Most cobalt exploration companies listed in Canada are effectively focusing on cobalt in North America, and the past producing Cobalt Camp is one of the most sought after areas. However, some Canadian companies are also venturing elsewhere. We previously discussed M2 Cobalt (MC.V) that started a cobalt exploration program in Uganda, but there are other prolific regions as well.

Golden Peak Minerals was a dormant company before it was rebranded as BlueBird Battery Metals (BATT.V) with a specific focus on exploring for cobalt in Australia. Although there are some ASX-listed cobalt exploration companies, the area hasn’t heated up as its North American counterpart, and the valuations of exploration stage properties are still relatively low. An additional bonus is the shorter timeframe to get things permitted in Australia.

Why Cobalt?

Cobalt could be considered the secret sauce in Lithium-Ion batteries. It protects the batteries from degradation due to repeated charging/discharging cycles, and it adds energy density so that more power and charge life can be obtained inside the battery.

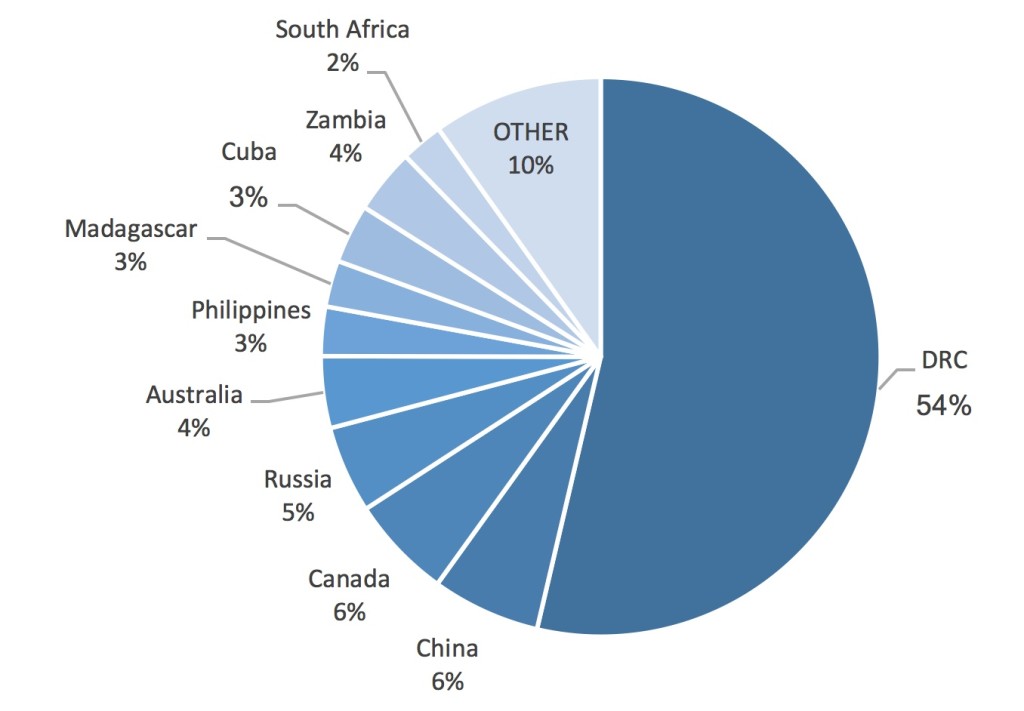

Cobalt usually is a by-product of copper and nickel mining with 98% of global supply coming from these mines. However, growing demand for cobalt from cell phones and electric vehicles has caused a dramatic price spike in the cobalt price, and a supply deficit has happened. Projecting into the next four to five years, cobalt demand is expected to dramatically increase causing the deficit to grow. BlueBird has decided to focus on cobalt for this reason.

How does Cobalt occur?

Aside from being tied up in copper and nickel minerals, cobalt occurs in a suite of minerals, called cobalt arsenides. These are minerals that contain cobalt plus arsenic plus sulphur. This is a major problem as arsenic is toxic and carcinogenic, and the deposits in Ontario and Idaho contain this nasty element. The Australian cobalt projects appear to have a more ‘benign’ form of cobalt mineralization. Additionally, one of the hot spots for cobalt exploration (and production) is the DRC, which isn’t immediately known for its reliable legal framework.

