Grade is king, and oh so important in the current silver price environment. Whilst most low-grade Mexican projects won’t work at $20 or even $25 silver, it’s always important to identify projects and companies that actually do have a chance to develop a silver mine that could actually be profitable at the current silver prices.

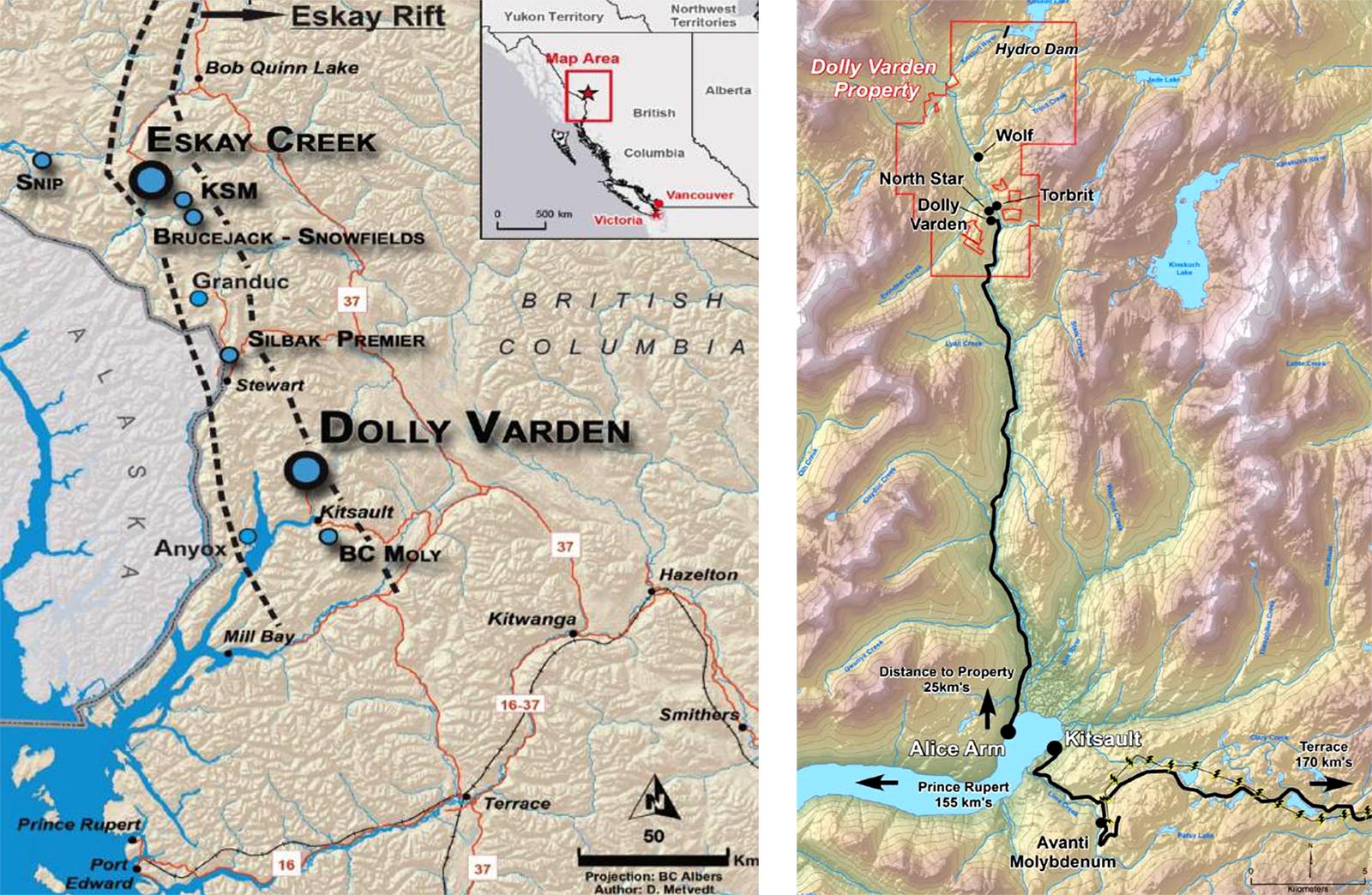

Add the fact that location is now more important than ever (you really don’t want to develop projects in Siberia or Venezuela right now), and Dolly Varden Silver (DV.V) is a logical candidate for a shortlist of high-grade silver projects in an existing (and safe) mining district.

