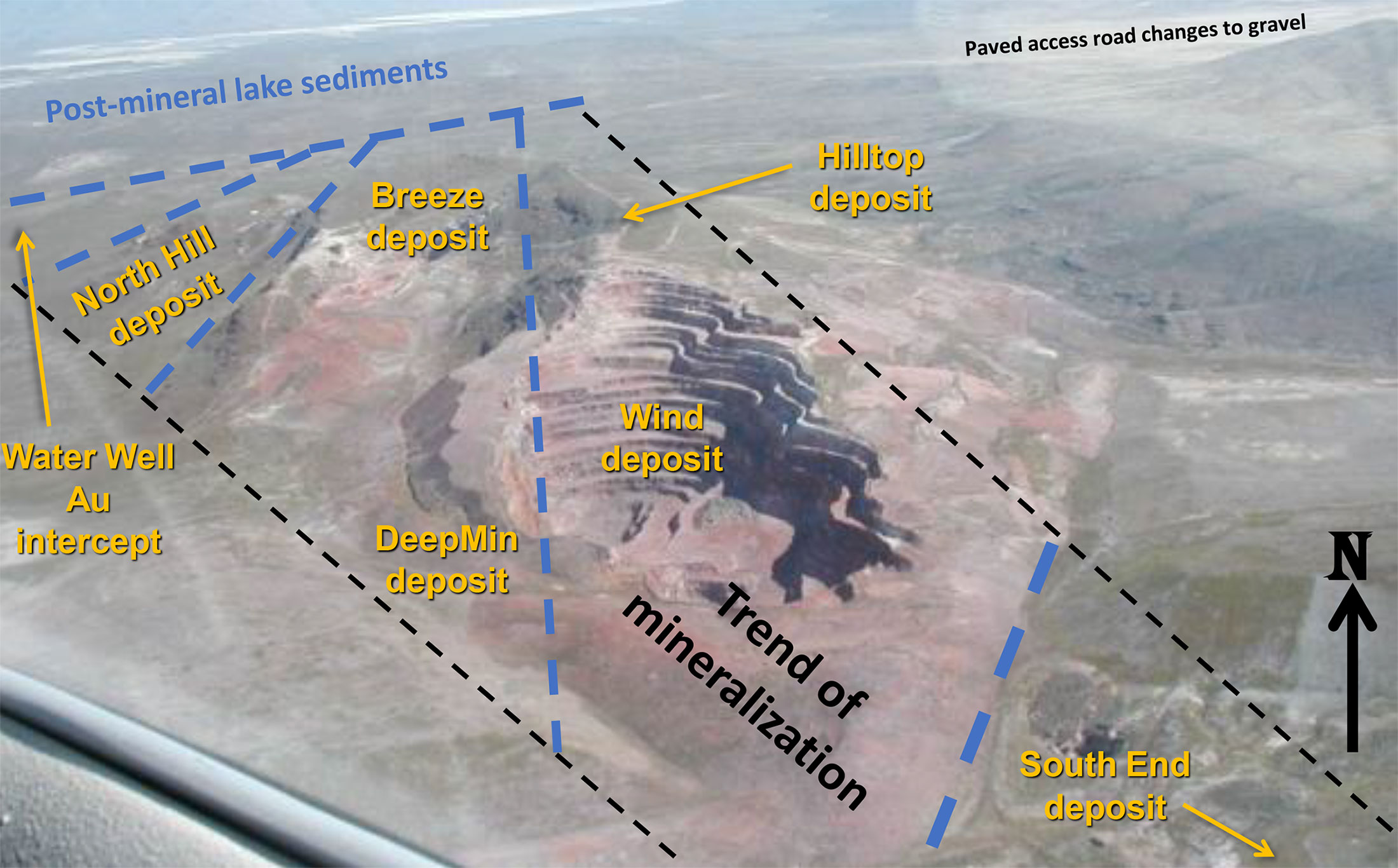

About ten years after the previous Preliminary Economic Assessment, Bravada Gold (BVA.V) has released an updated PEA on its flagship Wind Mountain project in Nevada. The location of the project is great, right next to a paved highway with well-maintained gravel roads leading right up to the past-producing open pit and the nearby mineralized zones. Additionally, there are two powerlines running through the property: one high-voltage line running from the large Lake Bonneville Hydropower Station south directly to Los Angeles; and one line previously used by AMAX when they mined Wind Mountain that is connected to the Nevada state-wide power grid. This lower-voltage line passes by the nearby Ormat-owned geothermal power plant just to the south of Wind Mountain and it may be possible that Bravada Gold (or anyone who will build the project) can tap into the geothermal plant directly.

