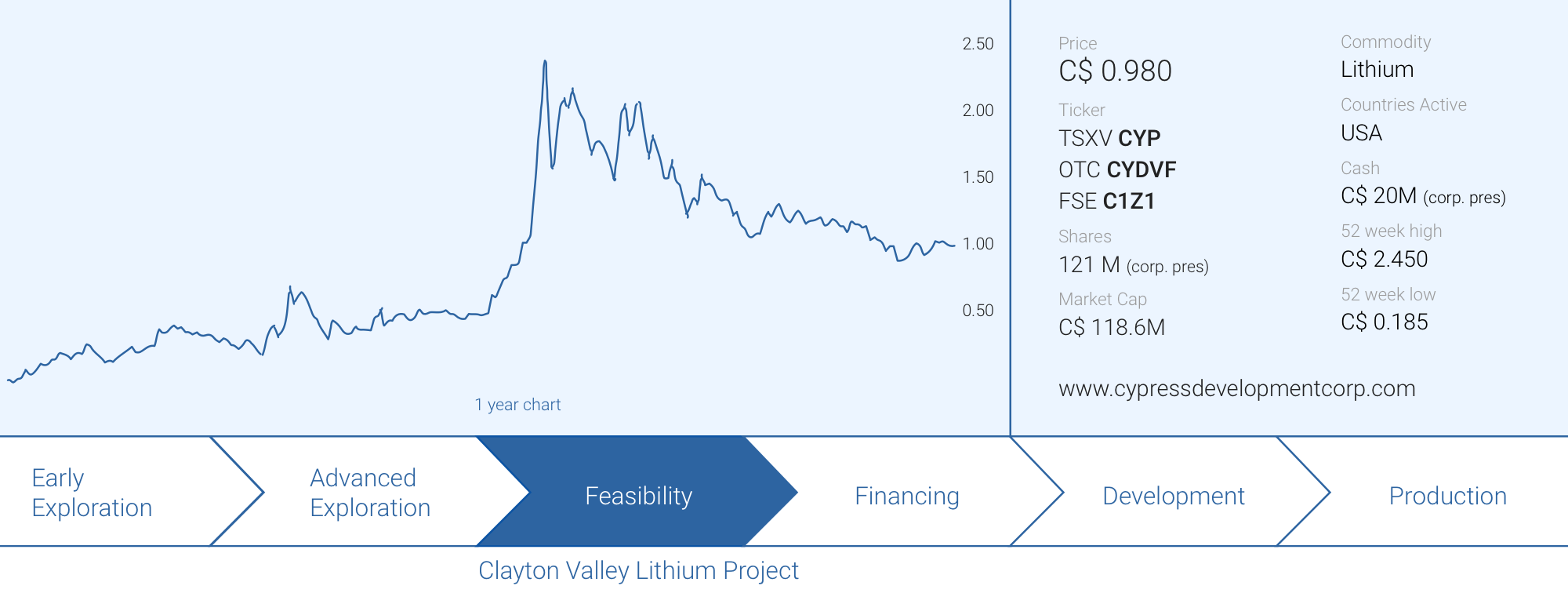

Cypress Development (CYP.V) is making good progress to rapidly advance the Clayton Valley lithium project in Nevada. The company did not waste any time after the PEA and released the results of a pre-feasibility study in the summer of last year.

Meanwhile, further optimization efforts are ongoing and Cypress is now also giving the chloride leach option a closer look as that would reduce the water consumption level on the project and make it ‘greener’. While those optimization studies are still ongoing, Cypress announced a US$3M deal to acquire water rights. A smart move given the scarcity of new water permits in that area of Nevada and securing water rights well ahead of a construction decision is a very prudent move.

The US$3M also would hardly make a dent in the company’s strong treasury as Cypress raised C$19.6M in Q1 and a few million warrants are in the money and will be exercised later this year. This provides Cypress Development with sufficient flexibility to further de-risk Clayton Valley towards a feasibility study and ultimately, a construction decision.

