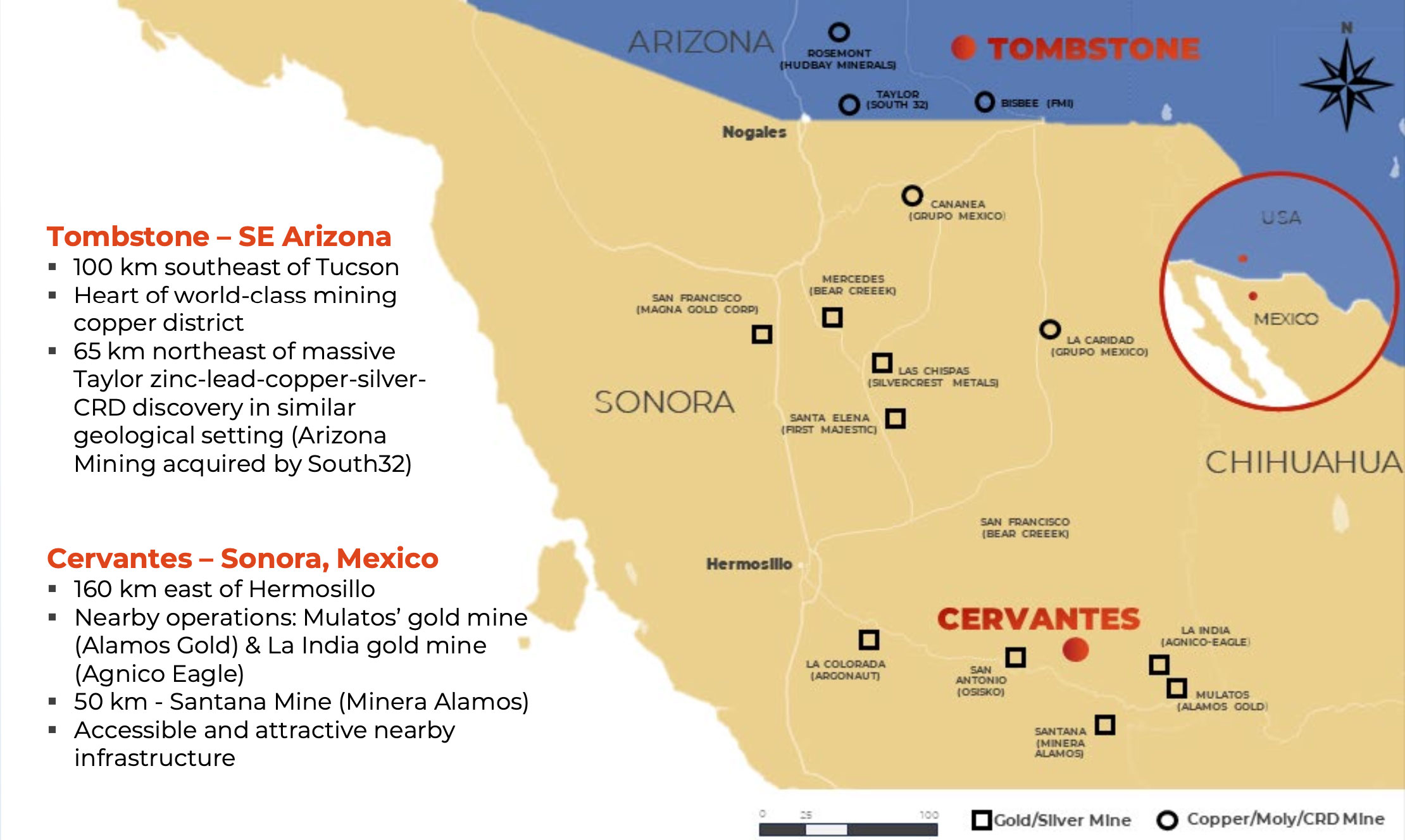

Aztec Minerals (AZT.V) has shifted gears in the past few years to thoroughly exploring its Tom tbstone gold-silver-CRD project in Arizona. While the company’s initial focus a few years ago was on the oxide-hosted Cervantes gold project in Mexico’s Sonora state, Mexico’s tougher permitting climate when it comes to open pits have resulted in the Cervantes project taking a back seat.

2024 was a busy year for the company at Tombstone and it looks like Aztec Minerals is ready to hit the ground running again. The company is currently raising C$3M in a financing priced at C$0.18 per unit, and the vast majority of the funds that will be raised will be used to advance Tombstone. This will hopefully manoeuvre the company into a position to work towards a maiden resource calculation on the Arizona-based project.

As a reminder, Aztec Minerals is a banner sponsor of this website. You can read the entire disclosure and disclaimer at the bottom of this post.

