Non-revenue exploration companies are having a tough time this summer as it looks like Mr. Market doesn’t care about anything. This doesn’t make the life of junior executives easier and Aztec Minerals (AZT.V) is one of those victims. Despite releasing good drill results from its Tombstone gold-silver project in Arizona, the market just shrugged it off and the share price has lost about a third of its value since early May.

While we definitely like the company’s Cervantes project the most, Aztec’s Arizona-based Tombstone project definitely also has its merit. Aztec currently owns 75% of the project with the remaining 25% owned by private owners.The Tombstone project is a past-producing mine that ceased production right before the second world war after producing about 250,000 ounces of gold and in excess of 30 million ounces of silver. Mining didn’t stop because all the mineralization was recouped but because the water table was reached and the historical miners were unable to deal with the mine flooding around 1915.

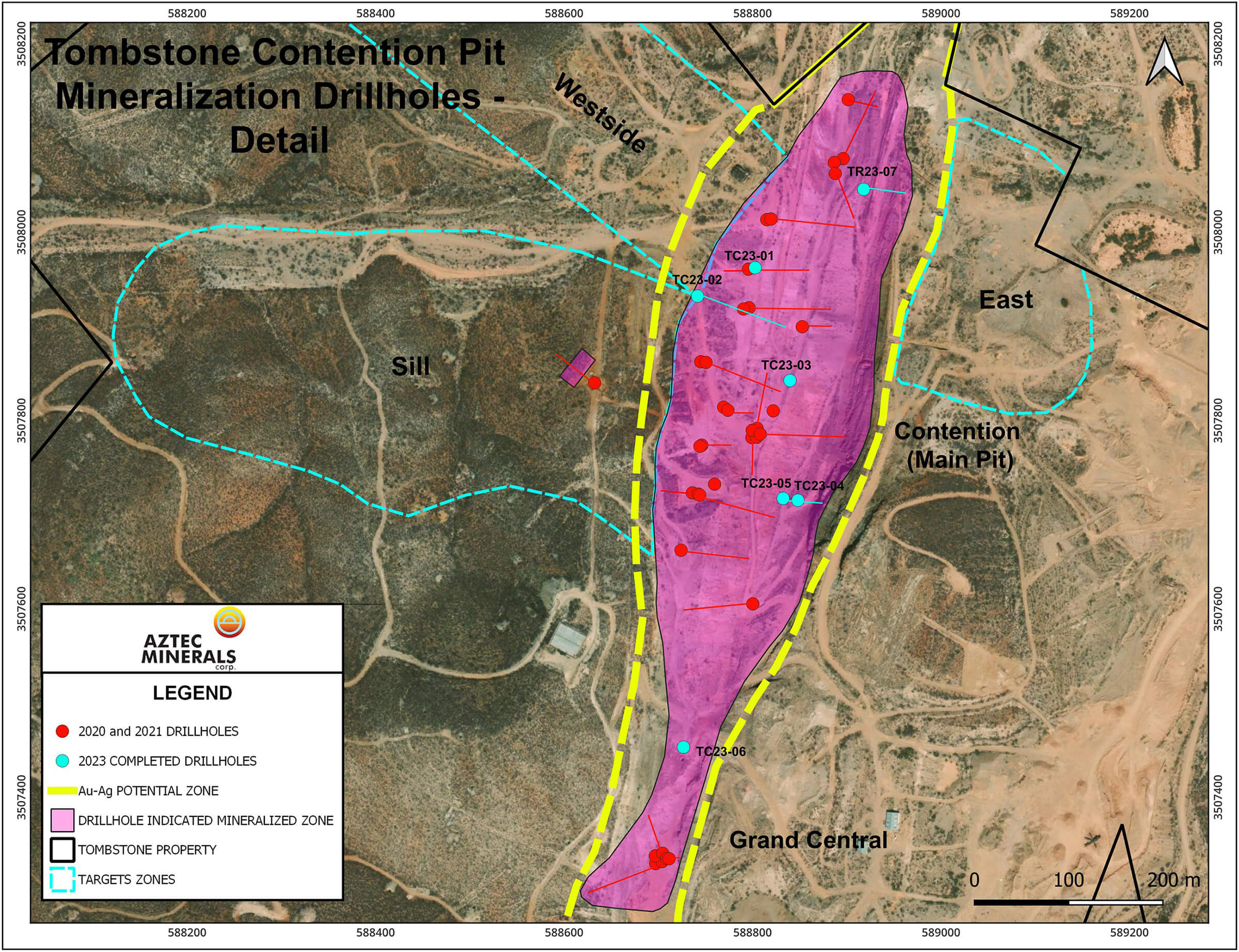

The claims (75% owned by Aztec after completing the (cheap) earn-in negotiated in 2018) include the majority of the patented claims and the contention pit where the gold and silver was recovered from. Those historical activities mainly focused on narrow and thin but very high-grade veins and mantos.

