Uranium is hot right now. The share price of producers and near-term producers have been on fire recently and the attention is slowly trickling down to the exploration segment of the uranium sector. The bull market is still in its infancy there, but it already feels like some companies have been left behind. Eagle Plains Resources (EPL.V) for instance, owns almost 20 uranium properties in Canada.

Of course, simply owning a uranium property is not sufficient to draw attention but in Eagle Plains’ case, a recently signed joint venture agreement on six uranium properties in the Athabasca Basin has lent more credibility to the company’s uranium plans. The joint venture partner has to spend serious money on advancing the asset and even if they don’t carry all six across the finish line, Eagle Plains will for sure benefit from the work that will be done on the assets.

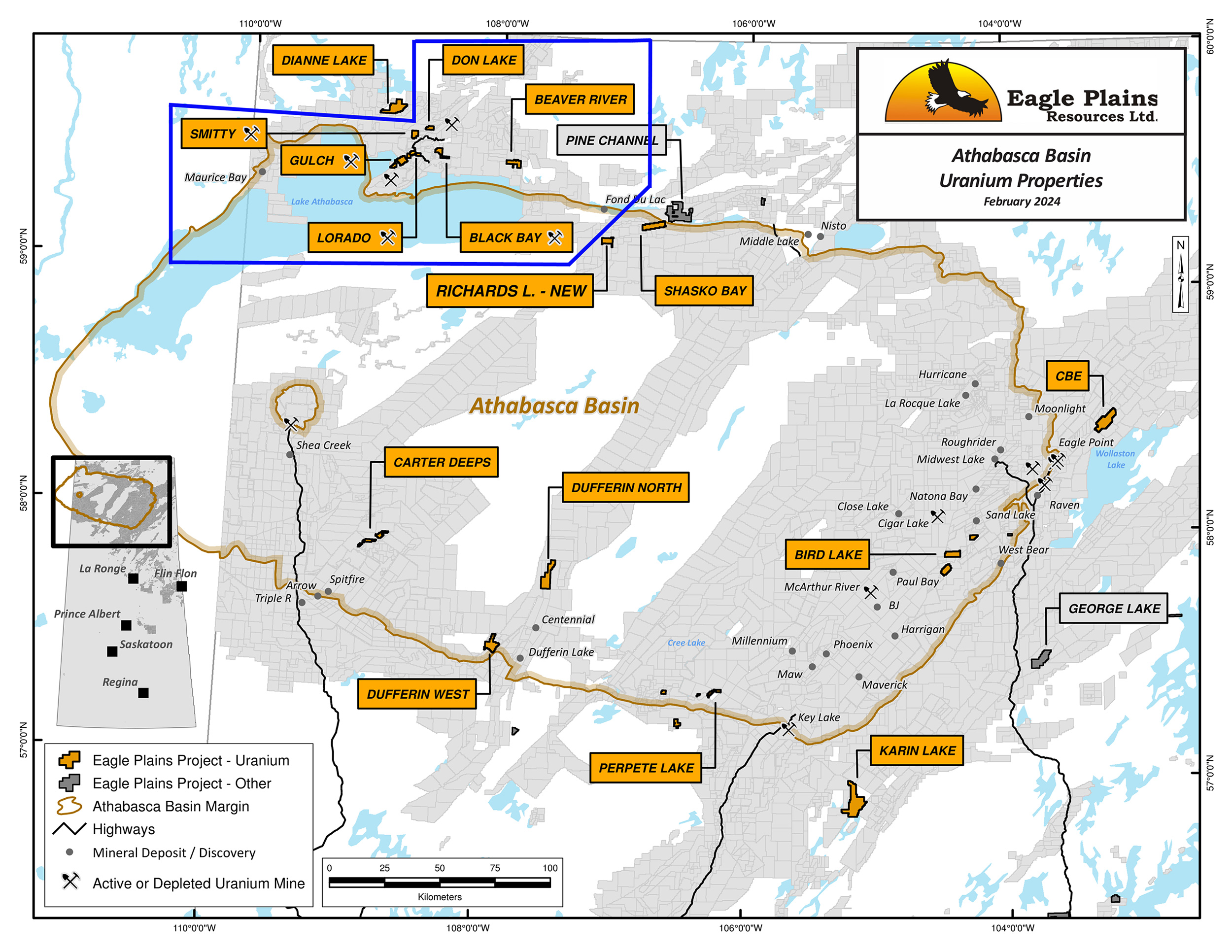

Earlier this week, Eagle Plains also reported it expanded its total Uranium portfolio in Saskatchewan to 40,050 hectares as it increased the land position at Lorado, Gulch, Collins Bay Extension and Dianne Lake while it also staked a new project called Richards Lake. This brings the total uranium asset portfolio in the Athabasca Basin to eighteen. An enviable position during this period of renewed interest in Uranium.

A closer look at the uranium properties

Before discussing a few of the uranium assets in more detail, perhaps we should explain the current joint venture deal with Xcite Resources.

Eagle Plains has signed six individual option agreements with Xcite Resources (XRI.V) whereby the latter can earn up to an 80% interest in six uranium projects. Those six projects contain a total land package of almost 6,000 hectares, located near Uranium City in Saskatchewan.

Xcite Resources will have to spend C$3.2M on exploration, issue 750,000 common shares to Eagle Plains and make cash payments totalling C$55,000 over four years. Those amounts are per project which means that if Xcite Resources would go ahead with all six projects, Eagle Plains will see C$19.2M in cumulative exploration efforts and receive C$330,000 in cash as well as 4.5 million shares of Xcite. Of course, it is unlikely all six projects will meet Xcite’s standards (or its ability to fund the required expenditures) but in any case, it does look like Eagle’s new partner will be spending some cash in the next few years to advance the projects.

