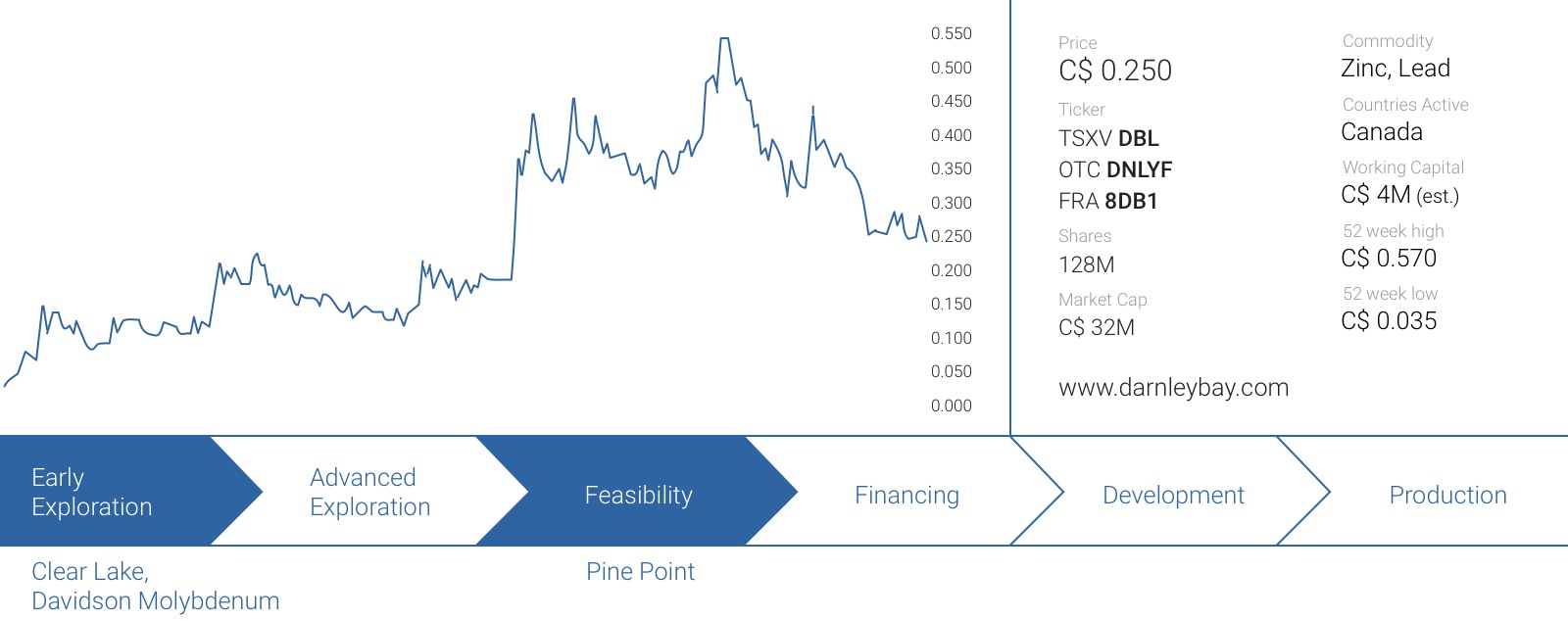

We first discussed Darnley Bay Resources (DBL.V) in February of this year, when we had a closer look at the Pine Point project in the Northwest Territories. We argued the project could work and be economic, as DBL already has an extensive database it inherited from the previous operators.

