District Metals (DMX.V) surprised the market last week with its announcement it applied for an exploration license which encompasses almost 70% of the Viken polymetallic deposit. Once owned by Continental Precious Metals (which reached a multi-hundred million dollar market cap on the back of it), the project was sold for a song at the end of last decade and the licenses lapsed after Sweden officially enacted its uranium mining moratorium.

The new world reality has caused world leaders to rethink their energy policy. Sweden is turning increasingly pro-nuclear power (which, in combination with renewable energy makes up 90% of the electricity production mix) and a domestic source of production could be of national strategic interest to the Scandinavian country.

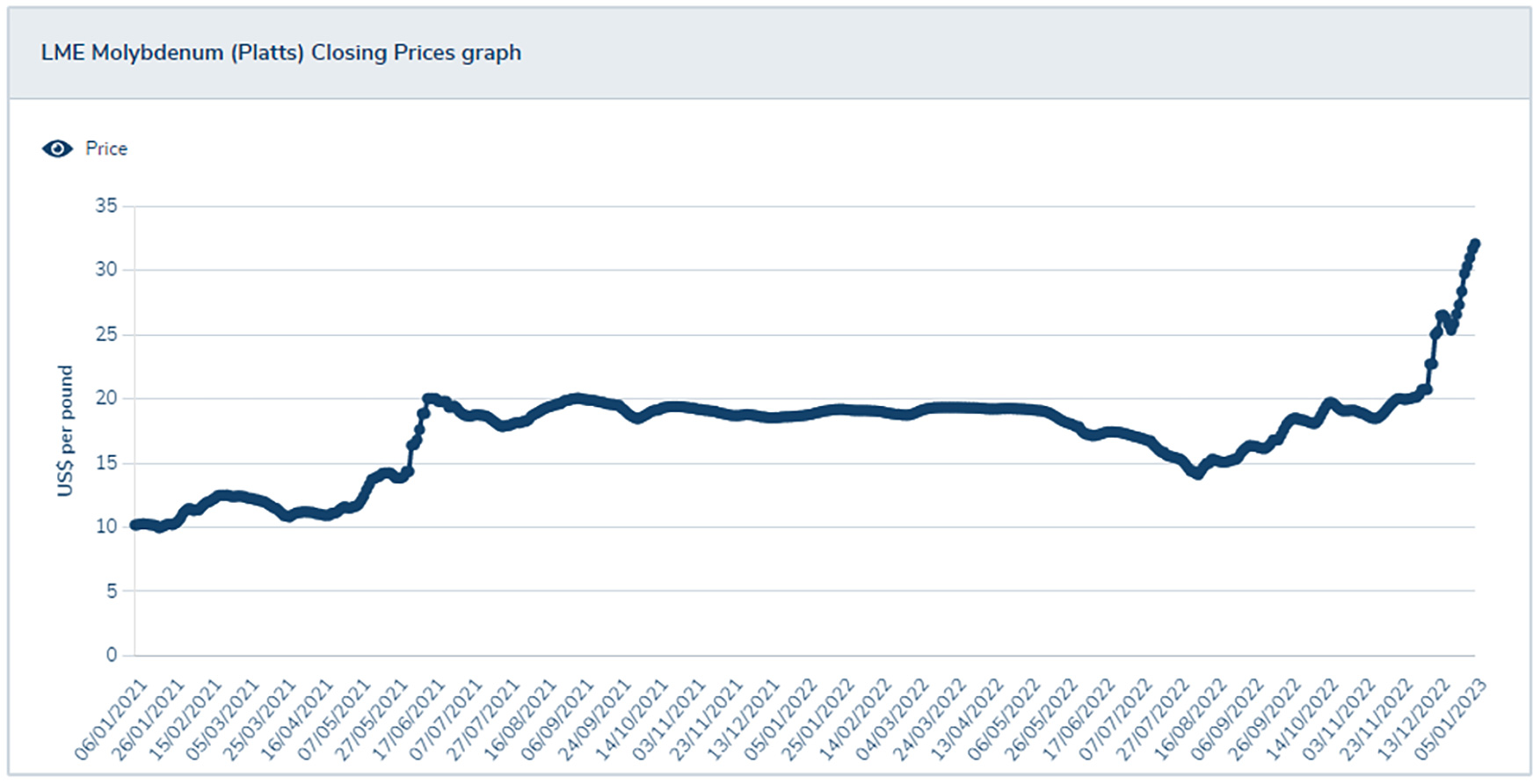

Of course, there are a lot more hoops to jump through to effectively be allowed to mine and process uranium, but we are actually more interested in the vanadium and molybdenum content of the resource. Two important metals and based on the current prices, not uranium but vanadium is the most valuable metal in the ground.

The deal

Viken was the flagship project of Continental Precious Metals in the past decade before the project was ‘forgotten’ due to a moratorium on uranium mining in Sweden. District has applied for a mineral license to explore for vanadium, nickel, molybdenum, zinc and other elements and the ministry will likely reach a decision on the application by the end of next month.

