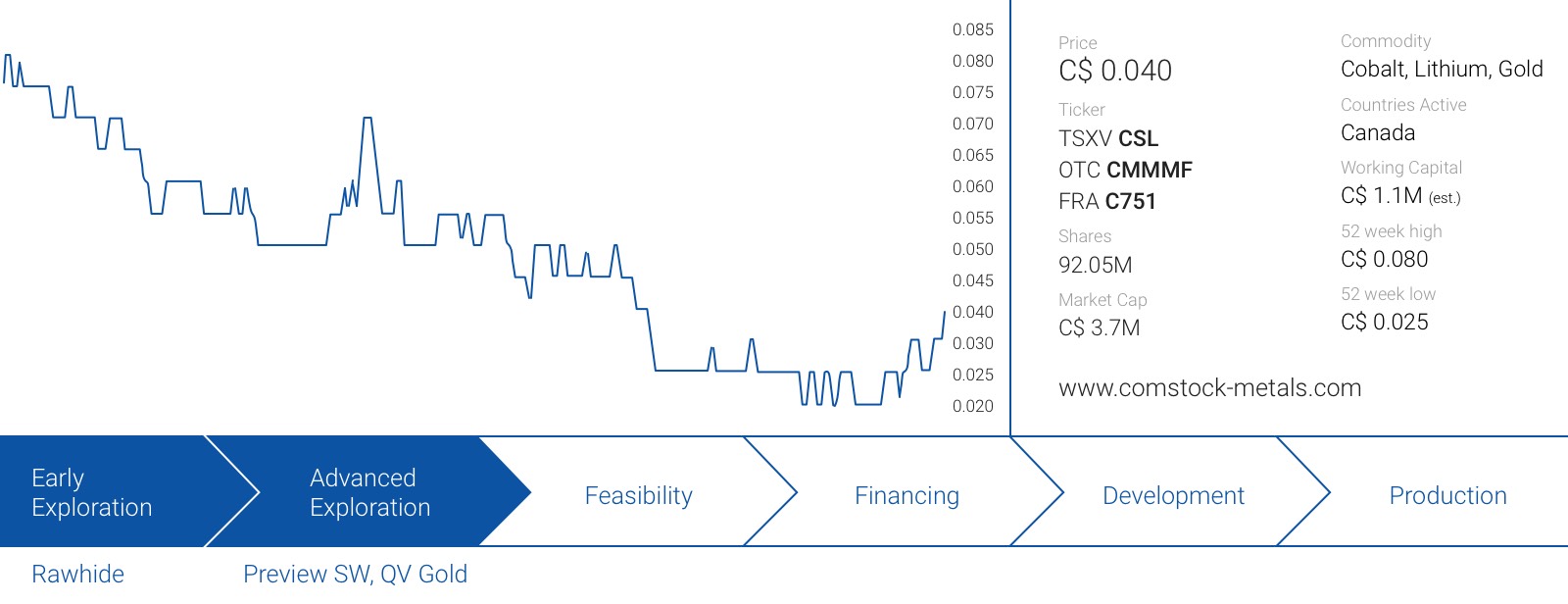

2018 was an interesting year for Canadian based Comstock Metals (CSL.V). In mid-May, CEO David Terry left the company, and director Steven Goldman was appointed as interim-CEO effective May 15th for an initial period of one year, as he enjoyed the trust of the two largest shareholders of Comstock Metals (Select Sands (SSV.V) with a 24.6% stake and Gracetree Investments (with a 17.2% stake)). Goldman was able to shed some non-core assets to reduce the size of the asset portfolio while adding cash to the bank, as well as enter into a joint venture agreement and a small equity position in petro-lithium company E3 Metals (ETMC.V). Finally, Comstock commenced a drilling program last month at its promising Preview SW gold deposit in Saskatchewan while also obtaining an exploration permit for its Rawhide Property (cobalt/silver) in Ontario. Please note, the working capital position mentioned above was the WC position as of the end of June (the most recent financial statements). Since June 30, Comstock has raised C$606,000 in an equity placement, C$311,000 in asset sales and has spent C$400,000 on the investment in E3 Metals. Comstock should report its full-year financials (the financial year ends on September 30) soon, which will give us an updated view on its financial status.