The current capital raise

Last week, the company announced its intention to raise C$3M by issuing up to 16.7M units with each unit priced at C$0.18. The units will consist of one common share and ½ warrant with each full warrant allowing the warrant holder to acquire an additional share for C$0.24 during a three year period.

The proceeds will be used to complete another drill program on the Tombstone gold-silver project in Arizona. That drill program (which will consist of approximately 5,000 meters) will be focusing on two elements.

First of all, about 70% of the drill program will be zeroing in on the Contention Pit where the company is still tracking the mineralization and where it aims to further expand the mineralized footprint. Hopefully this will result in Aztec feeling comfortable to publish a maiden resource calculation by the end of this year to underpin the value of the Tombstone project and the company as a whole.

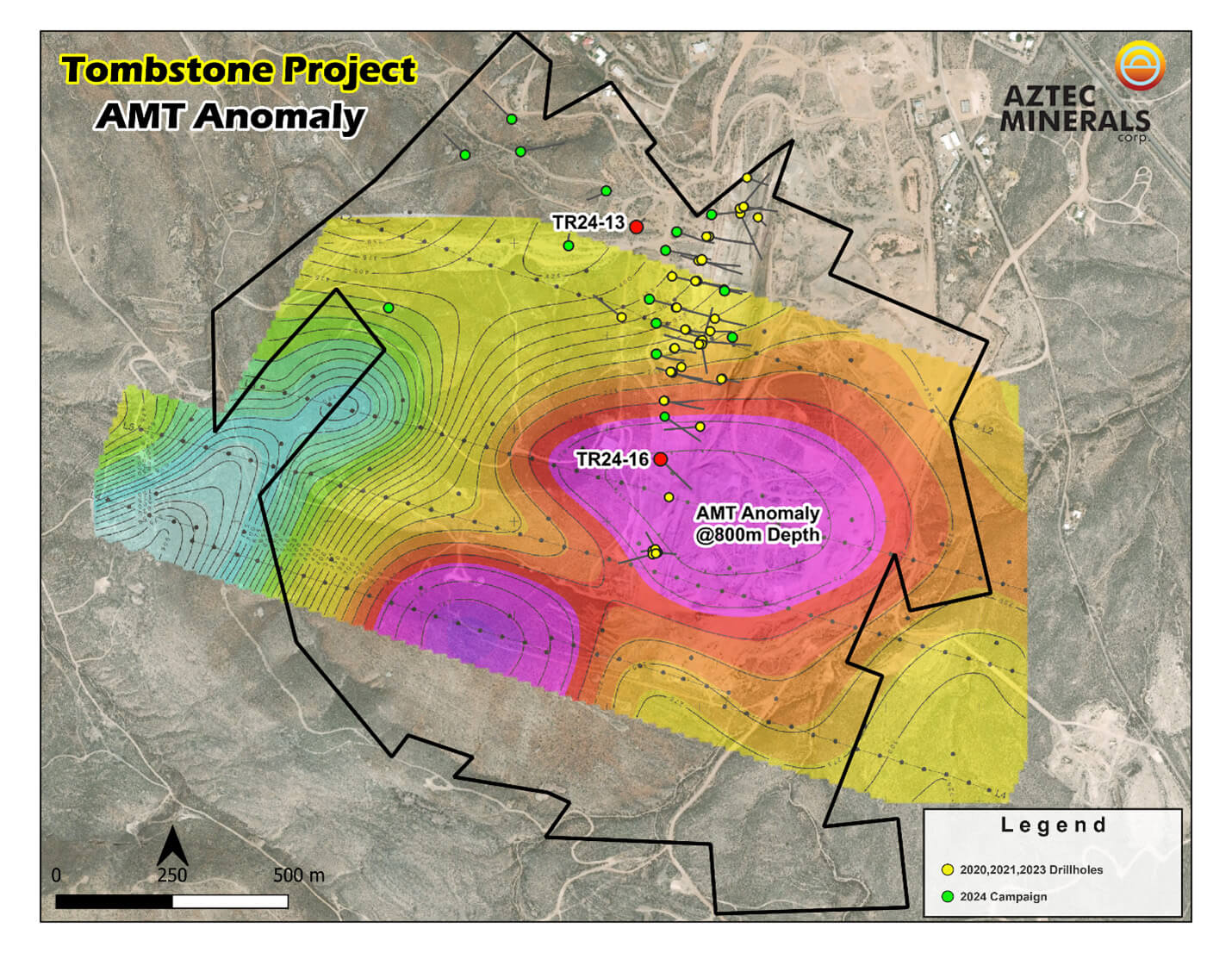

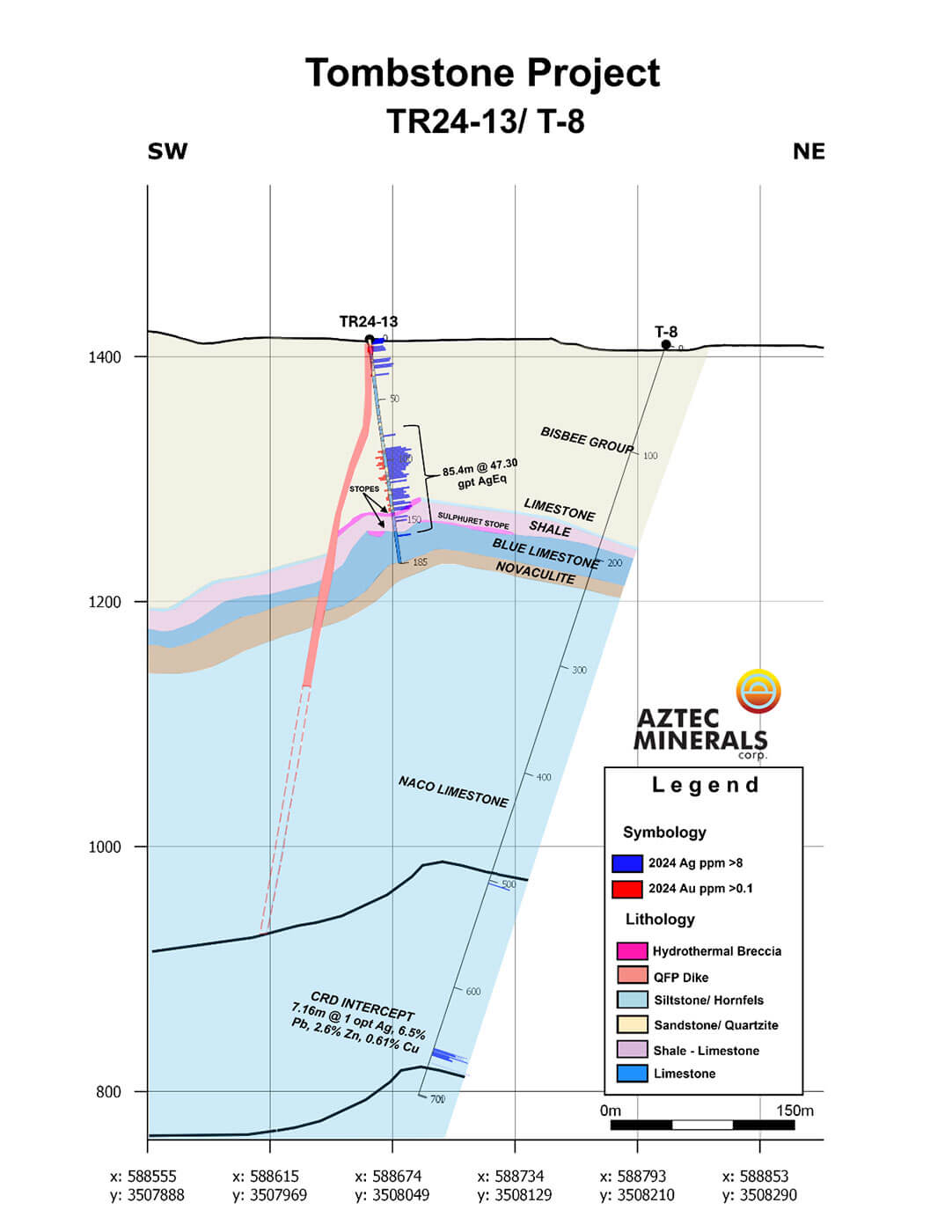

Zooming in on the CRD target

But quite a few investors are getting intrigued by the CRD prospects offered by a distinct area on the Tombstone project. Last month, the company announced that based on the recent drill results and 3D data modelling at Tombstone, the Aztec’s technical team now has an improved understanding of the potential CRD mineralization below the oxide-hosted gold-silver zone. The company has combined the data from the recent drill program and 3D modelling with the data obtained from the NSAMT geophysics program (natural-source audio-frequency magneto-telluric survey), and this resulted in pinpointing a few high priority CRD targets.

