Sometimes companies catch a break. Right before Vizsla Resources (VZLA.V) announced its set of barn-burner exploration results on a newly discovered vein on its Panuco silver-gold project, Brigadier Gold (BRG.V) announced the acquisition of an option to earn full ownership in the Picachos project which is located within walking distance from the Panuco tenements. Brigadier had been dormant for a while and was only reactivated on the TSX Venture exchange at the end of June.

This means that Brigadier is nót a company that just jumped on a ‘nearology’ play but a formerly dormant company coming out of hibernation while putting an interesting asset portfolio together. QP Michelle Robinson, responsible for assembling the claim package, has about a decade of experience on the project and seems to be the right person to lead the future exploration programs as her knowledge of the project will ensure an efficient exploration program.

First things first: a background check on the company and the people

When a company rebrands itself, it usually has to deal with the public perception that may still linger around. In Brigadier’s case, we wanted to make sure we knew what we were getting into as Brigadier Gold completely overhauled its business plan in just a few months’ time. Back in 2019, Brigadier signed a deal with a Chinese CBD company after getting its change of business plans approved by the shareholders and the exchange, only to have a change of heart in April. Subsequently, in May, Brigadier signed an agreement to acquire the Killala Lake diamond property which allowed it to regain its listing as a resource company (as the existing NI43 report on Killala Lake is sufficient to continue to be listed as a resource business).

Needless to say we first wanted to check up on the merits of the project and the people. We noticed Steve Vanry (who is also the CFO of Oroco Resource Corp (OCO.V)) is a part of the company’s team and sources in Vancouver confirmed he is ‘a good guy’. We didn’t know the other people of the Brigadier team, but during our due diligence process all of our questions were truthfully answered and we didn’t have the impression any answer was dodged.

We also noticed Michelle Robinson is one of the principals of Minera Camargo, the Mexican company selling the project. We asked around about her as well, and all reactions were positive as well.

We also directly talked to Michelle Robinson to get more information on how the project was put together and how she envisages the path forward and when we enquired with the CEO of another exploration company in Sinaloa who told us he was taking a small position in the private placement, we were sufficiently convinced Brigadier Gold means serious business.

So while we realize it’s not ideal to see a company changing its business plan in the past twelve months, it now looks like Brigadier Gold has settled down on its Picachos gold-silver project in Mexico while the diamond property has been put on the backburner. The history of the company is water under the bridge and we expect the full focus of the company to be on the Picachos project going forward.

Long story short, Brigadier Gold was a dormant company and should be treated as a shell that recently acquired an interesting exploration project. And with the recently announced C$3.5M capital raise, it now has the required funds to hit the ground running in Mexico.

The Picachos project actually does look intriguing

It’s still early days at Picachos but the information that’s currently available is quite interesting. To keep things simple, there are two distinct targets and exploration theories on the tenements: the main focus in the near future will be the high-grade silver-gold veins on the southern portion of the tenements while privately-owned Minera Camargo detected a copper porphyry potential on the northern stretch of the Picachos project. Although Mexican copper porphyries could be very interesting, we won’t give this one too much attention as it’s too close to the border of the tenements (so even if a large porphyry would be discovered, a pit outline probably wouldn’t fit on the Picachos tenements so the surrounding land would have to be bought as well), and our full focus will be on the gold-silver areas where there appears to be some low-hanging fruit.

The project has been optioned before by other mining companies, but no serious exploration activities have been undertaken so far, and Brigadier Gold will be the first company with a dedicated and systematic exploration approach.