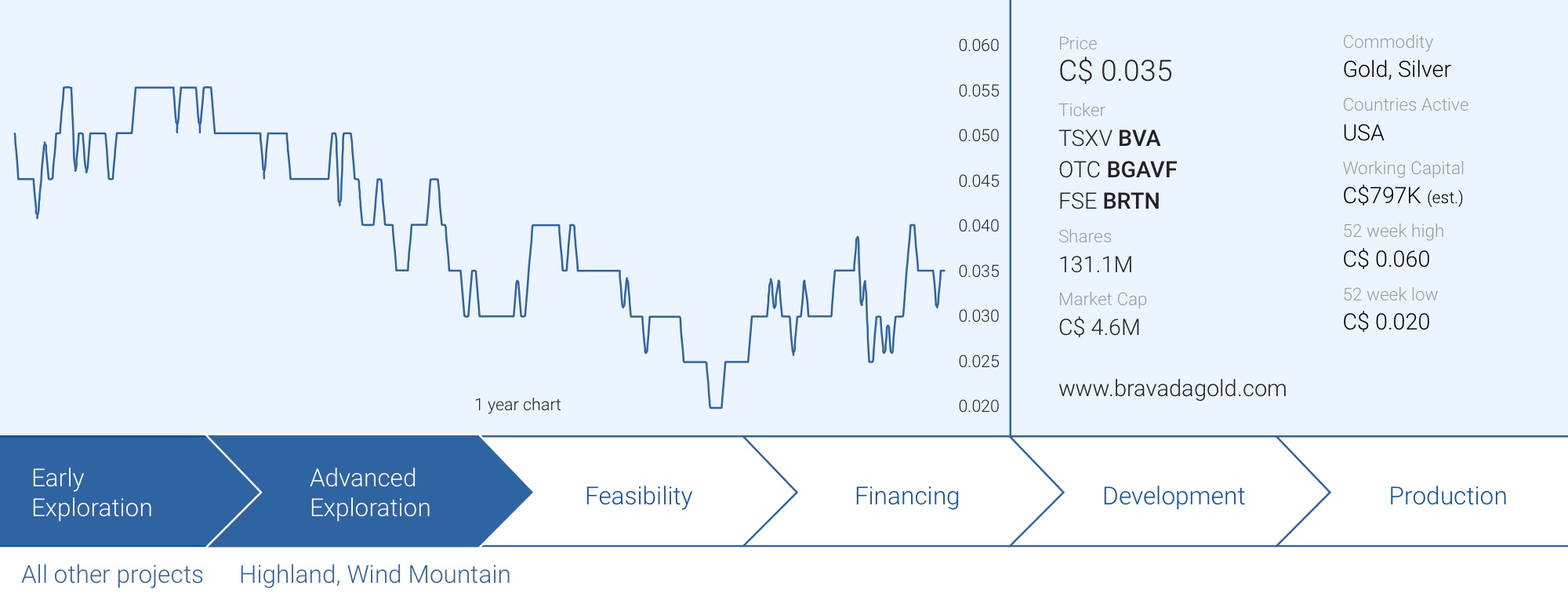

The good accessibility and access to existing infrastructure means the resource doesn’t have to be large to reach the critical mass. This is fortunately for Bravada Gold because after adjusting for higher capital and operating costs, it ended up with an in-pit resource of just under 500,000 ounces of gold and just under 12 million ounces of silver, of which 96% of the Phase I plan is in the indicated resource category. The original mineralization estimated during 2012 remains in place, and was verified to within 1%, but higher costs mean higher cut-off grades have to be used and that leaves material in the ground (possibly for another day if/when gold prices are materially higher than today).

