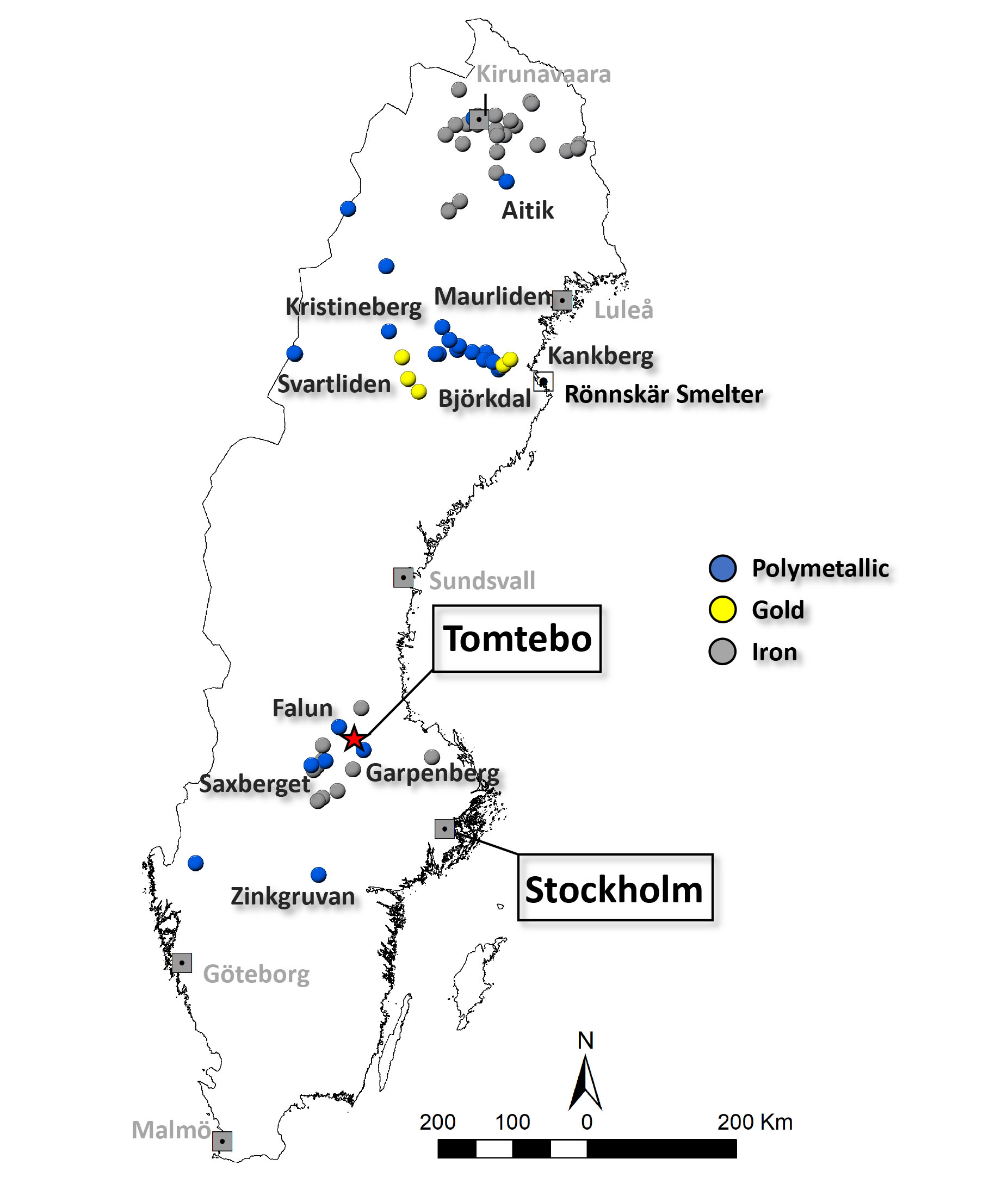

District Metals (DMX.V) has now released the assay results from 16 of the 22 holes it drilled on its Tomtebo VMS project in Sweden. Of those 16 holes, 14 intersected mineralization for a hit ratio of almost 90%. Despite this high hit ratio and despite not just encountering ‘some’ mineralization but consistent grades and thicknesses that appear to meet the economic cutoff grade, the market couldn’t be bothered by the drill results.

That’s surprising, as we will show some of the encountered mineralized intervals have very high gross rock values. And although we should take gross rock values with a grain of salt as the recovery rates and payability percentages for the end products still have to be determined, District Metals clearly is off to an excellent start.

Perhaps it’s a sign of the times with a temporary disinterest in base metals plays, but in any case, we are encouraged by the assay results of the first Tomtebo drill program in a few decades.

