In the past few years, there was an overabundance of newly created royalty companies. That ‘problem’ solved itself to a degree as we have seen plenty of M&A in that subdivision of the mining sector as companies joined forces to gain economies of scale and synergy benefits.

Every once in a while, we see or hear about new royalty companies being created, and we just shrug our shoulders. It’s not difficult to create royalties and fill a portfolio with royalties on non-producing assets, but that doesn’t necessarily mean the royalty company will succeed; everything depends on the quality of the assets and the management team.

The people at Eagle Plains Resources (EPL.V) have a strong history of spinning out assets at the right time. As Eagle Plains is a project generator, it often secured a Net Smelter Royalty (NSR) as part of a property deal. The company wasn’t getting any value for the royalties it owned, and it was a pretty easy decision to spin out the royalties into a new company. Eagle Royalties (ER.C) was born.

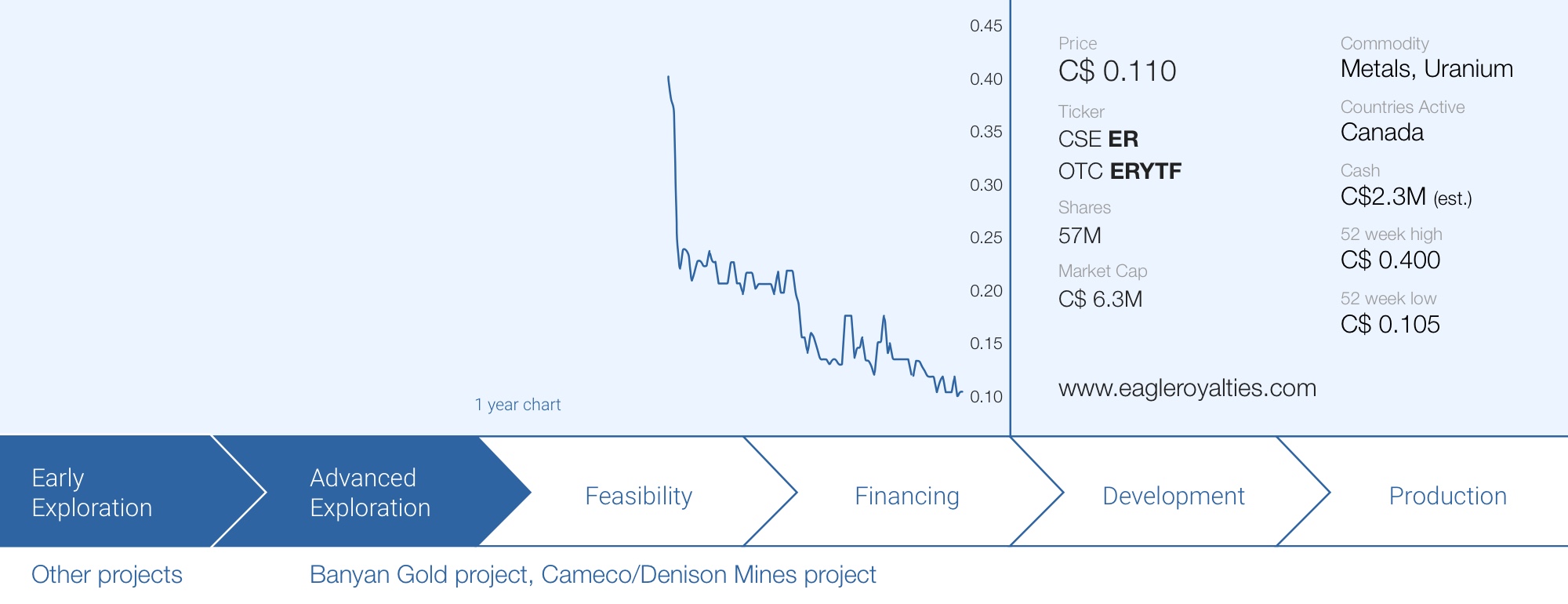

The adage that “timing is everything” applies perfectly to Eagle Royalties. After closing a C$3M financing and getting listed, ER hit the market into what some call the worst bear market in the junior mining sector in history. Although the company has a healthy treasury and very low overhead expenses, since the company listed, Eagle Royalties has seen its share price drop by in excess of 60%.

Undeservedly so. Although the company doesn’t have any income-producing royalties, we think its flagship royalty on Banyan Gold’s 6.2 million ounce Inferred Resource* (see the bottom of this article for clarification on the resource) at the AurMac/McQuesten property might be worth considerably more than its entire market capitalization right now.

