At the beginning of this year, Contact Gold (C.V) released a maiden resource estimate on its Pony Creek project. The most recent drill program on the property was completed in 2019 and the project had become a bit ‘dormant’ while Contact Gold was waiting for the plan of operations to be approved (which happened in 2020) and the company’s attention moved towards the equally promising Green Springs oxide gold project.

Although the project hasn’t seen any drilling in over two years, Contact Gold decided to go ahead with a resource calculation anyway as it would help the market to understand the value of Pony Creek and the potential to increase the resources going forward, while being able to showcase a resource containing several hundreds of thousands ounces of gold literally within kilometers from a much larger project in the feasibility stage also has value and although it was difficult to operate without an approved plan of operations, Contact’s management pushed ahead and this maiden resource estimate is the first step to unlock the value at Pony Creek.

Markets tend to be backward looking but it’s important to understand this maiden resource is just a ‘first step’. Contact Gold has not been able to drill some of its high-priority targets yet because of the late approval of the plan of operations, and there seems to be some low-hanging fruit for the company to pick.

In this report we will use some assumptions and interpretations which we think are fair and realistic, but it is important to treat those for what they are: assumptions and interpretations and most certainly not an official guidance by the company.

Circling back to the Pony Creek project and dissecting the maiden resource estimate

Pony Creek used to be Contact Gold’s flagship project before it acquired the Green Springs project and although both projects now appear to be on equal footing, Contact’s attempts to unlock value at Pony Creek have been held back by the lack of a plan of operations before 2020. Hopefully the updated resource estimate will rekindle the investor interest in the project.