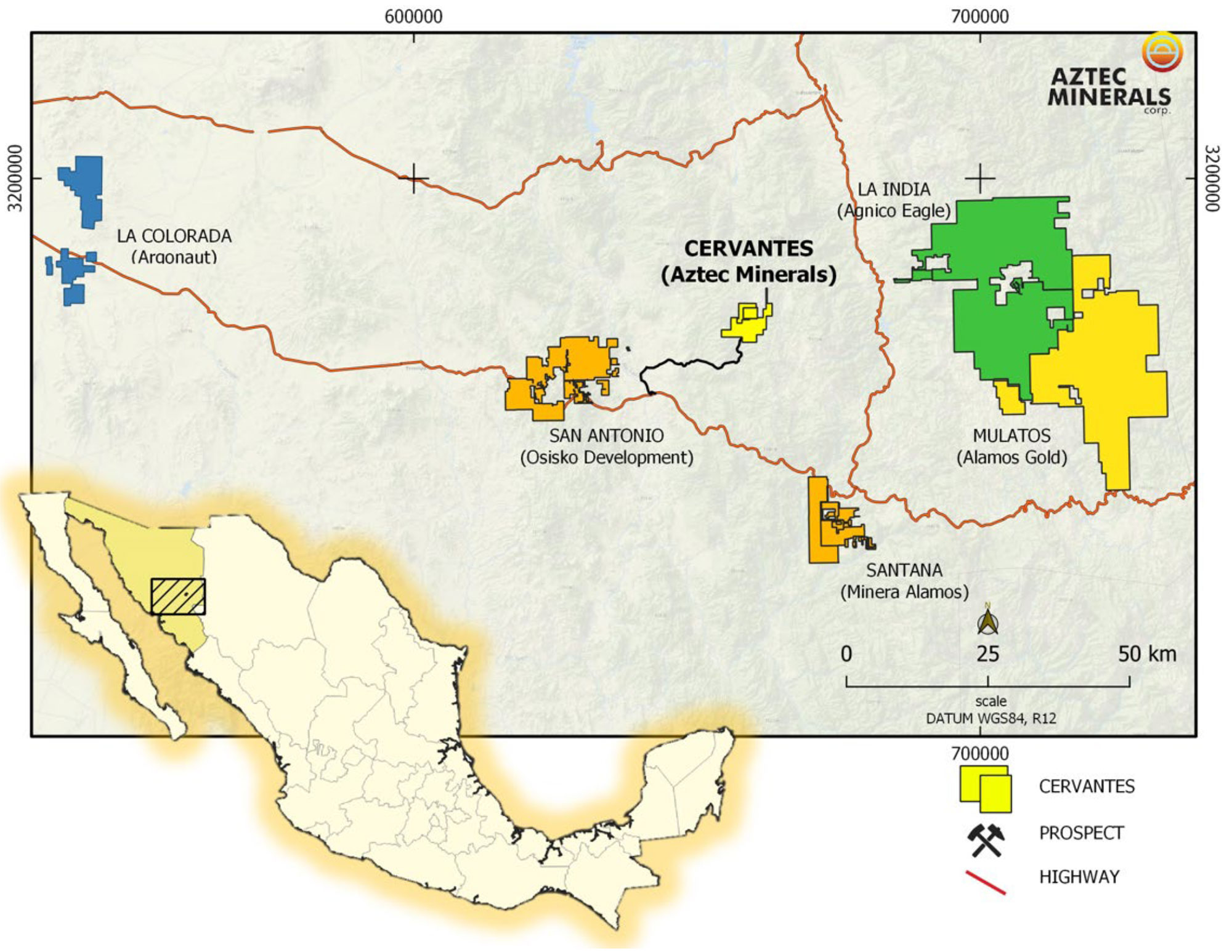

We recently sat down with CEO Simon Dyakowski to discuss the recent drill results from the Tombstone drill program and to look forward to the upcoming drill program at Cervantes. If that drill program proves to be successful, the company expects to be in a position to start running the numbers on a maiden resource estimate at Cervantes. This will be music to the ears of Alamos Gold (AGI, AGI.TO) which is one of the company’s largest shareholders. The positive drill results leading up to the summer of 2022 attracted the company as a strategic investor to Aztec’s story. Alamos Gold, who operates the Mulatos District (Alamos calls it a district rather than a mine) about fifty kilometers to the east, was the lead order in a June 2022 placement. The mid-tier producer which expects to produce180,000 ounces of gold at an AISC of less than $1000/oz this year at Mulatos, acquired 7.9 million shares of Aztec at C$0.30 per unit for a 9.9% stake in Aztec. Alamos also participated in Aztec’s February financing and currently owns 8.3 million shares and 7.9M warrants with a strike price of C$0.40. This means Alamos Gold currently owns a 8.7% stake in Aztec.