A brief history of the Dolly Varden property

The high-grade silver mineralization on Dolly Varden’s projects has been known for quite a while already, as the original Dolly Varden mine opened its doors in 1919, as a direct shipping operation (thanks to the exceptionally high average grade).

From 1919 on, the original Dolly Varden and North Star mines produced a total of 36,000 tonnes of ore at an average grade of in excess of 35 ounces (!) of silver per tonne. That’s right, the average grade at the projects was in excess of a stunning 1,100 g/t. As said, the ore was immediately transported to metal smelters, which were happy with the high-grade feed.

Another mine that was part of the historic Dolly Varden silver district, the Torbrit Mine, was in production from 1949-1959 and produced almost 19 million ounces of silver from less than 1.4 million tonnes of rock, resulting in an average grade of in excess of 13.5 ounces of silver per tonne of ore (with some minor lead credits).

As you can see, Dolly Varden’s claims have had a rich history of high-grade silver mining but hasn’t seen very much modern exploration in the past several decades, and this is exactly the opportunity Dolly Varden is trying to exploit. In the past 50 years, the exploration techniques have changed considerably, and an average grade of in excess of 10 ounces per tonne is something most mining companies can only dream of. Sure, there are some high-grade mines in Mexico, but most of the silver mines in the world consist of a mass tonnage open pit, where a high throughput is compensating for the lower average grade.

In excess of 25,000 meters has been drilled at the property in the past few decades, but Dolly Varden had to scale back its activities in the past few years when the low silver price basically closed the access to capital markets for pure explorers.

In late 2016, the window to finance exploration seems to have opened again, and Dolly Varden took advantage of this by raising C$7.2M earlier in 2016, followed by an additional C$3M in December which will now be used to advance the project and to increase ounces in the existing NI43-101 compliant resource estimate.

The location couldn’t be any better – right in the middle of a mining corridor with existing infrastructure

The Dolly Varden land package is located just over 200 kilometers from Terrace, and just 25 kilometers away from Kitsault, where a deepwater port has been planned by both Kitsault Energy (which aims to develop a LNG export facility) and Resource Capital Funds (which took control of Allycorp Mining/Avanti Mining), which owns a very large molybdenum project just a few kilometers from Kitsault.

Some people groan when a BC project is coming on the table, as the province has given the impression it’s sometimes taking a pretty difficult stance in the permitting process. This seems to be a perception problem, and as long as a company abides by the rules and respects the process and requirements, there’s no reason why permits wouldn’t be granted. In the past few years, several mines have been permitted in British Columbia. Copper Mountain Mining (CUM.TO) was allowed to re-open the old copper mine, whilst Pretium Resources (PVG, PVG.TO) is in the final phase of constructing its high-grade Valley of the Kings gold project.

Additionally, Imperial Metals (III.TO) was allowed to re-open the Mt Polley mine after the spill, which is perhaps the best piece of evidence British Columbia isn’t too difficult to deal with, as long as you play by the rules.

The existence of the (ghost town) Kitsault could play an important role for Dolly Varden, as it could allow its employees to settle in Kitsault, rather than being accommodated in a camp near the mine. Of course, it would be very helpful if either Kitsault Energy or RCF would be able to move ahead with their plans as well, as this could bring Kitsault back to life and make it so much easier to ‘re-open’ the town.

