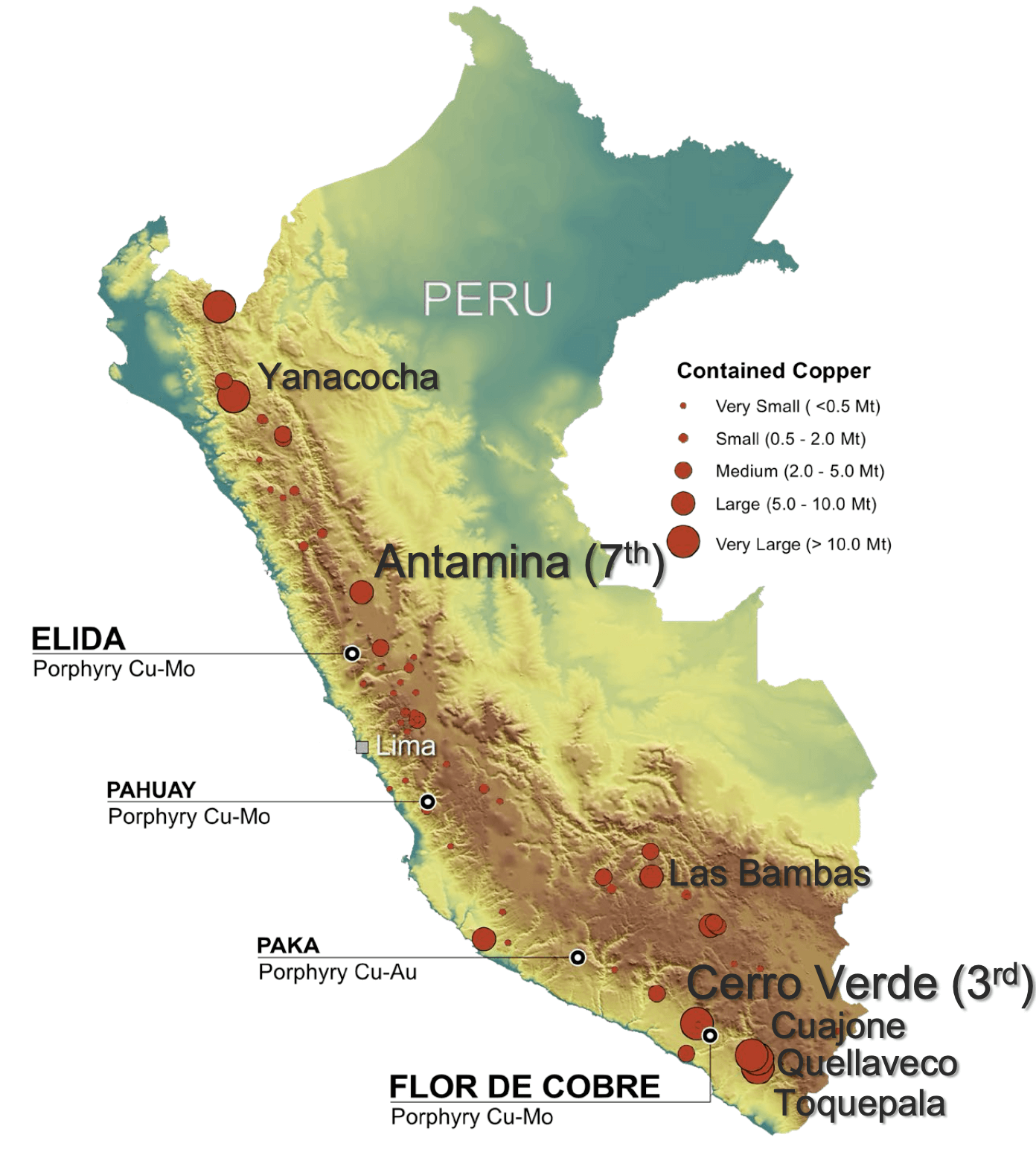

The world needs more copper, and it’s not easy to find large copper deposits. We won’t discuss the situation on the copper market ad nauseam, but it is clear the world and the world economy will continue to need copper and the discovery of new large scale copper deposits to ensure the copper supply can continue to meet the demand.

Element 29 Resources (ECU.V) owns the Elida copper-molybdenum-silver project in Peru (while we focus on the copper, let’s not forget the molybdenum which is also included on the list of critical minerals issued by the Canadian federal government). A maiden resource estimate completed in 2022 and based on the data of just 25 drill holes, the company’s independent consultants developed an initial pit-constrained resource of 322 million tonnes at an average grade of around 0.5% CuEq (using $22 molybdenum and $4.75 copper for the calculation. Note; this is our own back of the envelope calculation; the company has not published a copper-equivalent resource estimate yet as it is waiting for more metallurgical details), hosting 2.2 billion pounds of copper and in excess of 200 million pounds of molybdenum. As this project is located in the lower Andes (the entire mineralization is located below 2,000 meters above sea level) and has excellent access to infrastructure (including power, water and a deep sea port), the Elida project stands a good chance to prove its value further down the road.