The background of the creation of Eagle Royalties

One of the potential pitfalls of any junior mining company is liquidity events for shareholders. Eagle Plains Resources has a history of spinning out sufficiently advanced assets to ‘carry’ a new company and create significant shareholder value and liquidity.

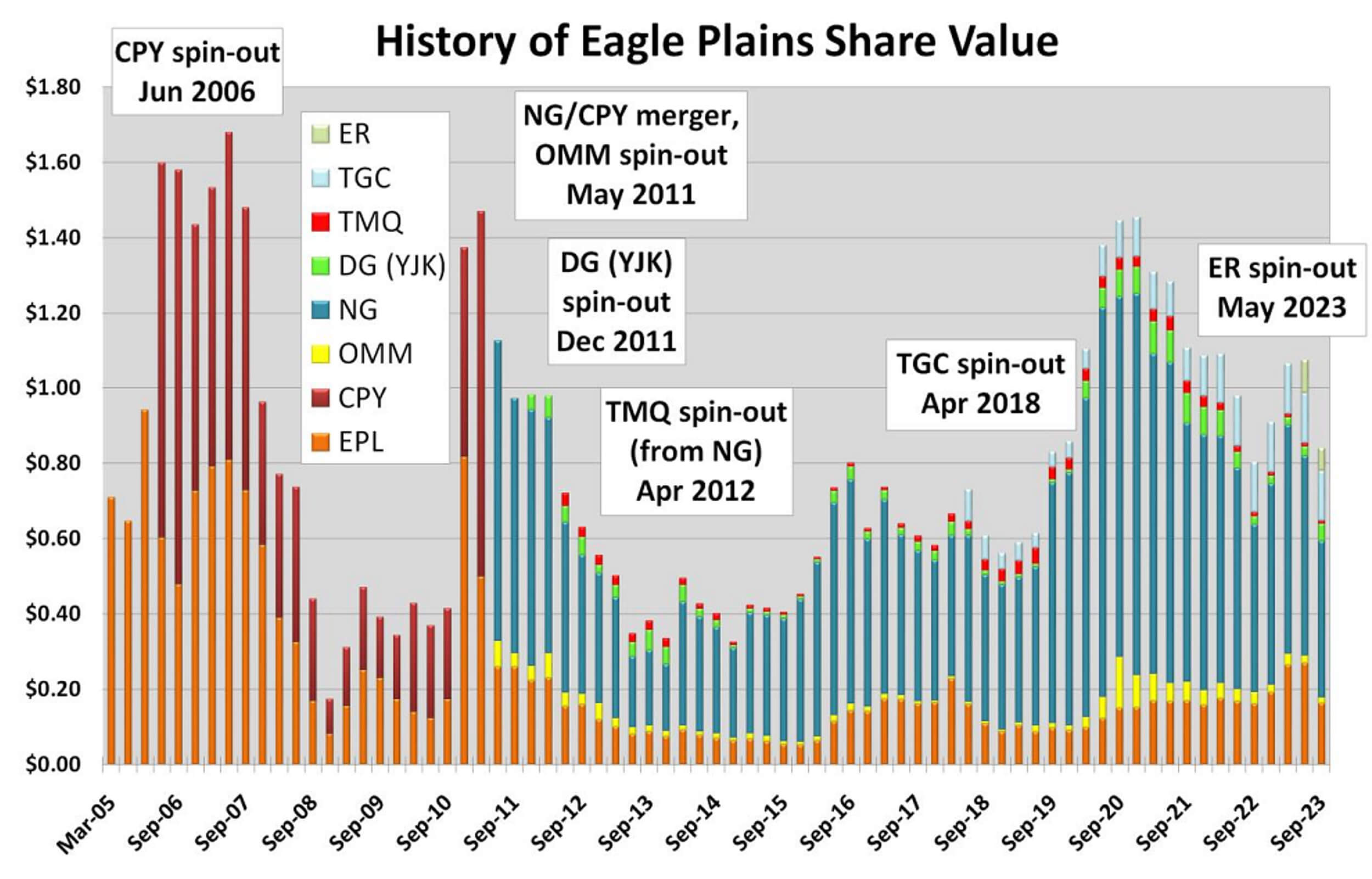

Eagle Plains has a history of rowing against the stream. As you can see in the image below, the company has spun out three other companies in its history. In 2006, it spun out Copper Canyon, which was subsequently acquired by NovaGold (NG) a few years later. That has set off a chain reaction of subsequent SpinCos like Omineca Mining & Metals and Trilogy Metals (TMQ), which were spun out during and after the NovaGold acquisition respectively.

