Some investors might prefer high-grade projects as ‘a high grade can be very forgiving’, we have a weak spot for heap leachable oxidized gold deposits. Thanks to finetuning the heap leach process over the past few decades, even low-grade projects with an average grade of 0.3-0.35 g/t can now be brought into (profitable) production. And massive earth-moving exercises like SSR Mining’s (SSRM, SSRM.TO) Marigold mine in Nevada can even make lower grades work.

We have been keeping an eye on the evolution of Aztec Minerals (AZT.V) since the company became a listed entity in 2017 – which feels like an eternity ago. But in the first three years following its IPO, Aztec’s share price only knew one direction: down.

This changed in 2020 when the gold price skyrocketed in the period between the COVID breakout and the confirmation a vaccine was being developed. This coincided with current CEO Simon Dyakowski taking the reigns from former CEO Joey Wilkins. And in the past 2.5 years, a lot of work has been completed. Drill programs on both Cervantes and Tombstone yielded excellent results and Aztec was able to secure full ownership of the Cervantes gold project in Mexico as it acquired Kootenay Silver’s 35% minority interest in a non-cash stock & NSR deal. Owning 100% of the project will make it easier for the company to market the story and perhaps attract a partner or a buyer for the asset further down the road.

A two-pronged approach with Cervantes and Tombstone

Cervantes

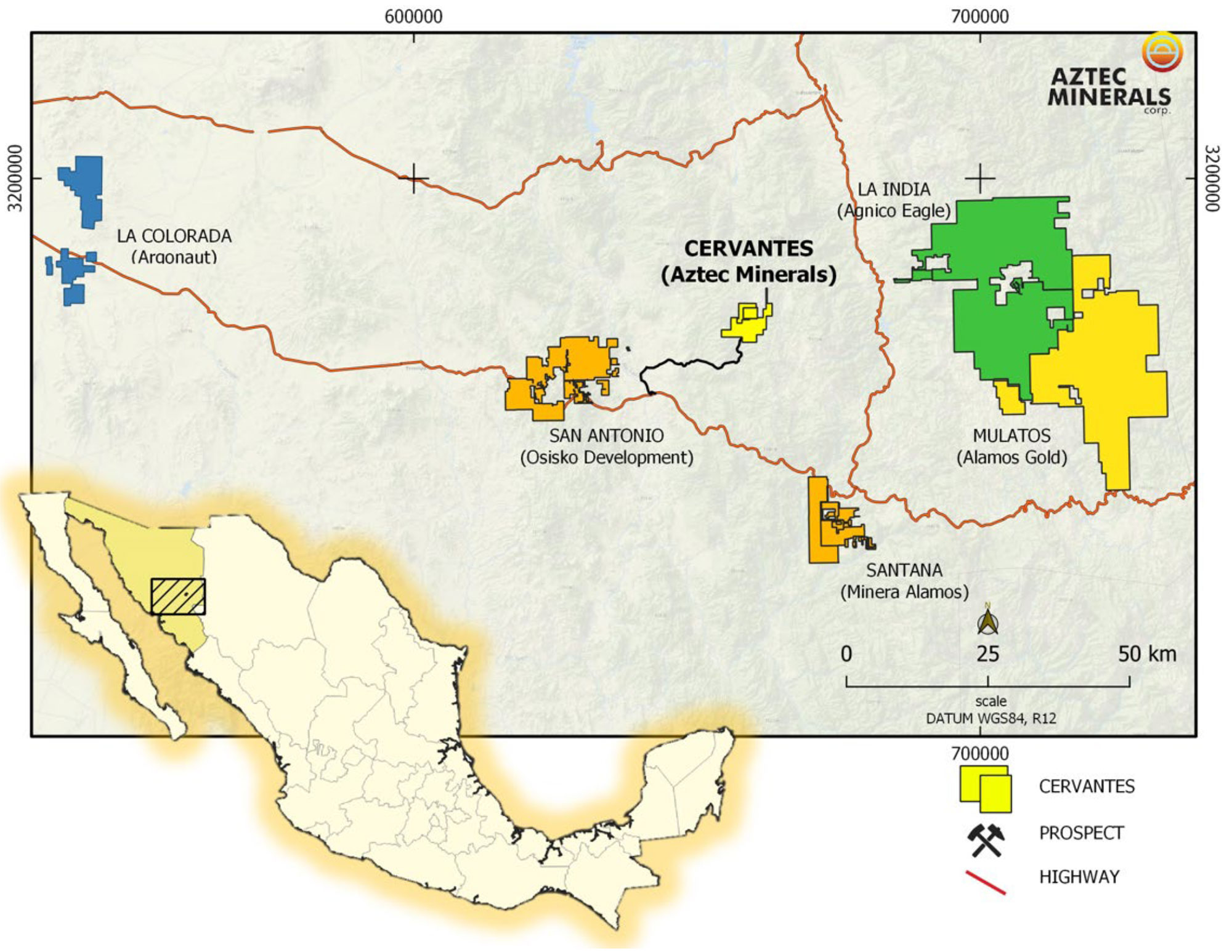

Cervantes clearly is Aztec’s flagship project. This project is located in Mexico’s Sonora province and is basically surrounded by mines and development projects as Agnico Eagle owns the La India mine (Running on its last legs with an anticipated closure date in 2024-2025) while Alamos Gold operates the well-known Mulatos gold mine and market favorite Minera Alamos (MAI.V) is generating positive cash flows from its Santana gold mine.

This area is an area that lives and breathes mining so finding skilled labour and going through the permitting process shouldn’t be too difficult. An additional bonus are the – currently – very short waiting times in the Hermosillo assay prep lab which means the turnaround time for drill programs is pretty short these days. Tocvan Ventures (TOC.V), which is also drilling in Sonora, recently reported turnaround times of just a few weeks, which is so much better than the months of waiting time in 2020 and 2021.

The positive drill results leading up to the summer of 2022 attracted a strategic investor to Aztec’s story. The well-respected Alamos Gold (AGI.TO, AGO), which operates the Mulatos mine about fifty kilometers to the east, was the lead order in a June 2022 placement. The mid-tier producer, with an anticipated production of 180,000 ounces of gold at an AISC of less than $1000/oz this year, acquired 7.9 million shares of Aztec at C$0.30 per unit for a 9.9% stake in Aztec. Each unit also consisted a full warrant with an exercise price of C$0.40 so if those warrants end up in the money before they expire in June 2024, Aztec can look forward to receiving another C$3M+ from Alamos.