The outcome of the PEA

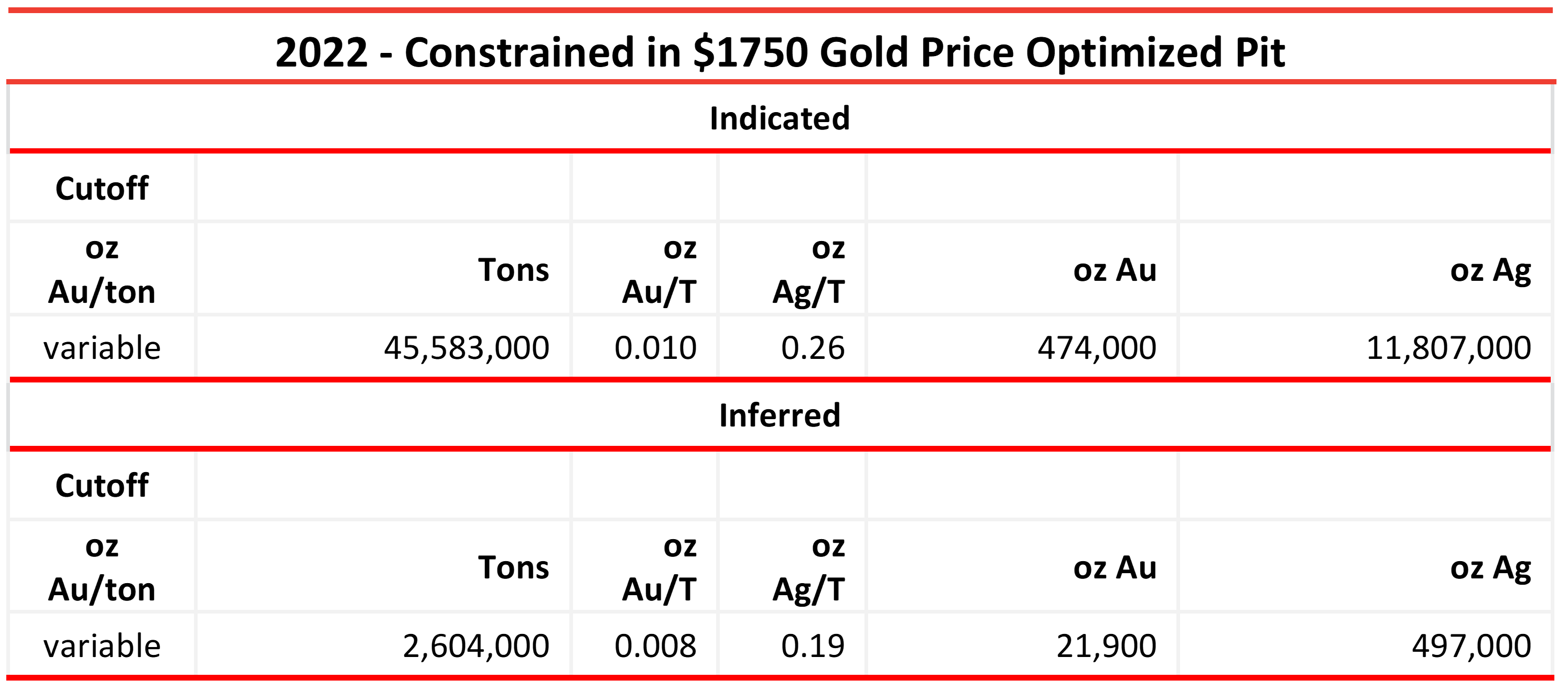

The Preliminary Economic Assessment recalculated pit-constrained resources at $1,750/oz gold and $21/oz silver for 474,000 ounces of gold and 11.8 million ounces of silver in the indicated resource category and about 22,000 ounces gold and just under half a million ounces of silver in the indicated category.