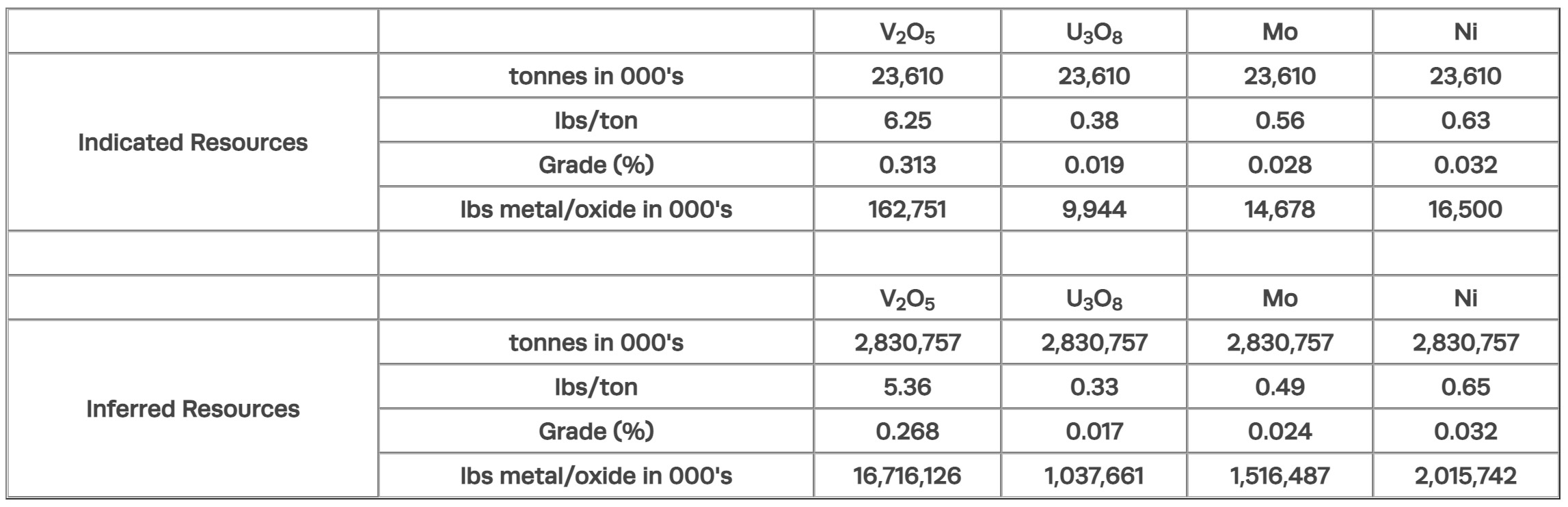

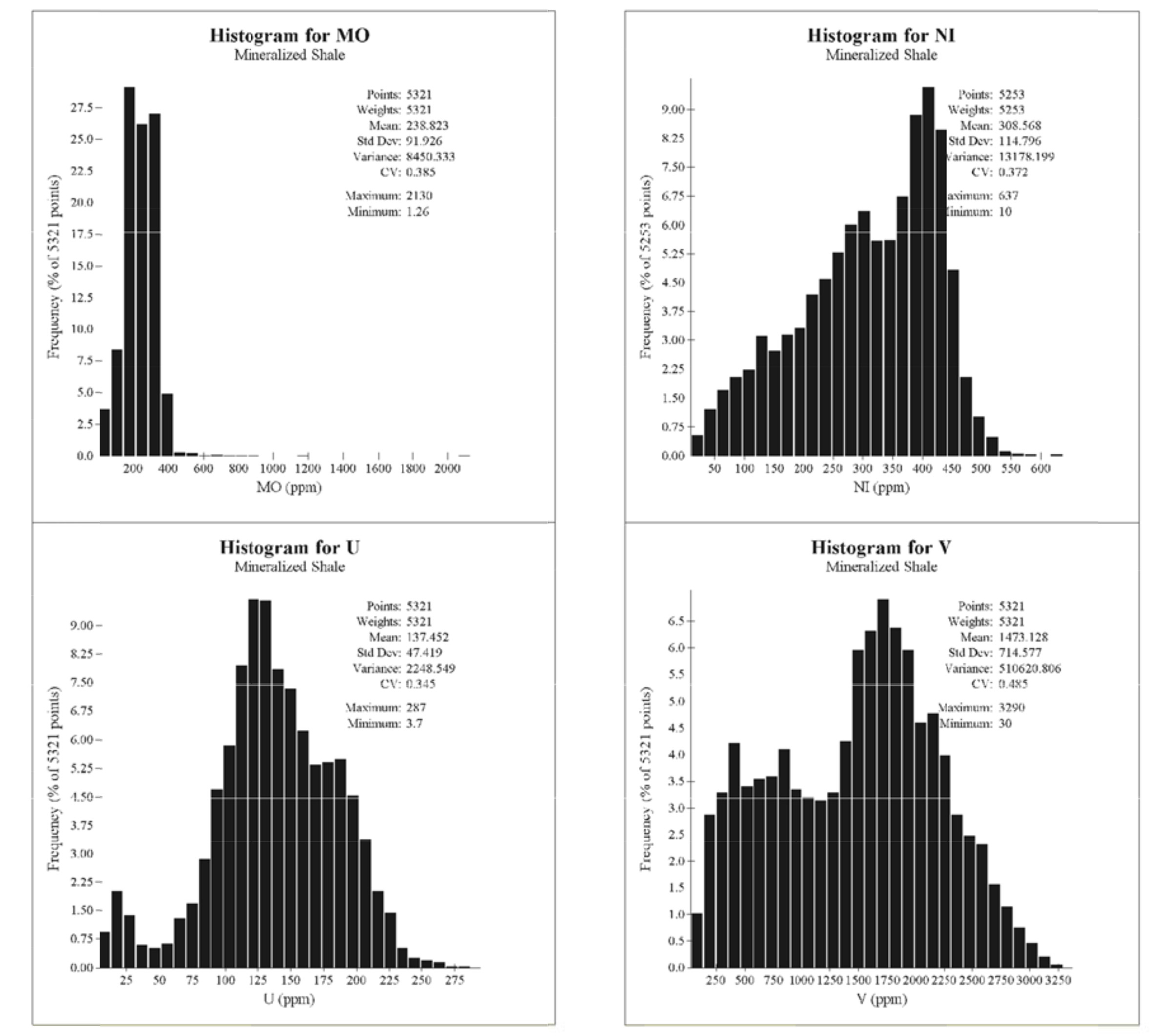

That moratorium could be overturned later this year which suddenly makes the Viken project interesting again. After all, the most recent resource estimate contained 43 million tonnes of rock in the indicated resources and over 3 billion tonnes (not a typo) in the inferred resource category. The 3 billion tonnes have an average grade of 0.017% U3O8, 0.034% Nickel, 0.012% copper and 0.042% Zinc. This resource excluded the vanadium and molybdenum potential which was outlined in 2010. With an average grade of 0.27% V2O5 and 0.024% Mo in the inferred resource category, Viken is one of the largest uranium-vanadium deposits in the world.

