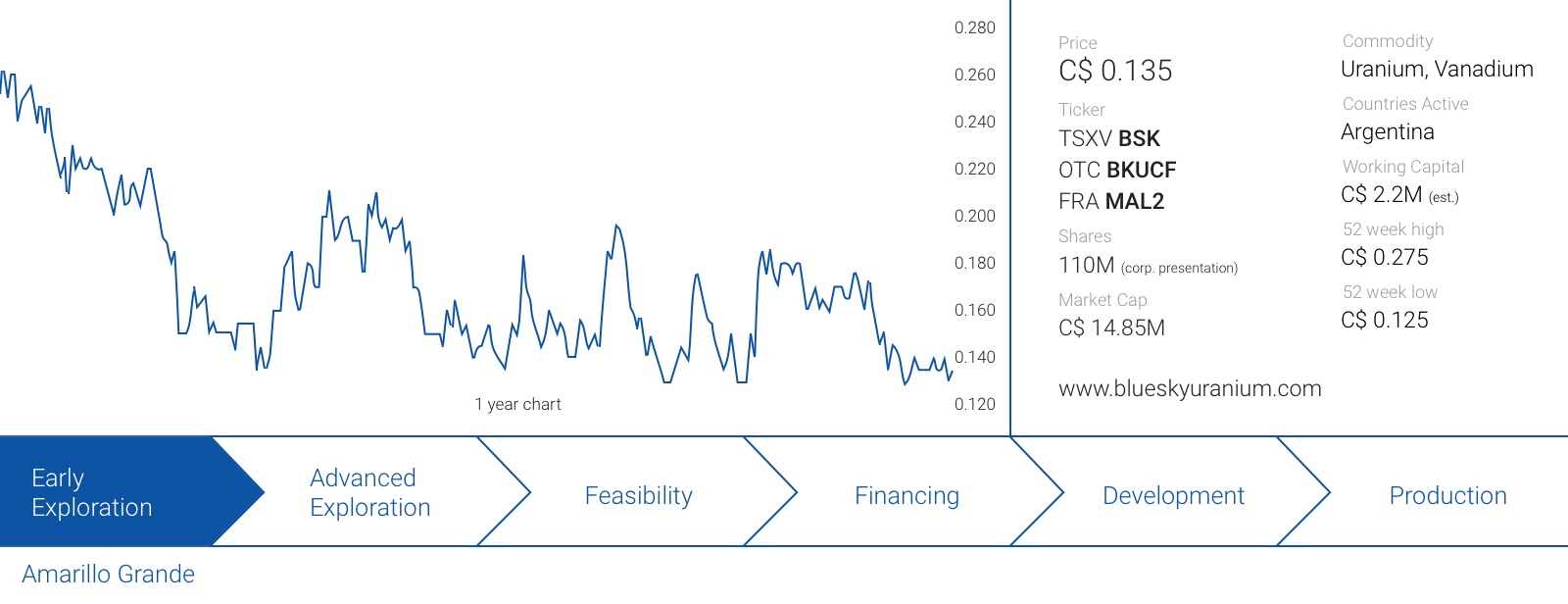

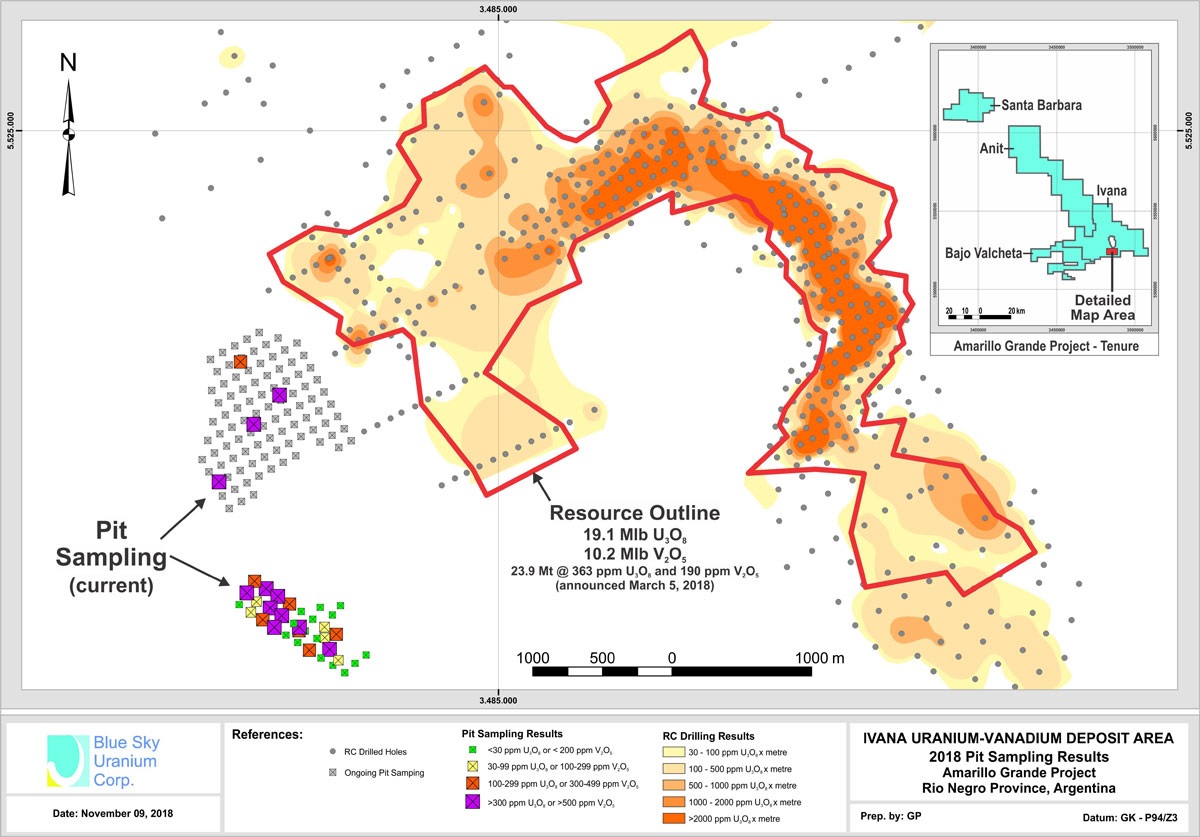

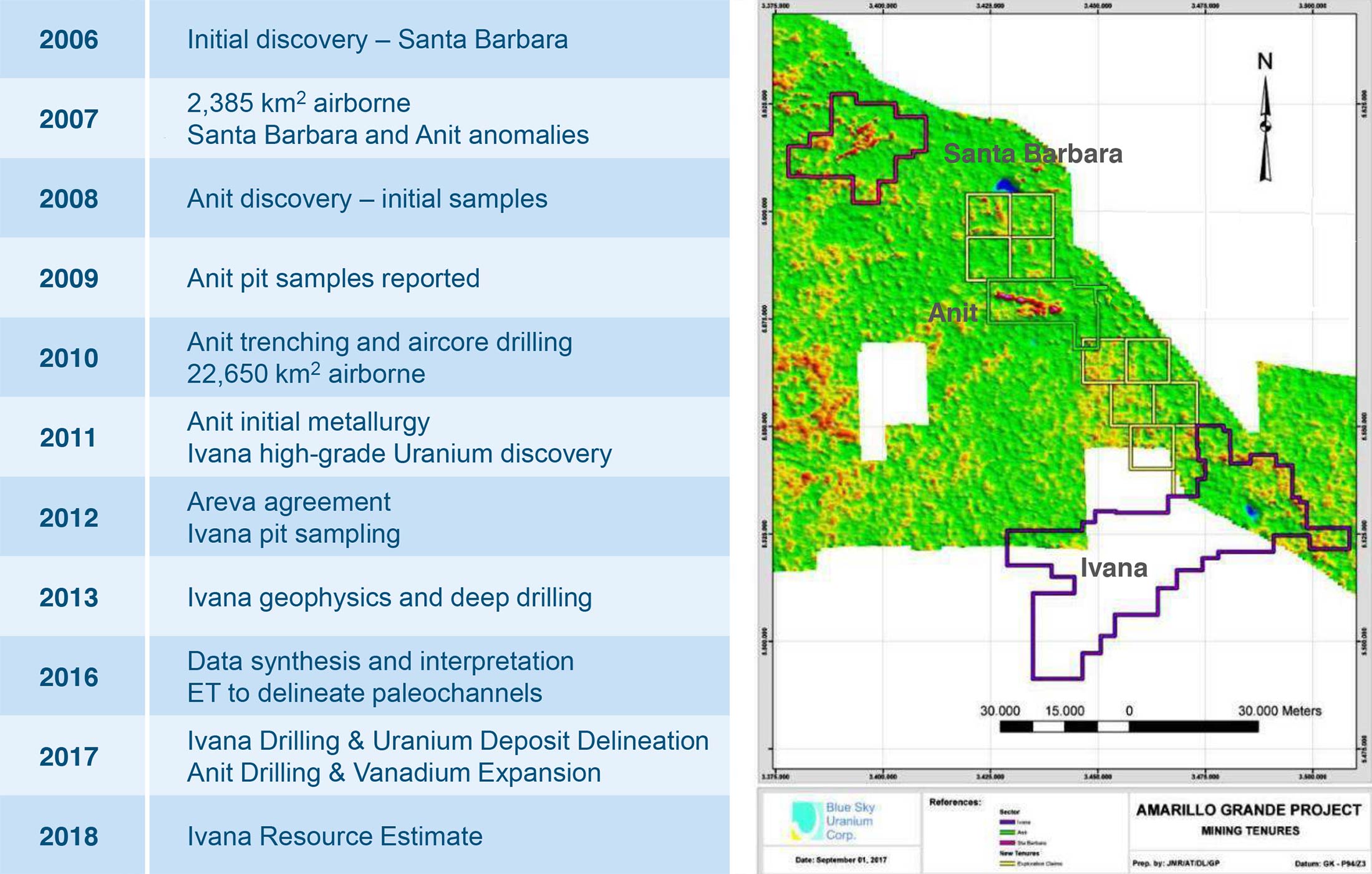

Blue Sky Uranium (BSK.V) continues to advance its Ivana uranium-vanadium project in Argentina. After publishing a maiden resource estimate last year, the company continued to drill the project to expand and upgrade the currently known resources, while it’s also working towards ticking all the boxes towards a PEA.

Blue Sky has recently published the results of a metallurgical test program that was conducted on samples taken from the Ivana project. The update contained interesting information as this was the very first time the company took a deeper dive to figure out the recovery rates of the two main elements (uranium and vanadium). The results will have an impact on the upcoming Preliminary Economic Assessment.

Explaining the metallurgical test results

As other companies have been doing some work on surficial deposits as well, Blue Sky Uranium had a pretty good idea of the required stages to process the ore. First of all, the ore (technically rock is only ore after its economic viability has been proven) was screened twice at respectively 100 micro-meter and 600 micro-meter to separate the fine particles from the different-sized coarse material.

