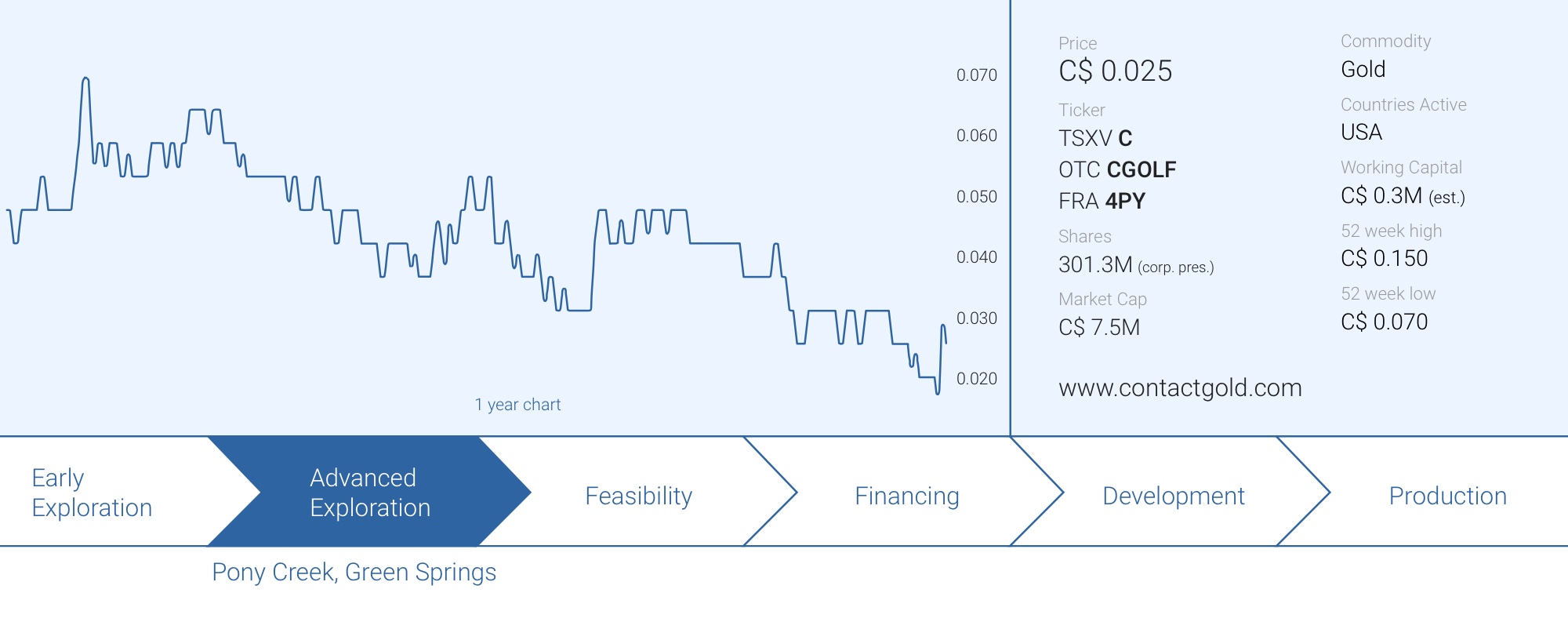

Situations change. Contact Gold (C.V) was stuck between a rock and a hard place as its share price has been sliding down all the way to just two cents for a market capitalization of C$6M. So what’s the plan? Issue 100 million new shares at that price to get another drill program underway? Complete a roll-back and then raise cash (which would have the same dilutive effect)?

The simple reality is that there was no good solution. The properties needed the exploration dollars, but Contact Gold’s treasury was starting to run on empty. An attempt to raise money at 5 cents per share during the summer didn’t work out, and Contact Gold had to back to its drawing board to figure out its future.