As the initial spin-off of Copper Canyon created value for its shareholders, Eagle Plains continued further down this path and in 2018, it deemed the Fisher property in Saskatchewan to be sufficiently advanced to continue as a standalone project. It created Taiga Gold as a host for the Fisher property and just four years later, in April 2022, SSR Mining (SSRM, SSRM.TO) completed the acquisition of Taiga Gold at C$0.265 in cash. As you can see below, most shareholders of Taiga Gold made money on the sale. We believe SSR Mining was mainly interested in eliminating the 2.5% NSR held by Taiga Gold on the Fisher property, where SSR Mining was spending millions of dollars to prove the potential.

According to Eagle Plains, all spin-outs have created in excess of C$100M of value to Eagle Plains shareholders on a combined basis.

Those two successful spin-offs gave Eagle Plains a lot of credibility: the market noticed the company wasn’t spinning off assets for the sake of spinning them off, but because it genuinely believed an asset was sufficiently advanced to create value that would result in the purchase of the company.

Earlier this year, Eagle Plains completed the spin-out of Eagle Royalties as it felt it didn’t get enough value (or even, any value) for its royalty portfolio. Over the past 30 years, Eagle Plains Resources had amassed dozens of royalties on its own projects and subsequently sold or vended to other companies.

That royalty portfolio was rehomed into Eagle Royalties. Eagle Royalties completed an amalgamation transaction with a numbered company after that numbered company closed a C$3M capital raise, priced at C$0.30. The financing consisted of just over 10 million units with each unit consisting of one common share and half a warrant with each full warrant allowing the warrant holder to acquire an additional share at C$0.50. That C$3M cash injection provided the working capital for Eagle Royalties to operate on a standalone basis.

Pursuant to the spin-out transaction, Eagle Royalties issued just under 42 million shares to Eagle Plains and its shareholders: about 5.18 million shares were issued to Eagle Plains while the shareholders of Eagle Plains received one share of Eagle Royalties for every three shares of Eagle Plains they owned. This means a total of 36.8M shares were issued to the Eagle Plains shareholders, and all of those shares were subject to an escrow agreement. An initial tranche of 20% was tradeable upon completion of the spin-out with additional 20% tranches becoming available at three month intervals. The second tranche came out of escrow on August 19th, the third tranche was released from escrow on November 19th; the final two release dates are February 19th and May 19th (both in 2024). This means that on the first anniversary of the spin-out transaction, all shares issued to Eagle Plains and its shareholders will be free tradeable.

This also means we may see increased liquidity around those quarterly release dates. Not necessarily on those exact dates as share certificates are being mailed out and shares still have to be deposited digitally and that may take a few days.

By not making all shares immediately free tradeable, Eagle Royalties wanted to avoid opening the floodgates in the first few days of trading. But unfortunately the share price wasn’t immune to the weakness on the junior mining markets and the share price is currently trading at just C$0.11, about 60% below its pre-merger financing level.