The recent drill results confirm the prospectivity of Tomtebo

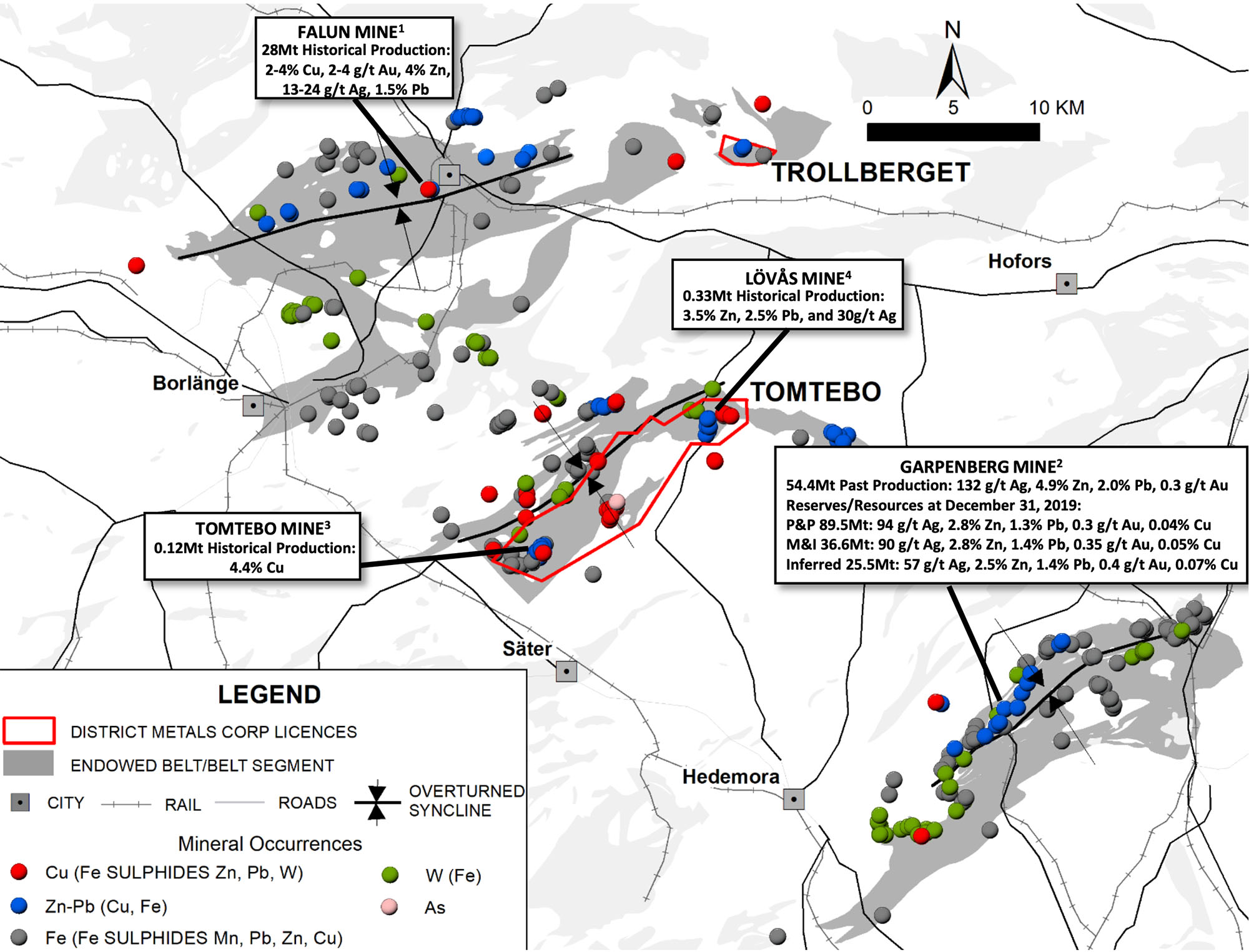

On June 28th, District released the assay results from an additional four holes that were drilled on the Tomtebo polymetallic project in Sweden. Previous results (discussed here) encountered high-grade lead-zinc intervals with decent gold and silver grades. The gross rock value per tonne ranged between US$193/t and US$522/t using the commodity prices at that point, which clearly was a good start to the Tomtebo drill program.

We did receive a comment about the low copper values in the initial few drill holes (and that’s not an issue considering the average grade of the other metals clearly made up for lower copper values), but the next two batches of assay results clearly hit the higher grade copper zones at Tomtebo. As mentioned, the assay results of four holes were released and one hole did not intersect mineralization while holes 15 (0.95 meters of 1.19% CuEq) and 16 (17.2 meters of 1.42% CuEq including 3 meters containing 4.73% CuEq) encountered decent (to good) copper grades over a decent interval, but it is clear hole 13 was the more interesting hole of the batch that was released.