As far as we are aware, Alamos does not have the right to maintain its position, and it will be interesting to see if Alamos decides to participate on a pro-rata basis in Aztec’s next financing.

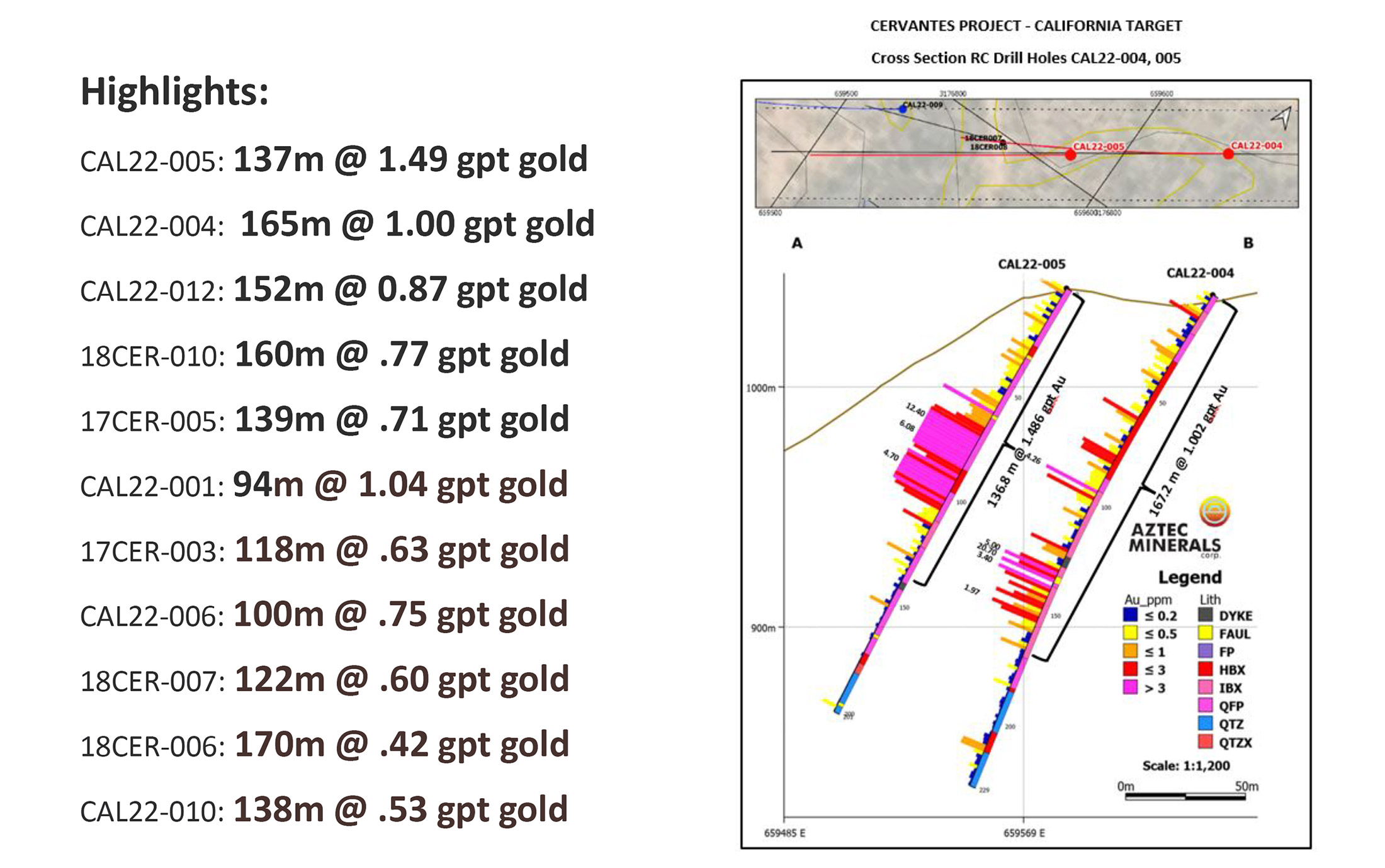

It’s not difficult to see and understand what Alamos likes at Cervantes. In the fourth quarter of last year, Aztec released the assay results from several new holes.

Hole CAL22-024 is particularly interesting as the 46.5 meter interval starts at surface and the 0.444 g/t gold grade is very decent for what ultimately will be an open pit heap leach project. Apparently, that hole also has some copper in it with grades of in excess of 500 ppm. An interesting geological feature but not very important for the oxide-hosted gold deposit as that copper grade is likely too low to have any meaningful contribution to the economics in a heap leach scenario. The other two holes contain gold as well with hole CAL22-023 showing an interesting interval of 26.7 meters of 0.54 g/t gold followed by 7.5 meters of 0.43 g/t gold with both intervals pretty close to surface.