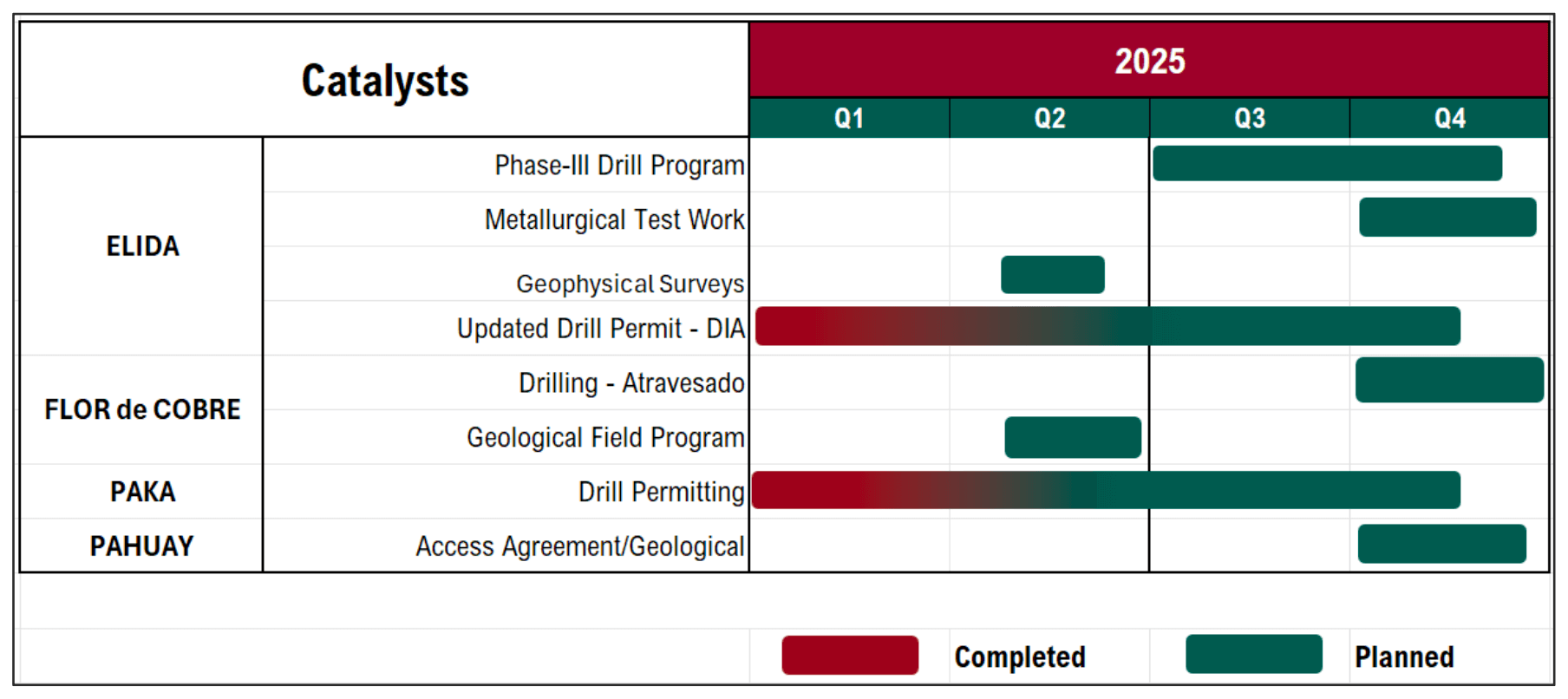

There currently are no economic studies on the project as Element 29 is focusing on expanding the current resource and reaching critical mass before starting to work on an economic study. Considering the most recent drill results encountered very consistent porphyry mineralization over lengths of in excess of 1,000 meters, Element 29 could be rapidly building its tonnage. The Phase III drill program will resume next quarter after integrating the data from a magnetotellurics (MT) geophysical survey into the drill plan.