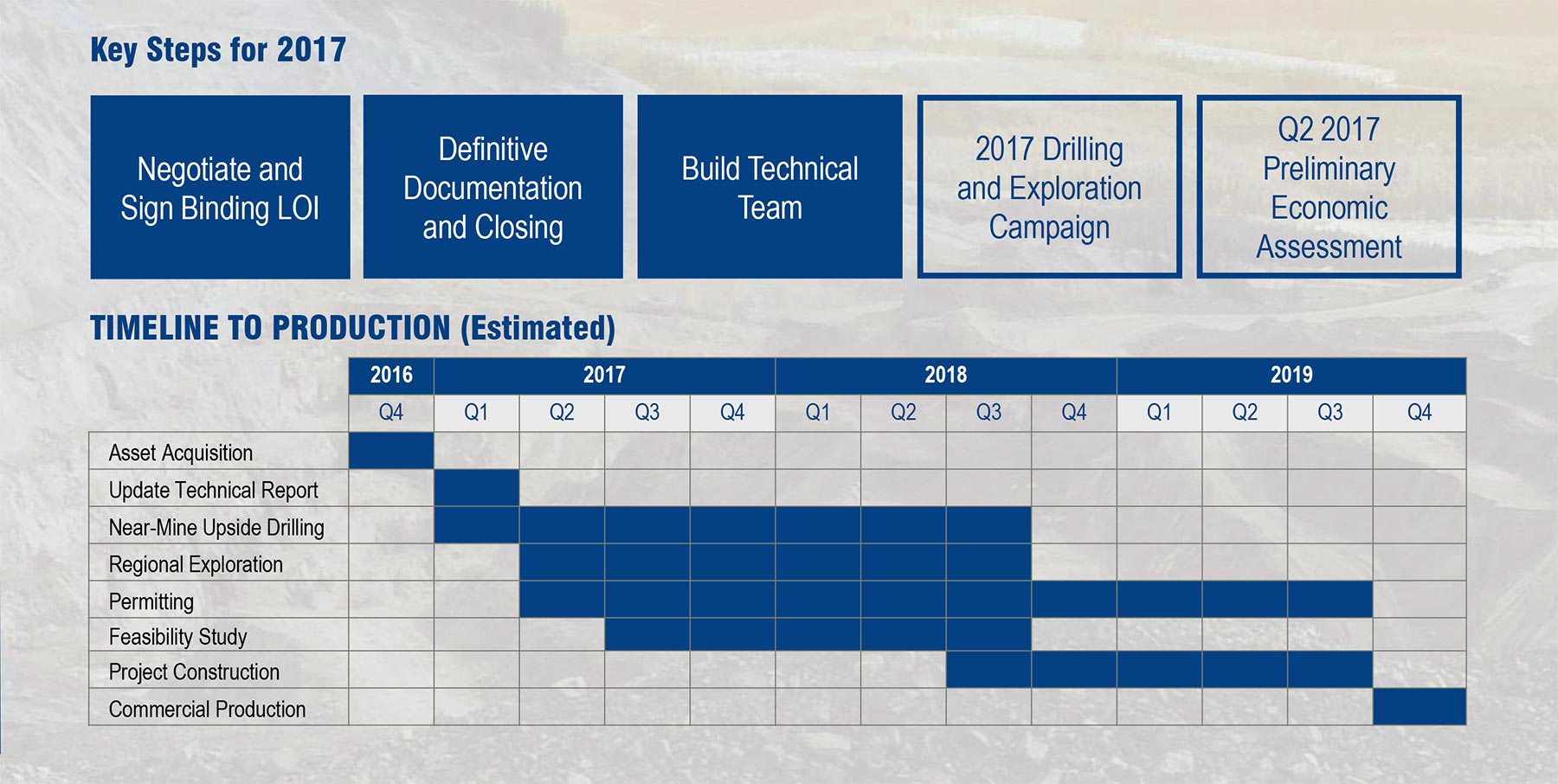

JDS Energy and Mining has now completed a Preliminary Economic Assessment on the Pine Point property and we obviously wanted to have a closer look at the end result, and how the numbers compare to our previous expectations.

A first quick look at the Pine Point PEA

JDS Energy & Mining has focused on the company’s open pits, and this should derisk the project quite significantly as it should be easier to control the water levels and the water flow in and around the pits, compared to the underground mines.

The concept is actually pretty simple. The open pit ore will be processed via a dense media separation plant (DMS), where after the traditional grinding and flotation process will take place. This should result in the production of two separate concentrates, a zinc concentrate (which is expected to have a very high zinc content, resulting in a premium price for the zinc con), and a lead concentrate.

The PEA mine plan is based on mining rates of 4,000 up to 6,800 tonnes per day of rock, of which the ore will be transported to a centralized facility (after having completed the DMS stage). The processing plant will have a capacity of 1,800 tonnes per day. This is pretty low (especially as the head grade is anticipated to be just 4% ZnPb), but keep in mind that’s why the DMS stage is important as this will increase the head grade of the ore going into the processing plant.