The plan to move the project forward

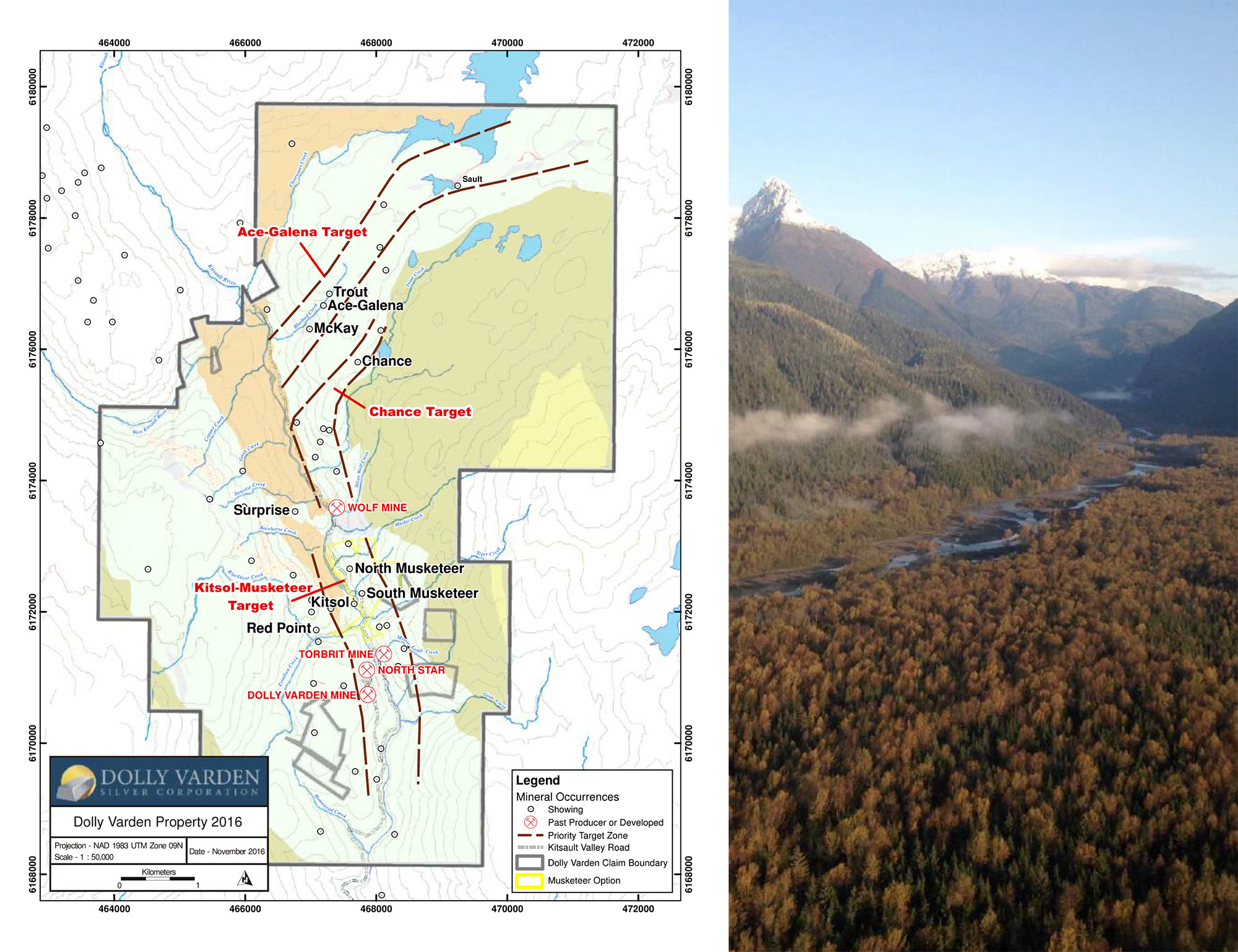

Dolly Varden has released a first resource estimate on the Dolly Varden property and included four zones (Wolf, Dolly Varden, North Star and Torbrit). The resource estimate contains a total of 42.5 million ounces of silver at an average grade of almost 11 ounces of silver per tonne of rock.

Surprisingly, the majority of the resources (75%) is part of the indicated resource category, at an average grade of 321.6 g/t silver. According to the technical report, the consultants used a cutoff grade of 150 g/t silver, which represents a rough in-situ value of US$84/t (at a 100% recovery rate). Given the high-grade nature of the resource, the potential access to existing infrastructure and the cheap Canadian Dollar, the cutoff grade is very realistic for this type of deposit.

Of course, the 42.5 million ounces of silver is just the starting point and all signs are pointing in the direction of Dolly Varden sitting on an entire silver district. And that wouldn’t be a huge surprise considering the Dolly Varden land package is right on trend with large producing and past-producing mines. Previous surveys have indicated intense alteration zones which are pretty typical for VMS deposits and epithermal vein deposits. And given the size of Dolly Varden’s claims (8,800 hectares), there still is a lot to explore!

Last year’s summer drill program has already confirmed a lot of the expectations. Dolly Varden has intersected several high-grade layers with an interval of 19.4 meters containing almost 500 g/t silver as eye-catcher! Assay results of four holes have been published (a fifth hole didn’t encounter any significant results as the hole was lost in historical mining workings before it could reach the target area), and all of them contain high-grade silver mineralization, which validates Dolly Varden’s thesis it shouldn’t be too difficult to increase the resources at Torbrit.

After all, last summer’s drill program has now confirmed there’s more silver mineralization than originally assumed in the resource estimate. According to the company, the summer drill program at Torbrit has now ‘filled some gaps’ in between existing (and known) mineralized zones where no historic drilling occurred. This could be interpreted in a way that once these previously ‘blank’ zones (which were presumed to be barren) are included in a new block model, the total resource estimate could increase considerably, and make any planned mine scenario in the future more economic and efficient. On top of that, the drill program at the Ace-Galena zone has now doubled (!) the strike length of the mineralization, and 90% of the total potential trend remains unexplored.

