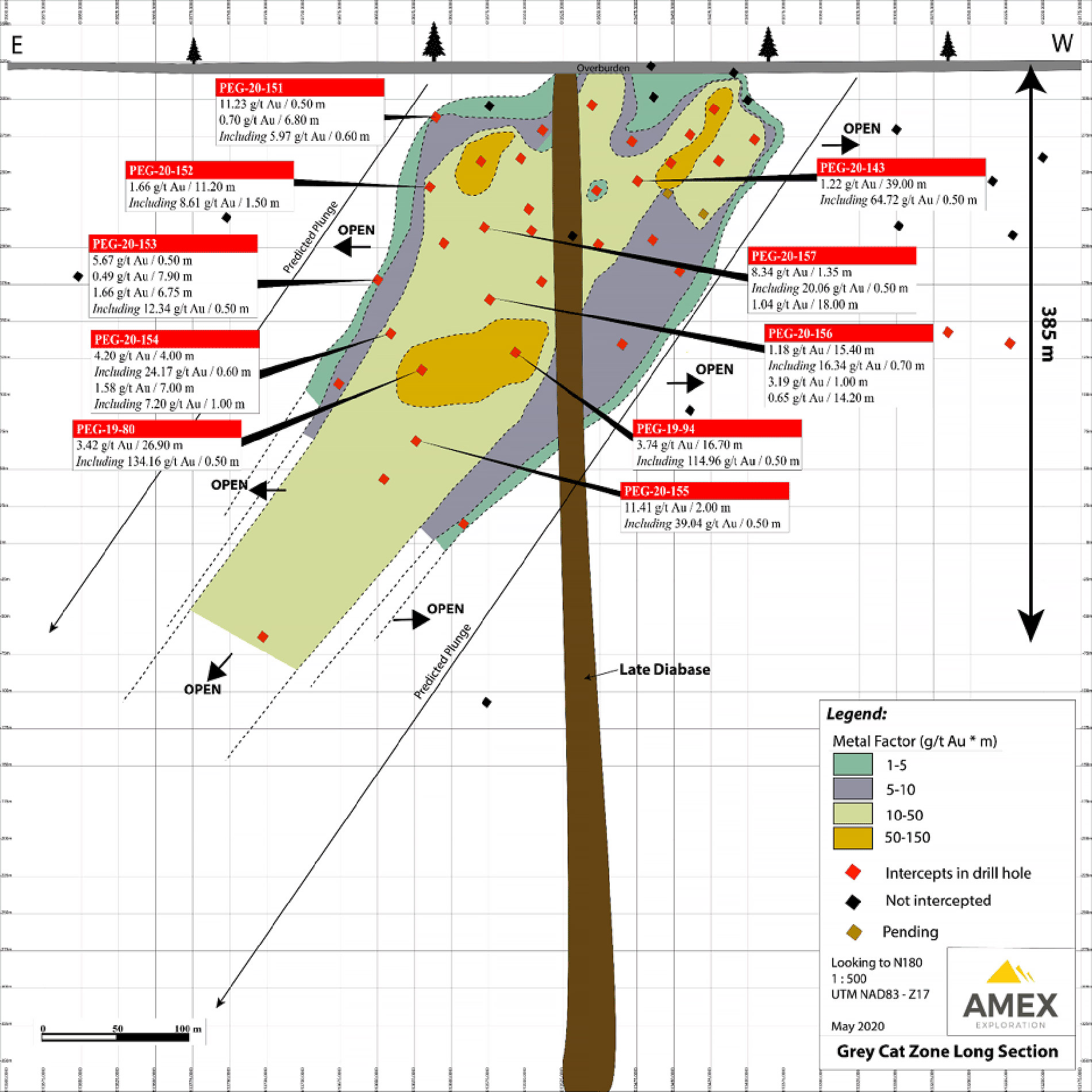

Grey Cat Zone (‘GCZ’)

The Grey Cat Zone is located right in between the Central Polymetallic Zone and the Gratien Gold Zone which are just a few hundred meters away on both ends. And once again, although the Grey Cat Zone is located very close to the Gratien Gold Zone, it’s clearly not a similar type of deposit. The gold mineralization at Grey Cat appears to be more widespread and no longer contained within the original veins.