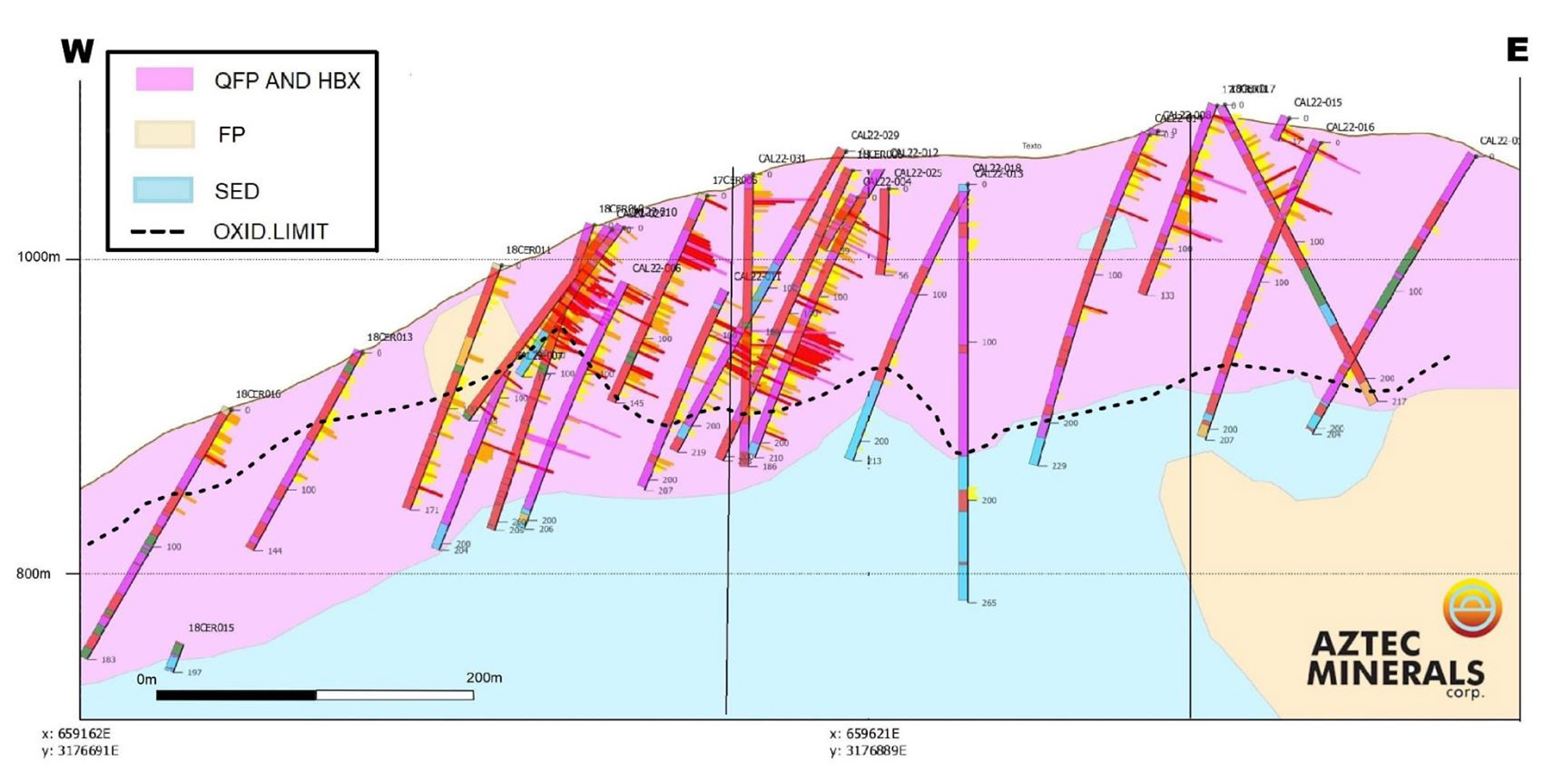

And in another update, Aztec released more holes with thick continuous intervals of oxide-hosted gold mineralization.

Hole 31, a vertical hole that successfully extended the mineralization at California to depth was the best hole. More importantly, the mineralization started at surface with an interval of 28.5 meters of 0.87 g/t gold at surface, followed by 85.5 meters starting at a depth of 49.5 meters down-hole, with an average grade of 0.58 g/t gold.

The company also reported on hole 30 with two separate mineralized zones with 7.5 metes of 0.315 g/t gold and 6 meters of 0.54 g/t gold.

Those widths and gold grades are phenomenal for heap-leachable projects as it allows Aztec Minerals to build tonnage rapidly. And another keyword important for these types of projects is ‘consistency’.

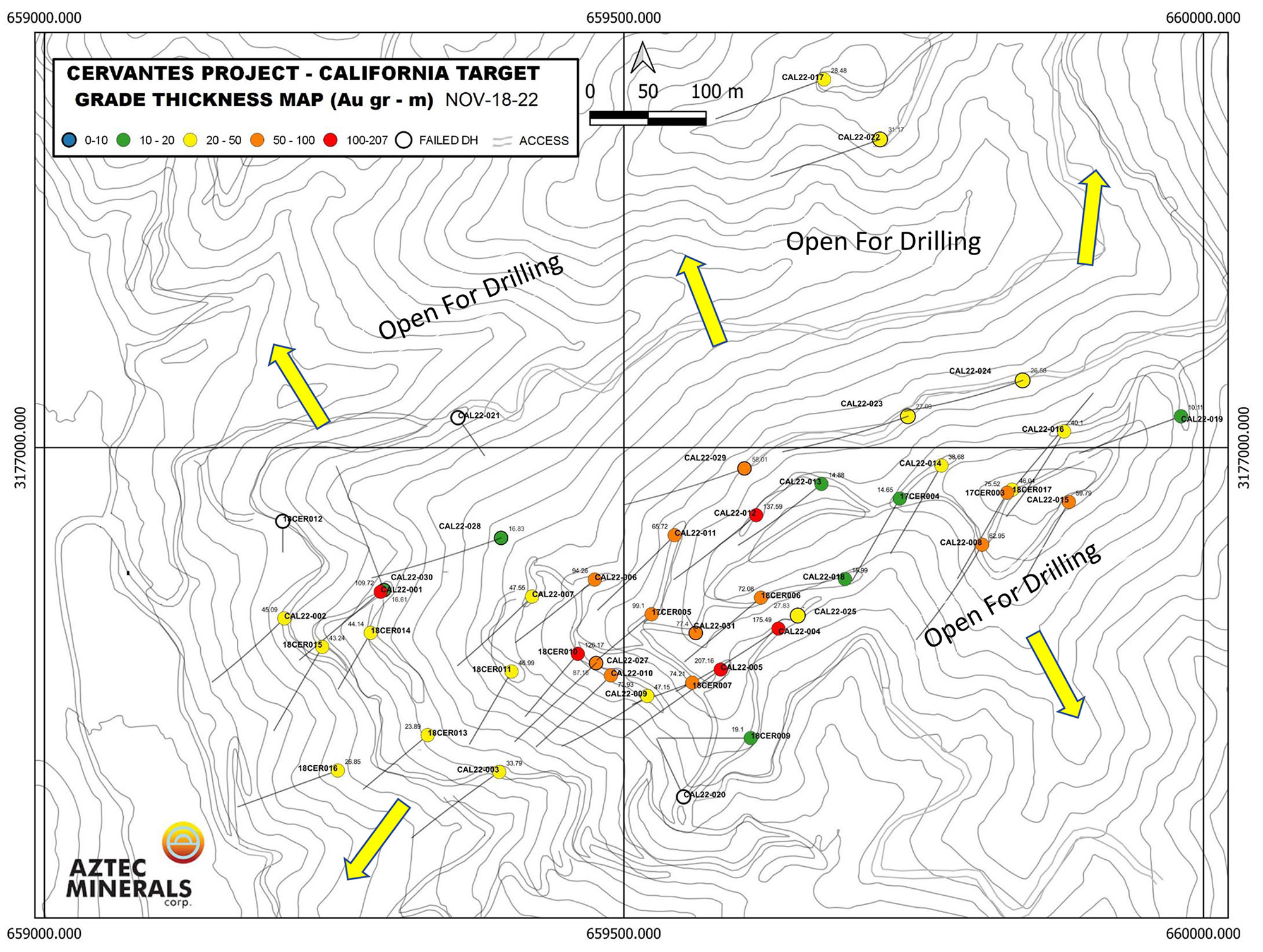

The California now has a pretty well-defined ‘core’ area, but the mineralization appears to remain open in multiple directions, and adding more holes on this ‘virgin’ land could further increase the tonnage on the project.