The lithium price is now recovering fast

Just like for so many other commodities, 2020 was not a great year for the lithium space and the lithium prices. However, looking at it from a long-term perspective, the pandemic will likely prove to be a blessing for lithium and the lithium price as it looks like the switch to establish a ‘greener’ society has been made and lithium plays an important role.

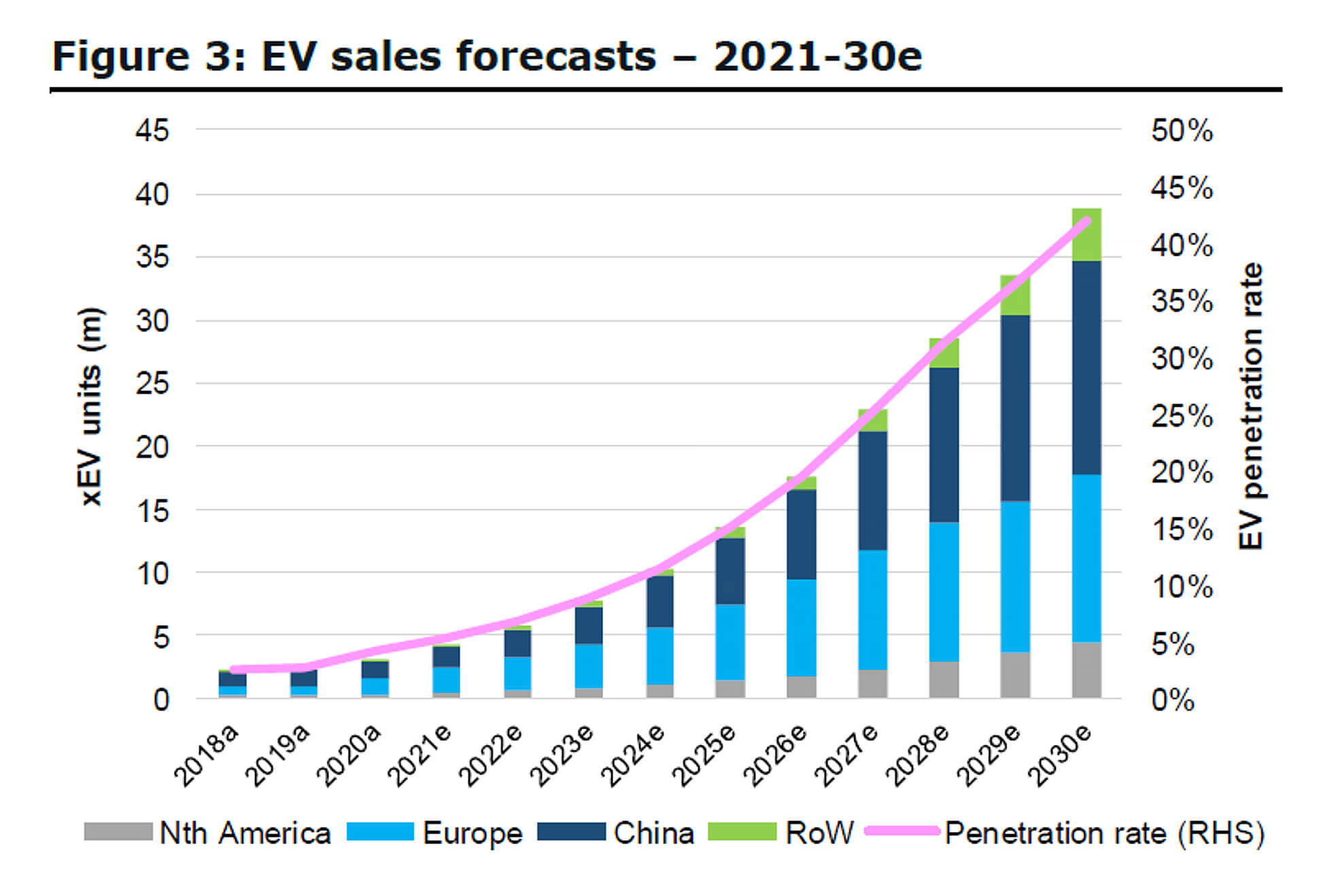

The EV sales are picking up all over the world and there will be a noticeable growth in pretty much every jurisdiction. The growth in Europe was quite interesting as about 1.4 million EVs were sold, beating China’s number. For 2021, additional growth could be expected, partly because people want to make the switch, partly because government incentives are pushing car buyers towards a certain category. In an excellent recent research report, Canadian brokerage firm Canaccord Genuity estimated just over 4M EVs will be sold in 2021 growing to almost 15M EVs in 2025 and a stunning 40 million EVs in 2030. Even if Canaccord is off by 50%, we can expect the amount of EV sales to quadruple or quintuple from the 2020 levels. Which means a whole lot more lithium will be needed.

In the same report, Canaccord continues ‘to forecast longer term deficits post 2025 growing into significant market deficits towards 2030. From 2025 we anticipate the market growing at 200-300kt LCE each year, which is >65% of the total current market size.’

So while the lithium market will likely remain in an equilibrium situation on the supply/demand side in the next few years, things seem to change in 2024 which appears to be the tipping point with the demand outpacing the supply by a few ten thousand tonnes of LCE per year. That is still manageable as it will take a few years before the market has absorbed the surplus production of the 2017-2023 period, but as the demand for lithium carbonate is