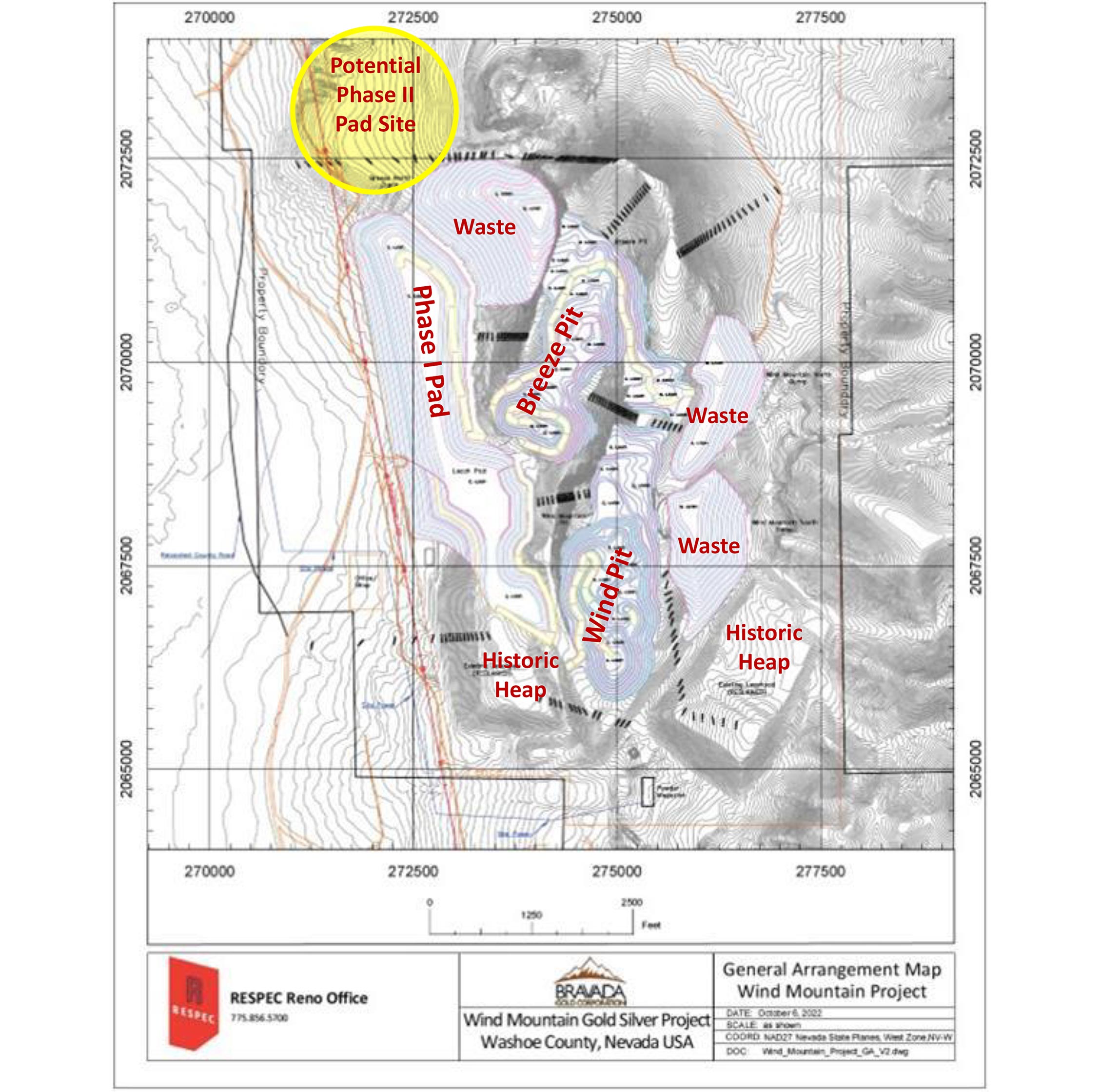

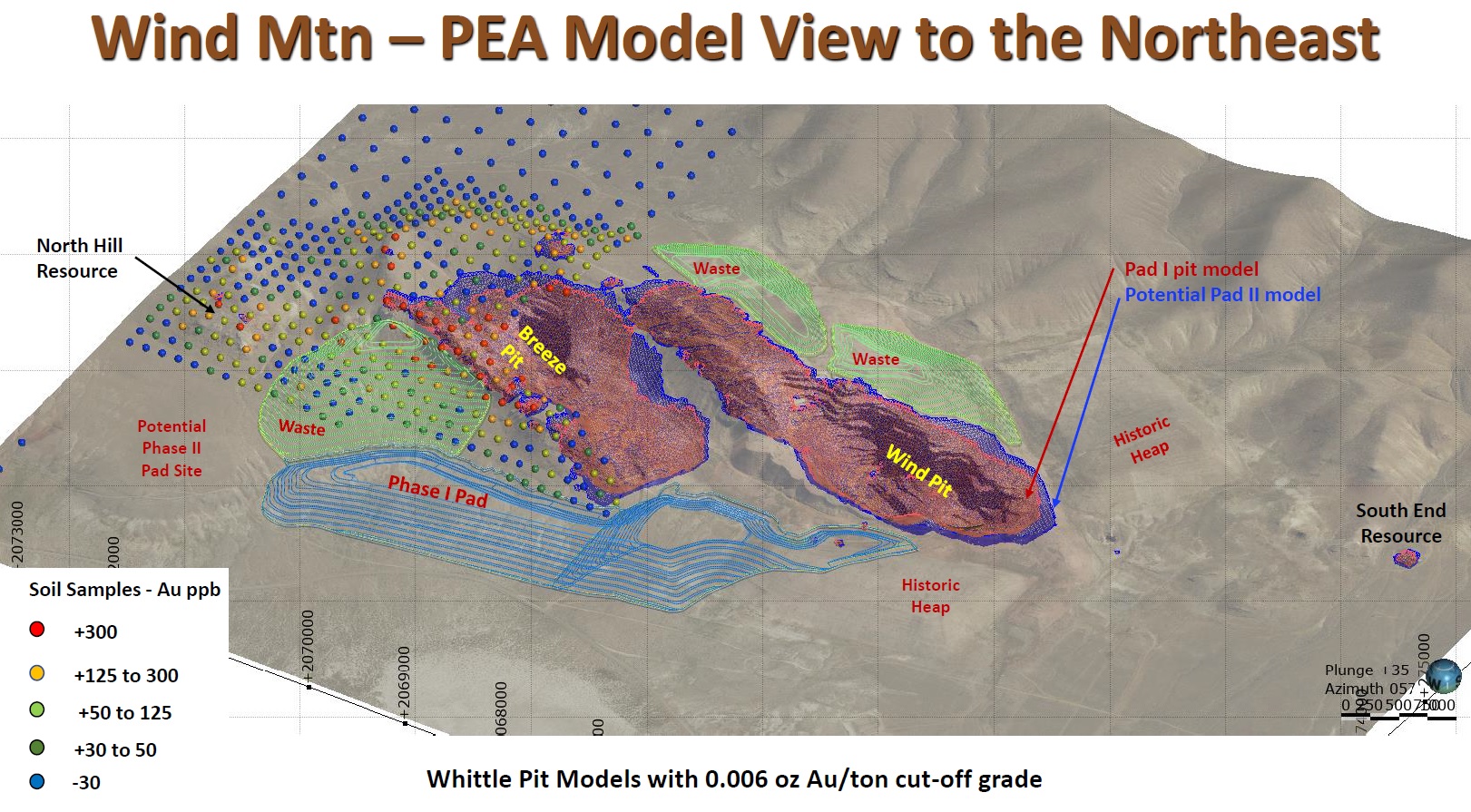

Unfortunately, not all ounces in the Pit-constrained Resource are included in the Phase I mine plan as in this updated economic study, there are some physical limitations when it comes to the Phase I leach pad. The pad can hold about 30.3 million tonnes of leachable rock, which represents just over 60% of the pit-constrained resource. As you can see on the image below, there is the potential to construct a second leach pad just a little bit further to the north, but only Phase I was included in the PEA.

This indeed means the PEA is based on just 344,000 ounces of gold and 8 million ounces of silver in the preliminary mine plan, and in excess of 100,000 ounces of gold are ‘ignored’ in this first phase, but anticipated as a potential phase II program that is expected to continue directly following Phase I.