Initial metallurgical test work also confirmed good recovery results for gold and silver. The average recovery rate for the oxide-hosted material exceeds 85% and while the average recovery rate for silver is traditionally low in oxide deposits, Aztec’s initial tests confirmed a recovery rate of almost 50% silver. That’s nice to see but as Cervantes doesn’t contain a lot of silver, we are just cataloguing as a ‘fait divers’: good to know, but it won’t create a noticeable impact on the economics. Aztec will likely do some more met work towards the end of this year, including completing a column leach test.

Aztec plans to drill 26 holes for a total of 4,000 meters in 2023, at a total cost of just under C$1M. About 75-80% of the planned program – which is anticipated to be completed in the second quarter will solely be focusing on the oxide zones but some of the holes will be deeper to target the sulphide mineralization underneath the oxide layer. Keep in mind not every hole of this 26 hole drill program will hit gold: Aztec anticipates to drill off some of the areas to see where the gold mineralization actually ends as the margin of the deposit will undoubtedly be hit sometime. But in any case, the data gathered from the drill bit in 2023 should be sufficient for Aztec to start working towards a maiden resource estimate.

On top of the C$0.9M earmarked for the 4,000 meter drill program, Aztec has budgeted for a C$250,000 sampling program, to refine and generate additional drill targets,: the field team will collect in excess of 1,300 samples including 950 samples to be taken from road cuts on top of 120 soil samples and 250 outcrop samples.

Our preliminary interpretation of the Cervantes zone shows a total strike length of 900 meters with widths of 250 up to 500 meters. The vertical extent of the deposit tends to be 75-150 meters which would result in a total tonnage of 46-75 million tonnes (to be refined and defined in the upcoming drill program. At an average grade of 0.5 g/t, this deposit would host 900,000-1.5 million ounces of gold. Of course this is just our back-of-the-envelope calculation (and not a projection or guidance made by the company). We expect the 2023 drill program to provide more detail and Aztec to come in close to a million ounces of gold should it decide to pull the trigger on a resource calculation by the end of this year.

And considering even smaller projects have proven to be economical (we would estimate 400,000-500,000 ounces to be the critical mass to develop a Mexico-based heap leach project these days), any maiden resource coming in even close to that million-ounce mark would be a clear positive for the project.

And let’s not forget about the copper potential either. There is a gold-copper sulphide target that still has to be thoroughly drilled and could provide an interesting copper angle. The 2022 drill holes were also assayed for copper and for instance the 94.2 meter interval of 1.04 g/t gold also included 0.36% copper. While we are not including the copper potential in our consideration just yet, it does provide a target for Aztec to follow up on.

