It’s hardly a secret Contact Gold (C.V) has been struggling for a while. The company started trading in 2017 at an issue price of C$1 (the last private round was conducted at C$0.50 per share and senior gold producer Goldcorp participated in the C$1 going public round) but has lost about 98% of its value versus the IPO price. An abysmal performance which was likely caused by a number of factors.

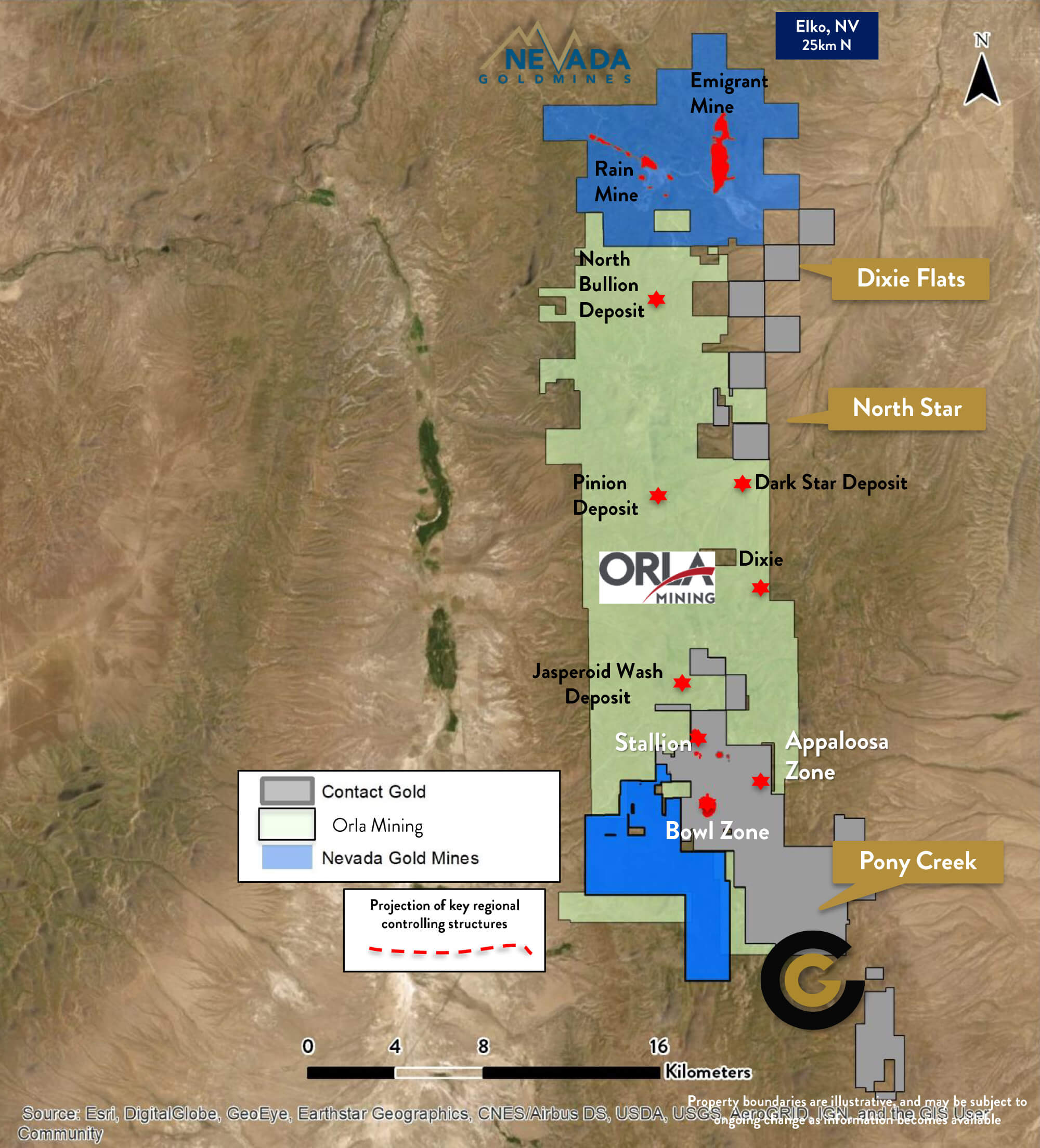

The flagship Pony Creek project took a bit more time and effort to bring to a NI43-101 compliant resource estimate and the sale of Gold Standard Ventures to Orla Mining has complicated things a little bit. While we are still convinced it makes sense for Pony Creek to be developed jointly with the Jasperoid Wash zone on Orla Mining’s (OLA.TO, ORLA) Railroad-Pinion land package, there is no guarantee a deal, any deal will occur. It would make a lot of sense given the proximity, the continuation of the mineralized trend and the permitted drill targets at Pony Creek now the Bureau of Land approved the plan of operations in 2020. That was a major milestone for the project and will make future drilling more efficient.