The mineralization has now been traced to a vertical depth of in excess of 400 meters and remains open at depth and along strike. As the mineralization is coming close to surface, the Grey Cat Zone appears to be another open pit prospect. The gold mineralization appears to be narrow but the strike length and depth of the mineralization make up for the lack of width. This obviously doesn’t mean this will indeed become an open pit with a depth of 400 meters as the strip ratio will ultimately determine the tonnage and ounces that will effectively end up in the resource estimate, but having an additional near-surface zone is a good problem to have. And every mineable tonne defined by Amex Exploration is a tonne that will add value to the Greater Perron Project.

‘Regional’ exploration targets

While we have now highlighted the most important areas on the Perron project, it doesn’t end here and Amex Exploration has initiated a ‘regional’ exploration program. We can’t really call it regional because everything is within walking distance from each other but that’s exactly the strength of the Perron project. The area between the Normetal Fault and the Perron Fault appears to be very prospective and quite a bit of mineralization appears to be ‘trapped’ between both faults. And now it’s up to the Amex Exploration team to connect the dots and figure out if there’s a mineable and viable scenario to be developed.

The focus in 2022 will be on further drill-testing the Denise Zone along the known strike length up to 1,500 meters further east (remember, the current mineralized strike length is just 450 meters). On that section of the strike length, very limited drilling has actually taken place and there seems to be more room to expand the known mineralized zones in that direction. This further confirms our interpretation the bulk tonnage target at Denise may grow.

Additionally, the HGZ will be drilled to reach a resource-stage drill pattern, providing a higher level of confidence in the upcoming resource estimate while drilling off the mineralization to a depth of 1,000 meters. While the Perron project now hosts about a dozen high-priority drill targets, the Eastern Gold Zone (HGZ and Denise) offers the easiest path forward to prove up a resource that will underpin the valuation of the company.