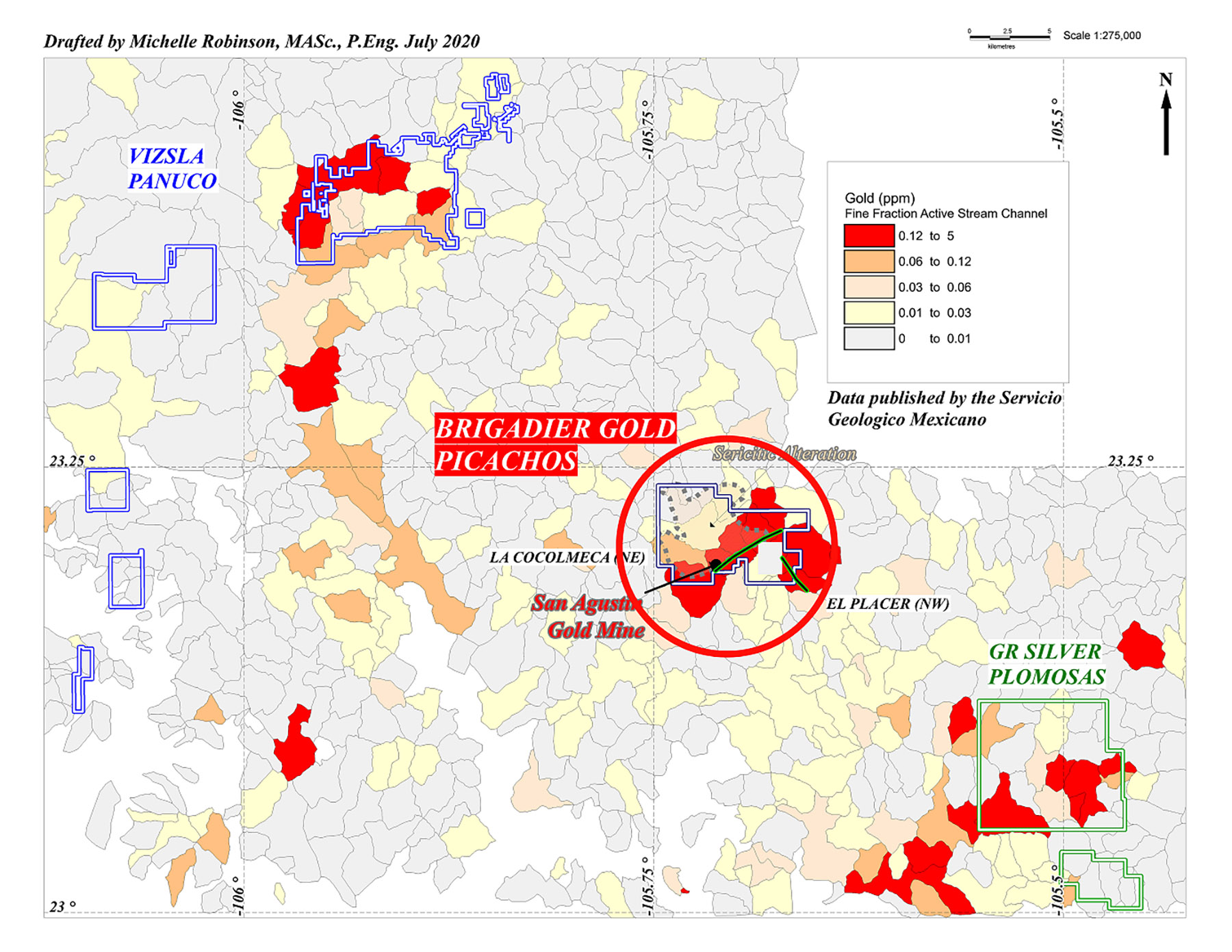

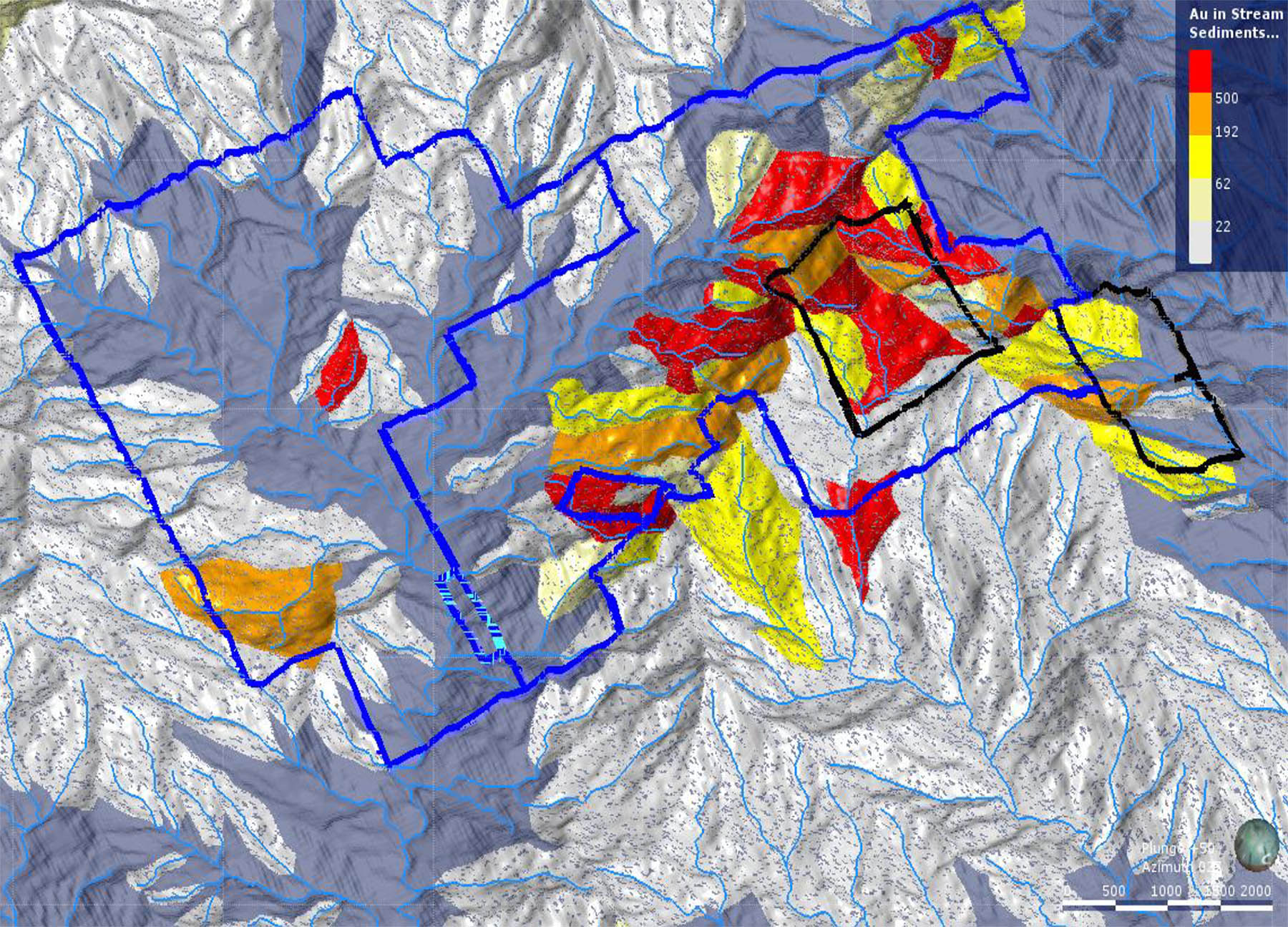

One of the main reasons why Minera Camargo was so interested in the land package was the stream sediment sampling results.

As you can see in the image above, the historical sampling program outlined some high-grade values on the eastern portion of the land package. This sampling program was completed by a government agency of Mexico and as such is deemed to be reliable.

You also see there’s one claim in the middle of that intriguing stream sediment sampling zone, and according to our information, those claims are owned by a subsidiary of a large Mexican mining company. Further due diligence revealed that mining company does not have any active assets in the province of Sinaloa and these claims could be seen as some sort of ‘orphan status’ claims and it’s not unreasonable to think Brigadier will try to further consolidate the area.

Of specific interest on the Picachos claims is the past-producing San Agustin mine (located in the blue rectangle covering the red zone on the stream sediment sampling map above). The San Agustin mine has approximately 665 meters of historical underground development while the stoped area is approximately 100 meters long and 80 meters high. The width of the stope is on average 2 meters and this coincides well with the anticipated average vein width of 2-3 meters.

The most recent work program at San Agustin was completed by London-listed Vane Minerals. Vane tested three areas on the southern part of San Agustin and ran the rock through its mill in Nayarit. The average values of the samples that were processed were just over half an ounce of gold (15.8 g/t and just over 2 ounces of silver (63 g/t) per tonne of rock. Great values, but we should take those with a grain of salt as Vane’s exploration program was quite limited. While these precious metals values indicate the potential at San Agustin, there’s not enough data available to accept those values as standard.

