District Metals Corp. (DMX.V) came out of the gate about 18 months ago but has recently been focusing on the acquisition and interpretation of the Tomtebo project in Sweden, where it’s earning a 100% ownership from EMX Royalty Corp. (EMX.V).

District also recently announced it sold an 80% stake in the Bakar property to Sherpa II Holdings, a shell which needed a qualifying transaction to come out of the gate. District Metals will receive C$50,000 in cash and 1 million shares from Sherpa which also committed to spend C$200,000 in exploration expenditures. As you may remember, District paid C$50,000 in cash and issued 1.25M shares to the underlying vendor, so DMX is basically recouping its investment with the sale of 80% to Sherpa and perhaps can make a few extra shekels should the remaining 20% end up being worth something.

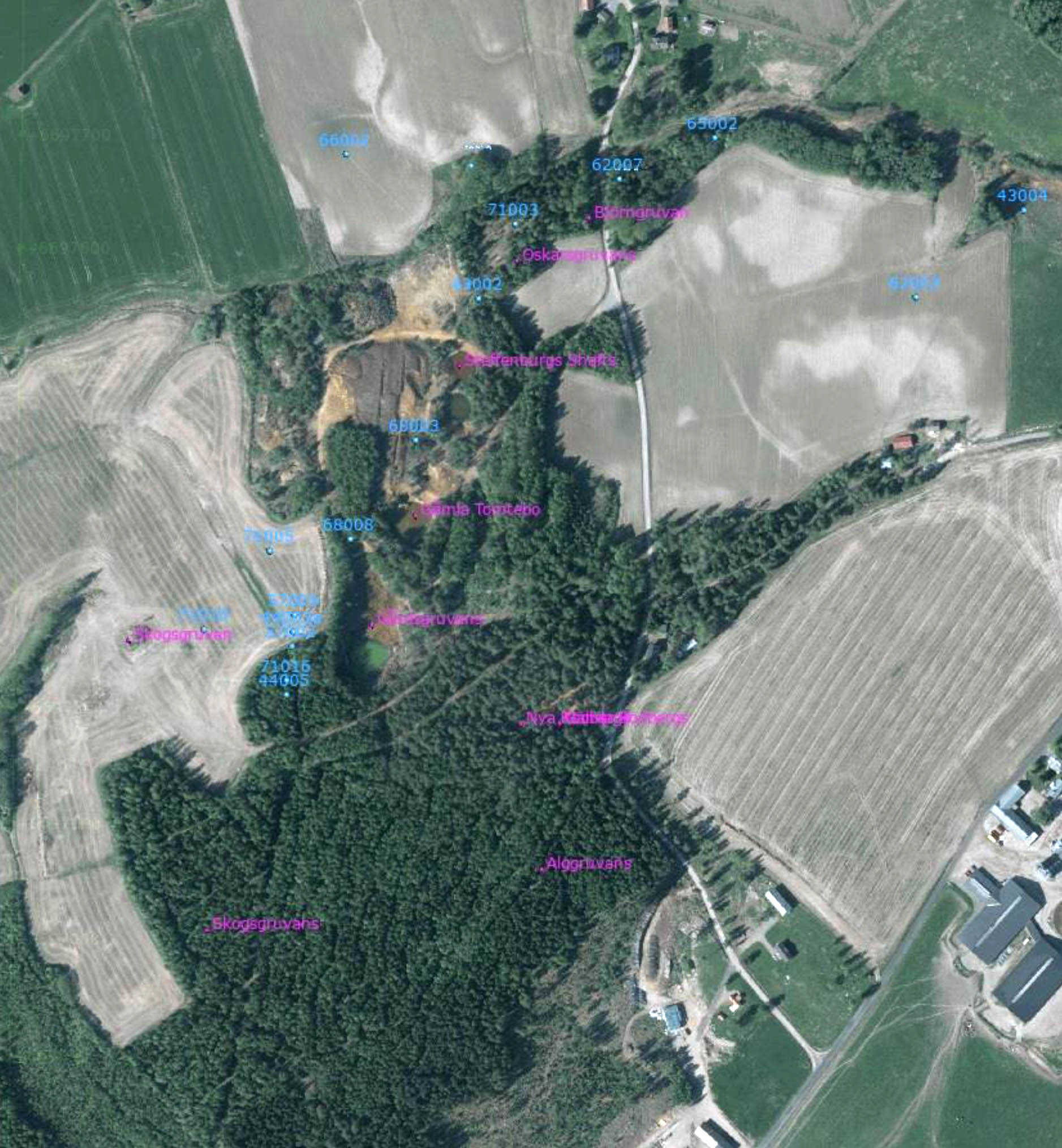

The background of the district

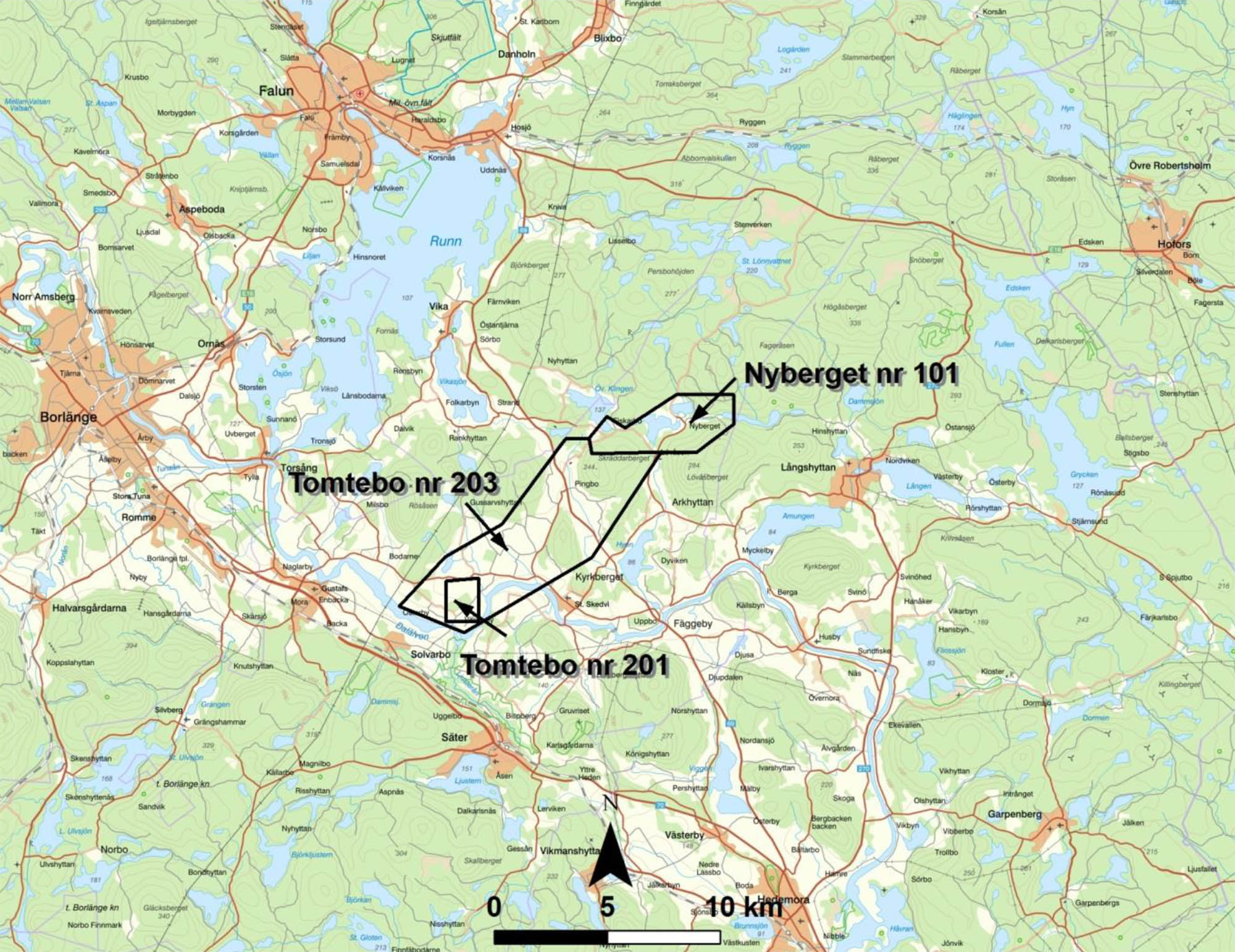

The 5,144 hectare Tomtebo project is located about 200 kilometers northwest of Sweden’s capital, Stockholm. The project contains three separate licenses that are contiguous to each other and where exploration activities can be traced back to the middle ages with first production at Tomtebo in 1648 while the Lovas Mine was in production in 1561. Of course, the historical production wasn’t meaningful in today’s terms given the poor technology available and limited options.