The flagship asset? A royalty on a portion of Banyan’s flagship project

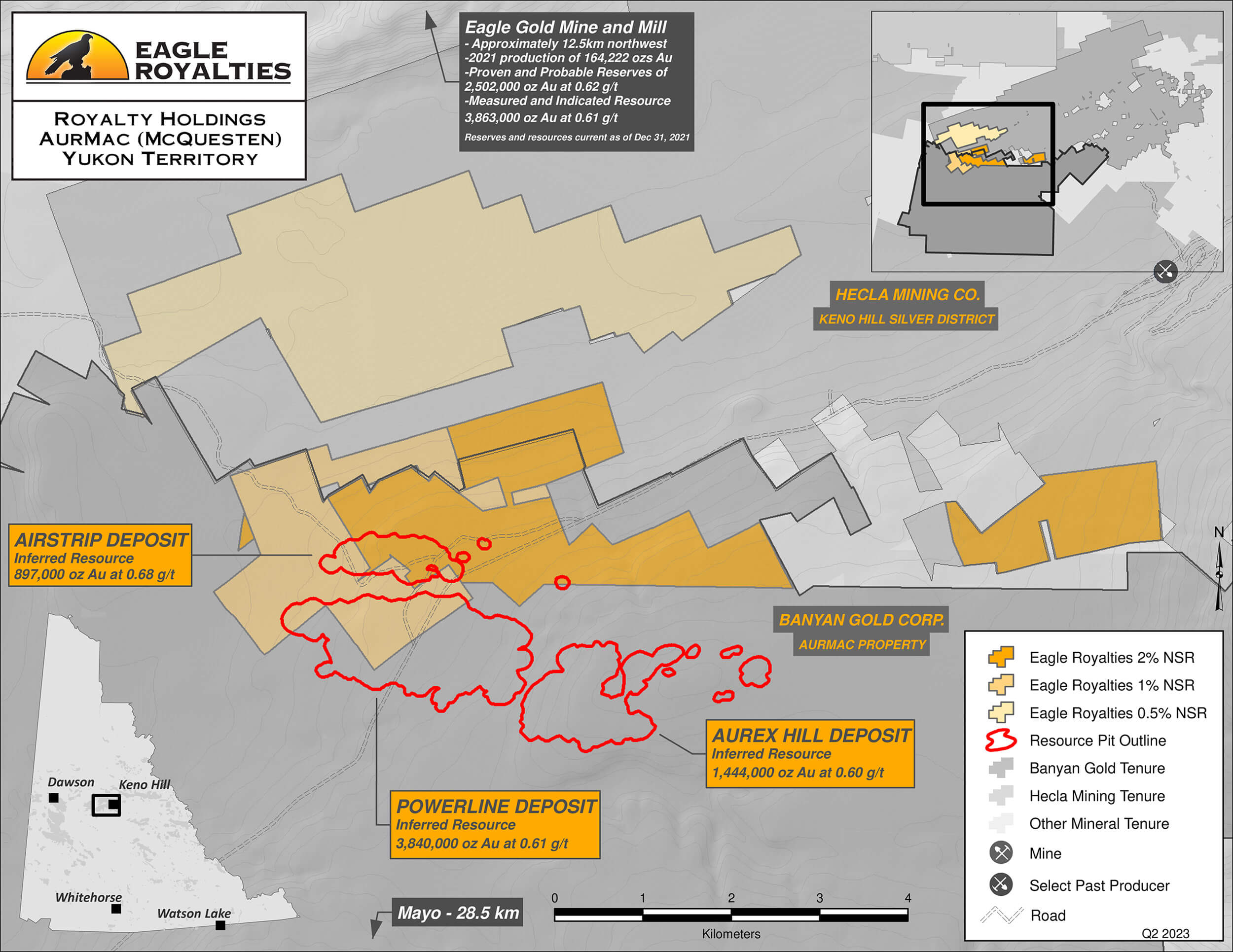

While none of the royalties are currently generating any revenue, a few royalties caught our eye with the 0.5%-2% Net Smelter Royalty on the AurMac/McQuesten project owned by Banyan Gold (BYN.V). Eagle Plains Resources acquired that royalty in September 2007 when it closed a deal with Alexco Resources (since acquired by Hecla Mining(HL)), which provided a 0.5-2% NSR on certain claim blocks on the property. The image below shows the approximate location of the land package Eagle Royalties has a royalty on. Note there are three different royalty ‘rates’, ranging from 0.5% to 2% with certain blocks subject to a 1% NSR.

As you can see, a portion of the AurMac Inferred Resource outline is subject to an NSR payable to Eagle Royalties. Looking at the map presented by Eagle Royalties, approximately 30% of the Powerline resource area (Inferred Resource of 3,840,000 ounces of Au) is overlain by claims subject to the 1% royalty. The Airstrip deposit, which has a current Inferred Resource of 897,000 ounces of gold, is entirely overlain by either a 1% or 2% NSR payable to Eagle Royalties. There appears to be plenty of room to expand the resource areas further onto ground subject to ER royalties. The mineralization at the Powerline and Airstrip deposits is near or on-surface and the AurMac project is transected by the main Yukon highway and access road to the Victoria Gold (VGCX.TO) open-pit, heap leach Eagle Gold mine and benefits from a 3-phase powerline and existing power station.

Additionally, the NSRs held by Eagle Royalties at AurMac do not have a buyback or buydown clause. Typically, NSR agreements include a clause between the NSR holder and the NSR payer, whereby the NSR payer can reduce the NSR by a one-time cash payment at an agreed to price. In the case of the Eagle Royalties AurMac NSR, in the event of an NSR sale, Eagle Royalties can set the price. This makes the AurMac NSR much more attractive to either a potential buyer or to Eagle Royalties as a long-term payable, non-reducible royalty.