This was an important step of the process as a simple screening procedure allows Blue Sky to immediately upgrade the average grade of the ore by removing the majority of the waste. Of course, some of the uranium and vanadium particles are lost as well, but as only 11% of the material was lost, the test was extremely successful. After all, the remaining 89% of the uranium and vanadium was retained in just 23% of the total amount of material. Perhaps to explain this better: if the head grade of a deposit is 1% uranium, and 89% gets recovered in just 23% of the original amount of rock, the new head grade of the first concentrate is 0,89% / 23% = 3,87%. This means the average grade of the rock that effectively ends up in the leaching stage (no flotation will be required) has already increased by 287%.

As such, the average grade of Blue Sky’s flotation-ready rock increased to 1757 ppm U3O8 and 1138 ppm V2O5. This is an important step as it means less rock will have to be alkaline-leached.

Blue Sky’s metallurgical consultants conducted six different tests to figure out the leaching results using different temperatures and acid consumption levels.

Of all six tests, only one stood out: using a temperature of 95 degrees and moderate levels of sodium carbonate and bicarbonate, the leaching results indicated a recovery rate of 94.5% for uranium and 60.1% for the vanadium. Note, these percentages are based on the average grade of the alkaline leachable material, so after 11% of the mineral was ‘lost’ during the screening process.

This means that 94.5% of 89% of the uranium and 60.1% of 89% of the Vanadium was recovered, resulting in an effective recovery rate of 84.1% for the uranium and 53.5% for the vanadium pentoxide (Blue Sky used an overall process recovery of 85% for uranium and 53% for vanadium, the differences are very likely explained by rounding the intermediate results).

What does this mean for the upcoming PEA?

The met work is important as it indicates A) how much of the uranium (and vanadium) will be recovered and B) by what ratio the ore will be concentrated before initiating the leaching process.

This enables us to run a very basic back of the envelope calculation to figure out the preliminary economics of the deposit.