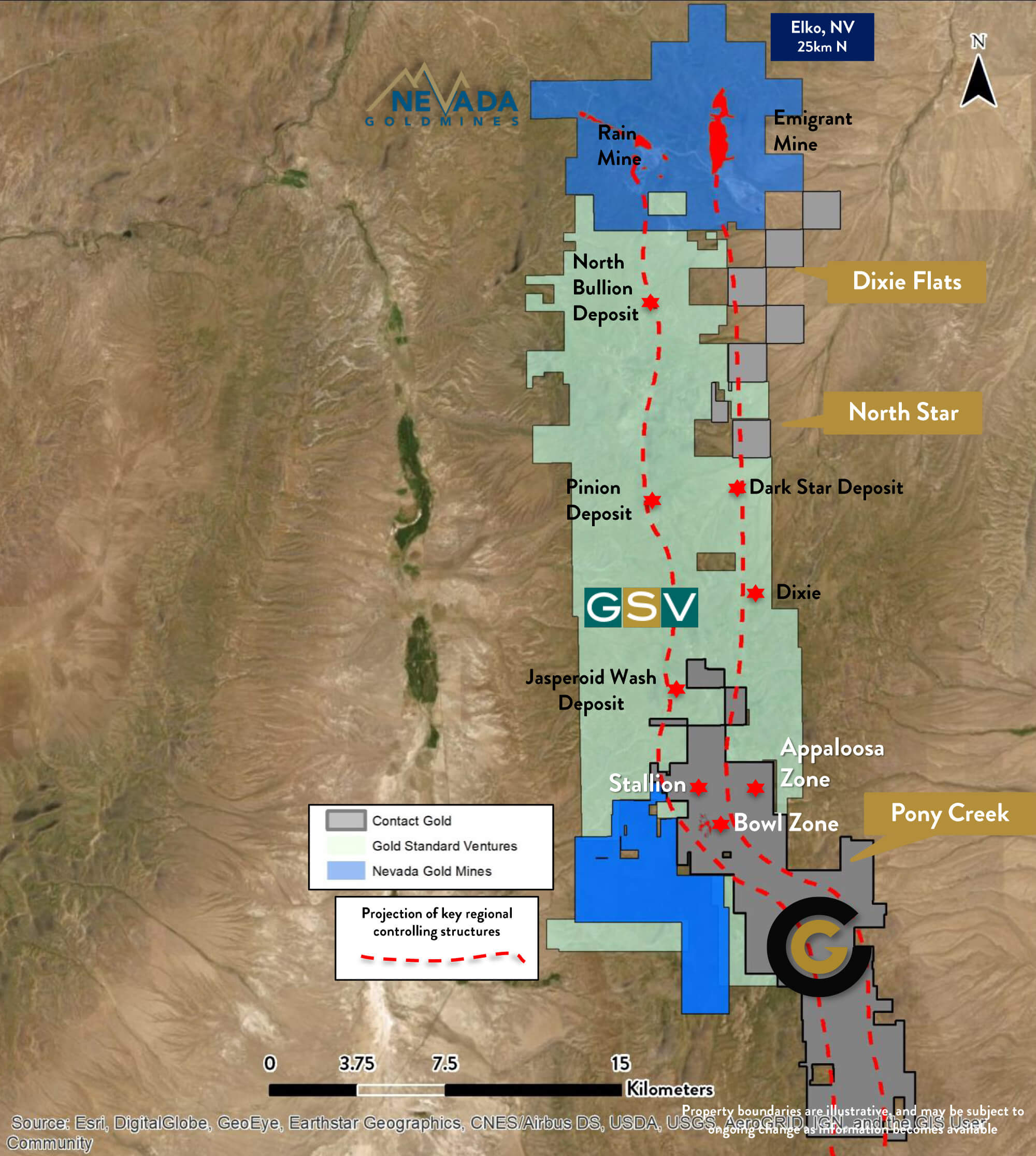

Pony Creek is located in Elko County in Nevada just about 50 kilometers southwest of Elko in the Railroad mining district where Gold Standard Ventures likely is the best-known company. The project currently consists of in excess of 20,000 acres (over 8,000 hectares). As the project is serviced by major and secondary access routes and isn’t located at a particularly elevated level, the property can be explored year-round.

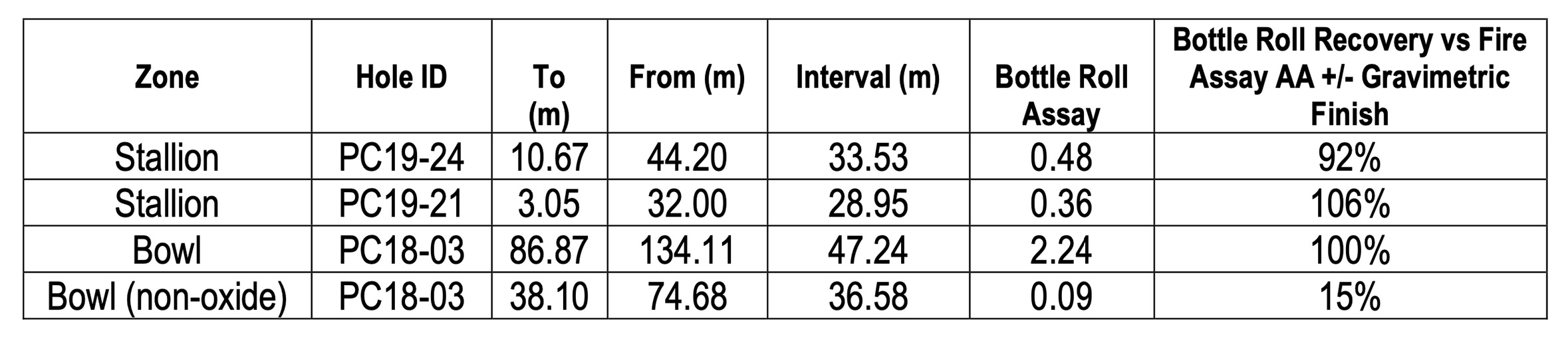

Before Contact Gold acquired the project, previous operators completed in excess of 250 drill holes (a combination of diamond and RC drill holes) for a total of 50,600 meters. In the first few years after acquiring the project, Contact Gold completed an additional 25,900 meters of drilling in 113 RC holes and 5 diamond drill holes. Contact Gold also completed a metallurgical test program on the Bowl and Stallion zones of the project. Whereas the average recovery rate for the oxide-hosted gold mineralization was approximately 85%-90% in the 2018 metallurgical test program, the recovery rates were increased to 100% at Bowl in the 2020 study while the average recovery rates of the of the gold zones in the Stallion zone came in at 92% and 106%.

You may be wondering how anyone can obtain a recovery rate of in excess of 100% as this basically means one is recovering more gold than there’s in the system. The explanation is rather straightforward as the lab results from fire assays aren’t necessarily completely correct as there always is a margin of error. Usually this does not result in meaningful differences when it comes to recovery rates but in Contact Gold’s case, the metallurgical qualities of the rock are so good that it actually shows the shortcomings of the fire assay results. The main takeaway here is that the recovery rates on both the Bowl Zone as well as the Stallion Zone will be very high for a heap leach project.