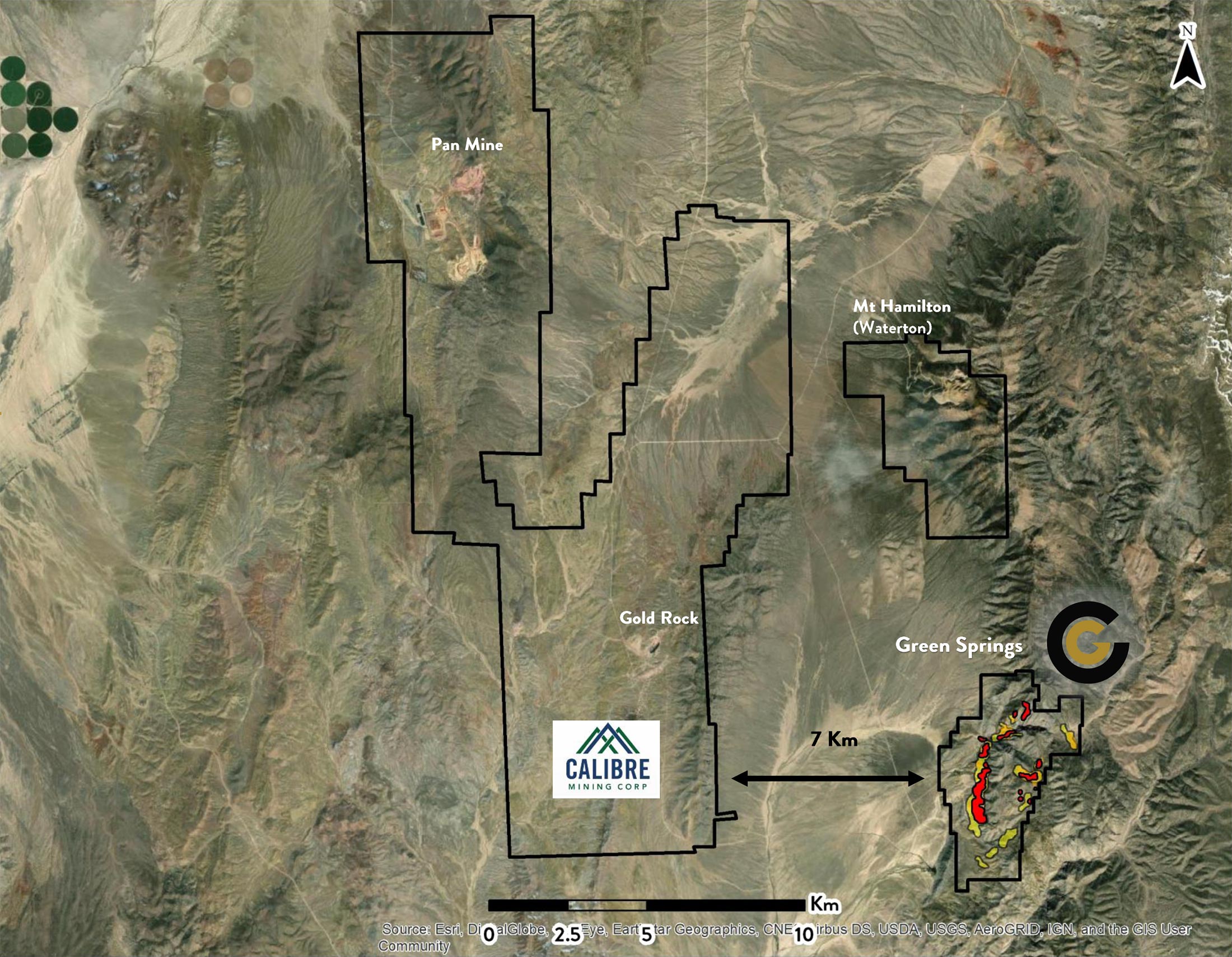

That’s why the recently signed agreement with Centerra Gold (CG.TO, CGAU) isn’t such a bad deal. It definitely is not what we had anticipated when Contact Gold acquired the Green Springs project, but given the current circumstances, it very likely was and is the best solution to continue to advance the project while retaining a meaningful stake in the project.

Explaining the deal

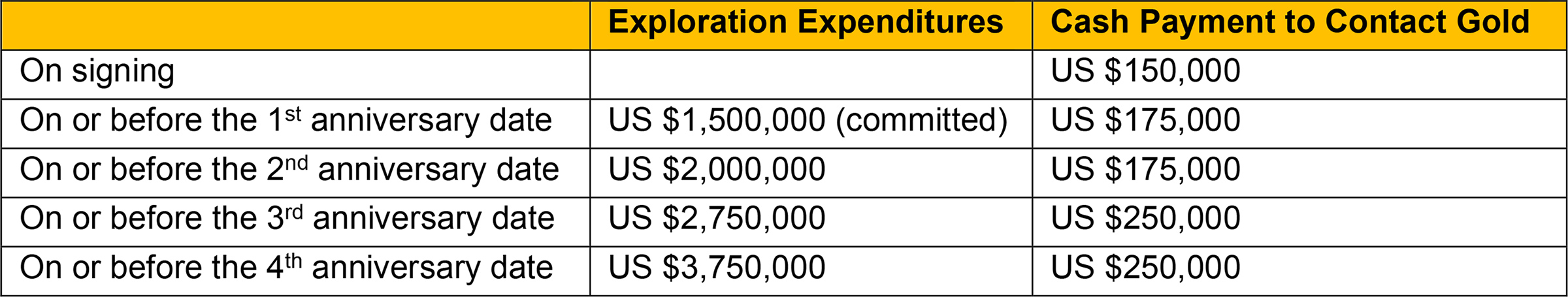

The agreement between Contact Gold and Centerra Gold is actually very straightforward. Centerra Gold is required to invest US$10M in exploration and make US$1M in cash payments to Contact Gold to earn a 70% stake in the project. Spending a single dollar less than that US$11M requirement will result in Contact Gold retaining full ownership in the project.