The Elida property

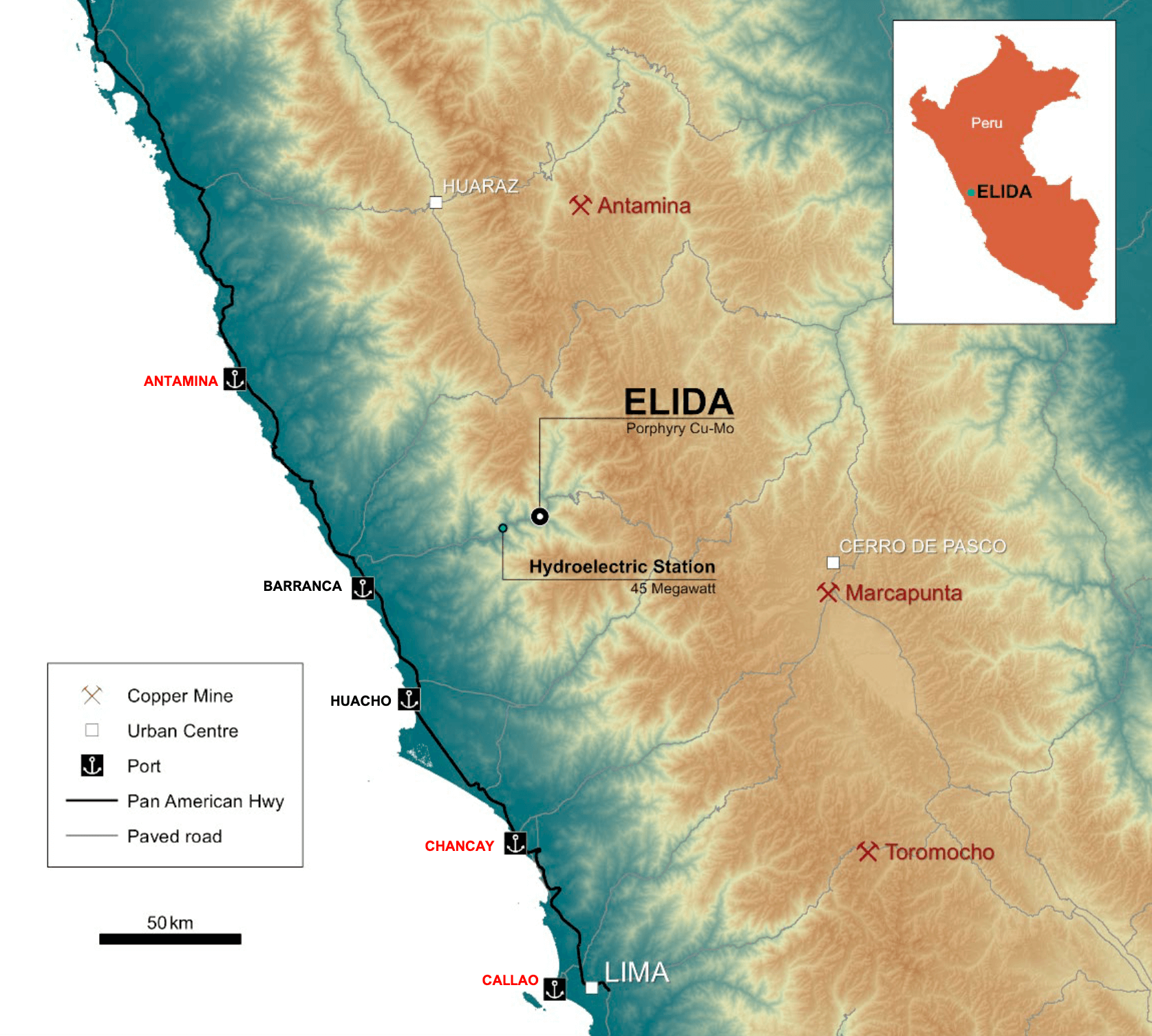

The Elida project (which is 100% owned by the company) consists of almost 20,000 hectares in the Cajatambo and Ocros provinces in Peru. The project is accessible by road from Lima, the capital, via the Pan American Highway before taking an exit to the east and follow a section of paved and unpaved roads over a 53 kilometer distance. The main drill target at Elida is found near the bottom of a steep valley at approximately 1,200-1,400 meters above sea level. That’s important as this means the deposit is located at a relatively low altitude which makes the working circumstances so much better resulting in a lower-cost and more efficient exploration effort. The main issue the company has to deal with is the rainy season during their summer (November-March) but exploration can continue year round making the Elida project an excellent location. The rainy season mainly has an impact on accessing the project but is not a major deterrent to the actual exploration activities.

Water shouldn’t be a major issue either as the local river has a flow rate of 12,000 liters per second in the dry season and 236,000 liters per second in the rainy season (with an average flow rate of 48,000 liters per second on a year-round basis). The river runs down to the Cahua hydroelectric plant which is located just 14 kilometers downstream from the property and produces approximately 300 GWh of electricity per year. Another hydroelectric power plant about 45 kilometers to the southeast produces 837 GWh per year.

It’s also important to note the project is located near an active mining district and the surrounding area is sparsely populated while agricultural activities (apples, mangos, avocados,…) are limited to the river valley bottom. While Element 29 isn’t even close to developing the project and building a mine (the exploration programs are designed to reach ‘critical mass’ before kicking off the economic studies on the project), we consider the accessible location without having too many neighbours a clear positive for the project.