Upon reaching an 80% stake in any of the projects, both companies will form an 80/20 joint venture whereby Eagle Plains’ 20% stake will be a carried interest until a bankable feasibility study has been published, which indeed means Eagle Plains is in a very advantageous position as it would only have to start spending cash after the completion of a feasibility study. Additionally, Eagle Plains will retain a 2% Net Smelter Royalty on all properties. And if even just one of the properties would become a serious contender to actually being built, a royalty could potentially be very valuable.

This is an excellent deal for Eagle Plains. Signing six individual agreements at those terms is advantageous as Xcite will be required to spend millions of dollars before it will likely zoom in on the best of the six projects. Meanwhile, the company will retain exposure thanks to the Xcite-shares it will receive. Additionally, Eagle Plains will be the operator of exploration program and will likely earn a management fee for those services as its subsidiary company, Terralogic Exploration, will plan and conduct the exploration programs

And now it is up to Xcite Resources to actually raise the money.. The six projects subject to this joint venture agreement are Beaver River, Black Bay, Don Lake, Gulch, Lorado and Smitty (the Gulch and Lorado projects were recently expanded due to the low-cost staking activities of Eagle Plains). They are all located on the northwestern end of the Athabasca Basin, close to Uranium City. The 4,100 hectare Dianne Lake is not part of the Xcite agreement. A 2022 sample program encountered grades of in excess of 1% U3O8 on the asset. Interestingly, the company was previously focusing on the silver-copper mineralization at Dianne Lake.

These assets are located in the Beaverlodge District where uranium mineralization was discovered almost 100 years ago. The Beaverlodge camp actually was the very first area in the Athabasca Basin where meaningful amounts of uranium were produced. The official records show a total historic production of in excess of 70 million pounds of uranium between 1950 and 1982 from rock with an average grade of 0.23% U3O8. And just to provide some context: 0.1% of U3O8 represents 2.2 pounds of uranium per tonne. An average grade of 0.23% thus represents just over 5 pounds of Uranium per tonne of rock. And at the current spot price of around US$100/pound, the in-situ rock value was close to US$500/tonne. And just to provide even more context; 0.23% U3O8 would be the equivalent of almost 8 g/t gold. Needless to say, the Beaverlodge District is a good area to own projects in.