A recap of 2018

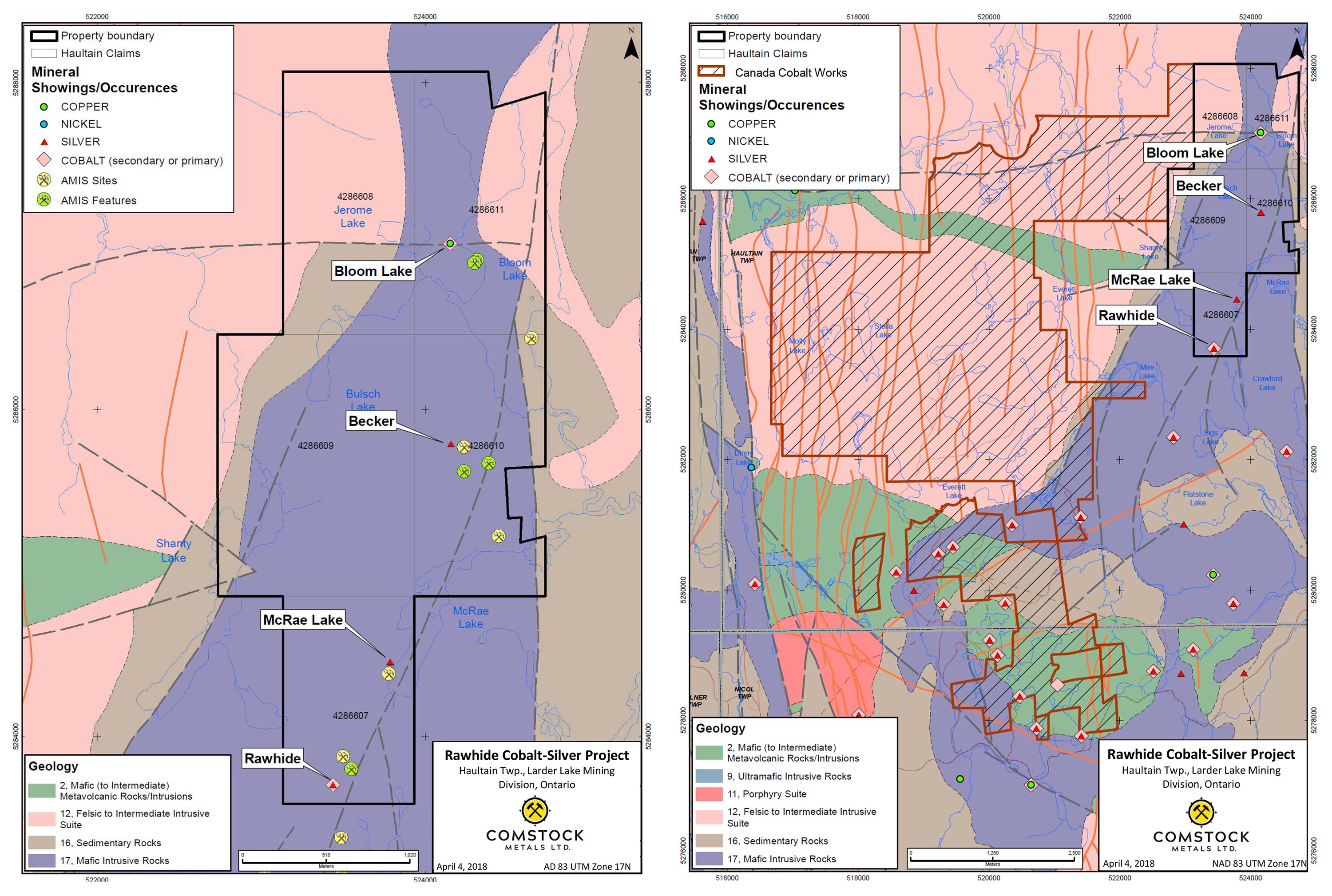

Comstock re-thought its mission statement last winter, and decided to include a focus on battery metals (specifically lithium and cobalt) in its corporate strategy, instead of solely focusing on its gold projects at QV (Yukon) and Preview SW (Saskatchewan) in Canada. It then entered into an option agreement in April to acquire 100% of the Rawhide cobalt-silver property in Ontario’s Cobalt camp which has a total historical production of in excess of half a billion ounces of silver as well as almost 30 million pounds of cobalt. While the amount of cobalt found in the camp may at first glance appear to be low, keep in mind that historic miners mainly cared about the silver, and not about the cobalt.