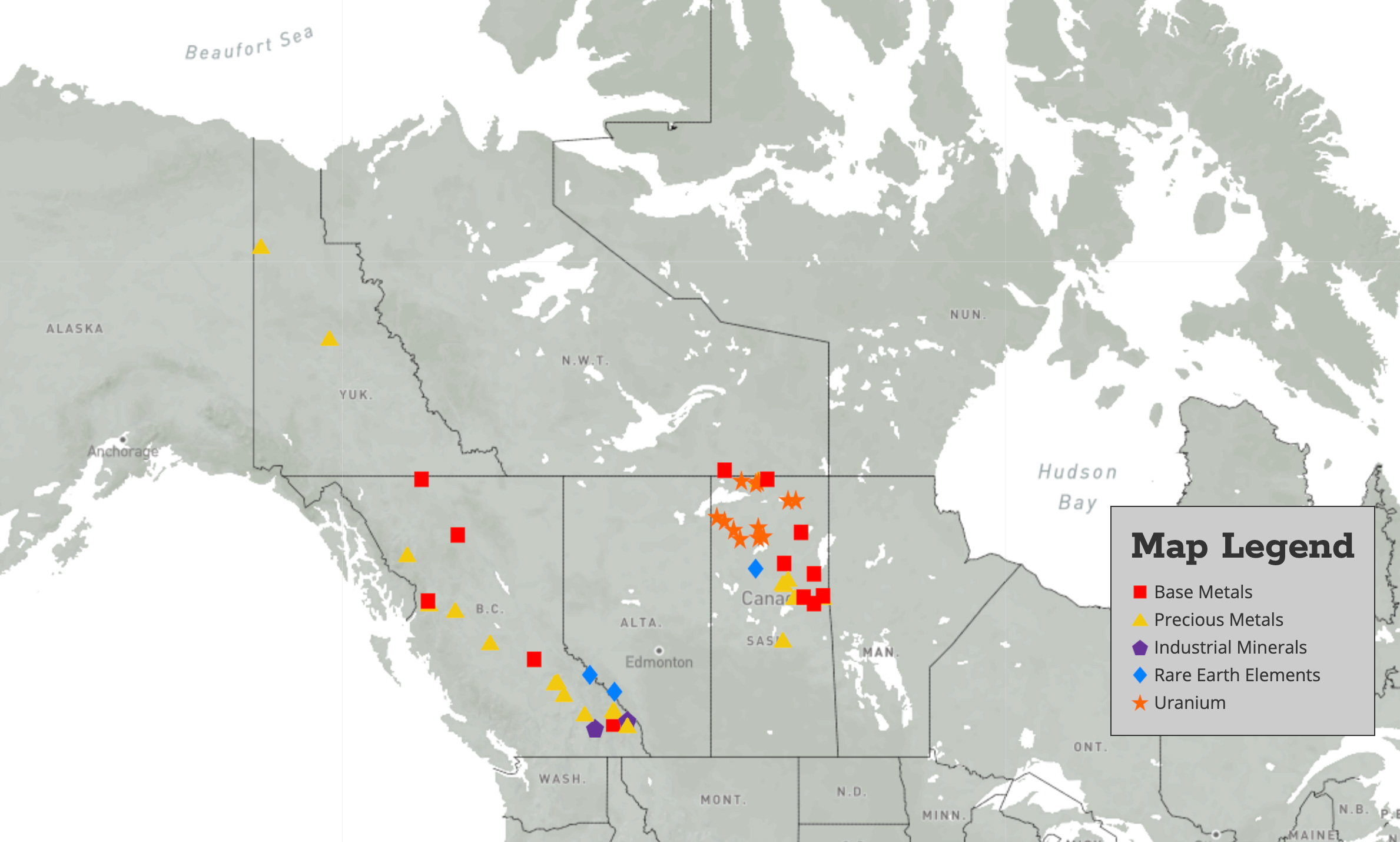

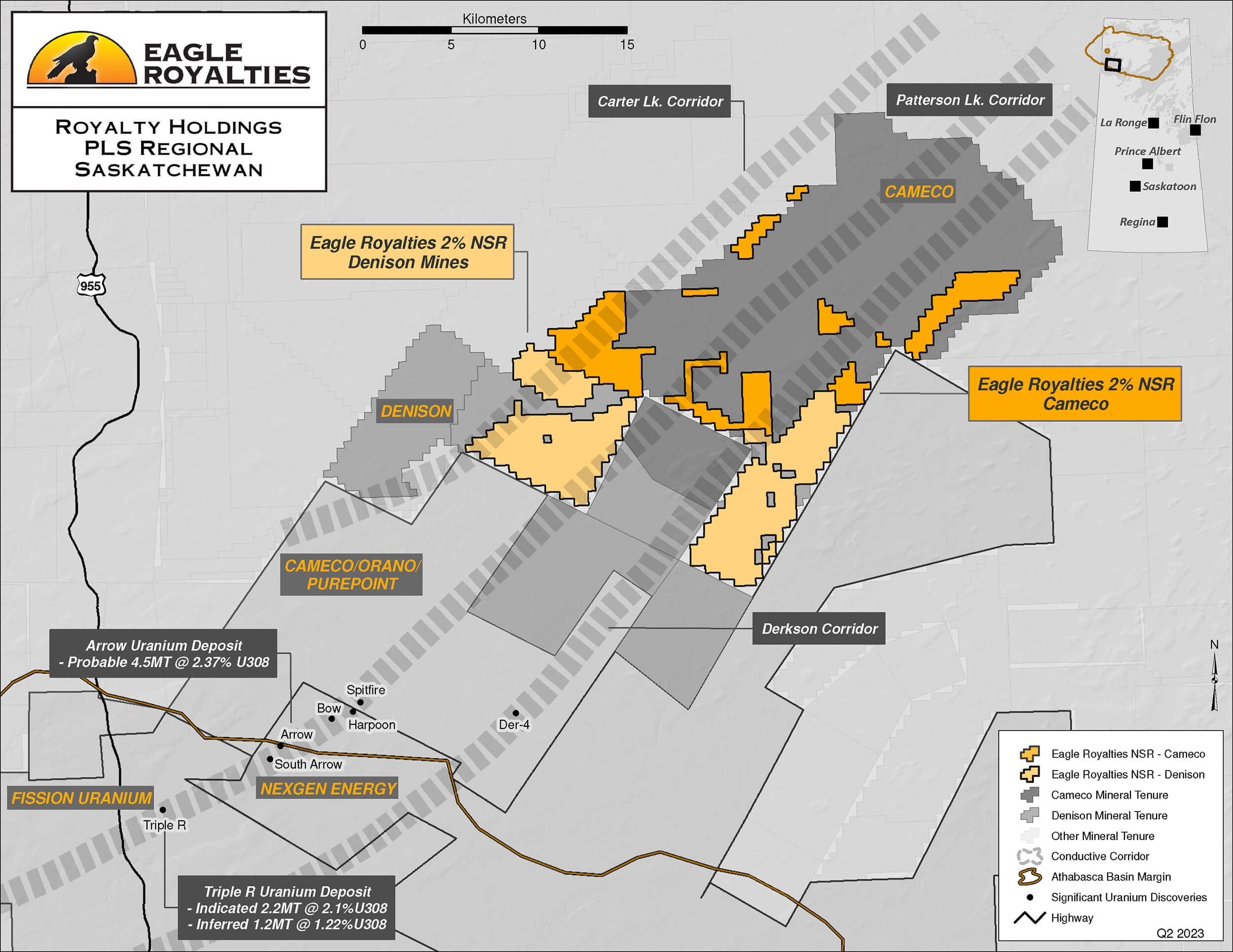

A second royalty (or rather, a set of royalties) we would like to highlight is the 2% NSR on the Cameco (CCJ, CCO.TO) and Denison Mines (DNN, DML.TO) owned land in the Patterson Lake region of the Athabasca Basin.

The 2% NSR is valid on the almost 13,000 hectares of land as shown in the image above, although there is a buyback provision whereby both operators can buy back half of the royalty for C$1M.