The exploration commitments and cash payments to Contact Gold are well-spread out in time. Contact received US$150,000 (approximately C$0.2M) in cash upon signing the agreement, and will receive another tranche of US$175,000 in one year from now. Meanwhile, within that first year, Centerra Gold has committed to spend US$1.5M on exploration at Green Springs.

We are particularly pleased with the annual step-up in the required exploration expenditures. In the third year of the option agreement, Centerra needs to spend US$2.75M. That’s almost C$4M and you can get quite a bit of RC drilling done with that type of budget. And as Contact Gold will be the operator of the exploration programs, it will likely earn a few hundred thousand dollar per year in operator fees.

All things considered, this is an extremely simple and straightforward earn-in agreement. Centerra needs to cough up approximately C$15M to obtain a 70% stake in Green Springs. When that happens and Centerra formally notifies Contact Gold it has completed the earn-in requirement, both companies will advance the project in a 70/30 joint venture. Should Contact Gold elect to dilute its stake in the project by no longer contributing to the joint venture, it will end up with a 1.5% Net Smelter Royalty if its stake gets diluted to less than 10%.

Sitting down with Matt Lennox-King

We had a chat with CEO Matt Lennox-King to discuss the agreement with Centerra and to get some more color on the decision and the path going forward.

How long has this deal been in the works? And could you elaborate on why Centerra Gold is a good partner for Contact Gold (other than its very strong net cash position)?

The deal has been in the works for a while. We know the Centerra team well, dating back to our time in Turkey with Fronteer and Pilot Gold. Vance and George both worked for Centerra back in the day as well.

Centerra have been making a strong move back into Nevada over the past few years (with for instance the acquisition of its Goldfield District project and the option agreement with Viscount Mining), and importantly, have a lot of confidence in our team and our approach to exploration. This goes a long way to creating good alignment between the partners.

You surely must have discussed the project and upcoming 2023 drill program with the technical people at Centerra Gold. Are all noses pointing in the same direction when it comes to the exploration approach?

The goals and approach are well aligned for 2023 and we expect to publish our exploration plans for 2023 in January.

According to our interpretation of the agreement, it appears to be an ‘all or nothing’ deal for Centerra. Is our assumption correct that if Centerra walks at any given time before completing the US$10M In exploration and US$1M in cash payments, you will retain a 100% interest in the project?

That’s correct. It’s an all-or-nothing proposition, there are no increments on the way to 70% so either Centerra spends US$10M on the project or it ends up empty-handed.

Let’s say for the sake of argument another company had been contemplating looking at Green Springs as you have multiple neighbors. Is there any way any of those companies can come knock on your door and cancel the agreement with Centerra?

The way the agreement is drafted precludes anything like that from happening. To gain access to the project a 3rd party would have to successfully bid for Contact Gold and take it from there as Centerra’s new partner.

May we assume Contact Gold is the operator of the upcoming programs and as such, will earn a 10% operator fee?

Correct. We are the operator for 2023 at least, and will likely be for the full 4 years. And as a side note; there is a bit of a sliding scale on the management fee, but, on most expenditures it is 10%

Does Centerra have a ROFR or right to match on the remaining 30% stake in the Green Springs Project?

No – it becomes a standard 70-30 JV with typical dilution provisions.