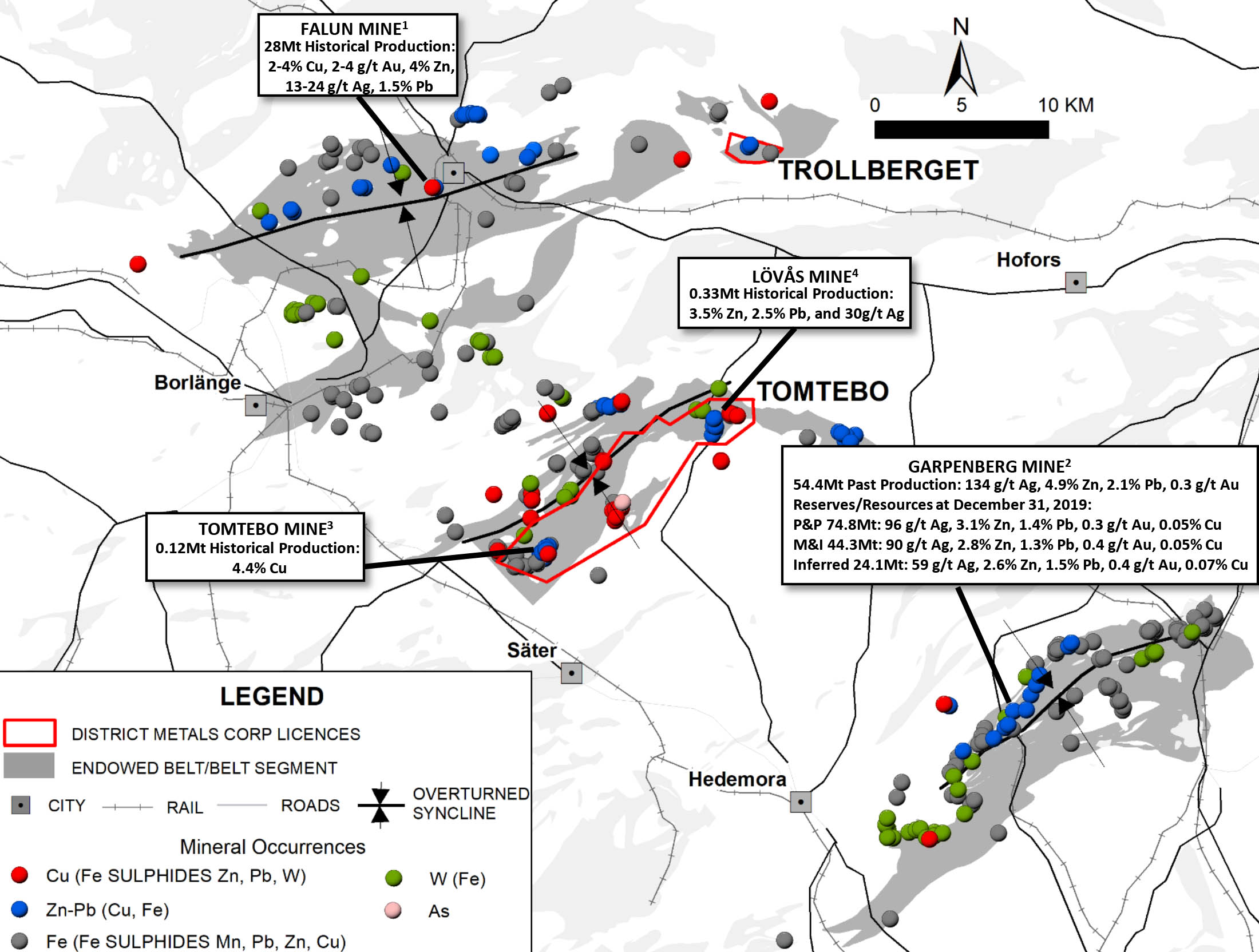

The best location to try to find a new mine is in the shadow of an existing mine. Not only did District Metals secure a land package containing two past-producing mines, the Tomtebo land package is located in the Bergslagen district of Sweden, known for its numerous iron and precious metals rich polymetallic occurrences. The Tomtebo project is within hiking distance from the Garpenberg mine, currently owned and operated by Boliden, a well-respected Swedish commodity group (and the fifth largest zinc producer and sixth largest zinc smelter in the world).

While this report is focusing on Tomtebo, it does make sense to zoom into Garpenberg for a minute as that is perhaps the best example to show how prolific the Scandinavian VMS deposits can be. This mine has produced about 55 million tonnes of ore and still contains 75 million tonnes of ore in the reserve categories with an additional 68 million tonnes in the measured, indicated and inferred resource categories. If anything, this shows how big those Swedish VMS deposits can be.