Based on the excellent recovery rates obtained from the metallurgical test program, Contact Gold’s independent consultants were able to use a cutoff grade of 0.15 g/t for the oxide-hosted gold and 0.22 g/t for transitional and non-oxidized rock. The cutoff grade for the latter is higher as the gold will likely have to be recovered using a VAT leach approach.

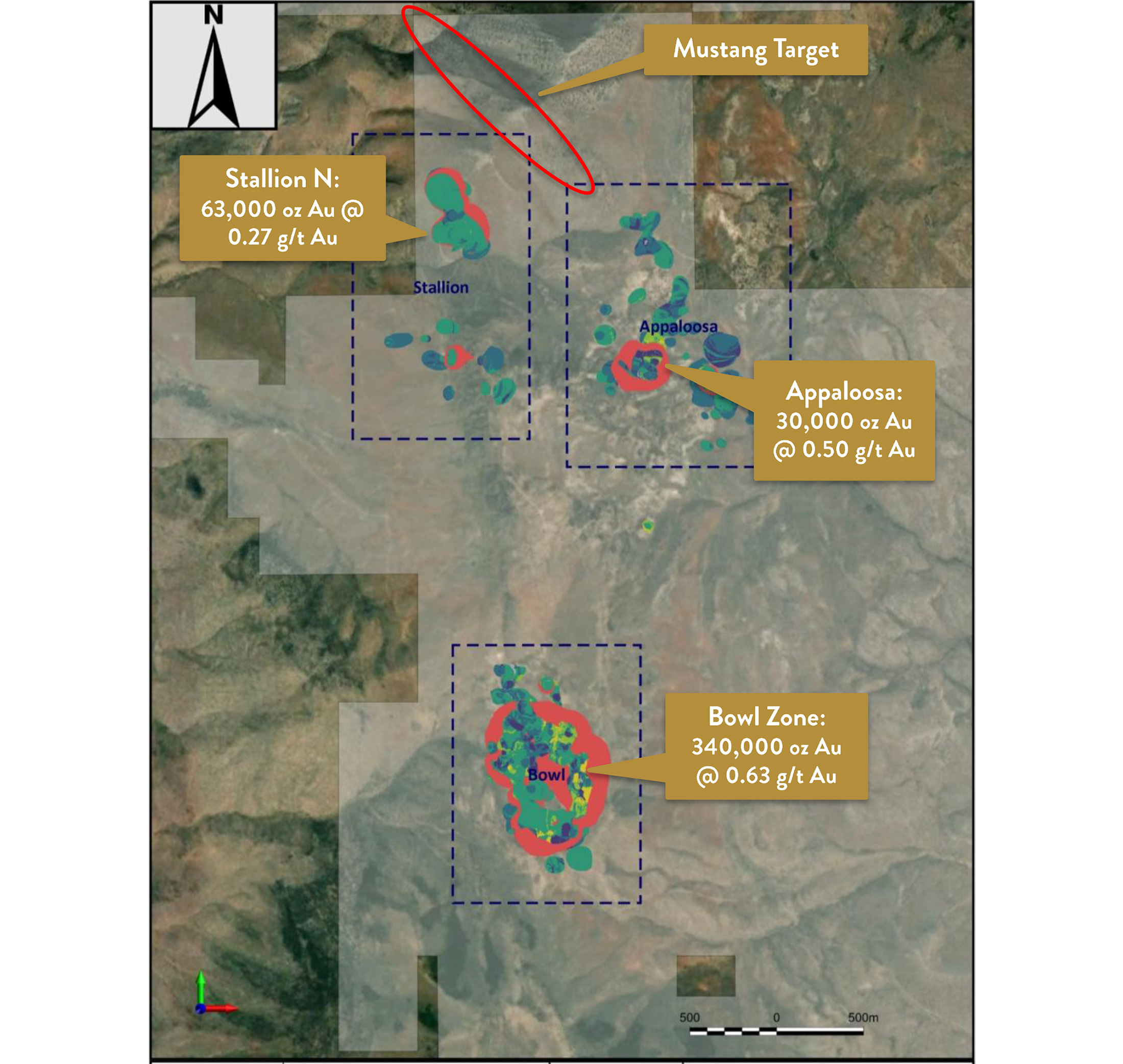

The maiden resource estimate contains a resource calculation on three separate zones of the Pony Creek project. The Bowl Zone is by far the most important zone, and it currently hosts just under 17 million tonnes at 0.63 g/t for a total of 340,000 ounces of gold. The Appaloosa and Stallion Zones are substantially smaller with a total amount of contained gold of just 30,000 ounces and 63,000 ounces respectively but looking at the maps there appears to be a lot of low-hanging fruit around both Appaloosa and Stallion. As you can see in the image below, the drill bit has intersected more mineralization directly adjacent to the pit outline, but substantial portions of those areas have not made it into the resource calculation due to a lack of drill density.