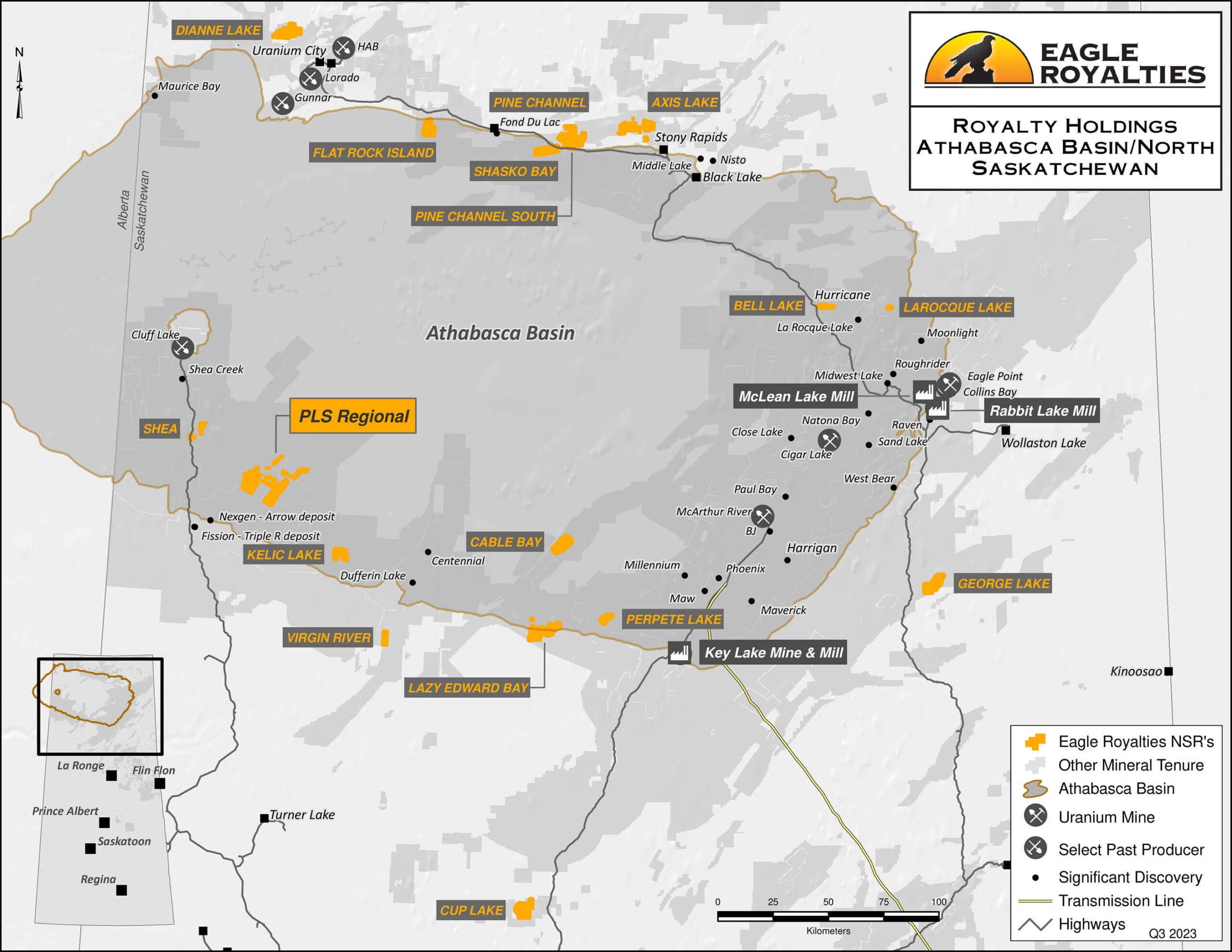

And as uranium is heating up, it is interesting to see Eagle Royalties actually has over a dozen different royalties on individual uranium projects all over the Athabasca Basin. While all of the assets are still in the early-stage exploration phase, owning over a dozen uranium royalties could be of interest to larger uranium-focused players. Additionally, all you need is just one discovery in the basin on one of the royalty land packages to unlock the value of this entire portfolio. And with an enterprise value of less than C$5M, it feels like little is needed to attract attention to this portfolio portion.