The company is in an excellent financial shape

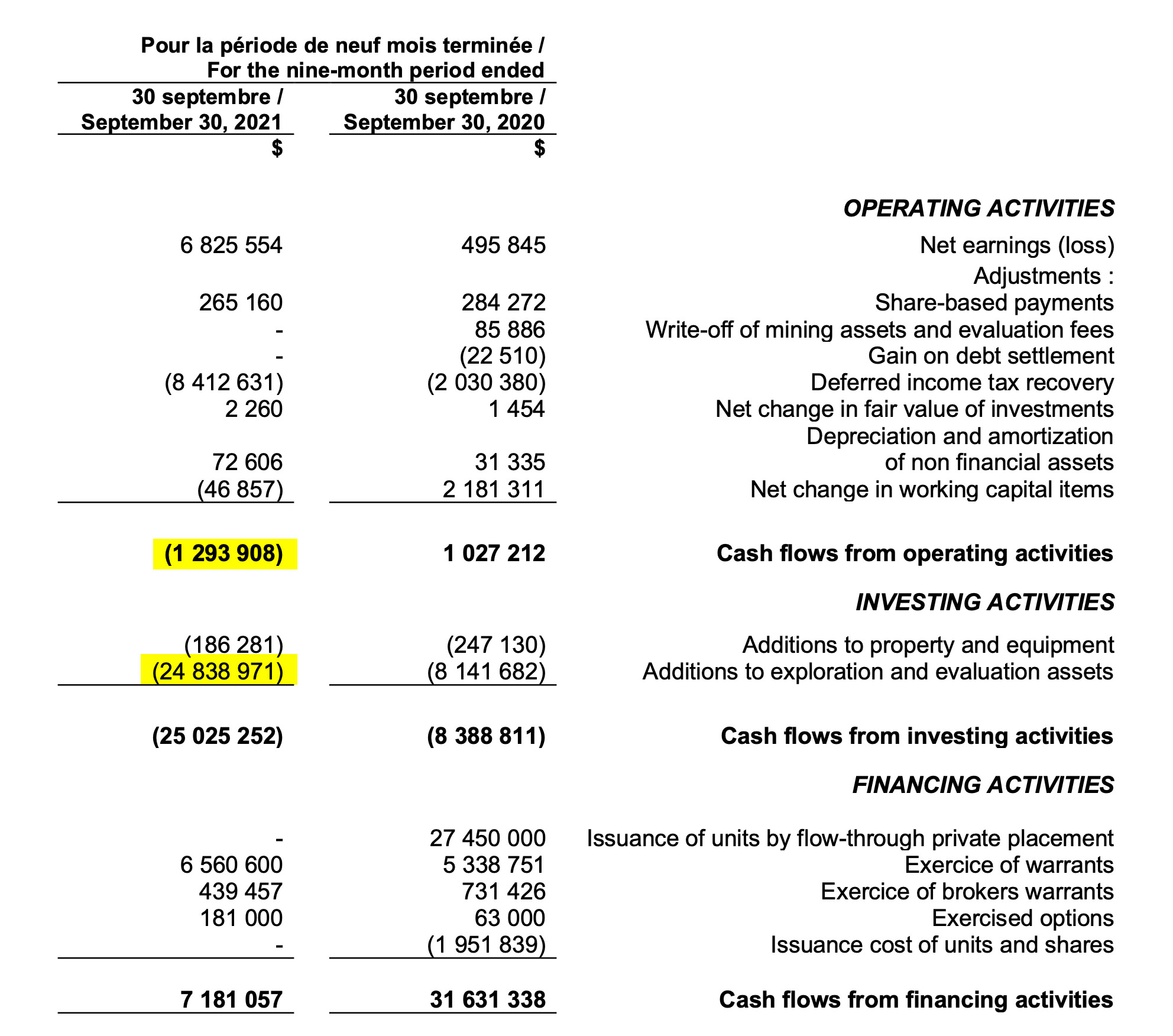

Aggressively drilling a project obviously requires cash. Amex Exploration started 2021 in an enviable position as the company was able to start last year with a working capital position of approximately C$22M. As of the end of September, the most recent financial statements filed by the company, Amex still had a positive working capital position of in excess of C$11M. And rest assured, the vast majority of the cash ‘burn’ was spent on exploration activities.

As you can see on the image above, the total cash burn was approximately C$26.3M and almost C$25M was spent on exploring the Perron project. This means that approximately 94% (!) of the entire cash burn was spent on the project in the first nine months of the year, and that is a very high ratio.

Amex also received approximately C$6.5M from the exercise of warrants during the first nine months of the year, and warrants have proven to be a very efficient and effective way to keep the treasury filled. Amex had a final batch of 2.9 million warrants with an exercise price of C$2.10 that had an expiry date of December 17th and in a recent update, Amex confirmed that all C$2.10 warrants and all remaining 80,824 broker warrants were exercised. While the press release mentions respectively 3.125M warrants and 203,000 broker warrants were exercised for total proceeds of C$7M, those were the total amount of warrants that were issued and some of these warrants had already been exercised prior to September 30th and the company received approximately C$6.2M in warrant proceeds between the end of September and the expiry date of the warrants.

The timely warrant exercise will ensure the company once again ended the year with a strong cash and working capital position. We will have to wait for Amex to file its full-year financial results, but we would for sure expect the year-end working capital position to exceed C$10M and the current raise will put the company in great shape for the upcoming 2022 exploration efforts.

While investors sometimes fear warrants are causing an overhang, the continuous exercise of warrants has helped Amex Exploration to maintain a healthy cash position and allowed the company to continue its exploration activities uninterrupted. Now the last C$2.10 warrants have been exercised, there currently are no warrants outstanding at all.

Amex is doing an excellent job at keeping the treasury at a healthy level. That’s important for a non-revenue company as you don’t want the market to start speculating against you if it thinks you’re running on fumes. As mentioned above, we anticipate Amex to have ended 2021 with about C$10M in cash, but the company has already tapped the market again in a strongly priced flow-through bought deal financing.