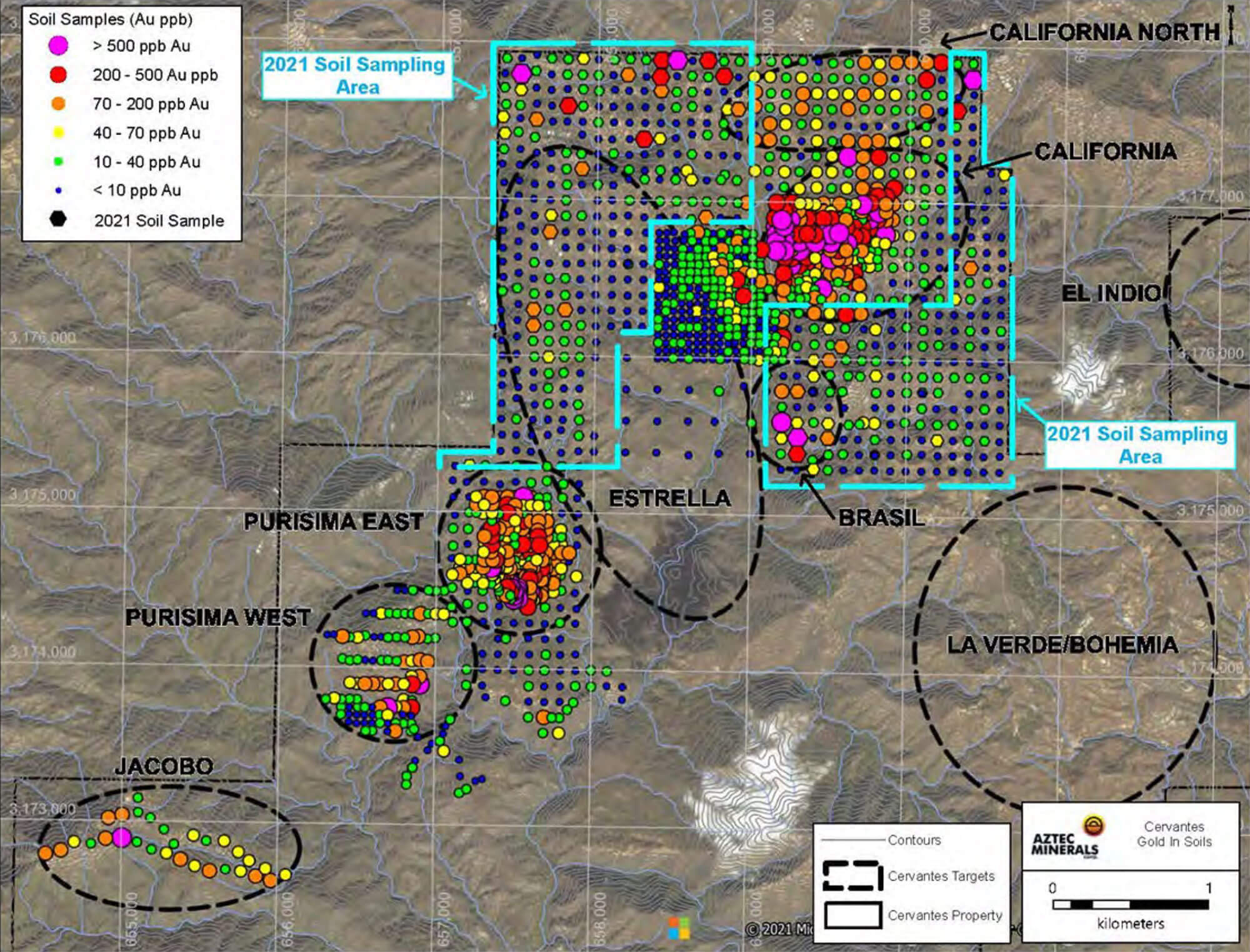

Additionally, let’s also not forget the California and California North targets at Cervantes are just two of the eleven (!) targets at Cervantes. While not all of those targets will contain gold in economically viable quantities or grades, it’s not hard to imagine there could be at least one and perhaps multiple satellite zones to the main California and California North zones.

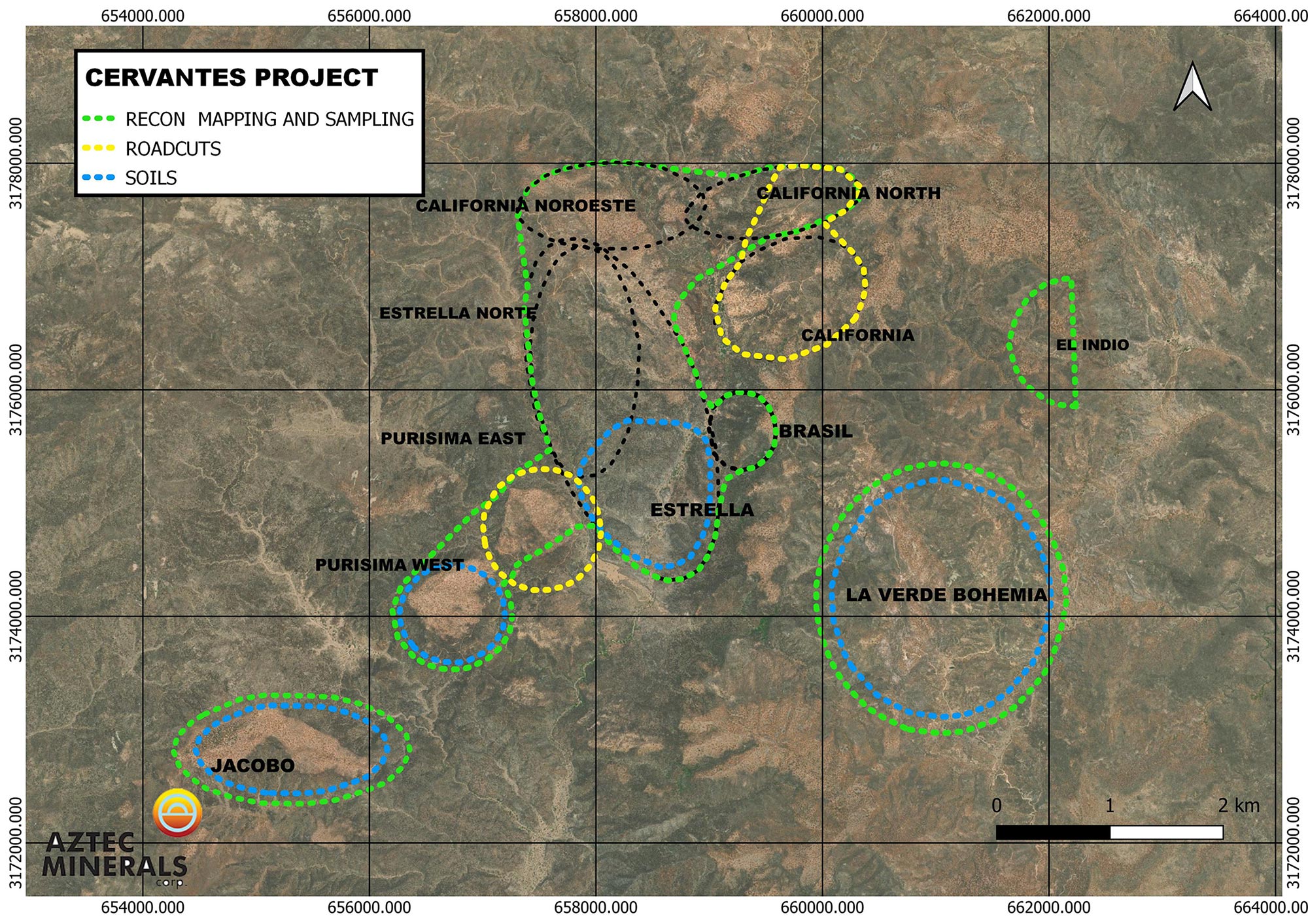

Aztec plans to complete a mapping and sampling program on some of these targets: the company plans to complete a first pass fieldwork program at La Verde and El Indio, and it will further zoom in on the Brasil, Jacobo, California Noroeste and Estrella Norte targets.

Aztec decided to acquire full ownership of Cervantes in the third quarter of last year as it signed an agreement with Kootenay Silver (KTN.V) which owned the remaining 35% stake in Cervantes at that point. To acquire that stake, Aztec Minerals issued a 0.5% NSR to Kootenay, as well as 10 million shares valued at C$0.25 per share for a pro-forma value of C$2.5M.

Unfortunately, we have seen Kootenay starting to sell some of its shares as it sold about 200,000 shares in December 2022 at prices ranging from C$0.303-0.315 and Kootenay sold an additional 50,000 shares in January of this year at an average price of C$0.30.