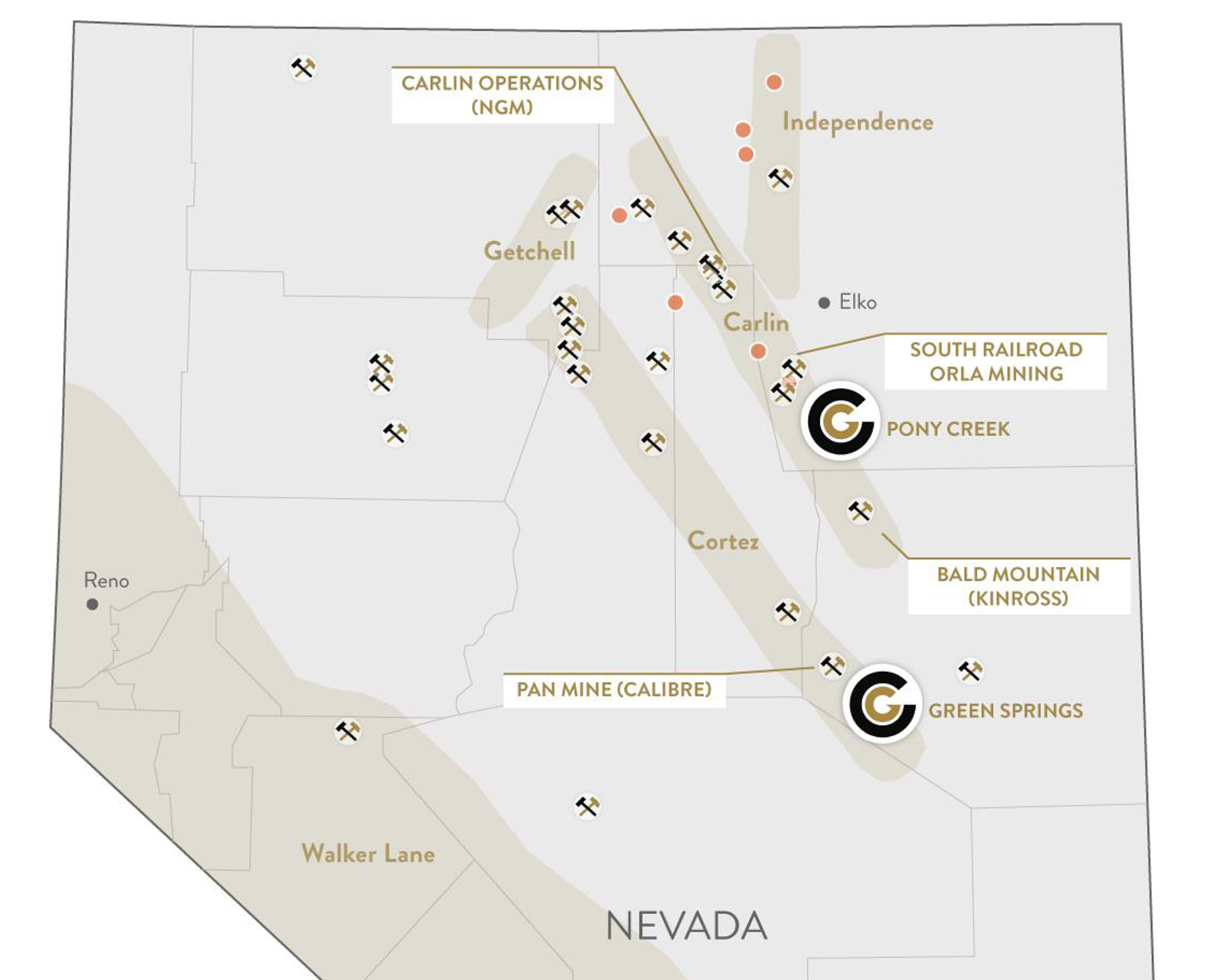

Has Centerra Gold also kicked the tires of Pony Creek? We think Orla Mining (OLA.TO, ORLA) still is the most logical buyer/partner for Pony Creek but perhaps seeing a third party sniff around may heat up the interest in the property.

Good question! We’ve had a lot of visitors at Pony Creek over the years. I agree the most logical suitor for Pony is the neighbours, Orla, previously GSV. Logic doesn’t always win out though…

Would you consider doing a similar deal on Pony Creek, or would you prefer an ‘all or nothing’ deal there?

We’re open to different scenarios on Pony Creek, whether that’s funding the resource growth ourselves, bringing in a partner in a similar deal to the Green Springs deal, or contemplating a deal for 100% either project level or corporate level…really comes down to where we see the most value.

Conclusion

Centerra Gold is committing to spend C$15M on Green Springs to earn a 70% stake in the project. As that represents about 2.5 times Contact Gold’s own market capitalization before the deal was announced, it would have been very difficult for Contact Gold to have come up with that much cash on its own.

Could Centerra Gold walk away from the deal in ten months from now after having spent US$1.5M? Yes, absolutely. They are big boys and if a project doesn’t meet their criteria they won’t be scared to cut their losses and walk away. But even in this worst-case scenario (or perhaps, for some investors, this would be a best-case scenario), Contact Gold will have bought time and will have spent about C$2M of someone else’s cash. And perhaps the markets will improve and allow Contact Gold to raise cash to self-fund future exploration activities in the theoretical scenario Centerra would walk.

The bottom line is: whether or not Centerra completes the earn-in program and spends US$10M on exploration or not, Contact Gold is likely better off in the long run. If Centerra Gold spends US$10M on exploration over the next few years, there will be a good enough reason to do so and Contact Gold will basically be carried in the near future. And if Centerra decides to walk, that’s fine as well as Contact will retain 100% ownership and have access to more useful data it can use to advance the project by itself.

But for now, the default assumption should be that Centerra Gold will complete the earn-in option and Contact Gold will be left with a 30% stake in the project.

Disclosure: The author has a long position in Contact Gold. Contact Gold is a sponsor of the website. Please read our disclaimer.