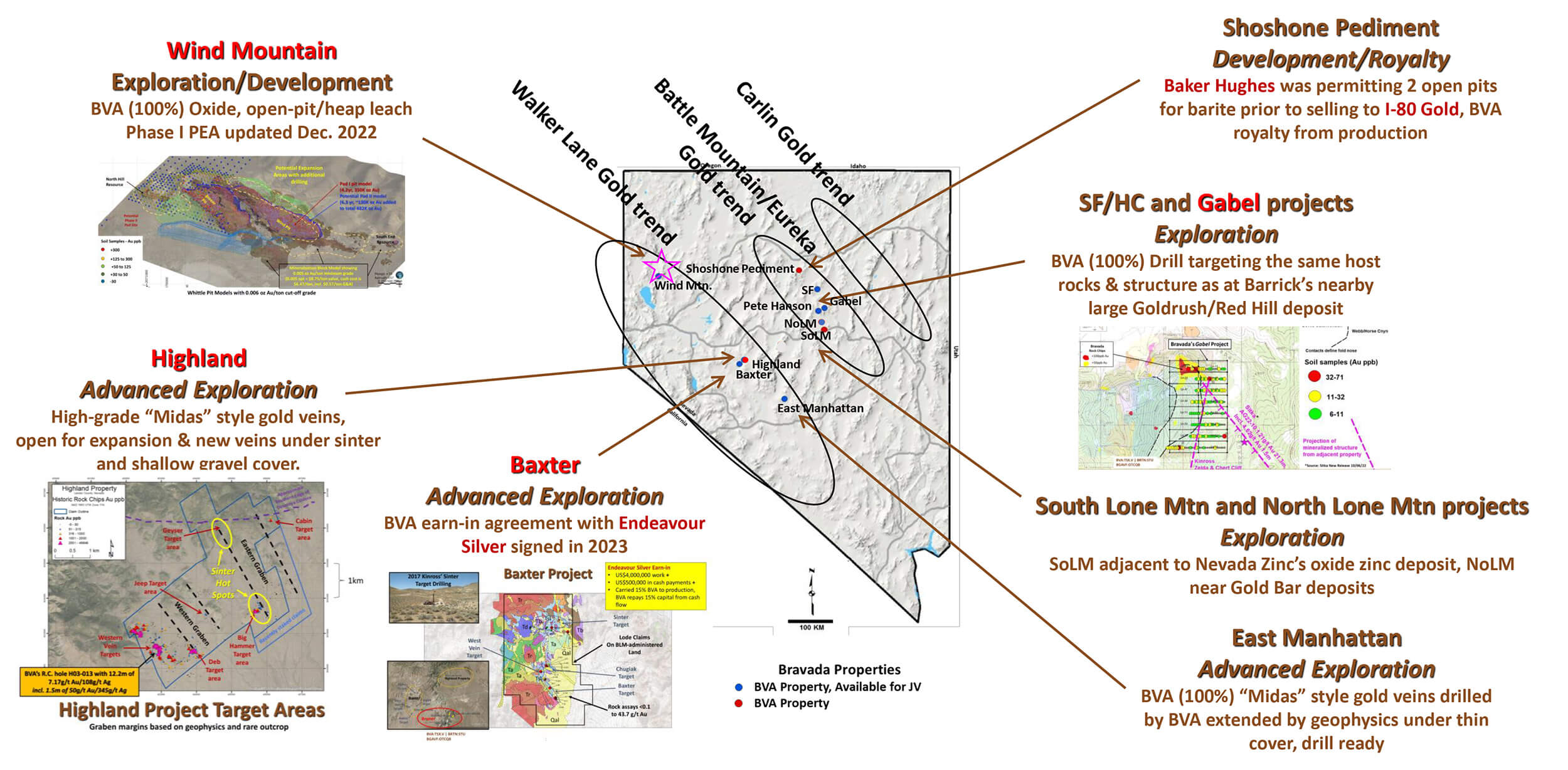

The high gold price is very forgiving and projects that weren’t (very) viable or attractive at $1500 or $1750 gold may find renewed interest. Bravada Gold’s (BVA.V) flagship Wind Mountain project remained dormant for about two years as the 2022 PEA was a little bit uninspiring and there was no investor appetite to fund the advancement of the project.