As you can see in the image above, the inferred resource contains 16.7 billion pounds of vanadium pentoxide, 1.04 billion pounds of uranium, 1.5 billion pounds of Molybdenum and 2 billion pounds of Nickel.

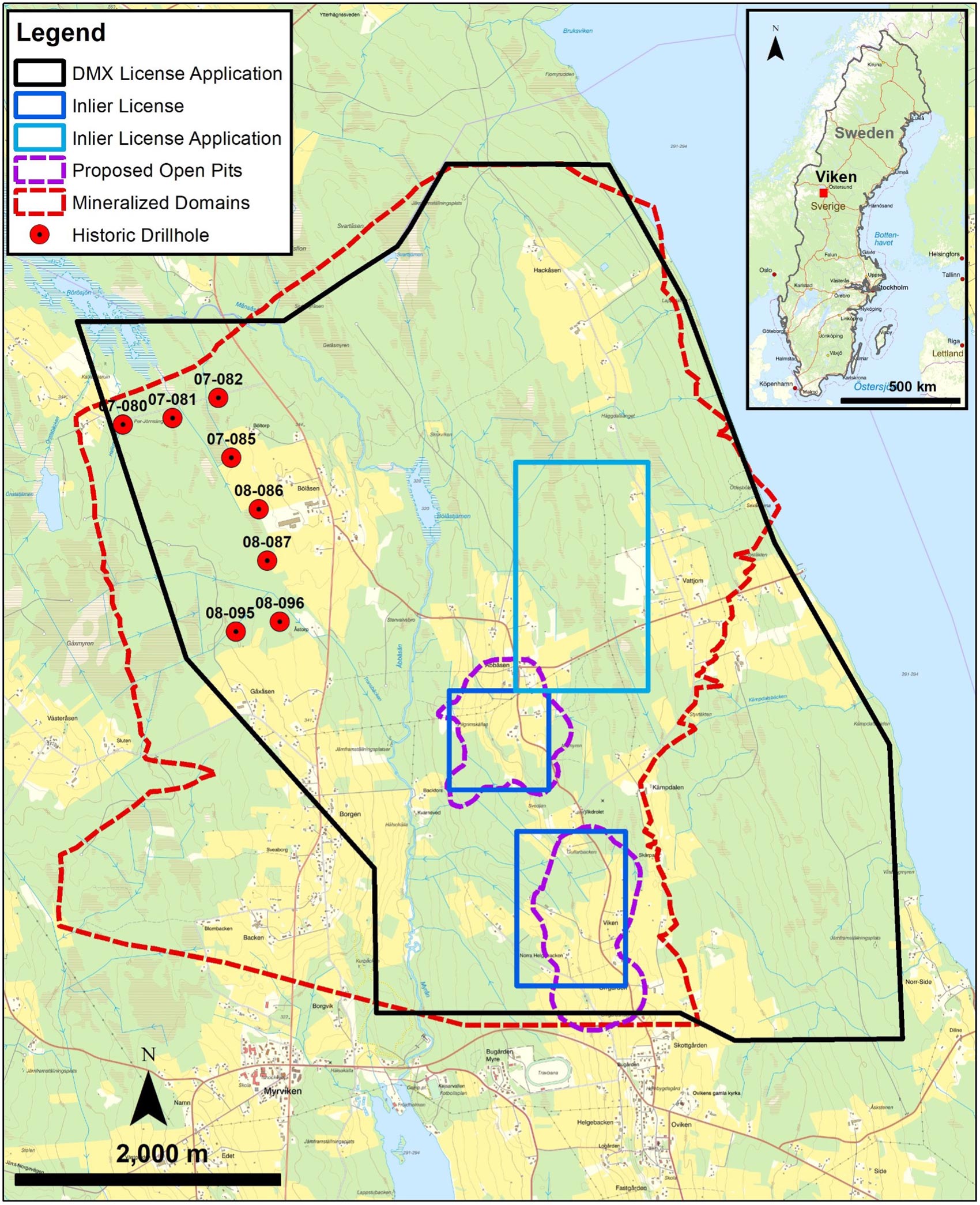

Unfortunately, District was not able to stake the license encompassing the entire resource as another party obtained two licenses and applied for a third. But, according to District, almost 70% of the total known resource falls on the District land.