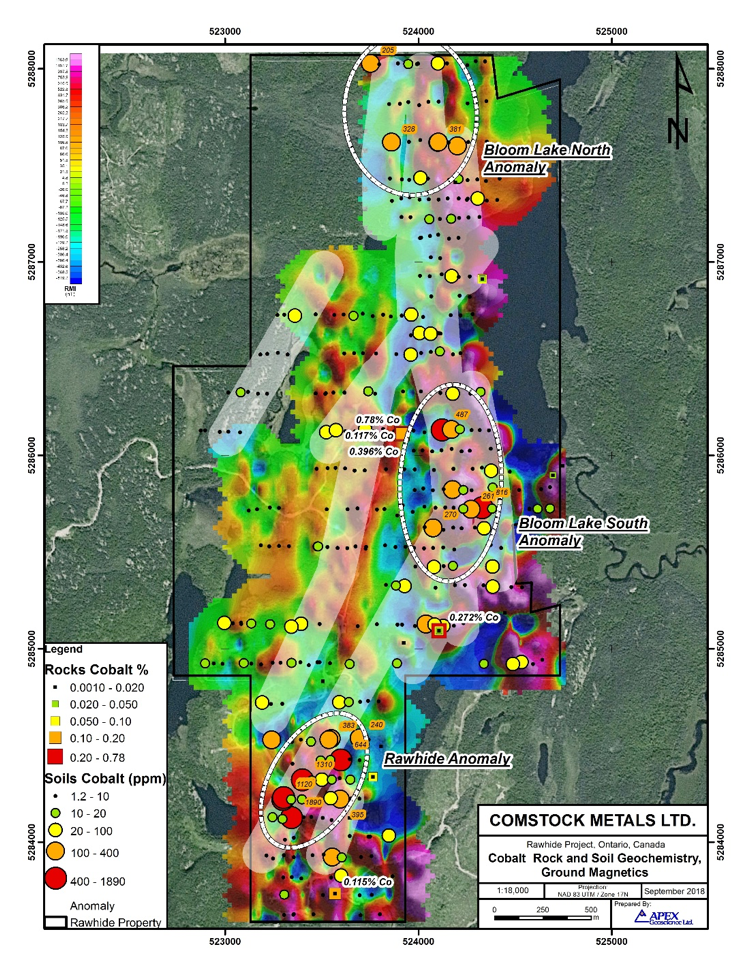

Comstock’s Rawhide property is an early stage exploration project, but by no means a greenfield project as the property has already been the subject of sampling and trenching programs. Previous operators completed 650 meters of drilling in the 1950’s and 1960’s. The holes that were drilled as part of that exploration program were relatively shallow (the average depth was less than 50 meters), but did result in some high-grade silver, copper and cobalt assays. Plenty of reason for Comstock Metals to follow up on those early Rawhide drill results with a surface exploration program conducted this past summer which returned promising values for cobalt, copper and silver.

In July, Comstock closed a C$600,000 private placement after issuing 12.15 million units, with each unit consisting of one common share in Comstock as well as a full warrant allowing a warrant holder to buy an additional share of Comstock at C$0.10 within 24 months after the closing date of the placement (July 3rd, 2020).

$400,000 of the proceeds of this placement was immediately re-invested in E3 Metals (ETMC.V) as Comstock acquired 1 million units at C$0.40. Each unit in E3 Metals consisted of 1 common share and a full warrant, allowing Comstock to purchase an additional 1 million shares at C$0.40 for an initial period of 4 months (now expired), increasing to C$0.60 until August 20, 2019. This initial 1 million share acquisition gives Comstock Metals a stake of almost 5% in E3 Metals (with the potential to acquire an additional 4% plus equity position in E3 Metals if the warrants are exercised, assuming no material additional financing takes place in the interim). As part of the arrangement with E3 Metals, Steven Goldman joined E3 as a strategic advisor. We will discuss the investment rationale for Comstock’s investment later in this report.