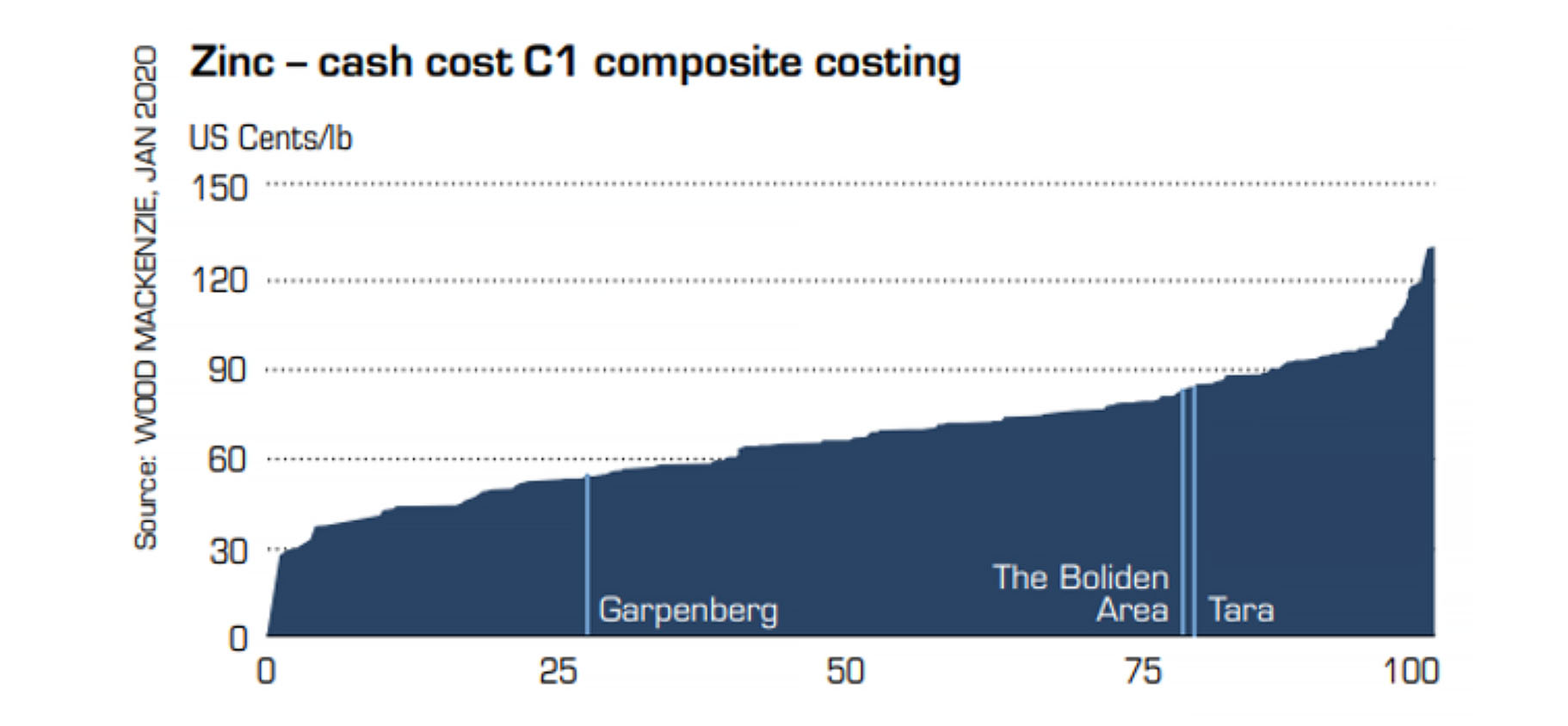

With an average reserve grade of just over 3 ounces of silver per tonne of rock, 4.5% ZnPb and traces of gold (0.3 g/t) and copper (0.05%), the mineralization is very profitable as Boliden is able to use efficient underground mining techniques and a high degree of automation. In fact, the production cost at Garpenberg is almost in the lowest quartile in the world (and given the strong precious metals prices, we expect the Garpenberg production cost to effectively reach the lowest quartile this year):

This means Garpenberg is a solid performer for Boliden as it generated almost 2.1B SEK in operating profit in 2019, just marginally behind the Aitik mine in Ireland. Needless to say, the Garpenberg mine and by extension the entire district is seen as a core area for Boliden. In 2019, Garpenberg produced almost 250 million pounds of zinc, 80 million pounds of lead, 8.2 million ounces of silver and 16,500 ounces of gold. An impressive performance by any standard.

Interestingly, the mineralization in the historical resource estimate at Tomtebo actually shows better grades than Garpenberg. The 385,000 tonne resource has an average grade of 55g/t silver (lower than Garpenberg) but also contains 5.56% ZnPb, 0.67% copper and 0.66 g/t gold (all higher), so the company does seem to have a head start.

Of course, there’s no guarantee or assurance District Metals will discover a new Garpenberg, but it does show you the type of elephant the company is hunting.