Tombstone

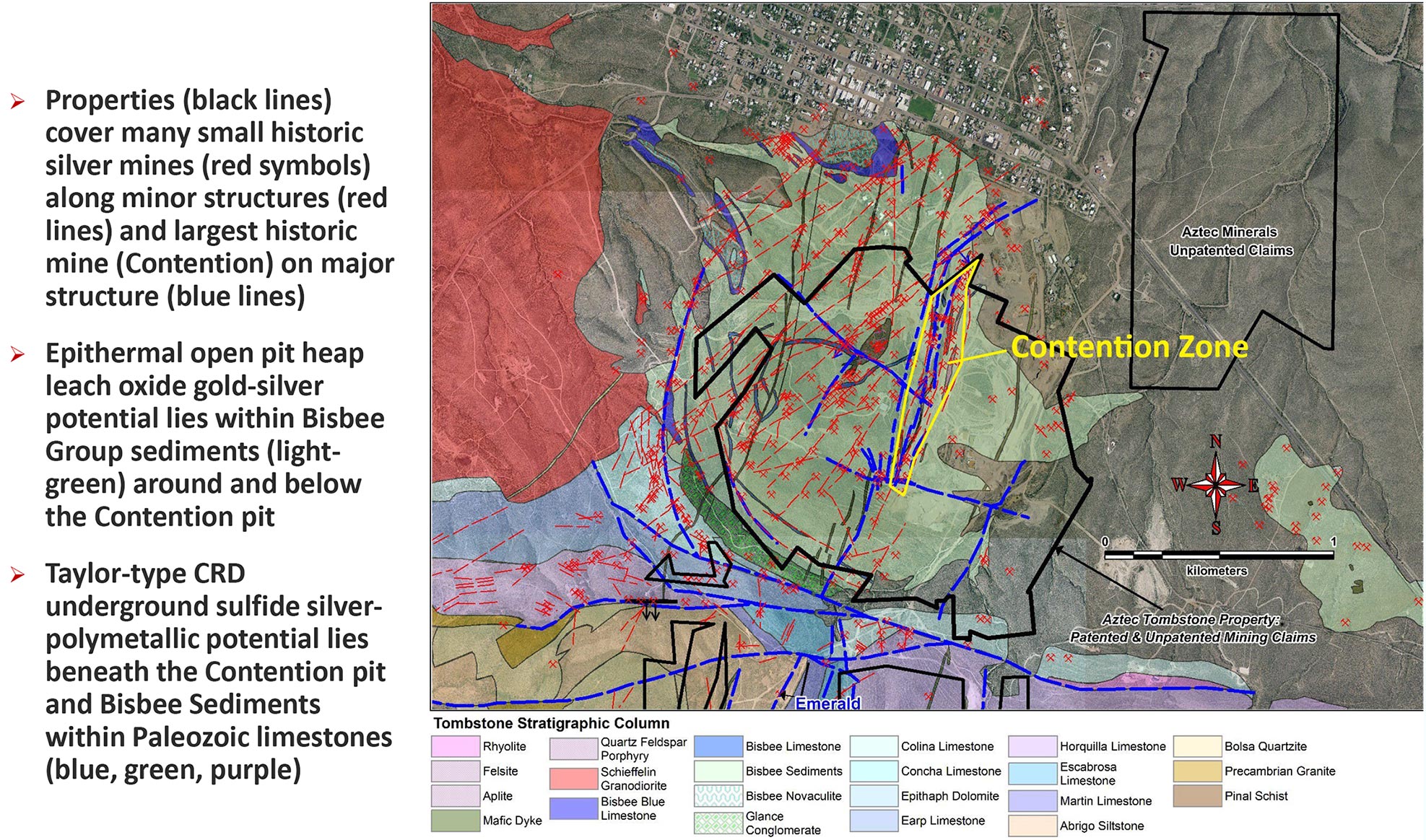

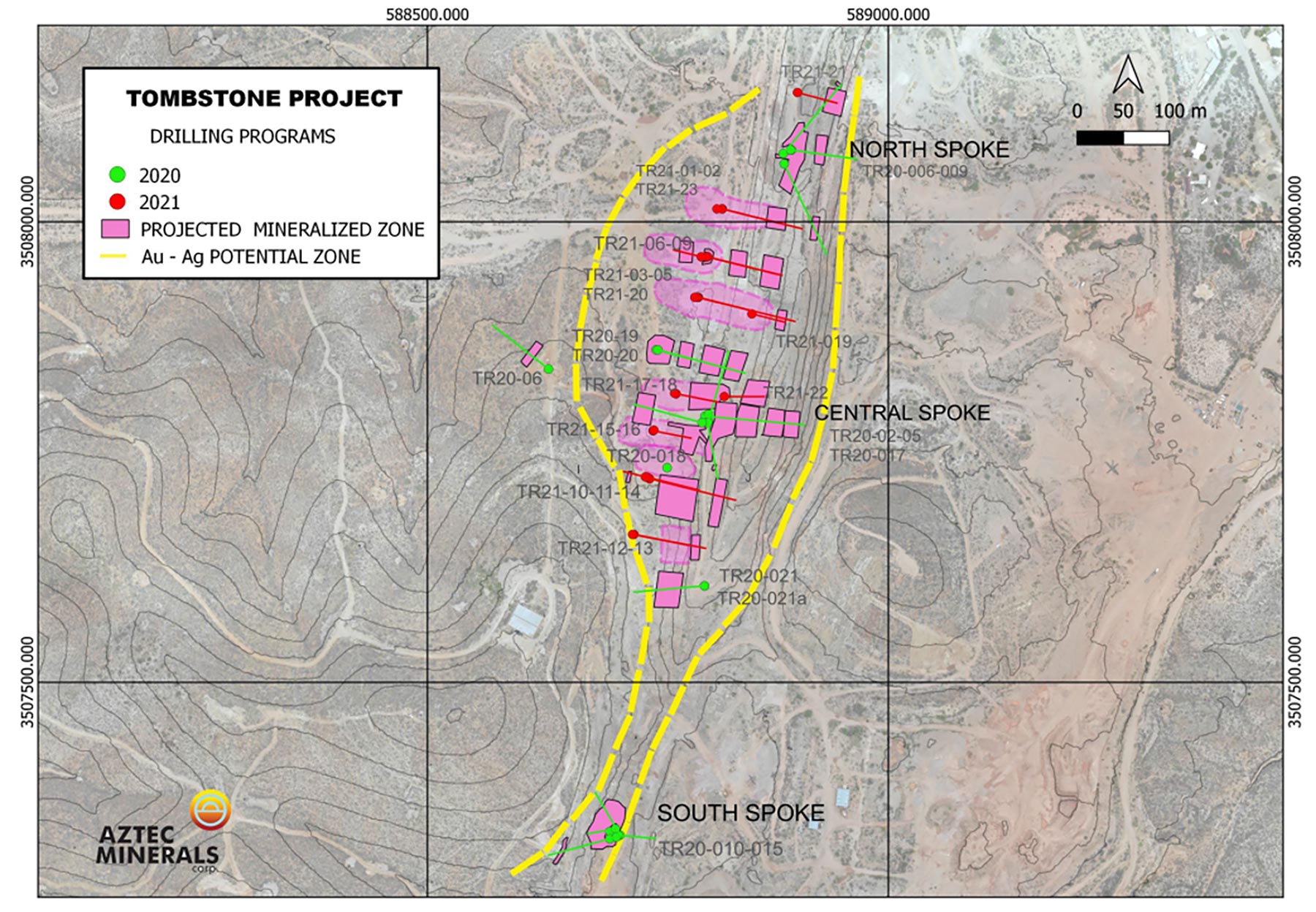

While we definitely like the Cervantes project the most, Aztec’s Arizona-based Tombstone project definitely also has its merit. Aztec currently owns 75% of the project with the remaining 25% owned by private owners.The Tombstone project is a past-producing mine that ceased production right before the second world war after producing about 250,000 ounces of gold and in excess of 30 million ounces of silver. Mining didn’t stop because all the mineralization was recouped but because the water table was reached and the historical miners were unable to deal with the mine flooding around 1915.

The claims (75% owned by Aztec after completing the (cheap) earn-in negotiated in 2018) include the majority of the patented claims and the contention pit where the gold and silver was recovered from. Those historical activities mainly focused on narrow and thin but very high-grade veins and mantos.