- TOM21-013 intersected 8.65 m at 2.92% Cu and 0.43 g/t Au (76.65 to 85.30 m) including 7.05 m at 3.47% Cu and 0.52 g/t Au (77.45 to 84.50 m), and 5.15 m at 1.56% Cu and 0.32 g/t Au (191.30 to 196.45 m).

- TOM21-016 intersected 17.2 m at 0.94% Cu and 0.28 g/t Au (191.6 to 208.8 m) including 3.0 m at 2.80% Cu and 1.21 g/t Au (201.1 to 204.1 m).

The 8.65 meters containing 3.56% copper-equivalent starting at just 76.65 meters downhole was excellent while there were some more distinct higher grade zones like the 5.7 meters of 4.38% CuEq. Hole 13 also contained a bunch of narrow intervals and a blend of higher grade and lower grade copper(-equivalent) intervals, and that’s not entirely unexpected. That specific hole was designed to target copper mineralization down dip from the Gardsgruvan open pit.

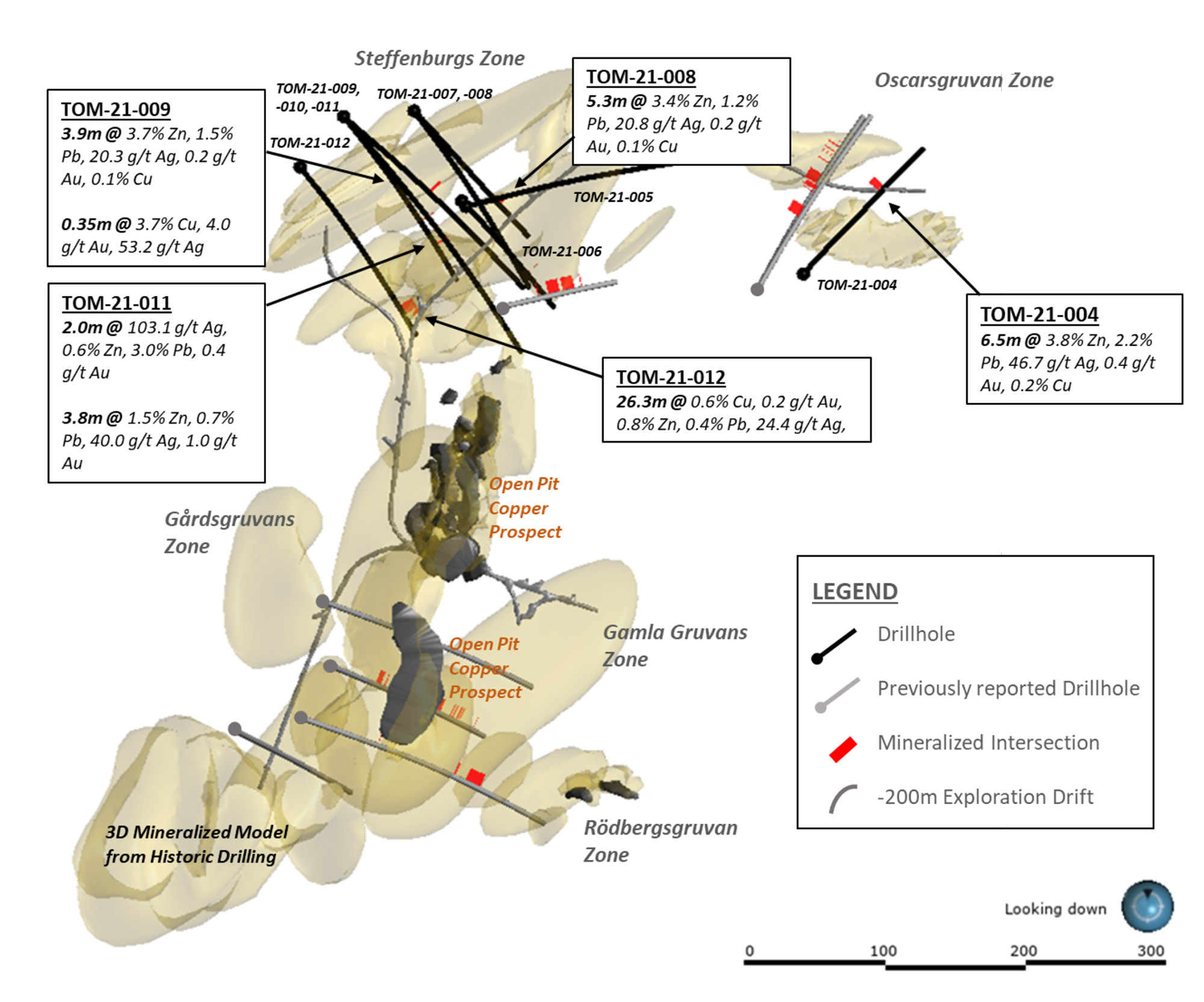

And in another update just last week, District reported on the assay results of an additional nine drill holes. Eight holes were drilled on the Steffenburgs zone and encountered classic VMS type mineralization while hole 4 was drilled at the Oscarsgruvan zone and encountered Garpenberg-style mineralization which has higher values of silver, lead and zinc (the producing Garpenberg mine barely recovers any gold and copper at this point).