Adding the DMS stage also keeps the initial capital expenditures relatively low. The initial capex is estimated at C$154M, with an additional C$118M required as sustaining capex.

Using a zinc price of US$1.10 per pound and a lead price of $1.00 per pound, JDS estimates the cash cost per pound of zinc to be approximately 60 cents, although it’s unclear if this includes the C$118M in sustaining capex (which equates to approximately 7 cents per produced pound of zinc).

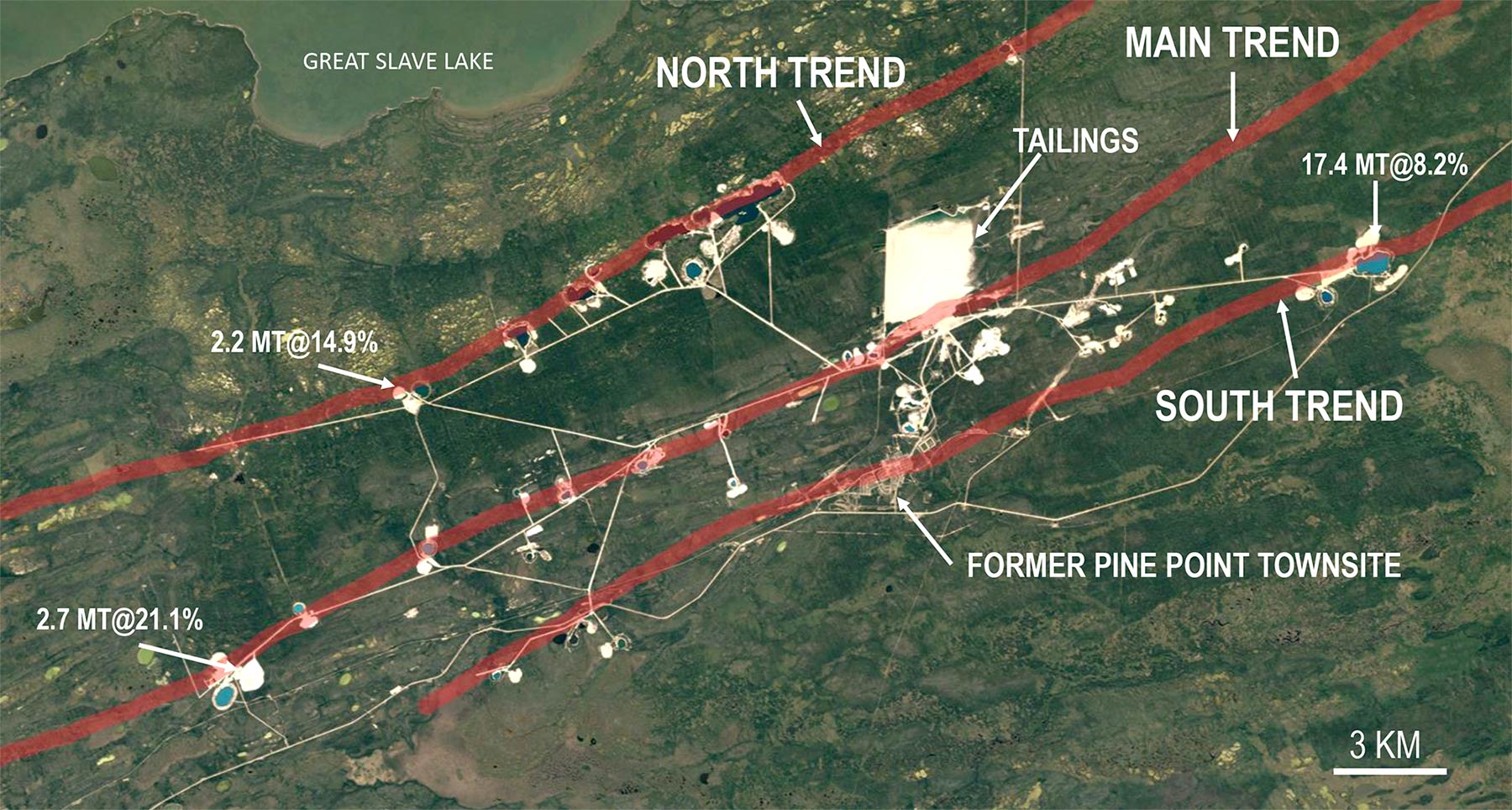

With all these parameters and based on the mine sequencing outlined by JDS in the mine plan, the project boasts an after-tax IRR of almost 35% whilst the net present value is approximately C$211M. Keep in mind this scenario is based on 10 open pits, and excludes the regional exploration potential (where more mineable and mineralized zones could be discovered), the 36 other pits that are currently known and also excludes all underground deposits. Adding the two underground zones (R190 and X25), Darnley Bay would be able to access and process an additional 3 million tonnes or rock at an average grade of in excess of 8% zinc).

And there are more possibilities to further improve and increase the value of the project.