On December 3, Comstock announced that it was able to sell two non-core properties. The Old Cabin gold project in Ontario was sold for C$96,000 while Fresnillo PLC (FRES.L) exercised its option to purchase the Corona project in Mexico in which Comstock had an interest. Comstock received US$164,000 (approximately C$215,000) in cash for selling its 50% stake in the Mexican Corona property. On top of that, Comstock retains a 0.5% Net Smelter Royalty at Corona. As Comstock wasn’t planning to do any real work on these properties, we agree with the company’s management team to take the approximately C$310,000 cash inflow and to focus on the portfolio’s Tier 1 assets.

One of those Tier 1 assets is the Preview SW gold project in Saskatchewan. Last month Comstock completed a drill program at the north zone of Preview SW (the “North Zone”), where it was planning to follow up on its previous successful 2017 exploration results on the northern end of the mineralization. Last month’s drill program was designed to test the down-plunge extension of the gold-bearing veins in the northeast structural trend North Zone which was explored during the summer and fall of 2017. The results from the fall 2017 drilling program included 17.98 g/t Au over 5.71 m starting at 10 m below surface, 5.96 g/t Au over 5.66 m starting at 19 m below surface and, 1.88 g/t Au over 21.26 m starting at 29 m below surface.

The North Zone is located just a couple of kilometers north of the current resource at Preview SW (158,300 ounces at 1.89 g/t in the indicated resource and 270,800 ounces at 1.48 g/t in the inferred category). Drilling in North Zone which began early last month should be completed by now, and we expect to see the assay results later this month or next month.