The recovery rate of the gold and silver is still pretty low at 62% and 15% for the oxide-hosted resource but in line with comparable projects that don’t use a crusher. That’s a pity as we had hoped Bravada Gold would have been able to increase the recovery rate of the gold by a few percent. As a reminder, every 1% increase in the gold recovery rate would increase the pre-tax and undiscounted cash flow at Wind Mountain by in excess of US$5M. While we remain hopeful the metallurgical process can still be optimized to squeeze out a little bit more gold, it doesn’t sound like that’s high on the to-do list of the Bravada management as it will per definition be a tradeoff between a higher capex (to add a crusher to the flow sheet) and the higher revenue and cash flow.

Based on the known recoveries, the mine will produce 213,000 ounces of gold and about 1.2 million ounces of silver. The cash cost per ounce of gold is estimated at $1,045 per ounce of gold while the AISC is anticipated to come in at $1,175/ounce. This production cost and AISC estimate is based on a silver price of $21 per ounce. For every dollar the silver price increases, the AISC per ounce of gold decreases by $5/oz.

The initial capex of the Wind Mountain mine is estimated at US$46M. That’s low, and represents a capital intensity of US$215 per produced and recovered ounce of gold. The low capex does mean the silver production could be a potential source of funding: while the 1.2 million ounce recoverable production is pretty small, it could be of interest to a small streaming company and given the current silver price, a silver stream would likely fetch US$15-20 million which would satisfy the equity needs to build the mine.