Darnley Bay plans to do some more metallurgical testing this year, in an attempt to increase the recovery rates and/or the average grade of the final concentrate. Additionally, handling the water (one of the risks associated with the project, as we outlined in our February report) is one of the areas defined by Darnley Bay where cost savings could have an impact on the economics. We’ll have to wait for the technical report to see how expensive the water-related costs are, and what the potential is to shave off some of these costs.

And finally, Darnley Bay will try to secure all its power needs from the existing power grid. It might take a few million dollars to upgrade the grid and the Taltson River hydroelectric dam, but the cost savings would be pretty substantial as the power needs are now based on a combination of grid power and natural gas generators.

How does this compare to our expectations?

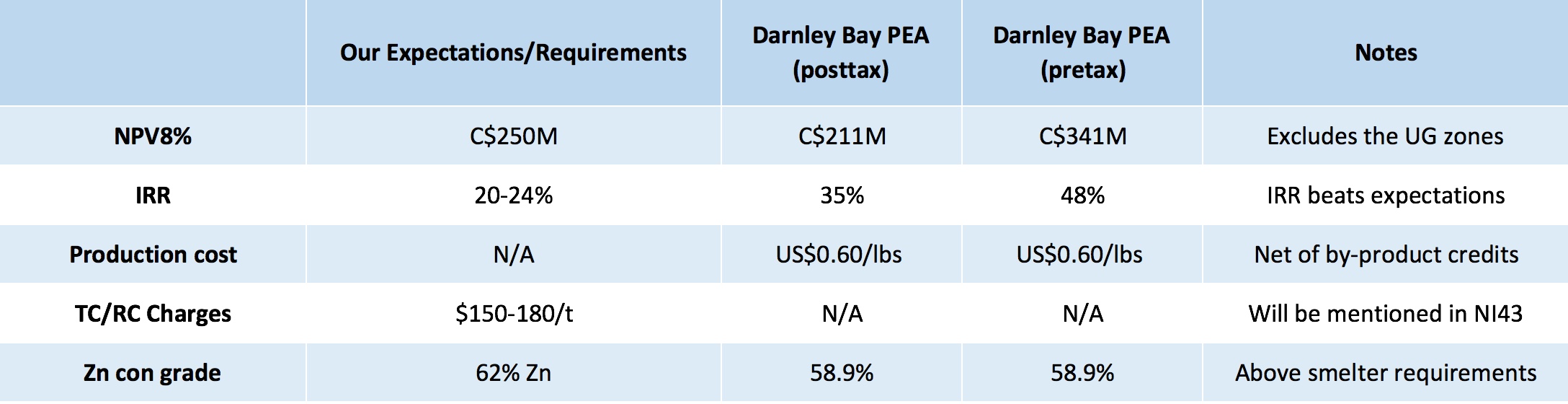

In our previous report, which was released in February, we also provided you with some of our expectations (and requirements) and it’s obviously always interesting to compare our expectations with the final results of the PEA. The next table provides you with some of the key elements for a comparison.

The results of the PEA were generally in line with our expectations with a clear beat on the Internal Rate of Return we would like to see on a project. The NPV8% came in below our expectations, but this is very likely entirely caused by the fact Darnley Bay will focus on the open pits and didn’t incorporate any of the high-grade underground zones in its preliminary mine plan.