This means District suddenly sits on a historical resource of 11.5 billion pounds of vanadium pentoxide, 700 million pounds of uranium, over a billion pounds of molybdenum and about 1.4 billion pounds of nickel. For a total cost of just C$7,000 (see later).

Of course the grade is low, very low. A 2014 PEA focused on uranium, nickel, copper and zinc. Still, given the current commodity prices, vanadium and molybdenum are pretty valuable metals as well, and we expect any future study to focus on recovering those two metals as that will likely be the deciding factor on whether or not the project is economical.

This means it’s pretty useless to look at the 2014 PEA and its outcome as a nine-year-old study will never provide a representative overview of a project. The capex and opex will be outdated, undermining the credibility of the results. Additionally, as vanadium and molybdenum were not included in that study, we’d rather wait for District to work on an updated study that includes these metals.

Historical metallurgical test work indicated 90% of the vanadium and 85% of the molybdenum could be recovered. Applying a vanadium pentoxide price of $7.5 per pound (currently $8.90) and a molybdenum price of $15 per pound (currently $31/pound), the net recoverable rock value would be boosted by $42/t. That’s three times the recoverable uranium value per tonne (US$14/t based on a $50/lbs uranium price).

A Q&A with CEO Garrett Ainsworth

The Application

In your press release, you stated District applied for a mineral license to explore for ‘vanadium, nickel, molybdenum, zinc and other elements’ without specifically naming Uranium. Is this because the moratorium is officially still in effect?

That is correct, the moratorium on uranium in Sweden that came into affect on

August 1, 2018 does not allow any company or individual to explore or mine solely for uranium. Mining of polymetallic ore with greater than 0.02% U is not allowed, which is convenient because the concentration of uranium in the polymetallic Viken Deposit is just under the 0.02% U threshold. Much of the value of the Viken Deposit comes from the vanadium, which has moderate grades in the range of 0.27 to 0.31% V2O5, so the Viken Deposit can be further developed on this basis while we wait for the new Swedish Government to hopefully remove the moratorium on uranium.

Could you walk us through the process here? Assuming your application is confirmed by the end of February, what are the next steps? How long is it valid for, are there minimum work commitments and what’s required after the initial term?