Some of the projects that have been optioned to Xcite Resources actually are past producers in the Beaverlodge District. Black Bay, for instance, processed 1,375 tonnes with an average grade o 0.17% U3O8. The Lorado project has a more meaningful historical production with 95,000 tonnes that have been processed with an average grade of 0.19% U3O8. That’s almost half a million pounds of uranium that were mined with relatively rudimentary techniques as the 95,000 tonnes were recovered in the late 1950s. That’s more than 60 years ago, and it goes without saying mining and processing techniques have tremendously improved since the Korean War.

Although most action in Eagle Plains’ Athabasca Basin portfolio will come from the six properties that are part of the Xcite Resources agreement, we wanted to highlight three other assets in the Basin.

The recently staked Richards Lake project is located approximately 14 kilometers south of Fond-du-Lac. This 1,317 hectare property was staked in the past few weeks and it basically allowed Eagle Plains to stake claims which were previously explored by UEX. That company completed an airborne geophysical survey which confirmed the presence of conductive trends. UEX followed up on this airborne survey with a ground survey in 2007 which further finetuned the targets. Unfortunately, the property has never been drilled but that also is the reason why Eagle Plains was able to just stake the land.

The Dufferin West project is also quite interesting. The almost 3,000 hectare property is located at the southern margin of the Athabasca Basin. The claims were acquired in 2023 and according to the company’s technical team, the geology on the property is favorable for uranium deposits. The asset is also located in the right area as the Centennial uranium deposit (owned by Cameco and Orano) is located just 20 kilometers to the east-northeast.