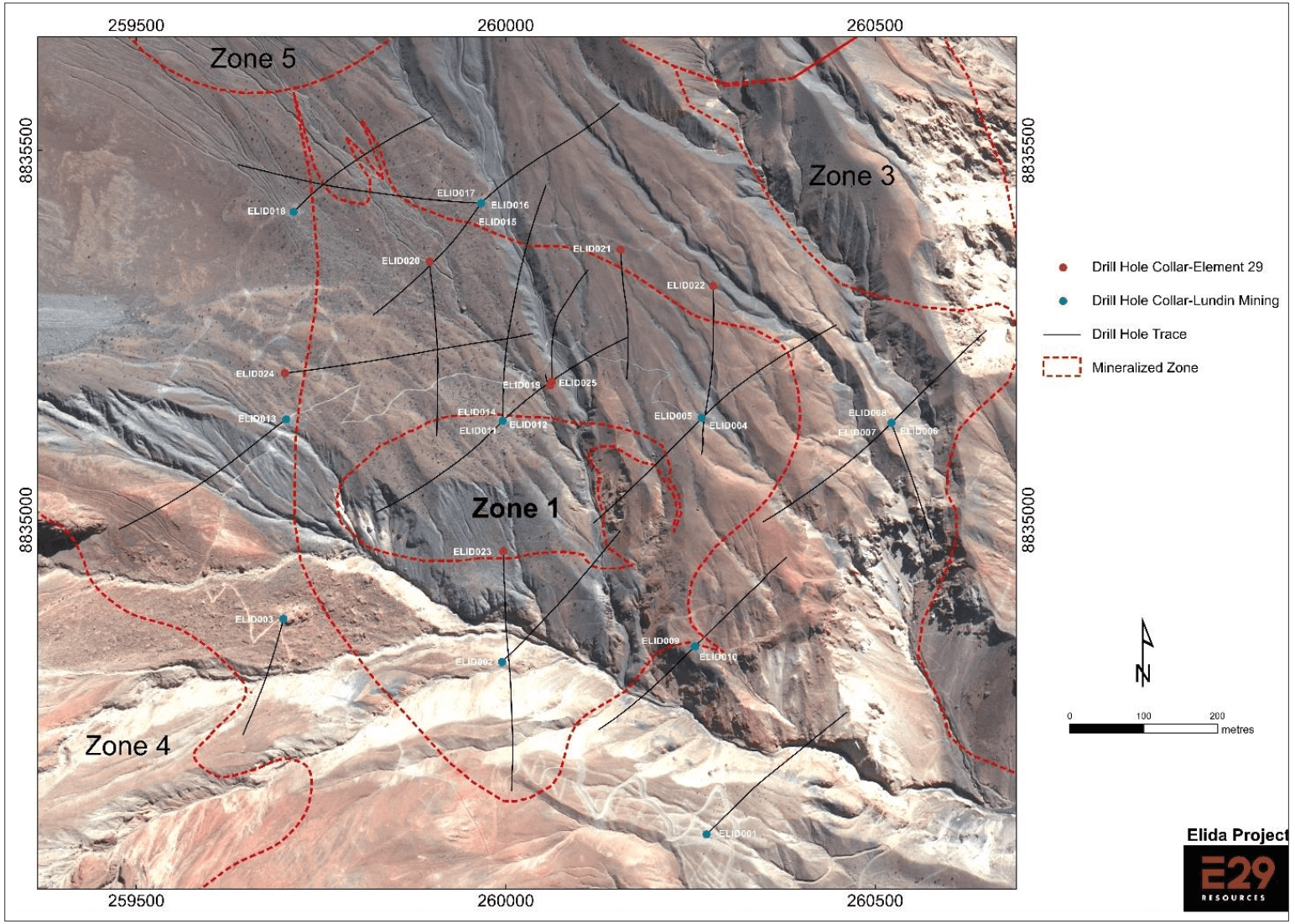

Initial drilling was conducted by Lundin Mining in 2014 and 2015 when a total of almost 10,000 meters was drilled in 18 holes. All 18 holes intersected copper-molybdenum mineralization with about a third of those holes intersecting ‘significant’ mineralization with the best hole returning 503 meters of 0.42% copper, 0.046% molybdenum and 3.23 g/t silver. Lundin Mining Peru dropped the option in 2016 (when the copper price was just $2.5 per pound) and the property was returned to GlobeTrotters Resource Group Inc. and later spun into Element 29 in 2018 in exchange for equity and a NSR royalty.

Element 29 completed a 7 hole drill program for a total of just over 4,600 meters in 2021, strictly focusing on the Zone 1 area of the Elida deposit where the company expected to put together a maiden resource estimate. That resource calculation was completed in late 2022.