An important element from the Vane Minerals program was the average recovery rate in the mill: the reported recovery rates reached levels above 90% using a three-step processing plan with gravity, flotation and cyanidation. As Vane basically just threw the rocks in the mill, optimizing the flow sheet could easily boost the recovery rates by a few percents.

The majority of the San Agustin mine has collapsed which paves the way for a normal exploration program with a surface drill program rather than hastily going back in the old workings to pick some low-hanging fruit. Upon our conversations with Michelle Robinson who acts as QP for the project, Brigadier will not cut any corners, and the exploration program will focus on tracing the mineralization in the veins and hopefully, this will result in a small maiden resource estimate in 2021.

The Picachos project also contains the Gloria mine as well as the copper porphyry target, but the interpretation of the Gloria zone is not as advanced as the San Agustin project so we would expect the majority of Brigadier’s exploration efforts to be focusing on San Agustin where there appears to be an easier path forward towards a maiden resource estimate in 2021.

Brigadier hasn’t provided a detailed exploration plan just yet, but now the financing has been closed and we expect to see an update soon.

The earn-in agreement to acquire Picachos from Minera Camargo

Brigadier’s agreement to earn a 100% interest in Picachos is relatively straightforward and spans a 5-year earn-in period. Brigadier will have to issue 4M shares of Brigadier, make US$275,000 in cash payments and incur US$3.85M in exploration expenditures.

Additionally, Brigadier Gold will have to make certain milestone payments. 1M additional shares will be due if an inferred resource estimate of 350,000 ounces can be completed while an additional 1M shares and a US$725,000 cash payment (with the option to pay half in stock) will be payable to Minera Camargo upon the completion of a positive feasibility study. A final US$2M cash payment (with the option to pay half in stock) will be due when commercial production has been declared on the project. And finally, Minera Camargo will retain a 2% Net Smelter Royalty.

The terms for this acquisition aren’t cheap, but this actually strengthens the case for Picachos as Minera Camargo, the seller, clearly isn’t letting this property go for a song.

The earn-in terms are clear and straightforward and upon reaching commercial production, Brigadier will have had to issue 6 million shares, pay US$3M in cash and spend at least US$3.85M on exploration (although it will cost Brigadier a multiple of the US$3.85M to complete a feasibility study on the project.

The financing has now closed with Brigadier raising C$3.5M

At the end of last week, Brigadier announced the closing of the C$3.5M financing, priced at C$0.26 per unit. 89 placees participated in the financing, indicating the average investment per participant was approximately C$40,000. As mentioned before each 26 cent unit consisted of one share as well as a full warrant with an exercise price of C$0.40, valid for one year.

Brigadier’s C$0.26 financing comes hot on the heels of an initial C$0.05 financing which was completed in June. 14 million units consisting of one share and one full warrant with a strike price at C$0.10 valid for one year were issued as part of that financing and the 4 month and one day lockup period expires on October 4th. Considering the warrants are deeply in the money and participants in that funding round are currently up by a factor of 17 (based on a share price of C$0.48), one could and should expect some selling to occur around that date. Definitely worth putting that date in the calendar and depending on the company’s exploration progress it could make sense to put in some stinkbids as you can definitely expect warrant clipping to occur, especially as both the 10 cent and 40 cent warrants already expire in 2021.

Considering all 27.5M warrants are currently in the money, investors should be aware they will very likely be exercised during the next 10-12 months. While this will sometimes weigh on the share price, there also is a silver lining. Should all warrants be exercised, Brigadier Gold will receive approximately C$6.7-6.8M in net proceeds. This means that if the exercise happens gradually over the next 10-12 months, the combination of the C$4M Brigadier currently has in the treasury and the warrant proceeds could indicate the company won’t have to go back to the market before the end of next year (unless of course it accelerates its exploration program).

The team

As you’ll notice below, most of the people involved in Brigadier Gold don’t have a technical background. Garry Clark is by far the most experienced technical person and based on our conversations with CEO Ranjeet Sundher, Clark acts as an excellent soundboard and provides valuable technical expertise.