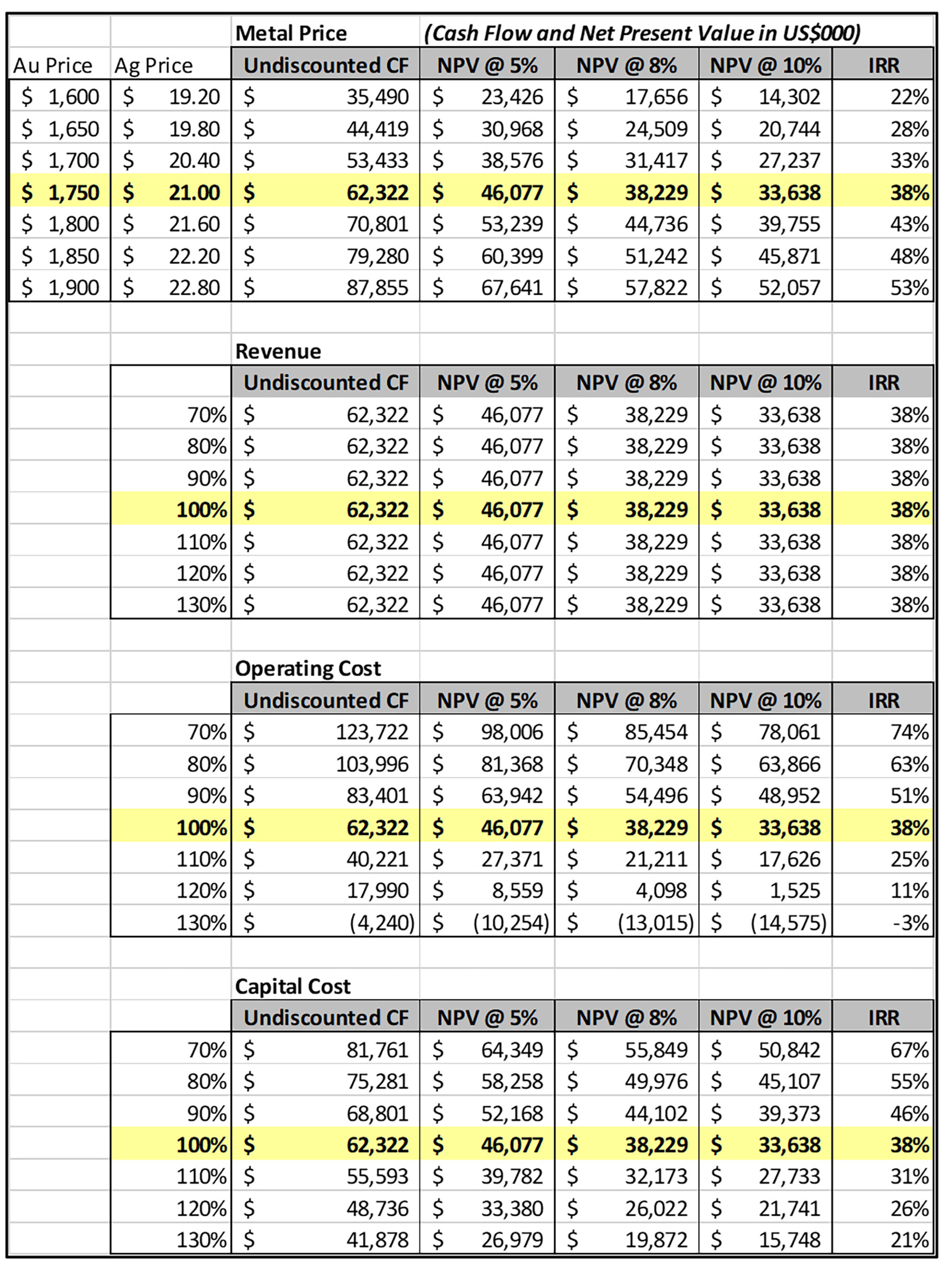

The after-tax NPV5% is estimated at US$46M as well, indicating the net after-tax and discounted cumulative cash flows from the 213,000 ounces gold and 1.2 million ounces of silver exceed US$90M over the currently planned 4.2 year mine life (the sum of the undiscounted cash flows is approximately US$110M). The after-tax IRR is 38% and the payback period is less than 2 years at $1,750 gold.

Bravada Gold also published a sensitivity analysis that shows the project remains economic at lower gold and silver prices as well. At $1,600 gold and $19.20 silver, the after-tax NPV5% is still US$23.5M. And in a positive scenario using $1,900 gold, the after-tax NPV5% would increase by almost 50% as well, to almost US$68M. Keep in mind the sensitivity analysis is only based on the 30 million tonnes placed on the Phase I leach pad and still does not take a potential Phase II expansion into account.

Is there room for improvement?

The low-hanging fruit would likely be to build the Phase II leach pad during the final year of Phase I production, which should be feasible from cash flow. Considering almost the entire in-pit resource is already in the indicated resource category, we know the gold is there, and Bravada already has an above-average confidence level in those ounces considering most companies only use an inferred resource in a preliminary economic assessment.

Keep in mind there are about 15 million tonnes of rock (or about 150,000 ounces of gold) across all categories that simply don’t fit on the Phase I leach pad. This makes constructing the Phase II leach pad a logical next step, and the engineering company that conducted the PEA is assessing the physical constraints of adding that pad. The capex estimate for this second, smaller leach pad would likely be around US$15-20M, and applying the same recovery rates, Wind Mountain would recover an additional 80-90,000 ounces of gold and 0.5 million ounces of silver. Assuming a similar AISC of just under $1,200/oz, we estimate recovering an additional 80,000 ounces of gold would add about US$15-20M to the after-tax NPV5% after taking the additional capex into consideration. The Phase II leach pad fell outside the scope of the Phase I PEA but could likely be a useful addition to extend the mine life and recovery of additional gold and silver.

There still are waste dumps on the project and previous programs have estimated a residual grade of 0.22 g/t on those dumps. That gold could theoretically be recovered, based on Bravada’s limited surface and trench sampling; however, the recovery rate will still be pretty low and considering the leach pad size is the limiting factor here, the first priority should be to bring the higher-grade in-pit ounces into a mine plan as that will add more value than processing and reprocessing waste rock. The only upside here is the approximately 1.1 million tonnes of waste rock that would have to be moved anyway in order to accommodate the open pit.

Conclusion

Bravada’s team recognizes its talents lie as explorationists and it has advanced Wind Mountain to the point of needing experienced mine builders. The in-pit resource will likely remain limited to relatively small increments of growth. The attempts to discover a high-grade feeder zone haven’t yielded the desired result and perhaps we will see the company monetize its interest in Wind Mountain.

Bravada Gold has several other exploration projects in its portfolio, and with Wind Mountain either joint ventured or sold, we expect the company to focus on making discoveries on those exploration assets in 2023 and beyond.

Disclosure: The author has a long position in Bravada Gold. Bravada Gold is a sponsor of the website. Please read our disclaimer.