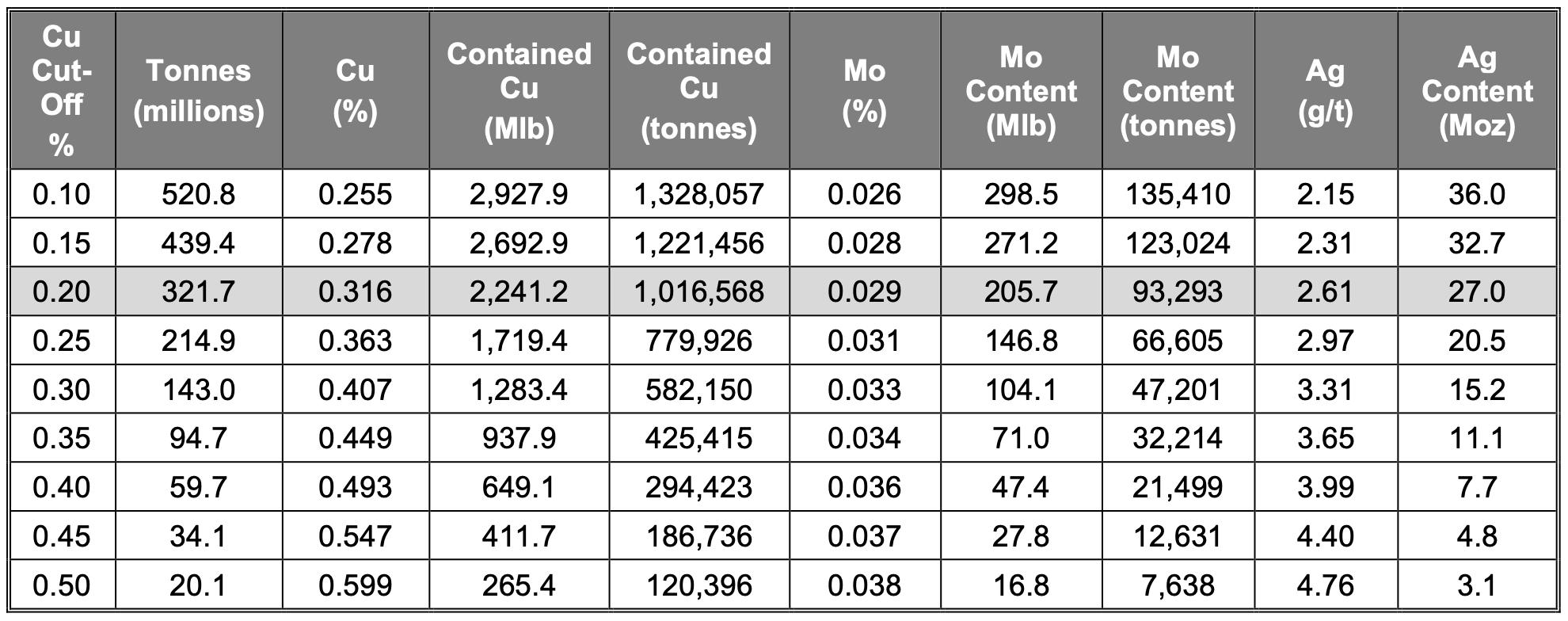

The Elida resource estimate

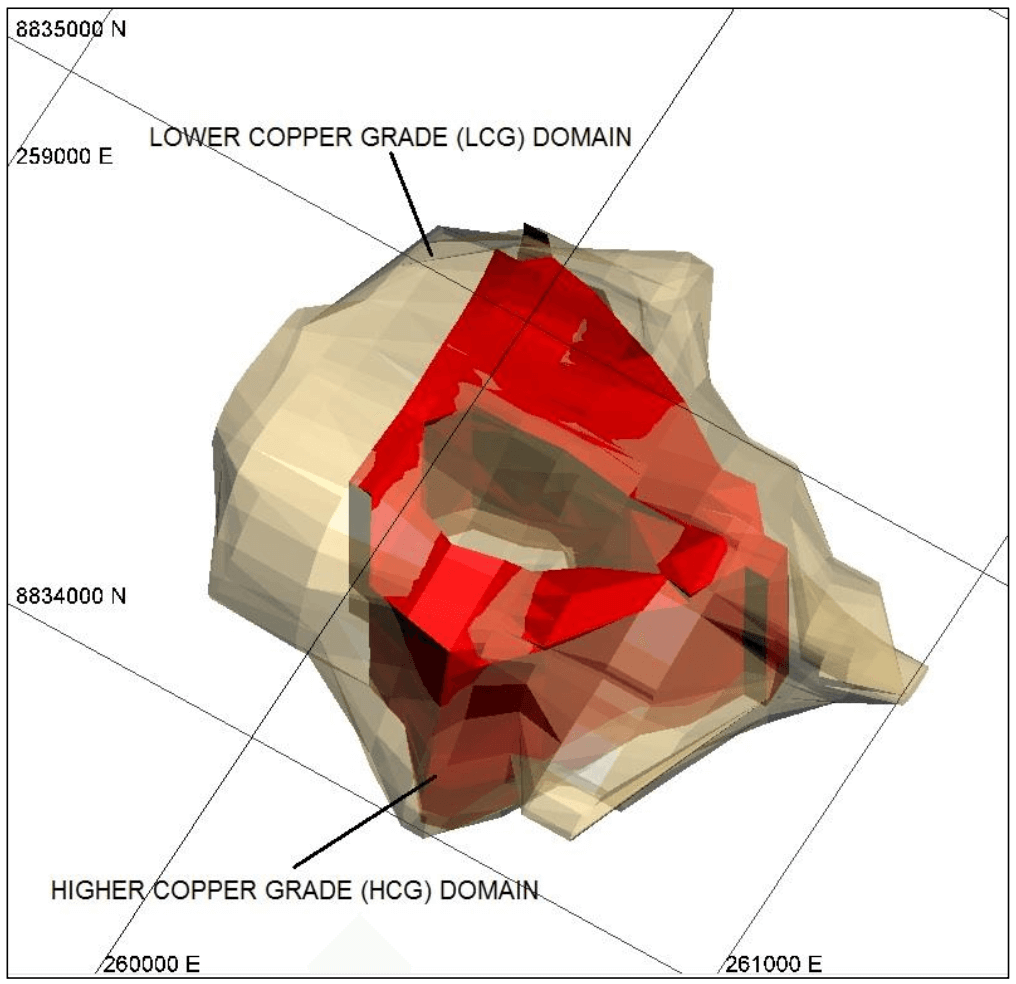

As the mineralization at Elida is very consistent, the combined 25 drill holes (18 completed by Lundin Mining Peru and 7 completed by Element 29) for a total of just over 14,500 meters of drilling was sufficient to complete a maiden inferred resource estimate on the property. As per the NI43-101 technical report, the geological model was developed based on two mineralized domains: a higher copper grade domain and a lower copper grade domain with the former applying a cutoff grade of 0.25% copper and the latter using a cutoff grade of 0.08% copper.

The resource calculation focused on an open pit, and the initial pit-constrained resource hosts 322 million tonnes of rock (using a cutoff grade of 0.20% copper). The average grade in the resource was just under 0.32% copper, 0.029% molybdenum and 2.61 g/t silver for a total metal content of 2.2 billion pounds of copper, 205 million pounds of molybdenum and 27 million ounces of silver.

This resource calculation was completed in 2022 and obviously does not take any of the recent drilling into account. That being said, the maiden resource does provide investors with initial parameters that will be important to prove the economic viability of the project. The resource estimate uses an 87% recovery for the copper, but unfortunately it doesn’t provide any anticipated recovery rates for the molybdenum and the silver -which could prove to be important by-product credits further down the road. That’s why we are definitely looking forward to seeing the results of an updated metallurgical test program which is scheduled for this year. We hope to see a slightly higher copper recovery rate while it would be good to establish a recovery rate for the molybdenum as well considering the resource hosts almost 1pound of molybdenum for every 10 pounds of copper.

Two other important elements that definitely deserve to be highlighted: the preliminary metallurgical test work (again, to be updated later this year) the level of impurities (arsenic) is quite low (which could indicate the project’s concentrate would be rather clean) while the strip ratio is estimated at just 0.74:1 and that is exceptionally low.

A second element is that of the almost 322 million tonnes of rock, there is a higher-grade sub-section of 143 million tonnes at 0.41% copper including almost 60 million tonnes at an average grade of 0.49% copper, 0.04% molybdenum and almost 4 g/t silver (using a cutoff grade of 0.40% copper). And this could create flexibility in how this deposit could potentially be developed further down the road.