- TOM21-004 intersected 6.5 m at 3.8% Zn, 2.2% Pb, 46.7 g/t Ag, 0.4 g/t Au, and 0.2% Cu (198.9 to 205.4 m) including 1.65 m at 10.9% Zn, 5.0% Pb, 93.4 g/t Ag, 0.4 g/t Au and 0.1% Cu (198.9 to 200.55 m).

- TOM21-008 intersected 5.3 m at 3.4% Zn, 1.2% Pb, 20.8 g/t Ag, 0.2 g/t Au, and 0.1% Cu (218.7 to 224.0 m).

- TOM21-009 intersected 3.9 m at 3.7% Zn, 1.5% Pb, 20.3 g/t Ag, 0.2 g/t Au, and 0.1% Cu (141.4 to 145.3 m) and 0.35 m at 4.0 g/t Au, 3.7% Cu, 53.2 g/t Ag, 0.1% Zn, and 0.1% Pb (184.65 to 185.0 m).

- TOM21-012 intersected 26.3 m at 0.6% Cu, 0.2 g/t Au, 0.8% Zn, 0.4% Pb, 24.4 g/t Ag (301.9 to 328.2 m) including 3.8 m at 0.7% Cu, 0.3 g/t Au, 1.7% Zn, 0.9% Pb, 35.7 g/t Ag (308.55 to 312.35 m).