Having ‘just’ Garry with a technical background doesn’t necessarily have a negative impact on the company in the short term (as Minera Camargo will be engaged for the initial exploration plans at Picachos), but we would expect Brigadier to add some more geo-flesh on the bones over the next few months. Of course, Picachos is a brand-new acquisition and we don’t expect the entire board and advisory board to be overhauled right away but it will be something we will look out for in the future. For now, Michelle Robinson of Minera Camargo is the perfect fit for Picachos as her decade-long experience with the project should result in an efficient exploration program.

Ranjeet Sundher – President & CEO

Mr. Sundher is the President of Canrim Ventures Ltd., a Singaporean advisory firm specializing in early-stage project finance and structure and has raised over $50 million for companies in which he was a founder / partner. Ranjeet has lived in Asia for the last 20 years and has 25 years of capital markets experience and has developed and sold several successful private and public companies in the technology and resource and software space.

Garry Clark – Director

Mr. Clark is the Executive Director of the Ontario Prospectors Association (OPA). He has been a Director, Vice President or President of OPA since its formation in the early 1990s. Mr Clark currently serves on the Minister of Mines Mining Act Advisory Committee (Ontario) and the Ontario Geological Survey Advisory Board. He graduated with an HBSc (Geology) from Lakehead University, Thunder Bay. Mr. Clark brings to the company extensive experience in managing large scale exploration and development programs internationally including Asia and North America. In addition to over 30 years of consulting experience, he held geological positions with a number of mining companies and has served as a director of other TSX Venture Exchange listed companies including his current position and NexOptic Technology Corp. and US Cobalt Inc. (USCO.V)

Oscar Mendoza – Special Advisor Mexico

Oscar Mendoza was born and raised in Mexico and currently resides near the city of Monterrey, Mexico. Mr. Mendoza is a Graduate of The University of North Texas in the United States where he completed his undergraduate degree with Honors in Political Science and Finance. Mr. Mendoza then went on to work for investment banks including Morgan Stanley and Frontier Securities, covering Natural Resources & Energy sectors. He actively led and successfully closed several financing transactions in equity capital markets with a focus on mining and resource companies and has facilitated and structured several custom-tailored debt and investment banking transactions for mining companies listed on the London Stock Exchange, Toronto Stock Exchange, Australian Stock Exchange and Mongolian Stock Exchange. Mr. Mendoza is frequently invited as guest speaker for various panel discussions and conferences held in Beijing, Hong Kong and Ulaanbaatar including such events as Power Asia and Mines & Money. He is also a recurrent editorial expert for several Mexican Local Newspapers and a Local Television Show where his area of expertise and advice are shared with large audiences.

Steve Vanry

Mr. Vanry has 25-years professional experience in senior management positions with public and private companies, providing expertise in capital markets, strategic planning, corporate finance, mergers and acquisitions, regulatory compliance, accounting and financial reporting. His breadth of experience spans various industries, including; mining, oil and gas, renewable energy, high-technology and manufacturing. Mr. Vanry regularly consults for other listed companies in the role of director and/or senior executive. Steve holds the right to use the Chartered Finance Analyst (CFA) and Canadian Investment Manager (CIM) designations and is a member of the CFA Institute and the Vancouver Society of Financial Analysts.

Conclusion

Brigadier Gold came out of the gate running, and this was pretty much a stroke of good fortune. The company was already in the final negotiation stages to acquire the Picachos project from privately owned Minera Camargo when Vizsla reported its ultra high-grade silver values from the newly discovered Napoleon vein. And just days after Brigadier Gold announced its option to acquire Picachos, Vizsla hit the gas pedal as well as additional holes confirmed the existence of high-grade silver-gold mineralization on its Sinaloa project.

This makes Brigadier Gold an interesting ‘nearology’ play, but one with merit. Historical gold and silver values encountered at the past-producing San Agustin mine are intriguing and with almost C$4M in the bank (and C$6.7M worth of warrants in the money), Brigadier can tackle the exploration challenges at Picachos head-on. We expect the company to unveil a substantial exploration program within the next few weeks, and this will almost certainly contain an initial drill program before the end of the year.

Disclosure: The author has a long position in Brigadier Gold Ltd. Brigadier Gold Ltd. is a sponsor of the website.