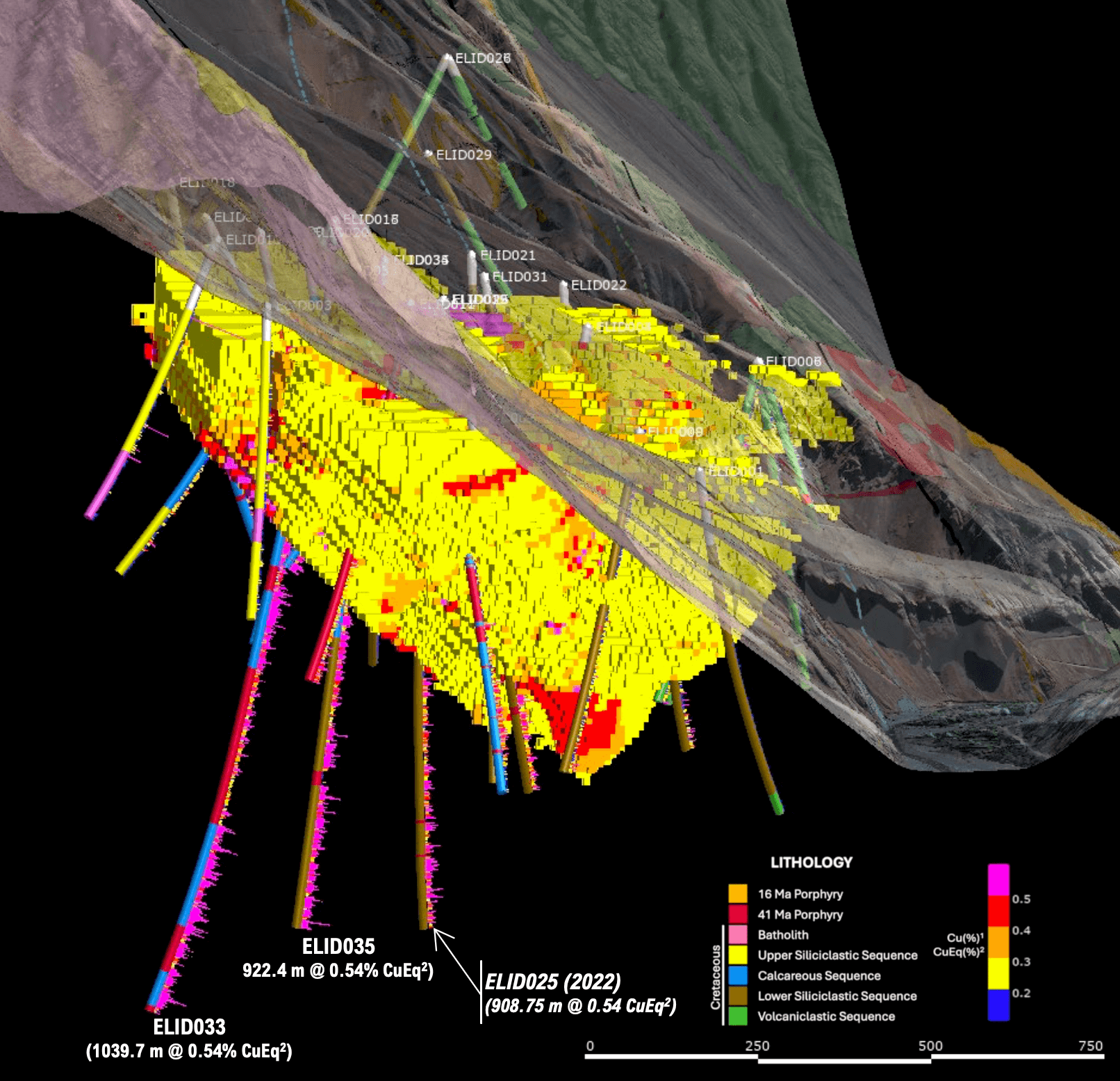

It could for instance make sense to only focus on a portion of the current pit constrained resource that could actually be mined as an open pit. Meanwhile, as the mineralization continues at depth (the image above clearly shows how the deeper holes confirm the continuity of the mineralization at depth) and given the topography of the area, it could make a lot of sense to start considering a block cave mining method and mine the vast majority of the mineralization that way. Of course this is just our own opinion. The company does not have any economic study, and readers are cautioned the current NI43-101 solely focuses on the pit-constrained resource.

The plans for the near future

In its May 21st update, Element 29 Resources mentioned it has launched a large-scale MT geophysical survey at Elida where a 5 kilometer by 6 kilometer will be the main focus point. The MT survey will include more than 100 MT stations which will provide a 3D resistivity model of the subsurface to a total depth of in excess of 2,000 meters. According to the company, MT surveys have contributed to the discovery of several large porphyry copper systems at depths of over 1,500 meters.

The company plans to use the data gathered from the MT survey to get a better understanding of the mineralization and alteration footprint below 500 meters, ahead of the planned third phase of the drill program which will restart in the early third quarter of this year.

While the MT survey is ongoing, Element 29 is getting everything in place for the next drill program. It has submitted its DIA environmental approval application to the appropriate Peruvian ministry requesting an increase of the amount of allowed drilling platforms from 20 to 40. The upgraded DIA is a necessary step towards securing a new drill permit to keep the extensive exploration activities ongoing. In tandem, Element 29 is preparing a Collective Impacts Report to support a request to obtain an exemption from the Consulta Previa process and it recently signed a new five year surface access agreement with the local community.

The Phase III drill program was halted at the end of 2024 after completing just two holes, but those two holes yielded very intriguing results with almost 1,040 meters of 0.54% CuEq including 310.1 metres of 0.71% CuEq which remains open at depth as well as another hole intersecting 922 meters containing 0.54% CuEq. Needless to say that finding thick intervals at a very consistent grade is the best way to build tonnage at the project.

The company has more assets in its pipeline

While we focus on Elida as the company’s flagship project, Element 29 has assembled a portfolio of other copper porphyry projects, but those aren’t as advanced as Elida, which clearly is the company’s flagship project.

The Flor de Cobre, Paka and Pahuay projects offer valid exploration targets as well, but the current valuation of the company is definitely underpinned by the inferred resource and resource expansion potential at Elida, and that’s why we focus on Elida in this report. We will of course provide an overview when the company advances the other projects.