expected to continue to increase at a faster pace than the supply, subsequent to 2024, the real problems may start in 2025-2026. The same Canaccord research report mentions a total supply of 1 million tonnes of LCE in 2026 which will not be anywhere close to covering the 1.275M tonne demand. And still according to Canaccord, the LCE supply deficit will increase in excess of 1 million tonnes per year by 2029, although the 2029 production will be almost 4 times higher than the 2019 output.

So, while the lithium price may still be facing a bumpy road in the next few years, the supply/demand picture is very intriguing looking at it with a longer-term perspective. And that works just fine in the Cypress case as the current timeline seems to anticipate a construction decision in 2023, with commercial production not expected before 2025. And that could be perfect timing as that is exactly the year wherein the supply/demand ratio will be shifting to an undersupplied lithium market.

On top of seeing the lithium price recover on the back of a continuously strong demand, we noticed there have been quite a few M&A deals in the sector. ASX-listed Pilbara Minerals (PLS.AX) scooped up the assets from Altura Mining out of bankruptcy while Orocobre (ORL.TO, ORE.AX) made an offer to acquire its non-producing competitor Galaxy Resources (GXY.AX). The objective of the buyers in both cases is clear: getting their hands on additional resources to secure their asset pipeline for decades to come.

While this has nothing to do with Cypress Development at this point in time, we do expect assets with an established multi-decade mine life to be closely looked at by larger players in the industry as everyone is scrambling for supply for years and decades to come. As Cypress continues to de-risk the Clayton Valley lithium project, the project (and company) is bound to pop up on more radar screens of the who is who in the lithium sector.