Sitting down with CEO Simon Dyakowski

Tombstone

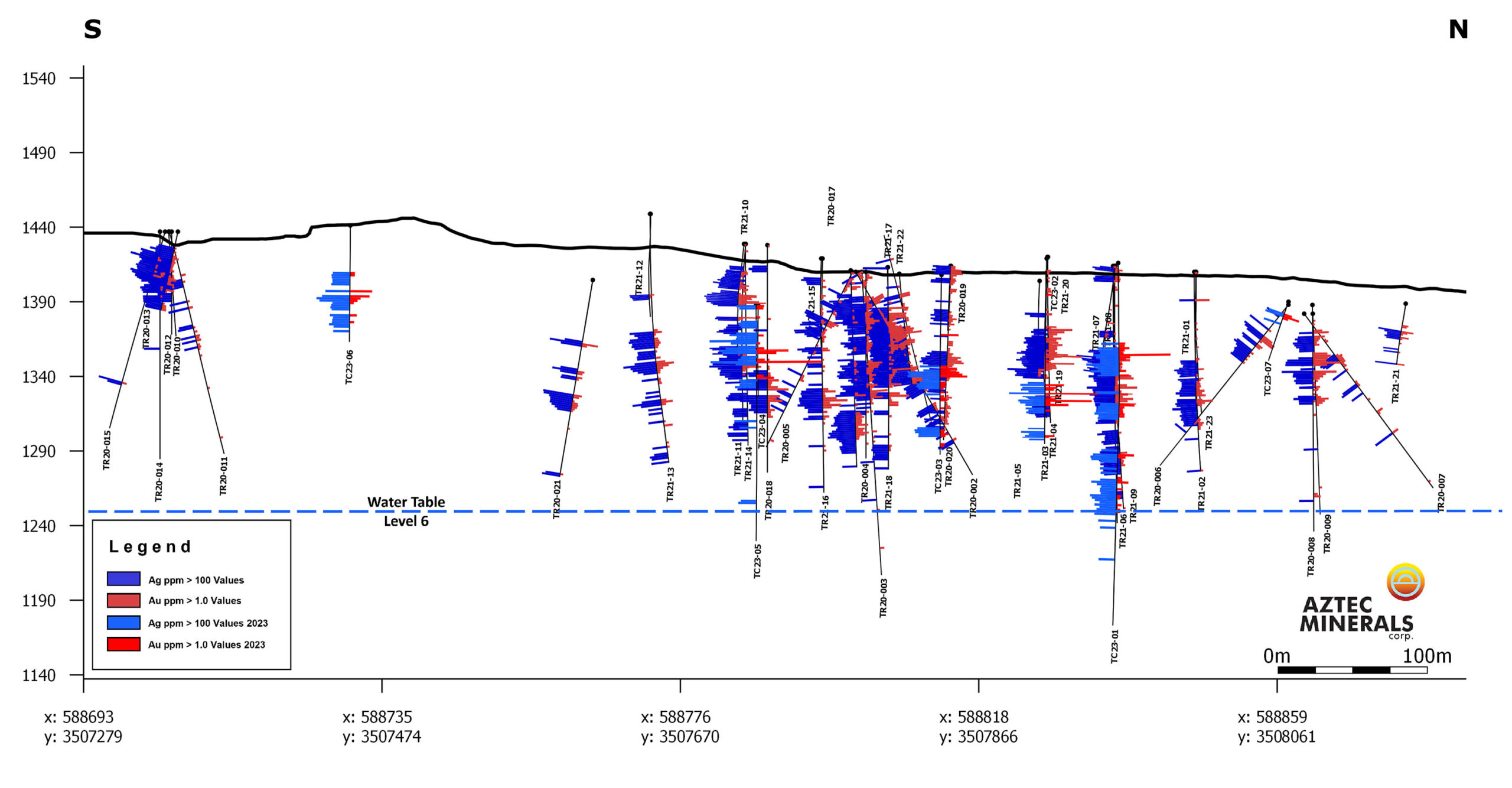

We think it’s safe to say your Tombstone drill program was a success. All assay results have been received and released now and all seven holes encountered gold and silver mineralization. Some intervals had an exceptionally high grade structure and hole 5 for instance looked pretty spectacular with 15.5 meters containing 6.45 g/t gold and 408 g/t silver. There is however quite a bit of ‘grade variation’ between holes. For readers that aren’t as tuned into the Tombstone project, could you perhaps briefly explain this?

The Tombstone Core Drill program was testing the Contention Pit Target Zone of almost 700m strike length with numerous target zones within. Various parts of the zone have significant mineralization. The variation you see in the results is because the holes were not adjacent to each other (except for 4 & 5). The mineralization is hosted in various lithological units, and as these units change, the precious metals values can vary from unit to unit.

During this year’s drill program you encountered stopes in six of the seven holes. While this was generally expected as Tombstone has a rich history of high-grade gold and silver production by the old-timers, how did this impact your drilling efforts in terms of efficiency and costs?

In fact, we encountered old mine working in all of the holes we drilled, and were able to successfully cross them in each instance – particularly hole 1 which passed through 4 separate workings. While Core Drilling through stopes is very challenging and can be costly we were able to complete several holes successfully and were able to obtain necessary information for modelling and future targeting.

To further elaborate on the challenges of drilling through the historic mine workings: the ground and drilling conditions in these holes tends to be less stable and prone to caving and can require cementing to require passing through the ground in question.

That said, now that we obtained valuable drill core information, we should be able to revert to RC drilling with casing, which will also provide for the ability to intersect multiple workings.