Contact Gold swiftly changed gears and acquired the Green Springs gold project elsewhere in Nevada. A good move as exploration is possible on a year-round basis. Unfortunately the market didn’t care too much either although Contact Gold was able to attract mid-tier producer Centerra Gold (CG.TO, CGAU) as joint venture partner. Centerra Gold is currently spending US$10M on exploration and US$1M in cash payments to obtain a 70% stake in the project.

The most recent reason we heard to explain the weak performance of Contact Gold was the presence of Waterton as a large shareholder. Waterton owned just over 100 million shares of Contact Gold for an ownership stake of almost 30%. Some investors felt this was a prohibiting block of stock making Contact Gold less appealing to invest in, and less appealing for other companies to try to work out a strategic deal.

Contact Gold has been working behind the scenes to find a buyer for the block owned by Waterton and announced in the final week of April a consortium of buyers had stepped up the plate and crossed out Waterton’s position. Let’s hope this deals with the perceived risk of having Waterton as the company’s largest shareholder as the current market cap of the company is less than half of what Centerra Gold is required to spend to obtain a 70% stake in Green Springs.

Waterton selling out

Contact Gold has confirmed its large shareholder Waterton Precious Metals has sold its entire position in Contact. Apparently there was a diverse group of buyers described by Contact Gold as ‘experienced precious metals investors’ and ‘insiders’ that took down the entire block of just over 100 million shares at a price of C$0.015 per share for a total consideration of C$1.5M.

Although Contact Gold acquired its Pony Creek property from Waterton (which is how Waterton ended up with a block of Contact stock), it felt like the presence of Waterton with a controlling block of stock (the initial position of Waterton in Contact increased after the conversion of the preferred shares into common shares) was holding the stock back. With the 100M+ share overhang removed and the controlling block of shares now redistributed into the hands of new and existing shareholders, let’s hope Contact Gold’s upcoming drill program at Green Springs (funded by joint venture partner Centerra Gold) will spark a renewed interest in the stock.

The upcoming drill program at Green Springs

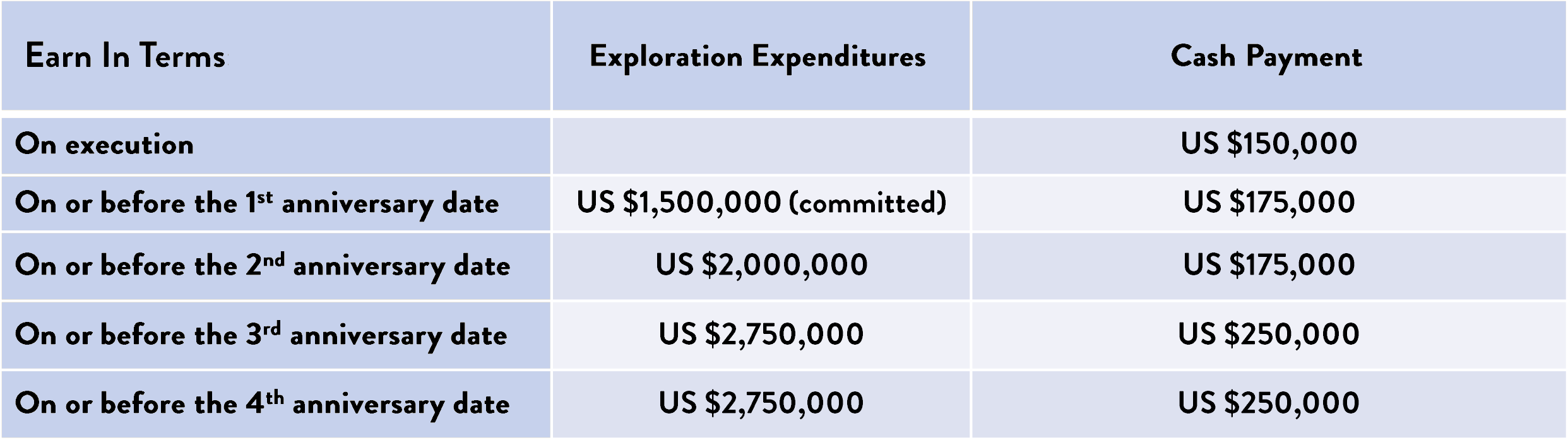

The company recently released the initial plans for this year’s exploration program on the Green Springs gold project in Nevada. As a reminder, Centerra Gold (CG.TO, CGAU) is currently earning a 70% stake in the project by making US$1M in cash payments to Contact Gold while completing US$10M in exploration and work commitments.