The one image that matters

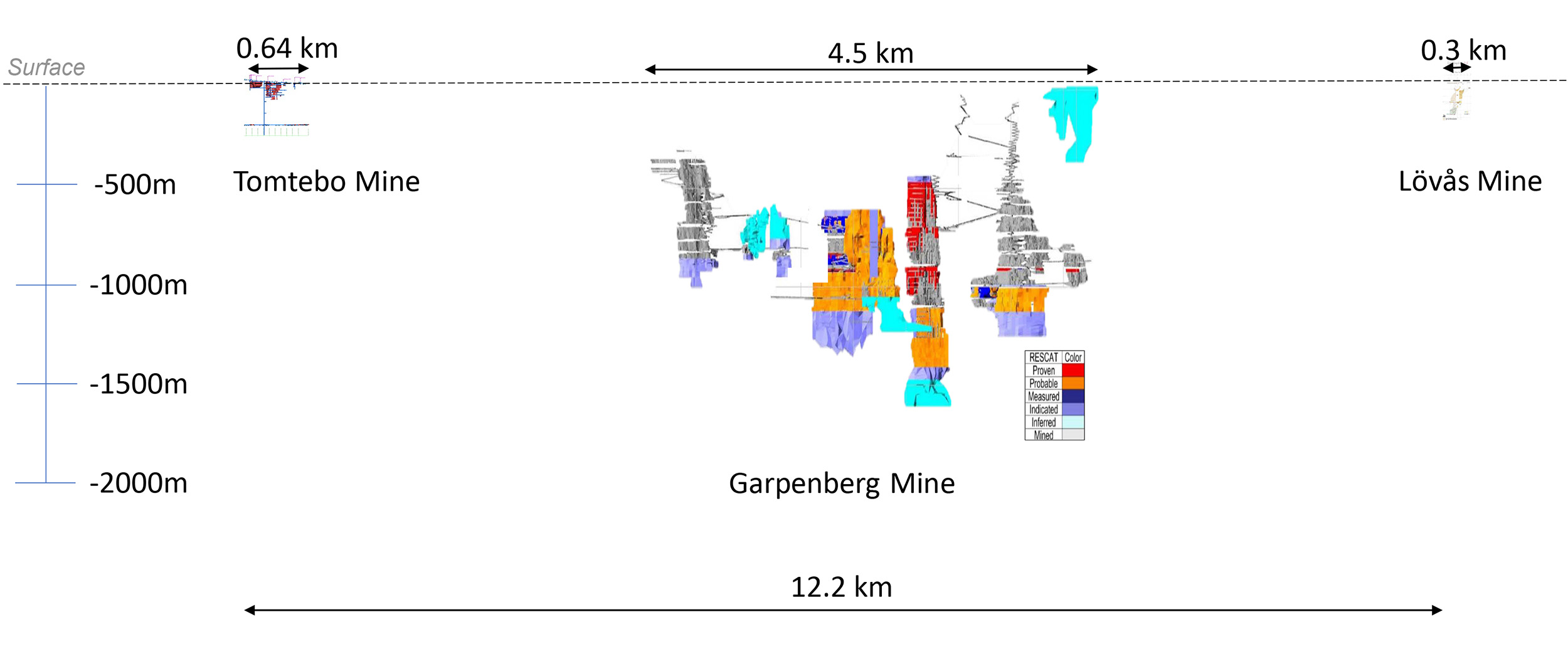

On the risk of overly simplifying things, one of the elements that make it a bit easier to explain why Tomtebo is such an interesting exploration project (other than just being a nearology play) is the conceptual long section shown here:

As you can see on the image above, the Garpenberg mine is a beast: its mineralization extends to over 1,600 meters from surface and Bolliden doesn’t seem to have reached the end of the mineralization at depth so the mine is far from mined out. The Garpenberg mine is currently being mined at a depth of 1,400 meters while Lundin Mining’s (LUN.TO) Zinkgruvan mine has reached a depth of 1,300 meters. These VMS systems in Sweden can go deep, very deep. And the 200 meters vertical depth reached at Tomtebo and 190 meters at Lovas aren’t even close to the depths reached by the large producers.

Compared to Garpenberg, the Tomtebo and Lovas operations have indeed barely scratched the surface. Does this mean those areas contain a Garpenberg 2.0? No, but there most certainly must be some low-hanging fruit that’s being left behind by the previous operators. And if future exploration programs are able to put a ‘Garpenberg Junior’ together, the upside potential could be massive.