In those past 2.5 years since the Preliminary Economic Assessment was published, a lot has changed. Not in the least the gold price, which is now almost double the price that was used in the base case scenario of the PEA. Needless to say this rekindled interest in the project and Bravada Gold was able to raise just over C$1M on the back of the Wind Mountain project and about 2/3rd of the amount raised will effectively be spent on moving the gold project into the pre-feasibility stage.

We caught up with president Joe Kizis to get additional color on Bravada’s plans for Wind Mountain and how the project could be improved beyond just slapping a higher gold price on the mine plan. But first, let’s revisit the numbers from the 2022 Wind Mountain PEA.

Pulling up the 2022 PEA results

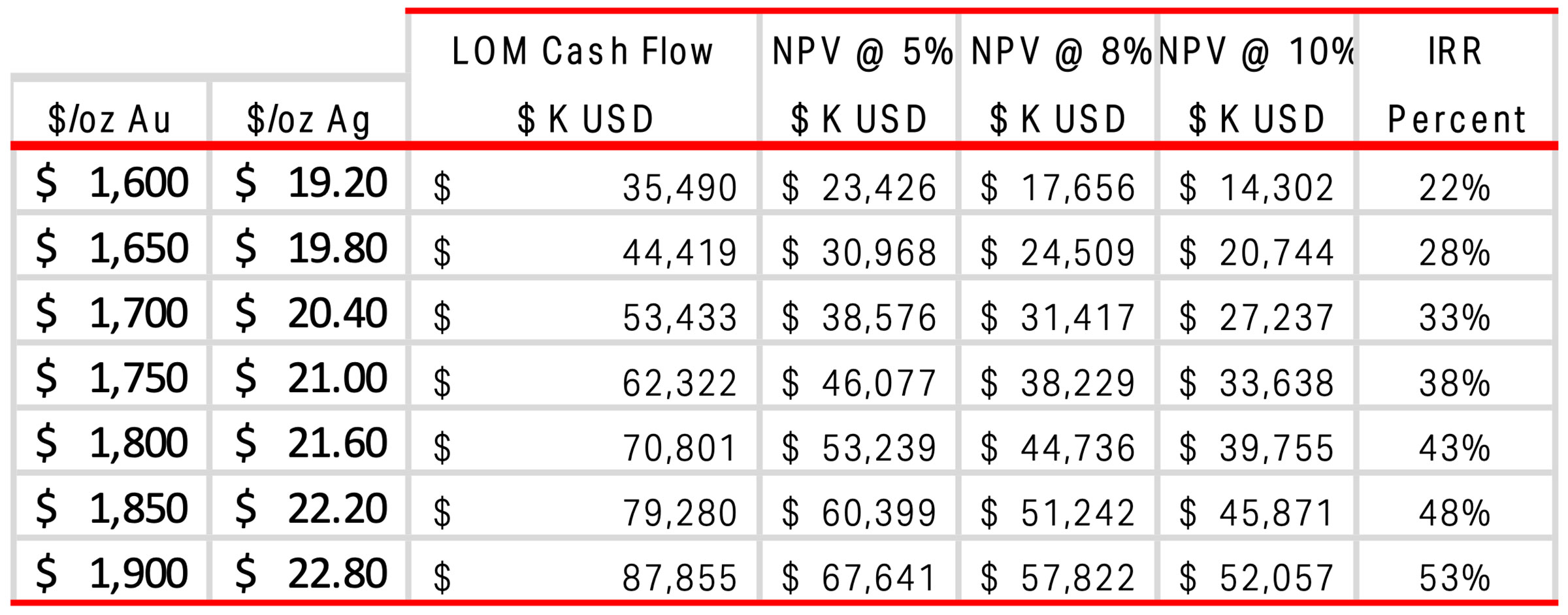

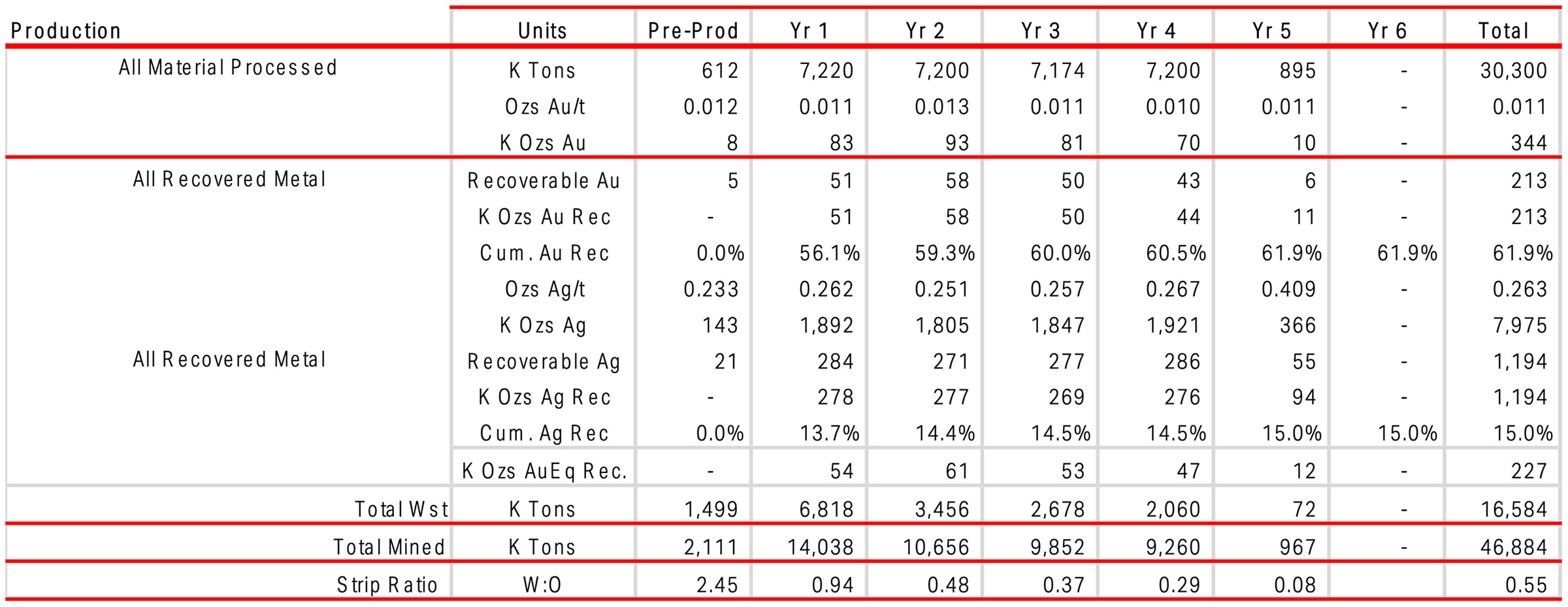

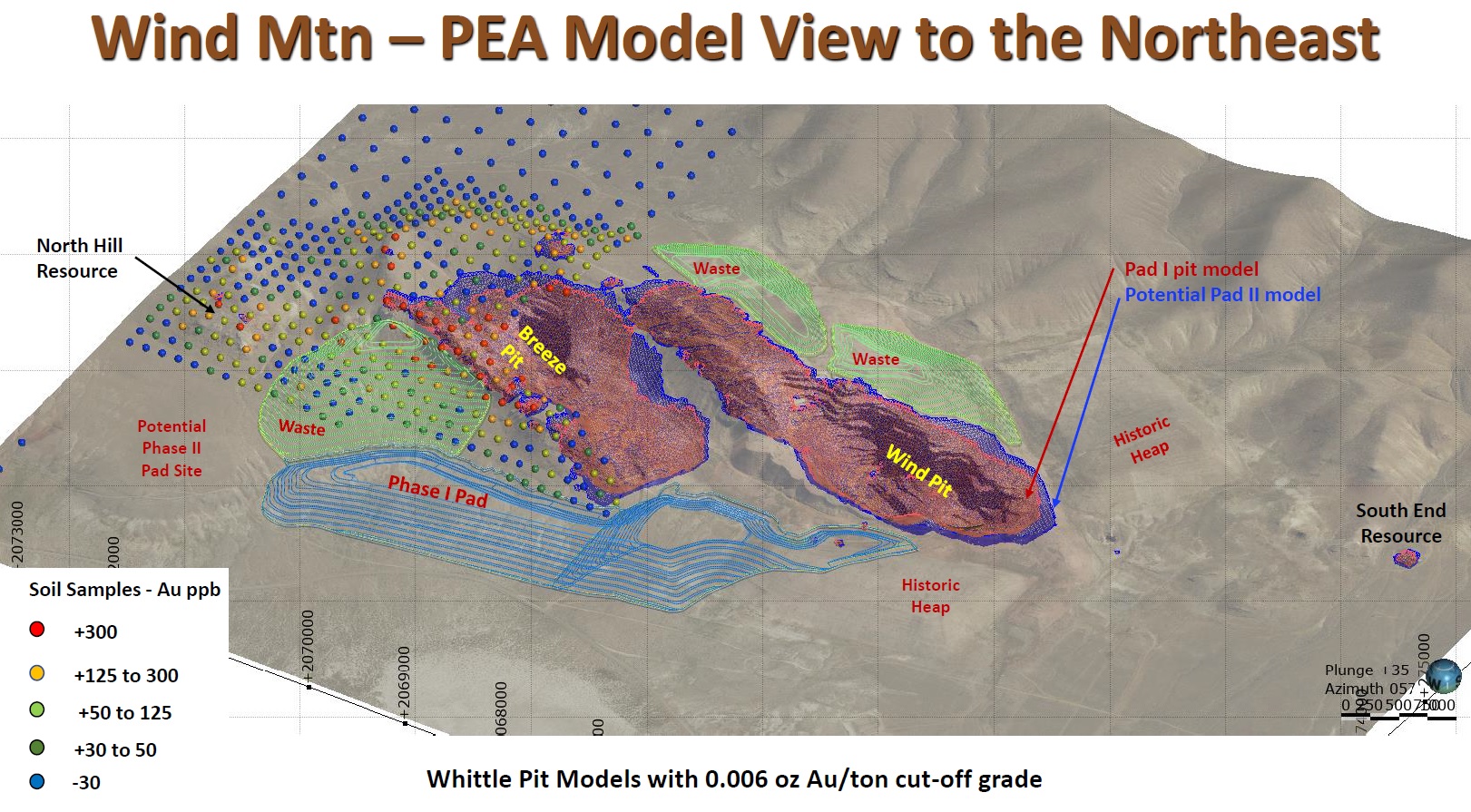