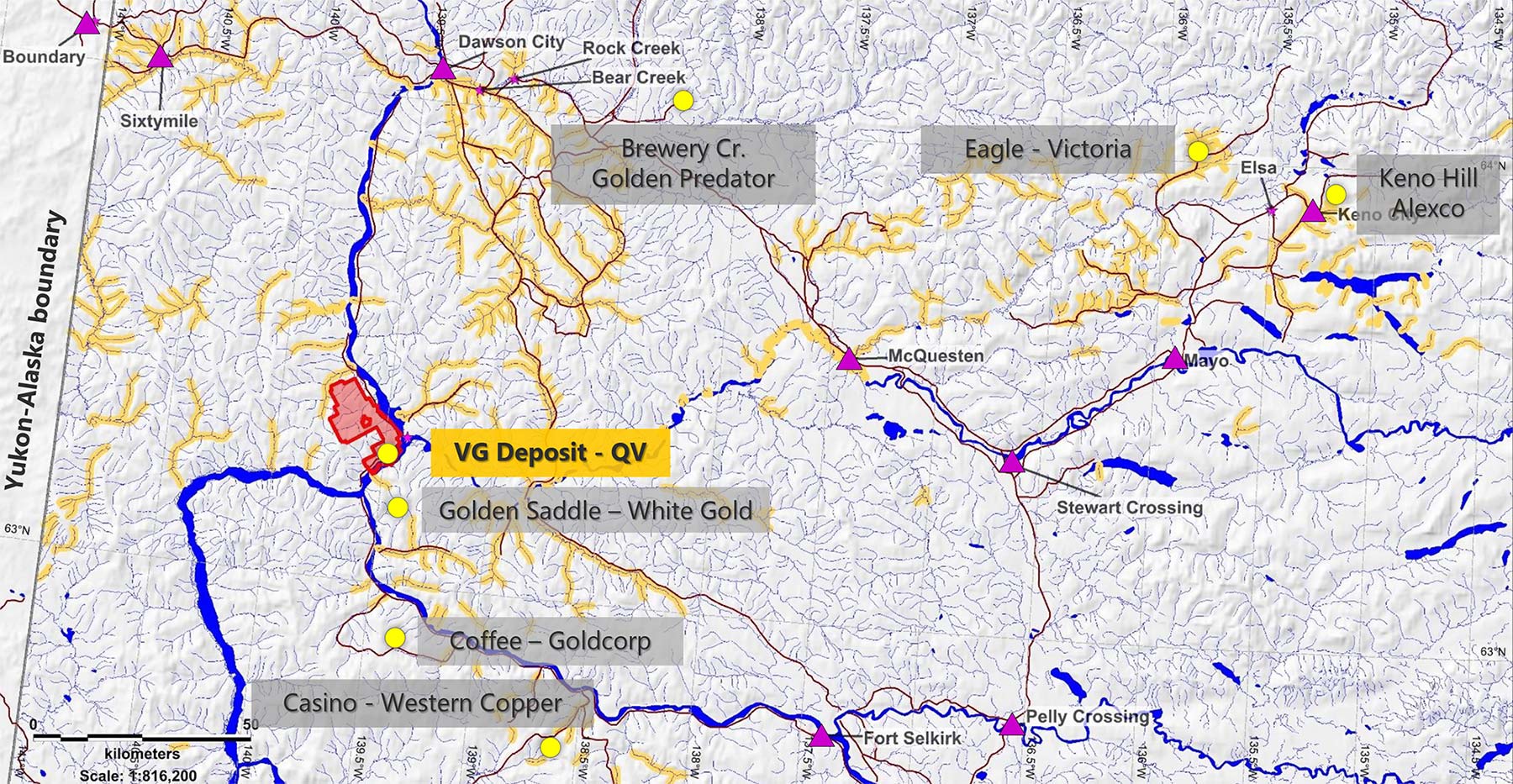

Comstock Metals also owns the QV Gold project located in the prolific White Gold district of Canada’s Yukon Territory, which is pretty much right across the river from White Gold Corp.’s (WGO.V) gold discoveries. Agnico Eagle Mines (AEM.TO, AEM) and Kinross Gold (K.TO, KGC) own about 19.5% each (approximately 39% in total) of White Gold Corp., which has been releasing some pretty impressive drill results in the White Gold district since the fall of 2018 in the area surrounding Comstock’s QV deposit. As exploration can be quite expensive in the Yukon, Comstock preferred to spend its exploration budget this past year on ‘cheaper’ regions like the Preview North Zone in Saskatchewan. No active exploration work was done on the QV project in 2018 after completing a successful 6-hole drill program in 2017, which encountered 45.5 meters at 1.42 g/t gold and successfully confirmed the deposit was extending more than 125 meters down dip from where the previous drill program ended. It is just a matter of setting priorities this past year and getting the biggest bang for its bucks.

Drilling at QV Gold Property

Drilling at QV Gold Property

Comstock’s plans for 2019

Comstock Metals hasn’t determined a final exploration budget for 2019 yet as it’s waiting for a few updates (and the results from the Preview SW winter drill program) before deciding on its capital spending for 2019. Depending on the anticipated drilling results from the Preview North Zone and available financing, Comstock is looking at further drilling and exploration on a number of projects in 2019 including its Preview SW North Zone, a drilling program on its Rawhide property (cobalt/silver), and further exploration work on QV.

At Preview SW, the drill results from last month’s drill program are anticipated to start coming in later this month or early February, and will help decide what steps, if any, Comstock Metals will take this year to expand its exploration program in the Preview North Zone.

Comstock’s official position is that it is ‘cautiously optimistic’ about the upcoming drill results as it’s basing its expectations on the results of the summer and fall 2017 exploration program as well as some very positive early feedback from Comstock’s project geologists (at Apex GeoScience).

It’s also interesting to note Comstock has been approved by the government of Saskatchewan’s Targeted Mineral Exploration Incentive scheme (“TMEI”) and will very likely receive a C$50,000 incentive payment from the government of Saskatchewan towards its current drilling program on Preview.

When we discussed the future of the QV Gold project with CEO Goldman, he mentioned;

“We are actively considering our various options for our QV deposit; whether continuing to explore QV with our own drilling exploration program, or partnering and working with other mining companies. The White Gold district has become an area of great interest by many of Canada’s leading mining companies at the moment, including Agnico-Eagle and Kinross (through White Gold Corp.) as well as Goldcorp and Victoria Gold (VIT.V). Comstock will consider all of its options to most effectively move our QV project forward and unlock value for our shareholders.”

On December 23, Comstock received its exploration permit for the Rawhide polymetallic project which is valid for 3 years. Comstock also hopes to resolve any outstanding issues with the First Nations communities in the area. Comstock wants to ensure that it respects the First Nations’ rights in the area and has been in discussions with the two First Nations communities who have been active in the area where Rawhide is located. Comstock could design additional exploration programs and perhaps a maiden drill program at Rawhide to be conducted later in 2019, subject to available financing.

