Contact Gold (C.V) has been doing everything right: it got rid of the preferred shares and was able to raise C$8M on top of what was needed to make the preferred share class disappear. The cash is being put to work on the Green Springs gold project in Nevada where the company continues to release good drill results, but Contact Gold just doesn’t seem to be getting any love from the market.

Undeservedly so, as the current market cap of just over C$25M would perhaps be fair (but still on the lower end for Nevada) for just one of the flagship projects but not for the combination of the two main properties (Pony Creek and Green Springs) and the early stage exploration properties in the portfolio.

The recent drill results at Green Springs

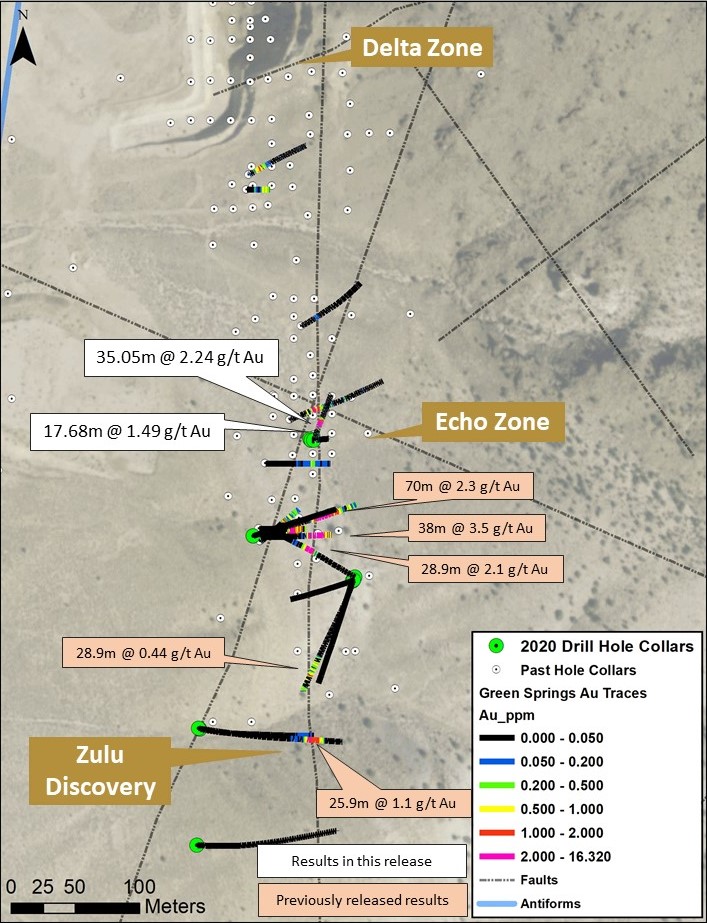

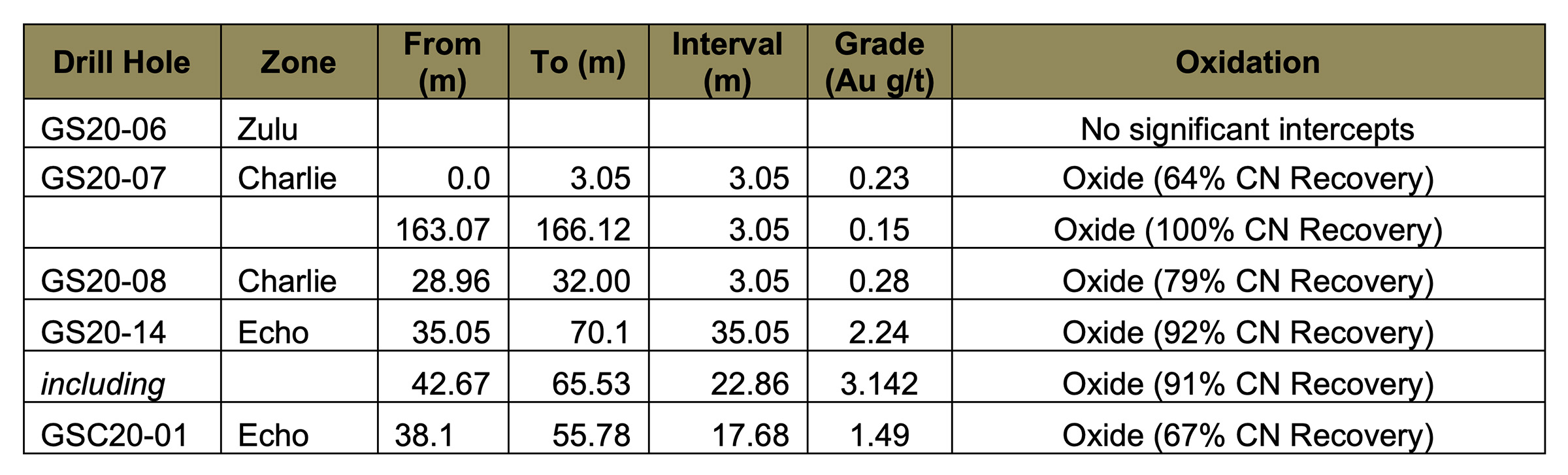

Last week, Contact Gold reported on the assay results of an additional five holes part of the 41 hole drill program at Green Springs (10 core holes and 31 RC holes for a total of just under 5,800 meters).