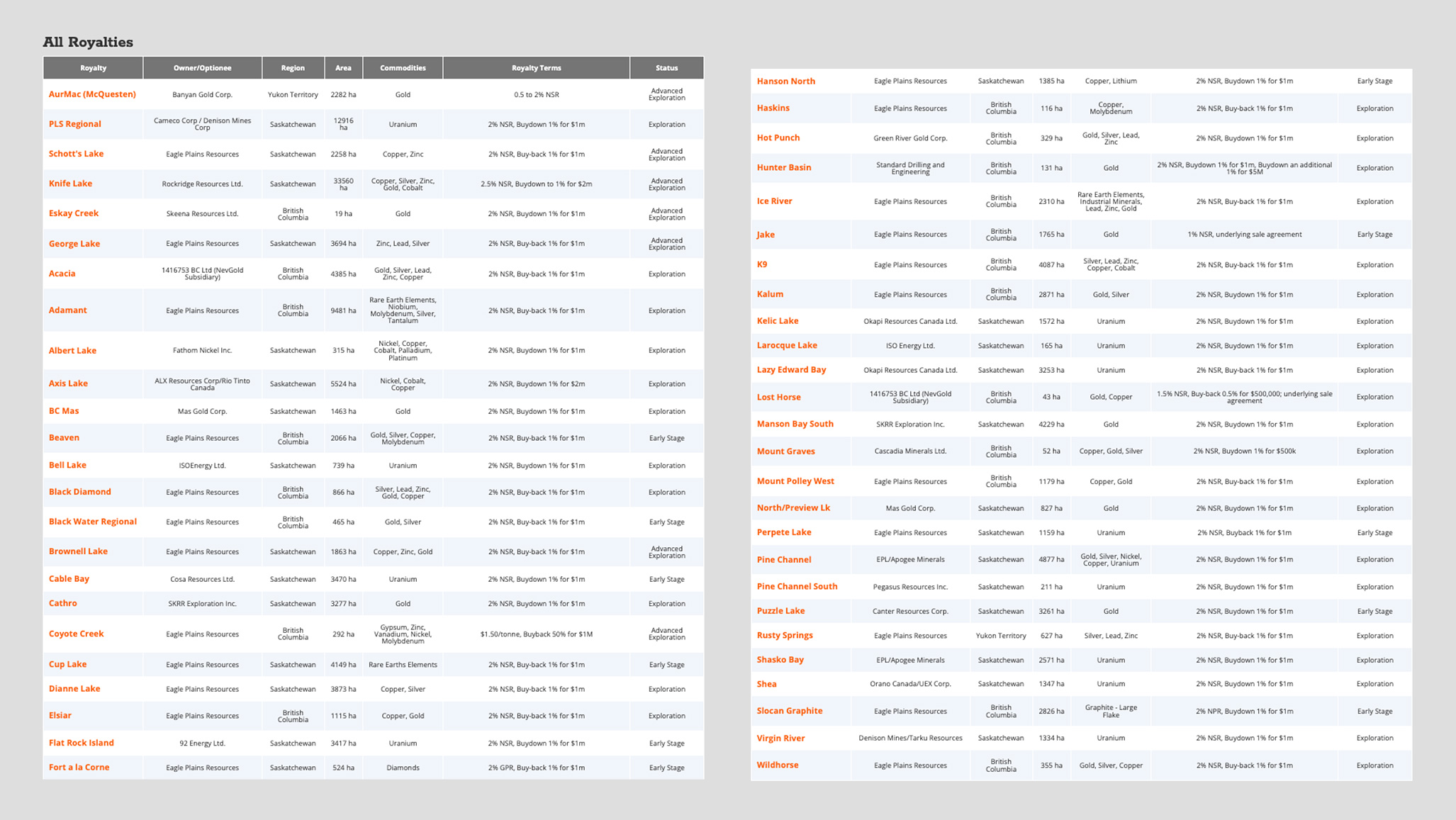

These are the royalties we consider to be the most interesting ones, but Eagle Royalties of course has a few dozen other royalties. The list is pretty long, but Eagle Royalties does an excellent job in listing all royalties and the owners/optionees as well as the focus commodity on its website. A dedicated page keeps track of all royalties and highlights the royalties the company thinks are the most important. Every royalty, even those described as royalties on early-stage exploration assets, have a dedicated page providing additional details and we tip our hat to Eagle Royalties’ attention for detail.

Conclusion

There are almost no guarantees in life and even fewer guarantees in the junior mining space. In a way, an investment in Eagle Royalties is a bet on the management team. A management team that has proven several times in the past its spin-outs are creating value for its shareholders. And while there is absolutely no guarantee Eagle Royalties will be a success, we are charmed by its flagship asset: the royalties on AurMac/McQuesten. While it is difficult to estimate the value of that royalty without seeing an official mine plan issued by Banyan Gold, it does look like there is some value there.

And while that is the company’s flagship asset, there are plenty of other interesting royalties in the portfolio. While none of the royalties generate any cash flow, a portfolio of 50 royalties could be of interest to a larger player in the royalty space looking to boost its pipeline. Especially now the share price is trading at a discount of approximately 60% to the IPO price, the company may be vulnerable. Keep in mind that with a market capitalization of C$6.5M and in excess of C$2M in cash and working capital, the enterprise value of the company is just C$4.5M. Although none of the royalty assets are generating any revenue, we are looking at the asset portfolio as one main flagship asset (the AurMac/McQuesten royalty) with four dozen additional lottery tickets. There are no guarantees any of those will be successful, but the NSRs are a ‘free’ call option on exploration success.

Eagle Royalties is a bet on the management team and a bet on Banyan Gold further advancing its AurMac/McQuesten gold project in the Yukon Territory. But with about a third of the current market capitalization in net cash on the balance sheet, Eagle Royalties is in strong financial shape. Overhead expenses should be low, and the existing cash position of C$2.3M should be sufficient to get through the next few years.

*The updated Resource Estimate for the AurMac Project was prepared by Marc Jutras, P.Eng., M.A.Sc., Principal, Ginto Consulting Inc., an independent Qualified Person in accordance with the requirements of NI 43-101. The technical report supporting the Resource Estimate entitled “AurMac Property, Mayo Mining District, Yukon Territory, Canada” (the “Technical Report”) was filed on SEDAR at www.sedar.com on July 7, 2023. The effective date for the Mineral Resource is May 18, 2023.

Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, changes in global gold markets or other relevant issues.

The CIM Definition Standards were followed for classification of Mineral Resources. The quantity and grade of reported Inferred Mineral Resources in this estimation are uncertain in nature and there has been insufficient exploration to define these Inferred Mineral Resources as an Indicated Mineral Resource and it is uncertain if further exploration will result in upgrading them to an Indicated or Measured Mineral Resource category

Disclosure: The author has no position in Eagle Royalties yet. Eagle Royalties is a sponsor of the website. Please read the disclaimer.