But there’s more.

It could be very easy to add more tonnes (and ounces) to the existing resource estimate. Not only will the ‘blank zones’ be drilled which should add more tonnes to the resources, Dolly Varden now also thinks the total density of the rock has been underestimated in the resource estimate. In layman’s terms, it’s very likely the weight of the rock per cubic meter is higher than originally assumed. This basically means that even if the total volume of the block model would remain stable, the total tonnage could increase, boosting the silver resource (as the contained silver was calculated based on the expected tonnage, and not on the volume).

And finally, last year’s drill results have confirmed the existence of lead and zinc in the mineralized areas. Even though those average grades are relatively low, recovering the lead and zinc could allow Dolly Varden Silver to produce a valuable by-product which would reduce the production cost per produced ounce of (pure) silver.

Hecla attempted the to acquire the company last this year, will they be back?

Right before the summer of 2016, Dolly Varden Silver was the subject of an attempt of senior silver producer Hecla Mining (HL) to launch a hostile offer to take control of the company. Hecla offered C$0.69 per share which was deemed inadequate by Dolly Varden’s special committee, and Dolly Varden immediately announced a private placement to raise cash.

Hecla Mining wanted to block this private placement from happening, as it felt those new shares should not be allowed to decide on the acquisition proposal. The regulator sided with Dolly Varden, and Hecla Mining (reluctantly) withdrew its bid.

Was this the end of the takeover potential? Probably not. Hecla actually elected to participate in the placement it tried to block, and now still owns almost 15% of Dolly Varden Silver. This could definitely be interpreted as a hint Hecla is still very interested in the Dolly Varden district, and we can imagine it’s now even more anxious than ever before to try to get its hands on one of the most promising high-grade silver districts in the world.

Dolly Varden’s management team

Gary Cope – President & CEO

Gary Cope has accumulated over 33 years of experience in Corporate Management & Strategy, with a specific emphasis on Public Company Finance. Mr. Cope arranged financing for the South Kemess project, and later became heavily involved with the negotiations & selling of the deposit to Royal Oak Mines. In the past 12 years, he has acted as a Senior Officer & Director for various publicly held companies, such as St. Phillips Resources. Mr. Cope served as the President, CEO & Director of Orko Silver Corp., and was instrumental in negotiating and arranging the sale of Orko Silver to Coeur d’Alenes Mine Corp in 2013, and currently holds those positions with Orex Minerals Inc., and Barsele Minerals Corp.

Ben Whiting, P.Geo. – Vice President Exploration

Ben Whiting is a professional geoscientist with more than 35 years experience in the international mining industry. He has worked for both major & junior companies, managing a wide range of operations from exploration through to production. He has also acted as a special advisor on mining industry matters to government agencies, the World Bank, and is a past Adjunct Professor of Queen’s University in the Geological Sciences & Mining Engineering departments. Mr. Whiting is an “Economic Geology” medal award winner and winner of the 2008 IAC “Explorer of the Year” award. He is a member of the Association of Professional Engineers & Geoscientists of British Columbia (APEGBC), the Association of Professional Geoscientists of Ontario (APGO), La Asociación de Ingenieros de Minas Metalurgistas y Geólogos de México (AIMMGM), the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) and a Fellow and past-editor of the Society of Economic Geologists (SEG). He is the current Vice President of Exploration for Orex Minerals Inc. and Barsele Minerals Corp.

Robert van Egmond, P.Geo. – Chief Geologist

Rob van Egmond is a professional geologist with over 25 years of experience in the international mining industry. His career encompasses a wide spectrum of experiences ranging from grass roots project generation to pre-feasibility level resource development and mine geology. He has worked with major mining companies (Cominco, BHP, Kennecott) and junior explorers (Orex Minerals, Platinum Group Metals, Candente, Northern Dynasty, Keewatin) gaining experience in a wide variety of commodities and deposit types spanning locations North and South America as well as Africa. Included in his experience are several years of exploration and pre-development work in the Iskut River/Golden Triangle area with Cominco. Mr. van Egmond holds a B.Sc. degree in geological sciences from the University of British Columbia and he is a member of the Association of Professional Engineers and Geoscientists of British Columbia (APEGBC).