Historical drill results confirm the exploration thesis

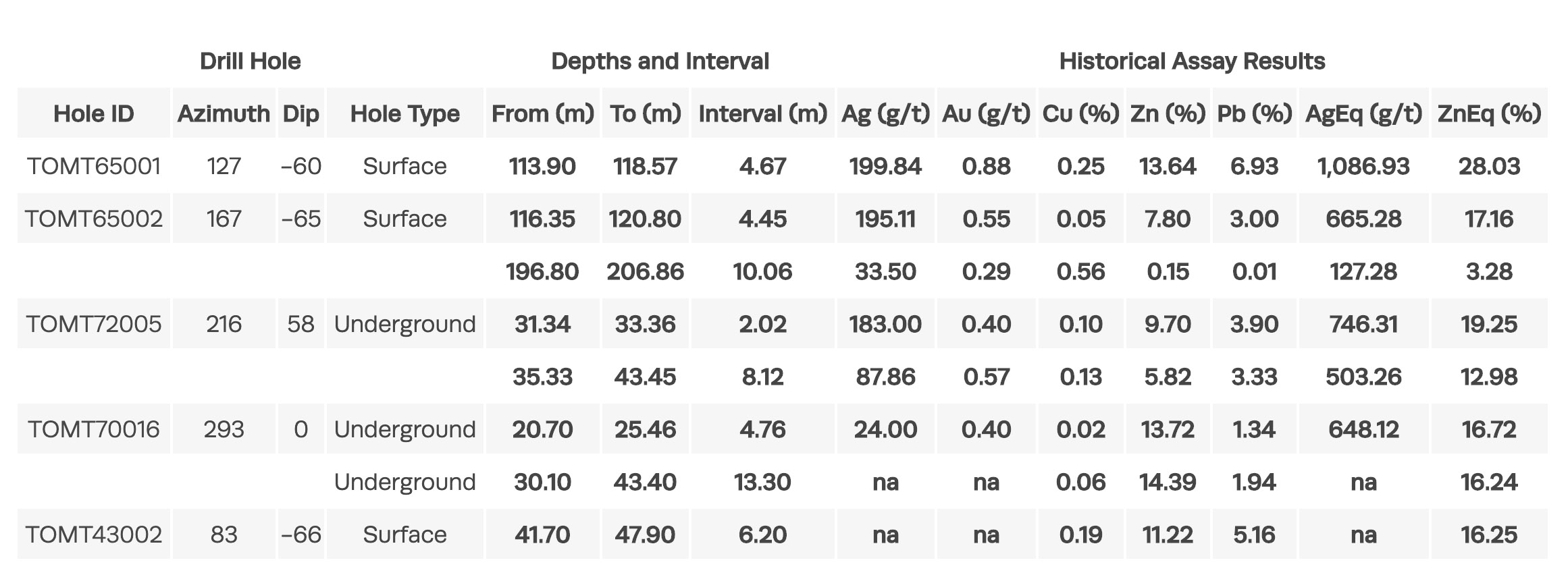

Besides taxes and death there are no certainties in life and perhaps the junior exploration sector, but District Metals added more meat to its exploration thesis by re-analyzing historical drill results. Not only do those assay results confirm the existence of high-grade mineralization, it also gives District an excellent opportunity to refine and define drill targets ahead of the 2021 drill program. District Metals released three batches of historical drill results with the first batch immediately showing jaw-dropping results with hole TOMT65001 for instance encountered almost 5 meters containing almost 200 g/t silver, just under a gram of gold per tonne of rock and almost 21% ZnPb combined, resulting in a silver-equivalent grade of in excess of 1000 g/t (or a zinc-equivalent grade just exceeding 28%). And that wasn’t just a lucky shot, as you can see on the image below, several holes also encountered high-grade mineralization within this zone. Some intervals are narrower than others, some grades are higher and lower than others, but every single hole that has been published shows phenomenal grades.

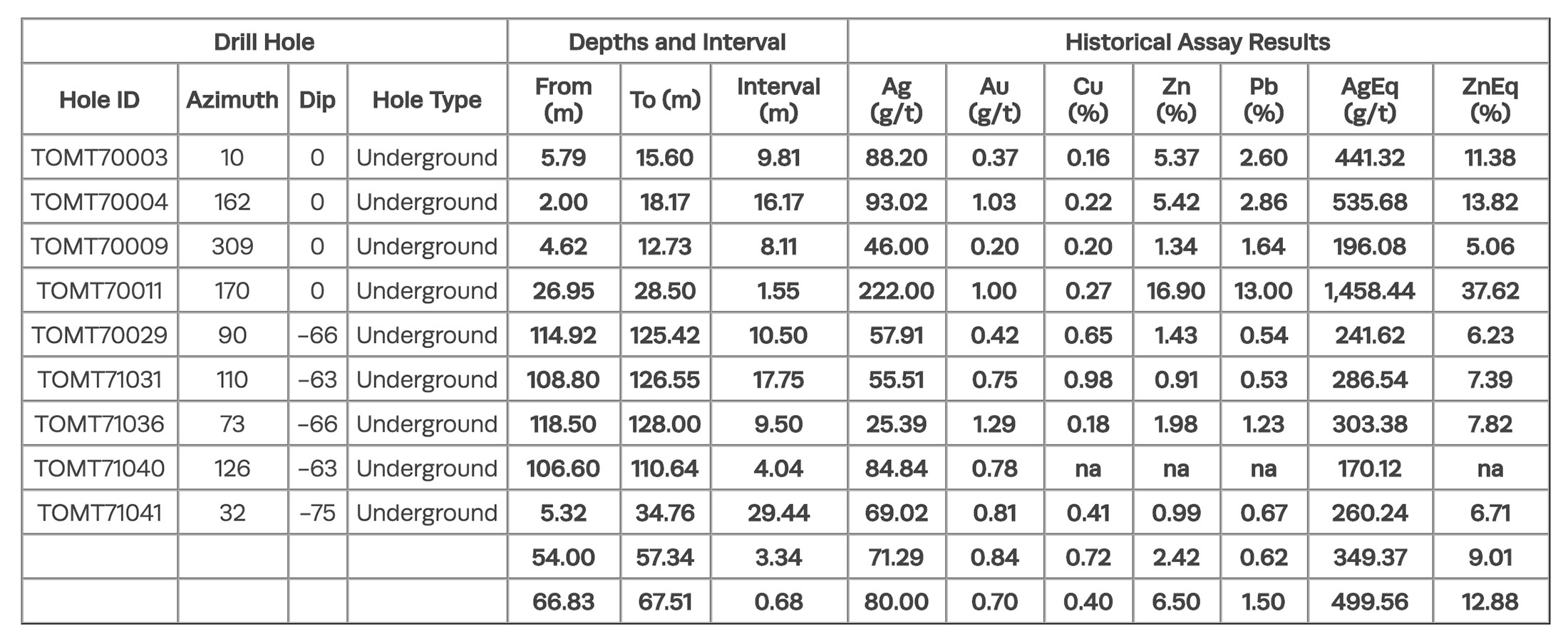

In subsequent updates, District Metals continued to keep the market up to date on historical assay results as the company worked through the available data. At the Steffenburgs zone of the Tomtebo project, District Metals was able to outline a zone that appears to have a dominant silver-lead-zinc mineralization (with lower copper and gold values) at a depth of just 200 meters below surface. These exploration holes were drilled from existing underground exploration drifts by the past owner of the project, a few decades ago.