While we don’t want to speak out of turn, it looks like it should be rather easy to rapidly expand the inferred resources at both Appaloosa and Stallion. There also appear to be excellent opportunities to grow the resources at the Bowl, Appaloosa and Stallion through step out drilling, as all three resource areas remain open.

And these are just three of the multiple targets on the Pony Creek project. Other areas of interest would be the Pony Spur, Palomino, Mustang and Elliott Dome targets. The last two have not been drilled yet, and boast strike lengths in excess of 1 km.

A very preliminary look at the (potential) economics

While the grade appears to be low, keep in mind those grades are perfectly normal for a heap leach mining scenario. As the gold is captured in oxidized zones, it should leach pretty well and preliminary bottle roll tests in 2020 have confirmed good leaching features of the rock.

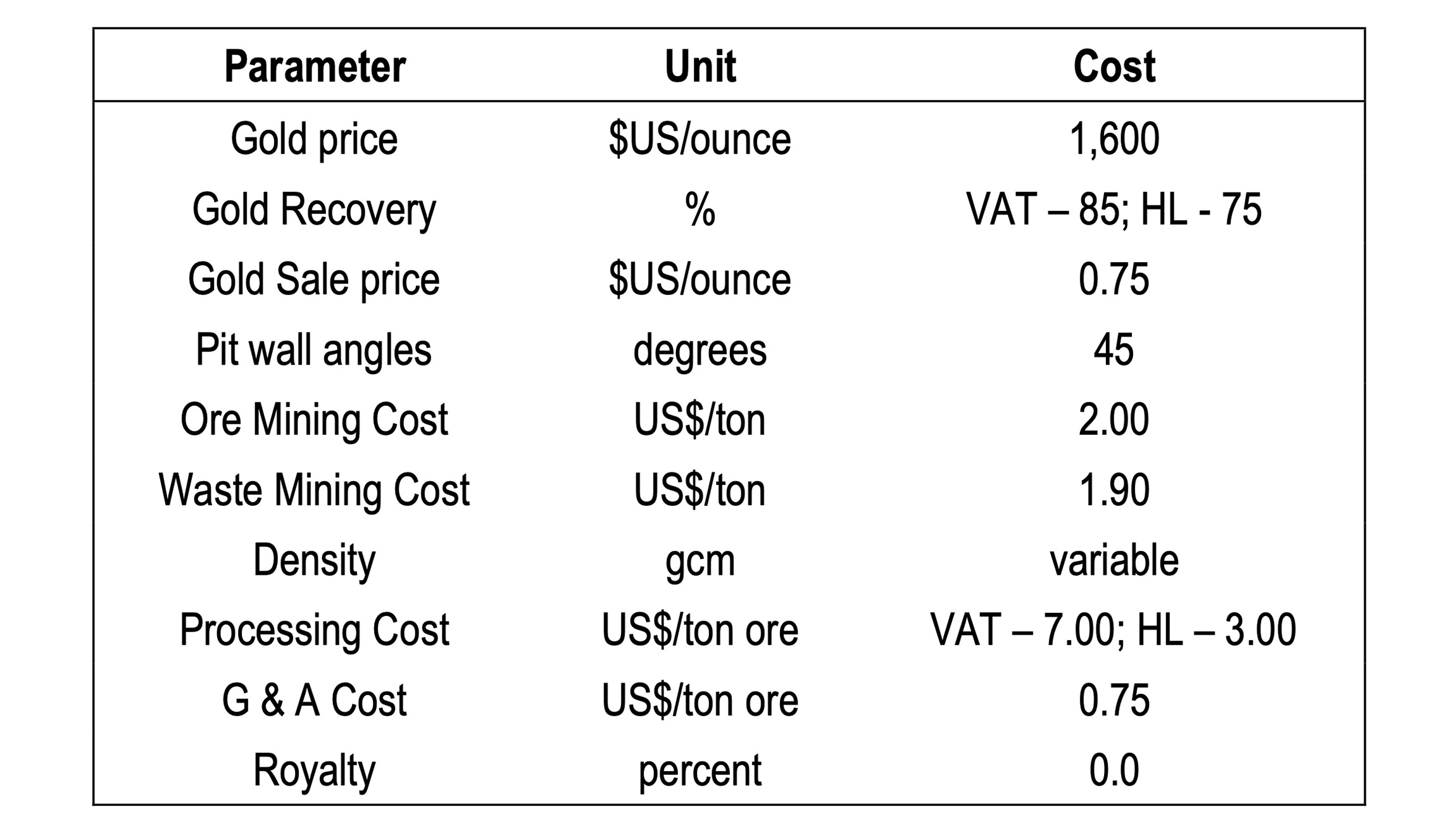

This means Contact Gold won’t have to build an expensive mill and tailings facilities which means the required size and grade of a deposit doesn’t have to be high. To explain this, we worked on a very simplified back-of-the-envelope calculation of potential economics to determine the average production cost per ounce of gold. Of course Contact Gold is still quite a while away from reaching the PEA stage at Pony Creek as it will likely want to update the resource first before committing to a PEA, and this means you should take our calculations with a grain of salt as they are just merely meant to explain how a low-grade oxide deposit could be viable.

The resource estimate was based on a pit outline using a 45-degree pit wall angle and a mining cost of US$2/tonne. The processing cost is estimated at US$3/tonne for a heap leach operation and the average recovery rate used in that scenario is 75% for the gold. VAT leaching is also an option and the decision will fully depend on a cost/benefit calculation. The VAT process has an operating cost of US$7/t which is more than twice as high as the heap leach cost per tonne, but in a VAT scenario the average gold recovery rate is 85%. It all boils down to the size of the project: the larger the project resource will end up being, the more sense it makes to pursue VAT leaching. And of course, the non-oxide gold zones will have to be processed using VAT.

This makes things slightly more complicated as the technical report does not provide a clear distinction between oxide and transitional zones. This means we will work with averages. That’s not entirely correct, but remember the purpose of these calculations are explanatory and not intended to build a reliable model at this stage. Working with averages means we will use an average recovery rate of 78% (we are using a 60/40 ratio of oxide versus transitional mineralization) the final recovery rate to be higher than this given the successful metallurgical test results in 2020). We will also use a 60/40 split between the VAT and heap leach operating costs and thus end up with an average processing cost of $4.2/t. Keep in mind that this likely overestimates the true anticipated operating expenses as we would expect the majority of the resource to be oxide-hosted.

We are using a strip ratio of 3:1 (the real strip ratio was not included in the technical report so you should also take this ratio with a grain of salt until we see an official number communicated by the company)and that results in the following calculation for the operating expenses:

An operator will have to dig up 4 tonnes of rock to get to 1 tonne of paydirt (3 tonnes waste, 1 tonne paydirt) and at an operating cost of $2/t, this will cost about $8 per processed tonne.

The processing cost is coming in at $4.2 per tonne and using a G&A cost of $0.80 per tonne results in a total operating cost of $13 per tonne of processed rock.