Conclusion

It’s still very early days at Dolly Varden, but the magical milestone of 100 million ounces of silver doesn’t seem to be too far out of reach given the substantial size of the land package and the consistently high-grade nature of the mineralization. More drilling will be needed but this year’s exploration program has confirmed the huge potential at Dolly Varden.

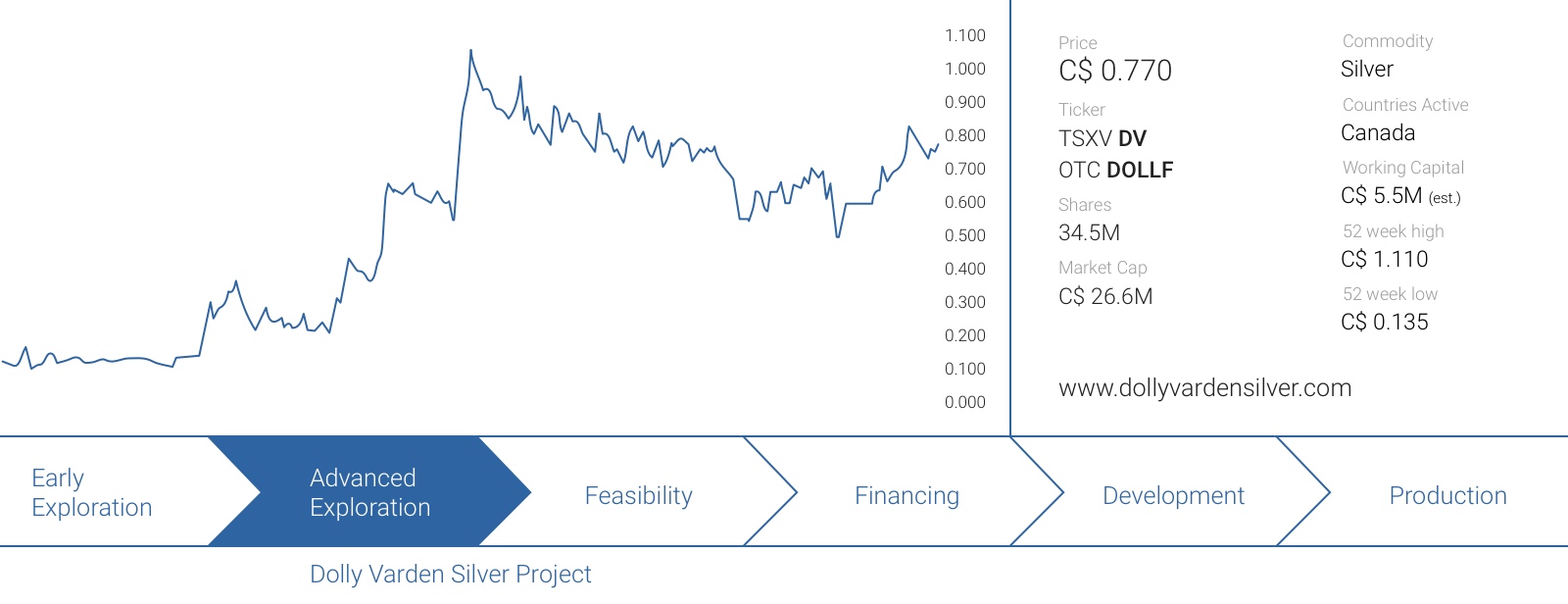

Unfortunately (or, well, fortunately for new investors), Dolly Varden’s market capitalization is still just C$26.6M, and this basically means that per share of C$0.77, you buy almost 1.25 ounces of silver in the ground (excluding the zinc and lead potential, as well as future resource updates), and we expect this ratio to increase as Dolly Varden now has a working capital position of in excess of C$5M, of which C$2.5M are flow-through funds which will have to be spent on the property.

Dolly Varden is one of the very few junior exploration companies that aren’t ‘speculating’ on a buyout. Thanks to the very high grade of the mineralized zones in the Dolly Varden silver district, the company could easily develop its own mine plan. After all, at an average feed grade of 8 ounces of silver per tonne (lower than the current 10+ oz/t in the indicated category to account for dilution) and a recovery rate of 85%, a 1,000 tonnes per day plant would be able to produce almost 2.5 million ounces of silver per year. So if Hecla wants it, it will have to fork over more dollars than the original C$0.69 offer was worth. If the company would be valued at US$0.75 per ounce of silver in the ground, C$1.25 seems to be a more acceptable share price.

Disclosure: Dolly Varden Silver is a sponsoring company. We have a long position. Please read the disclaimer