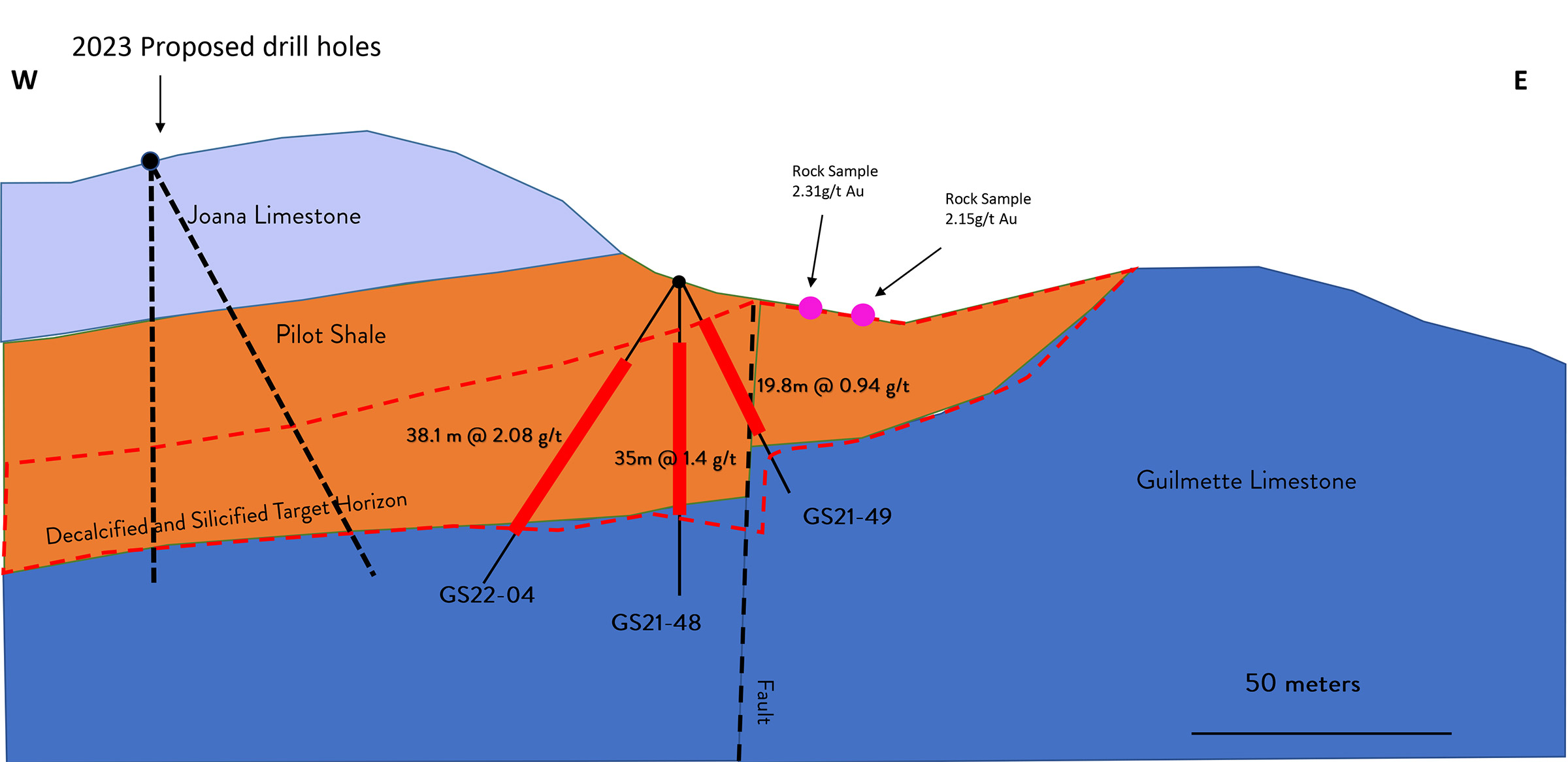

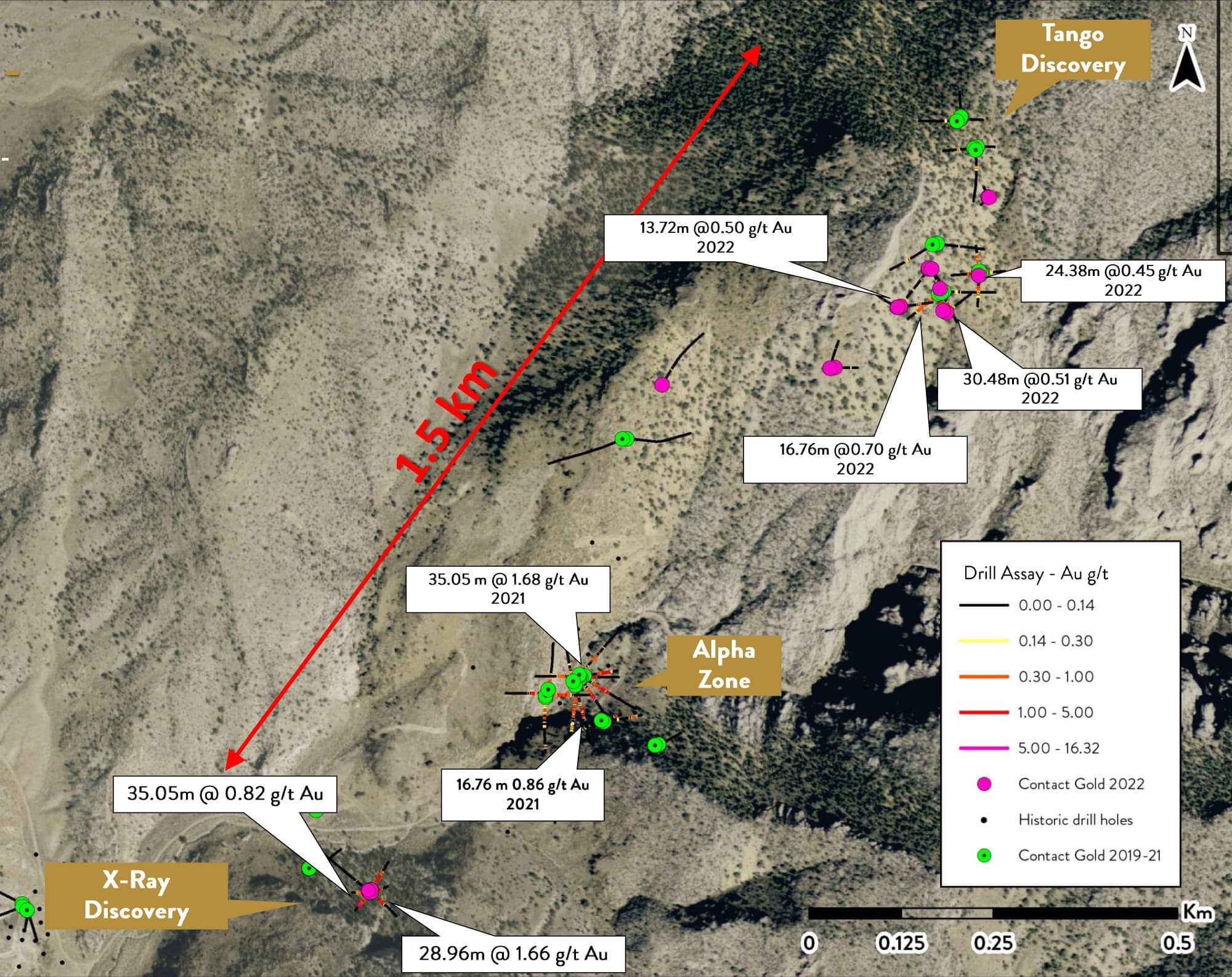

There was a firm exploration commitment of US$1.5M for 2023 but Centerra and Contact have approved a 23% larger budget and Centerra will be spending approximately US$1.85M at Green Springs this year. The majority of the budget will be spent on a 4,500 meter Reverse Circulation drill program where the focus will be on expanding the X-Ray and Tango zones while a portion of the planned 45 holes will be drilled on high conviction greenfield targets.

According to Contact’s press release, the partners will drill 4-6 holes at the B-C Gap and C-D Gap targets while they will also drill 6-8 holes on the yet undrilled Whiskey and Foxtrot targets. Additionally, 2-4 holes will be drilled on the Zulu target in the southernmost portion of the land package as Contact thinks the mine trend is ‘wide open for expansion to the south east’.