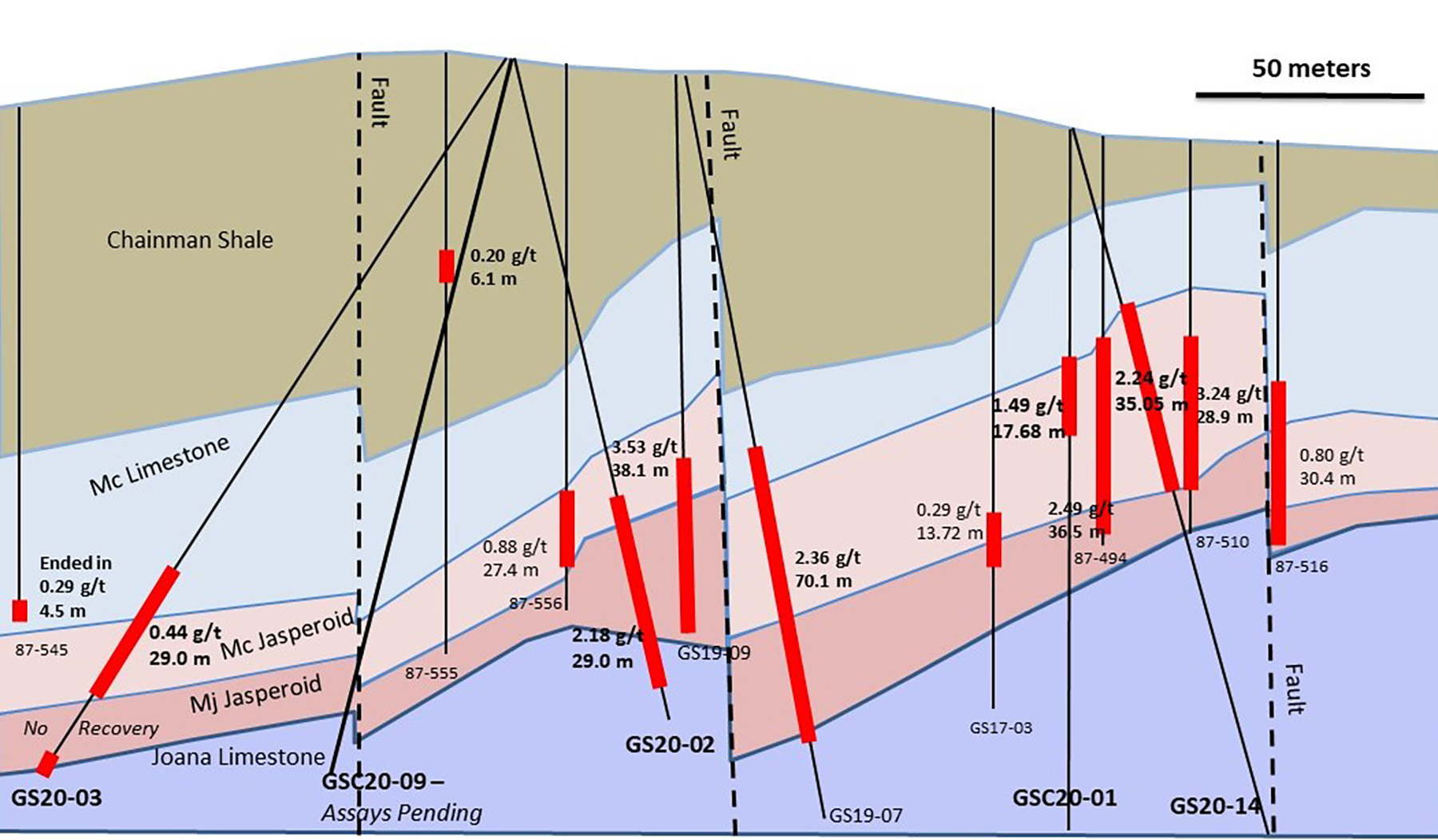

The assay results from the Echo zone look most promising with 35 meters containing 2.24 g/t gold in an RC hole (starting at a depth of just 35 meters down-hole) while a core hole on the Echo Zone encountered almost 18 meters at 1.49 g/t gold, also in oxide. The cyanide recovery in the core hole was a bit low which could be explained by the hole hitting a less oxidized parts of the mineral body.

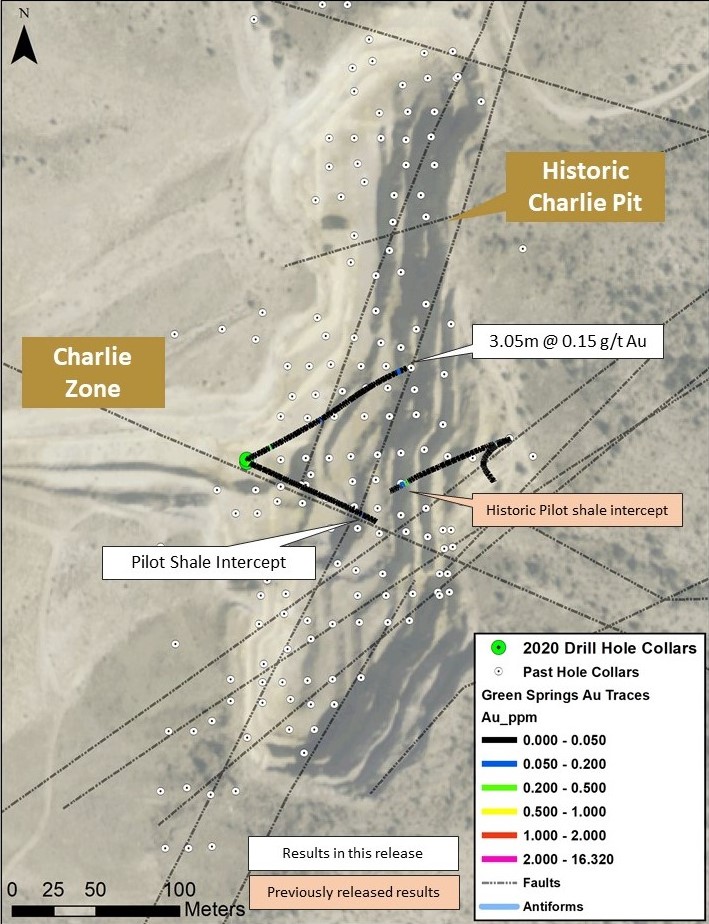

Contact Gold also completed two holes on the Charlie zone and while the assay results of 3 meters of 0.23 g/t gold, 0.15 g/t gold and 0.28 g/t gold are pretty low, the main takeaway from these results is the fact the pilot shale appears to be mineralized. And that was a major part of Contact Gold’s exploration theory. Although the Green Springs project is a past-producing gold project, the lower Pilot Shale horizon remained underexplored and these first drill results appear to be very encouraging to further drill-test this theory and chasing higher grade material.