Also, the company’s consultants have used quite conservative recovery rates for the zinc, as Darnley Bay expects to achieve a higher recovery rate than the 88% used in the PEA. Every 1% increase in the recovery rate will boost the total zinc production by approximately 10-15 million pounds, and will obviously have a very important impact on the economics.

A first hole has been completed with assays sent to the lab, but we would expect the metallurgical test work to continue throughout the year, to make sure all tests are representative (the recently announced infill drill hole had an average grade of more than twice the planned head grade).

A short Q&A with Jamie Levy, CEO

Prior and subsequent to the release of the results of the Preliminary Economic Assessment, we sat down with CEO Jami Levy to discuss some updates in more detail.

You recently received drill permits for the Pine Point Lead-Zinc project and expect to kick off with an initial 3,500 meter drill program. Could you elaborate on what the focus of this drill program will be, and what you’d like to achieve in this first phase?

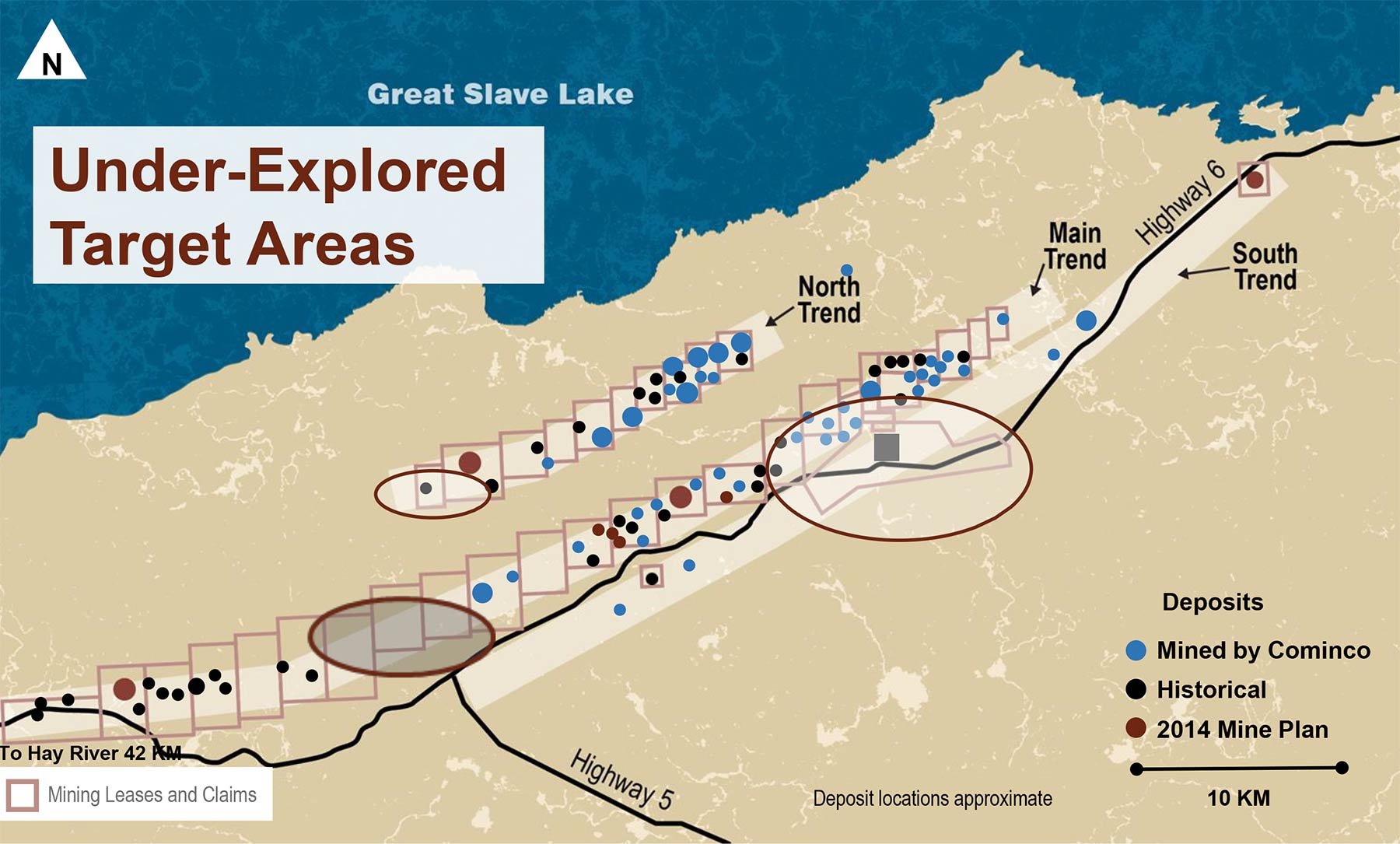

Our drilling program is designed to accomplish three things: first, we want to do “confirmation drilling” on some of the historical lead-zinc deposits so they can be added to the initial 10 deposits that were included in our Preliminary Economic Analysis. There are an additional 36 deposits on the property which are not included in our current mine plan. These were discovered by Cominco many years ago and have had no recent drilling. It is a cheap and sure-fire way to add pounds of lead and zinc to the mining plan so it makes a lot of sense for us to chase these zones first.

Second, we will be exploring for additional new deposits.

Despite the fact that this property has had 18,000 drill holes, there are still about 15 kilometres of the total of 100-km structures that have been under-explored including the old town site which is in the heart of the camp but has had no exploration whatsoever. Our average grade currently is about 4% lead-zinc, while Cominco’s historical average in the 52 deposits they mined out was 10.1%. Since the structure has so far yielded more than one deposit for every one kilometre of strike length along the structures, we think our chances are good to find one or more of these 10%+ grade deposits. This would definitely strengthen the economics of the Pine Point project.

