District Metals (DMX.V) has seen quite a bit of volatility in its share price in the past few years. Until November 2025, the company was a ‘black or white’ type of speculative investment, waiting for the Swedish parliament to take the required steps to lift the ban on uranium exploration and mining in Sweden. That process is now in full swing, which means the focus will shift from a political angle to an exploration and development angle. Since January 1st, exploring for uranium is now completely legal again in Sweden and that changed the narrative for District.

It’s now up to District Metals’ technical team to execute on the plans to actually develop their uranium assets. The flagship Viken project is of course the most advanced project in the company’s asset portfolio, and based on District’s plans for 2026, we should see considerable progress at Viken this year.

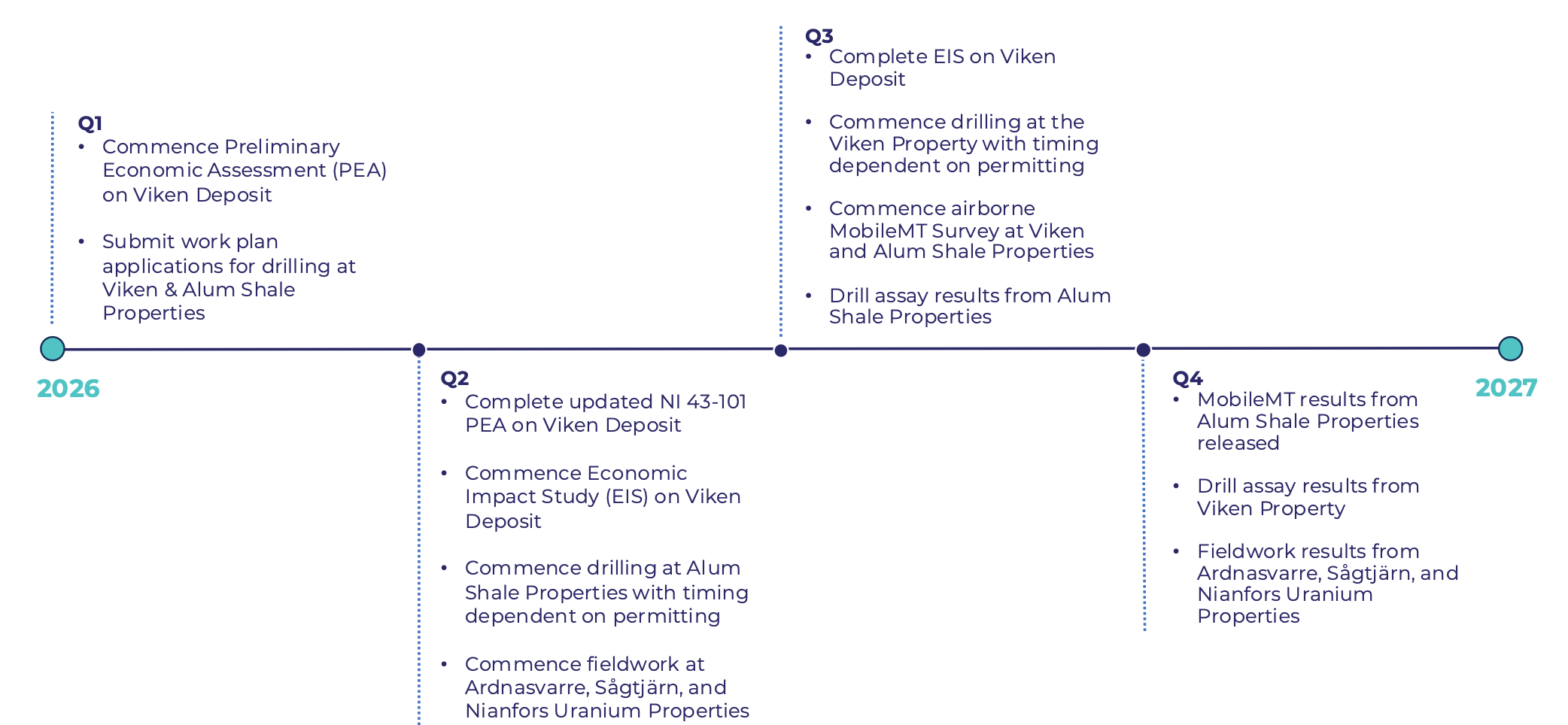

The plans for 2026

One of the key elements to look forward to this year is the anticipated publication of the Preliminary Economic Assessment (PEA) on the flagship Viken project. The company has engaged P&E Mining Consultants to prepare a NI 43-101 compliant PEA while it has engaged another consultant named METS Engineering to finetune the metallurgical component of the PEA. District Metals hopes to publish the results of the PEA in the second quarter, but as the mining sector is notorious for its delays, perhaps the timing will slip a little bit. We’ll get a better idea of where the company stands with its PEA plans after the first quarter.