Why Australia?

Two reasons explain BlueBird’s strategy to start exploring in Australia. The first reason are the environmentally friendly cobalt deposits that occur there. Environmentally friendly, as the host rock appears to contain less arsenic and sulphur.

In Australia you can find a specific class of deposits called residual oxide deposits, where cobalt is found in a form where arsenic and other nasty elements are (completely) absent. Manganese is a key to this type of deposit as it acts as a sponge to suck up the cobalt in elemental form.

Secondly, not only is the permitting phase much faster in Australia, it overall is a great place to be working in. Looking at the 2017 report of the Fraser Institute wherein it published the results of its annual survey of mining companies, it becomes clear it’s a very desired destination.

When looking at the investment attractiveness index (which combines the mineral potential of a country/region with the existing mining policies), there are just a handful mining destinations that are better than Western Australia (83.56). In fact, WA is scoring higher than for instance Québec and Ontario, and that’s quite an important statement. New South Wales (62.31) is the other Australian province Bluebird Battery Metals is operating in, and although this province scores a bit worse, it’s still handsomely ahead of Northern Ireland (62.29), Nova Scotia, Colombia (56.10)and Burkina Faso (52.64).

Not only is Australia mining-friendly, mines can go from discovery to production in less than five years, compared to ten years or more in North America. For example, the last major Australian nickel mine had its discovery hole drilled in 2012, and was in production during 2016. We’re talking about the Nova Bollinger deposit discovered by Sirius Resources and recently acquired and developed by Australia-based Independence Group (IGO.AX).

BlueBird expects the EV disruption to occur in the next five years so the ability to deliver cobalt in this time frame makes Australia attractive to the company, especially when taking the time value of money into account. Cash flow in five years’ time is more than twice as valuable compared to cash flow ten years from now due to the applicable discount rates.