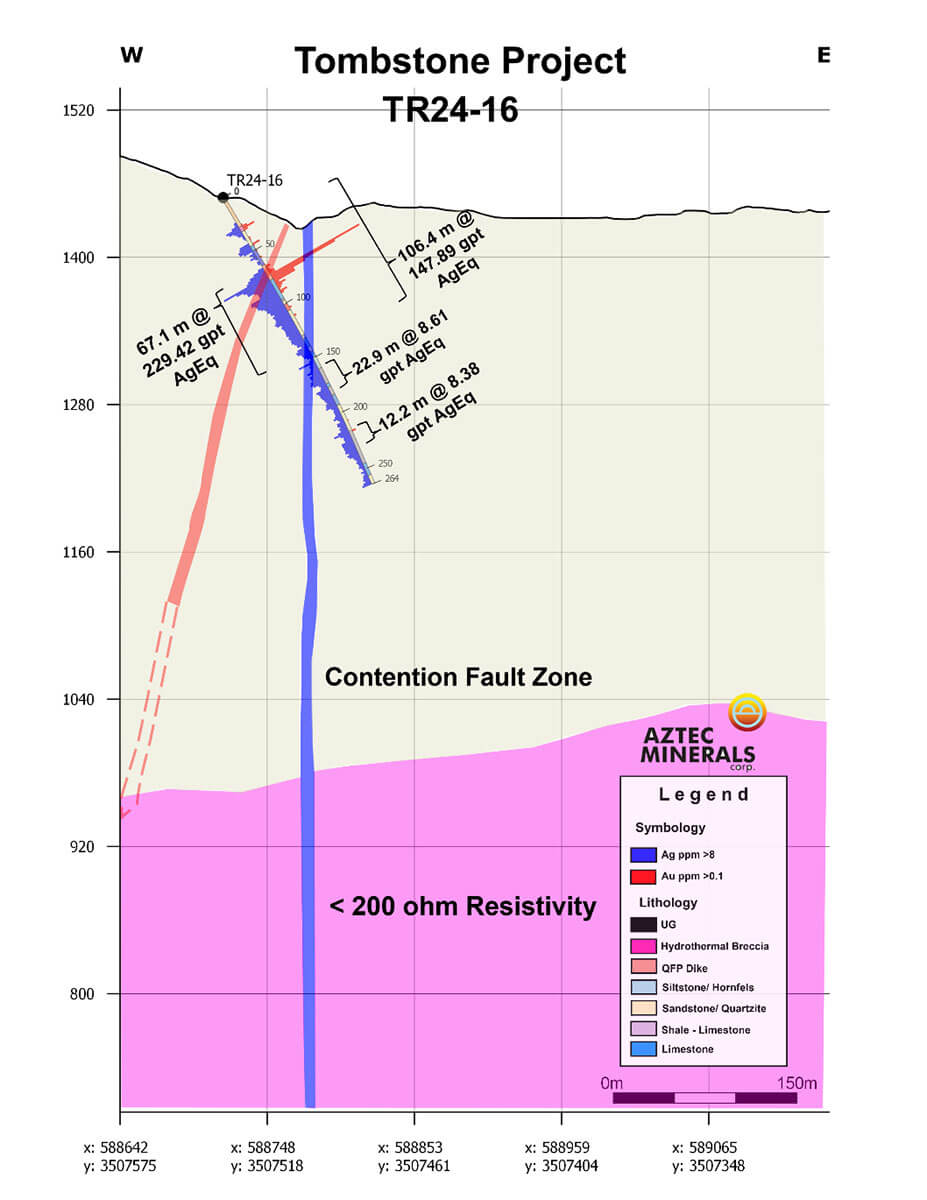

The image above clearly shows the location of hole TR24-16. That hole encountered just over 67 meters of 229 g/t silver—equivalent, and the deeper sections of this hole encountered almost 23 meters of 8.6 g/t silver-equivalent followed by 12.2 meters containing just under 8.4 g/t silver-equivalent. Those last two intervals don’t really raise any eyebrows, but as the image below shows, that hole did not intersect the low-resistivity zone.

A low-resistivity zone at that level usually indicates three possible results. Water, graphite or metal. Water would be bad (but perhaps the least likely of the three options). Graphite would be interesting but not relevant for Aztec Minerals’ attempt to locate a CRD system. What the company’s team rally is looking for is a low-resistivity zone that is caused by the metal content in that portion of the project. Whether or not any mineralization is economic, that’s up to the drill bit to figure out.

It’s our understanding Aztec Minerals will drill three holes to drill-test the high-priority CRD target. Older holes TR24-13 and TR24-16 will be drilled deeper to reach the desired depth. And Aztec plans to drill a third hole in between the two large AMT anomalies shown above.

Conclusion

As the clouds are still hanging over open pit mining in Mexico, Aztec Minerals continues to focus on its Arizona-based Tombstone gold-silver project with an additional CRD angle.

The current C$3M placement will go a long way to allow the company to get the open pit portion of Tombstone ready for a maiden resource calculation as that should underpin the company’s valuation and provide investors with something ‘tangible’.

Disclosure: The author has a long position in Aztec Minerals and will participate in the current placement. Aztec Minerals is a banner sponsor of the website. This post is for educational purposes only; be mindful investing in junior mining stocks is risky and you may lose your entire investment if things go wrong. Please read our disclaimer.