District has also engaged BDO Canada to work on an Economic Impact Study (EIS) which will highlight the economic and strategic benefits of the Viken project. The results of this study will only be published after the PEA, as it requires certain components from the economic study to be incorporated in the EIS.

Despite the already vast size of the resource on the Viken project, District Metals will continue to explore its assets. Results from the MobileMT geophysical targets confirmed a strong correlation between historical drill results and the conductive signature that shows up from the MagnetoTelluric survey. Interpreting the data from the survey allowed District Metals to outline an additional 9 drill targets on the Viken project, but it also highlighted no fewer than 15 additional conductive targets across the Alum Shale properties.

And thus the company is gearing up to complete 5,000-7,000 meters of drilling across the properties. The size and timing of the drill programs will depend on the timing of the drill permits which could take six weeks to six months, depending on the project.

Meanwhile, District Metals also plans to complete an additional airborne MobileMT survey over the additional 72,078 hectares of land it has applied for. The timing and focus of the airborne program will depend on when the licenses will actually be awarded, but District is hopeful it can complete the survey by the end of the summer.

And the summer months will be busy for District, as the company will send field teams to complete a program of geological mapping, prospecting and geochemical sampling at the Ardnasvarre, Sågtjärn and Nianfors projects.

The cash position

The company ended September with a positive working capital position of approximately C$9.55M with C$9.24M in cash while the current pro forma value of the 1M shares it holds in Sherpa II Holdings is approximately C$150,000 (this is just theoretical at this point as the trading volumes in Sherpa II stock are virtually non-existent).

Subsequent to the end of Q3, the company received C$350,000 in warrant and stock option exercises. The treasury is in a good shape and we expect District Metals to be opportunistic if and when it decides to raise money this year.

The valuation of the nearby Haggan project raises eyebrows

Last week, Aura Energy surprised us by entering into a deal with MMCap out of Toronto whereby the latter will take a stake in the Haggan project. Additionally, the new entity Haggan will end up in will likely be listed in Canada.

Aura has signed a binding agreement with MMCap whereby the ownership of Haggan will be transferred to unlisted SIU Metals, which will end up becoming the 100% owner of Haggan. MMCap will fund SIU Metals with C$10M in cash resulting in a minority stake, while Aura Energy will retain a 78.7% stake in SIU Metals.

In theory, this is a logical step for Aura Energy as it continues to focus on its Mauritanian uranium asset. Monetizing what they consider to be a non-core asset makes a lot of sense, but the price tag is surprisingly low. Aura appears to be happy that it achieved a C$50M but we are very negatively surprised.

The explanation for this sweetheart deal may be twofold (and note, these are just our own assumptions). First of all, as Aura continues to focus on its Mauritanian asset, it’s understandable it’s looking at all its options. If they want to sell (or at least value) a promising asset at a bargain valuation, that’s Aura’s problem.

Secondly, we also need to understand who Aura is dealing with. Not only does MMCap have a reputation for shrewd deals, it also is Aura’s largest shareholder. As such, this deal should be seen as a related party transaction. Although Aura’s Nominated Advisor in the UK and the independent board members have approved the valuation, we expect to see a substantial higher valuation of SIU Metals once it starts trading later this year. If anything, we expect to see SIU trading closer to District Metals’ valuation rather than the other way around. At a C$50M valuation for Haggan, MMCAP appears to be the clear winner in this related party transaction, and we expect the market cap of SIU Metals (or its successor to reflect a higher valuation.

Conclusion

District Metals was a ‘political’ investment in the past few years but now the moratorium on uranium exploration and mining has been lifted, it again becomes an exploration and development story. The company already has a massive resource on the flagship Viken project, but having a Preliminary Economic Assessment will allow District Metals to talk numbers and economics. And if the September 2023 scoping study on the Haggan project completed for Aura Energy offers any indication, the market may be pleasantly surprised by the numbers.

All these elements mean that 2026 will be an important year for District Metals. The company has plenty of tailwinds as the uranium price remains strong, and it’s now up to CEO Garrett Ainsworth and his team to continue to create value for the District shareholders.

Disclosure: The author has no position in District Metals. District Metals is a sponsor of the website. This post is for educational purposes only; be mindful investing in junior mining stocks is risky and you may lose your entire investment if things go wrong. Please read our full disclosure.