While the copper and gold values are indeed negligible, the silver and zinc values make up for that and with intervals like 16.17 meters at 13.82% ZnEq (true widths are currently unknown so we will have to wait for the 2021 drill program to get a better understanding of this zone).

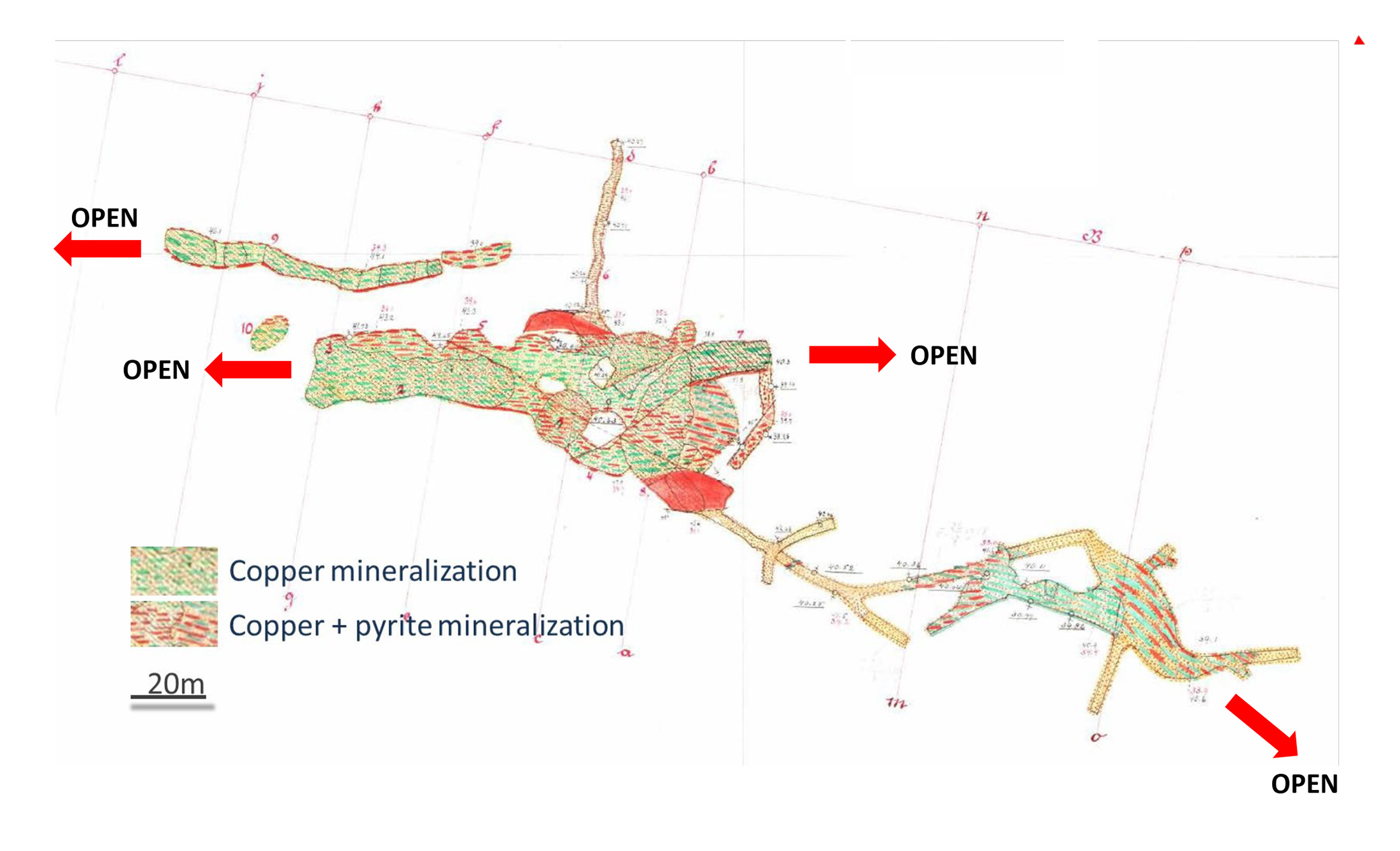

In a third update on the re-analysis of historical drill results, District Metals zoomed in on the Gardsgruvans Zone, which appears to be a copper-dominant area. Based on the historical drill data the intervals of for instance 4 meters at 11.79% is brilliant, as are the other intervals that appear to indicate a relatively consistent copper value depending on the width.