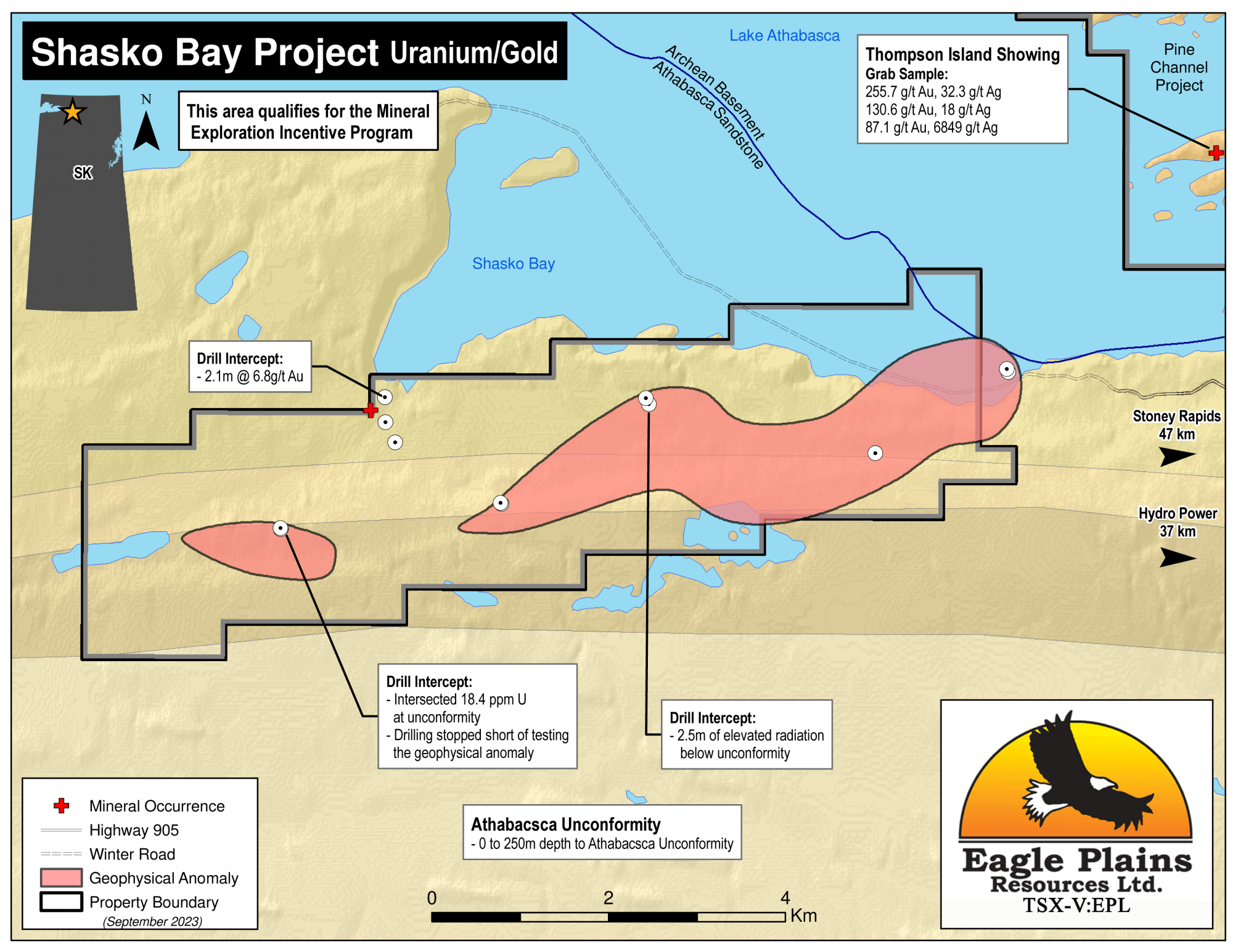

The Shasko Bay project is located on the southeastern shore of Lake Athabasca and was initially staked by the company for its gold and uranium occurrences. Indeed, a historical drill program encountered 2.1 meters of 6.8 g/t gold right at the property boundary, but the project is now having its day in the spotlight due to the presence of uranium.