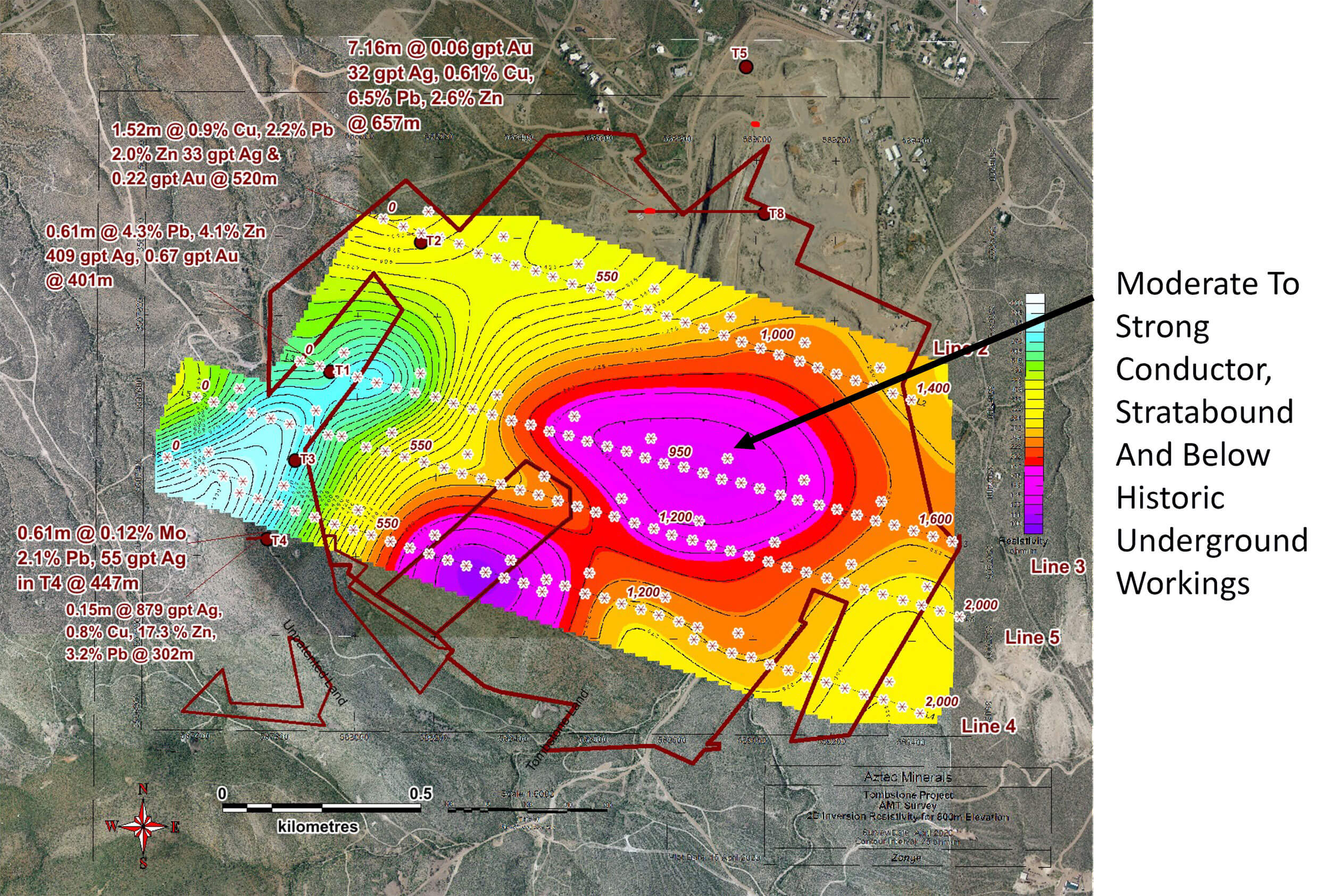

In your corporate presentation you are referring to the CRD potential at Tombstone. Could you elaborate on why you think that is a realistic theory and how you plan to follow up on that theory? Is that taking a backseat right now to favor the gold-silver structures at Tombstone at this moment?

There are numerous historic drill holes at depth that demonstrate the CRD potential; and these targets have been bolstered by Aztec’s NSAMT survey conducted in 2020 indicating at least 2 large conductive bodies at depth. We are currently finalizing our geological modelling to best target this potential and it will be incorporated into a future drill program where we will likely pre-collar deep drillholes with reverse circulation drilling before completing to target depth in the limestone horizon with core drilling.