Investee E3 Metals is making good progress on its petro-lithium project

We talked to Goldman about Comstock’s investment in Alberta based E3 Metals Corp. (ETMC.V) which was a move in a different direction for Comstock. Goldman provided his thoughts on why he thought a joint venture and equity interest in E3 Metals was the right move.

E3 Metals has been rapidly advancing its enormous petro-lithium project located in the Leduc Reservoir, Alberta (6.7 million tons Lithium carbonate equivalent (‘LCE’) based on three separate NI-43-101 reports). To put that in perspective, according to E3 Metals, 6.7 million tons of Lithium carbonate (if proven out) would make it the 5th largest lithium deposit in the world. As well, E3 Metals has been advancing its proprietary lithium extraction and concentration technology, to be proven out on a commercial scale.

During July, Comstock entered into a joint venture agreement with E3 Metals to explore various options in battery metals, with Steven Goldman acting as an advisor to E3 Metals.

Given the expected rapid expansion in demand for lithium in battery manufacturing in the next number of years, and given the current spot market for Lithium carbonate (LCE is trading at about US$10-11,000/t and Lithium hydroxide at about US$15,000/t), Goldman believes that E3 Metals has a potentially exceptional valuable asset on its hands.

Indeed, should E3 Metals be successful and confirm its technology could be applied on the Leduc reservoir on a larger scale, E3 Metals’ petro-lithium project could be potentially worth a lot of money if it all works out over the next 3 to 5 years as it would confirm the viability of a low-grade lithium asset.

E3 Metals currently has about 21 million shares outstanding, of which Comstock Metals owns 1M common shares. Comstock’s additional 1M warrants can be exercised to acquire an additional million common shares in E3 Metals for C$600,000.