In a first step, we can calculate the net revenue of the rock. Applying the respective net recovery rates on the uranium and vanadium results in a recoverable grade of 306 ppm U3O8 (0.675 pounds per tonne) and 102 ppm (0.225 pounds per tonne) V2O5 based on the average grade of 0.036% U3O8 and 0.019% V2O5 as defined by the current resource estimate. Using a long-term uranium price of $45/pound and a vanadium price of $15/pound for V2O5 concentrate, this would result in a recoverable value of $30 for the uranium and $3.37 for the vanadium.

We are unsure about the payability percentage for vanadium pentoxide so we will apply an 85% payability for vanadium pentoxide and 100% for uranium, resulting in a net recoverable and payable revenue of US$32.90 per tonne of rock that would be dug up from the Ivana deposit. This also means the total value of the by-product credit would be US$2.90 per tonne of rock, or approximately US$4.30 per produced pound of uranium. It won’t move the needle, but it’s a very welcome bonus!

If we would use an average mining cost of US$2.5 per tonne mined and a 1:1 ratio, it would cost approximately US$5 to dig up one tonne of mineralized rock. Looking at the PEA of the Gibellini project in Nevada, the cost per processed tonne of rock was estimated at approximately $11/t for the leaching process, but unfortunately this is based on leaching the vanadium and doesn’t take the different leach results for a uranium-vanadium deposit into consideration. Even if we would use a total processing cost of US$15/t into consideration, Blue Sky’s Ivana project should have superior margins.

After all, we need to multiply the $15 per tonne of processed ore by 23% as only 23% of the mined rock will be processed. This means the processing cost will be just US$3.5 per mined tonne of rock and the anticipated cost to mine and process the rock will be approximately US$8.5 per mined tonne of uranium-bearing rock. We still have to apply royalty expenses and G&A expenses for an operation, but even if we’d use a production cost of $12 per mined tonne of rock, the operating margin would remain very robust as we previously established a recoverable rock value of US $32.9/t while it would cost just US$12.5 to mine and process the rock.

This indicates the operating margin could be roughly US$20 per tonne of mined material, while the pure production cost per pound of uranium would be approximately $15 (calculated as US$10/t production cost after deducting the vanadium credit from the operating cost, divided by 0.675 recoverable pounds of uranium per tonne of mined material).

Of course, this isn’t exact science. We used quite a few assumptions in our calculations and the leaching cost will depend on the effective cost (and amount) of sodium carbonate and bicarbonate used in the process, while the strip ratio may end up being different from our 1:1 assumption as well. Additionally, we would like to see a confirmation of our assumed operating expenses per tonne of processed rock as well.

Drilling at Amarillo Grande, Argentina

What’s next?

These metallurgical test results will be used in the company’s upcoming Preliminary Economic Assessment which Blue Sky still expects to release later this quarter. Assuming 20 million tonnes will be included in the mine plan, we are anticipating seeing a total undiscounted pre-tax net operating cash flow of approximately US$400M based on the aforementioned uranium and vanadium prices and based on our (very preliminary!) calculations.

Perhaps this means the upcoming PEA won’t be impressive yet (after factoring in the initial capex, sustaining capex, royalties and taxes), but it will provide a sound basis and a good stepping stone to further advance the project. Keep in mind Blue Sky’s 2018 exploration program has identified more mineralized zones located outside of the current resource envelope, and we don’t anticipate these zones to be included in the upcoming PEA.

As such, the current resource estimate of almost 24 million tonnes of rock and the NPV of the first economic study will merely be a starting point for Blue Sky. An important starting point as it will allow us to extrapolate the economics from the PEA to figure out how the NPV-needle would move if an additional 5, 10, 15 million tonnes would get added to the mine plan.

Conclusion

We admit our calculations are very preliminary and should only be seen as hypothetical back of the envelope calculations, but we are fairly confident to see a production cost of US$15-18 per produced pound of uranium after deducting the V2O5 as a by-product credit revenue. This indicates the project could be very profitable, even at a lower uranium price so it will be interesting to see if Blue Sky Uranium will provide a sensitivity analysis.

Once the PEA confirms our preliminary expectations, it will be up to Blue Sky Uranium to continue to grow the deposit and the Net Present Value of the Ivana uranium project.

Disclosure: Blue Sky Uranium is a sponsor of this website, we have a long position. Please read the disclaimer