If markets remain tough, will Tombstone move back to the backburner? Alamos Gold, your main corporate shareholder, invested in Aztec for the merits of the Cervantes project. Is it fair to assume that for further exploration activities at Tombstone, you are at the mercy of the market to raise money specifically earmarked for Tombstone exploration?

Tombstone is not moving to the backburner, but rather, taking a much needed breather to digest the drillhole data, historical information, and geophysical information obtained to-date to continue to expand both the shallow oxide zone and to test the CRD potential at depth in a future drill program. This process is expected to take 2 – 3 months and is underway currently, and is critical to having another successful drilling campaign. This is a similar approach to what we have done at Cervantes, which has been in drill preparation since late 2022 and is now in the final planning stages before our planned Q3 RC drill program. We are at the mercy of the markets to a certain extend on both projects, but we do feel that a window could be opening later this year where the equity market could begin rewarding exploration success.

Cervantes

You recently announced you received all required permits for your next drill program at Cervantes. How is the bureaucratic process these days, do you see any delays or slow turnarounds or is it pretty much ‘business as usual’?

Permitting for drilling has been business as usual. In fact, our recently permit approval was received ahead of our expected timeline.

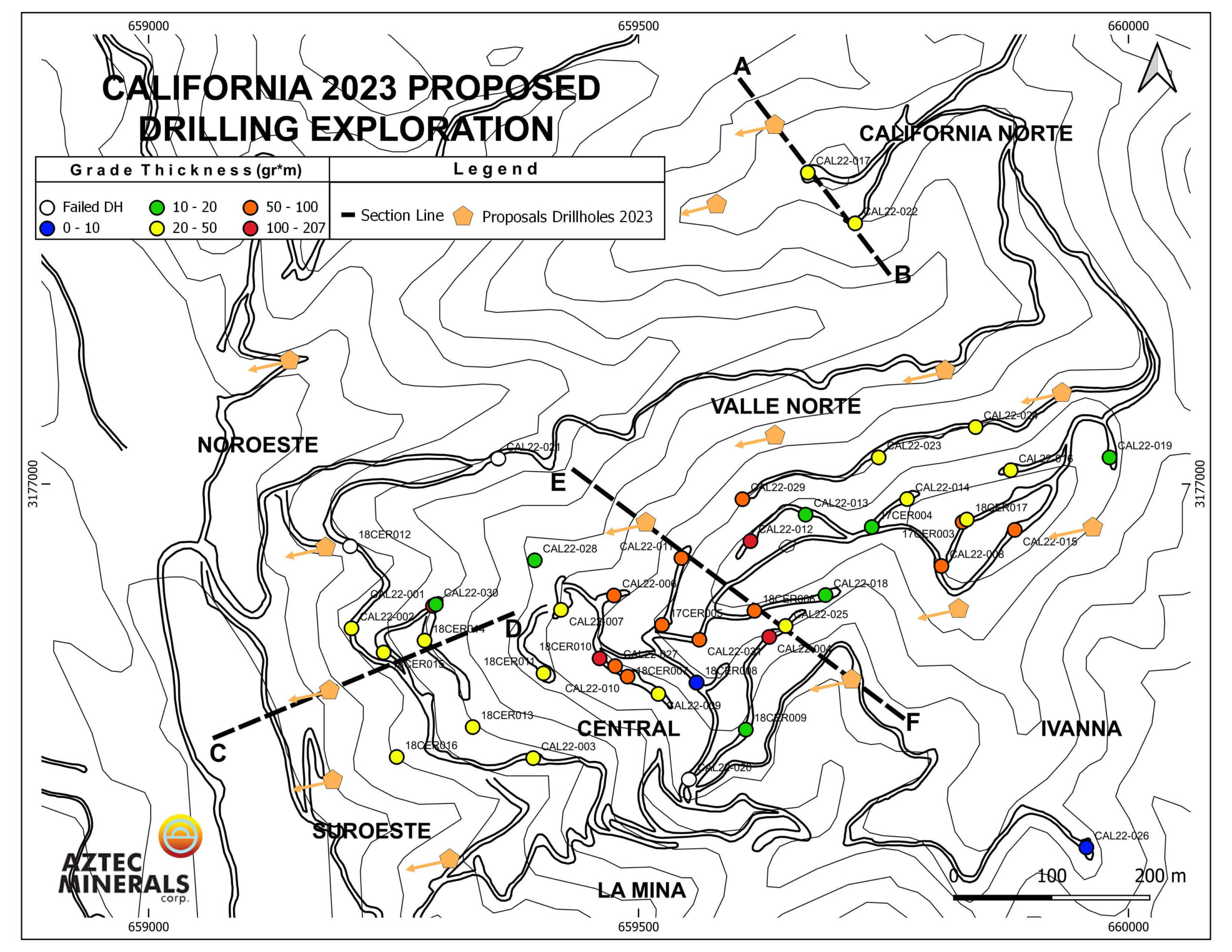

Your upcoming drill program will consist of two phases and the first phase will be following up on the results of the roadcut sampling program which you have just completed. Can you elaborate on what you did in the field and how this has helped to refine and define drill targets?