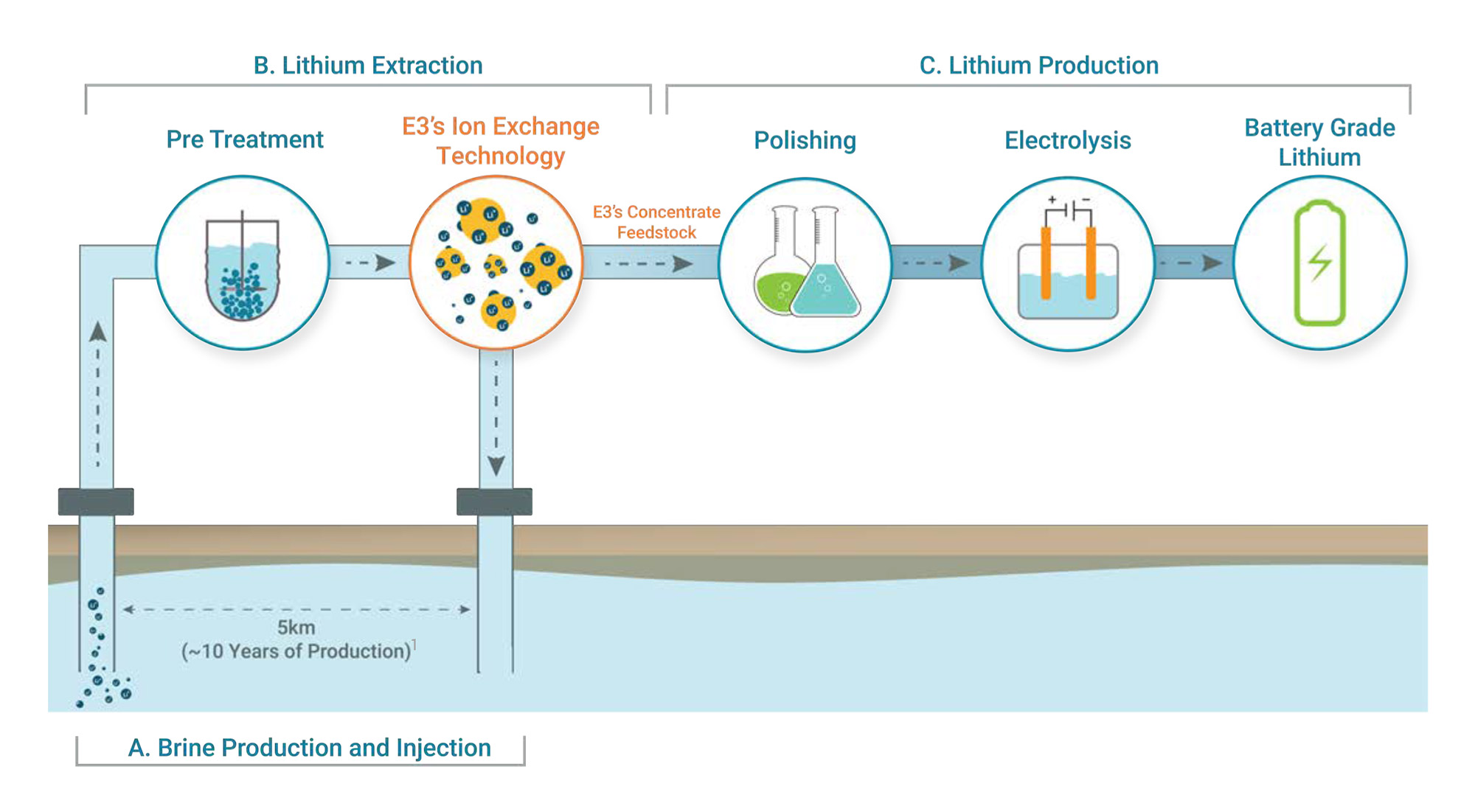

On December 4, E3 Metals released a very significant update on its proprietary petro-lithium extraction and concentration technology, after completing four test runs at its laboratory testing facility. As we explained before the average grade of the petro-brine in the Leduc Reservoir is usually very low (72 mg/L for the brine used in E3’s test work), increasing the grade was (and still is) a vital part of the plan to end up with a viable petro- lithium project in Alberta as an evaporation pond wouldn’t really work up there.

E3’s test results (in the laboratory) have definitely exceeded our expectations, as the average lithium recoveries were 90% while increasing the lithium content by an average of 1700% (!) to 1308 mg/L. These were just the averages, as E3 Metals has been able to demonstrate a recovery of up to 99% while reducing the volumes by 20 times to end up with a final grade of 1498 mg/L. And in the process, the ion-exchange sorbent removed 99% of the impurities.

This is a major step forward for E3 Metals (and Comstock Metals) as increasing the lithium grade is a key component of defining the economic viability of the project. The higher the grade, the cheaper the potential extraction and production cost. E3 Metals is now able to outline a full cycle flow sheet for the production of lithium hydroxide on the lab level.

Comstock’s CEO Goldman sounds very optimistic about the future prospects of E3 Metals:

“As a result of E3 Metals’ significant potential in Lithium carbonate and Lithium hydroxide and its technology, we believe there will be serious interest in E3 Metals’ petro-lithium asset and technology potential. Assuming E3 Metals continues to prove out its proprietary petro-lithium technology (including building a prototype plant), 2019 or 2020 could see E3 Metals find a strategic partner or enter into an off-take agreement to supply lithium carbonate or hydroxide.”

Conclusion

Under the leadership of Steven Goldman, Comstock Metals has streamlined its asset portfolio and monetized two non-core exploration properties. This allowed CSL to increase its cash position and to focus on three core mining projects: QV (gold) in the Yukon Territory, Rawhide (cobalt/silver) in Ontario and Preview SW (gold) in Saskatchewan, as well as to joint venture and invest in E3 Metals (petro-lithium). Comstock is now waiting for the drilling results from last month’s drilling program at its Preview SW gold project in Saskatchewan, with result expected to being released later this month and/or next month.

Seeing a small exploration-stage company like Comstock investing in another junior, E3 Metals, in the lithium space was an interesting move. We admit that at first, we weren’t fully convinced about this decision, but the potential upside available on E3’s potential enormous petro-lithium resource, together with the results of its proprietary extraction and concentration technology process to ‘upgrade’ the average lithium grade in the petro- lithium-brine has reduced our concerns. Now it’s up to E3 Metals to continue to advance its technology to ensure the Alberta-based petro-lithium brines can compete with the low-cost brine production in Argentina and Chile. 2019 should be an exciting year for both E3 Metals and Comstock.

Disclosure: Comstock Metals is a sponsor of the website. We have a long position.

Pingback: Comstock Metals: Becoming 'Lean and Mean' With a Focus On Its Core Properties | Investing News Network