This project was drilled in 2020 and into late 2021 by Aztec Minerals, but since last year, more of the drilling was focused on the Cervantes project. Not because the Tombstone drill results disappointed, but because cash still wasn’t easy to come by for a company with a market capitalization of C$15-18M.

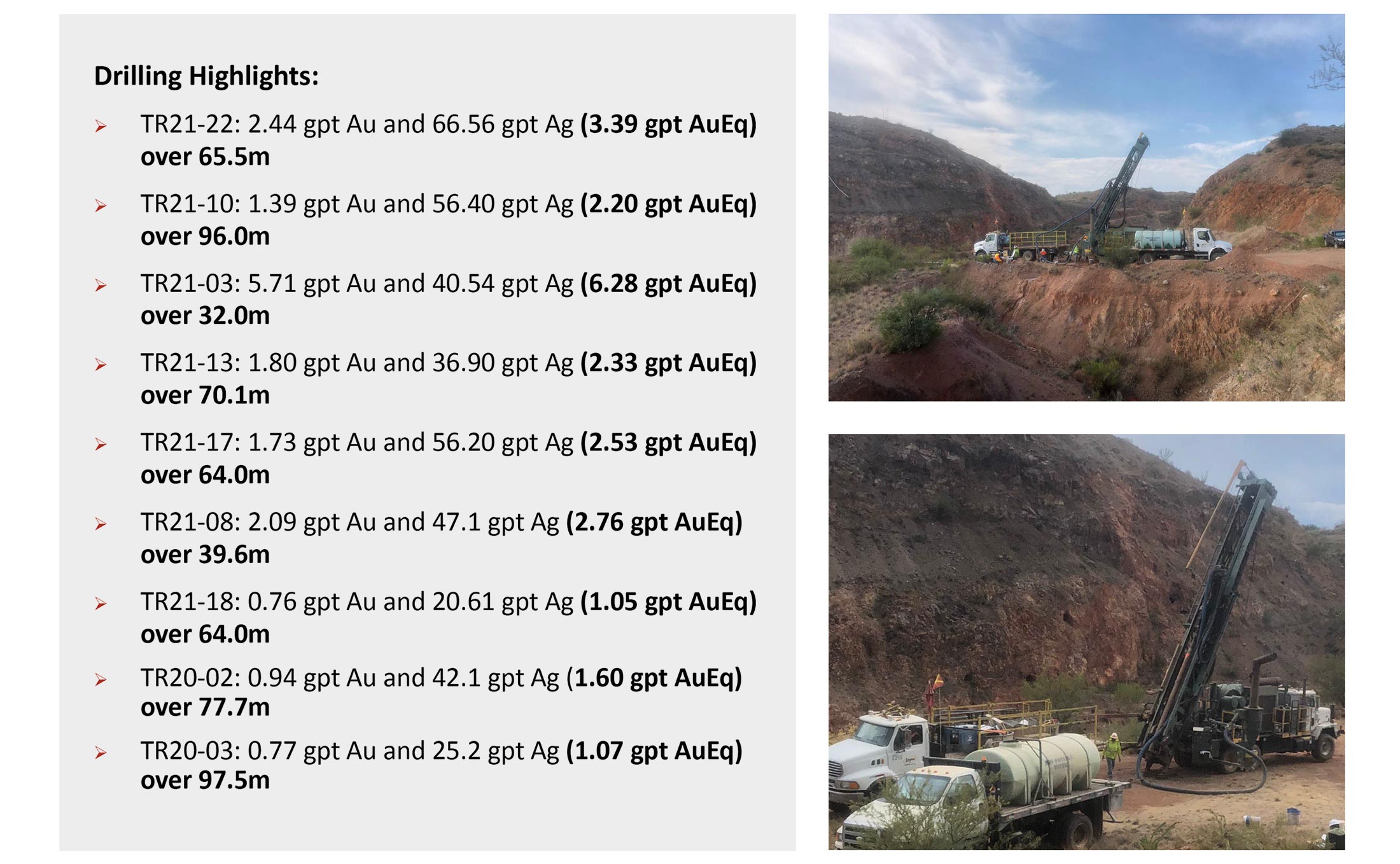

The 2020 holes were actually pretty good. Hole TR20-002 encountered 67 meters of 1.07 g/t gold and 42 g/t silver while holes TR20-003 and -004 intersected 93 meters of 0.77 g/t gold and 25 g/t silver and 55 meters of 0.54 g/t gold and 26 g/t silver respectively. This confirms the theory the old-timers only mined the very high-grade stuff but left a lot of the lower grade mineralization behind. 0.54 g/t gold or even 1 g/t gold likely wasn’t profitable 100 years ago, but it would likely be profitable with today’s processing techniques and improved understanding of metallurgy.