It looks like Contact will have to revert to core drilling to continue its methodological drill-testing of the Pilot shale as the Joana limestone layer appears to be quite cavernous which makes RC drilling less reliable.

The company is now fully cashed up

At the end of Q3, Contact Gold (C.V) had closed its underwritten offering which ultimately resulted in the company issuing almost 74M units at C$0.20 to raise a total of C$14.8M. Each unit consisted of one share as well as half a warrant with each warrant entitling the warrant holder to acquire an additional share of Contact Gold at C$0.27 over a two year period.

C$5M of the offering was used to redeem a portion of the preferred shares while Waterton also subscribed for C$13.4M in new shares priced at C$0.195 per share, which will subsequently be used by Contact to redeem the remaining preferred shares. This means that ultimately, Contact Gold issued around 136M common shares, retained about C$8.7M in cash from the placements while getting rid of almost C$20M in liabilities related to the preferred shares. Not having to deal with that liability on the balance sheet will increase the flexibility of Contact Gold as this move substantially de-risks the company: should Contact have defaulted on the full repayment of the preferred shares (and accumulated interest payments) when they became due in 2022, Waterton could theoretically have seized Contact’s assets.

That issue has now been averted and not only did Contact erase all preferred securities, the company also took advantage of a financing window in the market to really fill up its treasury. When the entire refinancing operation was completed, Contact Gold ended September with about C$8M in cash and a working capital position of just over C$7M, giving the company plenty of fire power to complete its Green Springs drill program and perhaps consider doing something on the Pony Creek project, bordering Gold Standard Ventures (GSV, GSV.TO).

Conclusion

In hindsight, it looks like Contact Gold timed its capital raise very well. It was able to complete the raise at C$0.20 per share and the recent share price of C$0.11 represents a discount of 45% to the price the new shares were issued at. This also means that despite the increased share count (almost 241M shares), the market capitalization of Contact Gold is now just over C$25M which appears to be on the lower end of the spectrum for a Nevada-based exploration company with about C$8M in cash and two projects with merit. With the various investor rights agreements, management holdings and long holders in names like Newmont, 50% of those 241M shares effectively do not trade giving a better looking float number of 120M shares.

We aren’t sure what else Contact Gold can do to signal the market it’s sitting on two promising projects. Sure, the grades at Pony Creek the past few years haven’t been really exciting but now the plan of operations has been approved Contact Gold will have much more flexibility to design potential future drill programs at Pony Creek.

As Pony Creek has been ‘downgraded’ to the second project in the portfolio, the drill results from the Green Springs project will remain a main catalyst for the share price but if a stunning result of in excess of 35 meters containing 2.24 g/t gold doesn’t help to move the market, we aren’t sure what will move the market. Sure, Green Springs will never be a huge project (1-1.5 million ounces as exploration target seems pretty reasonable) but if a resource of 0.7-1 million ounces at 1 g/t gold could be outlined, Contact Gold should consider completing a PEA on the Green Springs project as the publication of an official NPV could perhaps put a bottom under the company’s valuation.

Contact Gold has been doing the right thing by eliminating the preferred shares, raising money and releasing good drill results from Green Springs and it’s terribly frustrating to see the company’s share price trading close to its multi-year lows. But with 31 more drill holes worth of results to come, there is still an opportunity to see its share price appreciate.

Disclosure: The author holds a long position in Contact Gold. Contact Gold is a sponsor of the website. Please read our disclaimer.