And just as a reminder, the agreement between Contact Gold and Centerra Gold is actually very straightforward. Centerra Gold is required to invest US$10M in exploration and make US$1M in cash payments to Contact Gold to earn a 70% stake in the project. Spending a single dollar less than that US$11M requirement will result in Contact Gold retaining full ownership in the project.

The exploration commitments and cash payments to Contact Gold are well-spread out in time. Contact received US$150,000 (approximately C$0.2M) in cash upon signing the agreement, and will receive another tranche of US$175,000 in December of this year. Meanwhile, within that first year, Centerra Gold has committed to spend US$1.5M on exploration at Green Springs.

We are particularly pleased with the annual step-up in the required exploration expenditures. In the third year of the option agreement, Centerra needs to spend US$2.75M. That’s almost C$4M and you can get quite a bit of RC drilling done with that type of budget. And as Contact Gold will be the operator of the exploration programs, it will likely earn a few hundred thousand dollar per year in operator fees.

All things considered, this is an extremely simple and straightforward earn-in agreement. Centerra needs to cough up approximately C$15M to obtain a 70% stake in Green Springs. When that happens and Centerra formally notifies Contact Gold it has completed the earn-in requirement, both companies will advance the project in a 70/30 joint venture. Should Contact Gold elect to dilute its stake in the project by no longer contributing to the joint venture, it will end up with a 1.5% Net Smelter Royalty if its stake gets diluted to less than 10%.