The acquisitions in Western Australia: Canegrass and Ashburton

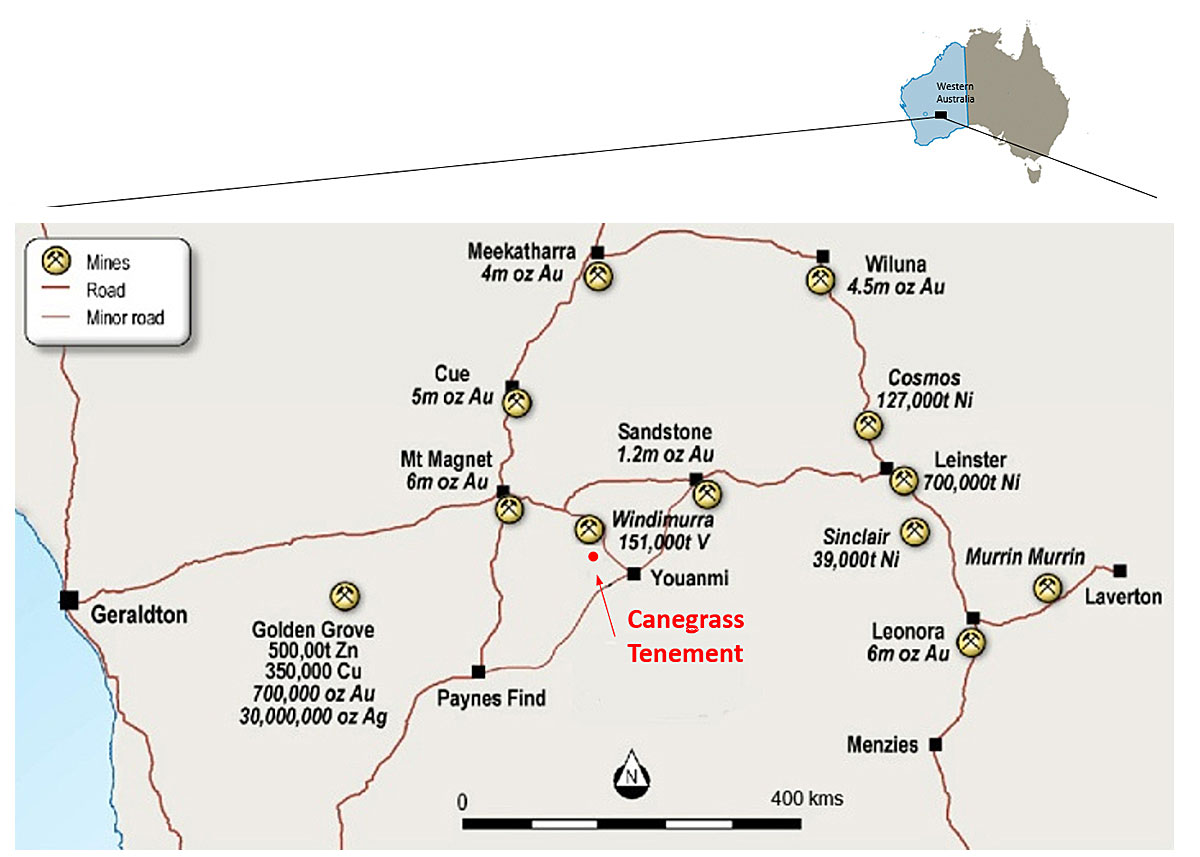

Bluebird Battery Metals really kicked off its exploration strategy and focus on Australia when it announced the option to acquire full ownership of the Canegrass project. Canegrass is located in Western Australia’s Mt. Magnet region and was the subject of (small) exploration campaigns by the previous owners.

In a five-year period between 2010 and 2015, the project was subject to the standard array of early stage exploration methods, and after completing a sampling and mapping program in 2010-2012 and an aerial VTEM survey in 2013, the logical next step was to further define drill targets by completing a ground Electro-Magnetic and normal magnetic surveys over some of the ‘hot spots’ from the VTEM survey.

Once the previous owner reduced the amount of drill targets, two of the 14 targets were effectively drill-tested with 2 holes (diamond) on one target and 7 holes (6 diamond, 1 RC hole) on the second target. Nine of the ten holes have intersected anomalous cobalt, copper and nickel mineralization. A good start, as the smoke indicates there might something to be found there, but let’s be clear about the status of Canegrass: it’s an early stage project.

That’s also why the acquisition terms were so favorable. Bluebird is paying just C$25,000 in cash (and issued 3 million shares), and will issue an additional 1.875M shares on the 1st anniversary and 2nd anniversary of the deal. So the cash component is very small and whilst some could complain about the ‘dilution’, the 6.75M shares had a value of less than C$1.35M based on the share price of Bluebird Battery Metals when it was still called Golden Peak Minerals, trading at just C$0.20 per share.

A few months later, in June, Bluebird added another property to its WA portfolio as it entered into a LOI to acquire the Ashburton Cobalt project. The Ashburton project is located in the so-called Edmund Basin in Western Australia, and although we won’t go too deep into the geological characteristics (there’s a tonne of information on Bluebird’s website for people that would like to get additional technical information), the main reason why Bluebird Battery Metals decided to pick up this property is its location on the Talga Fault Zone, a Northwest-Southeast trending fault, forming a ‘suture’ between the Ashburton and Gascoyne complexes. All this might not mean much to non-geologists, but it could indicate the existing manganese zones on the properties might host more cobalt than what has currently been encountered.

And that’s an intriguing setting. Exactly because the cobalt and manganese mineralization are being encountered in the same zones, the metallurgy to recover the cobalt from the manganese mineralization might be relatively straight forward. But of course, this is still just a theory, as Bluebird still has to figure out the extent and average grade of the mineralization.

Rock chip samples that were taken as part of an earlier exploration program did detect anomalous values of cobalt (and some decent-grade samples returned up to 0.31% Cobalt), but the proof will be in the pudding. Additionally, we would be really interested in finding out whether or not the manganese could be recovered and upgraded to some sort of ‘saleable’ concentrate. If that would indeed be possible, Bluebird could be in a position to generate a decent additional revenue from selling the manganese ore as a by-product.