The financial situation

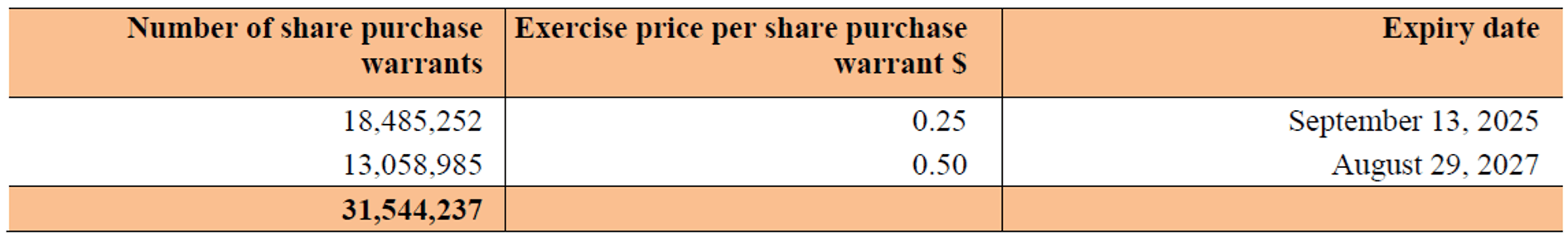

At the end of the first quarter, Element 29’s working capital position increased to approximately C$1.1M coming from C$0.9M at the end of 2024. During the first quarter of the current financial year, ECU received in excess of C$0.8M in cash proceeds from warrant holders exercising just over 2.7 million warrants.

While the working capital position is a bit low, odds are Element 29 will likely be able to raise north of C$4.5M through warrant exercises. As the table below shows, the company still had almost 18.5M warrants with an exercise price of C$0.25 that are expiring in the next three months.

That’s both a positive and a negative. The positive side is of course the expectation to get C$4.6M in cash proceeds from the warrant exercise which would put the company on strong financial footing. The downside is of course related to the potential pressure on the share price if some of those warrant holders decide to sell some shares to exercise the warrants. While it is our understanding the majority of these warrants are held by what Element 29 considers to be ‘strong hands’, there will always be some pressure and fortunately the current share price is trading at a high enough level to avoid being ‘capped’. For the time being, the warrant exercises appear to happen in an orderly fashion and we are looking forward to seeing the company’s next quarterly update.

Once all the C$0.25 warrants have rolled off, the company can hopefully gradually rake in the proceeds from the in excess of 13M warrants with an exercise price of C$0.50 that are still outstanding. That could provide an additional C$6.5M in cash proceeds but those warrants don’t expire for another two years.

During the current quarter, approximately 450,000 options at an exercise price of $0.30 were/are slated to expire, and this will likely boost the treasury by an additional C$135,000.

As the company is currently working on its MT survey and drilling will only start in a few months from now, the timing works out well as Element 29 can hopefully get some more cash in the bank from warrant exercises before kicking off the Phase III drill program.

Highlighting some management and board members

Richard Osmond, P. Geo., ICD.D

Mr. Osmond has over 25 years of experience in the mining sector including experience with INCO (VBNC), Falconbridge and Anglo American. He was involved in exploration discoveries at Vale’s Voisey’s Bay deposit and Glencore’s Raglan mine. He was later hired as a senior technical leader with Anglo American responsible for North America and Europe focused on Ni exploration in northern Canada, Alaska and Scandinavia as well as IOCG and porphyry Cu-Mo exploration in Mexico and Alaska. Mr. Osmond is currently the President of GlobeTrotters Resource Group Inc.

Manuel Montoya, CTO

Mr. Montoya brings over 35 years of experience in South America’s natural resource sector. He played a key role in discovering the Elida and Atravezado porphyry Cu-Mo-Ag targets and has worked across both mining and petroleum industries. His past roles include Chief and Principal Geologist at Teck, where he focused on Tier-1 porphyry copper projects across South America and contributed to the discovery of the Zafranal deposit in southern Perú. His expertise spans porphyry Cu, epithermal Au, CRD-skarn, MVT, VMS, SEDEX, orogenic Au, and IOCG deposits.

Brad Mercer, Chair on the Board

Mr. Mercer led exploration and operations at Capstone Copper Corp. from 2005 until retiring as COO in 2022. He helped grow the company from under $20 million to a $5+ billion mid-tier copper producer. Key achievements include tripling mine life and doubling production at the Minto and Cozamin mines. Before Capstone, he managed exploration teams across Canada and has discovery experience in porphyry copper, IOCG, epithermal gold, and structurally controlled gold deposits in Chile, Mexico, and Canada.

Conclusion

Element 29 Resources appears to have one of the most promising copper exploration projects with an actual chance of being developed. While Element 29 is obviously still in the exploration stage and fully focused on expanding the current resource, we hope the company will be in a position to start working on a preliminary economic assessment to underpin the valuation of the company.

Hopefully the results of the MT Survey will help the company to get a better understanding of the mineralization at depth as this could make the follow-up drill program more efficient and help Element 29 to build tonnage and advance the project towards a potential Tier-1 discovery.

Disclosure: The author has had a long position in Element 29 Resources since its IPO in 2020. Element 29 Resources is a sponsor of the website. This report is for educational purposes only; be mindful that investing in junior mining stocks is risky, and you may lose your entire investment if things go wrong. Please read our disclaimer.