This doesn’t mean there’s no high grade material left. The same 2020 drill program also encountered 30.5 meters of 3.2 g/t gold and 45.6 g/t silver (3.78 g/t gold-equivalent) and 7.6 meters of 4.18 g/t gold and 174 g/t silver for a gold-equivalent grade of 6.36 g/t.

While in the 2022-2023 era most of the exploration efforts were focusing on Cervantes, Aztec did go back for another drill program at Tombstone in 2021. The assay results were even better than the 2020 drill program with for instance 32 meters with in excess of 6 g/t gold-equivalent and 96 meters containing 2.2 g/t gold-equivalent. Another highlight hole returned a thick mineralized intersection of 65.6m averaged 3.30 gpt AuEq, and bottomed in 7.6m averaging 22gpt AuEq. That is excellent by any open pit or underground mining standard.

We know CEO Dyakowski is dying to get back in the field at Tombstone in 2023 and depending on the company’s ability to raise cash, we may see a (relatively) small drill program to follow up on the high grade zones and expand the known mineralization which currently has a strike length of 900 meters with an average width of 30-50 meter reaching a depth of about 120 meters. Building tonnage will be key here as well.

Aztec’s financial situation

We still have to wait for Aztec’s full-year financial results to be filed so we have to work with the Q3 financials for now. At the end of September, Aztec had a positive working capital position of just under C$2.7M, including almost C$2.5M in cash.

While we obviously expect the cash and working capital position to be substantially lower now, keep in mind CEO Simon Dyakowski is running a very tight ship. During the third quarter, Aztec’s operating expenses came in at less than C$0.25M including C$57,000 in share-based payments. Excluding this, the overhead expenses were just over C$170,000 per quarter. While that is pretty low, keep in mind there likely is some sort of ‘seasonality’ as the total amount spent on shareholder relations during the third quarter was just a fraction of what was spent during the first semester. But even if you’d look at the financial results in the first nine months of the year, the total cash expenses were just over C$0.9M after deducting the C$367,000 in non-cash share-based expenses.

In sharp contrast to that, the company spent almost C$1.9M on capitalized exploration so approximately 2/3rds of the total cash burn in the first nine months of the year was actually spent on the projects. CEO Dyakowski takes home about C$13,750/month which is relatively low in the junior mining space these days. Dyakowski currently owns 1.76 million shares and at the current value of approximately C$0.30 per share, the value of his stock position represents almost 4 times his annual salary. A ratio we don’t see very often in this sector unless of course that management was able to load up on cheap stock in a founders’ round. CEO Dyakowski only entered the scene in 2020 when the company had been a public vehicle for several years and established his position in a financing that year, which was open to the public.

Management

Simon Dyakowski – President & CEO, Director

Mr. Dyakowski most recently acted as an adviser to TSX Venture Exchange listed mineral exploration companies on their corporate development strategies. Mr. Dyakowski holds an MBA from the University of British Columbia, is a CFA charter holder and holds an undergraduate finance degree from the University of Western Ontario. He previously worked at the Bank of Tokyo-Mitsubishi UFJ and Royal Bank of Canada dealing with investment-grade and mid-market Canadian corporate clients. Mr. Dyakowski has also worked in the equity research and equity sales departments at Salman Partners and Leede Financial.

Allen Heyl – VP Exploration

Mr. Heyl brings to Aztec more than 38 years of experience in the mining industry, including senior corporate and technical positions with both major mining companies and junior exploration companies, working mostly in the Andean countries of South America and in North America.

Mr. Heyl was most recently Vice President, Operations for Duran Ventures, responsible for overseeing the operation of a small processing plant in northern Peru, as well as corporate development, evaluations, acquisitions, exploration and administration. Throughout his career, David developed expertise in all aspects of mineral exploration and resource evaluation, and has worked at operating mines in grade control, mine design, construction supervision and operations oversight.

He has played key roles in the discovery and evaluation of more than 30 million oz gold and 25 million tonnes copper in reserves and resources including Marmato-Echandia in Colombia for Colombia Gold (now Aris Gold); Pierina, Alta Chicama, and Quicay (now Centauro) for Barrick; Motherlode (now Corvus Gold) and Reward (now Waterton) in Beatty, Nevada, and Rocky Bar for GEXA; Tantahuatay, Cuajone, and Quelleveco for Southern Peru Copper; Rio Blanco for Monterrico Metals (now Zijin Mining); El Toro, Minaspampa (both now COMARSA), Tres Cruces and Nueva Condor/Huampar for OroPeru.

Mark Rebagliati – Director

Mr. Rebagliati has worked in mineral exploration from 1966 to the present in Canada, USA, Mexico, South America, Africa, Europe, Caucasus and China. In 1986 he established Rebagliati Geological Consulting Ltd and in that year began a 28 year association with the Hunter Dickinson group of companies playing an instrumental role in the discovery of the Mt. Milligan, Southern Star, Kemess South, Kemess North (BC), Pebble East (Alaska), Xietongmen and Newtongmen (China) porphyry copper-gold deposits and a cluster of VMS Cu-Zn-Au-Ag deposits (Mexico).

Mr. Rebagliati is the recipient of AMEBC H. H. Huestis and Colin Spence awards for Excellence in Prospecting and Global Mineral Exploration, PDAC Bill Dennis and Thayer Lindsley Prospector of the Year and International Discovery awards, SME Robert Dreyer Award, and has been inducted into the Academy of Geological and Mining Sciences (MTU) and the Canadian Mining Hall of Fame.

Conclusion

It already looks like Aztec Minerals has what it takes to ensure its flagship Cervantes project reaches critical mass. This year’s anticipated 4,000 meter drill program will likely allow the company to gather enough data to move to the resource calculation stage by the end of this year, which would put a somewhat ‘tangible’ element on the asset. 500,000 ounces of gold should be sufficient to reach critical mass for this heap leach gold project, but Aztec may come in closer to a million ounces and that would likely put it on the map and even higher on Alamos Gold’s radar screen.

While we don’t want to give Tombstone the stepmotherly treatment here, we think most of the value has come from and will come from Cervantes as the company’s exploration programmes are much more advanced.

Aztec currently has just over 90 million shares outstanding, which means the market capitalization is just C$27M (US$20M) at this point. Continued drill success and outlining a 0.8-1Moz gold resource at Cervantes should unlock value here as a resource and a subsequent PEA would be something tangible for investors to point at.

Disclosure: The author has a long position in Aztec Minerals. Aztec Minerals is a sponsor of the website. Please read our disclaimer.