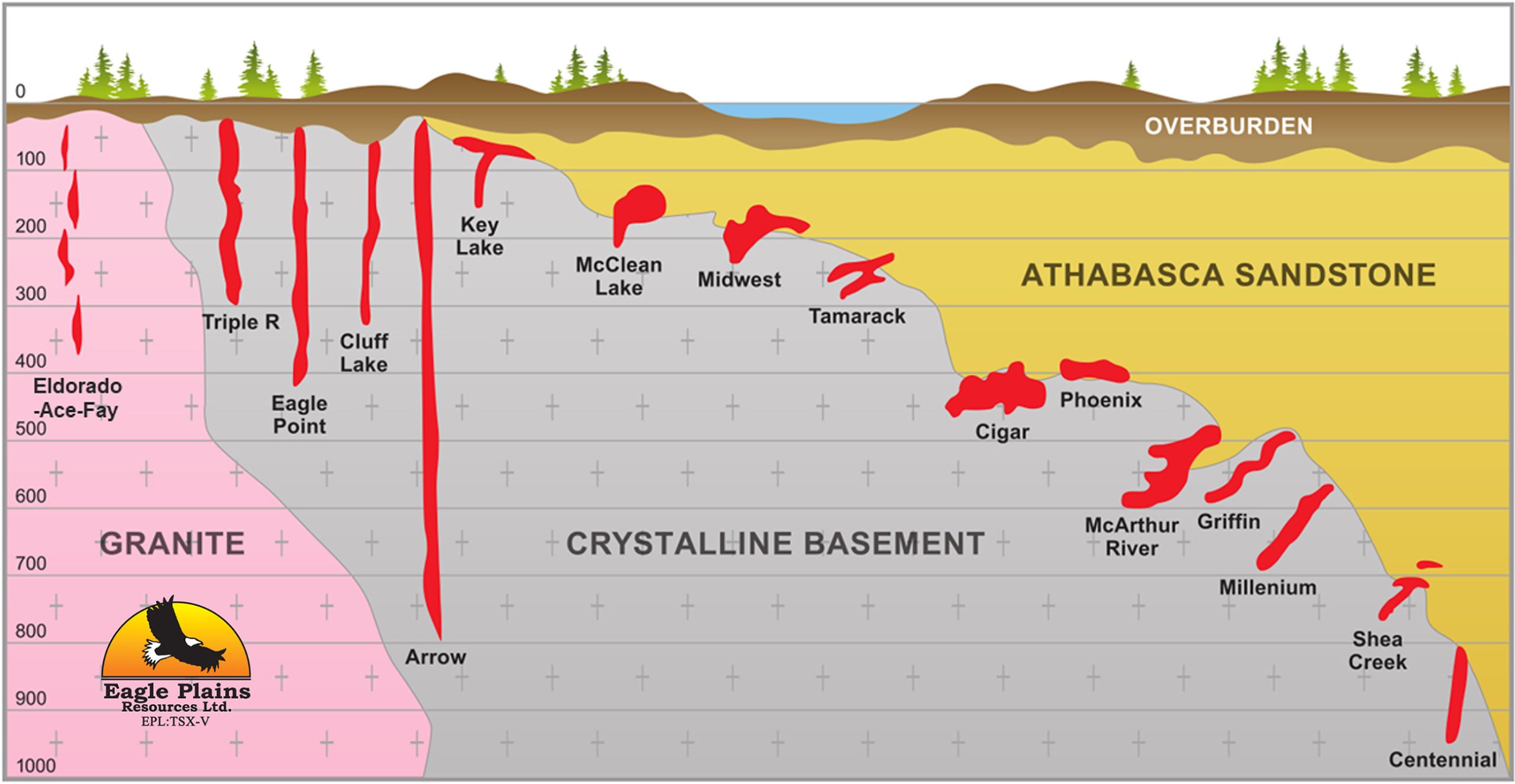

Previous drill programs have encountered uranium mineralization at the unconformity but the drill program was stopped before the geophysical anomaly was effectively tested. An important feature of this project is the fact the Athabasca Unconformity is located pretty close to surface. As the image below shows, the contact zone between the sandstone and basement is the host of numerous uranium projects and mines with a total endowment of hundreds of millions of pounds of uranium.

As you can see above, Eagle Plains has exposure to all three types of uranium deposit occurrences in the Athabasca Basin. The deal with Xcite Resources will predominantly focus on the Beaverlodge style deposits and we expect Eagle Plains to sign more joint venture agreements with other parties on the remaining dozen-odd projects.

The balance sheet would make other companies jealous

While we feel the market isn’t giving the company any credit for the uranium properties in its portfolio, the market is ignoring another very important element in today’s environment: a fortress-like balance sheet.

Right now, a lot of exploration companies are running on fumes and we expect to see a number of financings leading up to, or right after the PDAC conference in Toronto early next month. Fortunately, that’s a hassle Eagle Plains doesn’t have to deal with as its balance sheet looks squeaky clean.