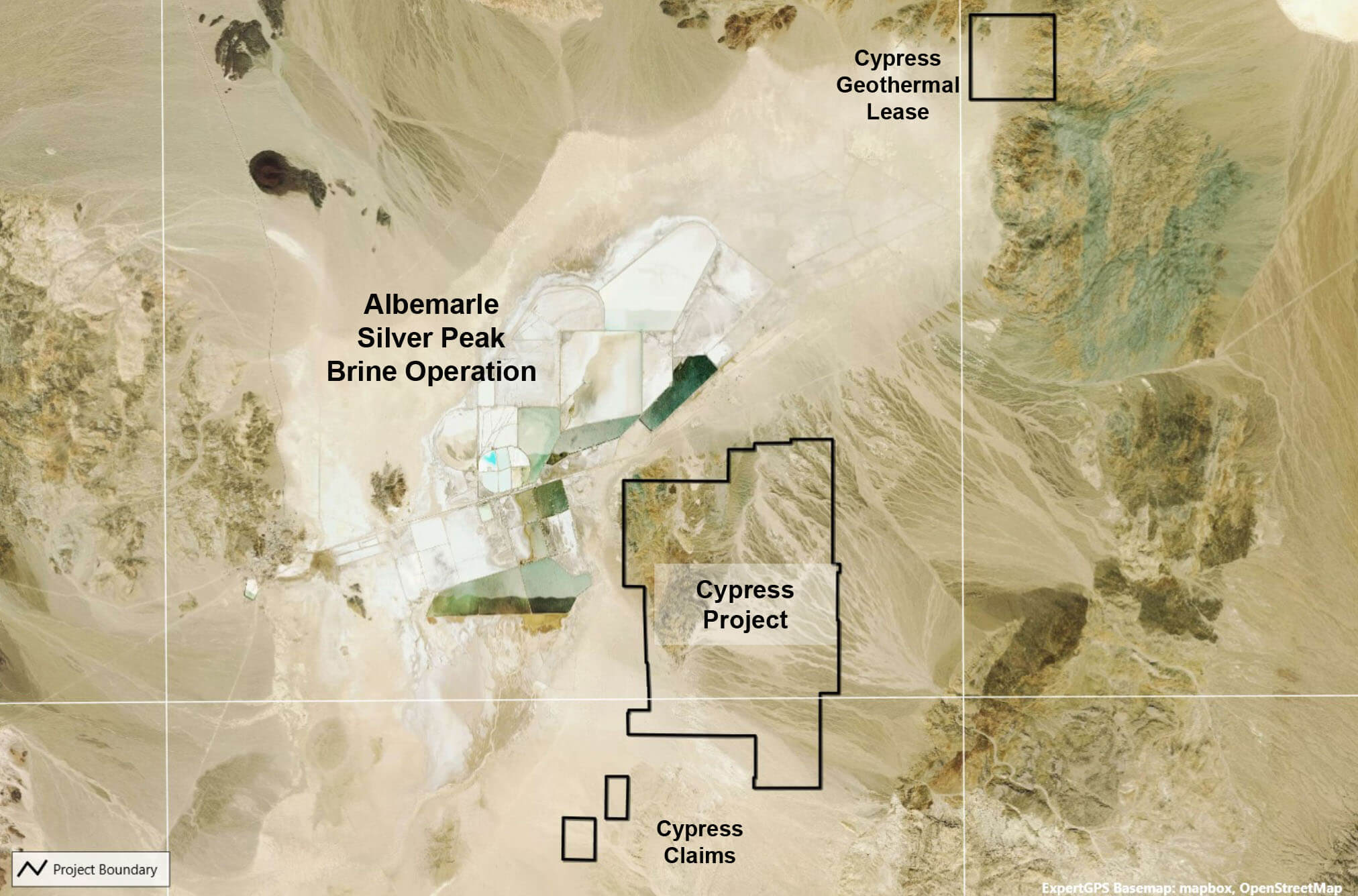

Cypress is in an excellent position to help supply the North American market

Cypress continues to make good progress on its Clayton Valley lithium project in Nevada. After completing a pre-feasibility study last summer, the company is now constructing a pilot plant and the assembly phase should have started by now. This means the company remains on track to have the pilot plant up and running by July, whereafter the metallurgical test work can commence at a feed rate of about one tonne per day of lithium-bearing clay.

The plant will be able to confirm the flowsheet, processes, and anticipated recovery rates (and reagent consumption levels) used in the pre-feasibility study. Additionally, Cypress Development has mentioned the pilot plant will focus on chloride-based leaching. Looking into chloride-based leaching instead of sulfide-based leaching could unlock additional environmental and economic benefits as initial test work indicated higher recovery rates using hydrochloric acid (85.3%) versus sulfuric acid (80.2%). Recovering about 6% more lithium at roughly the same operating cost could indeed boost the economics of the project as both the IRR and NPV could be positively impacted and that’s why the results from the pilot plant program will be important.