Although the pit-constrained resource contained almost 46 million tonnes, the Phase I mine plan only included roughly 30 million tonnes of rock due to the leach pad size constraints. This resulted in an economic study that didn’t really live up to expectations with a mine life of just over 4 years. Although the Internal Rate of Return was good, the after-tax NPV5% of US$46M at $1750/oz gold was a bit underwhelming.

But as the sensitivity analysis above shows, even a small increase in the gold price would result in very noticeable NPV and IRR swings. As you can see above, an 8.6% increase in the gold price (going from $1750 to $1900) would result in a 48% NPV increase (we are using the after-tax NPV5% numbers).

Even in 2022 it was very clear this project provided quite a bit of torque on the gold price and even small gold price swings could add a lot of value, as per the PEA. While this also works in the other direction, the gold price fortunately moved up, by quite a bit. It goes without saying the numbers from a 2022 PEA will also be subject to inflation-related increases in opex and capex, but these increases will likely easily be absorbed by using a higher gold price in the model. And that doesn’t mean the company will have to use the spot price to make the project appealing; most PEAs and PFS documents we have lately seen appear to be using a gold price in the $2250-2450/oz range and even at that price the Wind Mountain project should have better economics than the 2022 study.

On top of that, the company has identified a suitable area for a second leach pad which means the pre-feasibility study will likely be able to include a higher tonnage than the 30Mt that was included in the PEA mine life. While cash flows that occur later in the mine life are obviously dealing with a higher total discount factor, it goes without saying a larger project will appeal to a broader range of investors.

Sitting down with Joe Kizis, President

While the 2022 PEA was just so-so, the higher gold price is creating new opportunities. We sat down with President Joe Kizis to discuss the next steps for Bravada Gold.