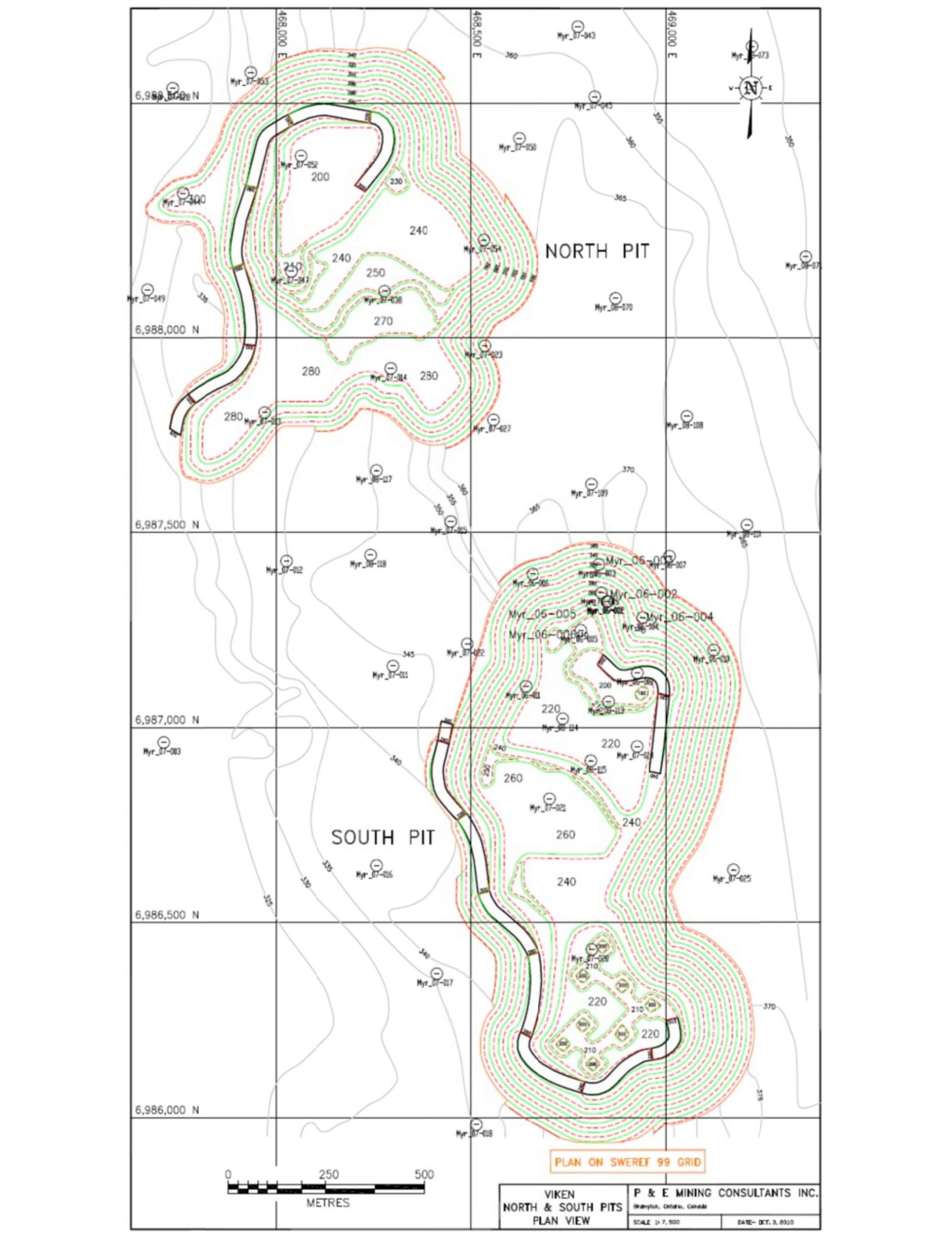

With assistance from a Swedish consulting firm, we submitted our application for the Viken nr 101 mineral license to the Bergsstaten (Mining Inspectorate), which involves filling out a standard form and providing a map with UTM co-ordinates for the corner points. Our Viken nr 101 mineral license application is approximately 2,300 hectares and covers 68% of the surface area of the Viken Deposit.

Assuming we get approval from the Bergsstaten, the cost to hold the Viken nr 101 mineral license for 3 years will come in at CAD$7,000. By the third year we’ll need to do minimal exploration work that could include geological mapping, geochemical or geophysical surveys. It’ll cost about CAD$7,000 to hold this mineral license for years 4 to 6 where drilling will need to be carried out in order to be eligible to continue for years 7 to 10.

What’s the latest on the uranium moratorium? What are the steps that still need to be completed? Is the motion to unwind the moratorium well-supported on the entire political spectrum in Sweden?

The new center-right coalition government formed in October 2022 where they have already changed Sweden’s stance on nuclear energy by calling for the possible restart and construction of new nuclear reactors. The new center-right coalition government in Sweden passed a motion on November 22, 2022 to revert the Minerals Act back to its original wording before August 1, 2018, such that uranium mining would be possible again in Sweden.

The former center-left coalition government was in the process of winding down nuclear energy in Sweden, and they were also responsible for applying the moratorium on uranium.