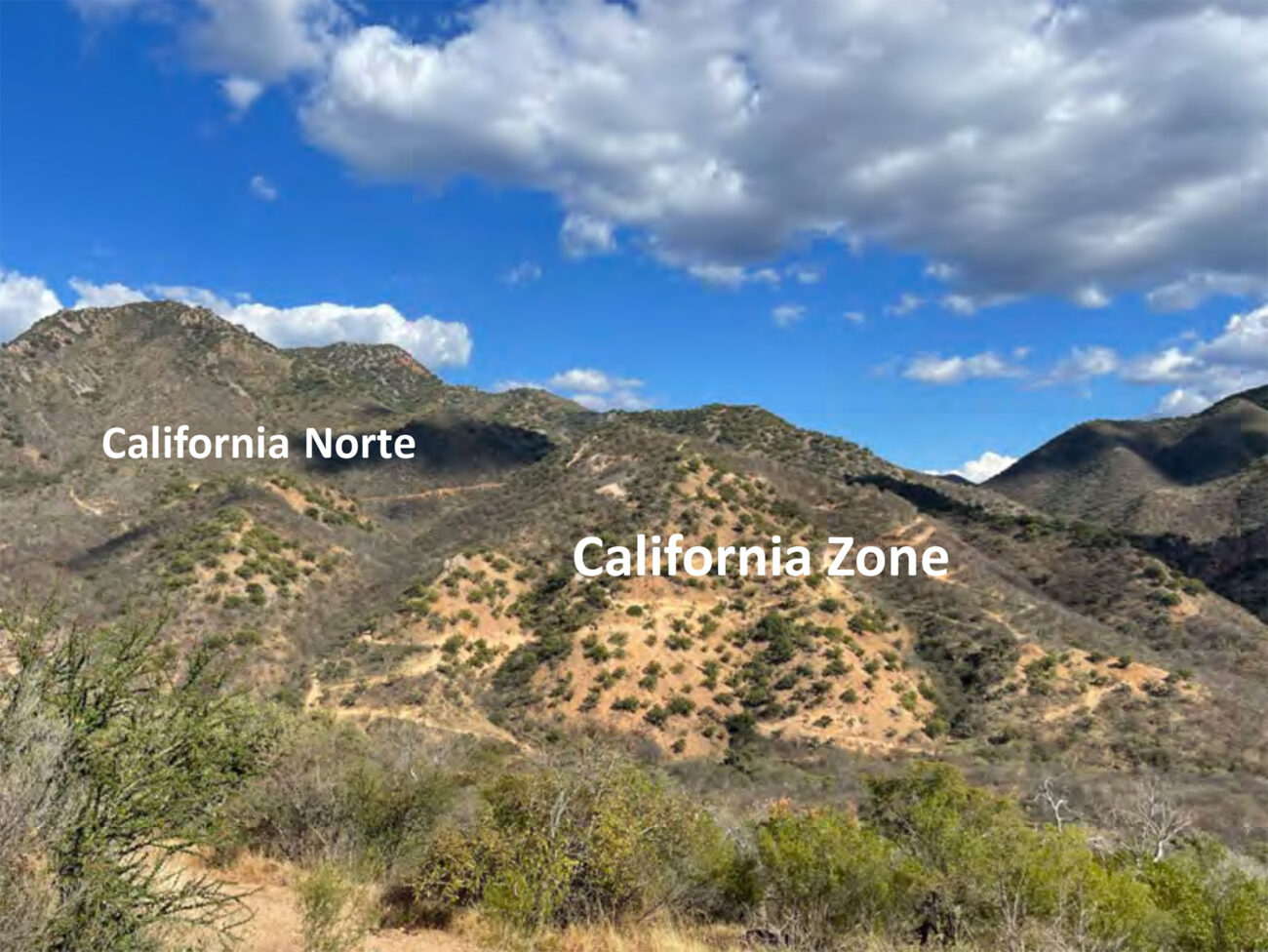

Our field campaign consisted of detailed mapping, and road cut channel sampling, which allows us to identify and then focus on the key geological aspects related to the mineralization at Cervantes. An example of this is that we now have a much better definition of the alteration zoning of the porphyry system which is crucial to exploration of new targets and well as potentially expanding the gold mineralization around the primary California zone target.

According to your press release, the first phase will consist of 2,100 meters in 14 holes (for an average depth of 150 meters per hole) and the location of the drill holes in the second phase (for a similar amount of meters and holes) will be determined based on the results of the first phase. Does this mean there will be a 6-8 week break in between both phases to ensure you have received all data from the first phase?

Correct, there will be a break over an expected several weeks between the stages of drilling to consolidate the data acquired in the first stage and to modify the second stage based upon the initial results. The time frame for this break will be determined by several factors including assay times, results, interpretation, availability of crew and equipment and funding.

What’s your anticipated drill cost per meter at Cervantes?

We have conservatively budgeted an all in our cost per metre of approximately US$240 per meter for the Cervantes drilling campaign. This includes the construction and maintenance of a remote camp site, and construction of drill access roads.

Do you reckon completing an additional 4,200 meters of drilling this year will be sufficient to reach the critical mass to start thinking about putting a resource estimate together?

Yes, we believe the additional drilling would be sufficient to consider establishing a maiden resource estimate on the initial drilling of the California zone target. It is important to note that Aztec has drilled just over 10,000 meters over the entire project on a limited number of targets ; therefore, any initial resource estimate would be limited to the shallow portions of the California zone. We consider this project still to be very early in its exploration.