Third, we are taking samples for metallurgical testing. Since not all of deposits in our PEA had testing done previously, our engineers were conservative and estimated a recovery rate of only 88% for zinc, compared with the 96% recovered by Cominco in the past.

These samples are expected to confirm that recoveries are in fact higher than the 88%, and will make a positive impact on the economics of the project. A 5% increase in recovery adds C$75 million to the NPV of the project. Note that for a variety of reasons, we don’t expect them to come in at 96%, but something a bit lower.

This initial 3,500 meter drill program is just the start, and you’re already planning to follow up with an additional two-phase drill program. Will the size and focus of these two programs completely depend on the results of Phase I, or can you already shine some light on what you would like to do in the next drill phases?

We are in the process of reassessing our drilling program in light of the results from the PEA, now that we know how much money it costs to mine and process a tonne of ore. Suffice to say the total size of the drill program will be larger than 3500 metres and we hope to make an announcement on that sometime soon.

You have emphasized the drill company you have contracted is aboriginally-registered. How important is it for Darnley Bay to keep the locals engaged in your plans?

It is important for any mining company anywhere to keep the locals engaged, employed and enriched. Everywhere we can, we are insisting that contracts are handed out locally and that native groups have a chance to bid on our various contracts, whether on their own or with joint ventures with outside contractors. This is a common way of working with the natives in the Northwest Territories.

You have staked an additional 3,490 hectares of ground at Pine Point. Where are these new claims located, and how does this fit in the bigger picture?