In June 2021, a Novus poll of the Swedish People showed 46% in favour of building new nuclear power plants, 31% in favour of continuing to run existing ones, and 14% wanting to phase out nuclear power. 10% of respondents were undecided. These numbers have likely shifted even more favourably towards support for nuclear energy given the ongoing energy crisis in Europe since Russia invaded Ukraine in February 2022.

Areal View of the Project area Looking West with Lake Storsjön in the Foreground (Continental Precious Minerals)

The project and deposit itself

We were initially thrown off by the image of two proposed pits, which were staked by a third party. But after reading the 2014 PEA, it looks like those were just relatively arbitrary ‘starter pits’ with less than 700 million tonnes of the 3B+ tonne resource, and you could just drill out an in-pit resource elsewhere on your license, is that correct?

The Polymetallic Viken Deposit is very large and our application covers the majority of the Viken Deposit, so it would be possible to drill out an in-pit mineral resource estimate (indicated/measured) elsewhere within the Viken Deposit that is on our mineral license application. The host rock is a black shale (Alum Shale), which are regionally extensive in Sweden. The Viken Deposit is an outcropping to near surface anticline (ridge) where the Alum Shale has been thickened from 20 to 30 m to upwards of 180 m, which is why the 2010 and 2014 PEAs show such positive numbers.

We also notice the third party did not stake all the way around the originally planned open pits. May we assume this indicates the third party will either have to redesign its pits to make sure the laybacks etc fit within the application, or that he would have to deal with District to fully optimize his own open pits?

The third party is an individual, and in Chapter 2, Section 1 of the Swedish Minerals Act a mineral license area must not be larger than what the applicant can be assumed to explore in an efficient way. So, in practice 100 hectares is typically the largest mineral license area that a private person can claim, which is likely why the third party did not stake all the way around the originally planned open pits from the 2014 PEA.

Mineral license boundaries go from surface down to the center of the earth, so mining of ore outside of one’s mineral license is prohibited. The third party would have to redesign the proposed open pits from the 2014 PEA, which would be easy enough to do.

The PEA outlined a scenario with a strip ratio of less than 0.7:1. Do you feel this is representative of the entire deposit?

No, the strip ratio will be variable across the entire Viken Deposit because the host Alum Shale occurs as both in situ and fault detached blocks, which means at some locations it will be outcropping at surface and in other locations it will be near surface (within 150 m).

Diamond drill information suggests that a Northwest trending zone approximately 1,000 m

wide that traverses the entire Viken Mineral Licence application is underlain by Alum Shale exposed at surface, which would have the best strip ratio in a mining scenario.

In the same PEA, molybdenum and vanadium were completely ignored (the PEA mentions they ‘would be assessed in future studies’). Do you know why? Based on the current prices, it looks like the vanadium could be more valuable than the uranium on a net recoverable basis?

The 2010 PEA focused on vanadium (90% recovery), uranium (85% recovery), and molybdenum (85% recovery) which were to be recovered by fine grinding and tank alkaline leaching, followed by roasting.

The 2014 PEA focused on bio-heap leach mineral processing, which returned recoveries of 81% uranium, 76% nickel, 70% copper, and 82% zinc. The bio-heap leach is considered to be better from an environmental standpoint, and also improved the cash flow numbers. It was suggested that the recovery of vanadium and molybdenum could be considered, provided the technical feasibility is verified by test work and the economics are proven to be attractive. So, more work is needed to figure out the recovery of vanadium and molybdenum under a bio-heap leach scenario.

Yes, much of the value of the Viken Deposit comes from the vanadium, so deciding on the best mineral processing flow chart that includes vanadium will be important.

Should this project ever be developed, it will likely be a large earth moving exercise to unlock economies of scale. The downside at that point would then be you are producing more Vanadium than the world demand could handle. A luxury problem?

The size of the Viken Deposit lends itself to a multitude of sizes for a potential mining operation, which can be utilized to balance out the right CAPEX and supply considerations. The last large price peak of vanadium (V2O5) to almost US$30/lb in 2018 was a reaction to the anticiated demand of vanadium for batteries and as an alloy in steel, which will be with us for the foreseeable future.