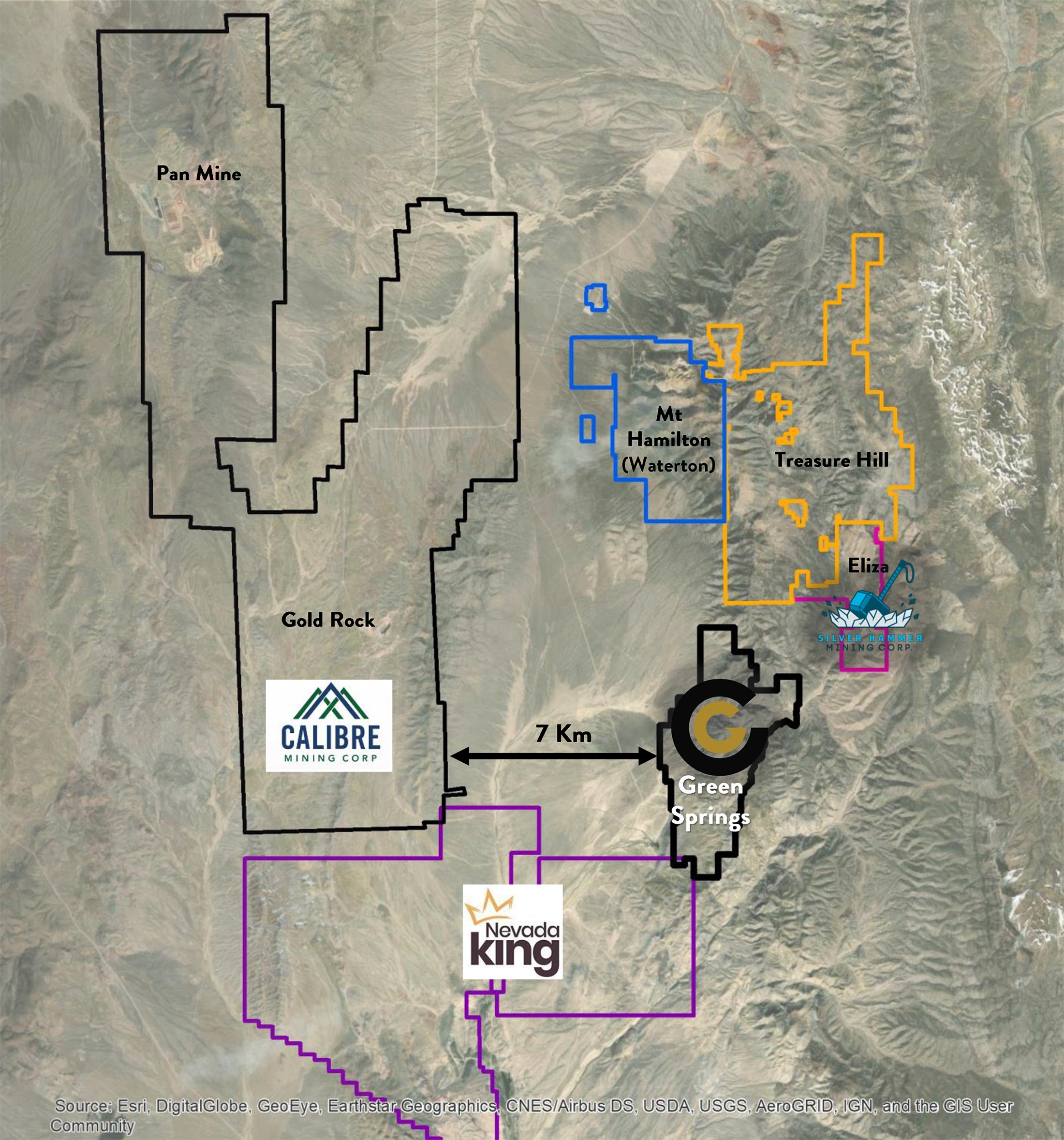

Green Springs is located in an interesting part of Nevada as the project is within walking distance from Calibre Mining (CXB.V) which operates the Pan gold mine and the Gold Rock exploration project. Elsewhere, Mt Hamilton and Treasure Hill are just a few kilometers north of Green Springs. It could make sense for someone to consolidate the district and while Calibre Mining would be in the pole position due to its existing mining operations, seeing Centerra Gold entering the district is quite interesting as well.

Sitting down with Matthew Lennox-King

Let’s start with Green Springs. Just last week, you announced Contact Gold has staked 47 claims at Green Springs. What is the rationale behind that?

As we’ve explored over the past 3 years we’ve continued to generate and develop new drill targets, such as Whiskey in the NE and the Oscar target in the NW. Whiskey was right on the property boundary and we wanted to protect/cover off potential extensions before we start drilling there this year. In the case of Oscar, it’s a brand new target that laid outside the original claim boundary…so we needed to stake that before drilling.

It’s been a few months since you signed the earn-in agreement with Centerra Gold. How are they to work with? Does its technical team work closely with you? Do/did they provide useful input or do you have free reign and flexibility?

Centerra has been a great partner to work with. Our VP Exploration, Vance Spalding happens to be former Centerra as does our Director, George Salamis and we have crossed paths with a number of their team over the years.

Centerra has a representative on the project, who Vance and I have worked with for years at Contact Gold, Pilot Gold (now Liberty Gold) and Fronteer Gold. As far as program design, our team developed the exploration plans for 2023 and they were approved by Centerra. I believe there is strong alignment on both sides, making program decisions straightforward.

Regarding Waterton. Do you agree with the viewpoint of some investors the large stake of Waterton in the company was a deterrent? Did Contact Gold play a big role in organizing the block sale?

The presence of Waterton on the registry was pointed to by a number of potential investors as a reason not to invest in Contact, more pointedly in recent years.

We’ve certainly had a lot of additional inbound interest since the block trade was completed.

The block trade was something that management had been working on for some time.

We noticed you acquired 2.65M shares in the block sale and CFO Wenger acquired 670,000 shares. Who else participated? Existing shareholders? New shareholders?

I did participate, as did our CFO John Wenger as you pointed out. On top of that, our VP Exploration, Vance Spalding also purchased shares. Other purchasers included two institutional investors, a number of existing shareholders and some new shareholders as well. All told we had roughly 20 participants in the trade.

Conclusion

Crossing out Waterton was a necessary step, even if perhaps a little bit of a ‘Hail Mary’ decision by Contact Gold as all its previous attempts to create shareholder value have fallen flat. After the recent capital raise, which was completed in February, the company has some cash to drill the Pony Creek project again this year, while joint venture partner Centerra Gold will bankroll the exploration plans at Green Springs. It has been a while since Contact Gold was simultaneously drilling both projects and hopefully the news flow from this summer on will spark some interest from the investment community.

Not in the least because every additional financing at the current fire-sale valuation likely destroys more value than it creates. For every C$1M that has to be raised at C$0.02/share, an additional 50 million shares have to be printed, which means Contact Gold would be facing the difficult decision between blowing up the capital structure entirely or going into hibernation again on Pony Creek while letting Centerra Gold do the heavy lifting at Green Springs.

2023 will be a pivotal year for Contact Gold and drill results on Green Springs and Pony Creek will play an important role to decide on the fate of the company.

Disclosure: The author has a long position in Contact Gold. Contact Gold is a sponsor of the website. Please read our disclaimer.