PI Financial, the lead underwriter, has agreed to acquire 8.95 million flow-through shares at a price of C$4.82/share which will allow the company to raise about C$43.1M (which means the net proceeds will be just over C$40M). The underwriters also have the option to exercise the greenshoe and place an additional 15% which would bring in an additional C$6M+ in proceeds. Once the bought deal closes, likely sometime next week, we expect Amex Exploration to have approximately C$50M in cash and about 100.5M shares outstanding. The back-end of the flow-through financing was priced at C$2.68/share and it’s also important to highlight this is a no-warrant financing, so no additional warrant overhang will be created. The current share count should be approximately 100.5M shares once the bought deal financing closes.

There still are some options outstanding (6.5 million to be precise) and all options are currently in the money as well with 1.875M options with an exercise price of C$0.24, 2.7 million options (expiring in 2024) with an exercise price of C$1.19 and a final 1.925M options with a strike price of C$2.77 expiring in 2025. Should all these options be exercised, an additional C$10M would hit the Amex treasury. Of course, as most options are only expiring in 2024 and 2025 we shouldn’t really count on those proceeds coming in right away, other than the 1.875M options at C$0.24 which are expiring in the first half of this year. The net cash proceeds from this option exercise will be in excess of C$450,000.

The management team

Victor Cantore – President and CEO, Director

Mr. Cantore is a seasoned capital markets professional specializing in the resource and hi tech sectors. He has more than 20 years of advisory and leadership experience having begun his career in 1992 as an investment advisor and then moving into management roles at both public and private companies. During his career he has organized and structured numerous equity and debt financings, mergers and acquisitions, joint venture partnerships and strategic alliances. Mr. Cantore serves on the boards of various companies both private and public.

Kelly Malcolm – VP Exploration

Mr. Malcolm is a Professional Geologist with extensive exploration experience focused on precious metal exploration. He specializes in the integration and interpretation of geological, geochemical, and geophysical data to guide exploration and development activities. He was recently involved in the discovery and delineation of Detour Gold’s high grade 58N gold deposit, and has acted as director, advisor, or management for several public and private mineral exploration companies. He holds a Bachelor of Science Honours in geology and a Bachelor of Arts in economics, both from Laurentian University.

Jacques Trottier – Executive Chairman of the Board

Mr. Trottier holds a PhD in economic geology from École Polytechnique of Montréal and has more than 30 years experience in mining exploration and has held senior positions with number of public mining companies. He was most recently the CEO of Sulliden Exploration where he bought the Shahuindo Mines in Peru and grew the asset to approximately 3M ounces of gold. This transaction led to the merger between Sulliden and Rio Alto, transforming Rio Alto into a mid-tier producer which later merged with Tahoe Resources.

Pierre Carrier – Chief Operating Officer, Director

Mr. Carrier was President of Opsens (OPS: TSX-V) until January, 2013, a position that he held for almost 10 years. M. Carrier obtained a Bachelor’s degree in Geology from Université du Québec in May 1979. Previously, he was President and Chief Executive Officer of Roctest Ltd, a company whose shares were traded on the Toronto Stock Exchange. He has carried out several financing and acquisitions in his career.

Conclusion

Amex Exploration will release a resource estimate by the end of this year, and unfortunately, the NI43-101 rules don’t allow the company to publish an official exploration target. We feel that the lack of hand-holding is working against Amex Exploration and the market will only really start paying attention when the initial resource estimate will be published.

Investors should keep in mind the first resource estimate will exactly be that: a ‘first’ resource. The recent exploration activities have shown there’s much more work to be done on the Perron project where high-priority drill targets are popping up left and right. The exploration results in the past two years have been great, and now it’s up to the company’s technical team and external consultants to connect the dots and get Perron – and specifically the Eastern Gold Zone – ready for the maiden resource estimate.

Disclosure: The author has a long position in Amex Exploration. Amex Exploration is a sponsor of the website. Please read our disclaimer.