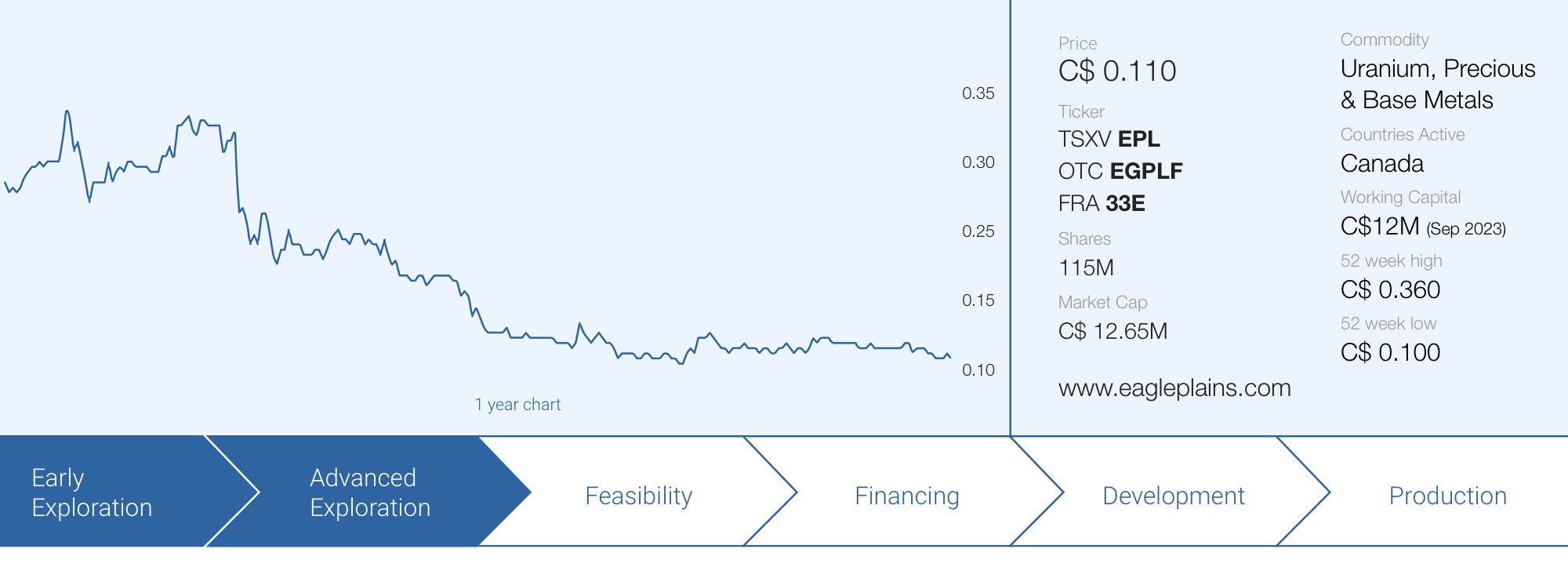

At the end of September (the most recent financial statements have been published by the company), Eagle Plains had a positive working capital position of almost C$10M and no long-term liabilities. As Eagle Plains still has just 115M shares outstanding, the net positive working capital position represents a value of C$0.086 per share which means that at the current share price of $0.110, an investor is only paying C$0.024 per share for the entire asset portfolio and the management know-how as the vast majority of the share price is backed by cash and investments.

Investors should also be aware Eagle Plains is actually generating revenue. That revenue is generated by its fully-owned subsidiary TerraLogic Exploration Inc., which provides geological services to third parties. Not only does this help Eagle Plains to keep its brain power in one spot, it actually almost covers the entire overhead expenses of the company.

As you can see above, Eagle Plains generated a revenue of C$2.05M in the third quarter of 2023, resulting in a gross profit of C$0.4M which was sufficient to cover the overhead expenses of Eagle Plains as a publicly listed company. The operating income in Q3 was a positive C$51,000 and although the 9M 2023 operating income was negative, that’s mainly due to seasonality while 2023 obviously wasn’t a great year for exploration either. But as the income statement above shows, the total gross profit generated in the first nine months of 2023 was almost C$1M. And that for sure is a very comfortable position to be in, as the TerraLogic subsidiary allows Eagle Plains to retain the technical people it wants and needs while that division also covers a substantial portion of the other overhead expenses on the Eagle Plains level. And that definitely is an under-appreciated feature of the company.

Conclusion

The joint venture with Xcite Resources on the uranium properties is interesting as it creates a win/no lose scenario. In the best-case scenario, Xcite is able to raise the money it needs to complete a thorough exploration program on all six projects and in an ideal world, it wants to retain all six assets resulting in Eagle Plains ending up with a 20% stake in all six assets and a 2% NSR. However, even if Xcite drops some of the projects, it will likely only do so after having spent enough cash to determine the value and prospectivity of the projects before dropping them.

This means that in a worst-case scenario, Eagle Plains will just see the properties being returned to them after having spent a few million dollars on them. And that is a ‘no lose’ scenario. It is now up to Xcite to effectively raise the cash to hit the ground running and Eagle Plains is in a very comfortable position as it’s Xcite that needs to spend money on the assets.

And while we focused on Uranium in this report, keep in mind Eagle Plains has a few dozen other projects in its asset portfolio. Some of those assets will be advanced by third parties, but Eagle Plains will likely continue to work on some of its fully-owned projects as well.

With a net working capital position of close to C$10M (and increasing, as Eagle Plains will receive cash and stock from Xcite Resources), Eagle Plains is in excellent financial shape. And that will allow the company to continue to advance its own projects as well.

Although many of the junior explorers may have limited 2024 work programs due to their inability to access working capital, Eagle Plains is in an enviable position. The combination of a strong, debt free balance sheet and option partners actively funding exploration programs, should generate steady news flow in 2024 and beyond. 2024 could very well be a very busy year for the company and we sincerely hope Xcite Resources can hit the ground running on the uranium properties.

Disclosure: The author has a long position in Eagle Plains Resources. Eagle Plains Resources is a sponsor of the website.