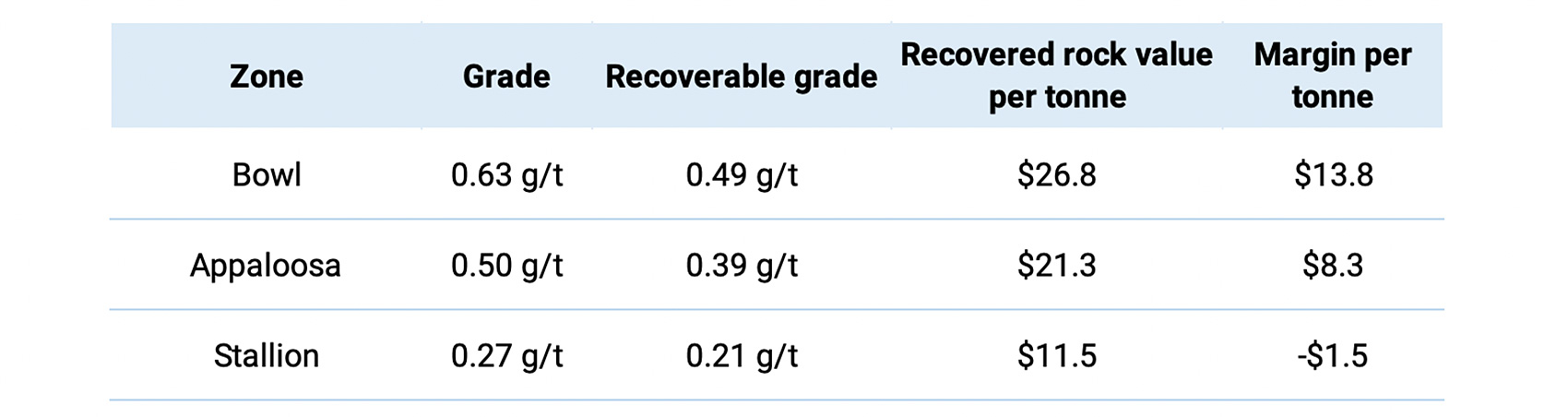

We also know the average grade of the deposits as well as the recovery rates and using a gold price of $1700/oz, we calculated the average recoverable rock value per tonne.

Of course this is a back-of-the-envelope calculation based on assumptions. The higher the ratio of oxide versus transitional rock is, the higher the margins likely will be. We also assumed a flat 3:1 strip ratio but this will obviously not consistent in all zones. That’s also why you shouldn’t read too much into the negative margin per tonne at Stallion. If the strip ratio there would for instance be 2:1, the negative margin would immediately turn positive. There are a lot of moving parts, and we are just using assumptions.

Of course the calculations above are based on Pony Creek as a standalone operation and are only discussing the potential margins per tonne. As Pony Creek is still lacking the critical mass to be developed as a standalone operation, it’s perhaps useless to already start thinking about capex and sustaining capex right now. Not having the desired size yet doesn’t mean Pony Creek should be ignored. We still think the project will eventually be progressed along with Gold Standard Ventures’ (GSV, GSV.TO) Railroad-Pinion project. The Jasperoid Wash and Dixie zones at Railroad-Pinion are literally within walking distance from Pony Creek and in a perfect world the Pony Creek resource could be a satellite deposit to Railroad-Pinion. After all, if someone is already putting in the infrastructure to develop and mine a similar project just a few kilometers further north, it only makes sense to see the assets as one larger ‘district’ and a conveyor belt could for instance get the rock from the Pony Creek pits to the central processing facilities at Railroad-Pinion. It makes even more sense when seeing the mine life at Railroad-Pinion is currently just eight years so adding additional ounces to that mine life will help make the sunk costs (the initial capex) more palatable.

Of course, this isn’t an ideal world and it’s not because something makes economic sense that it will happen. This is the mining sector and money and egos can get in the way. But from a purely theoretic perspective, it makes sense to co-develop the properties and a resource of 433,000 ounces of gold will surely have some value to the neighbours.

The Jasperoid Wash target on the Railroad-Pinion project has a current resource estimate of 10.6 million tonnes at an average grade of 0.34 g/t. That’s rather small and low-grade so the nearby Bowl Zone which has twice that grade could offer some serious synergy benefits in a co-development scenario.

Conclusion

Publishing a maiden resource estimate on the Pony Creek project is a positive achievement by Contact Gold. While some investors may have been disappointed to see a substantial decrease of the size of the resource compared to the historical resource, it’s important to put things into perspective as there’s a reason why companies have to follow a strict process under the NI43-101 rules. Also keep in mind this really is just a ‘first pass’ as Contact Gold was hindered by the lack of an approved plan of operations. This means the company had very limited drill options and so far was unable to drill in all the spots it really wanted to drill-test.

The plan of operations was approved in 2020 and this will allow additional flexibility for Contact Gold to (hopefully) rapidly add ounces in future drill programs as the company has gotten a good understanding of the mineralization and several zones that were drilled but without the drill density required for a resource estimate could more easily be drilled now to rapidly expand the resource.

The 433,000 ounces at Pony Creek are just the start and although Contact Gold still has plenty of work to further advance the project, it does provide for a juicy satellite target for neighbour Gold Standard Ventures which published a feasibility study on the adjacent property showing a mine life of just 8 years in its definitive study. If a satellite deposit could extend the useful mine life by a few years it would and should be something Gold Standard Ventures want to keep close tabs on

Disclosure: The author has a long position in Contact Gold. Contact Gold is a sponsor of the website. Please read our disclaimer.