Bluebird Battery Metals can acquire 100% of Ashburton by paying C$25,000 in cash (completed) and issuing C$1.5M worth of stock. Again in order to minimize dilution, the acquisition is staged over two years and issued in dollars’ value of stock. If BlueBird can execute its plan, the number of shares, similar to their second acquisition Sandy Point in New South Wales (discussed next) will be relatively minimal in year 2.

Opening up New South Wales for exploration: The Sandy Point cobalt project

Bluebird Battery Metals isn’t just focusing on Western Australia as it also acquired the Sandy Point cobalt project in New South Wales. Although the Canegrass project looks pretty interesting, we feel like the Sandy Point project might be easier for BATT to prove up the value of the property.

The project is located in the Bungonia Battery Metal Cobalt District in NSW, and truth be told, we had never heard about this district before. But according to Bluebird, ‘real estate’ in the district appears to be heating up as the region seems to be quite prolific for cobalt mineralization.

The project comes with a database of sampling results, and the previous owner discovered samples with high-grade assay results like 1.75% cobalt, 0.88% cobalt and 0.77% cobalt. Using a 0.10% Co cutoff grade, 38 samples were used to determine an average grade of 0.35% cobalt. After removing the four quoted high-grade samples from the equation, the average grade of the 34 remaining samples (meeting the cutoff grade of 0.10%) is approximately 0.27%.

These grades are very enticing when one considers the mineralization is at surface and cobalt is worth over $35 per pound. So 0.35% is about 7 pounds of cobalt or about $245 per tonne, which are definitely good values for an open pit project.

Bluebird’s acquisition of the Sandy Point project includes full control over a land package with a total surface area of in excess of 200 square kilometers.

The surface cobalt grades occur in two ‘arcs’ separated by a buried area roughly circular in shape and 36 square kilometers in size. This buried area has no outcrop and is covered by a thin layer of younger rocks. The area has never been drilled, so this will be one of the first (and most exciting) zones Bluebird would like to take a peek under the hood.

And there’s some evidence to back these claims up: the region was actually known for its cobalt production in the late 1800’s, and cobalt continued to be recovered well into the 1900’s when old-school miners were basically ‘scraping off’ the sandstone hills to recover the cobalt. So yes, there have been some historic mining activities here which might give Bluebird a good idea of where they should start looking, but don’t forget this also is an early stage exploration project.

What makes the Sandy Point project even more appealing though is that it’s located right in the middle of a ‘mining hot spot’. We previously discussed the company’s claims about the Bungonia district being an up-and-coming battery metals region, the district is probably more known for its Woodlawn-related mining projects.

As you can see in the next image, the previous operator of the Sandy Point project has defined an ‘area of interest’ measuring 6 by 6 kilometers that needs to be followed up on.

Bluebird’s Sandy Point project appears to be in the right prospective area, as the neighboring license is owned by Cazaly Resources, which encountered rock chips with a similar high grade. But what’s even more interesting (and important) is that the rock from the Cazaly tenements has been subject to metallurgical test work. Sure, that’s based on very preliminary data and there’s no guarantee the flow sheet will also be valid for Bluebird’s land package, but with recoveries of 83.2% cobalt, 79.5% copper and 85.9% nickel, you are getting a pretty good idea why these manganese-hosted base metal zones appear to be easier to process.