Let’s go back to metallurgical test work. The 2014 PEA used bio-heap leaching, which resulted in an 80% recovery rate for uranium and 75% for nickel. Would Vanadium and molybdenum even be recoverable using a heap leach process, or do you expect to go back to the drawing board when it comes to designing a flow sheet?

The 2014 PEA was incomplete in the sense that they did not resolve whether vanadium or molybdenum would be recoverable using the bio-heap leach process. The fact that the 2014 PEA returned positive cash flow analysis without the vanadium shows that there is potentially a lot of meat left on the bone to add value through additional metallurgical work.

Corporate

You’re a small company with limited financial resources and human capital. How will you prioritize exploration plans and what will determine your focus?

It’s not every day that you have the potential to acquire a property that covers the majority of a large polymetallic deposit with historic resource estimates and positive economic studies for approximately CAD$7,000.

Upon confirmation that we have been granted the Viken nr 101 mineral license we will delve into all of the available data to make the best informed decisions on the next steps. However, at this stage the next steps look like infill and expansion drilling to upgrade the resource category and increase the mineral resource estimate, and additional studies on the metallurgy focused on vanadium and molybdenum.

You obviously have a history in Uranium although your recent experience with NexGen was high-grade uranium in Saskatchewan. Can you apply your general (technical) knowledge on a low-grade deposit like Viken?

Once an area with thickened Alum Shale has been established the delineation drilling of that target to obtain a mineral resource estimate is much, much easier than any delineation drilling of high grade uranium in the Athabasca Basin. Drill delineation of the Viken Deposit requires shallow and vertical holes that are spaced widely apart (30 m to 380 m) given the shallow and continuous nature of the polymetallic mineralization in the Alum Shale. This is nothing like the often challenging drilling conditions and 15 to 50 m step outs that are required to delineate a deposit in the Athabasca Basin.

What the Viken Deposit lacks with high grades it then makes up for it with high tonnage and a low strip ratio shovel and truck open pit mining scenario.

Sweden currently requires 3.3 million pounds of uranium per year to keep its nuclear power plants going. May we assume rolling back the uranium moratorium fits in Sweden’s long-term plans to remain self-reliant when it comes to energy? Nuclear represents about a third of the electricity production and nuclear + wind + hydro represents about 90% of the electricity production.

Yes, that is some of the noise coming from politicians and academics in Sweden. Now that the new Swedish Government has pivoted the Country towards being pro-nuclear it makes sense for Sweden to also be self-reliant on the uranium that is needed to fuel their nuclear reactors. This line of thinking has intensified further with the ongoing energy crisis in Europe, and the desire to not be reliant on authoritarian regimes for any commodity as part of an effective critical minerals strategy.

Conclusion

While the low grade of the Viken deposit is a buzzkill, the downside for District Metals is limited as the cost to obtain the license is just C$7,000 for the first three years. Of course, once District starts exploring the property the total project-related cash outflow will increase. Still, District could obtain a NI43-101 resource calculation pretty fast given how shallow and homogenous the deposit is.

The project stands or falls with overturning the ban on uranium mining. It now appears that ban could indeed be overturned in 2023, but that isn’t the holy grail. Yes, the Viken deposit contains uranium. A lot of uranium. But the deposit’s future will be based on the economic viability (and recovering the vanadium and molybdenum will likely play a critical role here) as well as obtaining a social license from the local communities. Overturning the uranium ban does not mean the project automatically gets a green light as there still are plenty of hurdles to jump over.

Some would argue this is a pivot, but it is clear the market didn’t care too much about the good drill results at Tomtebo and District was just looking to create value elsewhere. Additionally, as the company remains active in the same country and is playing to the strength of the CEO with a rich history in uranium, we don’t see this transaction as a massive pivot. Future exploration results and the political climate will determine the fate of the Viken project. And as mentioned, the (monetary) downside risk is pretty limited.

Disclosure: The author has a long position in District Metals. District Metals is a sponsor of the website. Please read our disclaimer.