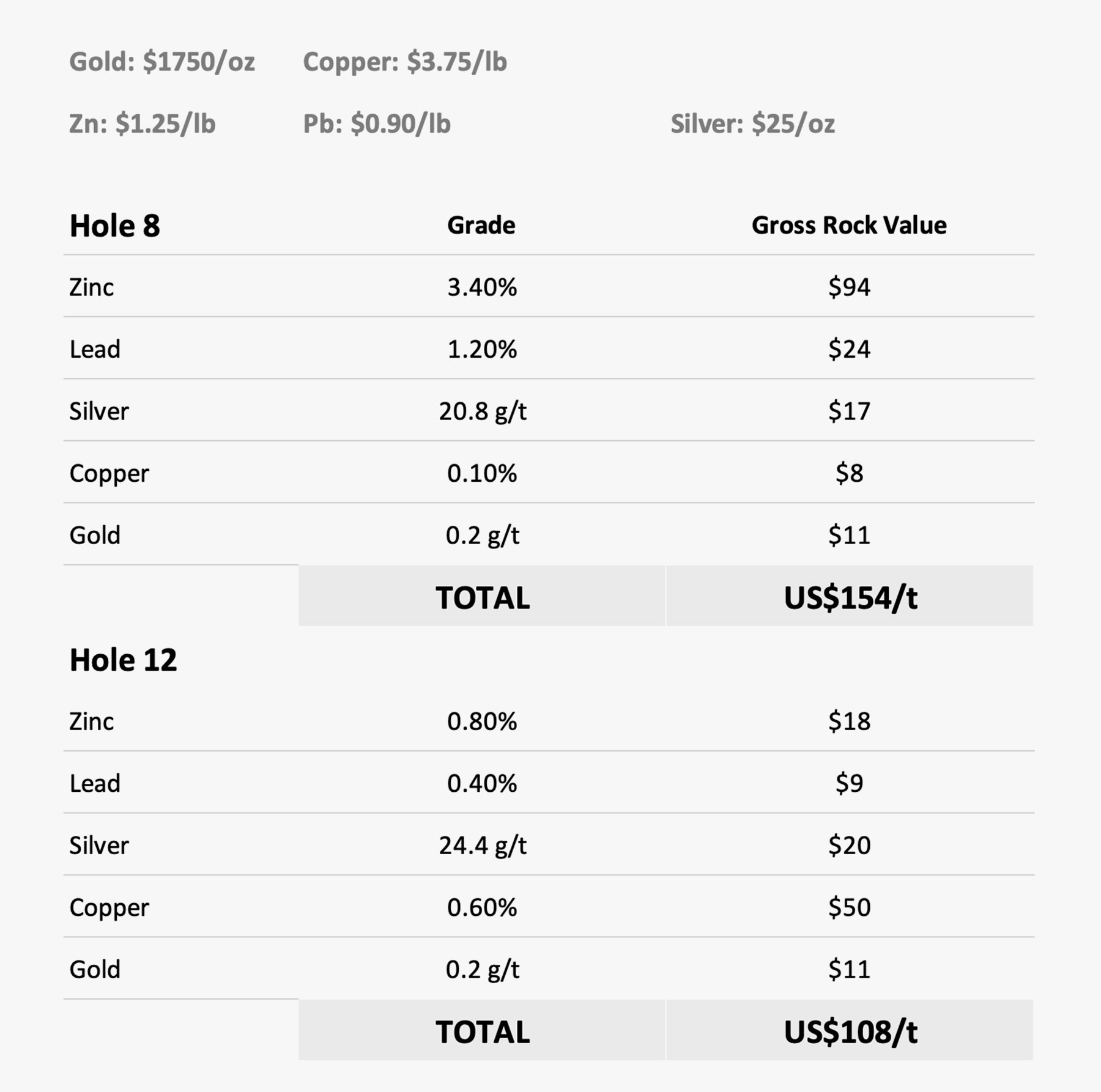

We calculated the gross rock value of holes 8 and 12 here below.

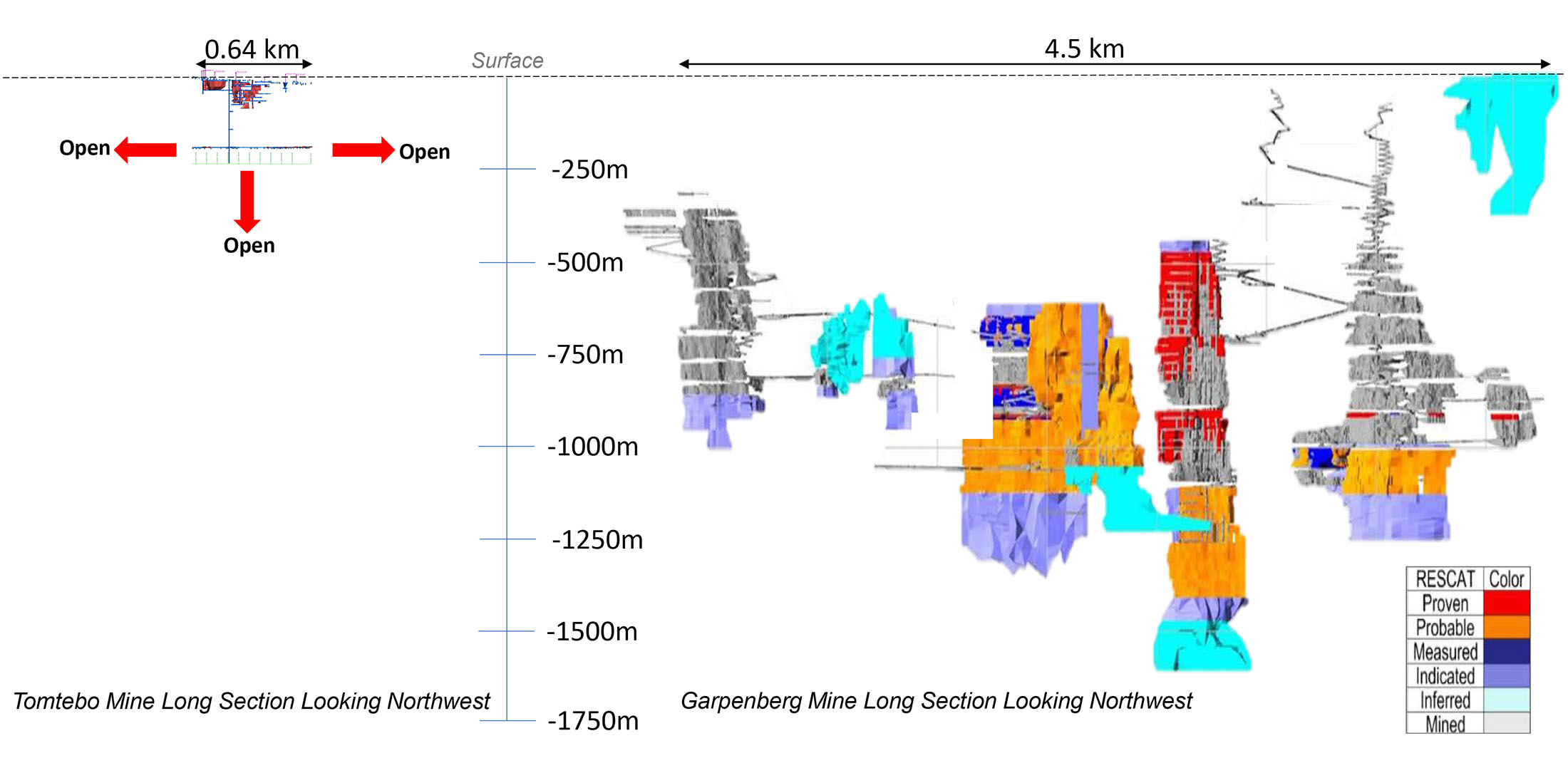

The gross rock values of these holes are still exceeding respectively US$150/t and US$108/t and it seems to be pretty clear the mineralization in those holes would exceed the required cutoff grades. As a comparison: the Garpenberg mine uses a cutoff grade of just $32/t (on a NSR basis) which is very low for an underground mining operation. Of course, the low cutoff grade at Garpenberg is made possible thanks to the high throughput creating substantial economies of scale and it is obviously way too early to assume a potential mining scenario at Tomtebo will have the same economics, but with a gross rock value vastly exceeding US$100/t over mineable widths in some of the highlighted holes, the assay results that have been released so far are very encouraging.