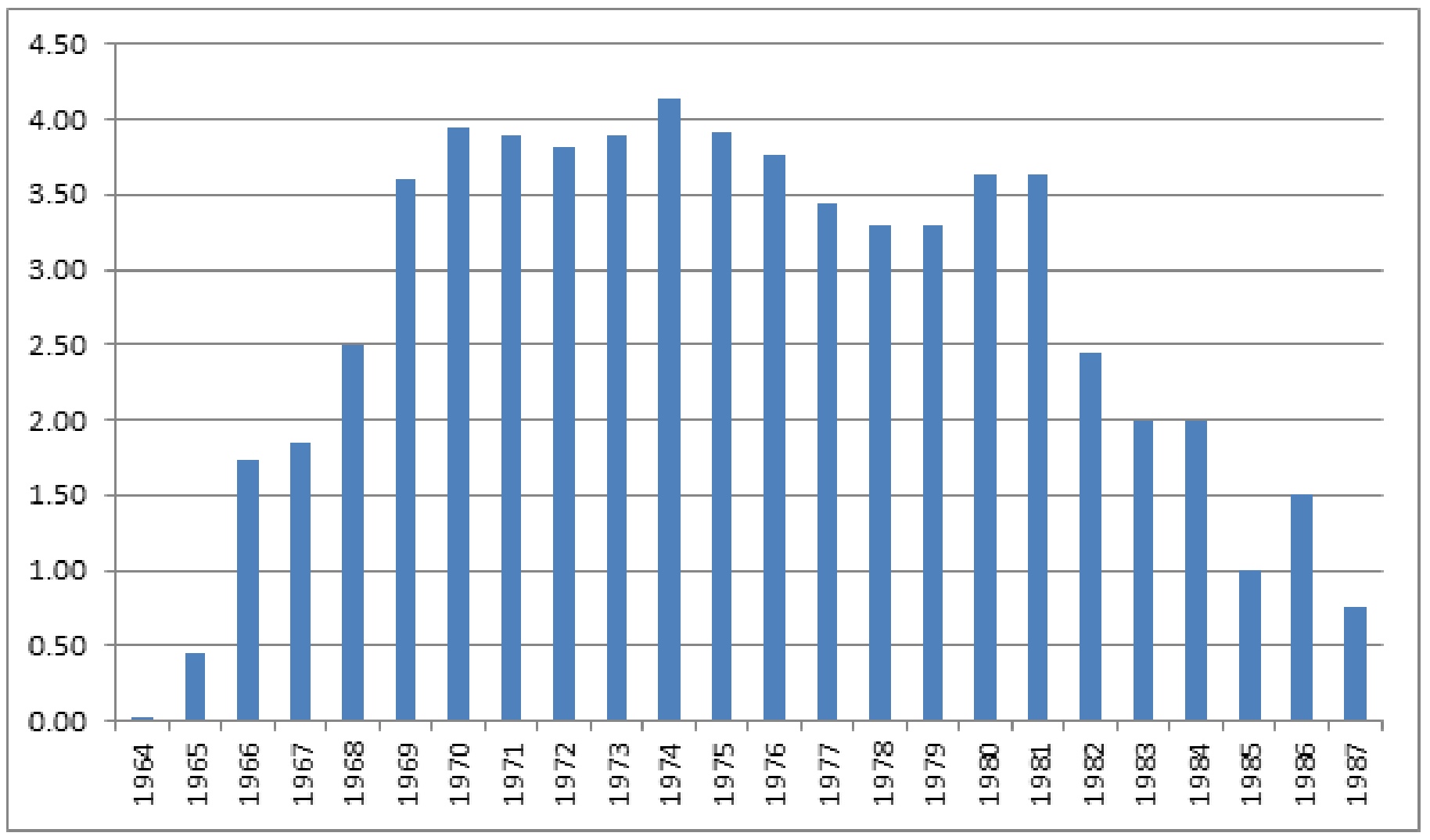

These claims were in a number of areas but the key claims are where the town of Pine Point used to be located. The town has now been removed. In an interesting back-story, when Cominco built the mine in 1962-64, there were two mineral trends now known as the Main Trend and the North Trend. The town was located south of these trends and its borders were withdrawn from staking. Then in 1965, a small company discovered the South Trend, which went on to supply 30% of the historical production from Pine Point. The trend goes right through the old town site for 6 km, which as was stated above, has never been explored. We plan to initiate geophysics (IP) this spring followed by drilling of any targets in the summer. It is here we have strong hopes for some high grade deposits.

What’s Darnley Bay’s current (approximate) cash position?

We have $4 milllion in flow through dollars left and intend to spend most or all of that this year. We obviously also have some “hard dollars” in the till as well.

Conclusion

Darnley Bay’s completion of a Preliminary Economic Assessment in less than six months after acquiring the Pine Point lead-zinc property is a positive achievement. As expected the IRR and NPV of the mine plan are excellent as the initial capital expenditures remain quite low.

Darnley Bay is about to start a drill program which will focus on increasing the resources to extend the mine life at Pine Point, whilst also upgrading some of the resources into higher categories. 2017 will be action-packed at Darnley Bay, and if the company would be able to A) keep the water flows under control and B) execute on some of the identified cost savings and economics-boosting measures, the current after-tax NPV8 of C$211M (C$341M pre-tax) could be just the beginning.

Disclosure: The author owns a long position in Darnley Bay, but the company isn’t a sponsor of the website at this time. Please read the disclaimer