Although the Gardsgruvans zone only has copper assay results with sporadic gold values available, it’s very important to emphasize the copper zones are traditionally accompanied by significant gold and silver values. Seeing zero values in the comprehensive table of the historical drill results doesn’t mean the precious metals aren’t there: the past operators simply didn’t care to assay the core for metals other than copper. So if anything, the Gardsgruvans zone could potentially provide a massive (positive) surprise as the copper-equivalent grade could easily be 50-100% higher than the reported copper grade upon re-assaying this zone.

Since publishing the data from these historical drill programs, District has actually commenced field work which will focus on mapping, prospecting and geochemical sampling. This methodological approach, in combination with the interpretation of the recently completed aerial survey should help District to start a preliminary drill program in 2021.

The acquisition terms

District Metals understood it is important in this market to try to obtain full ownership of projects and its earn-in agreement with EMX Royalty will indeed result in full and unencumbered ownership of the Tomtebo and Trollberget properties.

District Metals was required to make C$35,000in cash payments to EMX as well as giving the latter a 9.9% stake in District Metals (which has been completed now). Additionally, to avoid a clawback clause by EMX Royalties, District will have to spend C$1M in exploration on the properties within a two year period and has to commit to a minimum of 2,000 meters of drilling within three years and 5,000 meters within three years. Considering District has been hitting the ground running we would actually expect these exploration requirements to be met by next summer.

Additionally, EMX will retain a 2.5% NSR (as that ultimately is what EMX cares about) of which 0.5% can be repurchased for C$2M within six years. EMX is also entitled to keep its stake in District Metals at 9.9% for no additional consideration (read: free shares) within the first five years of the transaction or District raising C$3M, whichever comes first. Considering DMX is planning a drill program in 2021 and may need additional funds to do so, we think it’s safe to assume this threshold will be reached in the next few months.

As you can see, the earn-in agreement is pretty straightforward, and more important, pretty cheap. Virtually no cash payments to EMX were/are required and EMX clearly wants to maximize the value of its equity stake in District Metals and the Net Smelter Royalty further down the road.

Management & Technical Team

Garrett Ainsworth – President, CEO

Mr. Ainsworth is an accomplished professional geologist and mining executive that has been awarded for two significant mineral discoveries, and has raised more than $300M in equity and convertible debt throughout his career.

Prior to joining District Metals Corp., Mr. Ainsworth was Vice President Exploration & Development at NexGen Energy Ltd. where he led the technical team, and was involved with marketing and raising capital. For his technical work at NexGen, Mr. Ainsworth was co-recipient of the 2018 PDAC Bill Dennis Award, and the 2016 Mines and Money Exploration Award. Prior to NexGen, Mr. Ainsworth was the Vice President Exploration at Alpha Minerals Inc., and project managed the discovery of the Patterson Lake South high-grade uranium boulder field and drill discovery of the Triple R Uranium deposit. Mr. Ainsworth was named co-recipient of the AMEBC Colin Spence Award in 2013 for his lead role in the discovery of Triple R.

Mr. Ainsworth is currently a Director with Standard Uranium Ltd. and a Technical Advisor with Genesis Metals Corp. Mr. Ainsworth was previously a Director of IsoEnergy Ltd. and NxGold Ltd. from 2016 to 2018.

Galen McNamara – Technical Advisor

Mr. McNamara is a geologist who has been involved in the resource industry since 2007. He shared the 2018 PDAC Bill Dennis “Prospector of the Year” Award and 2016 Mines and Money Exploration Award, for his work on the Arrow uranium deposit. In 2014, Mr. McNamara co-founded Pioneer Exploration Consultants Ltd., a successful exploration consulting business, and Pioneer Aerial Surveys Ltd, a company focused on developing UAV-borne geophysical surveys. Prior to that, he managed surface exploration at what is now SSR Mining’s Seabee Gold Operation where he worked on the early drill development of the currently producing Santoy Gap gold deposit.

Conclusion

Perhaps one final note about CEO Ainsworth. He was appointed as CEO of District Metals in July 2018 and only entered into the agreement with EMX Royalty in February 2020. This means he spent about 18 months looking for the right fit for District Metals as this is his first stint as CEO of a public company after earning his keep in the exploration sector with his discoveries of the Triple R and Arrow uranium deposits in Canada, which contain hundreds of millions pounds of uranium.

Taking his time was the right move and at first we were very suspicious about Tomtebo being available at a bargain price. After numerous conversations with Ainsworth and seeing the assay results from historical drill data we are convinced about the prospects of Tomtebo and District Metals may very well be sitting on Sweden’s next exciting polymetallic mine.

Of course, it will take a lot of dedication and exploration efforts to unveil the potential riches hosted by Tomtebo. But with about C$2M in cash in the bank and a drill programme planned for 2021 once the results of the aerial survey will be analyzed District is taking all the right steps and we are charmed by the methodological approach adopted by Ainsworth and his team.

Disclosure: The author holds a long position in District Metals. District Metals is a sponsor of the website.