Wind Mountain

Gold was trading at $1775/oz when you published the Wind Mountain PEA in December 2022. The current price of $3350 is approximately 90% higher and we expect this will change the scope of the Wind Mountain project pretty drastically. Even in 2022 it was very clear the project was very sensitive to the gold price as $1750 gold resulted in an after-tax NPV5% of US$46M but adding just $150/oz to the base case gold price boosted the NPV by almost 50%. According to our calculations, at $2500 gold, your after-tax NPV5% likely comes in at around US$130-150M. What’s your take on this assumption?

We have just begun the Pre-Feasibility process, which will provide investors with defendable economics, so I can’t really comment on specifics until we publish the results of the study. We feel that the increase in metal prices, a more favorable permitting environment, and the addition of another leach pad site will derisk Wind Mountain with favorable economics.

Mines are long-term investments, of course, and it is expected that prices will fluctuate during the life of a mine. Economic studies must incorporate these swings, so picking a base case for pricing can’t just use the high end of a price cycle. The prices we used for gold and silver in the 2022 Wind Mtn PEA were the 3-year trailing averages, which was a pretty common practice at that time. We are now evaluating various methods to determine reasonable prices to use that is acceptable to the Company and to the independent consultants doing the economic study. I see that many recently published gold resources are using a base-case price in the range of $2,200-2,300 per gold ounce, which might be the life-of-mine average price, but then also report results using a “current” gold price, which could be a significant economic bump for the next few years and possibly well beyond.

You will use the majority of the proceeds of a recent financing to complete a pre-feasibility study on Wind Mountain. Will the parameters be the same as in the PEA, or are you anticipating large changes by incorporating a Phase II leach pad in the economic scenario? If so, what would be required in terms of additional baseline data?

Our geologic and metal-distribution model hasn’t changed since our 2022 PEA, so we can skip the geologic modeling step and go directly to re-designing a pit at higher metal prices, focusing on the Indicated-category Resource, which exceeds the amount that can be processed on the Pad 1 site alone. The Pad 1 site is directly down hill from some of the best-grade gold and silver mineralization that is exposed in the bottom of the existing Breeze Pit. The Pad is restricted by a high-tension power line that really can’t be moved economically, so for the 2022 PEA we considered a phased development approach, with Pad 1 as the “Starter” phase.

With the PEA indicating attractive economics for the Pad 1 starter phase, we recognized that a longer mine life would enhance the project. We evaluated another space that is north of Pad 1 to leach the remaining Indicated Resource as well as additional Resources that are not yet drilled out to Indicated category. This Pad 2 site is fairly extensive and can accommodate the current Indicated Resource, as well as shallow, oxide gold/silver mineralization at the North Hill target, and possible extensions of mineralization to the north, east and south of the Breeze and Wind Pits.

Infill drilling will be required to convert that mineralization into the Indicated category, but should extend mine life. As you know, only Indicated and Measured categories of Resource can be included in a Pre-Feasibility Study (PFS). Inferred Resources are considered waste by a PFS until it has been upgraded by infill drilling.In anticipation of potential infill drilling for resource expansion and required Geotech studies, we recently had our previously reclaimed drill sites inspected by the Bureau of Land Management. All sites and access trails now have been released as being fully reclaimed, giving us a full 5 acres of disturbance for new drilling.

Can you elaborate on the North Hill and Zephyr exploration targets? Are you planning on doing anything on those targets?

North Hill is a relatively small target, but grades are pretty good, and the deposit sticks out of the ground uphill from the Pad 2. Although probably not more than a year or so of additional mine life, ounces there should be very easy to produce; mineralization is strongly oxidized with very little waste to strip.

Mineralization at the Zephyr target is too deeply buried below younger barren gravel to be economic at this time, but there are poorly drilled areas around the Wind and Breeze deposits that should add additional years of production with further drilling. In part, the re-design of the pit will guide us in prioritizing which areas will provide the best return for exploration drilling, but these areas are for mining phases beyond the current PSF study. In addition, other potentially mineable mineralization may come from the South End target and waste piles that contain leach-grade material.

In the 2022 PEA, your base case scenario was based on a run-of-mine plan, wherein you sacrificed recovery rates (just 61.9% for gold and 15% for silver) for a low up-front capex. Now gold is trading above $3000/oz and silver is closing in on $40/oz, are you rethinking this approach by including a crushing circuit? Or will run-of-mine continue to be your base case scenario?