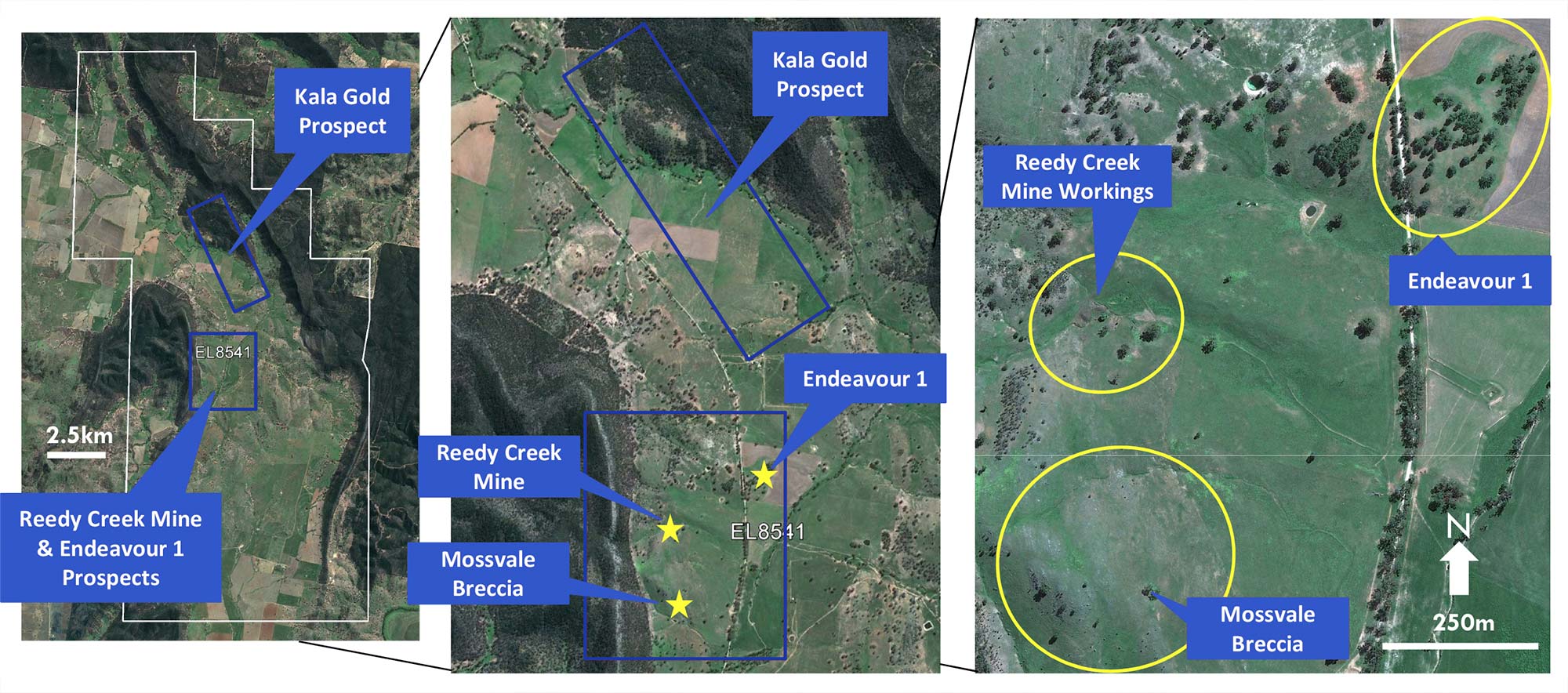

The Sandy Point acquisition also includes the purchase of the Greendale and Reedy Creek Polymetallic projects. Reedy Creek is located towards the northwest of Sandy Point, and is the target of a Copper-Zinc-Lead-Gold-Silver exploration program. There has been some historic drilling with 9.5 meters containing 1.45% copper, which is a high grade interval within a longer interval of almost 34 meters containing 0.83% copper, and almost 0.5% ZnPb. A second hole returned just over 28 meters containing 0.36% copper and 0.20% PbZn and although this doesn’t appear to be economic, our conclusion is the same as at Canegrass and Sandy Point: there’s a lot of smoke here, and now it’s up to Bluebird to figure out where the fire is.

Despite the decision to drill four holes at Reedy Creek, the previous owners should have conducted a large systematic exploration program on the tenements, as there appear to be several skarn zones (polymetallic sulphide zones) that are ‘covered’ by gold-bearing epithermal quartz veins. It’s a really interesting setting, and we would expect Bluebird Battery Metals to first conduct a district-wide exploration program to really figure out what they are dealing with before spending money on a drill campaign. The Greendale and Reedy Creek also offer spin-out opportunity to a potential NewCo focused on base metals in Australia. Bluebird’s management is still reviewing the opportunity and next steps.