Corporate

How much cash do you currently have, and how far will that get you?

As of our last published financials of March 31st we had approximately C$1.7M in working capital. Some modest additional capital will be required to conduct the planned Cervantes drilling program.

Despite releasing good assay results from the Tombstone drill program and getting ready to get back in the field at Cervantes, the market doesn’t seem to be caring at all. Do you think it will be a slow summer? And what do you think will be required for people to start caring about exploration stage companies again?

To say it has been a slower summer for junior exploration stories would be an understatement! That said, gold continues to hover just below all time highs and there is a reasonable chance that the gold price outperforms as the Fed and other central banks approach the terminus of their current rate hiking regimes. The close of Summer and a gold price breakout could bring more interest to the sector.

Conclusion

Aztec Minerals is advancing two projects at the same time. The assay results from the recent Tombstone drill program were important for Aztec to get a better understanding of the mineralization at Tombstone.

The Cervantes drill program is up next. The company plans to complete 4,200 meters of additional drilling at Cervantes in a two-phase drill program. CEO Dyakowski appears to be confident this year’s drill program should be sufficient to push the project over the critical mass hurdle and reckons it is possible to start working on a maiden resource estimate. That could be helpful for the investment community to have some sort of ‘tangible’ underpinning the share price.

Disclosure: The author has a long position in Aztec Minerals. Aztec Minerals is a sponsor of the website. Please read our disclaimer.