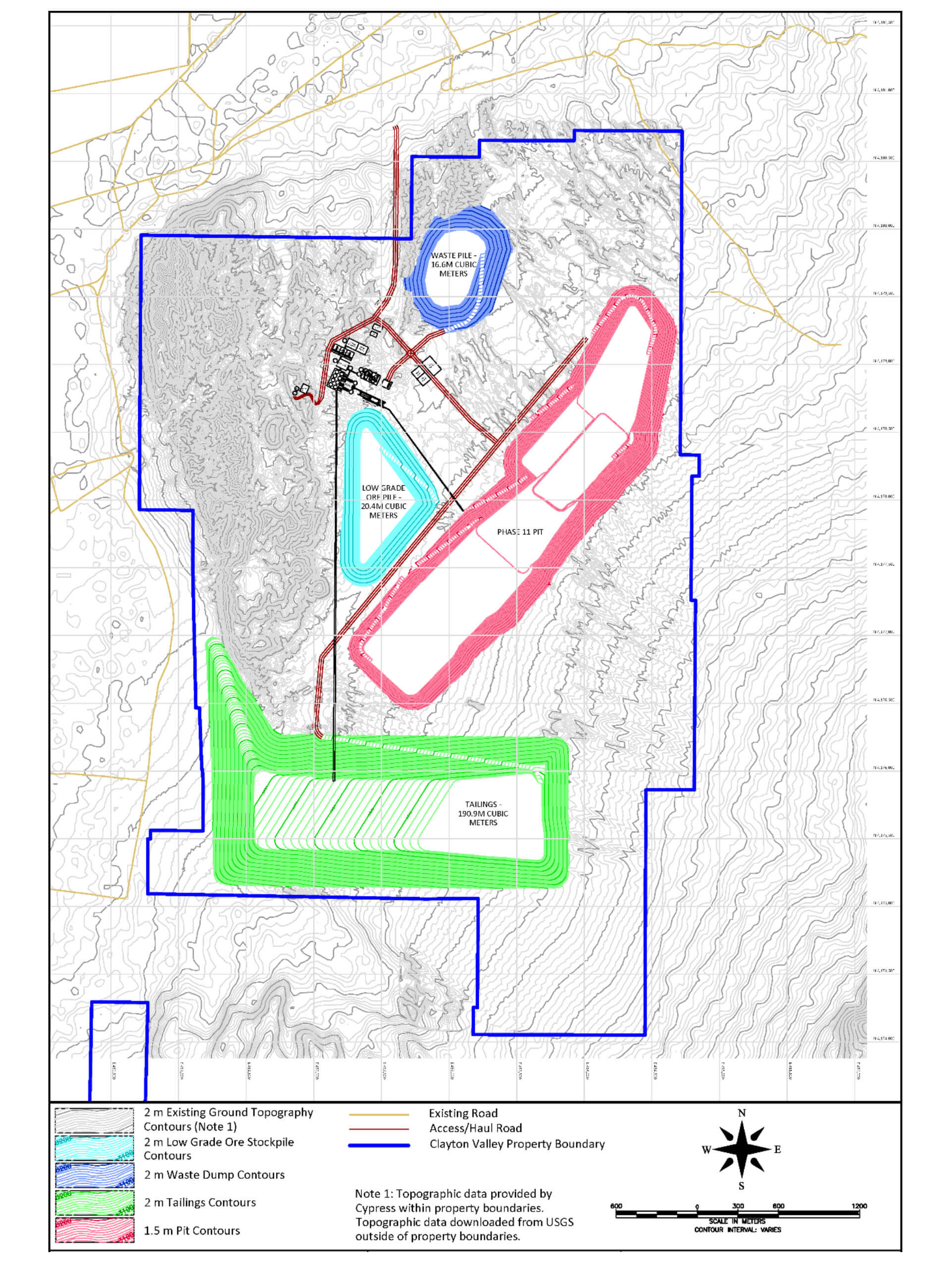

While investigating the potential to use hydrochloric acid rather than sulfuric acid, Cypress obviously continues to develop the project in-line with the recommendations outlined in the pre-feasibility study, which was published in June last year, with an updated version filed in March of this year. The pre-feasibility study pretty much confirmed the findings of the Preliminary Economic Assessment.