Despite the intriguing features of the projects, Bluebird Battery appears to have struck a good deal with the sellers. The 100% ownership will be obtained by paying C$245,000 in cash (over a two-year period) as well as issuing C$1.175M worth of Bluebird stock. On top of that, the sellers will retain a 1% Net Smelter Royalty, of which 0.5% could be repurchased for a C$350,000 cash fee. Similar to the Ashburton deal, the shares will be issued based on dollar value of stock, and looks to minimize dilution as they push forward.

Share structure, cash and management

Currently BlueBird has about 40 million shares outstanding, and with about 2 million warrants (@$0.20) expiring in September, and the dilution attributable to the Sandy Point and Ashburton acquisitions Year 1 stock issuances, would have about 45 million out to start the fall. This is without no further acquisitions. Management has hinted it continues to review other accretive acquisitions.

Management is also currently reviewing other board and management candidates to add this fall.

Peter Ball – CEO & Chairman

Mining professional with 25 years of experience in mining engineering, corporate finance, business development and marketing. Mr. Ball is currently VP Operations of Bonterra Resources, and most recently President & CEO of Redstar Gold Corp. Mr. Ball has held various management and senior executive roles for numerous companies including Hudson Bay Mining & Smelting, Echo Bay Mines Ltd., Eldorado Gold Corp., Adriana Resources Inc., Argentex Mining Corp., Century Mining Corp., and Columbus Gold Corp. He currently serves as a Director for several publicly listed companies and is a graduate of the Haileybury School of Mines and Georgian Business College.

Alfred Stewart – President & director

Career spanning over 40 years in the resource and investment industries. Mr. Stewart’s career included time spent as a geologist, stock exchange regulator, investment banker, analyst and investment advisor. Mr. Stewart has worked for such firms as Bank of Montreal, Esso Minerals, Erickson Gold Mining, Canaccord Capital, Haywood Securities, Golden Capital, and Raymond James. Alf has been involved in financing mining companies for over two decades, including discoveries in the base and precious metals sectors.

Terry Topping – Director

Mr. Topping, currently Executive Chairman of Kairos Minerals Ltd. (ASX: KAI), has more than 25 years of experience in mineral exploration and development worldwide and has played a key role in the incubation, listing and development of numerous ASX-listed resource companies over the past two decades. Mr. Topping brings a broad contact network throughout the global resource sector as well as extensive capital markets experience, where he has been involved in numerous IPOs, corporate transactions, capital raisings and project acquisitions and divestments. Mr. Topping is also Non-Executive Director of Orinoco Gold Ltd (ASX: OGX), and recently listed copper-cobalt explorer Accelerate Resources Ltd (ASX: AX8).

Wes Hanson – Director

Mining Professional with over 35 years of extensive mining and geological experience to the Company. Previously VP Technical Services for Kinross Gold and VP Mine Development for Western Goldfields, Mr. Hanson is a graduate of Mount Allison University (B.Sc. Geology – 1982). Mr. Hanson was the President and CEO of Noront Resources Ltd. from 2009 through 2013, Mr. Hanson has served as a director of Cobrizza Metals and St. Eugene Mining and is currently the Chief Operating Officer with Unigold Inc.