The recent two batches of results followed up on previous zinc-heavy drill results

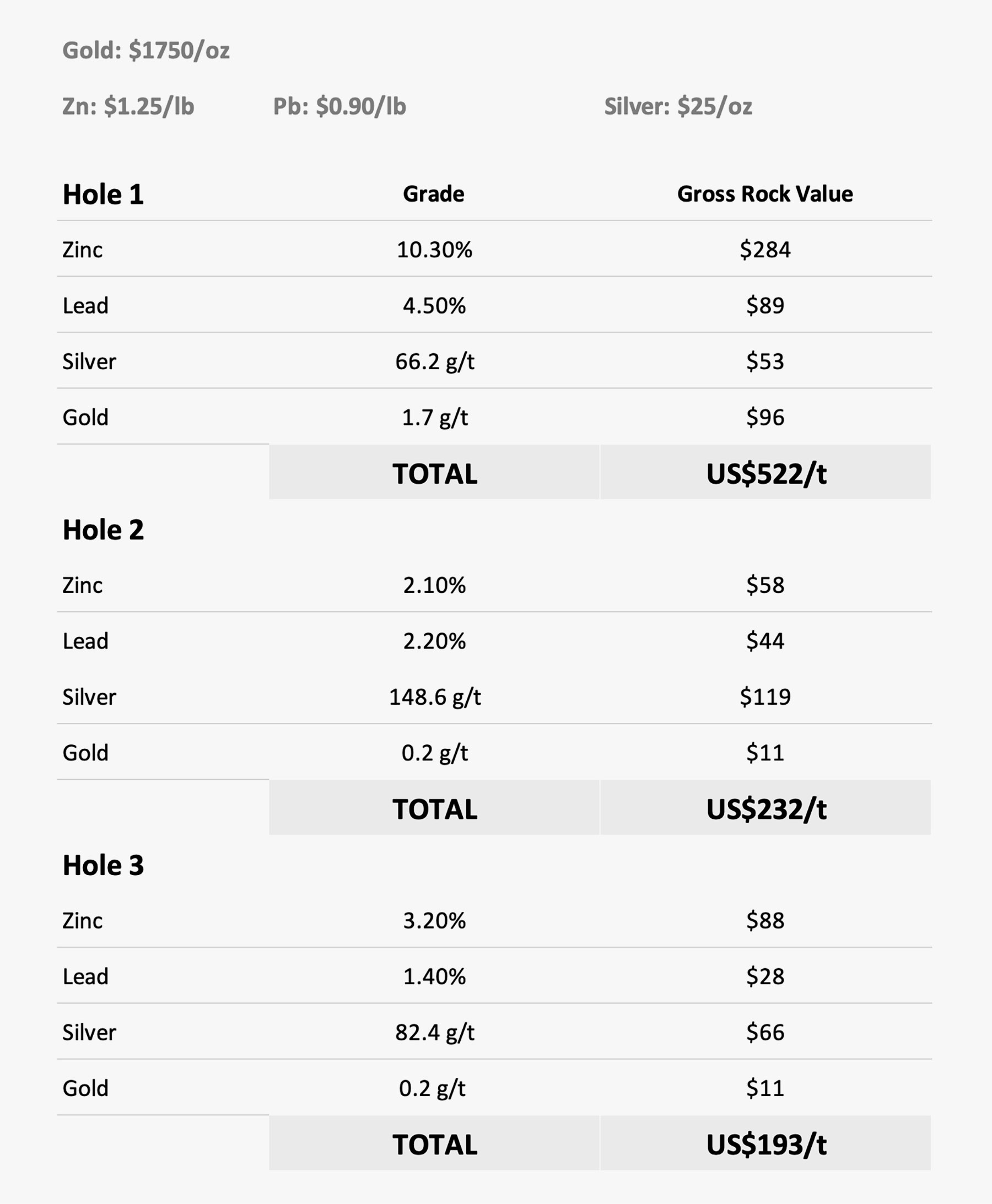

The two recent exploration updates were following up on the first batch of assay results which was released in May. In that update, the assay results of three holes were published, and all three holes in that very first update contained mineralization that would clearly exceed the typical NSR cutoff values for an underground polymetallic mine.