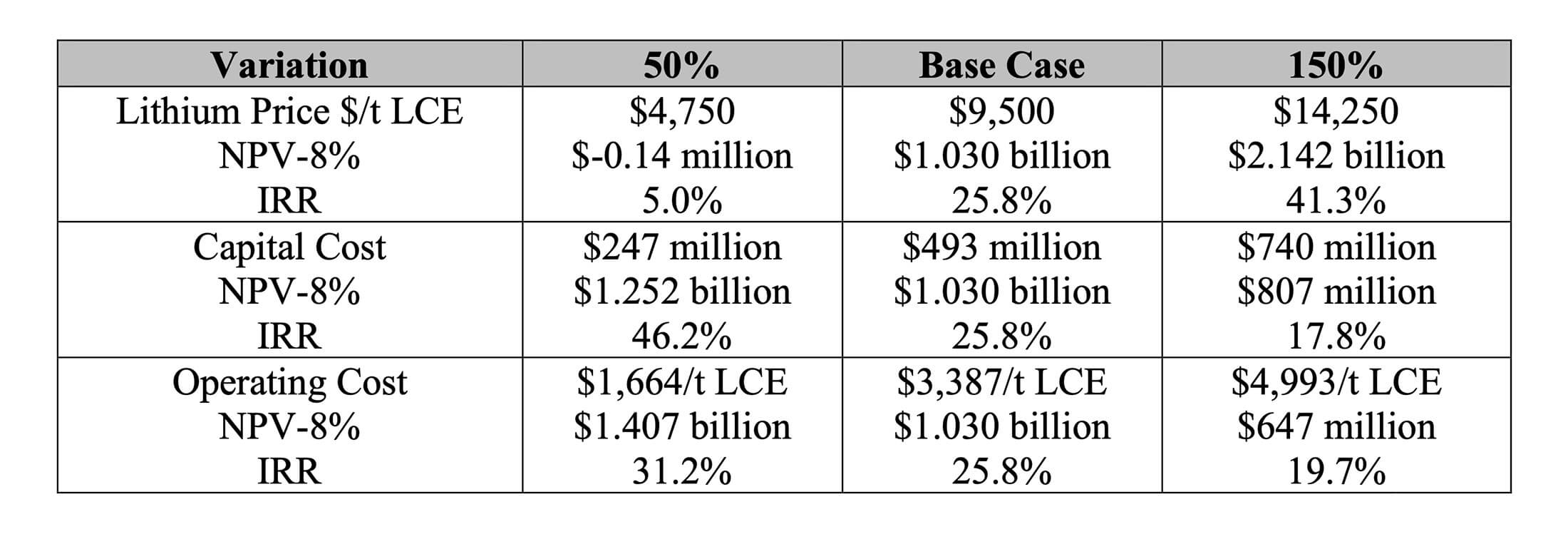

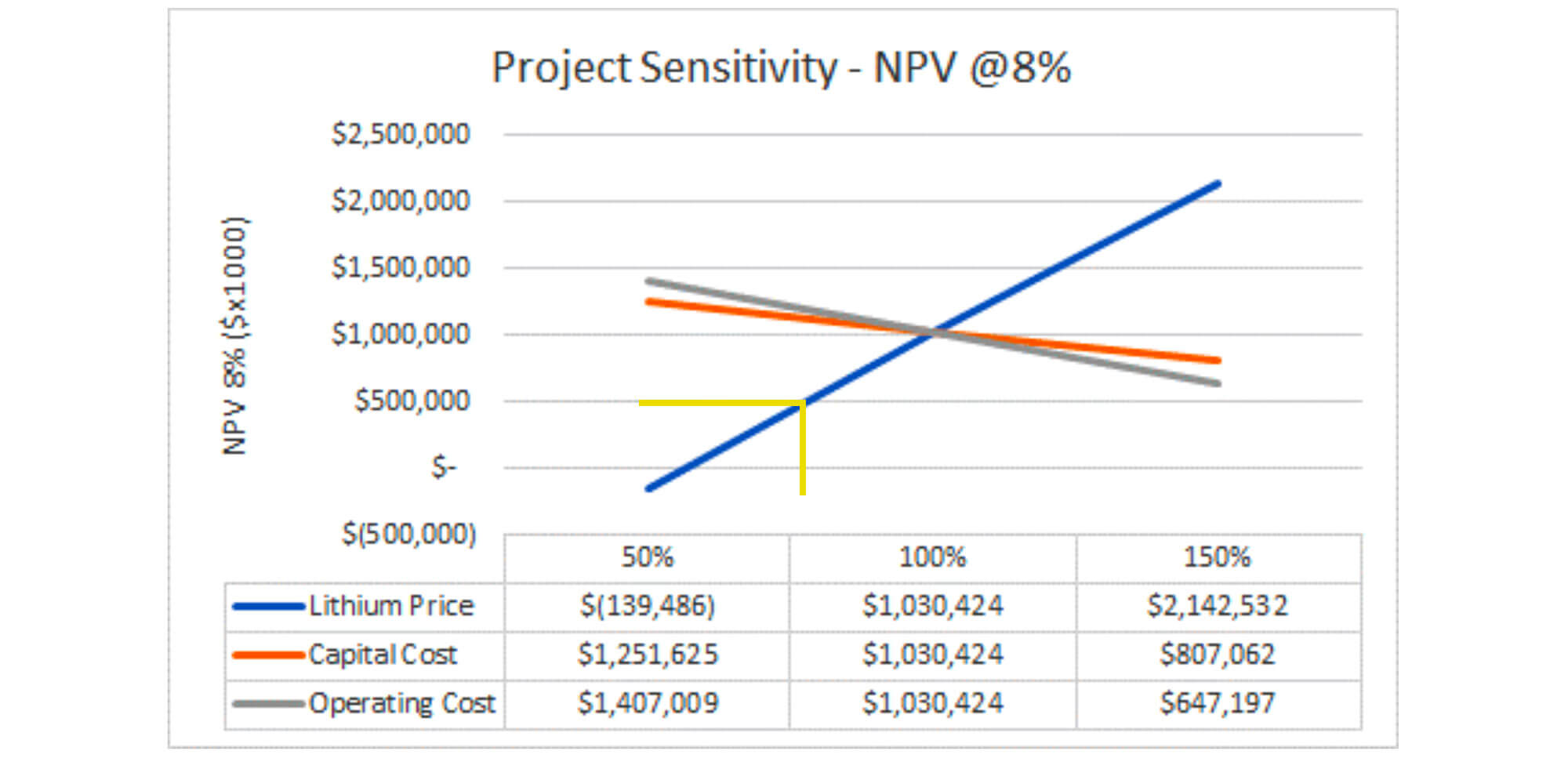

Focusing on a 15,000 tonnes per day throughput, the Clayton Valley lithium project would produce about 27,400 tonnes of lithium carbonate per year at a production cost of just under $3,400/t LCE during a 40-year mine life. The initial capex appears to be very manageable at less than US$500M, resulting in an after-tax NPV8% of $1.03B and an IRR of just under 26% using a lithium carbonate price of $9,500/t. That’s slightly lower than the current spot price but given the recent volatility on the LCE pricing front (with prices below $6,000/t just a few months ago), it’s also a good idea to keep an eye on the sensitivity analysis, which indicates the NPV and IRR are holding up quite well although a +50% and -50% scenario doesn’t provide much relevant information for anyone who’s looking for the impact of a 20% or 30% different lithium price on the economics.

Fortunately, there is an excellent chart in the updated pre-feasibility study where we can deduce the impact of a 25% lower lithium price on the NPV. The yellow lines are ours, and are drawn in the middle between the 100% and 50% scenario, and according to this rudimentary approach, the after-tax NPV8% using a lithium carbonate price of $7,125/t (75% of the base case price of $9,500/t). The IRR (not shown) appears to be coming in around 15%, which is more than fine for a project with a mine life spanning multiple decades.