Higher prices for gold, and particularly silver, certainly justify reviewing crushing options for Wind Mtn. Our engineering consultants did a cost-benefit evaluation of crushing vs run-of-mine (ROM) as part of our 2022 PEA. Crushing and ROM options were economically very similar, so we chose ROM because it is less complicated and less capital and operating intensive. Our testing at Wind Mountain shows that gold recovery increases with increasing amounts of crushing, as expected, and silver recovery increases even more. I suspect crushing will be advantageous, but we will do the cost-benefit evaluation.

One study we did a few years ago was to look at how much gold and silver remained in various size fractions on one of the two historic heap leach piles at Wind Mountain. We found that the smallest size fractions were well leached of their gold, but uncrushed, larger size fractions retained original gold grades. This makes sense to us from another study that shows early-stage silicification made the host rock dense and brittle prior to the mineralizing event, resulting in fractures hosting high concentrations of gold, silver, and other metals. It makes sense that more gold should be released if more fractures being exposed to the cyanide leaching fluid due to crushing.

As you are on the ground in Reno, Nevada, how has inflation impacted the capex and opex in the State? Has a rush on qualified labor resulted in a substantial increase in the hourly rates?

I get this question about inflation-cost increases a lot, and I must defer to our consulting engineers that have a better feel for costs. They tell me the price of precious metals has gone up more than the costs of producing them. We will have the best current numbers we can find for CapEx and OpEx in the PFS.

Other Projects

Are you planning to do any work on any of the other projects in your portfolio in the second half of this year?

We are only planning work for the Wind Mountain PSF; however, we continue to hold our other property positions and seek JV partners to advance them. Currently we have only Baxter in a JV, with Endeavour Silver (EDR.TO, EXK) planning drilling this year.

Now the gold price firmly remains above $3,000/oz and now there clearly is a renewed interest in US projects, are you seeing additional inbound calls from companies that are interested to partner on one of the less-advanced assets? Or do you still have the impression there is a ‘risk-off’ attitude in the space when it comes to exploration?

Yes, this year I’ve received a lot of calls about projects. However, many calls are from groups that are clearly underfunded or want advanced projects that are cheap to acquire and have huge upside. There are not many around in Nevada with these features, of course. In general, we prefer to work with mining companies to advance our projects, as they have the fire power in manpower, experience, and funding to successfully develop and operate a new mine. We have already identified attractive exploration drill targets on our project, and in many cases, we have drilled significant intercepts of gold and silver. Many of the known advanced projects are tied up or have negative issues, so I feel we may finally be in the early stages of a bull market for grass-roots and early-stage exploration, which is where the risk is high, but where we can discover potentially great new mines.

Corporate

You recently raised just over C$1M in a private placement, can you share the approximate use of proceeds?

We expect to spend 65% of the funds on the Wind Mountain PFS, 15% on claims and property payments for our other projects, and 20% on Working Capital required to run a public company.

At the end of the most recent quarter you reported on (April 2025), the liabilities owed to related parties had increased to C$0.6M while there was an additional C$0.5M in payables. While the C$1M cash inflow alleviates any near-term concerns, do you have a plan in place to deal with the short-term liabilities?

Related party payables are basically interest-free loans at this time; however, we may consider shares-for-debt in the future. Sales of assets and property payments have also been used to reduce debt.

Conclusion

The higher gold price creates a new opportunity for the Wind Mountain gold project, which is now moving towards the pre-feasibility study. We expect the PFS to confirm the robust economics of the project at higher gold prices and the IRR and NPV should be pretty robust (vis-à-vis the capex requirements) compared to the 2022 Preliminary Economic Assessment.

The company just raised C$1M in a placement priced at C$0.03 per unit and with about 2/3rd of that amount pledged to advance Wind Mountain, the remainder of 2025 could be interesting.

Disclosure: The author has a small long position in Bravada Gold. Bravada Gold is not a sponsor of the website. This report is for educational purposes only; be mindful that investing in junior mining stocks is risky, and you may lose your entire investment if things go wrong. Please read our disclaimer.