As this is the first drill program in a few decades and while District Metals is still just scratching the surface, it’s encouraging to see the very high-grade results in the very first hole drilled on the property in a few decades, and the decent enough grades in holes 2 and 3 where the silver values are higher but the base metal values lower.

- TOM21-001 intersected 8.2 m at 10.3% Zn, 4.5% Pb, 66.2 g/t Ag, 1.7 g/t Au, and 0.08% Cu (65.3 to 73.5 m) including 3.2 m at 17.8% Zn, 8.3% Pb, 124.4 g/t Ag, 1.6 g/t Au and 0.07% Cu (70.3 to 73.5 m).

- TOM21-002 intersected 12.55 m at 148.6 g/t Ag, 2.1% Zn, 2.2% Pb, 0.2 g/t Au, and 0.04% Cu (90.8 to 103.35 m) including 4.75 m at 198.5 g/t Ag, 4.5% Zn, 3.1% Pb, 0.3 g/t Au, and 0.04% Cu (98.6 to 103.35 m); and 4.8 m at 197.0 g/t Ag, 4.9% Zn, 2.4% Pb, 0.3 g/t Au, and 0.03% Cu (125.0 to 129.80 m).

- TOM21-003 intersected 14.85 m at 82.4 g/t Ag, 3.2% Zn, 1.4% Pb, 0.2 g/t Au, and 0.02% Cu (161.3 to 176.15 m) including 7.8 m at 117.6 g/t Ag, 3.5% Zn, 1.9% Pb, 0.3 g/t Au, and 0.02% Cu (163.3 to 171.1 m) and including 2.95 m at 74.2 g/t Ag, 6.2% Zn, 1.3% Pb, 0.2 g/t Au, and 0.03% Cu (173.2 to 176.15 m).

The high precious metals content doesn’t really come as a surprise as those are very important credits at the nearby Garpenberg mine, owned and operated by Boliden.

While this clearly is a VMS system and while most VMS systems indeed contain a chunk of copper, the grades of the other metals clearly make up for the low copper values in the first few holes. In the table below, we have summarized the three headline results and provided the gross rock value per tonne.

While we would like to emphasize the ‘GROSS’ in gross rock value (as recovery rates and the different percentages of payable metal will have a major impact on the net rock value) even if you’d apply a 30-35% haircut to the gross metal value in the Tomtebo rocks, you are still ending up with high quality and high-value rock.

And just for comparison sake, the Garpenberg mine reported a recovery rate of approximately 90% for zinc, 78% for silver (which almost all ends up in the lead concentrate) and 84% for lead. The copper and gold recovery rates at Garpenberg are low, not because the metallurgy is too difficult, but because Boliden doesn’t really care too much about those two metals and hasn’t put in an additional circuit to actually recover gold and copper.

Clearly hole 1 is the best hole of the batch of three, that’s obvious. But it would be a major coincidence if the very first hole of the very first modern-day drill program at Tomtebo would be the best interval on the property and while the assay results of holes 2 and 3 may be the main reason why the share price reaction was lukewarm, there’s obviously more to come and it remains important to understand District Metals has barely been scratching the surface at Tomtebo and the data from the first few holes will be a major driver to figure out where and how to drill next.

While this May 25th update contained very intriguing assay results, the most important portion of that press release was the quote provided by Rodney Allen who, during his 10-year stint at Boliden, helped to rapidly improve the understanding of the Garpenberg project. Allen is known as a very reasonable and realistic person and doesn’t have a history of being too ‘arm-wavy’. Whereas we take overly exciting quotes from management teams with the necessary grains of salts, having Rodney Allen going on record with the next few quotes will for sure have caused some ears in Sweden to perk up.

“The first drill hole in the 2021 program provides an excellent intersection of the Zn-Pb-Ag massive sulphide mineralization at Tomtebo and is a giant step forward in understanding the Tomtebo mineral system. This drill hole provides the critical information that confirms the nature of the targets in the Tomtebo area”

Rodney Allen

And he continues (the emphasis is ours):

“This indicates a second type of target, somewhat different to that in hole one, in which mineralizing hydrothermal solutions moved up through the volcanic stratigraphy, forming a stockwork of sulphide veins, and where the solutions met chemically reactive limestone beds, they spread out laterally along the contacts of the limestone, forming skarn in the limestone and mineralizing both the volcanic rock and the skarn. This is a similar style of mineralization to that at the nearby giant Garpenberg mine”

Rodney Allen

So while at that point the results of just three holes were known, Rodney Allen was already drawing the comparison with the nearby Garpenberg mine.