The pre-feasibility study also mentioned access to water as one of the project’s main risks, and Cypress Development took immediate action to address this issue.

Water – a very important input of the production process

It is important to secure all relevant inputs for the production process well ahead of time. One of the potential issues a lot of Nevada-based projects are facing is securing enough water as it often means companies need to get permits to pump up water from known aquifers and, understandably, there is more involved than just getting a request rubber-stamped. This is especially true in the Clayton Valley as the Nevada Division of Water Resources has previously stated no new permits would be issued.

Cypress Development has been very proactive and announced in May it signed a Letter of Intent with a subsidiary of Nevada Sunrise Gold (NEV.V) which owns a permit allowing it to draw down on 1,770 acre-feet of water for mining activities. According to Cypress, this water pumping permit has the largest volume allowance of all available existing permits in Clayton Valley and will take care of a large percentage of the water needs as calculated in the pre-feasibility study.

While the currently permitted pumping rate is not sufficient to cover all the water needs for the mine, keep in mind Cypress Development is working on the chloride leaching option to process the Clayton Valley rock. This would reduce the water consumption level and the water permit may be sufficient after all.

Water clearly is a critical element for the Clayton Valley operations, and the proactive approach of Cypress Development is commendable. The water rights will be secured at an advantageous price as well: Cypress was required to make US$150,000 in non-refundable deposits and upon closing the company will be required to make a US$2M cash payment and issue US$0.85M in new shares. A very reasonable price for a key element in the production process.

Cypress is now fully cashed up after the recent bought deal

Cypress needed cash. The easiest solution was a bought deal offering and in January, Cypress announced a C$8.5M bought deal financing with PI Financial as sole underwriter and book runner. The demand for the financing appeared to be much higher than anticipated and just one day later, Cypress doubled the size of the financing. And the market still was not satisfied.

The company ended up closing the financing raising a total of C$19.55M as the underwriter exercised its over-allotment rights. A total of 15.64M units were issued with each unit consisting of one common share and a full warrant with each warrant allowing the owner to acquire an additional share at C$1.75 by March 22nd, 2024.

While a full warrant may be seen as generous, it also provides an excellent possibility for Cypress Development as a ‘secondary financing’: should the lithium sector continue to be quite popular and if Cypress Development continues to de-risk its project, the share price may very well exceed the C$1.75 exercise price in which case the warrants would result in a cash inflow if about C$28M. But, of course, with a current share price of C$0.98, we aren’t even close to the warrants being in the money but it still is a good optionality to have.

Meanwhile, there still are about 5 million warrants that will expire later this year and are currently (deep) in the money. It is quite likely Cypress Development will receive an additional C$1.5M in cash from these warrant exercises which will keep the cash position at a record high.

Conclusion

Perception is very important for the sector and it is a little bit a head-scratcher to see a company like Piedmont Lithium trade at a market cap of in excess of US$1B, which is about 10 times the market capitalization of Cypress Development. That must be very frustrating for the Cypress Development team, but as they are taking the right steps to further advance the Clayton Valley lithium project it is not unreasonable to expect a re-rating as the project de-risks.

With about C$20M in cash in the bank, Cypress is in an enviable position of being on the path to secure water rights while moving full steam ahead on the pilot plant and getting the project ready for the feasibility study, which is expected to be underway this year.

The pre-feasibility study mentioned two risks: access to water, and further work on the metallurgy of the project. Access to water has now been addressed through the deal with Nevada Sunrise while the pilot plant should be up and running in a matter of weeks, which will provide the necessary data to firm up the anticipated recovery rates of the lithium. The icing on the cake could be the use of hydrochloric acid which could boost the recovery rate (and reduce the operating expenses), so we will be looking forward to seeing the results of the pilot plant runs!

Disclosure: Cypress Development is a sponsor of this website. The author has a long position in Cypress Development. Please read the disclaimer.