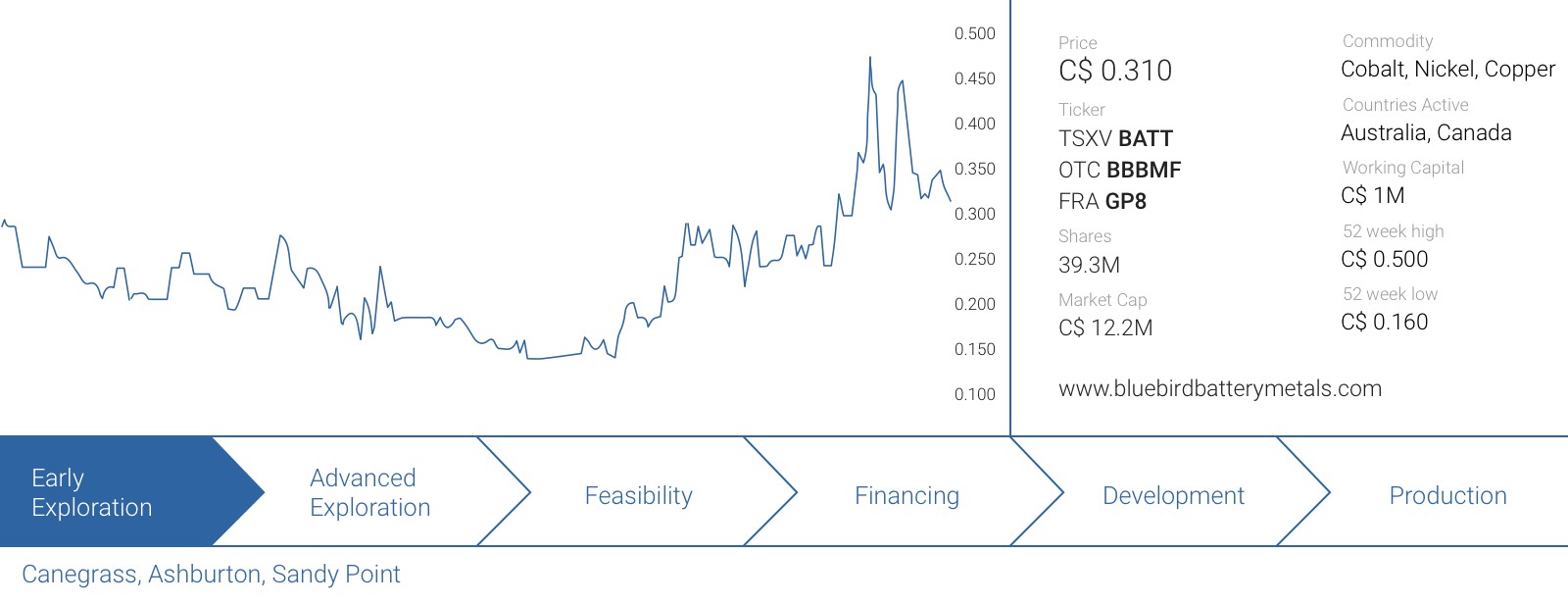

Explaining the recent share price weakness

Bluebird Battery Metals had some very strong trading days in May and June as the market started to catch up on the company’s plans and its focus on Australia. However, the share price lost quite a bit of momentum in the past few weeks and is currently trading at just C$0.31, as the market seems to be anticipating the end of the lock-up period of the private placement which was completed in February.

In February, Bluebird raised C$1.7M in a financing priced at C$0.12 per unit, with each unit consisting of one common share and one warrant priced at C$0.15 valid for two years. As the share price is currently trading 150% higher than the financing level, it’s realistic to assume a substantial part of the paper could continue to hit the market in the next few days and weeks. We aren’t too worried about the situation as A) the company has made a lot of progress since the placement closed, which should increase the confidence level of its shareholders and B) there were some bidders with big blocks on the bid-side, waiting to be filled.

The volatility will definitely be higher in the next few days and weeks, so there could be an excellent opportunity to take a speculative position in Bluebird Battery Metals. After all, at the current share price, the company’s market capitalization is just C$12.2M, which isn’t too expensive, even considering the relatively early stage its projects are in.

Conclusion

Although the company also owns the right to earn an 80% stake in a Yukon-based cobalt property, it’s pretty clear Bluebird Battery Metals will be focusing on its Australian exploration properties. It doesn’t happen very often to see Canadian companies venturing in Australia (with Novo Resources, Pacton Gold and Vendetta Mining as the best known examples), but Bluebird’s strategy is to pick up exploration properties at a lower cost than what it would have to pay for Canadian properties. We discussed the (preliminary) plans with the company, and reading between the lines of the conversation, we have the impression Bluebird will add more Australian properties to its exploration portfolio.

The current cash position is just C$1M, so Bluebird will have to raise some cash in order to conduct some meaningful exploration programs. We don’t think the company plans to raise the cash anytime soon, as we would expect Bluebird to wait for the wave of selling the 12 cent paper to be over.

Disclosure: BlueBird Battery Metals will become a sponsor of this website. We have a long position. Please read the disclaimer