Putting the pieces of the puzzle together

Investors need to keep in mind the VMS mineralization at Tomtebo isn’t currently oriented like a classical layered VMS project. The geology of the Tomtebo area is quite old and has been folded on its side. So rather than encountering the copper-gold zone below the base metals rich Ag-Zn-Pb zones as you would expect from a classical VMS system, the mineralization is on its side rather than at depth.

This means the copper-gold feeder zones are found east and south of the zinc-lead-silver distal zones, and that’s an important distinction. We received a message from a reader expressing his surprise to see the copper-gold zone to be this close to surface, thinking Tomtebo was a classic VMS system in its original orientation, which would indicate the thickness of the base metals layer would be thinner than anticipated. But exactly because the mineralized system has tilted, the exploration approach also changes as District Metals will have to drill-test the mineralized structures on a lateral basis, rather than drilling very deep at this point in time.

Remember this is the very first time in several decades the Tomtebo project is the subject of a drill program. And with every single drill hole, District Metals gets a better understanding of the style and geometry of the mineralization. This is a classic case of how a project could benefit from having a fresh set of eyes look at it as previous exploration companies didn’t make the connection between the different types of mineralization and how this relates to the bigger picture.

It’s encouraging to see the company’s Steffenburg and Oscarsgruvan zones (the upper portion of the image above) seem to have intersected the typical zinc-lead-silver mineralization but the majority of this area remains un(der)explored.

It’s refreshing to see how District Metals always includes a very comprehensive overview and explanation of the geological background of the drill results, and how every additional hole adds more data and increases the understanding of the mineralized zones. In the June 28th update, for instance, the press release contained an entire page on the theory behind the mineralization, clearly explained in layman’s terms by Rodney Allen, District Metals’ technical advisor and expert in these types of deposits in Sweden.

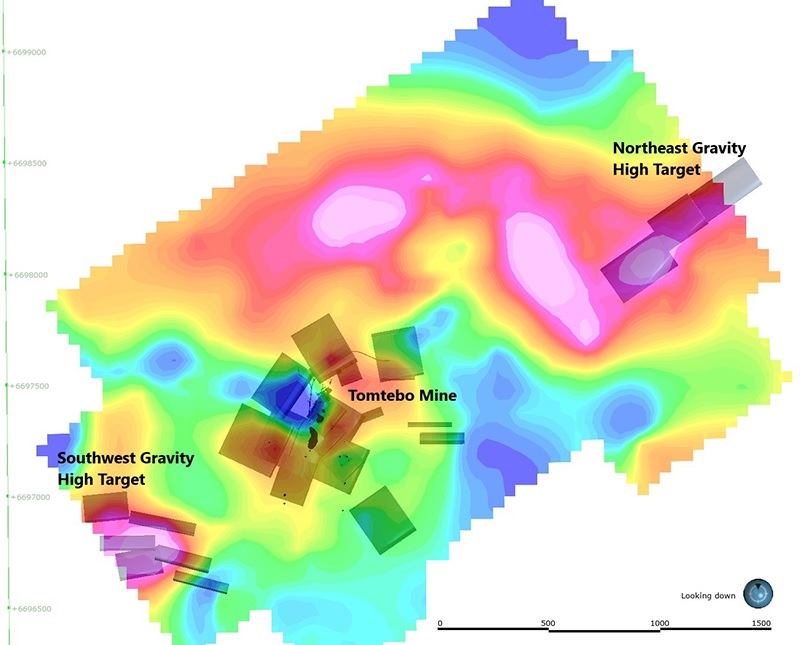

The assay results of the final six holes of the drill program will be released in a few weeks. Subsequent to those additional assay results, District Metals will be releasing the results of a downhole electromagnetic survey which will help it to get a better understanding of the system and to design the Phase Two drill program which should start after the summer and we expect District Metals to drill a few larger stepout holes in order to rapidly build tonnage at Tomtebo to reconfirm the potential of the district. There are a few juicy anomalies on the Tomtebo land package that have never been drilled before, and we expect District Metals to drill a few wildcat holes.

Conclusion

It’s tough to try to understand why the District Metals share price is so weak. The C$0.30 financing completed at the end of last year became tradeable more than two months ago, so perhaps there is a delayed reaction with people clipping the warrant and selling the stock on the news.

Perhaps the market is betting against District Metals and is expecting the company to head back to the capital markets to raise more cash. That wouldn’t be the smartest move from those speculators as District Metals still has in excess of C$3M in cash and the upcoming second phase 5,000 meter drill program will only cost between C$1.5M and C$2M, so we don’t anticipate District Metals to raise money anytime soon (unless a strategic investor shows up). We think the game plan is to complete the phase 2 drill program and look for a window of opportunity to raise cash on the back of those results. District is in no rush as it has sufficient cash on hand to last at least another six months, including the completion of a 5,000-meter drill program.

Disclosure: The author has a long position in District Metals. District Metals is a sponsor of the website. Please read our disclaimer.